Edible Garden AG Incorporated (“Edible Garden” or the

“Company”) (Nasdaq: EDBL), a leader in

controlled environment agriculture (CEA), locally grown, organic

and sustainable produce and products, today provided a business

update and reported financial results for the three months ended

June 30, 2024.

Mr. Jim Kras, Chief Executive Officer of Edible

Garden, commented, “We are pleased to announce another

exceptionally strong quarter, as illustrated by a 157% increase in

gross profit, fueled by impressive year-over-year growth of 61% in

cut herbs and 30% in vitamins & supplements for the second

quarter of 2024. Our shift away from the dependence on third-party

growers is driving our gross profit margin improvement. With

approximately 95% of our fresh product line now produced in our own

facilities, gross margin increased to a record 36.7% in the second

quarter of 2024, compared to 13.1% for the same period last year.

Additionally, we have reviewed our business operations and made a

strategic decision to shift away from less profitable business

segments, directing our focus and efforts toward more profitable,

higher-margin segments. We believe that this shift in strategic

focus, combined with the vertical integration of our operations,

positions us well to continue improving our results and achieving

our goals of positive cash flow and profitability.”

"In the second quarter, we expanded the

distribution of our Pulp line of USDA organic, fermented, and

sustainable gourmet sauces and chili-based products, with the

addition of UNFI Distributors, a top North American wholesaler of

health and specialty foods serving over 30,000 locations. Through

KeHE Distributors and UNFI Distributors, as well as our own

e-commerce platform, retailers across the continent now have access

to our 'Bland to Bold' Pulp products. Our growing roster of major

retailers now includes Target, Whole Foods, Meijer, Morton

Williams, Dierbergs Markets, Woodman’s and others. According to

Research and Markets, the global sauces and condiments product

category is expected to grow to $240.7 billion in 2028 from $172.79

billion in 2021, and the response from consumers to the Pulp line

has been overwhelmingly positive.”

"We also bolstered our distribution through our

partnership with Hemingways, which serves over 350 retailers across

the Northeast, including an innovative integrated rack program

designed to enhance herb displays at their retail locations. We

have further expanded our retail network to include Seasons Kosher

and Lincoln Market. Lastly, we are excited that our entire product

line, including Pulp, is now available at every Brooklyn Fare

location in New York City."

“In late April, we launched distribution of our

Garden Starters—potted herbs and basil bowls tailored for home

gardening—to Midwestern retailers. Originally launched in 2023 to

meet the increasing popularity of home gardening, these

eco-friendly cultivated herbs respond to the needs of the 35% of

American households that grow at least some of their own food,

providing them with diverse flavor options for their meals. Our

vertically integrated Edible Garden Heartland facility in Grand

Rapids, Michigan, now fully manages the production, packaging, and

distribution of these products. By placing them next to our cut

herbs and sustainably sourced produce in supermarkets, we aim to

offer maximum convenience to our customers.”

“During the second quarter, we implemented

several new proprietary innovations in packaging and shipping to

significantly extend the shelf life of our products, reducing

spoilage and driving cost savings for our retail partners. These

innovations, including our patented self-watering in-store display,

differentiate Edible Garden by minimizing waste and ensuring

retailers can showcase plants at their peak, aligning with our

Zero-Waste Inspired® mission. Furthermore, we launched a

comprehensive training program with Abilities of Northwest Jersey

Inc., building on our decade-long partnership that integrates

dedicated workers with disabilities, benefiting both Edible Garden

and these individuals. Our programs provide valuable skills and

professional development, enhancing employability and enriching our

workforce, while remaining committed to community involvement,

local investment, and leadership in ESG and sustainability

initiatives."

“The impressive results we achieved in the

second quarter and first half of 2024 reflect the tireless efforts

and years of hard work by the entire Edible Garden team and our

capacity to consistently perform at a high level resulting in high

fill rates and an outstanding reputation as a trusted supplier

within the industry. This growth also underscores the positive

impact that vertical integration has had on our operations.”

Financial results for the three months ended June 30,

2024

For the quarter ended June 30, 2024, revenue

totaled $4.3 million, compared to $4.2 million for the three months

ended June 30, 2023. The increase was primarily attributable to

growth in our core products.

Cost of goods sold totaled $2.7 million for the

three months ended June 30, 2024, compared to $3.7 million for the

three months ended June 30, 2023. The decrease was primarily driven

by the elimination of the use of large third-party growers that

previously made up a material portion of our cost of goods

sold.

Selling, general and administrative (“SG&A”)

expenses were $2.7 million for the three months ended June 30,

2024, compared to $2.4 million for the three months ended June 30,

2024. The increase was primarily driven by a one-time bonus charge

of $0.1 million and higher audit, accounting and legal fees.

Net loss was $1.9 million, or ($1.21) per share,

for the three months ended June 30, 2024, compared to a net loss of

$638 thousand, or ($4.83) per share, for the three months ended

June 30, 2023. The increase in net loss was primarily due to a

one-time, $1.2 million credit related to the submission of a claim

to the IRS for the employee retention credit (“ERC”) in the three

months ended June 30, 2023.

The complete financial results for the three

months ended June 30, 2024, are available in the Company’s

Quarterly Report on Form 10-Q, which will be filed with the

Securities and Exchange Commission and available at:

www.sec.gov.

Conference Call

Edible Garden will host a conference call today

at 8:00 A.M. Eastern Time to discuss the Company’s financial

results for the quarter ended June 30, 2024, as well as the

Company’s corporate progress and other developments.

The conference call will be available via

telephone by dialing toll-free +1 888-506-0062 for U.S. callers or

+1 973-528-0011 for international callers and entering access code

421315. A webcast of the call may be accessed at

https://www.webcaster4.com/Webcast/Page/2914/50971 or on the

investor relations section of the company’s website,

https://ediblegardenag.com/presentations/.

A webcast replay will be available on the

investor relations section of the Company’s website at

https://ediblegardenag.com/presentations/ through August 14, 2025.

A telephone replay of the call will be available approximately one

hour following the call, through Wednesday, August 28, 2024, and

can be accessed by dialing +1 877-481-4010 for U.S. callers or +1

919-882-2331 for international callers and entering access code

50971.

ABOUT EDIBLE GARDEN®Edible

Garden AG Incorporated is a leader in controlled environment

agriculture (CEA), locally grown, organic, and sustainable produce

and products backed by Zero-Waste Inspired® next generation

farming. Offered at over 5,000 stores in the US, Edible Garden is

disrupting the CEA and sustainability technology movement with its

safety-in-farming protocols, use of sustainable packaging, patented

GreenThumb software and self-watering in-store displays. The

Company currently operates its own state-of-the-art greenhouses and

processing facilities in Belvidere, New Jersey and Grand Rapids,

Michigan, and has a network of contract growers, all strategically

located near major markets in the U.S. Its proprietary GreenThumb

2.0 patented (US Nos.: US 11,158,006 B1, US 11,410,249 B2 and US

11,830, 088 B2) software optimizes growing in vertical and

traditional greenhouses while seeking to reduce

pollution-generating food miles. Its proprietary patented (U.S.

Patent No. D1,010,365) Self-watering display is designed to

increase plant shelf life and provide an enhanced in-store plant

display experience. Edible Garden is also a developer of

ingredients and proteins, providing an accessible line of plant and

whey protein powders under the Vitamin Way® and Vitamin Whey®

brands. In addition, the Company offers a line of sustainable food

flavoring products such as Pulp gourmet sauces and chili-based

products. For more information on Pulp products go to

https://www.pulpflavors.com/. For more information on Edible Garden

go to https://ediblegardenag.com/.

Forward-Looking Statements

This press release contains forward-looking

statements, including with respect to the Company’s ability to

improve its financial results, the Company’s growth strategies, the

Company’s ability to expand into new product lines, and its

performance as a public company. The words “aim,” “anticipate,”

“believe,” “design,” “expect,” “objective,” “plan,” “seek,” “will,”

and similar expressions are intended to identify forward-looking

statements. These forward-looking statements are subject to a

number of risks, uncertainties, and assumptions, including market

and other conditions and the Company’s ability to achieve its

growth objectives, and other factors set forth in the Company’s

filings with the Securities and Exchange Commission, including the

Company’s annual report on Form 10-K for the year ended December

31, 2023 and subsequent quarterly reports on Form 10-Q. Actual

results might differ materially from those explicit or implicit in

the forward-looking statements. The Company undertakes no

obligation to update any such forward-looking statements after the

date hereof to conform to actual results or changes in

expectations, except as required by law.

Investor Contacts:Crescendo

Communications, LLC212-671-1020EDBL@crescendo-ir.com

(tables follow)

|

EDIBLE GARDEN AG INCORPORATED |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(unaudited, in thousands, except shares) |

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash |

$ |

2,188 |

|

|

$ |

510 |

|

|

Accounts receivable, net |

|

3,080 |

|

|

|

1,249 |

|

|

Inventory |

|

891 |

|

|

|

678 |

|

|

Prepaid expenses and other current assets |

|

146 |

|

|

|

210 |

|

|

|

|

|

|

|

|

|

Total current assets |

|

6,305 |

|

|

|

2,647 |

|

|

|

|

|

|

|

|

|

Property, equipment and leasehold improvements, net |

|

3,499 |

|

|

|

3,893 |

|

|

Intangible assets, net |

|

45 |

|

|

|

47 |

|

|

Other assets |

|

34 |

|

|

|

69 |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

$ |

9,883 |

|

|

$ |

6,656 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

(DEFICIT) |

|

LIABILITIES: |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and other accrued expenses |

$ |

3,719 |

|

|

$ |

2,517 |

|

|

Short-term debt, net of discounts |

|

4,901 |

|

|

|

387 |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

8,620 |

|

|

|

2,904 |

|

|

|

|

|

|

|

|

|

Long-term liabilities: |

|

|

|

|

|

|

Long-term debt, net of discounts |

|

752 |

|

|

|

4,040 |

|

|

Long-term lease liabilities |

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

Total long-term liabilities |

|

752 |

|

|

|

4,040 |

|

|

|

|

|

|

|

|

|

Total liabilities |

|

9,372 |

|

|

|

6,944 |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT): |

|

|

|

|

|

|

Common stock ($0.0001 par value, 100,000,000 shares authorized,

3,159,019 and 285,282 shares outstanding as of June 30, 2024 and

December 31, 2023, respectively (1)) |

|

1 |

|

|

|

1 |

|

|

Series A Convertible Preferred stock ($0.0001 par value, 10,000,000

shares authorized; nil shares outstanding as of June 30, 2024 and

December 31, 2023) |

|

- |

|

|

|

- |

|

|

Additional paid-in capital |

|

36,679 |

|

|

|

29,971 |

|

|

Accumulated deficit |

|

(36,169 |

) |

|

|

(30,260 |

) |

|

|

|

|

|

|

|

|

Total stockholders' equity (deficit) |

|

511 |

|

|

|

(288 |

) |

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

(DEFICIT) |

$ |

9,883 |

|

|

$ |

6,656 |

|

|

|

|

|

|

|

|

|

(1) Adjusted to reflect the stock splits as described in Note

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

EDIBLE GARDEN AG INCORPORATED |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(unaudited, in thousands, except share and per-share

information) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

4,268 |

|

|

$ |

4,221 |

|

|

|

$ |

7,401 |

|

|

$ |

6,676 |

|

|

Cost of goods sold |

|

2,702 |

|

|

|

3,668 |

|

|

|

|

5,811 |

|

|

|

6,148 |

|

|

Gross profit |

|

1,566 |

|

|

|

553 |

|

|

|

|

1,590 |

|

|

|

528 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

2,748 |

|

|

|

2,380 |

|

|

|

|

6,632 |

|

|

|

5,071 |

|

|

Loss from operations |

|

(1,182 |

) |

|

|

(1,827 |

) |

|

|

|

(5,042 |

) |

|

|

(4,543 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

(419 |

) |

|

|

(44 |

) |

|

|

|

(536 |

) |

|

|

(277 |

) |

|

Gain (Loss) from extinguishment of debt |

|

(335 |

) |

|

|

- |

|

|

|

|

(335 |

) |

|

|

70 |

|

|

Employee retention credit |

|

- |

|

|

|

1,233 |

|

|

|

|

- |

|

|

|

1,233 |

|

|

Other income / (loss) |

|

4 |

|

|

|

- |

|

|

|

|

4 |

|

|

|

- |

|

|

Total other income (expenses) |

|

(750 |

) |

|

|

1,189 |

|

|

|

|

(867 |

) |

|

|

1,026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS |

$ |

(1,932 |

) |

|

$ |

(638 |

) |

|

|

$ |

(5,909 |

) |

|

$ |

(3,517 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income / (Loss) per common share - basic and diluted (1) |

$ |

(1.21 |

) |

|

$ |

(4.83 |

) |

|

|

$ |

(5.21 |

) |

|

$ |

(35.60 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-Average Number of Common Shares Outstanding - Basic and

Diluted (1) |

|

1,590,188 |

|

|

|

132,074 |

|

|

|

|

1,133,921 |

|

|

|

98,795 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Adjusted to reflect the stock splits. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

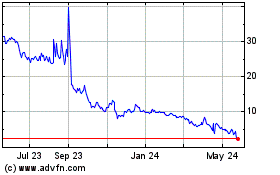

Edible Garden (NASDAQ:EDBL)

Historical Stock Chart

From Oct 2024 to Nov 2024

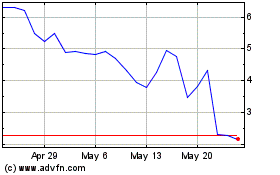

Edible Garden (NASDAQ:EDBL)

Historical Stock Chart

From Nov 2023 to Nov 2024