Form 8-K - Current report

13 November 2024 - 8:39AM

Edgar (US Regulatory)

false000141389800014138982024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 12, 2024

DallasNews CORPORATION

(Exact name of registrant as specified in its charter)

Commission file number: 1-33741

| | |

| | |

Texas | | 38-3765318 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

P. O. Box 224866, Dallas, Texas 75222-4866 | | (214) 977-8869 |

(Address of principal executive offices, including zip code) | | (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Series A Common Stock, $0.01 par value | | DALN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 12, 2024, DallasNews Corporation announced its consolidated financial results for the three months ended September 30, 2024. A copy of the announcement press release is furnished with this report as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | |

| | | | | | |

Date: November 12, 2024 | | | | DALLASNEWS CORPORATION |

| | | |

| | | | By: | | /s/ Catherine G. Collins |

| | | | | | Catherine G. Collins |

| | | | | | Chief Financial Officer |

DallasNews Corporation Announces Third Quarter 2024 Financial Results

DALLAS – DallasNews Corporation (Nasdaq: DALN) (the “Company”) today reported a third quarter 2024 net loss of $3.9 million, or $(0.73) per share, and an operating loss of $4.1 million. In the third quarter of 2023, the Company reported a net loss of $1.4 million, or $(0.26) per share, and an operating loss of $1.6 million. The third quarter 2024 net loss includes severance expense of $3.0 million, primarily due to the Company’s anticipated headcount reductions related to the previously announced transition to a smaller printing facility.

For the third quarter of 2024, on a non-GAAP basis, DallasNews reported operating loss adjusted for certain items (“adjusted operating loss”) of $0.7 million, an improvement of $0.2 million or 18.5 percent when compared to an adjusted operating loss of $0.9 million reported in the third quarter of 2023. The improvement is due to expense savings of $3.5 million, partially offset by a total revenue decline of $3.4 million that is primarily attributable to the Company exiting its shared mail program and discontinuing its print-only niche publications.

Grant Moise, Chief Executive Officer, said, “The third quarter $0.2 million year-over-year financial improvement in adjusted operating loss reflects our continued focus on returning to sustainable profitability. I discussed in the second quarter 2024 investor call, that while we have not reached sustainable operating profitability, we are making progress. The third quarter was highlighted by Medium Giant’s advertising and marketing services revenue growth of $0.4 million adjusting for the termination of the shared mail program and print-only niche publications in August 2023.

DallasNews Corporation Announces Third Quarter 2024 Financial Results

November 12, 2024

Page 2

“I noted in our last investor call that we were reviewing our strategy to optimize subscription volume and pricing. In the third quarter, we modified our digital subscription strategy to a volume-centric strategy. This change successfully ended our 14-month volume decline, with the growth exceeding our expectations since we implemented the new pricing. This strategic change will take time to be reflected in revenue growth, but we are pleased with how consumers are responding to the new pricing in its early stages.”

Third Quarter Results

Total revenue was $31.1 million in the third quarter of 2024, a decrease of $3.4 million or 9.7 percent when compared to the third quarter of 2023.

Revenue from advertising and marketing services, including print and digital revenues, was $12.0 million in the third quarter of 2024, a decrease of $2.7 million or 18.5 percent when compared to the $14.7 million reported for the third quarter of 2023. The decline is primarily due to a $3.1 million decrease in print advertising revenue resulting from the Company ending its shared mail program and print-only niche publications at the end of August 2023. All remaining advertising and marketing services revenue improved $0.4 million.

Circulation revenue was $16.1 million in the third quarter of 2024, a decrease of $0.1 million or 0.8 percent when compared to the $16.2 million reported for the third quarter of 2023. The digital-only subscription revenue increase of $0.4 million or 8.8 percent mostly offset the print circulation revenue decline of $0.5 million or 4.2 percent.

Printing, distribution and other revenue was $3.1 million, a decrease of $0.5 million or 14.0 percent when compared to the third quarter of 2023, primarily due to declines in revenue from commercial printing and distribution, and mailed advertisements for business customers.

DallasNews Corporation Announces Third Quarter 2024 Financial Results

November 12, 2024

Page 3

Total consolidated operating expense in the third quarter of 2024, on a GAAP basis, was $35.3 million, an improvement of $0.9 million or 2.4 percent when compared to the third quarter of 2023. The improvement is primarily due to expense savings of $1.9 million in distribution and $1.1 million in newsprint, partially offset by expense increases of $1.5 million in employee compensation and benefits, including severance, and $0.7 million in outside services.

On a non-GAAP basis, adjusted operating expense was $31.9 million, an improvement of $3.5 million or 10.0 percent when compared to the third quarter of 2023. Excluding severance, employee compensation and benefits expense improved $1.2 million.

As of September 30, 2024, the Company had 534 employees, a headcount decrease of 74 or 12.2 percent when compared to the prior year period, resulting from the 2023 Voluntary Severance Program participants and additional first quarter headcount reductions at Medium Giant. Cash and cash equivalents were $14.0 million at September 30, 2024, and the Company had no debt.

DallasNews Corporation Announces Third Quarter 2024 Financial Results

November 12, 2024

Page 4

Segment Information

In the second quarter of 2024, based on changes made in the reporting package used by the Company’s Chief Operating Decision Maker (“CODM”) for purposes of allocating resources and assessing performance, the Company determined it has two reportable segments. The two reportable segments are the following:

|

·

| |

TDMN primarily generates revenue from subscriptions and retail sales of The Dallas Morning News, and sales of advertising within its newspaper and on related digital platforms by Medium Giant’s cross-functional sales team. |

|

·

| |

Agency generates revenue from the services offered by the Company’s full-service advertising agency, Medium Giant. |

In addition to the reportable segments, the Company has a Corporate and Other category that includes expenses not directly attributable to a specific reportable segment.

The CODM, who is the Chief Executive Officer, uses adjusted operating income (loss) for the purposes of evaluating performance and allocating resources. Adjusted operating income (loss) by reportable segment and for the Corporate and Other category is included in the exhibits to this release.

DallasNews Corporation Announces Third Quarter 2024 Financial Results

November 12, 2024

Page 5

Non-GAAP Financial Measures

Reconciliations of operating loss to adjusted operating loss, and total operating costs and expense to adjusted operating expense are included in the exhibits to this release.

The Company calculates adjusted operating loss by adjusting operating loss to exclude depreciation, severance expense, (gain) loss on sale/disposal of assets, and asset impairments (“adjusted operating loss”). The Company believes that inclusion of certain noncash expenses and other items in the results makes for more difficult comparisons between years and with peer group companies.

Adjusted operating income (loss) is not a measure of financial performance under generally accepted accounting principles (“GAAP”). Management uses adjusted operating income (loss) and similar measures in internal analyses as supplemental measures of the Company’s financial performance, and for performance comparisons versus its peer group of companies. Management uses this non-GAAP financial measure for the purposes of evaluating consolidated Company performance. The Company therefore believes that the non-GAAP measure presented provides useful information to investors by allowing them to view the Company’s business through the eyes of management and the Board of Directors, facilitating comparison of results across historical periods and providing a focus on the underlying ongoing operating performance of its business. Adjusted operating income (loss) should not be considered in isolation or as a substitute for net income (loss), cash flows provided by (used for) operating activities or other comparable measures prepared in accordance with GAAP. Additionally, this non-GAAP measure may not be comparable to similarly-titled measures of other companies.

DallasNews Corporation Announces Third Quarter 2024 Financial Results

November 12, 2024

Page 6

Financial Results Conference Call

DallasNews Corporation will conduct a conference call on Thursday, November 14, 2024, at 9:00 a.m. CST to discuss financial results. The conference call will be available via webcast by accessing the Company’s website at investor.dallasnewscorporation.com/events. An archive of the webcast will be available at dallasnewscorporation.com in the Investor Relations section.

To access the conference call, dial 1-844-291-6362 and enter the following access code when prompted: 4239907. A replay line will be available at 1-866-207-1041 from 12:00 p.m. CST on November 14, 2024 until 11:59 p.m. CST on November 20, 2024. The access code for the replay is 5933346.

DallasNews Corporation Announces Third Quarter 2024 Financial Results

November 12, 2024

Page 7

About DallasNews Corporation

DallasNews Corporation is the Dallas-based holding company of The Dallas Morning News and Medium Giant. The Dallas Morning News is Texas’ leading daily newspaper with an excellent journalistic reputation, intense regional focus and close community ties. With offices in Dallas and Tulsa, Medium Giant is a full-service advertising agency dedicated to designing, creating and delivering stories that drive customers to act. For additional information, visit dallasnewscorporation.com or email invest@dallasnews.com.

Statements in this communication concerning the Company’s business outlook or future economic performance, revenues, expenses, cash balance, investments, business initiatives, working capital, dividends, future financings, and other financial and non-financial items that are not historical facts are “forward-looking statements” as the term is defined under applicable federal securities laws. Words such as “anticipate,” “assume,” “believe,” “can,” “could,” “estimate,” “forecast,” “intend,” “expect,” “may,” “project,” “plan,” “seek,” “should,” “target,” “will,” “would” and their opposites and similar expressions are intended to identify forward-looking statements. Forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those set forth in forward-looking statements. Such risks, trends and uncertainties are, in most instances, beyond the Company’s control, and include changes in advertising demand and other economic conditions; volatility in the North Texas real estate market; the timeline for transitioning print operations; consumers’ tastes; newsprint and distribution prices; program costs; the Company’s ability to successfully execute the Return to Growth Plan; the Company’s ability to maintain compliance with the continued listing requirements of The Nasdaq Capital Market; the success of the Company’s digital strategy; labor relations; cybersecurity incidents; and technological obsolescence. Among other risks, there can be no guarantee that the board of directors will approve dividends in the future or that the Company’s financial projections are accurate, as well as other risks described in the Company’s Annual Report on Form 10-K and in the Company’s other public disclosures and filings with the Securities and Exchange Commission. Forward-looking statements, which are as of the date of this communication, are not updated to reflect events or circumstances after the date of the statement.

DallasNews Corporation and Subsidiaries

Consolidated Statements of Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

|

In thousands, except share and per share amounts (unaudited)

|

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Net Operating Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advertising and marketing services

|

|

$

|

11,977

|

|

$

|

14,699

|

|

$

|

36,407

|

|

$

|

46,231

|

|

Circulation

|

|

|

16,062

|

|

|

16,194

|

|

|

48,543

|

|

|

48,201

|

|

Printing, distribution and other

|

|

|

3,101

|

|

|

3,606

|

|

|

9,353

|

|

|

11,281

|

|

Total net operating revenue

|

|

|

31,140

|

|

|

34,499

|

|

|

94,303

|

|

|

105,713

|

|

Operating Costs and Expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee compensation and benefits

|

|

|

18,048

|

|

|

16,565

|

|

|

48,903

|

|

|

51,174

|

|

Other production, distribution and operating costs

|

|

|

15,498

|

|

|

16,778

|

|

|

45,603

|

|

|

52,099

|

|

Newsprint, ink and other supplies

|

|

|

1,301

|

|

|

2,382

|

|

|

3,887

|

|

|

6,912

|

|

Depreciation

|

|

|

411

|

|

|

388

|

|

|

1,216

|

|

|

1,118

|

|

Total operating costs and expense

|

|

|

35,258

|

|

|

36,113

|

|

|

99,609

|

|

|

111,303

|

|

Operating loss

|

|

|

(4,118)

|

|

|

(1,614)

|

|

|

(5,306)

|

|

|

(5,590)

|

|

Other income, net

|

|

|

536

|

|

|

342

|

|

|

1,788

|

|

|

1,082

|

|

Loss Before Income Taxes

|

|

|

(3,582)

|

|

|

(1,272)

|

|

|

(3,518)

|

|

|

(4,508)

|

|

Income tax provision

|

|

|

345

|

|

|

139

|

|

|

322

|

|

|

397

|

|

Net Loss

|

|

$

|

(3,927)

|

|

$

|

(1,411)

|

|

$

|

(3,840)

|

|

$

|

(4,905)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share Basis (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.73)

|

|

$

|

(0.26)

|

|

$

|

(0.72)

|

|

$

|

(0.92)

|

|

Diluted

|

|

$

|

(0.73)

|

|

$

|

(0.26)

|

|

$

|

(0.72)

|

|

$

|

(0.92)

|

|

Number of common shares used in the per share calculation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

5,352,490

|

|

|

5,352,490

|

|

|

5,352,490

|

|

|

5,352,490

|

|

Diluted

|

|

|

5,352,490

|

|

|

5,352,490

|

|

|

5,352,490

|

|

|

5,352,490

|

|

(1)

| |

The Company’s Series A and Series B common stock equally share in the distributed and undistributed earnings. There were no options or RSUs outstanding as of September 30, 2024 and 2023, that would result in dilution of shares or the calculation of EPS under the two-class method as prescribed under ASC 260 – Earnings Per Share. |

DallasNews Corporation and Subsidiaries

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

|

|

December 31,

|

|

In thousands (unaudited)

|

|

2024

|

|

2023

|

|

Assets

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

13,988

|

|

$

|

11,697

|

|

Short-term investments

|

|

|

—

|

|

|

10,781

|

|

Accounts receivable, net

|

|

|

11,236

|

|

|

9,923

|

|

Other current assets

|

|

|

4,702

|

|

|

4,532

|

|

Total current assets

|

|

|

29,926

|

|

|

36,933

|

|

Property, plant and equipment, net

|

|

|

11,504

|

|

|

7,099

|

|

Operating lease right-of-use assets

|

|

|

18,034

|

|

|

16,141

|

|

Deferred income taxes, net

|

|

|

253

|

|

|

271

|

|

Other assets

|

|

|

1,885

|

|

|

1,790

|

|

Total assets

|

|

$

|

61,602

|

|

$

|

62,234

|

|

Liabilities and Shareholders’ Equity

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

5,018

|

|

$

|

3,963

|

|

Accrued compensation and other current liabilities

|

|

|

13,068

|

|

|

10,449

|

|

Contract liabilities

|

|

|

9,396

|

|

|

9,511

|

|

Total current liabilities

|

|

|

27,482

|

|

|

23,923

|

|

Long-term pension liabilities

|

|

|

15,593

|

|

|

17,353

|

|

Long-term operating lease liabilities

|

|

|

18,124

|

|

|

16,924

|

|

Other liabilities

|

|

|

979

|

|

|

1,076

|

|

Total liabilities

|

|

|

62,178

|

|

|

59,276

|

|

Contingent liabilities

|

|

|

|

|

|

|

|

Total shareholders' equity

|

|

|

(576)

|

|

|

2,958

|

|

Total liabilities and shareholders’ equity

|

|

$

|

61,602

|

|

$

|

62,234

|

DallasNews Corporation and Subsidiaries

Revenue by Reportable Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

|

In thousands (unaudited)

|

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

TDMN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print advertising (1)

|

|

$

|

5,404

|

|

$

|

9,082

|

|

$

|

17,601

|

|

$

|

28,672

|

|

Digital advertising (2)

|

|

|

2,156

|

|

|

2,108

|

|

|

6,388

|

|

|

6,440

|

|

Agency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing and media services (2)

|

|

|

4,417

|

|

|

3,509

|

|

|

12,418

|

|

|

11,119

|

|

Advertising and Marketing Services

|

$

|

11,977

|

|

$

|

14,699

|

|

$

|

36,407

|

|

$

|

46,231

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TDMN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print circulation

|

|

|

11,460

|

|

|

11,964

|

|

|

34,819

|

|

|

36,489

|

|

Digital circulation

|

|

|

4,602

|

|

|

4,230

|

|

|

13,724

|

|

|

11,712

|

|

Circulation

|

$

|

16,062

|

|

$

|

16,194

|

|

$

|

48,543

|

|

$

|

48,201

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TDMN

|

|

|

3,101

|

|

|

3,499

|

|

|

9,353

|

|

|

10,856

|

|

Agency

|

|

|

—

|

|

|

107

|

|

|

—

|

|

|

425

|

|

Printing, Distribution and Other

|

$

|

3,101

|

|

$

|

3,606

|

|

$

|

9,353

|

|

$

|

11,281

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue

|

|

$

|

31,140

|

|

$

|

34,499

|

|

$

|

94,303

|

|

$

|

105,713

|

|

(1)

| |

Includes $3,099 and $10,748 for the three and nine months ended September 30, 2023, respectively, of revenue generated from the Company’s shared mail program to deliver weekly preprints, as well as advertising in the print-only editions of its niche publications. At the end of August 2023, the Company made the strategic decisions to exit its shared mail program and discontinue print-only editions of its niche publications. |

|

(2)

| |

Prior to the segment reporting change, digital advertising, and marketing and media services revenues were reported in aggregate. |

DallasNews Corporation - Non-GAAP Financial Measures

Reconciliation of Operating Loss to Adjusted Operating Loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

|

In thousands (unaudited)

|

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Total net operating revenue

|

|

$

|

31,140

|

|

$

|

34,499

|

|

$

|

94,303

|

|

$

|

105,713

|

|

Total operating costs and expense

|

|

|

35,258

|

|

|

36,113

|

|

|

99,609

|

|

|

111,303

|

|

Operating Loss

|

|

$

|

(4,118)

|

|

$

|

(1,614)

|

|

$

|

(5,306)

|

|

$

|

(5,590)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating costs and expense

|

|

$

|

35,258

|

|

$

|

36,113

|

|

$

|

99,609

|

|

$

|

111,303

|

|

Less:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

411

|

|

|

388

|

|

|

1,216

|

|

|

1,118

|

|

Severance expense

|

|

|

2,982

|

|

|

336

|

|

|

3,758

|

|

|

1,161

|

|

Adjusted Operating Expense

|

|

$

|

31,865

|

|

$

|

35,389

|

|

$

|

94,635

|

|

$

|

109,024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net operating revenue

|

|

$

|

31,140

|

|

$

|

34,499

|

|

$

|

94,303

|

|

$

|

105,713

|

|

Adjusted operating expense

|

|

|

31,865

|

|

|

35,389

|

|

|

94,635

|

|

|

109,024

|

|

Adjusted Operating Loss

|

|

$

|

(725)

|

|

$

|

(890)

|

|

$

|

(332)

|

|

$

|

(3,311)

|

DallasNews Corporation - Non-GAAP Financial Measures

Adjusted Operating Income (Loss) by Reportable Segment, and Corporate and Other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30,

|

|

Nine Months Ended September 30,

|

|

In thousands (unaudited)

|

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

TDMN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net operating revenue

|

|

$

|

26,723

|

|

$

|

30,883

|

|

$

|

81,885

|

|

$

|

94,169

|

|

Adjusted operating expense

|

|

|

21,965

|

|

|

25,877

|

|

|

65,562

|

|

|

80,974

|

|

Adjusted Operating Income

|

|

$

|

4,758

|

|

$

|

5,006

|

|

$

|

16,323

|

|

$

|

13,195

|

|

Agency

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net operating revenue

|

|

$

|

4,417

|

|

$

|

3,616

|

|

$

|

12,418

|

|

$

|

11,544

|

|

Adjusted operating expense

|

|

|

4,372

|

|

|

4,288

|

|

|

12,744

|

|

|

13,160

|

|

Adjusted Operating Income (Loss)

|

|

$

|

45

|

|

$

|

(672)

|

|

$

|

(326)

|

|

$

|

(1,616)

|

|

Corporate and Other

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total net operating revenue

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

Adjusted operating expense

|

|

|

5,528

|

|

|

5,224

|

|

|

16,329

|

|

|

14,890

|

|

Adjusted Operating Loss

|

|

$

|

(5,528)

|

|

$

|

(5,224)

|

|

$

|

(16,329)

|

|

$

|

(14,890)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Adjusted Operating Loss

|

|

$

|

(725)

|

|

$

|

(890)

|

|

$

|

(332)

|

|

$

|

(3,311)

|

|

Excluded expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

411

|

|

|

388

|

|

|

1,216

|

|

|

1,118

|

|

Severance expense

|

|

|

2,982

|

|

|

336

|

|

|

3,758

|

|

|

1,161

|

|

Operating Loss

|

|

$

|

(4,118)

|

|

$

|

(1,614)

|

|

$

|

(5,306)

|

|

$

|

(5,590)

|

|

Other income, net

|

|

|

536

|

|

|

342

|

|

|

1,788

|

|

|

1,082

|

|

Loss Before Income Taxes

|

|

$

|

(3,582)

|

|

$

|

(1,272)

|

|

$

|

(3,518)

|

|

$

|

(4,508)

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

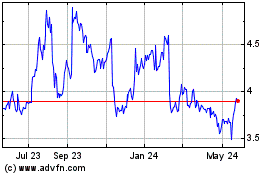

DallasNews (NASDAQ:DALN)

Historical Stock Chart

From Mar 2025 to Apr 2025

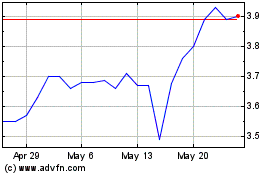

DallasNews (NASDAQ:DALN)

Historical Stock Chart

From Apr 2024 to Apr 2025