false

0001410098

0001410098

2024-05-09

2024-05-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 9, 2024

CORMEDIX INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-34673 |

|

20-5894890 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

300 Connell Drive, Suite 4200

Berkeley Heights, NJ |

|

07922 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area

code: (908) 517-9500

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2, below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, $0.001 par value |

|

CRMD |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On May 9, 2024, CorMedix Inc. (the “Company”)

issued a press release announcing its financial results for the first quarter ended March 31, 2024. A copy of the press release is furnished

as Exhibit 99.1 to this report.

The information in this Item 2.02 (including Exhibit

99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”)

or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CORMEDIX INC. |

| |

|

|

| Date: May 9, 2024 |

By: |

/s/ Joseph Todisco |

| |

Name: |

Joseph Todisco |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

CorMedix

Inc. Reports First Quarter 2024 Financial Results and Provides Business Update

Conference

Call Scheduled for Today at 8:30 a.m. Eastern Time

Berkeley Heights,

NJ – May 9, 2024 – CorMedix Inc. (Nasdaq: CRMD), a biopharmaceutical company focused on developing and commercializing

therapeutic products for life-threatening diseases and conditions, today announced financial results for the first quarter ended March

31, 2024 and provided an update on its business.

Recent Corporate Highlights:

| ● | On April 2, 2024, CMS published its HCPCS coding decision for DefenCath, establishing a new HCPCS Level

II code for the product. CMS subsequently notified the Company on April 18th of its determination that DefenCath meets the

criteria for a Transitional Drug Add-On Payment (TDAPA) and will be effective July 1, 2024. The TDAPA program currently provides for five

years of additional payment reimbursement beyond the ESRD bundled rate to outpatient providers. |

| ● | On April 15, 2024, the Company commenced commercial launch of DefenCath® in the inpatient setting,

and remains on schedule to commence outpatient launch in July. |

| ● | The Company announced in April that it entered into a 5-year commercial supply contract with ARC Dialysis,

LLC, a Florida-based dialysis provider, for the supply of DefenCath. |

| ● | The FDA granted the Company’s Type C meeting request to discuss an updated development plan for

DefenCath in Total Parenteral Nutrition (TPN) and pediatric study requirements. The Company expects to receive feedback from the FDA by

the end of the second quarter of 2024. |

| ● | The Company submitted to FDA earlier this week a supplement to the CorMedix NDA adding Siegfried Hameln

as an alternate finished dosage manufacturing site for DefenCath. Pending FDA review and approval, the Company anticipates approval of

the supplement by the end of 2024. |

| ● | Cash and short-term investments, excluding restricted cash, at March 31, 2024, amounted to $58.6 million. |

Joe Todisco, CorMedix

CEO, commented, “I am excited about the Company’s recent progress as we have officially transitioned to a commercial stage

organization. In only a few weeks of inpatient deployment we have received meaningful interest in scheduling DefenCath for formulary review

at various institutions, and we look forward to additional progress in the coming months. We are also focusing simultaneously on our upcoming

outpatient launch and actively engaging with customers regarding the potential to implement DefenCath as a preventative measure to reduce

the risk of CRBSI in their respective hemodialysis patients with CVCs.”

First Quarter 2024 Financial Highlights

For the first quarter of 2024, CorMedix recorded

a net loss of $14.5 million, or $0.25 per share, compared with a net loss of $10.6 million, or $0.24 per share, in the first quarter of

2023, an increase of $3.9 million, driven primarily by an increase in operating expenses, partially offset by the sale of New Jersey NOLs

for $1.4 million.

Operating expenses in the first quarter 2024 were

$15.9 million, compared with $11.0 million in the first quarter of 2023, an increase of approximately 44%. The increase was driven

by higher SG&A expenses which increased approximately 98% to $15.0 million, partially offset by a decrease in research and development

expenses of approximately 75%. The increase in SG&A was primarily driven by the hiring of sales force, medical affairs and marketing

personnel. Additionally, as a result of the post FDA approval commercial operations, costs related to medical affairs and certain personnel

expenses that supported R&D efforts prior to the FDA approval of DefenCath have been recognized in selling, general and administrative

expense during the three months ended March 31, 2024, as compared to the same period last year during which these items were recognized

in R&D, which drove the decrease in R&D expenses for this period compared to the same period last year.

The Company reported cash and short-term investments

of $58.6 million at March 31, 2024, excluding restricted cash. The Company believes that it has sufficient resources to fund operations

for at least twelve months from the issuance of the Company’s Quarterly Report on Form 10-Q.

Conference Call Information

The management team

of CorMedix will host a conference call and webcast today, May 9, 2024, at 8:30am Eastern Time, to discuss recent corporate

developments and financial results. Call details and dial-in information are as follows:

| Thursday, May 9th @ 8:30am ET |

| Domestic: |

1-888-886-7786 |

| International: |

1-416-764-8658 |

| Conference ID: |

32817785 |

| Webcast: |

Webcast Link |

About CorMedix

CorMedix Inc. is a biopharmaceutical company focused

on developing and commercializing therapeutic products for the prevention and treatment of life-threatening conditions and diseases. The

Company is focused on commercializing its lead product DefenCath®, which was approved by the FDA on November 15, 2023 and launched

in inpatient settings in April 2024. CorMedix anticipates the commercial launch of DefenCath in outpatient settings in July 2024. CorMedix

also intends to develop DefenCath as a catheter lock solution for use in other patient populations. For more information visit:

www.cormedix.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are subject to risks and uncertainties. Forward-looking

statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “will,”

“plan,” “project,” “seek,” “should,” “target,” “will,” “would,”

and similar expressions or variations intended to identify forward-looking statements. All statements, other than statements of historical

facts, regarding management’s expectations, beliefs, goals, plans or CorMedix’s prospects should be considered forward-looking

statements. Readers are cautioned that actual results may differ materially from projections or estimates due to a variety of important

factors, and readers are directed to the Risk Factors identified in CorMedix’s filings with the SEC, including its Annual Report

on Form 10-K and its Quarterly Reports on Form 10-Q, copies of which are available free of charge at the SEC’s website at www.sec.gov

or upon request from CorMedix. CorMedix may not actually achieve the goals or plans described in its forward-looking statements, and such

forward-looking statements speak only as of the date of this press release. Investors should not place undue reliance on these statements.

CorMedix assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

Investor Contact:

Dan Ferry

Managing Director

LifeSci Advisors

daniel@lifesciadvisors.com

(617) 430-7576

CorMedix

Inc. and SubsidiarIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

AND COMPREHENSIVE LOSS

(Unaudited)

| |

|

For the Three

Months Ended

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Revenue |

|

|

|

|

|

|

| Revenue, net |

|

$ |

- |

|

|

$ |

- |

|

| Cost of revenues |

|

|

(818,539 |

) |

|

|

- |

|

| Gross loss |

|

|

(818,539 |

) |

|

|

- |

|

| Operating Expenses |

|

|

|

|

|

|

|

|

| Research and development |

|

|

(837,445 |

) |

|

|

(3,407,502 |

) |

| Selling, general and administrative |

|

|

(15,048,252 |

) |

|

|

(7,609,677 |

) |

| Total operating expenses |

|

|

(15,885,697 |

) |

|

|

(11,017,179 |

) |

| Loss from Operations |

|

|

(16,704,236 |

) |

|

|

(11,017,179 |

) |

| Other Income (Expense) |

|

|

|

|

|

|

|

|

| Total other income |

|

|

843,343 |

|

|

|

449,953 |

|

| Net Loss Before Income Taxes |

|

|

(15,860,893 |

) |

|

|

(10,567,226 |

) |

| Tax benefit |

|

|

1,394,770 |

|

|

|

- |

|

| Net Loss |

|

|

(14,466,123 |

) |

|

|

(10,567,226 |

) |

| Other Comprehensive Income (Loss) |

|

|

|

|

|

|

|

|

| Total other comprehensive (loss) income |

|

|

(10,647 |

) |

|

|

18,489 |

|

| Other Comprehensive (Loss) Income |

|

$ |

(14,476,770 |

) |

|

$ |

(10,548,737 |

) |

| Net Loss Per Common Share – Basic and Diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.24 |

) |

| Weighted Average Common Shares Outstanding – Basic and Diluted |

|

|

57,503,154 |

|

|

|

44,090,998 |

|

CORMEDIX INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET DATA

(Unaudited)

| | |

March 31, | | |

December 31, | |

| | |

2023 | | |

2023 | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| Cash, cash equivalents and restricted cash | |

$ | 35,359,907 | | |

$ | 43,823,192 | |

| Short-term investments | |

$ | 23,370,989 | | |

$ | 32,388,130 | |

| Total Assets | |

$ | 68,023,742 | | |

$ | 82,059,957 | |

| | |

| | | |

| | |

| Total Liabilities | |

$ | 10,011,022 | | |

$ | 11,917,528 | |

| Accumulated deficit | |

$ | (336,166,136 | ) | |

$ | (321,700,013 | ) |

| Total Stockholders’ Equity | |

$ | 58,012,720 | | |

$ | 70,142,429 | |

CORMEDIX INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| |

|

For the Three

Months Ended

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

| Cash Flows from Operating Activities: |

|

|

|

|

|

|

| Net loss |

|

$ |

(14,466,123 |

) |

|

$ |

(10,567,226 |

) |

| Net cash used in operating activities |

|

|

(17,310,294 |

) |

|

|

(10,393,886 |

) |

| Cash Flows Used in Investing Activities: |

|

|

|

|

|

|

|

|

| Net cash provided by (used in) investing activities |

|

|

8,944,932 |

|

|

|

(14,686,805 |

) |

| Cash Flows from Financing Activities: |

|

|

|

|

|

|

|

|

| Net cash (used in) provided by financing activities |

|

|

(97,118 |

) |

|

|

7,200,406 |

|

| Net Decrease in Cash and Cash Equivalents |

|

|

(8,463,285 |

) |

|

|

(17,878,001 |

) |

| Cash and Cash Equivalents and Restricted Cash - Beginning of Period |

|

|

43,823,192 |

|

|

|

43,374,745 |

|

| Cash and Cash Equivalents and Restricted Cash - End of Period |

|

$ |

35,359,907 |

|

|

$ |

25,496,744 |

|

6

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

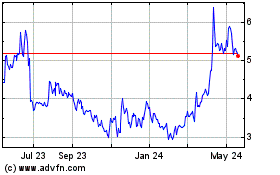

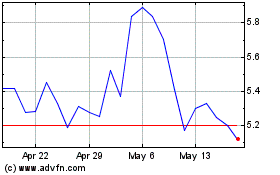

CorMedix (NASDAQ:CRMD)

Historical Stock Chart

From May 2024 to Jun 2024

CorMedix (NASDAQ:CRMD)

Historical Stock Chart

From Jun 2023 to Jun 2024