Canterbury Park Holding Corporation (“Canterbury” or the “Company”)

(Nasdaq: CPHC) today reported financial results for the fourth

quarter and full year ended December 31, 2024.

| |

| ($ in thousands,

except per share data and percentages) |

| |

|

|

|

| |

Three Months Ended December 31, |

|

Twelve months ended December 31, |

| |

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

|

Net revenues |

$11,978 |

|

|

$12,527 |

|

|

-4.4 |

% |

|

$61,562 |

|

|

$61,437 |

|

|

0.2 |

% |

| Net income(1) |

-$1,245 |

|

|

$1,364 |

|

|

-191.3 |

% |

|

$2,113 |

|

|

$10,563 |

|

|

-80.0 |

% |

| Adjusted EBITDA(2) |

$1,335 |

|

|

$2,051 |

|

|

-34.9 |

% |

|

$10,234 |

|

|

$10,446 |

|

|

-2.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Basic EPS(1) |

-$0.25 |

|

|

$0.28 |

|

|

-189.3 |

% |

|

$0.42 |

|

|

$2.15 |

|

|

-80.5 |

% |

| Diluted EPS(1) |

-$0.25 |

|

|

$0.27 |

|

|

-192.6 |

% |

|

$0.42 |

|

|

$2.13 |

|

|

-80.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Net income and basic and diluted EPS

for the twelve months ended December 31, 2024 include a $1.7

million gain to the transfer of land to a new joint venture. Net

income and basic and diluted EPS for the twelve months ended

December 31, 2023 include a $6.5 million gain on sale of

land.(2) Adjusted EBITDA, a non-GAAP measure, excludes

certain items from net income, a GAAP measure. Non-GAAP financial

measures are not intended to be considered in isolation from, a

substitute for, or superior to GAAP results. Definitions,

disclosures, and reconciliations of non-GAAP financial information

are included later in the release.

Management

Commentary“Throughout 2024, we focused on managing our

operations to address the evolution of our business and market. In

our seasonally slowest quarter, fourth quarter revenues of $12.0

million and adjusted EBITDA of $1.3 million, which together

resulted in an adjusted EBITDA margin of 11.1%, reflect the

efficacy of these efforts during a period when our Casino

operations faced a recent increase in competition,” said Randy

Sampson, President and Chief Executive Officer of Canterbury

Park.

“To address the increased Casino operations

competition, we are implementing several initiatives to further

elevate guest service and are expanding our marketing programs

beyond our traditional focus on existing customers to attract and

retain new customers. We also continue to introduce new table game

offerings to the market. Collectively, our goal is for these

efforts is to better position Canterbury as the gaming

entertainment venue with the best service and table game variety in

the region. We are also focused on further expanding the non-gaming

entertainment side of our business as we had more mid- and

large-scale events in 2024 than ever before, which drove higher

cash flow from Food & Beverage and Other operations. We expect

to accelerate this momentum in 2025 with more exciting events

planned than in prior years. As our business and market continue to

evolve, we are bringing additional attention to our expense control

strategies that are focused on creating more operating

efficiencies. We expect our collective revenue optimization and

expense control initiatives will help maintain our ability to again

deliver solid annual cash flow this year and beyond.

“Canterbury Commons is firmly positioned as a

premiere destination for living, playing and working that brings

consistently high levels of traffic and energy to the property.

With nearly 1,000 residential units, five restaurants and

breweries, two music and entertainment venues, 57,000 square-feet

of office space, and other distinct amenities already open or under

development, and another 50 acres available for future development,

we expect Canterbury Commons will create new long-term revenue

sources and positive economics for the Company.

“We remain focused on a range of strategies to

create long-term value for our shareholders, including significant

efforts to ensure Canterbury will benefit economically if online

sports betting is approved in Minnesota. We are well positioned for

the future as we generate consistent annual cash flow and have a

strong balance sheet with over $15 million in unrestricted cash and

short-term investments and nearly $19 million related to our tax

increment financing receivable. As we near the completion of both

our tax increment financing infrastructure and our barn relocation

and redevelopment plan, our capital expenditures will decline in

2025 compared to 2024 and further decline in 2026 to our historical

levels of between $2 to $3 million per year. Finally, we continue

to successfully unlock the significant value of our real estate

through the development of Canterbury Commons. Accordingly, we

believe that when considered collectively, these factors, along

with our return of capital initiative through our quarterly cash

dividend, are not reflected in our current valuation.”

Canterbury Commons Development

UpdateSwervo continues to make progress on the

construction of its state-of-the-art amphitheater. The Company’s

barn relocation and redevelopment plan is nearing completion with

over 300 new stalls completed and in operation, with the balance of

the planned backside improvements on schedule for completion prior

to the 2025 live racing season. Canterbury is also nearing

completion of the road adjacent to the amphitheater which will

unlock the development potential of roughly 25 acres of land in

that portion of the site.

Residential and commercial construction updates

related to joint ventures include:

- Phase II of The Doran Group’s

upscale Triple Crown Residences at Canterbury Park has leased 87%

of its available units.

- Repairs on Phase I of the Triple

Crown Residences were fully completed in late 2024 and a

certificate of occupancy was granted in February 2025.

- 80% of the 147 units of senior

market rate apartments at The Omry at Canterbury are leased.

- The pizza restaurant, fitness

center and BBQ restaurant in the 10,000 square-foot commercial

building within the Winners Circle development are all open.

- Construction of an additional

28,000 square-foot commercial office building within the Winners

Circle development is ongoing. The primary user has 50% of the

space under lease and discussions are ongoing with other potential

tenants.

- The Company’s joint venture

partner, Trackside Holdings, LLC, continues to make progress with

construction of an approximately 16,000 square foot project on 3.5

acres of trackside land that will house a new music venue,

restaurant and bar in the spring of 2025.

Residential and commercial construction updates

related to prior land sales include:

- Pulte Homes of Minnesota continues

development on the 45-unit second phase of its row home and

townhome residences.

Developer and partner selection for the

remaining 50 acres of Canterbury Commons, including 25 acres that

will become available for development following the completion of

the new road noted above, continues. Additional uses could include

office, retail, hotel and restaurants.

Summary of 2024 Fourth Quarter Operating

ResultsNet revenues for the three months ended December

31, 2024 were $12.0 million, compared to $12.5 million for the same

period in 2023. Compared to the prior-year period, Casino revenue

declined 4.9% primarily due to increased competition in the market

for certain games offered at Canterbury. Pari-mutuel revenue

declined 9.5%, primarily due to lower simulcasting handle. Food

& Beverage and Other revenue increased 1.7% and 2.0%,

respectively, year-over-year.

Operating expenses for the three months ended

December 31, 2024 increased slightly to $12.1 from $11.9 million

for the same period in 2023. The year-over-year increase primarily

reflects increased salaries and benefits, due primarily to annual

wage increases, and increased depreciation expenses, due to placing

assets into service related to the first and second phases of the

Company’s barn relocation and redevelopment plan, partially offset

by lower advertising and marketing expenses, reflecting proactive

efforts to lower overall costs.

The Company recorded a loss from equity

investment of $2.1 million for the three months ended December 31,

2024 primarily related to the Company’s share of depreciation,

amortization and interest expense from the Doran Canterbury joint

ventures. For the three months ended December 31, 2023, the Company

recorded income from equity investment of $939,000 related to a

gain recognized on insurance proceeds received by Doran Canterbury

I.

The Company recorded an income tax benefit of

$440,000 for the three months ended December 31, 2024 compared to

income tax expense of $708,000 for the three months ended December

31, 2023. The Company recorded a net loss of $1.2 million, or $0.25

per diluted share for the three months ended December 31, 2024,

compared to net income and diluted earnings per share for the three

months ended December 31, 2023 of $1.4 million and $0.27 per share,

respectively.

Adjusted EBITDA, a non-GAAP measure, for the

three months ended December 31, 2024 and December 31, 2023 was $1.3

million and $2.1 million, respectively.

Summary of 2024 Full-Year Operating

ResultsNet revenues for the twelve months ended December

31, 2024 were $61.6 million, compared to $61.4 million for the same

period in 2023. Casino revenues were $38.8 million for the 2024

full year period compared to $39.8 million for the same period in

2023 partially reflecting the increased competition in the market

noted above. Pari-mutuel revenues were $8.2 million for the 2024

full year period and $8.3 million in for the same period in 2023.

Full year Food & Beverage and Other revenues both increased in

2024 to $8.0 million and $6.6 million, respectively, from $7.8

million and $5.6 million, respectively in 2023. The increase in

Food & Beverage and Other revenues reflects increased catering

operations and admissions revenues, respectively, related to

Canterbury’s hosting of new large scale special events in 2024.

Operating expenses for the twelve months ended

December 31, 2024 were $56.9 million, a slight increase from

operating expenses of $56.4 million for 2023. The year-over-year

increase reflects higher depreciation and amortization, due to

service upgrades for the Company’s barns and backside, and higher

salaries and benefits expenses, primarily due to annual wage

increases, which more than offset lower advertising and marketing

and professional and contracted services expenses as compared to

2023.

The Company recorded a $1.7 million gain on the

transfer of approximately 3.5 acres of land to a new joint venture

during the twelve months ended December 31, 2024. The Company

recorded a gain on sale of land of $6.5 million related to the sale

of 37 acres to Swervo during the twelve months ended December 31,

2023.

The Company recorded a loss from equity

investment of $5.5 million for the twelve months ended December 31,

2024 compared to a gain from equity investment of $1.5 million for

the twelve months ended December 31, 2023. The net loss for the

twelve month period ended December 31, 2024 is related to the

Company’s share of depreciation, amortization and interest expense

from the Doran Canterbury joint ventures, while the net gain for

the same period a year ago is related to a gain recognized on

insurance proceeds received by Doran Canterbury I related to an

outstanding claim.

The Company recorded income tax expense of $0.9

million for the twelve months ended December 31, 2024 compared to

income tax expense of $4.4 million for the twelve months ended

December 31, 2023.

The Company recorded net income of $2.1 million

and diluted earnings per share of $0.42 for the twelve months ended

December 31, 2024, compared to net income and diluted earnings per

share for the twelve months ended December 31, 2023 of $10.6

million and $2.13 per share, respectively.

Adjusted EBITDA was $10.2 million for the twelve

months ended December 31, 2024 compared with $10.4 million for the

same period in 2023.

Additional Financial

InformationFurther financial information for the fourth

quarter and full-year ended December 31, 2024, is presented in the

accompanying tables at the end of this press release. Additional

information will be provided in the Company’s Annual Report on Form

10-K that will be filed with the Securities and Exchange Commission

on or about March 11, 2025.

Use of Non-GAAP Financial

MeasuresTo supplement our financial statements, we also

provide investors with information about our EBITDA and Adjusted

EBITDA, each of which is a non-GAAP measure, and which exclude

certain items from net income, a GAAP measure. We define EBITDA as

earnings before interest, taxes, depreciation and amortization. We

define Adjusted EBITDA as earnings before interest income (net of

interest expense), income tax expense, depreciation and

amortization, as well as excluding stock-based compensation (which

includes our 401(k) match expense as this match occurs in Company

stock), gain on insurance proceeds relating to equity investments,

gain on disposal of assets, gain on the transfer or sale of land,

depreciation and amortization related to equity investments, and

interest expense related to equity investments. We define Adjusted

EBITDA margin as Adjusted EBITDA as a percentage of net revenues.

Neither EBITDA, Adjusted EBITDA, or Adjusted EBITDA margin are

measures of performance calculated in accordance with generally

accepted accounting principles ("GAAP"), and should not be

considered an alternative to, or more meaningful than, net income

as an indicator of our operating performance. See the table below,

which presents reconciliations of these measures to the GAAP

equivalent financial measure, which is net income. We have

presented EBITDA as a supplemental disclosure because we believe

that, when considered with measures calculated in accordance with

GAAP, EBITDA gives investors a more complete understanding of our

operating results before the impact of investing and financing

transactions and income taxes, and it is a widely used measure of

performance and basis for valuation of companies in our industry.

Other companies that provide EBITDA information may calculate

EBITDA or Adjusted EBITDA differently than we do. We have presented

Adjusted EBITDA as a supplemental disclosure because we believe it

enables investors to understand and assess our core operating

results excluding the effect of these items and is useful to

investors in allowing greater transparency related to a significant

measure used by management in its financial and operational

decision-making. Adjusted EBITDA has economic substance because it

is used by management as a performance measure to analyze the

performance of our business and provides a perspective on the

current effects of operating decisions.

About Canterbury ParkCanterbury

Park Holding Corporation (Nasdaq: CPHC) owns and operates

Canterbury Park Racetrack and Casino in Shakopee, Minnesota, the

only thoroughbred and quarter horse racing facility in the State.

The Company generally offers live racing from May to September. The

Casino hosts card games 24 hours a day, seven days a week, dealing

both poker and table games. The Company also conducts year-round

wagering on simulcast horse racing and hosts a variety of other

entertainment and special events at its Shakopee facility. The

Company is also pursuing a strategy to enhance shareholder value by

the ongoing development of approximately 140 acres of underutilized

land surrounding the Racetrack that was originally designated for a

project known as Canterbury Commons™. The Company is pursuing

several mixed-use development opportunities for the remaining

underutilized land, directly and through joint ventures. For more

information about the Company, please visit

www.canterburypark.com.

Cautionary StatementFrom time

to time, in reports filed with the Securities and Exchange

Commission, in press releases, and in other communications to

shareholders or the investing public, we may make forward-looking

statements concerning possible or anticipated future financial

performance, business activities or plans. These statements are

typically preceded by the words “believes,” “expects,”

“anticipates,” “intends” or similar expressions. For these

forward-looking statements, we claim the protection of the safe

harbor for forward-looking statements contained in federal

securities laws. Shareholders and the investing public should

understand that these forward-looking statements are subject to

risks and uncertainties which could affect our actual results and

cause actual results to differ materially from those indicated in

the forward-looking statements. We report these risks and

uncertainties in our Annual Report on Form 10-K for the year ended

December 31, 2024 filed with the SEC and subsequently filed

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

They include, but are not limited to: we may not be successful in

implementing our growth strategy; sensitivity to reductions in

discretionary spending as a result of downturns in the economy and

other factors; we have experienced a decrease in revenue and

profitability from live racing; challenges in attracting a

sufficient number of horses and trainers; a lack of confidence in

core operations resulting in decreasing customer retention and

engagement; personal injury litigation due to the inherently

dangerous nature of horse racing; material fluctuations in

attendance at the Racetrack; material changes in the level of

wagering by patrons; any decline in interest in horse racing or the

unbanked card games offered in the Casino; competition from other

venues offering racing, unbanked card games or other forms of

wagering; competition from other sports and entertainment options;

increases in compensation and employee benefit costs; the impact of

wagering products and technologies introduced by competitors; the

general health of the gaming sector; legislative and regulatory

decisions and changes; our ability to successfully develop our real

estate, including the effect of competition on our real estate

development operations and our reliance on our current and future

development partners; our obligation to make improvements in the

TIF district that will only be reimbursed to the extent of future

tax revenue; temporary disruptions or changes in access to our

facilities caused by ongoing infrastructure improvements; inclement

weather and other conditions affecting the ability to conduct live

racing; technology and/or key system failures; cybersecurity

incidents; the general effects of inflation; our ability to attract

and retain qualified personnel; dividends that may or may not be

issued at the discretion of our Board of Directors; and other

factors that are beyond our ability to control or predict.

The forward-looking statements in this press

release speak only as of the date of this press release. Except as

required by law, Canterbury assumes no obligation to update or

revise these forward-looking statements for any reason, even if new

information becomes available in the future.

|

|

|

|

Investor Contacts: |

|

|

Randy Dehmer |

Richard Land, Jim Leahy |

|

Senior Vice President and Chief Financial Officer |

JCIR |

|

Canterbury Park Holding Corporation |

212-835-8500 or cphc@jcir.com |

|

952-233-4828 or investorrelations@canterburypark.com |

|

|

|

|

- Financial tables follow -

| |

|

CANTERBURY PARK HOLDING CORPORATION'S |

|

SUMMARY OF OPERATING RESULTS |

| |

|

|

|

| |

Three months ended |

|

Twelve months ended |

| |

December 31, |

|

December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Operating Revenues: |

|

|

|

|

|

|

|

|

Casino |

$8,994,643 |

|

|

$9,459,017 |

|

|

$38,774,702 |

|

|

$39,781,166 |

|

|

Pari-mutuel |

1,125,731 |

|

|

1,243,905 |

|

|

8,226,047 |

|

|

8,253,615 |

|

|

Food and Beverage |

1,038,071 |

|

|

1,020,738 |

|

|

7,968,157 |

|

|

7,828,980 |

|

|

Other |

819,092 |

|

|

803,403 |

|

|

6,593,382 |

|

|

5,573,097 |

|

|

Total Net Revenues |

11,977,537 |

|

|

12,527,063 |

|

|

61,562,288 |

|

|

61,436,858 |

|

| Operating Expenses |

(12,075,269 |

) |

|

(11,939,193 |

) |

|

(56,861,654 |

) |

|

(56,425,975 |

) |

| Gain on Transfer/Sale of

Land |

- |

|

|

- |

|

|

1,732,353 |

|

|

6,489,976 |

|

| (Loss) Income from

Operations |

(97,732 |

) |

|

587,870 |

|

|

6,432,987 |

|

|

11,500,859 |

|

| Other (Loss) Income, net |

(1,587,787 |

) |

|

1,484,047 |

|

|

(3,396,260 |

) |

|

3,479,390 |

|

| Income Tax Benefit

(Expense) |

440,116 |

|

|

(708,000 |

) |

|

(923,885 |

) |

|

(4,417,000 |

) |

| Net Income |

$(1,245,403 |

) |

|

$1,363,917 |

|

|

$2,112,842 |

|

|

$10,563,249 |

|

| Basic Net Income Per Common

Share |

($0.25 |

) |

|

$0.28 |

|

|

$0.42 |

|

|

$2.15 |

|

| Diluted Net Income Per Common

Share |

($0.25 |

) |

|

$0.27 |

|

|

$0.42 |

|

|

$2.13 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED

EBITDA |

| |

|

|

|

|

|

|

|

| |

Three months ended |

|

Twelve months ended |

| |

December 31, |

|

December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

NET INCOME |

($1,245,403 |

) |

|

$1,363,917 |

|

|

$2,112,842 |

|

|

$10,563,249 |

|

|

Interest income, net |

(478,835 |

) |

|

(544,769 |

) |

|

(2,071,511 |

) |

|

(1,978,122 |

) |

|

Income tax (benefit) expense |

(440,116 |

) |

|

708,000 |

|

|

923,885 |

|

|

4,417,000 |

|

|

Depreciation and amortization |

944,807 |

|

|

837,100 |

|

|

3,620,899 |

|

|

3,145,372 |

|

| EBITDA |

(1,219,547 |

) |

|

2,364,248 |

|

|

4,586,115 |

|

|

16,147,499 |

|

|

Stock-based compensation |

372,932 |

|

|

335,817 |

|

|

1,447,009 |

|

|

1,378,373 |

|

|

Gain on insurance proceeds related to equity investments |

- |

|

|

(1,698,800 |

) |

|

- |

|

|

(4,227,701 |

) |

|

Loss on disposal of assets |

55,714 |

|

|

176,425 |

|

|

49,214 |

|

|

157,160 |

|

|

Gain on transfer/sale of land |

- |

|

|

- |

|

|

(1,732,353 |

) |

|

(6,489,976 |

) |

|

Depreciation and amortization related to equity investments |

1,415,230 |

|

|

439,270 |

|

|

3,086,695 |

|

|

1,753,256 |

|

|

Interest expense related to equity investments |

711,109 |

|

|

434,186 |

|

|

2,796,932 |

|

|

1,727,192 |

|

| ADJUSTED EBITDA |

$1,335,438 |

|

|

$2,051,146 |

|

|

$10,233,612 |

|

|

$10,445,803 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

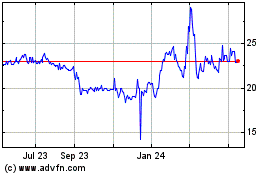

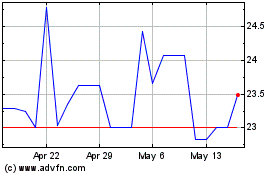

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Feb 2025 to Mar 2025

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Mar 2024 to Mar 2025