false

0001729427

0001729427

2025-02-19

2025-02-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 19, 2025

___________________________

CNS Pharmaceuticals, Inc.

(Exact name of registrant as specified in its

charter)

___________________________

| Nevada |

001-39126 |

82-2318545 |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

2100 West Loop South, Suite 900

Houston,

Texas 77027

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code: (800) 946-9185

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

___________________________

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbols(s) |

Name of each exchange on which registered |

| Common stock, par value $0.001 per share |

CNSP |

The NASDAQ Stock Market LLC |

| Item 3.03. | Material Modifications of Rights of Security Holders. |

At

the CNS Pharmaceuticals, Inc. (the “Company”) special meeting of stockholders held on November 26, 2024, the stockholders

of the Company approved a proposal granting the Company’s board of directors the authority to effect the reverse stock split at

a ratio in the range of 1-for-2 to 1-for-50, with such ratio to be determined in the discretion of the Company’s board of directors

and with such reverse stock split to be effected at such time and date, if at all, as determined by the Company’s board of directors

in its sole discretion.

Pursuant

to such authority granted by the Company’s stockholders, the Company’s board of directors approved a one-for-fifty (1:50)

reverse stock split (the “Reverse Stock Split”) of the Company’s common stock as of February 21, 2025 (the “Effective

Time”), such that, at the Effective Time, every fifty shares of the Company’s issued and outstanding common stock will automatically

be combined into one issued and outstanding share of common stock, without any change in par value per share, which will remain $0.001.

As

a result of the Reverse Stock Split, the number of shares of common stock outstanding will be reduced from approximately 136.93 million

shares as of February 20, 2025 to approximately 2.74 million shares, and the number of authorized shares of common stock will remain at

300 million shares. As a result of the Reverse Stock Split, proportionate adjustments will be made to the per share exercise price and/or

the number of shares issuable upon the exercise or vesting of all outstanding stock options, restricted stock unit awards and warrants,

which will result in a proportional decrease in the number of shares of the Company’s common stock reserved for issuance upon exercise

or vesting of such stock options, restricted stock unit awards and warrants, and, in the case of stock options and warrants, a proportional

increase in the exercise price of all such stock options and warrants. In addition, the number of shares reserved for issuance under the

Company’s equity compensation plan immediately prior to the Effective Time will be reduced proportionately.

No

fractional shares will be issued as a result of the Reverse Stock Split. Stockholders of record who would otherwise be entitled to receive

a cash payment in lieu of such fractional share. The cash payment to be paid will be equal to the fraction of a share to which such holder

would otherwise be entitled multiplied by the closing price per share of common stock on the date of the effective time of the reverse

stock split, as reported by Nasdaq (as adjusted to give effect to the Reverse Stock Split).

The

Company’s common stock began trading on a Reverse Stock Split-adjusted basis on The Nasdaq Capital Market at the open of the markets

on February 21, 2025. The trading symbol for the common stock will remain “CNSP.” The Company’s post-Reverse Stock Split

common stock has a new CUSIP number (CUSIP No. 18978H409), but the par value and other terms of the common stock are not affected by the

Reverse Stock Split.

On

February 19, 2025, the Company issued a press release to announce the Reverse Stock Split. A copy of the press release is attached to

this report as Exhibit 99.1 and is incorporated by reference herein.

The

table below sets forth the impact of the Reverse Stock Split on the Company’s net loss per common share – basic and diluted;

weighted average common shares outstanding – basic and diluted; and shares issued and outstanding, for the years ended December

31, 2023 and 2022; the three months ended March 31, 2024 and 2023; the six months ended June 30, 2024 and 2023; and the nine months ended

September 30, 2024 and 2023:

| | |

PRE-SPLIT | | |

POST-SPLIT | |

| | |

12 Months Ended | | |

12 Months Ended | |

| | |

Dec 31, 2023 | | |

Dec 31, 2022 | | |

Dec 31, 2023 | | |

Dec 31, 2022 | |

| Net Loss | |

$ | (18,851,226 | ) | |

$ | (15,274,134 | ) | |

$ | (18,851,226 | ) | |

$ | (15,274,134 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 75,348 | | |

| 27,235 | | |

| 1,507 | | |

| 545 | |

| Diluted | |

| 75,348 | | |

| 27,235 | | |

| 1,507 | | |

| 545 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (250.19 | ) | |

$ | (560.83 | ) | |

$ | (12,509.11 | ) | |

$ | (28,025.93 | ) |

| Diluted | |

$ | (250.19 | ) | |

$ | (560.83 | ) | |

$ | (12,509.11 | ) | |

$ | (28,025.93 | ) |

| | |

PRE-SPLIT | | |

POST-SPLIT | |

| | |

3 Months Ended | | |

3 Months Ended | |

| | |

Mar 31, 2024 | | |

Mar 31, 2023 | | |

Mar 31, 2024 | | |

Mar 31, 2023 | |

| Net Loss | |

$ | (3,544,748 | ) | |

$ | (4,931,947 | ) | |

$ | (3,544,748 | ) | |

$ | (4,931,947 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 174,254 | | |

| 38,130 | | |

| 3,486 | | |

| 763 | |

| Diluted | |

| 174,254 | | |

| 38,130 | | |

| 3,486 | | |

| 763 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (20.34 | ) | |

$ | (129.35 | ) | |

$ | (1,016.85 | ) | |

$ | (6,463.89 | ) |

| Diluted | |

$ | (20.34 | ) | |

$ | (129.35 | ) | |

$ | (1,016.85 | ) | |

$ | (6,463.89 | ) |

| | |

PRE-SPLIT | | |

POST-SPLIT | |

| | |

3 Months Ended | | |

3 Months Ended | |

| | |

Jun 30, 2024 | | |

Jun 30, 2023 | | |

Jun 30, 2024 | | |

Jun 30, 2023 | |

| Net Loss | |

$ | (2,530,753 | ) | |

$ | (4,021,234 | ) | |

$ | (2,530,753 | ) | |

$ | (4,021,234 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 376,643 | | |

| 77,547 | | |

| 7,533 | | |

| 1,551 | |

| Diluted | |

| 376,643 | | |

| 77,547 | | |

| 7,533 | | |

| 1,551 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (6.72 | ) | |

$ | (51.86 | ) | |

$ | (335.96 | ) | |

$ | (2,592.67 | ) |

| Diluted | |

$ | (6.72 | ) | |

$ | (51.86 | ) | |

$ | (335.96 | ) | |

$ | (2,592.67 | ) |

| | |

PRE-SPLIT | | |

POST-SPLIT | |

| | |

6 Months Ended | | |

6 Months Ended | |

| | |

Jun 30, 2024 | | |

Jun 30, 2023 | | |

Jun 30, 2024 | | |

Jun 30, 2023 | |

| Net Loss | |

$ | (6,075,501 | ) | |

$ | (8,953,181 | ) | |

$ | (6,075,501 | ) | |

$ | (8,953,181 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 275,113 | | |

| 57,874 | | |

| 5,503 | | |

| 1,158 | |

| Diluted | |

| 275,113 | | |

| 57,874 | | |

| 5,503 | | |

| 1,158 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (22.08 | ) | |

$ | (154.70 | ) | |

$ | (1,104.03 | ) | |

$ | (7,731.59 | ) |

| Diluted | |

$ | (22.08 | ) | |

$ | (154.70 | ) | |

$ | (1,104.03 | ) | |

$ | (7,731.59 | ) |

| | |

PRE-SPLIT | | |

POST-SPLIT | |

| | |

3 Months Ended | | |

3 Months Ended | |

| | |

Sep 30, 2024 | | |

Sep 30, 2023 | | |

Sep 30, 2024 | | |

Sep 30, 2023 | |

| Net Loss | |

$ | (5,605,934 | ) | |

$ | (4,522,795 | ) | |

$ | (5,605,934 | ) | |

$ | (4,522,795 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 22,180,874 | | |

| 83,542 | | |

| 443,618 | | |

| 1,671 | |

| Diluted | |

| 22,180,874 | | |

| 83,542 | | |

| 443,618 | | |

| 1,671 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.25 | ) | |

$ | (54.14 | ) | |

$ | (12.64 | ) | |

$ | (2,706.64 | ) |

| Diluted | |

$ | (0.25 | ) | |

$ | (54.14 | ) | |

$ | (12.64 | ) | |

$ | (2,706.64 | ) |

| | |

PRE-SPLIT | | |

POST-SPLIT | |

| | |

9 Months Ended | | |

9 Months Ended | |

| | |

Sep 30, 2024 | | |

Sep 30, 2023 | | |

Sep 30, 2024 | | |

Sep 30, 2023 | |

| Net Loss | |

$ | (11,681,435 | ) | |

$ | (13,475,976 | ) | |

$ | (11,681,435 | ) | |

$ | (13,475,976 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 7,581,312 | | |

| 66,553 | | |

| 151,627 | | |

| 1,332 | |

| Diluted | |

| 7,581,312 | | |

| 66,553 | | |

| 151,627 | | |

| 1,332 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per Share | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (1.54 | ) | |

$ | (202.48 | ) | |

$ | (77.04 | ) | |

$ | (10,117.10 | ) |

| Diluted | |

$ | (1.54 | ) | |

$ | (202.48 | ) | |

$ | (77.04 | ) | |

$ | (10,117.10 | ) |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CNS Pharmaceuticals, Inc. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

/s/ Chris

Downs |

|

| |

|

Chris Downs |

|

| |

|

Chief Financial Officer |

|

| |

|

|

|

| Dated: February 21, 2025 |

|

|

|

Exhibit 99.1

CNS Pharmaceuticals Announces Reverse Stock

Split

HOUSTON, TX (February 19, 2025) –

CNS Pharmaceuticals, Inc. (NASDAQ: CNSP) (“CNS”

or the “Company”), a biopharmaceutical company specializing in the development of novel treatments for primary and metastatic

cancers in the brain and central nervous system, today announced a 1-for-50 reverse split of its common stock. Beginning on February 21,

2025, the Company’s common stock will continue to trade on The Nasdaq Capital Market (“Nasdaq”) on a split adjusted

basis under the trading symbol “CNSP”, but will trade under the following new CUSIP number: 18978H409. The reverse stock split

is primarily intended to increase the Company’s per share trading price and bring the Company into compliance with the Nasdaq’s

listing requirement regarding minimum share price.

As a result of the reverse stock split, every

50 shares of common stock issued and outstanding as of the effective date will be automatically combined into one share of common stock.

Outstanding warrants, equity-based awards and other outstanding equity rights will be proportionately adjusted by dividing the shares

of common stock underlying the securities by 50 and multiplying the exercise/conversion price, as the case may be, by 50. No fractional

shares will be issued if, as a result of the reverse stock split, a stockholder would otherwise become entitled to a fractional share

because the number of shares of common stock they hold before the reverse stock split is not evenly divisible by the split ratio. Instead,

each stockholder will be entitled to receive a cash payment in lieu of a fractional share. The par value of the common stock will remain

unchanged at $0.001 per share after the reverse split, and the number of authorized shares of common stock will remain at 300 million

shares. The reverse split affects all stockholders uniformly and will not alter any stockholder’s percentage interest in the Company’s

equity, except to the extent that the reverse split results in some stockholders owning a fractional share as described above.

About CNS Pharmaceuticals, Inc.

CNS Pharmaceuticals a clinical-stage pharmaceutical

company developing a pipeline of anti-cancer drug candidates for the treatment of primary and metastatic cancers of the brain and central

nervous system. The Company’s lead drug candidate, Berubicin, is a novel anthracycline and the first anthracycline to appear to

cross the blood-brain barrier. Berubicin is currently in development for the treatment of a number of serious brain and CNS oncology indications

including glioblastoma multiforme (GBM), an aggressive and incurable form of brain cancer.

For more information, please visit www.CNSPharma.com,

and connect with the Company on Twitter, Facebook,

and LinkedIn.

Forward-Looking Statements

Some of the statements in this press release are

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of 1995, which involve risks and uncertainties. Forward-looking statements in

this press release include, without limitation, the timing and completion of the reverse split. These statements relate to future events,

future expectations, plans and prospects. Although CNS believes the expectations reflected in such forward-looking statements are reasonable

as of the date made, expectations may prove to have been materially different from the results expressed or implied by such forward-looking

statements. CNS has attempted to identify forward-looking statements by terminology including ''believes,'' ''estimates,'' ''anticipates,''

''expects,'' ''plans,'' ''projects,'' ''intends,'' ''potential,'' ''may,'' ''could,'' ''might,'' ''will,'' ''should,'' ''approximately''

or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. These statements are

only predictions and involve known and unknown risks, uncertainties and other factors, including those discussed under Item 1A. "Risk

Factors" in CNS's most recently filed Form 10-K filed with the Securities and Exchange Commission ("SEC") and updated from

time to time in its Form 10-Q filings and in its other public filings with the SEC. Any forward-looking statements contained in this press

release speak only as of its date. CNS undertakes no obligation to update any forward-looking statements contained in this press release

to reflect events or circumstances occurring after its date or to reflect the occurrence of unanticipated events.

CONTACTS:

Investor Relations Contact

JTC Team, LLC

Jenene Thomas

833-475-8247

CNSP@jtcir.com

v3.25.0.1

Cover

|

Feb. 19, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 19, 2025

|

| Entity File Number |

001-39126

|

| Entity Registrant Name |

CNS Pharmaceuticals, Inc.

|

| Entity Central Index Key |

0001729427

|

| Entity Tax Identification Number |

82-2318545

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2100 West Loop South

|

| Entity Address, Address Line Two |

Suite 900

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77027

|

| City Area Code |

(800)

|

| Local Phone Number |

946-9185

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

CNSP

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

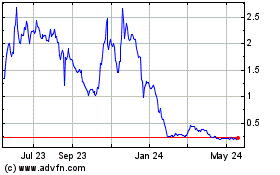

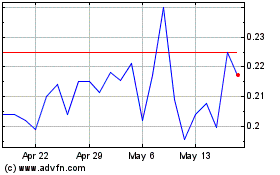

CNS Pharmaceuticals (NASDAQ:CNSP)

Historical Stock Chart

From Jan 2025 to Feb 2025

CNS Pharmaceuticals (NASDAQ:CNSP)

Historical Stock Chart

From Feb 2024 to Feb 2025