Fastenal Company Announces Cash Dividend

17 January 2025 - 8:15AM

Business Wire

Fastenal Company (Nasdaq:FAST) (collectively referred to as

'Fastenal' or by terms such as 'we', 'our', or 'us') reported its

board of directors declared a dividend of $0.43 per share to be

paid in cash on February 28, 2025 to shareholders of record at the

close of business on January 31, 2025. Except for share and per

share information, dollar amounts are stated in millions.

We began paying annual dividends in 1991, semi-annual dividends

in 2003, and then expanded to quarterly dividends in 2011. In

addition to these regular dividend payments, we have previously

paid special one-time dividends in December 2008, December 2012,

December 2020, and December 2023. Our board of directors currently

intends to continue paying quarterly dividends, though all future

determination as to payment of dividends will depend upon the

financial condition and results of operations of Fastenal and such

other factors as are deemed relevant by the board of directors at

that time.

In 2025, 2024, and 2023, we paid (or declared) dividends as

follows:

Year

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Sub-Total

(Regular)

Fourth Quarter

(Special)

Total

2025

$

0.43

2024

$

0.39

$

0.39

$

0.39

$

0.39

$

1.56

$

0.00

$

1.56

2023

$

0.35

$

0.35

$

0.35

$

0.35

$

1.40

$

0.38

$

1.78

Dividend and common stock purchase activity during the last ten

years:

Average Per

Total

Dividends per Share

Total Value of

Total Number

Share Price of

Dividend

Dividends

Regular

Special

Total

Common Stock

of Shares

Common Stock

Year

Payments

Paid

Dividend

Dividend

Dividend

Purchased

Purchased

Purchased

2025

One (1)

$

246.5

$

0.43

$

—

$

0.43

$

—

—

$

—

2024

Four

$

893.3

$

1.56

$

—

$

1.56

$

—

—

$

—

2023

Five (2)

$

1,016.8

$

1.40

$

0.38

$

1.78

$

—

—

$

—

2022

Four

$

711.3

$

1.24

$

—

$

1.24

$

237.8

5,000,000

$

47.58

2021

Four

$

643.7

$

1.12

$

—

$

1.12

$

—

—

$

—

2020

Five (2)

$

803.4

$

1.00

$

0.40

$

1.40

$

52.0

1,600,000

$

32.54

2019

Four

$

498.6

$

0.87

$

—

$

0.87

$

—

—

$

—

2018

Four

$

441.9

$

0.77

$

—

$

0.77

$

103.0

4,000,000

$

25.75

2017

Four

$

369.1

$

0.64

$

—

$

0.64

$

82.6

3,800,000

$

21.72

2016

Four

$

346.6

$

0.60

$

—

$

0.60

$

59.5

3,200,000

$

18.58

Ten Year Total

$

5,971.2

$

9.63

$

0.78

$

10.41

$

534.9

17,600,000

$

30.39

(1)

The Total Dividends Paid amount includes

the estimated impact from this announcement. The estimate is

calculated using the 573.3 million shares outstanding at December

31, 2024.

(2)

There was a supplemental dividend paid in

December 2020 and December 2023.

In the fourth quarter of 2024, we did not repurchase any of our

common stock.

We have authority to purchase up to 6,200,000 additional shares

of our common stock under the July 12, 2022 authorization. This

authorization does not have an expiration date.

All share and per share information reflects the two-for-one

stock split in 2019.

About Fastenal

Fastenal provides a broad offering of industrial supplies,

including fastener, safety, and metal cutting products, to

manufacturing, construction, and state and local government

customers through more than 3,600 in-market locations (branches and

customer-specific Onsite locations) spanning 25 countries. With

continual investment in tailored local inventory, dedicated local

experts, and flexible FMI® (Fastenal Managed Inventory) and digital

solutions, we help our business partners achieve product and

process savings across the supply chain – a "high-touch, high-tech"

approach encapsulated by our tagline, Where Industry Meets

Innovation™. Our local service teams are supported by 17

regional distribution centers, a captive logistics fleet, multiple

teams of industry specialists and support personnel, and robust

sourcing, quality, and manufacturing resources, enabling us to grow

by getting closer to customers and providing innovative and

comprehensive solutions to customer supply chain challenges.

Additional information regarding Fastenal is available on our

website at www.fastenal.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that are not historical

in nature and that are intended to be, and are hereby identified

as, "forward looking statements" as defined in the Private

Securities Litigation Reform Act of 1995, including a statement

regarding expectations as to payment of a quarterly cash dividend

in the foreseeable future. Any future determination as to payment

of dividends will depend upon the financial condition and results

of operations of Fastenal and such other factors as are deemed

relevant by the board of directors. For example, a change in

business needs including working capital and funding for

acquisitions, or a change in income tax law relating to dividends

or stock repurchases, could cause us to decide not to pay a

dividend in the future or not to repurchase common stock pursuant

to the existing share repurchase authorization. A discussion of

other risks and uncertainties is included in our filings with the

Securities and Exchange Commission, including our most recent

annual report and subsequent quarterly reports. FAST-D

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250116417890/en/

Taylor Ranta Oborski Accounting Manager 507.313.7959

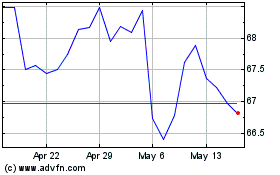

Fastenal (NASDAQ:FAST)

Historical Stock Chart

From Dec 2024 to Jan 2025

Fastenal (NASDAQ:FAST)

Historical Stock Chart

From Jan 2024 to Jan 2025