CorMedix Inc. (Nasdaq: CRMD), a biopharmaceutical company focused

on developing and commercializing therapeutic products for the

prevention and treatment of life-threatening diseases and

conditions, today announced financial results for the fourth

quarter and full year ended December 31, 2023 and provided an

update on its business.

Recent Corporate Highlights:

- On November 15,

2023, CorMedix received FDA approval for its new drug application

(NDA) for DefenCath® (taurolidine and heparin). DefenCath is a

catheter lock solution indicated to reduce the incidence of

catheter-related bloodstream infections (CRBSIs) for the limited

population of adult patients with kidney failure receiving chronic

hemodialysis (HD) through a central venous catheter (CVC).

- The Company

received an outpatient reimbursement determination for DefenCath

from the Center for Medicare & Medicaid Services (CMS), which

confirmed that DefenCath is eligible to receive a Transitional Drug

Add-on Payment, or TDAPA, under the End Stage Renal Disease

Prospective Payment System (ESRD PPS). CorMedix’s TDAPA application

remains under review, and CMS has confirmed that it is working

toward a July 1st effective implementation for TDAPA. Pending a

timely implementation of TDAPA, CorMedix intends to launch in the

outpatient setting in July 2024.

- CorMedix has

intensified preparations for commercial launch, has staffed and

trained experienced field sales and medical affairs organizations,

and remains on schedule to begin commercialization in the inpatient

setting on April 15, 2024.

- The Company is

in the process of ramping up inventory production to meet

anticipated demand, and remains on track to file with the FDA a

supplement to the DefenCath NDA adding an alternate manufacturing

site for finished dosage in April.

- CorMedix is

targeting by the end of the first quarter to submit a post-approval

meeting request to FDA with the objective of aligning with the

agency on a clinical pathway for an expanded label at a proposed

mid-year meeting.

- Cash and

short-term investments, excluding restricted cash, at December 31,

2023 amounted to $76.0 million.

Joe Todisco, CorMedix CEO, commented, “I am

excited about the Company’s recent progress as we have scaled up

activity ahead of our commercial launch in April. We have received

significant inbound interest from both inpatient facilities as well

as outpatient dialysis providers with respect to DefenCath, and we

are actively engaged in customer discussions in both settings of

care. I remain optimistic about the commercial potential for

DefenCath, and the product’s ability to have a meaningful impact on

CRBSI rates across the continuum of care in hemodialysis patients

with CVCs.”

4th

Quarter and Full Year 2023 Financial

Highlights

For the fourth quarter of 2023, CorMedix

recorded a net loss of $14.8 million, or $0.26 per share, compared

with a net loss of $8.2 million, or $0.20 per share, in the fourth

quarter of 2022. The increase in net loss in the fourth quarter of

2023 compared with 2022 was primarily driven by increases in costs

related to market research studies and pre-launch activities for

DefenCath and increases in personnel expenses due to new hires in

2023 compared to the same period in 2022. Operating expenses during

the fourth quarter of 2023 were $15.7 million, compared with $8.4

million in the fourth quarter of 2022, an increase of approximately

$7.3 million.

For the year ended December 31, 2023, CorMedix

recorded a net loss of $46.3 million, or $0.91 per share, compared

with a net loss during the year ended December 31, 2022 of $29.7

million, or $0.74 per share. The increase in net loss was driven

primarily by increases in operating expenses, primarily due to

increased pre-launch commercial activities for DefenCath.

Operating expenses during the year ended

December 31, 2023 amounted to $49.0 million compared with $30.7

million during the comparable period in 2022, an increase of $18.3

million, or 60%, due to a 79% increase and 23% increase in SG&A

expense and R&D expense, respectively.

Total cash on hand, cash equivalents and

short-term investments as of December 31, 2023 amounted to $76.0

million, excluding restricted cash of $0.2 million. The Company

believes that it has sufficient resources to fund operations for at

least twelve months from the issuance of its Annual Report on Form

10-K.

Conference Call Information

The management team of CorMedix will host a

conference call and webcast today, March 12, 2023, at 8:30 AM

Eastern Time, to discuss recent corporate developments and

financial results. Call details and dial-in information is as

follows:

Tuesday, March 12th @

8:30am ET

|

Domestic:

International: Conference ID:Webcast:

|

1-888-886-77861-416-764-865808695074Webcast Link |

DefenCath® (taurolidine and

heparin)IMPORTANT SAFETY

INFORMATION

This brief summary does not include all the information needed

to use DefenCath safely and effectively. Please see the full

Prescribing Information for more information.

LIMITED POPULATION: DefenCath is indicated to

reduce the incidence of catheter-related bloodstream infections

(CRBSI) in adult patients with kidney failure receiving chronic

hemodialysis (HD) through a central venous catheter (CVC). This

drug is indicated for use in a limited and specific population of

patients.

DefenCath is contraindicated and has warnings and precautions in

patients with:

- Known heparin-induced thrombocytopenia (HIT).

- Known hypersensitivity to any drug products in DefenCath,

including taurolidine, heparin or the citrate excipient or pork

products.

If exposure to either of the above occurs, discontinue use of

DefenCath and institute appropriate supportive measures.

The most frequently reported adverse reactions occurring in ≥2%

of patients using DefenCath as a CLS were hemodialysis catheter

malfunction, hemorrhage/bleeding, nausea, vomiting, dizziness,

musculoskeletal chest pain, and thrombocytopenia.

To report any safety concerns including suspected adverse

reactions, contact CorMedix Inc. at 1-888-424-6345 or FDA at

1-800-FDA-1088 or visit www.fda.gov/medwatch.

About CorMedix

CorMedix Inc. is a biopharmaceutical company

focused on developing and commercializing therapeutic products for

the prevention and treatment of life-threatening conditions and

diseases. The Company is focused on commercializing its lead

product DefenCath®, a non-antibiotic, antimicrobial catheter lock

solution approved to reduce the incidence of catheter-related

bloodstream infections in the limited population of adult patients

with kidney failure receiving chronic hemodialysis through a

central venous catheter. DefenCath was approved by the FDA on

November 15, 2023. CorMedix anticipates the commercial launch of

DefenCath in inpatient settings in April 2024 and in outpatient

settings in July 2024, pending a timely implementation of TDAPA.

CorMedix also intends to develop DefenCath as a catheter lock

solution for use in other patient populations. For more information

visit: www.cormedix.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that are subject to risks and uncertainties.

Forward-looking statements are often identified by the use of words

such as, but not limited to, “anticipate,” “believe,” “can,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “will,”

“plan,” “project,” “seek,” “should,” “target,” “will,” “would,” and

similar expressions or variations intended to identify

forward-looking statements. All statements, other than statements

of historical facts, regarding management’s expectations, beliefs,

goals, plans or CorMedix’s prospects, including, but not limited

to, statements regarding the commercial launch of DefenCath, the

timing of availability of DefenCath for inpatient and outpatient

settings, DefenCath receipt of TDAPA, CMS implementation of TDAPA

in July 2024, the interest in DefenCath by health systems, the

ability to manufacture sufficient DefenCath for commercial launch,

CorMedix’s future financial position, financing plans, future

revenues, projected costs and the sufficiency of our cash and

short-term investments to fund our operations, including the

commercial launch of DefenCath, should be considered

forward-looking statements. Readers are cautioned that actual

results may differ materially from projections or estimates due to

a variety of important factors, and readers are directed to the

Risk Factors identified in CorMedix’s filings with the SEC,

including its Annual Report on Form 10-K and its Quarterly Reports

on Form 10-Q, copies of which are available free of charge at the

SEC’s website at www.sec.gov or upon request from CorMedix.

CorMedix may not actually achieve the goals or plans described in

its forward-looking statements, and such forward-looking statements

speak only as of the date of this press release. Investors should

not place undue reliance on these statements. CorMedix assumes no

obligation and does not intend to update these forward-looking

statements, except as required by law.

Investor Contact:Dan FerryManaging

DirectorLifeSci Advisors(617) 430-7576

|

CORMEDIX INC. AND SUBSIDIARIESCONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(LOSS)(Audited) |

|

|

| |

|

For the Three Months Ended December 31, |

|

For the Years Ended December

31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

Net sales |

$ |

- |

|

|

$ |

29,702 |

|

|

$ |

- |

|

|

$ |

65,408 |

|

| Cost of

sales |

|

- |

|

|

|

(406 |

) |

|

|

- |

|

|

|

(3,734 |

) |

|

Gross profit (loss) |

|

- |

|

|

|

29,296 |

|

|

|

- |

|

|

|

61,674 |

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

(2,288,889 |

) |

|

|

(2,843,222 |

) |

|

|

(13,155,125 |

) |

|

|

(10,679,549 |

) |

|

Selling, general and administrative |

|

(13,379,854 |

) |

|

|

(5,575,302 |

) |

|

|

(35,802,663 |

) |

|

|

(20,006,093 |

) |

|

Total Operating Expenses |

|

(15,668,743 |

) |

|

|

(8,418,524 |

) |

|

|

(48,957,788 |

) |

|

|

(30,685,642 |

) |

|

Income (loss) From Operations |

|

(15,668,743 |

) |

|

|

(8,389,228 |

) |

|

|

(48,957,788 |

) |

|

|

(30,623,968 |

) |

|

Other Income (Expense): |

|

|

|

|

|

|

|

|

|

Interest income |

|

920,042 |

|

|

|

183,506 |

|

|

|

2,681,851 |

|

|

|

326,016 |

|

|

Foreign exchange transaction gain (loss) |

|

1,227 |

|

|

|

5,547 |

|

|

|

(28,994 |

) |

|

|

37,145 |

|

|

Interest expense |

|

(6,556 |

) |

|

|

(8,776 |

) |

|

|

(34,296 |

) |

|

|

(26,515 |

) |

|

Total Other Income (Expense) |

|

914,713 |

|

|

|

180,277 |

|

|

|

2,618,561 |

|

|

|

336,646 |

|

|

Net Loss Before Income Taxes |

|

(14,754,030 |

) |

|

|

(8,208,951 |

) |

|

|

(46,339,227 |

) |

|

|

(30,287,322 |

) |

|

Tax benefit |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

585,617 |

|

|

Net Loss |

|

(14,754,030 |

) |

|

|

(8,208,951 |

) |

|

|

(46,339,227 |

) |

|

|

(29,701,705 |

) |

|

Other Comprehensive Income (Loss) |

|

9,710 |

|

|

|

36,971 |

|

|

|

11,365 |

|

|

|

(4,387 |

) |

|

Comprehensive Loss |

$ |

(14,744,320 |

) |

|

$ |

(8,171,980 |

) |

|

$ |

(46,327,862 |

) |

|

$ |

(29,706,092 |

) |

|

Net Income (Loss) Per Common Share – Basic and

Diluted |

$ |

(0.26 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.91 |

) |

|

$ |

(0.74 |

) |

|

Weighted Average Common Shares Outstanding – Basic and

Diluted |

|

57,393,542 |

|

|

|

41,855,056 |

|

|

|

50,902,931 |

|

|

|

40,274,273 |

|

|

|

|

CORMEDIX INC. AND SUBSIDIARIESCONSOLIDATED BALANCE

SHEETS(Audited) |

|

|

| |

|

December 31, |

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

| ASSETS |

|

|

|

|

Cash, cash equivalents and restricted cash |

$ |

43,823,192 |

|

|

$ |

43,374,745 |

|

| Short-term investments |

$ |

32,388,130 |

|

|

$ |

15,644,062 |

|

| Total

Assets |

$ |

82,059,957 |

|

|

$ |

62,038,259 |

|

|

|

|

|

|

|

| Total

Liabilities |

$ |

11,917,528 |

|

|

$ |

6,978,523 |

|

| Accumulated deficit |

$ |

(321,700,013 |

) |

|

$ |

(275,360,786 |

) |

| Total Stockholders’

Equity |

$ |

70,142,429 |

|

|

$ |

55,059,736 |

|

|

|

|

CORMEDIX INC. AND SUBSIDIARIESCONSOLIDATED

STATEMENTS OF CASH FLOWS(Audited) |

|

|

| |

Years Ended December 31, |

|

|

2023 |

|

2022 |

|

|

|

|

|

| Cash Flows From

Operating Activities: |

|

|

|

|

Net loss |

$ |

(46,339,227 |

) |

|

$ |

(29,701,705 |

) |

| Net cash used in operating

activities |

|

(38,409,480 |

) |

|

|

(24,356,732 |

) |

| Cash Flows From

Investing Activities: |

|

|

|

| Net cash used in investing

activities |

|

(17,061,685 |

) |

|

|

(3,709,364 |

) |

| Cash Flows From

Financing Activities: |

|

|

|

| Net cash provided by financing

activities |

|

55,916,804 |

|

|

|

17,898,241 |

|

| Foreign exchange effects on

cash |

|

2,808 |

|

|

|

(8,677 |

) |

| Net Increase

(Decrease) in Cash and Cash Equivalents |

|

448,447 |

|

|

|

(10,176,532 |

) |

| Cash and Cash

Equivalents and Restricted Cash - Beginning of Period |

|

43,374,745 |

|

|

|

53,551,277 |

|

| Cash and Cash

Equivalents and Restricted Cash - End of Period |

$ |

43,823,192 |

|

|

$ |

43,374,745 |

|

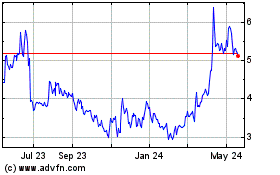

CorMedix (NASDAQ:CRMD)

Historical Stock Chart

From Mar 2025 to Apr 2025

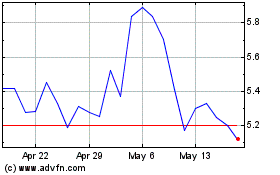

CorMedix (NASDAQ:CRMD)

Historical Stock Chart

From Apr 2024 to Apr 2025