FTAI Aviation Ltd. (NASDAQ: FTAI), a Cayman Islands exempted

company (the “Company” or “FTAI”) previously announced the

commencement of a tender offer (the “Tender Offer”) by Fortress

Transportation and Infrastructure Investors LLC (“FTAI LLC”), a

wholly owned subsidiary of the Company, to purchase for cash up to

$100,000,000 aggregate principal amount of its outstanding 9.750%

Senior Notes due 2027 (the “2027 Notes”) on the terms and

conditions described in FTAI LLC’s Offer to Purchase, dated June 3,

2024, as amended by the terms set forth herein (the “Offer to

Purchase”). FTAI LLC hereby amends the Tender Offer to purchase for

cash up to $300,000,000 in aggregate principal amount of the 2027

Notes. Capitalized terms used but not defined in this announcement

have the meanings given to them in the Offer to Purchase.

The Tender Offer will expire at 5:00 p.m., New

York City time, on July 2, 2024 (the “Expiration Time”), unless

extended or earlier terminated by FTAI LLC. FTAI LLC reserves the

right to amend, extend or terminate the Tender Offer at any time

subject to applicable law.

The following table sets forth certain terms of

the Tender Offer:

|

Series of Notes |

CUSIP

Number(1) |

Aggregate Principal Amount Outstanding |

Tender Cap |

Total

Consideration(2) |

Early Tender

Payment(2) |

Tender

Consideration(2) |

|

9.750%Senior Notes due 2027 |

34960P AC5 (144A)U3458L AG6 (Reg S) |

$400,000,000 |

$300,000,000 |

$1,029.00 |

$30.00 |

$999.00 |

|

|

|

|

|

|

|

|

(1) CUSIPs are provided for the convenience of

Holders. No representation is made as to the correctness or

accuracy of such numbers.

(2) Per $1,000 principal amount of 2027 Notes

accepted for purchase. Holders who validly tender and do not

validly withdraw their 2027 Notes and whose 2027 Notes are accepted

for purchase in the Tender Offer will also be paid accrued and

unpaid interest from and including the interest payment date

immediately preceding the applicable settlement date to, but not

including, the applicable settlement date.

Each holder who validly tenders, and does not

validly withdraw, its 2027 Notes on or prior to 5:00 p.m., New York

City time, on June 14, 2024, unless extended (such date and time,

as the same may be extended, the “Early Tender Deadline”) will be

entitled to an early tender payment, which is included in the total

consideration above, of $30.00 for each $1,000 principal amount of

2027 Notes validly tendered by such holder, if such 2027 Notes are

accepted for purchase pursuant to the Tender Offer.

Holders validly tendering, and not validly

withdrawing, 2027 Notes after the Early Tender Deadline and on or

before the Expiration Time will be eligible to receive only the

tender offer consideration, which represents the total

consideration less the early tender payment.

In addition, holders whose 2027 Notes are

accepted for payment in the Tender Offer will receive accrued and

unpaid interest from the last interest payment date to, but not

including, the applicable settlement date for their 2027 Notes

purchased pursuant to the Tender Offer. The 2027 Notes tendered

prior to 5:00 p.m., New York City time, on June 14, 2024 (the

“Withdrawal Deadline”), may be withdrawn at any time prior to the

Withdrawal Deadline. 2027 Notes tendered after the Withdrawal

Deadline may not be withdrawn. If the Tender Offer is fully

subscribed as of the Early Tender Deadline, holders who validly

tender 2027 Notes after the Early Tender Deadline will not have any

of their 2027 Notes accepted for payment.

Subject to the satisfaction or waiver of certain

conditions, FTAI LLC reserves the right, following the Early Tender

Deadline, to accept for purchase prior to the Expiration Time all

2027 Notes validly tendered on or prior to the Early Tender

Deadline (the “Early Settlement Election”). FTAI LLC will announce

whether it intends to exercise the Early Settlement Election (the

“Early Settlement Announcement”) following the Early Tender

Deadline. If FTAI LLC exercises the Early Settlement Election, it

will pay the total consideration promptly following the Early

Settlement Announcement, which is currently expected to occur on

June 18, 2024, subject to all conditions of the Tender Offer having

been satisfied or waived by FTAI LLC (the “Early Settlement Date”),

plus accrued and unpaid interest on the purchased 2027 Notes from

the interest payment date for the 2027 Notes immediately preceding

the Early Settlement Date to, but not including, the Early

Settlement Date.

FTAI LLC’s obligation to accept for purchase,

and to pay for, 2027 Notes validly tendered and not validly

withdrawn pursuant to the Tender Offer is subject to the

satisfaction or waiver of certain conditions, including, but not

limited to, the condition that FTAI LLC shall have completed a debt

financing on terms and conditions satisfactory to it (the

“Financing Condition”). The complete terms and conditions of the

Tender Offer are set forth in the Tender Offer documents that are

being sent to holders of 2027 Notes. Holders of 2027 Notes are

urged to read the Tender Offer documents carefully.

FTAI LLC has retained J.P. Morgan Securities LLC

to act as dealer manager in connection with the Tender Offer.

Questions about the Tender Offer may be directed to J.P. Morgan

Securities LLC at (866) 834-4666 (toll-free) or (212) 834-7489

(collect). Copies of the Tender Offer documents and other related

documents may be obtained from D.F. King & Co., Inc., the

tender and information agent for the Tender Offer, at (212)

269-5550 (banks or brokers) or (toll free) (800) 290-6432 or by

email at FTAI@dfking.com.

This press release amends the terms of the Offer

to Purchase. To the extent that any terms in the Offer to Purchase

are inconsistent with terms in this press release, the terms of

this press release shall control. Other than as set forth herein,

no other terms of the Tender Offer are being amended and there are

no other changes to the terms of the Tender Offer set forth in the

Offer to Purchase.

The Tender Offer is being made solely by means

of the Tender Offer documents. Under no circumstances shall this

press release constitute an offer to purchase or sell or the

solicitation of an offer to purchase or sell the 2027 Notes or any

other securities of FTAI LLC or any other person, nor shall there

be any offer or sale of any 2027 Notes or other securities in any

state or jurisdiction in which such an offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. In addition, nothing

contained herein constitutes a notice of redemption of the 2027

Notes. No recommendation is made as to whether holders of the 2027

Notes should tender their 2027 Notes.

About FTAI Aviation Ltd.

FTAI owns and maintains commercial jet engines with a focus on

CFM56 and V2500 engines. FTAI’s propriety portfolio of products,

including The Module Factory and a joint venture to manufacture

engine PMA, enables it to provide cost savings and flexibility to

our airline, lessor, and maintenance, repair, and operations

customer base. Additionally, FTAI owns and leases jet aircraft

which often facilitates the acquisition of engines at attractive

prices. FTAI invests in aviation assets and aerospace products that

generate strong and stable cash flows with the potential for

earnings growth and asset appreciation.

Cautionary Note Regarding

Forward-Looking Statements

Certain statements in this press release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements

are based on management’s current expectations and beliefs and are

subject to a number of trends and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements, many of which are beyond the Company’s

control, and include, but are not limited to our ability to

complete the offering of a new series of senior notes and our

ability to complete the Tender Offer on the terms contemplated, or

at all. The Company can give no assurance that its expectations

will be attained and such differences may be material. Accordingly,

you should not place undue reliance on any forward-looking

statements contained in this press release. For a discussion of

some of the risks and important factors that could affect such

forward-looking statements, see the sections entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in the Company’s most recent

Annual Report on Form 10-K and Quarterly Reports on Form 10-Q,

which are available on the Company’s website

(www.ftaiaviation.com). In addition, new risks and uncertainties

emerge from time to time, and it is not possible for the Company to

predict or assess the impact of every factor that may cause its

actual results to differ from those contained in any

forward-looking statements. Such forward-looking statements speak

only as of the date of this press release. The Company expressly

disclaims any obligation to release publicly any updates or

revisions to any forward-looking statements contained herein to

reflect any change in the Company’s expectations with regard

thereto or change in events, conditions or circumstances on which

any statement is based. This press release shall not constitute an

offer to sell or the solicitation of an offer to buy any

securities.

For further information, please

contact:

Alan AndreiniInvestor RelationsFTAI Aviation

Ltd.(646) 734-9414

Source: FTAI Aviation Ltd.

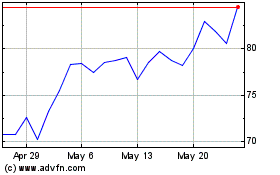

FTAI Aviation (NASDAQ:FTAI)

Historical Stock Chart

From Nov 2024 to Dec 2024

FTAI Aviation (NASDAQ:FTAI)

Historical Stock Chart

From Dec 2023 to Dec 2024