As filed with the Securities and Exchange Commission

on January 24, 2025

Registration

No. 333-[______]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

DLocal Limited

(Exact Name of Registrant as Specified in its Charter)

| The Cayman Islands |

|

Not Applicable |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification Number) |

| |

Dr. Luis Bonavita 1294

Montevideo, Uruguay 11300

|

|

| (Address, Including Zip Code, of Registrant’s Principal Executive Offices) |

| DLocal Limited Amended and Restated 2020 Global Share Incentive Plan |

|

(Full Title of the Plans)

|

|

Cogency Global Inc.

122 E 42nd Street, 18th floor

New York, NY 10168

(Name and Address of Agent For Service)

(800) 221-0102

(Telephone Number, including area code, of agent

for service)

|

Copies to:

Maurice Blanco

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

(212) 450 4000

|

Indicate by checkmark whether the registrant is

a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☒ |

Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ☐ |

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

REGISTRATION OF ADDITIONAL

SECURITIES PURSUANT TO GENERAL INSTRUCTION

Pursuant to General Instruction E to Form S-8,

DLocal Limited. (the “Registrant”) is filing this Registration Statement on Form S-8 (this “Registration Statement”)

with the U.S. Securities and Exchange Commission (the “Commission”) to register 4,000,000 additional Class A common

shares, par value US$0.002 per share (the “Common Shares”), for issuance under the Registrant’s Amended and Restated

2020 Global Share Incentive Plan. This Registration Statement hereby incorporates by reference the contents of the Registrant’s

registration statements on Form S-8 filed with the Commission on November 26, 2021 (Registration No. 333-261372). In accordance with the

instructional note to Part I of Form S-8 as promulgated by the Commission, the information specified by Part I of Form S-8 has

been omitted from this Registration Statement.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item

3. Incorporation of Documents by Reference

The following documents are incorporated herein

by reference:

(a) The

Registrant’s latest Form 20-F filed with the Commission on March 19, 2024 (the “Form 20-F”) pursuant to Section

13 or 15(d) of the Exchange Act (the “Exchange Act”), which contains the Registrant’s audited financial statements

for the latest fiscal year for which such statements have been filed (File No. 001-40451); and

(b) The

description of the Registrant’s Common Shares which is included as Exhibit 2.1 to the Form 20-F, including any amendments or supplements

thereto.

In addition, all documents filed subsequent to

the Form 20-F by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the

filing of a post-effective amendment to this Registration Statement which indicates that all securities offered have been sold or which

deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to

be a part hereof from the date of the filing of such documents.

Any statement contained in a document incorporated

or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement

to the extent that a statement contained herein (or in any other subsequently filed document which also is incorporated or deemed to be

incorporated by reference herein) modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed,

except as so modified or superseded, to constitute a part of this Registration Statement.

Item

5. Interests of Named Experts and Counsel

Not applicable.

Item

8. Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended (the “Securities Act”) the Registrant certifies that it has reasonable grounds to believe that it

meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the

undersigned, thereunto duly authorized, in the city of Montevideo, Uruguay, on this 24th day of January, 2025.

| |

DLocal Limited |

| |

|

| |

|

| |

By: |

/s/ Pedro Arnt |

| |

|

Name: |

Pedro Arnt |

| |

|

Title: |

Chief Executive Officer |

SIGNATURE OF AUTHORIZED

U.S. REPRESENTATIVE OF THE REGISTRANT

Pursuant

to the Securities Act, the undersigned, the duly authorized representative in the United States of the Registrant has signed this Registration

Statement or amendment thereto on the 24th day of January, 2025.

| |

Cogency Global Inc. |

| |

Authorized U.S. Representative

|

| |

|

|

| |

By: |

/s/ Colleen A. De Vries |

| |

Name: |

Colleen A. De Vries |

| |

Title: |

Senior Vice President |

Exhibit 5.1

DLocal Limited

PO Box 309, Ugland House

Grand Cayman

KY1-1104

Cayman Islands

January 24, 2025

DLocal Limited

We have acted as counsel as to Cayman Islands

law to DLocal Limited (the "Company") in connection with the Company's registration statement on Form S-8,

including all amendments or supplements thereto, filed with the United States Securities and Exchange Commission (the

"Commission") under the United States Securities Act of 1933, as amended (the "Act") (including

its exhibits, the "Registration Statement") relating to the registration of an additional 4,000,000 Class A common

shares of US$ 0.002 par value each in the capital of the Company (the "Shares") authorised for issuance pursuant to

the Company's Amended and Restated 2020 Global Share Incentive Plan (the "Plan").

We have reviewed originals, copies, drafts or conformed

copies of the following documents:

| 1.1 | The certificate of incorporation dated 15 February 2021 and the amended and restated memorandum and articles

of association of the Company as registered or adopted on 2 June 2021 (the "Memorandum and Articles"). |

| 1.2 | The written resolutions of the board of directors

of the Company dated 12 November 2021 (the "First Resolutions") and dated 2 December, 2024 (the "Second Resolutions"

and together with the First Resolutions, "the "Resolutions"). |

| 1.3 | The following corporate records of the Company maintained at its registered office in the Cayman Islands,

each as at the date of this opinion letter: |

| (a) | Register of Directors and Officers of the Company; and |

| (b) | Register of Mortgages and Charges of the Company. |

| 1.4 | A certificate of good standing with respect to the Company issued by the Registrar of Companies (the "Certificate

of Good Standing"). |

| 1.5 | A certificate from a director of the Company a copy of which is attached to this opinion letter (the "Director's

Certificate"). |

| 1.6 | The Registration Statement. |

| 1.8 | The form of award agreement to be executed by the Company and the participant referenced therein (the

"Award Agreement"). |

The following opinions are given only as to, and

based on, circumstances and matters of fact existing and known to us on the date of this opinion letter. These opinions only relate to

the laws of the Cayman Islands which are in force on the date of this opinion letter. In giving the following opinions, we have relied

(without further verification) upon the completeness and accuracy, as at the date of this opinion letter, of the Director's Certificate

and the Certificate of Good Standing. We have also relied upon the following assumptions, which we have not independently verified:

| 2.1 | The Registration Statement, the Plan and the Award Agreement have been or will be authorised and duly

executed and unconditionally delivered by or on behalf of all relevant parties in accordance with all relevant laws (other than, with

respect to the Company, the laws of the Cayman Islands). |

| 2.2 | The Registration Statement, the Plan and the Award Agreement are, or will be, legal, valid, binding and

enforceable against all relevant parties in accordance with their terms under the laws of the Cayman Islands and all other relevant laws

(other than, with respect to the Company, the laws of the Cayman Islands). |

| 2.3 | Copies of documents, conformed copies or drafts of documents provided to us are true and complete copies

of, or in the final forms of, the originals, and translations of documents provided to us are complete and accurate. |

| 2.4 | All signatures, initials and seals are genuine. |

| 2.5 | The capacity, power, authority and legal right of all parties under all relevant laws and regulations

(other than, with respect to the Company, the laws and regulations of the Cayman Islands) to enter into, execute, unconditionally deliver

and perform their respective obligations under the Registration Statement, the Plan or the Award Agreement. |

| 2.6 | There is no contractual or other prohibition or restriction (other than as arising under Cayman Islands

law) binding on the Company prohibiting or restricting it from entering into and performing its obligations under the Registration Statement. |

| 2.7 | No monies paid to or for the account of any party under the Registration Statement, the Plan or the Award

Agreement or any property received or disposed of by any party to the Registration Statement, the Plan or the Award Agreement in each

case in connection with the Registration Statement, the Plan or the Award Agreement or the consummation of the transactions contemplated

thereby represent or will represent proceeds of criminal conduct or criminal property or terrorist property (as defined in the Proceeds

of Crime Act (As Revised) and the Terrorism Act (As Revised), respectively). |

| 2.8 | There is nothing contained in the minute book or corporate records of the Company (which, other than the

records set out in paragraph 1.3 of this opinion letter, we have not

inspected) which would or might affect the opinions set out below |

| 2.9 | There is nothing under any law (other than the laws of the Cayman Islands) which would or might affect

the opinions set out below. Specifically, we have made no independent investigation of the laws of the State of New York or Brazil. |

| 2.10 | The Company has and will at all times have sufficient authorised but unissued Shares available for issue

under the Plan and the Award Agreements. |

| 2.11 | The Company will receive money or money's worth in consideration for the issue of the Shares and none

of the Shares were or will be issued for less than par value. |

| 2.12 | The Shares that will be issued pursuant to the Registration Statement, the Plan and the Award Agreement

will be duly registered, and will continue to be registered, in the Company’s register of members (shareholders). |

| 2.13 | No invitation has been or will be made by or on behalf of the Company to the public in the Cayman Islands

to subscribe for any of the Shares. |

Save as aforesaid we have not been instructed to

undertake and have not undertaken any further enquiry or due diligence in relation to the transaction the subject of this opinion letter.

Based upon, and subject to, the foregoing assumptions

and the qualifications set out below, and having regard to such legal considerations as we deem relevant, we are of the opinion that:

| 3.1 | The Company has been duly incorporated as an exempted company with limited liability and is validly existing

and in good standing with the Registrar of Companies under the laws of the Cayman Islands. |

| 3.2 | The Shares to be offered and issued by the Company as contemplated by the Registration Statement, the

Plan and the Award Agreement have been duly authorised for issue, and when such Shares are issued by the Company in accordance with the

Memorandum and Articles, the Registration Statement, the Plan and the Award Agreement and upon payment in full being made therefor as

contemplated in the Registration Statement, the Plan and the Award Agreement and such Shares being entered as fully-paid on the register

of members of the Company, such Shares will be validly issued, fully-paid and non-assessable. As a matter of Cayman Islands law, a share

is only issued when it has been entered in the register of members (shareholders). |

The opinions expressed above are subject to the

following qualifications:

| 4.1 | The obligations assumed by the Company under the Plan and the Award Agreement will not necessarily be

enforceable in all circumstances in accordance with their terms. In particular: |

| (a) | enforcement may be limited by bankruptcy, insolvency, liquidation, reorganisation, readjustment of debts

or moratorium or other laws of general application relating to protecting or affecting the rights of creditors and/or contributories; |

| (b) | enforcement may be limited by general principles of equity. For example, equitable remedies such as specific

performance may not be available, inter alia, where damages are considered to be an adequate remedy; |

| (c) | where obligations are to be performed in a jurisdiction outside the Cayman Islands, they may not be enforceable

in the Cayman Islands to the extent that performance would be illegal under the laws of that jurisdiction; and |

| (d) | some claims may become barred under relevant statutes of limitation or may be or become subject to defences

of set off, counterclaim, estoppel and similar defences. |

| 4.2 | To maintain the Company in good standing with the Registrar of Companies under the laws of the Cayman

Islands, annual filing fees must be paid and returns made to the Registrar of Companies within the time frame prescribed by law. |

| 4.3 | Under Cayman Islands law, the register of members (shareholders) is prima facie evidence of title

to shares and this register would not record a third party interest in such shares. However, there are certain limited circumstances where

an application may be made to a Cayman Islands court for a determination on whether the register of members reflects the correct legal

position. Further, the Cayman Islands court has the power to order that the register of members maintained by a company should be rectified

where it considers that the register of members does not reflect the correct legal position. As far as we are aware, such applications

are rarely made in the Cayman Islands and there are no circumstances or matters of fact known to us on the date of this opinion letter

which would properly form the basis for an application for an order for rectification of the register of members of the Company, but if

such an application were made in respect of the Shares, then the validity of such shares may be subject to re-examination by a Cayman

Islands court. |

| 4.4 | In this opinion letter the phrase "non-assessable" means, with respect to the issuance of shares,

that a shareholder shall not, in respect of the relevant shares and in the absence of a contractual arrangement, or an obligation pursuant

to the memorandum and articles of association, to the contrary, have any obligation to make further contributions to the Company's assets

(except in exceptional circumstances, such as involving fraud, the establishment of an agency relationship or an illegal or improper purpose

or other circumstances in which a court may be prepared to pierce or lift the corporate veil). |

We hereby consent to the filing of this opinion

letter as an exhibit to the Registration Statement. In providing our consent, we do not thereby admit that we are in the category of persons

whose consent is required under section 7 of the Act or the Rules and Regulations of the Commission thereunder.

We express no view as to the commercial terms of

the Registration Statement, the Plan or the Award Agreement or whether such terms represent the intentions of the parties and make no

comment with regard to warranties or representations that may be made by the Company.

The opinions in this opinion letter are strictly

limited to the matters contained in the opinions section above and do not extend to any other matters. We have not been asked to review

and we therefore have not reviewed any of the ancillary documents relating to the Shares and express no opinion or observation upon the

terms of any such document.

This opinion letter is addressed to you and may

be relied upon by you, your counsel and purchasers of Shares pursuant to the Registration Statement. This opinion letter is limited to

the matters detailed herein and is not to be read as an opinion with respect to any other matter.

Yours faithfully

/s/ Maples and Calder (Cayman) LLP

Maples and Calder (Cayman) LLP

Exhibit 23.1

CONSENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation

by reference in this Registration Statement on Form S-8 of DLocal Limited of our report dated March 18, 2024 relating to the financial

statements and the effectiveness of internal control over financial reporting, which appears in DLocal Limited 's Annual Report on Form

20-F for the year ended December 31, 2023.

/s/ Price Waterhouse & Co. S.R.L.

/s/ Mario Angel Julio

Partner

Buenos Aires, Argentina

January 24, 2025

Price Waterhouse & Co. S.R.L., Bouchard

557, piso 8°, C1106ABG - Ciudad de Buenos Aires

T: +(54.11) 4850.0000, www.pwc.com/ar

Exhibit 24

POWER OF

ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each

person whose signature appears below hereby constitutes and appoints Pedro Arnt and Mark Ortiz, and each of them, individually, as his

or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or

her name, place and stead, in any and all capacities, in connection with this Registration Statement, including to sign in the name and

on behalf of the undersigned, this Registration Statement and any and all amendments thereto, including post-effective amendments and

registrations filed pursuant to Rule 462 under the Securities Act, and to file the same, with all exhibits thereto, and other documents

in connection therewith, with the U.S. Securities and Exchange Commission, granting unto each such attorneys-in-fact and agents full power

and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to

all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents

or either of them or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this Registration Statement has been signed by the following persons on this day of in the capacities indicated.

| Signature |

Title |

| |

|

| /s/ Pedro Arnt |

Chief Executive Officer and Director (Principal Executive Officer) |

| Pedro Arnt |

|

| |

|

| /s/ Mark Ortiz |

Chief Financial Officer (Principal Financial Officer) |

| Mark Ortiz |

|

| |

|

| /s/ Alberto Eduardo Azar |

Chairman and Director |

| Alberto Eduardo Azar |

|

| |

|

| /s/ Sebastián Kanovich |

Director |

| Sebastián Kanovich |

|

| |

|

| /s/ Andres Bzurovski Bay |

Director |

| Andres Bzurovski Bay |

|

| |

|

| /s/ Sergio Enrique Fogel Kaplan |

Director |

| Sergio Enrique Fogel Kaplan |

|

| |

|

| /s/ Martín Escobari |

Director |

| Martín Escobari |

|

| |

|

| /s/ Luiz Ribeiro |

Director |

| Luiz Ribeiro |

|

| |

|

| /s/ Jacobo Singer |

Director |

| Jacobo Singer |

|

| |

|

| /s/ Mariam Toulan |

Director |

| Mariam Toulan |

|

| |

|

| /s/ Hyman Bielsky |

Director |

| Hyman Bielsky |

|

| |

|

| /s/ Verónica Raffo |

Director |

| Verónica Raffo |

|

| |

|

| /s/ Carlos Guendulain |

Chief Accounting Officer (Principal Accounting

Officer)

|

| Carlos Guendulain |

|

S-8

EX-FILING FEES

0001846832

0001846832

1

2024-12-06

2024-12-06

0001846832

2024-12-06

2024-12-06

iso4217:USD

xbrli:pure

xbrli:shares

Ex-Filing Fees

CALCULATION OF FILING FEE TABLES

S-8

DLocal Ltd

Table 1: Newly Registered and Carry Forward Securities

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Line Item Type |

|

Security Type |

|

Security Class Title |

|

Notes |

|

Fee Calculation

Rule |

|

Amount Registered |

|

Proposed Maximum Offering

Price Per Unit |

|

Maximum Aggregate Offering Price |

|

Fee Rate |

|

Amount of Registration Fee |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Newly Registered Securities |

| Fees to be Paid |

|

Equity |

|

Common Shares, par value US$0.002 per share |

|

(1) |

|

Other |

|

4,000,000 |

|

$ |

11.6000 |

|

$ |

46,400,000.00 |

|

0.0001531 |

|

$ |

7,103.84 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Offering Amounts: |

|

$ |

46,400,000.00 |

|

|

|

|

7,103.84 |

| Total Fees Previously Paid: |

|

|

|

|

|

|

|

0.00 |

| Total Fee Offsets: |

|

|

|

|

|

|

|

0.00 |

| Net Fee Due: |

|

|

|

|

|

|

$ |

7,103.84 |

__________________________________________

Offering Note(s)

| (1) | |

FN 1 to “Amount Registered”: Pursuant to Rule 416(a) under the Securities Act, this Registration Statement shall also cover any additional shares of the Registrant’s Common Shares that

become issuable in respect of the securities identified in the above table by reason of any stock dividend (share bonus issue), stock split (share subdivision or consolidation), recapitalization or

other similar transaction effected without the Registrant’s receipt of consideration that results in an increase in the number of the outstanding shares of the Registrant’s common shares.

FN 2 to "Proposed Maximum Offering Price per Unit": Estimated in accordance with Rules 457(c) and (h) of the Securities Act solely for the purpose of calculating the registration fee based

on the average of the high and low prices of the Registrant’s Common Shares as reported on the New York Stock Exchange on January 16, 2024. |

v3.24.4

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.4

Offerings - Offering: 1

|

Dec. 06, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Shares, par value US$0.002 per share

|

| Amount Registered | shares |

4,000,000

|

| Proposed Maximum Offering Price per Unit |

11.6000

|

| Maximum Aggregate Offering Price |

$ 46,400,000.00

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 7,103.84

|

| Offering Note |

FN 1 to “Amount Registered”: Pursuant to Rule 416(a) under the Securities Act, this Registration Statement shall also cover any additional shares of the Registrant’s Common Shares that

become issuable in respect of the securities identified in the above table by reason of any stock dividend (share bonus issue), stock split (share subdivision or consolidation), recapitalization or

other similar transaction effected without the Registrant’s receipt of consideration that results in an increase in the number of the outstanding shares of the Registrant’s common shares.

FN 2 to "Proposed Maximum Offering Price per Unit": Estimated in accordance with Rules 457(c) and (h) of the Securities Act solely for the purpose of calculating the registration fee based

on the average of the high and low prices of the Registrant’s Common Shares as reported on the New York Stock Exchange on January 16, 2024.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.4

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlPrevslyPdAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

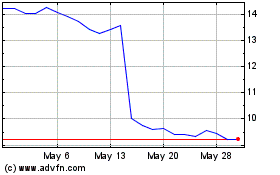

DLocal (NASDAQ:DLO)

Historical Stock Chart

From Dec 2024 to Jan 2025

DLocal (NASDAQ:DLO)

Historical Stock Chart

From Jan 2024 to Jan 2025