false000109355700010935572025-01-132025-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 13, 2025

DEXCOM, INC.

(Exact Name of the Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 000-51222 | 33-0857544 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

6340 Sequence Drive, San Diego, CA | | 92121 |

(Address of Principal Executive Offices) | | (Zip Code) |

(858) 200-0200

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 Par Value Per Share | | DXCM | | Nasdaq Global Select Market |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| ITEM 2.02. | RESULTS OF OPERATIONS AND FINANCIAL CONDITION. |

In connection with remarks to be made at the J.P. Morgan 43rd Annual Healthcare Conference on Monday, January 13, 2025, beginning at 12:00 p.m. (Eastern Time), DexCom, Inc. (“Dexcom”) Chairman, President and Chief Executive Officer, Kevin Sayer, will report preliminary, unaudited financial results for the fourth quarter of 2024 and fiscal year 2024, initial financial outlook for fiscal year 2025, and certain other information.

The fourth quarter and fiscal year 2024 preliminary unaudited financial results contained in Mr. Sayer’s presentation, the press release and this Current Report on Form 8-K are subject to finalization in connection with the preparation of Dexcom’s Annual Report on Form 10-K for the twelve months ended December 31, 2024. This Current Report on Form 8-K and the press release contain, and Mr. Sayer’s presentation on January 13, 2025 will contain, forward-looking statements that are not purely historical regarding Dexcom’s or its management’s intentions, beliefs, expectations and strategies for the future, including those related to Dexcom’s preliminary, unaudited revenue for the fourth quarter of and the full fiscal year 2024, including growth rates; total revenue guidance for fiscal 2025; Non-GAAP Gross Profit Margin and Non-GAAP Operating Margin guidance for fiscal 2024 and 2025, including expected growth rates; and potential strategic and business opportunities. All forward-looking statements included in Mr. Sayer’s presentation, the press release and in this Current Report on Form 8-K are made as of the date published, based on information currently available to Dexcom as of the date hereof. Forward-looking statements deal with future events and therefore are subject to various risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements. The risks and uncertainties that may cause actual results to differ materially from Dexcom’s current expectations are more fully described in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Dexcom’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. Should one or more of these risks or uncertainties materialize, or should any of Dexcom’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. Except as required by law, Dexcom assumes no obligation to update any such forward-looking statement after the date of this report or to conform these forward-looking statements to actual results.

In connection with Mr. Sayer’s presentation, on January 13, 2025, Dexcom issued a press release announcing preliminary, unaudited results for the fourth quarter of 2024 and fiscal year 2024, initial financial outlook for fiscal year 2025, and certain other information, which is attached here as Exhibit 99.1.

The information in this Item 2.02, including Exhibit 99.1 hereto, is furnished shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section. The information contained herein and in the accompanying exhibit is not incorporated by reference in any filing of Dexcom under the Securities Act of 1933 or the Exchange Act, whether made before or after the date hereof except as shall be expressly set forth by specific reference in such a filing.

| | | | | |

| ITEM 9.01. | FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits.

| | | | | | | | |

| | |

| Number | | Description |

| |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| DEXCOM, INC. |

| |

| By: | | /s/ JEREME M. SYLVAIN Jereme M. Sylvain Executive Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) |

| | |

Date: | | January 13, 2025 |

Exhibit 99.1

Dexcom Reports Preliminary, Unaudited Results for the Fourth Quarter and Fiscal Year 2024 and Initial 2025 Outlook

SAN DIEGO, CA - (BUSINESS WIRE-January 13, 2025) - DexCom, Inc. (Nasdaq: DXCM) today reported preliminary, unaudited results for the fourth quarter ended December 31, 2024 with total revenue of at least $1.113 billion, an increase of 8% over the fourth quarter of 2023. U.S. revenue is expected to be approximately $803 million, representing growth of 4% over the fourth quarter of 2023. International revenue is expected to be approximately $310 million, an increase of 17% over the fourth quarter of 2023.

For fiscal 2024, total preliminary, unaudited revenue is approximately $4.032 billion, an increase of 11% over 2023. In conjunction with the preliminary fourth quarter results, the company is also updating 2024 non-GAAP gross profit margin and non-GAAP operating margin guidance to 62% and 19% respectively. Fourth quarter gross margin is expected to be adversely impacted by a non-cash charge primarily related to inventory damaged in transit and certain build configurations that lowered production yield for the quarter.

“Dexcom made key strategic investments in 2024 that steadily progressed throughout the year, leaving us well positioned to capitalize on our growth opportunity ahead,” said Kevin Sayer, Dexcom’s chairman, president and CEO. “We plan to build on these investments in 2025 by further enhancing our differentiated product portfolio and advocating for greater CGM access globally.”

2025 Outlook

For 2025, Dexcom currently anticipates total revenue of $4.60 billion, representing expected growth of approximately 14% over 2024. This outlook considers sensor volume growth driven by increasing CGM access and awareness for people with diabetes, the continued rollout of Stelo, further international expansion, and overall market dynamics.

In addition, Dexcom currently estimates 2025 Non-GAAP Gross Profit Margin and Non-GAAP Operating Margin to be at the following levels:

–Non-GAAP Gross Profit Margin of approximately 64 – 65%

–Non-GAAP Operating Margin of approximately 21%

Fourth Quarter 2024 Financial Results Conference Call

Dexcom will report its audited full fourth quarter and fiscal 2024 financial results on Thursday, February 13, 2025 after the close of market. Management is currently scheduled to host a conference call at 4:30 p.m. (Eastern Time) that day. More details will be provided later.

About DexCom, Inc.

Dexcom empowers people to take control of health through innovative biosensing technology. Founded in 1999, Dexcom has pioneered and set the standard in glucose biosensing for more than 25 years. Its technology has transformed how people manage diabetes and track their glucose, helping them feel more in control and live more confidently.

Dexcom. Discover what you’re made of. For more information, visit www.dexcom.com.

Category: IR

Statement Regarding Use of Non-GAAP Financial Measures

This press release includes non-GAAP financial measures. We have not reconciled our Non-GAAP Gross Profit Margin and Non-GAAP Operating Margin guidance for fiscal years 2024 and 2025 because certain items that impact these figures are uncertain or out of our control and cannot be reasonably predicted. Accordingly, a reconciliation of Non-GAAP Gross Profit Margin and Non-GAAP Operating Margin is not available without unreasonable effort.

Cautionary Statement Regarding Forward Looking Statements

This press release contains forward-looking statements that are not purely historical regarding Dexcom’s or its management’s intentions, beliefs, expectations and strategies for the future, including those related to Dexcom’s preliminary, unaudited revenue for the fourth quarter of and the full fiscal year 2024, including growth rates; total revenue guidance for fiscal 2025; Non-GAAP Gross Profit Margin and Non-GAAP Operating Margin guidance for fiscal 2024 and 2025, including expected growth rates; and potential strategic and business opportunities. All forward-looking statements included in this press release are made as of the date of this release, based on information currently available to Dexcom as of the date hereof. Forward-looking statements deal with future events and therefore are subject to various risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements. The risks and uncertainties that may cause actual results to differ materially from Dexcom’s current expectations are more fully described in the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Dexcom’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings. Except as required by law, Dexcom assumes no obligation to update any such forward-looking statement after the date of this communication or to conform these forward-looking statements to actual results.

FOR MORE INFORMATION:

Sean Christensen

Vice President, Finance and Investor Relations

(858) 203-6657

www.dexcom.com

Dexcom, Dexcom Clarity, Dexcom Follow, Dexcom One, Dexcom Share, Stelo, and any related logos and design marks are either registered trademarks or trademarks of Dexcom, Inc. in the United States and/or other countries.

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

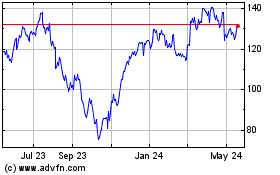

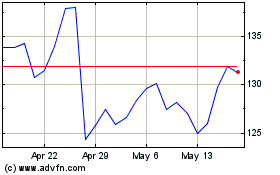

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Jan 2025 to Feb 2025

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Feb 2024 to Feb 2025