As Filed With the Securities and Exchange Commission on February 28, 2025

Registration No. 333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM S-8

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

_________________

Erie Indemnity Company

(Exact name of Registrant as specified in its charter)

Pennsylvania 25-0466020

(State of Incorporation) (I.R.S. Employer Identification No.)

100 Erie Insurance Place

Erie, Pennsylvania 16530

(814) 870-2000

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

_________________

Erie Indemnity Company Deferred Stock plan for Outside Directors

(Full title of the plan)

_________________

Brian W. Bolash, Esq.

Executive Vice President, Corporate Secretary & General Counsel

Erie Indemnity Company

100 Erie Insurance Place

Erie, Pennsylvania 16530

814-870-2000

(Name, address, including zip code, and telephone number, including area code of agent for service)

_________________

Copies to:

Michael C. Donlon, Esq.

Bond, Schoeneck & King, PLLC

200 Delaware Avenue, Suite 900

Buffalo, New York 14202

(716) 416-7000

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated file | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This registration statement is being filed to register additional securities of the same class as other securities for which a registration statement filed on Form S-8 relating to a director benefit plan is effective. Specifically, this Form S-8 registers additional shares of the registrant’s Class A Common Stock, no par value (the “Common Stock”), for issuance under the Erie Indemnity Company Deferred Stock Plan for Outside Directors (as amended, restated, supplemented or otherwise modified from time to time, the “Plan”). The Plan constituted a spin-off of the Deferred Stock Accounts from the Erie Indemnity Company Deferred Compensation Plan for Outside Directors (the “Deferred Compensation Plan”) and was generally effective as of July 29, 2015 and was amended and restated as of April 25, 2023. A previously filed Form S-8 (Reg. No. 333-148705) registered shares of Common Stock for issuance under the predecessor Deferred Compensation Plan, which remains effective for Common Stock to be issued under the Plan. Accordingly, pursuant to General Instruction E to Form S-8, this registration statement consists only of the facing page, this explanatory note, required consent and other exhibits, and the signature page. The contents of the above-referenced registration statement are incorporated by reference. The filing fee is being paid with respect to the additional securities only, as set forth in Exhibit 107 filed herewith.

The shares of Class A Common Stock to be issued pursuant to the Plan and registered hereunder will be purchased in the open market and will not increase the number of issued and outstanding shares of Class A Common Stock of the Registrant.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| | | | | |

| Item 8. | Exhibits. |

| 10.1 | |

| |

| 23 | |

| |

| 24 | |

| |

| 107 | |

[No opinion of counsel is being furnished because the securities being registered are not original issuance securities and the Plan is not subject to the requirements of ERISA.]

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Erie, Pennsylvania on February 28, 2025.

ERIE INDEMNITY COMPANY

By: /s/ Brian W. Bolash

Brian W. Bolash

Executive Vice President, Corporate Secretary & General Counsel

POWERS OF ATTORNEY

KNOW ALL BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints each of Brian W. Bolash or Julie M. Pelkowski his/her true and lawful attorney-in-fact and agent, each with full power of substitution and revocation, for him/her and in his/her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same with all exhibits thereto, and other documents in connection therewith, with the Commission, granting unto each attorney-in-fact and agent, full power and authority to do and perform each such and every act and thing requisite and necessary to be done, as fully to all intents and purposes as such person might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement and the foregoing Powers of Attorney have been signed by the following persons in the capacities indicated below on February 28, 2025.

| | | | | |

| Signature | Title |

/s/ Timothy G. NeCastro Timothy G. NeCastro | President and Chief Executive Officer |

/s/ Julie M. Pelkowski Julie M. Pelkowski | Executive Vice President and Chief Financial Officer |

/s/ Jorie L. Novacek Jorie L. Novacek | Senior Vice President and Controller |

/s/ J. Ralph Borneman, Jr. J. Ralph Borneman, Jr. | Director |

/s/ Eugene C. Connell Eugene C. Connell | Director |

/s/ Salvatore Correnti Salvatore Correnti | Director |

/s/ LuAnn Datesh LuAnn Datesh | Director |

/s/ Jonathan Hirt Hagen Jonathan Hirt Hagen | Director |

/s/ Thomas B. Hagen Thomas B. Hagen | Director |

/s/ C. Scott Hartz C. Scott Hartz | Director |

/s/ Brian A. Hudson, Sr. Brian A. Hudson, Sr. | Director |

/s/ George R. Lucore George R. Lucore | Director |

/s/ Thomas W. Palmer Thomas W. Palmer | Director |

/s/ Elizabeth Hirt Vorsheck Elizabeth Hirt Vorsheck | Director |

EX-FILING FEES0000922621FALSEErie Indemnity Companysharesiso4217:USDxbrli:pure00009226212025-02-282025-02-28000092262112025-02-282025-02-28

CALCULATION OF FILING FEE TABLE

Form S-8

(Form Type)

Erie Indemnity Company

(Exact name of Registrant as specified in its charter)

Table 1 - Newly Registered Securities

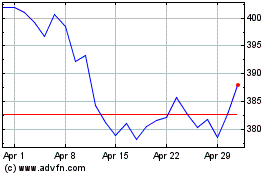

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered (1) | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

| Equity | Class A Common Stock | Rule 457(c) and Rule 457(h) | 50,000 | (2) | $ | 385.40 | | (3) | $ | 19,270,000 | | (3) | $153.10 per $1,000,000 | $ | 2,950.24 | |

| Total Offering Amounts | | | | $ | 19,270,000 | | | | $ | 2,950.24 | |

| Total Fee Offsets | | | | | | | $ | — | |

| Net Fee Due | | | | | | | $ | 2,950.24 | |

(1)Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also registers an indeterminate number of additional shares that may be issued pursuant to the above-named plans as the result of any future stock dividend, stock split, recapitalization or any other similar transaction effected without the receipt of consideration which results in an increase in the number of our outstanding shares of common stock.

(2)Represents additional shares of Class A common stock available for future issuance under the Erie Indemnity Company Deferred Stock Plan for Outside Directors (as amended, restated, supplemented or otherwise modified from time to time, the “Plan”) or that may become issuable under the Plan pursuant to its terms.

(3)This estimate is made pursuant to Rule 457(c) and 457(h) of the Securities Act solely for purposes of calculating the registration fee. The maximum offering price per share and the maximum aggregate offering price are based upon the average of the high and low prices of the Registrant's Class A common stock as reported on the Nasdaq Stock Market on February 21, 2025, which date is within five business days prior to filing this registration statement.

(4)The Registrant does not have any fee offsets.

Exhibit 23

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the Erie Indemnity Company Deferred Stock Plan for Outside Directors of our reports dated February 27, 2025, with respect to the consolidated financial statements of Erie Indemnity Company and the effectiveness of internal control over financial reporting of Erie Indemnity Company included in its Annual Report (Form 10-K) for the year ended December 31, 2024, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Indianapolis, Indiana

February 28, 2025

v3.25.0.1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.25.0.1

Offerings - Offering: 1

|

Feb. 28, 2025

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Class A Common Stock

|

| Amount Registered | shares |

50,000

|

| Proposed Maximum Offering Price per Unit |

385.40

|

| Maximum Aggregate Offering Price |

$ 19,270,000

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee |

$ 2,950.24

|

| Offering Note |

(1)Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also registers an indeterminate number of additional shares that may be issued pursuant to the above-named plans as the result of any future stock dividend, stock split, recapitalization or any other similar transaction effected without the receipt of consideration which results in an increase in the number of our outstanding shares of common stock. (2)Represents additional shares of Class A common stock available for future issuance under the Erie Indemnity Company Deferred Stock Plan for Outside Directors (as amended, restated, supplemented or otherwise modified from time to time, the “Plan”) or that may become issuable under the Plan pursuant to its terms. (3)This estimate is made pursuant to Rule 457(c) and 457(h) of the Securities Act solely for purposes of calculating the registration fee. The maximum offering price per share and the maximum aggregate offering price are based upon the average of the high and low prices of the Registrant's Class A common stock as reported on the Nasdaq Stock Market on February 21, 2025, which date is within five business days prior to filing this registration statement.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.25.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Erie Indemnity (NASDAQ:ERIE)

Historical Stock Chart

From Feb 2025 to Mar 2025

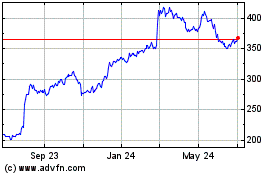

Erie Indemnity (NASDAQ:ERIE)

Historical Stock Chart

From Mar 2024 to Mar 2025