false000071439500007143952024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

______________________

Date of Report (Date of earliest event reported): January 25, 2024

GERMAN AMERICAN BANCORP, INC.

(Exact name of registrant as specified in its charter)

Indiana

(State or other jurisdiction of incorporation)

| | | | | | | | |

| 001-15877 | 35-1547518 |

| (Commission File Number) | (IRS Employer Identification No.) |

| 711 Main Street | |

| Jasper, | Indiana | 47546 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (812) 482-1314

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [☐]

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange

on which registered |

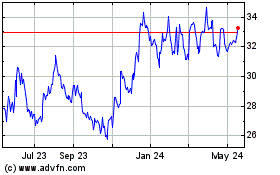

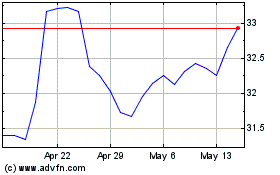

| Common Stock, no par value | | GABC | | Nasdaq Global Select Market |

Item 2.02. Results of Operations and Financial Condition.

On January 29, 2024, German American Bancorp, Inc. (the “Company”) issued a press release announcing its results for the quarter and year ended December 31, 2023, and making other disclosures. The press release (including the accompanying unaudited consolidated financial statements as of and for the quarter and year ended December 31, 2023, and other financial data) is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02, including the information incorporated herein from Exhibit 99.1, is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 5.05. Amendments to the Registrant’s Code of Ethics, or Waiver of a Provision of the Code of Ethics.

On and effective January 25, 2024, the Company’s Board of Directors (the “Board”), upon the recommendation of its Governance/Nominating Committee, approved an amended and restated Code of Business Conduct for the Company (the “Code”). The Code is applicable to all officers, directors and employees of the Company, including but not limited to the Company’s principal executive officer, principal financial officer, and principal accounting officer. The Code was amended to more clearly communicate the Company’s high standards for honest and ethical conduct, including formalizing the Company’s policies relating to bribery, corruption, money laundering, financial crimes, and the acceptance of gifts. The amendments to the Code did not relate to or result in any waiver, explicit or implicit, of any provision of the previous Code of Business Ethics.

The foregoing summary of the amendments to the Code is qualified in its entirety by reference to the full text of the Code, which is attached hereto as Exhibit 14.1 and will also be available on the Company’s website at www.germanamerican.com (under the Corporate Profile – Governance Documents tab of the Investor Relations section). The contents of the Company’s website are not incorporated by reference in this report.

Item 8.01. Other Events.

Cash Dividend. As announced in the press release furnished as Exhibit 99.1 to this report, the Company’s Board of Directors has declared a cash dividend of $0.27 per share which will be payable on February 20, 2024, to shareholders of record as of February 10, 2024.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits | | |

| | | |

| Exhibit No. | | Description |

| | | |

| | | German American Bancorp, Inc. Code of Business Conduct, effective January 25, 2024. |

| | | |

| | | Press release, dated January 29, 2024, issued by German American Bancorp, Inc. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* * * * * *

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: January 29, 2024 | By: | GERMAN AMERICAN BANCORP, INC.

/s/ D. Neil Dauby |

| | D. Neil Dauby, Chairman and Chief Executive Officer |

GERMAN AMERICAN BANCORP, INC. Code of Business Conduct Introduction We strive to conduct all of our businesses under the highest ethical standards, which require honesty and fair dealing. We rely on these standards to gain the trust of customers, peers and shareholders. Our goal is to operate in strict compliance with all applicable laws and regulations and internal policies, guidelines and procedures. We are guided by our vision of building a preeminent financial enterprise offering a full array of integrated products and services. We are mindful of our community banking roots and the importance of enhancing and growing the relationship we have with our shareholders, customers, employees and communities. In keeping with our purpose and values, our Board of Directors has adopted this Code of Business Conduct, which has been amended and restated as of January 25, 2024 (the “Code”). The Code applies to all of our employees, officers, directors, and regional advisory directors (past and present) (such persons are referred to this Code as “Covered Persons”), including those of German American Bancorp, Inc., and of each of its subsidiaries (collectively, the “Company”). The purpose of this Code is to set forth in writing standards that will deter wrongdoing and that will promote: honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional, official or employment relationships; full, fair, accurate, timely and understandable disclosure in reports and other documents that we file with or submit to the Securities and Exchange Commission (“SEC”) and in other public communications that we make; • compliance with applicable governmental laws, rules and regulations; • the prompt internal reporting of violations of this Code to appropriate specified persons; and • accountability for adherence to this Code’s provisions. To ensure familiarity and knowledge of our policies, including the Code of Business Conduct, our employee handbook (the “Handbook”) is reviewed and acknowledged by all new employees, and annually by all employees. The Code of Business Conduct is again acknowledged by all employees upon any material change to the policy.

2 SECTION I Reporting Our Covered Persons are encouraged to identify and raise potential issues before they lead to problems, and to ask about the application of this Code to themselves whenever in doubt. Inquiries in this regard, and requests for approvals or waivers, should be directed to the Chief Executive Officer of German American Bancorp, Inc. A Covered Person who becomes aware of information that could indicate the existence of any violation of this Code by any other person should promptly report that concern or information (which may be done on an anonymous confidential basis) through our third party reporting service under the “Section 301 Procedures” adopted by the Audit Committee. We have communicated our Section 301 Procedures to all of our Covered Persons, and they are posted on our intranet and in the Shareholder Info section of our website, www.germanamerican.com. Any employee who has a concern or complaint about employment or other matters that arise under the Handbook or other corporate policies, but which do not relate to any violation of this Code or to any concern regarding accounting or auditing matters, should notify the Corporate Director of Human Resources. Persons (including non-employees and other persons who are not Covered Persons) are encouraged to submit any complaints or concerns that they may have regarding accounting or auditing matters or other wrongdoing to our attention by reporting that complaint or concern through our Section 301 Procedures. We will not permit any form of retaliation against any person who, in good faith, reports to us known or suspected violations of this Code or any other illegal or unethical behavior, even if such report turns out to be in error. Any such retaliation is itself a violation of this Code and will subject the person(s) involved to disciplinary action. SECTION II The Core of our Code A. Conflicts of Interest A “conflict of interest” occurs when the private interest of an employee, officer or director improperly interferes with the interests of the Company. Conflicts of interest are prohibited as a matter of our policy, unless they have been reported to and approved by us. A Covered Person must never use or attempt to use his or her position with us to obtain any improper personal benefit for himself or herself, for his or her family members, or for any other person, including loans or guarantees of obligations, from any third person or

3 entity. Covered Persons should also avoid acquiring or maintaining outside financial interests, or business, professional, personal or employment relationships, that might interfere with their duties of loyalty and care to us, or might have the appearance of such interference. We encourage our Covered Persons to do business with us. Therefore, loan, deposit, insurance, investment, financial advisory, trust and other relationships or transactions that such individuals may have with us in the ordinary course of our businesses are not improper, and are therefore not considered to be “conflicts of interest” that are prohibited under this Code, provided that (a) an authorized disinterested employee of ours handles that business on our behalf, and (b) such business is conducted in accordance with all applicable laws, rules, regulations, and internal policies and guidelines, including where applicable the timely disclosure to us of all material information relating to any relationships that may exist between any of our Covered Persons, and the person who is transacting business with us. Whether particular conduct, relationships or transactions might be considered to be a conflict of interest may not always be clear. Any Covered Person may seek our guidance as to whether his or her conduct, relationships or transactions might be considered to be a conflict of interest, and whether we might nevertheless approve such conduct, relationships or transactions by contacting the Chief Executive Officer of German American Bancorp, Inc. B. Public Disclosure It is our policy that the information in our public communications, including SEC filings, be full, fair, accurate, timely and understandable. All Covered Persons who are involved in our disclosure process are responsible for upholding this policy. In particular, these individuals are required to maintain familiarity with the disclosure requirements applicable to us and are prohibited from knowingly misrepresenting, omitting, or causing others to misrepresent or omit, material facts about us to others, whether within or outside our company, including our independent auditors and its internal auditors. In addition, any Covered Person who has a supervisory role in our disclosure process has an obligation to discharge his or her responsibilities diligently. C. Safe, Healthy and Productive Work Environment The Company’s policy is to promote a safe, healthy and productive work environment. The Company intends to maintain a workplace free of sexual and other harassment, discrimination, and intimidation, including harassment based on race, color, ancestry, national origin, gender, sexual orientation, marital status, religion, ethnicity, age, disability, gender identity, results of genetic testing, military status, protected activity (i.e. opposition to prohibited discrimination or participation in the statutory complaint process), or any other protected categories under the law.

4 All Covered Persons have a responsibility to help us maintain a safe workplace by utilizing safe work practices, by following the safety instructions on all equipment they operate and by timely reporting any hazards to customers and employees immediately. The Company also maintains a firearm and weapons free workplace and prohibits all Covered Persons from carrying firearms and weapons inside all the banking centers, offices, and buildings owned or leased by the Company. A license to carry a weapon does not supersede this policy. We prohibit the use of tobacco products or alcohol in the buildings or on the premises. These commitments to a safe, healthy and productive work environment are encompassed in the Handbook, which is reviewed and acknowledged annually by all employees. D. Acceptance of Gifts No Covered Person should accept any cash, gifts exceeding a retail value of $250.00 cumulatively in a 12-month period, special accommodations, favors, or the use of property or facilities from anyone with whom such person is doing, negotiating, soliciting, or being solicited for business on behalf of the Company. It should be understood that under some circumstances a gift may be considered a crime under the Federal Bribery Act (see below). Notwithstanding the above, noncash gifts may be accepted if they are (1) appropriate, customary, and reasonable meals and/or entertainment at which the provider is present, such as an occasional business meal or sporting event; or (2) appropriate, customary, and reasonable gifts based on family or personal relationships, and clearly not meant to influence Company business. Any cash or gift received which does not comply with the limits set forth must be reported in writing to the Company’s Chief Administrative Officer. E. Anti-Bribery and Anti-Corruption The Company requires that all of its business activities be conducted in an honest and ethical manner, with zero tolerance for bribery and corruption. The Company further expects and requires compliance with the U.S. Foreign Corrupt Practices Act, the Bank Bribery Act and other laws and regulations related to anti-bribery and anti-corruption. The Bank Bribery Act makes it a federal criminal offense for any employee, officer, director or agent of the Company to corruptly give or offer, or to corruptly accept or agree to accept, anything of value to/from anyone intending to influence or be influenced or to reward or be rewarded in connection with the Company’s business. Violations of the Bank Bribery Act are punishable by imprisonment and/or significant fines.

5 F. Anti-Money Laundering and Financial Crimes Money laundering is an evasive process used by criminals to convert their illegally obtained criminal proceeds (dirty money) into legitimate (clean) money. The Company has strict policies and procedures in place (including “know your customer” and risk- based due diligence procedures) to prevent money laundering and to comply with all relevant laws and regulations, including the Bank Secrecy Act (the “BSA”) and economic sanctions. Economic sanctions are a tool used by governments to restrict financial transactions or activity with designated targets (e.g., countries, entities or individuals). Employees should never assist a customer in evading reporting requirements, including lowering transaction amounts to avoid FinCEN reporting, altering information or instructions in wire payments to avoid or circumvent economic sanctions, or any other methods designed to evade federal or state law or the policies and procedures of the Company. The penalties for doing so are severe and could include civil and criminal penalties, as well as job termination. Employees are responsible for being knowledgeable about the BSA and anti-money laundering laws that apply to the Company, and the Company’s related policies and procedures, so they can properly identify and report violations. G. Compliance with Laws, Rules and Regulations It is our policy to comply with all applicable laws, rules and regulations. It is the personal responsibility of each Covered Person to adhere to the standards and restrictions imposed by those laws, rules and regulations. The Handbook provides guidance to employees as to certain laws, rules and regulations that apply to our activities. Generally, it is both illegal and against our policy for any Covered Person who is aware of material nonpublic information relating to us, any of our clients, or any other private or governmental issuer of securities, to buy or sell any securities of those issuers, or recommend that another person buy, sell or hold the securities of those issuers. More detailed rules governing the trading of securities by our Covered Persons are set forth in our policy statement entitled “Insider Trading Policy” dated December 20, 2021. H. Corporate Opportunities Covered Persons owe a duty to us to advance our legitimate business interests when the opportunity to do so arises. Covered Persons are prohibited from taking for themselves (or directing to a third party) a business opportunity that is discovered through the use of corporate property, information or position, unless we have already been offered the opportunity and turned it down. More generally, Covered Persons are prohibited from using corporate property, information or position (including customer lists or information) for personal gain or competing with us. Sometimes the line between personal and corporate benefits is difficult to draw, and sometimes both personal and corporate benefits may be derived from certain activities. The only prudent course of conduct for our Covered Persons is to make sure that any use

6 by them of our property or services that is not solely for our benefit is approved by us beforehand through contact with the Chief Executive Officer of German American Bancorp, Inc. I. Confidentiality In carrying out our businesses, Covered Persons often learn confidential or proprietary information about us, or our clients/customers, prospective clients/customers or other third parties. Covered Persons must maintain the confidentiality of all information so entrusted to them, except when disclosure is authorized or legally mandated. Confidential or proprietary information includes, among other things, any non-public information concerning us, including our businesses, financial performance, customers, results or prospects, and any non-public information provided by a third party with the expectation that the information will be kept confidential and used solely for the business purpose for which it was conveyed. J. Fair Dealing We have a history of succeeding through honest business competition. We do not seek competitive advantages through illegal or unethical business practices. Each Covered Person should endeavor to deal fairly with our customers, clients, service providers, suppliers, competitors and employees. No Covered Person should take unfair advantage of anyone through manipulation, concealment, abuse of privileged information, misrepresentation of material facts, or any unfair dealing practice. K. Protection and Proper Use of Firm Assets All Covered Persons should protect our assets and ensure their efficient use. Our assets should be used for legitimate business purposes only. SECTION III Compliance and Enforcement A. Sanctions We will take any disciplinary or preventive action we deem appropriate to address any existing or potential violation of this Code brought to our attention. Violations of the Code may result in disciplinary measures against the violator. Such measures, depending on the nature and severity of the violation, whether the violation was a single or repeated occurrence, and whether the violation appears to have been intentional or inadvertent, may include written notices to the individual involved, censure, demotion or re- assignment, suspension with or without pay or benefits, and termination of employment. Directors and regional advisory directors may be asked to resign from their positions.

7 B. Waivers and Approvals From time to time, we may waive certain provisions of this Code and we may interpret the Code as applied to specific circumstance and approve certain matters that might raise questions under the Code. Any Covered Person may ask for such a waiver, approval or interpretation by contacting the Chief Executive Officer of German American Bancorp, Inc. Waivers, approvals and interpretations involving executive officers or directors of German American Bancorp, Inc. may be made only by the Board of Directors of German American Bancorp, Inc. and the Board’s determinations involving such persons, to the extent that those determinations represent waivers of this Code, will be promptly publicly disclosed (along with the reasons for the waiver) in accordance with applicable legal and stock market requirements. As used in this Code, a person is an “executive officer” of German American Bancorp, Inc., if he or she has been identified by its Board of Directors as an executive officer for purposes of the federal securities laws; the term “executive officer” includes, but is not limited to, the principal executive officer, principal financial officer, and principal accounting officer of German American Bancorp, Inc. Adopted on: January 25, 2024

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

1 of 17

JANUARY 29, 2024 GERMAN AMERICAN BANCORP, INC. (GABC) POSTS SOLID 4TH QUARTER AND ANNUAL 2023 EARNINGS; DECLARES 8% CASH DIVIDEND INCREASE

Jasper, Indiana: January 29, 2024 -- German American Bancorp, Inc. (Nasdaq: GABC) reported solid annual earnings of $85.9 million, or $2.91 per share, for the year ended December 31, 2023, representing the second highest level of earnings per share in the Company’s history. This level of reported annual earnings resulted in a 14.7% return on average shareholders’ equity, marking the 19th consecutive fiscal year in which the Company has delivered a double-digit return on shareholders’ equity. The Company also announced the declaration of an 8% increase in its quarterly cash dividend, marking the 12th consecutive year of increased cash dividends.

The Company’s 2023 reported net income represented an increase of $4.1 million, or approximately 5% on a per share basis, over 2022 net income of $81.8 million, or $2.78 per share, which was impacted by the one-time merger costs related to the January 1, 2022 acquisition of Citizens Union Bancorp of Shelbyville, Inc.

The 2023 annual operating performance was highlighted by an expanded net interest margin of 13 basis points, which increased from 3.45% to 3.58% as rising deposit costs from continued Federal Reserve rate increases and shifting of deposit composition did not escalate meaningfully until the second half of 2023. The re-mixing of earning assets from the securities portfolio into the higher yielding loan portfolio also contributed positively to the increased margin.

In addition, the 2023 year was marked by solid organic loan growth across most lending categories, continued strong credit metrics, solid gains in non-interest income led by wealth management and interchange fees, and ongoing optimization of our non-interest expenses. The Company’s operating results were also positively impacted by the execution of qualitative strategic initiatives such as meaningful talent acquisitions and ongoing technology/digital investment.

Given the tumultuous year in the banking industry led by economic uncertainty and multiple bank failures, German American remained well positioned for long term success with strong capital levels and solid liquidity. The Company’s combined enterprise, which encompasses 75 banking offices across two contiguous states, continues to benefit from its diversified footprint of rural, suburban and urban markets providing a strong deposit franchise base as well as significant organic growth opportunities.

On a quarter over quarter basis, fourth quarter 2023 net income of $21.5 million and earnings per share of $0.73 were consistent with third quarter 2023 net income of $21.5 million, or $0.73 per share. Net interest margin declined from 3.57% to 3.43%, or 14 basis points, quarter over quarter. This compression was driven by a lower level of accretion of discounts on acquired loans that negatively impacted the net interest margin

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

2 of 17

by 7 basis points and an overall increase in the cost of funds. The margin compression was partially offset by exceptional credit metrics, with no provision for credit losses being taken in the fourth quarter, largely as a result of a fully-reserved, non-performing commercial relationship being paid off.

In addition, the fourth quarter 2023 operating performance was highlighted by strong organic loan and deposit growth. Total loans increased $84 million, or approximately 9% on an annualized basis, and were broad-based across most loan categories and markets. Deposits increased $117 million, or 2% on a linked quarter basis, with non-interest bearing accounts remaining at a solid 28.4% of total deposits. Non-interest income growth of 5% and flat non-interest expenses, in each case on a linked-quarter basis, also contributed to the solid fourth quarter operating performance.

The Company also announced an 8% increase in the level of its regular quarterly cash dividend, as its Board of Directors declared a regular quarterly cash dividend of $0.27 per share, which will be payable on February 20, 2024 to shareholders of record as of February 10, 2024.

D. Neil Dauby, German American’s Chairman & CEO stated, “We are extremely pleased with our operating results in 2023, especially given the challenging economic environment, as we continue our decades long trend of exceptional financial performance. Thanks to the dedicated efforts of our relationship-focused team of professionals, we are confident that our strong community presence, healthy financial condition, and disciplined approach to risk management will continue to drive future profitability. We remain excited and committed to the vitality and future growth of our Indiana and Kentucky communities.”

Balance Sheet Highlights

Total assets for the Company totaled $6.152 billion at December 31, 2023, representing an increase of $146.5 million compared with September 30, 2023 and a decline of $3.8 million compared with December 31, 2022. The increase in total assets at December 31, 2023 compared with September 30, 2023 was largely related to an increase in the market value of the securities portfolio and an increase in total loans.

Securities available for sale increased $119.9 million as of December 31, 2023 compared with September 30, 2023 and declined $164.8 million compared with December 31, 2022. The increase in the available for sale securities portfolio during the fourth quarter of 2023 compared with the end of the third quarter of 2023 was largely attributable to fair value adjustments on the portfolio related to a decline in market interest rates while the decline from the fourth quarter of 2022 was primarily the result of the Company's utilization of cash flows from the securities portfolio to fund loan growth. Total cash flow generated from the portfolio totaled approximately $31.5 million during the fourth quarter of 2023, reflecting principal and interest payments. Current projections indicate approximately $150.0 million in principal and interest cash flows from the portfolio over the next twelve months with rates unchanged.

December 31, 2023 total loans increased $84.3 million, or 9% on an annualized basis, compared with

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

3 of 17

September 30, 2023 and increased $189.3 million, or 5%, compared with year-end 2022. The increase during the fourth quarter of 2023 compared with September 30, 2023 was broad-based across most segments of the portfolio. Commercial real estate loans increased $44.9 million, or 9% on an annualized basis, while agricultural loans grew $25.7 million, or 26% on an annualized basis, and retail loans grew by $18.1 million, or 10% on an annualized basis. Partially offsetting these increases was a modest decline in commercial and industrial loans of $4.4 million, or 3% on an annualized basis, as line of credit utilization remains muted.

The composition of the loan portfolio has remained relatively stable and diversified over the past several years, including 2023. The portfolio is most heavily concentrated in commercial real estate loans at 53% of the portfolio, followed by commercial and industrial loans at 17% of the portfolio, and agricultural loans at 11% of the portfolio. The Company’s commercial lending is extended to various industries, including multi-family housing and lodging, agribusiness and manufacturing, as well as health care, wholesale, and retail services. The Company's commercial real estate portfolio has limited exposure to office real estate, with office exposure totaling approximately 4% of the total loan portfolio.

| | | | | | | | | | | | | | | | | | | | |

| End of Period Loan Balances | | 12/31/2023 | | 9/30/2023 | | 12/31/2022 |

| (dollars in thousands) | | | | | | |

| | | | | | |

| Commercial & Industrial Loans | | $ | 661,529 | | | $ | 665,892 | | | $ | 676,502 | |

| Commercial Real Estate Loans | | 2,121,835 | | | 2,076,962 | | | 1,966,884 | |

| Agricultural Loans | | 423,803 | | | 398,109 | | | 417,413 | |

| Consumer Loans | | 407,889 | | | 396,000 | | | 377,164 | |

| Residential Mortgage Loans | | 362,844 | | | 356,610 | | | 350,682 | |

| | $ | 3,977,900 | | | $ | 3,893,573 | | | $ | 3,788,645 | |

The Company’s allowance for credit losses totaled $43.8 million at December 31, 2023 compared to $44.6 million at September 30, 2023 and $44.2 million at December 31, 2022. The allowance for credit losses represented 1.10% of period-end loans at December 31, 2023 compared with 1.15% at September 30, 2023 and 1.17% of period-end loans at December 31, 2022. The decline in the allowance for credit losses as of year-end 2023 was largely related to the resolution during the fourth quarter of 2023 of a single commercial borrowing relationship with minimal loss recognition for which the Company had established a significant reserve in previous periods.

Non-performing assets totaled $9.2 million at December 31, 2023, $12.4 million at September 30, 2023 and $14.3 million at December 31, 2022. Non-performing assets represented 0.15% of total assets at year-end 2023, 0.21% at September 30, 2023 and 0.23% at December 31, 2022. Non-performing loans totaled $9.2 million at December 31, 2023, $12.4 million at September 30, 2023 and $14.3 million at December 31, 2022. Non-performing loans represented 0.23% of total loans at December 31, 2023, 0.32% at September 30, 2023 and 0.38% at December 31, 2022. The decline in non-performing assets and loans at year-end

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

4 of 17

2023 was largely attributable to the payoff of the aforementioned single non-performing commercial credit relationship.

| | | | | | | | | | | | | | | | | |

| Non-performing Assets | | | | | |

| (dollars in thousands) | | | | | |

| 12/31/2023 | | 9/30/2023 | | 12/31/2022 |

| Non-Accrual Loans | $ | 9,136 | | | $ | 11,206 | | | $ | 12,888 | |

| Past Due Loans (90 days or more) | 55 | | | 1,170 | | | 1,427 | |

| Total Non-Performing Loans | 9,191 | | | 12,376 | | | 14,315 | |

| Other Real Estate | — | | | 24 | | | — | |

| Total Non-Performing Assets | $ | 9,191 | | | $ | 12,400 | | | $ | 14,315 | |

| | | | | |

| Restructured Loans | $ | — | | | $ | — | | | $ | — | |

Year-end 2023 total deposits increased $117.1 million, or 2% on a linked quarter basis, compared to September 30, 2023 and declined $97.1 million, or 2%, compared with December 31, 2022. The increase at year-end 2023 compared to September 30, 2023 was largely attributable to seasonal inflows of public entity funds combined with an inflow of time deposits. The Company has continued to see customer movement from both interest bearing and non-interest bearing transactional accounts to time deposits due primarily to a higher interest rate environment. Non-interest bearing deposits have remained relatively stable as a percent of total deposits with December 31, 2023 non-interest deposits totaling 28% of total deposits compared with 29% at September 30, 2023 and 32% at year-end 2022.

A competitive market driven by the rise in interest rates has been a significant contributing factor to the decline in total deposits over the course of the past year. Additionally, a meaningful level of the outflow of deposits experienced during the past year was captured within the Company's wealth management group.

December 31, 2023 total borrowings declined $92.3 million compared to September 30, 2023 and declined $9.9 million compared with year-end 2022. The decline in total borrowings during the fourth quarter of 2023 compared with September 30, 2023 was largely attributable to a decline in short-term borrowings primarily related to growth in overall deposits during the fourth quarter of 2023.

| | | | | | | | | | | | | | | | | | | | |

| End of Period Deposit Balances | | 12/31/2023 | | 9/30/2023 | | 12/31/2022 |

| (dollars in thousands) | | | | | | |

| | | | | | |

| Non-interest-bearing Demand Deposits | | $ | 1,493,160 | | | $ | 1,502,175 | | | $ | 1,691,804 | |

| IB Demand, Savings, and MMDA Accounts | | 2,992,761 | | | 2,932,180 | | | 3,229,778 | |

| Time Deposits < $100,000 | | 289,077 | | | 269,829 | | | 235,219 | |

| Time Deposits > $100,000 | | 477,965 | | | 431,687 | | | 193,250 | |

| | $ | 5,252,963 | | | $ | 5,135,871 | | | $ | 5,350,051 | |

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

5 of 17

At December 31, 2023, the capital levels for the Company and its subsidiary bank, German American Bank (the “Bank”), remained well in excess of the minimum amounts needed for capital adequacy purposes and the Bank’s capital levels met the necessary requirements to be considered well-capitalized.

| | | | | | | | | | | | | | | | | | | | |

| | 12/31/2023

Ratio | | 9/30/2023

Ratio | | 12/31/2022

Ratio |

| Total Capital (to Risk Weighted Assets) | | | | | | |

| Consolidated | | 16.50 | % | | 16.21 | % | | 15.45 | % |

| Bank | | 14.76 | % | | 14.83 | % | | 14.07 | % |

| Tier 1 (Core) Capital (to Risk Weighted Assets) | | | | | | |

| Consolidated | | 14.97 | % | | 14.66 | % | | 13.97 | % |

| Bank | | 14.04 | % | | 14.10 | % | | 13.42 | % |

| Common Tier 1 (CET 1) Capital Ratio (to Risk Weighted Assets) | | | | | | |

| Consolidated | | 14.26 | % | | 13.95 | % | | 13.26 | % |

| Bank | | 14.04 | % | | 14.10 | % | | 13.42 | % |

| Tier 1 Capital (to Average Assets) | | | | | | |

| Consolidated | | 11.75 | % | | 11.70 | % | | 10.50 | % |

| Bank | | 11.03 | % | | 11.26 | % | | 10.09 | % |

Results of Operations Highlights – Year ended December 31, 2023

Net income for the year ended December 31, 2023 totaled $85,888,000, or $2.91 per share, an increase of $4,063,000, or approximately 5% on a per share basis, from the year ended December 31, 2022 net income of $81,825,000, or $2.78 per share. The increase in net income during 2023, compared with 2022, was primarily attributable to increased non-interest income, a decline in non-interest expenses (which was driven by higher expenses in 2022 as a result of the January 1, 2022 acquisition of Citizens Union Bancorp of Shelbyville, Inc. (“CUB”)), and a lower provision for credit losses. The positive impact of those items was partially offset by a decline in net interest income resulting primarily from a reduced level of earning assets, which was somewhat mitigated by an improved net interest margin. The 2022 results of operations included acquisition-related expenses of $12,323,000 ($9,372,000 or $0.32 per share, on an after tax basis) and also included Day 1 provision for credit losses under the CECL model of $6,300,000 ($4,725,000 or $0.16 per share, on an after tax basis).

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

6 of 17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summary Average Balance Sheet | | | | | | | | | | | | |

| (Tax-equivalent basis / dollars in thousands) | | | | | | | | | | | | |

| | Year Ended December 31, 2023 | | Year Ended December 31, 2022 |

| | | | | | | | | | | | |

| | Principal Balance | | Income/ Expense | | Yield/Rate | | Principal Balance | | Income/ Expense | | Yield/Rate |

| Assets | | | | | | | | | | | | |

| Federal Funds Sold and Other | | | | | | | | | | | | |

| Short-term Investments | | $ | 39,452 | | | $ | 1,677 | | | 4.25 | % | | $ | 458,230 | | | $ | 5,765 | | | 1.26 | % |

| Securities | | 1,629,610 | | | 48,270 | | | 2.96 | % | | 1,860,730 | | | 50,263 | | | 2.70 | % |

| Loans and Leases | | 3,835,157 | | | 213,195 | | | 5.56 | % | | 3,680,708 | | | 169,593 | | | 4.61 | % |

| Total Interest Earning Assets | | $ | 5,504,219 | | | $ | 263,142 | | | 4.78 | % | | $ | 5,999,668 | | | $ | 225,621 | | | 3.76 | % |

| | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Demand Deposit Accounts | | $ | 1,553,082 | | | | | | | $ | 1,738,349 | | | | | |

| IB Demand, Savings, and | | | | | | | | | | | | |

| MMDA Accounts | | $ | 3,055,251 | | | $ | 40,484 | | | 1.33 | % | | $ | 3,487,741 | | | $ | 11,462 | | | 0.33 | % |

| Time Deposits | | 588,142 | | | 16,432 | | | 2.79 | % | | 474,409 | | | 2,052 | | | 0.43 | % |

| FHLB Advances and Other Borrowings | | 210,837 | | | 9,307 | | | 4.41 | % | | 159,029 | | | 4,828 | | | 3.04 | % |

| Total Interest-Bearing Liabilities | | $ | 3,854,230 | | | $ | 66,223 | | | 1.72 | % | | $ | 4,121,179 | | | $ | 18,342 | | | 0.45 | % |

| | | | | | | | | | | | |

| Cost of Funds | | | | | | 1.20 | % | | | | | | 0.31 | % |

| Net Interest Income | | | | $ | 196,919 | | | | | | | $ | 207,279 | | | |

| Net Interest Margin | | | | | | 3.58 | % | | | | | | 3.45 | % |

During the year ended December 31, 2023, net interest income, on a non tax-equivalent basis, totaled $190,433,000, a decline of $10,151,000, or 5%, compared to the year ended December 31, 2022 net interest income of $200,584,000. The decline in net interest income during 2023 compared with 2022 was primarily attributable to a decline in average earning assets, driven by a reduced level of deposits which was somewhat offset by an improved net interest margin resulting from the rise in market interest rates.

The tax equivalent net interest margin for the year ended December 31, 2023 was 3.58% compared with 3.45% for the year ended December 31, 2022. Accretion of loan discounts on acquired loans contributed approximately 5 basis points to the net interest margin in 2023 and 7 basis points in 2022. Accretion of discounts on acquired loans totaled $2,814,000 during 2023 and $4,341,000 during 2022.

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

7 of 17

During the year ended December 31, 2023, the Company recorded a provision for credit losses of $2,550,000 compared with a provision for credit losses of $6,350,000 for the year ended December 31, 2022. During 2022, the provision for credit losses included $6,300,000 for the Day 1 CECL addition to the allowance for credit loss related to the CUB acquisition.

During the year ended December 31, 2023, non-interest income increased $1,128,000, or 2%, compared with the year ended December 31, 2022.

| | | | | | | | | | | | | | |

| | Year Ended | | Year Ended |

| Non-interest Income | | 12/31/2023 | | 12/31/2022 |

| (dollars in thousands) | | | | |

| | | | |

| Wealth Management Fees | | $ | 11,711 | | | $ | 10,076 | |

| Service Charges on Deposit Accounts | | 11,538 | | | 11,457 | |

| Insurance Revenues | | 9,596 | | | 10,020 | |

| Company Owned Life Insurance | | 1,731 | | | 2,264 | |

| Interchange Fee Income | | 17,452 | | | 15,820 | |

| Other Operating Income | | 5,830 | | | 5,116 | |

| Subtotal | | 57,858 | | | 54,753 | |

| Net Gains on Sales of Loans | | 2,363 | | | 3,818 | |

| Net Gains on Securities | | 40 | | | 562 | |

| Total Non-interest Income | | $ | 60,261 | | | $ | 59,133 | |

Wealth management fees increased $1,635,000, or 16%, during 2023 compared with 2022. The increase during 2023 was largely attributable to increased assets under management within the Company's wealth management group as compared with 2022.

Insurance revenues declined $424,000, or 4%, during 2023 compared with 2022 which was primarily attributable to decreased contingency revenue. Contingency revenue during 2023 totaled $955,000 compared with $1,641,000 during 2022. Contingency revenue is reflective of claims and loss experience with insurance carriers that the Company represents through its property and casualty insurance agency.

Company owned life insurance decreased $533,000, or 24%, during 2023 compared with 2022. The decline in 2023 was primarily the result of a decrease in the death benefit claims received compared with 2022.

Interchange fee income increased $1,632,000, or 10%, during the year ended December 31, 2023 compared with the year ended December 31, 2022. The increase in the level of fees during 2023 compared with 2022 was due to increased card utilization by customers.

Other operating income increased by $714,000, or 14%, during the year ended December 31, 2023 compared with the year ended December 31, 2022. The increase during 2023 was largely attributable to the gain on sale of real estate related to the consolidation of various branch office facilities.

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

8 of 17

Net gains on sales of loans declined $1,455,000, or 38%, during the year ended December 31, 2023 compared with the year ended December 31, 2022. The decline during 2023 compared with 2022 was related to both a lower volume of loans sold and lower pricing levels. Loan sales totaled $109.0 million during 2023 compared with $168.1 million during 2022.

The Company realized $40,000 in gains on sales of securities during the year ended December 31, 2023 compared with $562,000 during the year ended December 31, 2022. The sales of securities, during both years, was a completed as part of modest shifts in the allocations within the securities portfolio.

During the year ended December 31, 2023, non-interest expense declined of $9,694,000, or 6%, compared to 2022. The year ended December 31, 2022 non-interest expenses included approximately $12,323,000 of non-recurring acquisition-related expenses for the acquisition of CUB.

| | | | | | | | | | | | | | |

| | Year Ended | | Year Ended |

| Non-interest Expense | | 12/31/2023 | | 12/31/2022 |

| (dollars in thousands) | | | | |

| | | | |

| Salaries and Employee Benefits | | $ | 83,244 | | | $ | 84,145 | |

| Occupancy, Furniture and Equipment Expense | | 14,467 | | | 14,921 | |

| FDIC Premiums | | 2,829 | | | 1,860 | |

| Data Processing Fees | | 11,112 | | | 15,406 | |

| Professional Fees | | 5,575 | | | 6,295 | |

| Advertising and Promotion | | 4,857 | | | 4,416 | |

| Intangible Amortization | | 2,840 | | | 3,711 | |

| Other Operating Expenses | | 19,573 | | | 23,437 | |

| Total Non-interest Expense | | $ | 144,497 | | | $ | 154,191 | |

Salaries and benefits declined $901,000, or 1%, during the year ended December 31, 2023 compared with the year ended December 31, 2022. The decline in salaries and benefits during 2023 compared with 2022 was largely related to approximately $1,480,000 of acquisition-related salary and benefit costs of a non-recurring nature in 2022 related to the CUB acquisition.

FDIC premiums increased $969,000, or 52%, during the year ended December 31, 2023 compared with 2022. The increase during 2023 compared with 2022 was primarily related to an industry-wide 2 basis point increase in the base FDIC premium assessment effective January 1, 2023.

Data processing fees declined $4,294,000, or 28%, during the year ended December 31, 2023 compared with the year ended December 31, 2022. The decline during 2023 compared with 2022 was largely driven by acquisition-related costs associated with the CUB transaction, which totaled approximately $4,982,000 during 2022.

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

9 of 17

Professional fees declined $720,000, or 11%, during the year ended December 31, 2023 compared with the year ended December 31, 2022. The decline during 2023 compared with 2022 was primarily due to merger-related professional fees associated with the CUB acquisition that totaled approximately $1,802,000 in 2022 partially mitigated by increased legal and other professional fees.

Intangible amortization declined $871,000, or 23%, during the year ended December 31, 2023 compared with the year ended December 31, 2022. Intangible amortization expense consists primarily of amortization associated with the core deposit intangible of acquired deposit portfolios. The decrease during 2023 compared with 2022 was primarily attributable to the accelerated amortization method for which the intangible assets are amortized.

Other operating expenses declined $3,864,000, or 16%, during the year ended December 31, 2023 compared to the year ended December 31, 2022. The decline during 2023 compared with 2022 was attributable to acquisition-related costs that totaled approximately $3,862,000 in 2022. The acquisition-related costs were primarily vendor contract termination costs.

Results of Operations Highlights – Quarter ended December 31, 2023

Net income for the quarter ended December 31, 2023 totaled $21,507,000, or $0.73 per share, which was consistent with the third quarter 2023 net income of $21,451,000, or $0.73 per share, and a decline of 12% on a per share basis compared with the fourth quarter 2022 net income of $24,415,000, or $0.83 per share. The decline in net income in the fourth quarter of 2023 compared to the fourth quarter of 2022 was largely driven by a reduced level of average earning assets and net interest margin resulting in a decline in net interest income.

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

10 of 17

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summary Average Balance Sheet | | | | | | | | | | | | | | | | | | |

| (Tax-equivalent basis / dollars in thousands) | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Quarter Ended | | Quarter Ended |

| | December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| | | | | | | | | | | | | | | | | | |

| | Principal Balance | | Income/ Expense | | Yield/ Rate | | Principal Balance | | Income/ Expense | | Yield/ Rate | | Principal Balance | | Income/ Expense | | Yield/ Rate |

| Assets | | | | | | | | | | | | | | | | | | |

| Federal Funds Sold and Other | | | | | | | | | | | | | | | | | | |

| Short-term Investments | | $ | 36,927 | | | $ | 473 | | | 5.09 | % | | $ | 20,243 | | | $ | 199 | | | 3.91 | % | | $ | 234,107 | | | $ | 2,200 | | | 3.73 | % |

| Securities | | 1,527,306 | | | 11,903 | | | 3.12 | % | | 1,596,653 | | | 11,677 | | | 2.93 | % | | 1,735,534 | | | 13,150 | | | 3.03 | % |

| Loans and Leases | | 3,921,967 | | | 56,257 | | | 5.69 | % | | 3,855,586 | | | 55,343 | | | 5.70 | % | | 3,728,788 | | | 47,262 | | | 5.03 | % |

| Total Interest Earning Assets | | $ | 5,486,200 | | | $ | 68,633 | | | 4.98 | % | | $ | 5,472,482 | | | $ | 67,219 | | | 4.88 | % | | $ | 5,698,429 | | | $ | 62,612 | | | 4.37 | % |

| | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | |

| Demand Deposit Accounts | | $ | 1,507,780 | | | | | | | $ | 1,524,682 | | | | | | | $ | 1,735,264 | | | | | |

| IB Demand, Savings, and | | | | | | | | | | | | | | | | | | |

| MMDA Accounts | | $ | 3,010,984 | | | $ | 12,433 | | | 1.64 | % | | $ | 2,973,909 | | | $ | 10,601 | | | 1.41 | % | | $ | 3,359,079 | | | $ | 6,347 | | | 0.75 | % |

| Time Deposits | | 709,534 | | | 6,577 | | | 3.68 | % | | 640,992 | | | 4,977 | | | 3.08 | % | | 426,710 | | | 692 | | | 0.64 | % |

| FHLB Advances and Other Borrowings | | 202,555 | | | 2,394 | | | 4.69 | % | | 219,371 | | | 2,505 | | | 4.53 | % | | 162,792 | | | 1,441 | | | 3.51 | % |

| Total Interest-Bearing Liabilities | | $ | 3,923,073 | | | $ | 21,404 | | | 2.16 | % | | $ | 3,834,272 | | | $ | 18,083 | | | 1.87 | % | | $ | 3,948,581 | | | $ | 8,480 | | | 0.85 | % |

| | | | | | | | | | | | | | | | | | |

| Cost of Funds | | | | | | 1.55 | % | | | | | | 1.31 | % | | | | | | 0.59 | % |

| Net Interest Income | | | | $ | 47,229 | | | | | | | $ | 49,136 | | | | | | | $ | 54,132 | | | |

| Net Interest Margin | | | | | | 3.43 | % | | | | | | 3.57 | % | | | | | | 3.78 | % |

During the fourth quarter of 2023, net interest income, on a non tax-equivalent basis, totaled $45,607,000, a decline of $1,952,000, or 4%, compared to the third quarter of 2023 net interest income of $47,559,000 and a decline of $6,774,000, or 13%, compared to the fourth quarter of 2022 net interest income of $52,381,000.

The decline in net interest income during the fourth quarter of 2023 compared with the third quarter of 2023 was primarily attributable to a decline in the Company's net interest margin. The decline in net interest income during the fourth quarter of 2023 compared with the fourth quarter of 2022 was primarily attributable to a decline in average earning assets, driven by a reduced level of average deposits, and a lower net interest margin.

The tax equivalent net interest margin for the quarter ended December 31, 2023 was 3.43% compared with 3.57% in the third quarter of 2023 and 3.78% in the fourth quarter of 2022. The decline in the net interest margin during the fourth quarter of 2023 compared with both the third quarter of 2023 and the fourth quarter of 2022 was largely driven by a lower level of accretion of discounts on acquired loans and an increase in the cost of funds. The cost of funds continued to accelerate higher in the fourth quarter of 2023 due to the continued increase of market interest rates, very competitive deposit pricing in the marketplace, customers

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

11 of 17

actively looking for yield opportunities within and outside the banking industry and a change in the Company's deposit composition.

The Company's net interest margin and net interest income have been impacted by accretion of loan discounts on acquired loans. Accretion of discounts on acquired loans totaled $280,000 during the fourth quarter of 2023, $1,288,000 during the third quarter of 2023 and $603,000 during the fourth quarter of 2022. Accretion of loan discounts on acquired loans contributed approximately 2 basis points to the net interest margin in the fourth quarter of 2023, 9 basis points in the third quarter of 2023 and 4 basis points in the fourth quarter of 2022.

During the quarter ended December 31, 2023, the Company did not record a provision for credit losses compared with a provision for credit losses of $900,000 in the third quarter of 2023 and a provision for credit losses of $500,000 during the fourth quarter of 2022. The lack of a provision in the fourth quarter of 2023 was largely related to the resolution during the fourth quarter of 2023 of a single commercial borrowing relationship with minimal loss recognition for which the Company had established a significant reserve in previous periods.

Net charge-offs totaled $881,000, or 9 basis points on an annualized basis, of average loans outstanding during the fourth quarter of 2023 compared with $520,000, or 5 basis points on an annualized basis, of average loans during the third quarter of 2023 and compared with $1,031,000, or 11 basis points, of average loans during the fourth quarter of 2022.

During the quarter ended December 31, 2023, non-interest income totaled $15,594,000, an increase of $790,000, or 5%, compared with the third quarter of 2023 and an increase of $1,926,000, or 14%, compared with the fourth quarter of 2022.

| | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Quarter Ended | | Quarter Ended |

| Non-interest Income | | 12/31/2023 | | 9/30/2023 | | 12/31/2022 |

| (dollars in thousands) | | | | | | |

| | | | | | |

| Wealth Management Fees | | $ | 3,198 | | | $ | 2,957 | | | $ | 2,420 | |

| Service Charges on Deposit Accounts | | 2,885 | | | 2,982 | | | 2,889 | |

| Insurance Revenues | | 2,266 | | | 2,065 | | | 2,050 | |

| Company Owned Life Insurance | | 455 | | | 446 | | | 496 | |

| Interchange Fee Income | | 4,371 | | | 4,470 | | | 3,972 | |

| Other Operating Income | | 1,887 | | | 1,270 | | | 1,258 | |

| Subtotal | | 15,062 | | | 14,190 | | | 13,085 | |

| Net Gains on Sales of Loans | | 532 | | | 614 | | | 494 | |

| Net Gains on Securities | | — | | | — | | | 89 | |

| Total Non-interest Income | | $ | 15,594 | | | $ | 14,804 | | | $ | 13,668 | |

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

12 of 17

Wealth management fees increased $241,000, or 8%, during the fourth quarter of 2023 compared with the third quarter of 2023 and increased $778,000, or 32%, compared with the fourth quarter of 2022. The increase during the fourth quarter of 2023 was largely attributable to increased assets under management within the Company's wealth management group as compared with both the third quarter of 2023 and fourth quarter of 2022.

Interchange fee income declined $99,000, or 2%, during the quarter ended December 31, 2023 compared with the third quarter of 2023 and increased $399,000, or 10%, compared with the fourth quarter of 2022. The decline in the fourth quarter of 2023 compared with the third quarter of 2023 was related to a modestly lower level of customer transaction volume. The increased level of fees during the fourth quarter of 2023 compared with the fourth quarter of 2022 was due to increased card utilization by customers.

Other operating income increased $617,000, or 49%, during the fourth quarter of 2023 compared with the third quarter of 2023 and increased $629,000, or 50%, compared with the fourth quarter of 2022. The increase during the fourth quarter of 2023 was largely attributable to the gain on sale of real estate related to the consolidation of various branch office facilities.

During the quarter ended December 31, 2023, non-interest expense totaled $35,734,000, an increase of $313,000, or 1%, compared with the third quarter of 2023, and increased $120,000, or less than 1%, compared with the fourth quarter of 2022.

| | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended | | Quarter Ended | | Quarter Ended |

| Non-interest Expense | | 12/31/2023 | | 9/30/2023 | | 12/31/2022 |

| (dollars in thousands) | | | | | | |

| | | | | | |

| Salaries and Employee Benefits | | $ | 20,948 | | | $ | 20,347 | | | $ | 20,922 | |

| Occupancy, Furniture and Equipment Expense | | 3,513 | | | 3,691 | | | 3,655 | |

| FDIC Premiums | | 701 | | | 700 | | | 442 | |

| Data Processing Fees | | 2,835 | | | 2,719 | | | 2,510 | |

| Professional Fees | | 1,170 | | | 1,229 | | | 1,171 | |

| Advertising and Promotion | | 1,151 | | | 1,278 | | | 1,036 | |

| Intangible Amortization | | 636 | | | 685 | | | 840 | |

| Other Operating Expenses | | 4,780 | | | 4,772 | | | 5,038 | |

| Total Non-interest Expense | | $ | 35,734 | | | $ | 35,421 | | | $ | 35,614 | |

Salaries and benefits increased $601,000, or 3%, during the quarter ended December 31, 2023 compared with the third quarter of 2023 and increased $26,000, or less than 1%, compared with the fourth quarter of 2022. The increase in salaries and benefits during the fourth quarter of 2023 compared with the third quarter of 2023 was primarily due to incentive and commission compensation along with higher health insurance benefit costs.

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

13 of 17

FDIC premiums were flat during the quarter ended December 31, 2023 compared with the third quarter of 2023 and increased $259,000, or 59%, compared with the fourth quarter of 2022. The increase in the fourth quarter of 2023 compared with the fourth quarter of 2022 was primarily related to an industry-wide 2 basis point increase in the base FDIC premium assessment effective January 1, 2023.

About German American

German American Bancorp, Inc. is a Nasdaq-traded (symbol: GABC) financial holding company based in Jasper, Indiana. German American, through its banking subsidiary German American Bank, operates 75 banking offices in 20 contiguous southern Indiana counties and 14 counties in Kentucky. The Company also owns an investment brokerage subsidiary (German American Investment Services, Inc.) and a full line property and casualty insurance agency (German American Insurance, Inc.).

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Readers are cautioned that, by their nature, forward-looking statements are based on assumptions and are subject to risks, uncertainties, and other factors. Forward-looking statements can often, but not always, be identified by the use of words like “believe”, “continue”, “pattern”, “estimate”, “project”, “intend”, “anticipate”, “expect” and similar expressions or future or conditional verbs such as “will”, “would”, “should”, “could”, “might”, “can”, “may”, or similar expressions. Actual results and experience could differ materially from the anticipated results or other expectations expressed or implied by these forward-looking statements as a result of a number of factors, including but not limited to, those discussed in this press release. Factors that could cause actual experience to differ from the expectations expressed or implied in this press release include:

a.changes in interest rates and the timing and magnitude of any such changes;

b.unfavorable economic conditions, including a prolonged period of inflation, and the resulting adverse impact on, among other things, credit quality;

c. the impacts related to or resulting from recent bank failures or adverse developments at other banks on general investor sentiment regarding the stability and liquidity of banks;

d. the impacts of epidemics, pandemics or other infectious disease outbreaks;

e. changes in competitive conditions;

f. the introduction, withdrawal, success and timing of asset/liability management strategies or of mergers and acquisitions and other business initiatives and strategies;

g. changes in customer borrowing, repayment, investment and deposit practices;

h. changes in fiscal, monetary and tax policies;

i. changes in financial and capital markets;

NEWS RELEASE

For additional information, contact:

D. Neil Dauby, Chairman and Chief Executive Officer

Bradley M Rust, President and Chief Financial Officer

(812) 482-1314

14 of 17

j. capital management activities, including possible future sales of new securities, or possible repurchases or redemptions by German American of outstanding debt or equity securities;

k. risks of expansion through acquisitions and mergers, such as unexpected credit quality problems of the acquired loans or other assets, unexpected attrition of the customer base or employee base of the acquired institution or branches, and difficulties in integration of the acquired operations;

l. factors driving impairment charges on investments;

m. the impact, extent and timing of technological changes;

n. potential cyber-attacks, information security breaches and other criminal activities;

o. litigation liabilities, including related costs, expenses, settlements and judgments, or the outcome of matters before regulatory agencies, whether pending or commencing in the future;

p. actions of the Federal Reserve Board;

q. the potential for increases to, and volatility in, the balance of our allowance for credit losses and related provision expense due to the current expected credit loss (CECL) standard;

r. changes in accounting principles and interpretations;

s. potential increases of federal deposit insurance premium expense, and possible future special assessments of FDIC premiums, either industry wide or specific to German American’s banking subsidiary;

t. actions of the regulatory authorities under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and the Federal Deposit Insurance Act and other possible legislative and regulatory actions and reforms;

u. impacts resulting from possible amendments or revisions to the Dodd-Frank Act and the regulations promulgated thereunder, or to Consumer Financial Protection Bureau rules and regulations;

v. the continued availability of earnings and excess capital sufficient for the lawful and prudent declaration and payment of cash dividends; and

w. other risk factors expressly identified in German American’s filings with the SEC.

Such statements reflect our views with respect to future events and are subject to these and other risks, uncertainties and assumptions relating to the operations, results of operations, growth strategy and liquidity of German American. Readers are cautioned not to place undue reliance on these forward-looking statements. It is intended that these forward-looking statements speak only as of the date they are made. We do not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect future events or circumstances or to reflect the occurrence of unanticipated events.

| | | | | | | | | | | | | | | | | |

| GERMAN AMERICAN BANCORP, INC. |

| (unaudited, dollars in thousands except per share data) |

| | | | | |

| Consolidated Balance Sheets |

| | | | | |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| ASSETS | | | | | |

| Cash and Due from Banks | $ | 78,805 | | | $ | 72,063 | | | $ | 75,476 | |

| Short-term Investments | 37,025 | | | 60,856 | | | 42,405 | |

| | | | | |

| Investment Securities | 1,597,185 | | | 1,477,309 | | | 1,762,022 | |

| | | | | |

| Loans Held-for-Sale | 5,226 | | | 7,085 | | | 8,600 | |

| | | | | |

| Loans, Net of Unearned Income | 3,971,082 | | | 3,887,550 | | | 3,784,934 | |

| Allowance for Credit Losses | (43,765) | | | (44,646) | | | (44,168) | |

| Net Loans | 3,927,317 | | | 3,842,904 | | | 3,740,766 | |

| | | | | |

| Stock in FHLB and Other Restricted Stock | 14,687 | | | 14,763 | | | 15,037 | |

| Premises and Equipment | 106,776 | | | 111,252 | | | 112,237 | |

| Goodwill and Other Intangible Assets | 186,664 | | | 187,373 | | | 189,783 | |

| Other Assets | 198,513 | | | 232,061 | | | 209,665 | |

| TOTAL ASSETS | $ | 6,152,198 | | | $ | 6,005,666 | | | $ | 6,155,991 | |

| | | | | |

| LIABILITIES | | | | | |

| Non-interest-bearing Demand Deposits | $ | 1,493,160 | | | $ | 1,502,175 | | | $ | 1,691,804 | |

| Interest-bearing Demand, Savings, and Money Market Accounts | 2,992,761 | | | 2,932,180 | | | 3,229,778 | |

| Time Deposits | 767,042 | | | 701,516 | | | 428,469 | |

| Total Deposits | 5,252,963 | | | 5,135,871 | | | 5,350,051 | |

| | | | | |

| Borrowings | 193,937 | | | 286,193 | | | 203,806 | |

| Other Liabilities | 41,740 | | | 45,210 | | | 43,741 | |

| TOTAL LIABILITIES | 5,488,640 | | | 5,467,274 | | | 5,597,598 | |

| | | | | |

| SHAREHOLDERS' EQUITY | | | | | |

| Common Stock and Surplus | 418,996 | | | 418,530 | | | 416,664 | |

| Retained Earnings | 461,622 | | | 447,475 | | | 405,167 | |

| Accumulated Other Comprehensive Income (Loss) | (217,060) | | | (327,613) | | | (263,438) | |

| SHAREHOLDERS' EQUITY | 663,558 | | | 538,392 | | | 558,393 | |

| | | | | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 6,152,198 | | | $ | 6,005,666 | | | $ | 6,155,991 | |

| | | | | |

| END OF PERIOD SHARES OUTSTANDING | 29,584,709 | | | 29,575,451 | | | 29,493,193 | |

| | | | | |

TANGIBLE BOOK VALUE PER SHARE (1) | $ | 16.12 | | | $ | 11.87 | | | $ | 12.50 | |

| | | | | |

|

(1) Tangible Book Value per Share is defined as Total Shareholders' Equity less Goodwill and Other Intangible Assets divided by End of Period Shares Outstanding. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GERMAN AMERICAN BANCORP, INC. |

| (unaudited, dollars in thousands except per share data) |

| | | | | | | | | | |

| Consolidated Statements of Income |

| | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| | December 31, 2023 | | September 30, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| INTEREST INCOME | | | | | | | | | |

| Interest and Fees on Loans | $ | 56,058 | | | $ | 55,196 | | | $ | 47,108 | | | $ | 212,517 | | | $ | 169,158 | |

| Interest on Short-term Investments | 473 | | | 199 | | | 2,200 | | | 1,677 | | | 5,765 | |

| Interest and Dividends on Investment Securities | 10,480 | | | 10,247 | | | 11,553 | | | 42,462 | | | 44,003 | |

| TOTAL INTEREST INCOME | 67,011 | | | 65,642 | | | 60,861 | | | 256,656 | | | 218,926 | |

| | | | | | | | | | |

| INTEREST EXPENSE | | | | | | | | | |

| Interest on Deposits | 19,010 | | | 15,578 | | | 7,039 | | | 56,916 | | | 13,514 | |

| Interest on Borrowings | 2,394 | | | 2,505 | | | 1,441 | | | 9,307 | | | 4,828 | |

| TOTAL INTEREST EXPENSE | 21,404 | | | 18,083 | | | 8,480 | | | 66,223 | | | 18,342 | |

| | | | | | | | | | |

| NET INTEREST INCOME | 45,607 | | | 47,559 | | | 52,381 | | | 190,433 | | | 200,584 | |

| Provision for Credit Losses | — | | | 900 | | | 500 | | | 2,550 | | | 6,350 | |

| NET INTEREST INCOME AFTER PROVISION FOR CREDIT LOSSES | 45,607 | | | 46,659 | | | 51,881 | | | 187,883 | | | 194,234 | |

| | | | | | | | | | |

| NON-INTEREST INCOME | | | | | | | | | |

| Net Gain on Sales of Loans | 532 | | | 614 | | | 494 | | | 2,363 | | | 3,818 | |

| Net Gain on Securities | — | | | — | | | 89 | | | 40 | | | 562 | |

| Other Non-interest Income | 15,062 | | | 14,190 | | | 13,085 | | | 57,858 | | | 54,753 | |

| TOTAL NON-INTEREST INCOME | 15,594 | | | 14,804 | | | 13,668 | | | 60,261 | | | 59,133 | |

| | | | | | | | | | |

| NON-INTEREST EXPENSE | | | | | | | | | |

| Salaries and Benefits | 20,948 | | | 20,347 | | | 20,922 | | | 83,244 | | | 84,145 | |

| Other Non-interest Expenses | 14,786 | | | 15,074 | | | 14,692 | | | 61,253 | | | 70,046 | |

| TOTAL NON-INTEREST EXPENSE | 35,734 | | | 35,421 | | | 35,614 | | | 144,497 | | | 154,191 | |

| | | | | | | | | | |

| Income before Income Taxes | 25,467 | | | 26,042 | | | 29,935 | | | 103,647 | | | 99,176 | |

| Income Tax Expense | 3,960 | | | 4,591 | | | 5,520 | | | 17,759 | | | 17,351 | |

| | | | | | | | | | |

| NET INCOME | $ | 21,507 | | | $ | 21,451 | | | $ | 24,415 | | | $ | 85,888 | | | $ | 81,825 | |

| | | | | | | | | | |

| BASIC EARNINGS PER SHARE | $ | 0.73 | | | $ | 0.73 | | | $ | 0.83 | | | $ | 2.91 | | | $ | 2.78 | |

| DILUTED EARNINGS PER SHARE | $ | 0.73 | | | $ | 0.73 | | | $ | 0.83 | | | $ | 2.91 | | | $ | 2.78 | |

| | | | | | | | | | |

| WEIGHTED AVERAGE SHARES OUTSTANDING | 29,575,398 | | | 29,573,461 | | | 29,485,940 | | | 29,557,567 | | | 29,464,591 | |

| DILUTED WEIGHTED AVERAGE SHARES OUTSTANDING | 29,575,398 | | | 29,573,461 | | | 29,485,940 | | | 29,557,567 | | | 29,464,591 | |

| | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GERMAN AMERICAN BANCORP, INC. |

| (unaudited, dollars in thousands except per share data) |

| | | | | | | | | | | |

| | | Three Months Ended | | Twelve Months Ended |

| | | December 31, | | September 30, | | December 31, | | December 31, | | December 31, |

| | | 2023 | | 2023 | | 2022 | | 2023 | | 2022 |

| EARNINGS PERFORMANCE RATIOS | | | | | | | | | | |

| Annualized Return on Average Assets | | 1.43 | % | | 1.43 | % | | 1.56 | % | | 1.42 | % | | 1.26 | % |

| Annualized Return on Average Equity | | 15.45 | % | | 14.36 | % | | 18.99 | % | | 14.70 | % | | 13.41 | % |

| Annualized Return on Average Tangible Equity (1) | | 23.26 | % | | 20.95 | % | | 30.14 | % | | 21.69 | % | | 19.51 | % |

| Net Interest Margin | | 3.43 | % | | 3.57 | % | | 3.78 | % | | 3.58 | % | | 3.45 | % |

| Efficiency Ratio (2) | | 55.87 | % | | 54.33 | % | | 51.36 | % | | 55.09 | % | | 56.60 | % |

| Net Overhead Expense to Average Earning Assets (3) | | 1.47 | % | | 1.51 | % | | 1.54 | % | | 1.53 | % | | 1.58 | % |

| | | | | | | | | | | |

| ASSET QUALITY RATIOS | | | | | | | | | | |

| Annualized Net Charge-offs to Average Loans | | 0.09 | % | | 0.05 | % | | 0.11 | % | | 0.08 | % | | 0.06 | % |

| Allowance for Credit Losses to Period End Loans | | 1.10 | % | | 1.15 | % | | 1.17 | % | | | | |

| Non-performing Assets to Period End Assets | | 0.15 | % | | 0.21 | % | | 0.23 | % | | | | |

| Non-performing Loans to Period End Loans | | 0.23 | % | | 0.32 | % | | 0.38 | % | | | | |

| Loans 30-89 Days Past Due to Period End Loans | | 0.33 | % | | 0.33 | % | | 0.37 | % | | | | |

| | | | | | | | | | | |

| SELECTED BALANCE SHEET & OTHER FINANCIAL DATA | | | | | | | | | | |

| Average Assets | | $ | 6,036,242 | | | $ | 6,003,069 | | | $ | 6,243,859 | | | $ | 6,037,874 | | | $ | 6,514,030 | |

| Average Earning Assets | | $ | 5,486,200 | | | $ | 5,472,482 | | | $ | 5,698,429 | | | $ | 5,504,219 | | | $ | 5,999,668 | |

| Average Total Loans | | $ | 3,921,967 | | | $ | 3,855,586 | | | $ | 3,728,788 | | | $ | 3,835,157 | | | $ | 3,680,708 | |

| Average Demand Deposits | | $ | 1,507,780 | | | $ | 1,524,682 | | | $ | 1,735,264 | | | $ | 1,553,082 | | | $ | 1,738,349 | |

| Average Interest Bearing Liabilities | | $ | 3,923,073 | | | $ | 3,834,272 | | | $ | 3,948,581 | | | $ | 3,854,230 | | | $ | 4,121,179 | |

| Average Equity | | $ | 556,914 | | | $ | 597,375 | | | $ | 514,335 | | | $ | 584,106 | | | $ | 610,066 | |

| | | | | | | | | | | |

| Period End Non-performing Assets (4) | | $ | 9,191 | | | $ | 12,400 | | | $ | 14,315 | | | | | |

| Period End Non-performing Loans (5) | | $ | 9,191 | | | $ | 12,376 | | | $ | 14,315 | | | | | |

| Period End Loans 30-89 Days Past Due (6) | | $ | 13,208 | | | $ | 12,673 | | | $ | 14,040 | | | | | |

| | | | | | | | | | | |

| Tax Equivalent Net Interest Income | | $ | 47,229 | | | $ | 49,136 | | | $ | 54,132 | | | $ | 196,919 | | | $ | 207,279 | |

| Net Charge-offs during Period | | $ | 881 | | | $ | 520 | | | $ | 1,031 | | | $ | 2,953 | | | $ | 2,316 | |

| | | | | | | | | | | |

| (1) | Average Tangible Equity is defined as Average Equity less Average Goodwill and Other Intangibles. | | | | |

| (2) | Efficiency Ratio is defined as Non-interest Expense less Intangible Amortization divided by the sum of Net Interest Income, on a tax equivalent basis, and Non-interest Income less Net Gain on Securities. | | | | |

| (3) | Net Overhead Expense is defined as Total Non-interest Expense less Total Non-interest Income. | | | | |

| (4) | Non-performing assets are defined as Non-accrual Loans, Loans Past Due 90 days or more, and Other Real Estate Owned. | | | | |

| (5) | Non-performing loans are defined as Non-accrual Loans and Loans Past Due 90 days or more. | | | | |

| (6) | Loans 30-89 days past due and still accruing. | | | | | | | | | | |

Cover

|

Jan. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 25, 2024

|

| Entity Registrant Name |

GERMAN AMERICAN BANCORP, INC.

|

| Entity Incorporation, State or Country Code |

IN

|

| Entity File Number |

001-15877

|

| Entity Tax Identification Number |

35-1547518

|

| Entity Address, Address Line One |

711 Main Street

|

| Entity Address, City or Town |

Jasper,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

47546

|

| City Area Code |

812

|

| Local Phone Number |

482-1314

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

GABC

|

| Security Exchange Name |

NASDAQ

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000714395

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |