SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934*

(Amendment No. 9)

Great Elm

Group, Inc.

(Name of Issuer)

Common Stock, par value $0.001 per share

(Title of Class of Securities)

39036P209

(CUSIP Number)

Todd Wiench

Imperial Capital Asset Management, LLC

3801 PGA Boulevard, Suite 603

Palm Beach Gardens, Florida 33410

(310) 246-3700

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May 5, 2023

(Date

of Event which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-l(f) or 240.13d-l(g), check the following

box. ☐

Note Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for

other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

| CUSIP No. 39036P209 |

|

|

|

Page

2

of 10 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Imperial Capital Asset Management, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) AF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

7,377,937* |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

7,377,937* |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

7,377,937* |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

|

PERCENT OF

CLASS REPRESENTED BY AMOUNT IN ROW (11) 22.5% |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) IA |

| * |

Includes 2,121,348 shares of common stock, par value $0.001 per share, of the Issuer (“Common

Stock”) underlying (i) a 5.0% Convertible Senior PIK Note due 2030 (the “Original Note”) issued by the Issuer pursuant to a Securities Purchase Agreement, dated as of February 26, 2020, by and among the Issuer and the

investors named therein, and (ii) additional 5.0% Convertible Senior PIK Notes due 2030 (together with the Original Note, the “Notes”) issued by the Issuer as interest pursuant to the terms of the Notes. |

|

|

|

|

|

| CUSIP No. 39036P209 |

|

|

|

Page

3

of 10 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Long Ball Partners, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

6,468,853* |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

6,468,853* |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,468,853* |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

|

PERCENT OF

CLASS REPRESENTED BY AMOUNT IN ROW (11) 19.7% |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) OO |

| * |

Includes 2,121,348 shares of Common Stock underlying the Notes. |

|

|

|

|

|

| CUSIP No. 39036P209 |

|

|

|

Page

4

of 10 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Imperial Capital Group Holdings II, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) AF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

460,900 |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

460,900 |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

460,900 |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

|

PERCENT OF

CLASS REPRESENTED BY AMOUNT IN ROW (11) 1.5% |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) OO |

|

|

|

|

|

| CUSIP No. 39036P209 |

|

|

|

Page

5

of 10 Pages |

|

|

|

|

|

|

|

| 1 |

|

NAMES OF REPORTING PERSONS

Jason Reese |

| 2 |

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP (a) ☐ (b) ☐

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS (SEE

INSTRUCTIONS) AF |

| 5 |

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

☐ |

| 6 |

|

CITIZENSHIP OR PLACE OF

ORGANIZATION United States of

America |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7 |

|

SOLE VOTING POWER

8,568,898* |

| |

8 |

|

SHARED VOTING POWER

0 |

| |

9 |

|

SOLE DISPOSITIVE POWER

8,568,898* |

| |

10 |

|

SHARED DISPOSITIVE POWER

0 |

|

|

|

|

|

|

|

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

8,568,898* |

| 12 |

|

CHECK BOX IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

☐ |

| 13 |

|

PERCENT OF

CLASS REPRESENTED BY AMOUNT IN ROW (11) 26.2% |

| 14 |

|

TYPE OF REPORTING PERSON

(SEE INSTRUCTIONS) IN, HC |

| * |

Includes 2,121,348 shares of Common Stock underlying the Notes. |

|

|

|

|

|

| CUSIP No. 39036P209 |

|

|

|

Page

6

of 10 Pages |

Explanatory Note: This Amendment No. 9 (this “Amendment”) to the

Schedule 13D (the “Initial 13D”) relating to the common stock, par value $0.001 per share (the “Common Stock”), of Great Elm Group, Inc. (the “Issuer”) filed by the Reporting Persons with the U.S. Securities and

Exchange Commission (the “SEC”) on May 6, 2019, as amended by Amendment No. 1 to the Initial 13D filed on March 3, 2020, Amendment No. 2 to the Initial 13D filed on May 21, 2021, Amendment No. 3 to the Initial

13D filed on May 11, 2022, Amendment No. 4 to the Initial 13D filed on June 13, 2022, Amendment No. 5 to the Initial 13D filed on September 30, 2022, Amendment No. 6 to the Initial 13D filed on December 27, 2022,

Amendment No. 7 to the Initial 13D filed on January 5, 2023, and Amendment No. 8 to the Initial 13D filed on January 10, 2023 (as so amended, the “Schedule 13D”), amends and supplements certain of the items set forth in

the Schedule 13D.

Item 2. Identity and Background

Each of Item 2(a) and Item 2(c) of the Schedule 13D is hereby amended and restated as follows:

(a) The term “Reporting Persons” collectively refers to:

| |

• |

|

Imperial Capital Asset Management, LLC (“ICAM”), a Delaware limited liability company;

|

| |

• |

|

Long Ball Partners LLC (“Long Ball”), a Delaware limited liability company; |

| |

• |

|

Imperial Capital Group Holdings II, LLC (“ICGH2”), a Delaware limited liability company; and

|

| |

• |

|

Jason Reese, a citizen of the United States of America, the Chief Executive Officer of the Issuer and the

Chairman of the board of directors of the Issuer (the “Board”). |

For the information required for this Item 2

by Instruction C to Schedule 13D with respect to the persons controlling ICAM and Long Ball (collectively, the “Covered Persons”), reference is made to Schedule A annexed hereto and incorporated herein by reference.

(c) ICAM is a registered investment adviser with the SEC and its principal business is acting as the managing member and investment manager to

Long Ball.

Long Ball is a private fund and its principal business is buying, selling and trading in securities and other investment

products pursuant to the investment objective and strategies described in its confidential offering memorandum and/or operating agreement.

ICGH2 is a private fund and its principal business is buying, selling and trading in securities and other investment products.

The principal occupation of Mr. Reese is acting as the Chairman and Chief Executive Officer of ICAM and portfolio manager to Long Ball,

and the Chief Executive Officer of the Issuer.

Item 3. Source and Amount of Funds or Other Consideration

Item 3 is hereby amended and supplemented as follows:

|

|

|

|

|

| CUSIP No. 39036P209 |

|

|

|

Page

7

of 10 Pages |

Since the filing of the last amendment to the Initial 13D, the source and amount of funds

used in purchasing the Common Stock by the Reporting Persons were as follows:

|

|

|

|

|

|

|

|

|

| Purchaser |

|

Source of Funds |

|

|

Amount |

|

| Long Ball |

|

|

Working Capital |

|

|

$ |

220,726.77 |

|

Shares held directly by Mr. Reese (and not beneficially owned by Long Ball, ICAM or ICGH2) were issued to

him in consideration of his service as Chief Executive Officer of the Issuer and Chairman of the Board.

Item 4. Purpose of

Transaction

Item 4 is hereby amended and supplemented as follows:

Change in Management

On May 5, 2023, the Issuer announced that Peter A. Reed resigned as Chief Executive Officer of the Issuer, effective immediately

following the filing of the Issuer’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023. On May 5, 2023 (the “Effective Date”), the Issuer appointed

Mr. Reese as the Issuer’s Chairman and Chief Executive Officer. Pursuant to a customary stock option award agreement, on May 11, 2023, the Issuer granted to Mr. Reese an option (the “Option”) to purchase up to 2,000,000

shares of Common Stock as compensation for Mr. Reese’s role as Chief Executive Officer of the Issuer. The Option will vest and become exercisable in five equal installments on the first, second, third, fourth and fifth anniversaries of the

Effective Date, subject to continued employment and subject to certain Stock Price Vesting Triggers (each, a “Stock Price Vesting Trigger”) as set forth below. For each of the five annual vesting tranches, the Stock Price Vesting Trigger

will be deemed achieved as of the first date following May 11, 2023 that the 30 calendar-day trailing average of the trading price of the Common Stock (as measured by the volume-weighted average price)

equals or exceeds: (i) $4.07 for the first tranche, (ii) $6.00 for the second tranche, (iii) $8.00 for the third tranche, (iv) $10.00 for the fourth tranche and (v) $12.00 for the fifth tranche. The exercise price per share of the Option is $2.05.

General

The

Reporting Persons purchased the Common Stock and Notes to acquire a strategic minority interest in the Issuer. Consistent with this purpose, the Reporting Persons may communicate with other stockholders from time to time with respect to operational,

strategic, financial, governance, or other matters and otherwise work with management and the Board with a view to maximizing stockholder value. These communications from time to time may include confidential discussions with, and/or confidential

proposals to, the Board and/or members of management regarding the potential acquisition of, or other strategic alternatives involving, the Issuer or additional securities of the Issuer. The Reporting Persons may seek to acquire additional

securities of the Issuer (which may include securities rights and securities exercisable or convertible into securities of Issuer), to dispose of all or a portion of the securities of the Issuer owned by them, or otherwise to engage in hedging

or similar transactions with respect to securities of Issuer. Any such transaction that any Reporting Person may pursue may be made at any time and from time to time without prior notice, and may be through open market transactions, block trades,

private arrangements or otherwise. In reaching any decision as to their course of action (as well as to the specific elements thereof), the Reporting Persons expect that they would take into consideration a variety of factors, including, but not

limited to, the following: the Issuer’s business and prospects; other developments concerning the Issuer and its businesses generally; other business opportunities available to the Reporting Persons; developments with respect to the business of

the Reporting Persons; changes in law and government regulations; general economic conditions; and money and stock market conditions, including the market price of the securities of the Issuer.

|

|

|

|

|

| CUSIP No. 39036P209 |

|

|

|

Page

8

of 10 Pages |

Except as otherwise set forth in this Amendment, none of the Reporting Persons have any

present plans or proposals that relate to or would result in any of the actions specified in clauses (a) through (j) of Item 4 of Schedule 13D, although the Reporting Persons, at any time and from time to time, may review,

reconsider and change their position and/or change their purpose and/or develop such plans and may seek to influence the Board or management of the Issuer with respect to the business and affairs of the Issuer and may from time to time consider

pursuing or proposing such matters with advisors, the Issuer or other persons.

To the extent required by Item 4 of Schedule 13D, the

information set forth in Item 6 of this Schedule 13D is incorporated herein by reference.

Item 5. Interest in Securities of

the Issuer

Item 5 is hereby amended as follows:

(a) & (b) The information relating to the beneficial ownership of Common Stock by each of the Reporting Persons set forth in Rows 7

through 13 of the cover pages hereto is incorporated by reference herein. The percentages set forth in Row 13 for all cover pages filed herewith are based on 30,643,918 shares of Common Stock outstanding as of April 27, 2023, as

reported in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on May 5, 2023.

(c) In the sixty days preceding the date of this Amendment, or since the filing of the last amendment to the Initial 13D by the Reporting

Persons, whichever is less, the Reporting Persons purchased 23,638 shares of Common Stock of the Issuer, the details of which are set forth in the table below, in open market transactions pursuant to the

10b5-1 Plan.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Purchase or Sale |

|

Date |

|

Number

of

Shares |

|

Weighted

Average

Price Per

Share |

|

|

Price or

Range of Prices |

| Long Ball |

|

Open Market Purchase |

|

03/16/2023 |

|

23,638 |

|

$ |

2.37 |

|

|

$2.30 – $2.40 |

(d) Not applicable.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Except for a customary stock option agreement evidencing the Option, there are no contracts, arrangements, understandings or relationships

among the Reporting Persons, or between the Reporting Persons and any other person, with respect to the securities of the Issuer.

|

|

|

|

|

| CUSIP No. 39036P209 |

|

|

|

Page

9

of 10 Pages |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: May 15, 2023

|

|

|

| Imperial Capital Asset Management, LLC |

|

|

| By: |

|

/s/ Jason Reese |

|

|

Jason Reese, Chairman & CEO |

|

| Long Ball Partners, LLC |

|

| By: Imperial Capital Asset Management, LLC

its Managing Member |

|

|

| By: |

|

/s/ Jason Reese |

|

|

Jason Reese, Chairman & CEO |

|

| Imperial Capital Group Holdings II, LLC |

|

|

| By: |

|

/s/ Jason Reese |

|

|

Jason Reese, its Authorized Signatory |

|

| Jason Reese |

|

| /s/ Jason Reese |

|

|

|

|

|

| CUSIP No. 39036P209 |

|

|

|

Page

10

of 10 Pages |

SCHEDULE A

Item 2. The name, principal occupation, and citizenship of each of the Covered Persons are set forth below.

|

|

|

|

|

| Name |

|

Principal Occupation |

|

Citizenship |

| ICAM Holdings, LLC |

|

100% owner of ICAM |

|

Delaware limited liability company |

|

|

|

| Imperial Capital Group Holdings, LLC |

|

Majority owner of ICAM Holdings, LLC and Managing Member of ICGH2 |

|

Delaware limited liability company |

|

|

|

| Randall Wooster |

|

Co-founder and 50% owner of Imperial Capital Group Holdings, LLC |

|

United States of America |

|

|

|

| Jason Reese |

|

Co-founder and 50% owner of Imperial Capital Group Holdings, LLC; Item 2(c) is incorporated herein by reference |

|

United States of America |

Items 3 – 6. Except through their relationship with ICAM, Long Ball and ICGH2 or as otherwise set

forth in Items 3 to 6 of this Schedule 13D, none of the Covered Persons beneficially owns any securities of the Issuer or has any contracts, arrangements, understandings or relationships with respect to any securities of the Issuer.

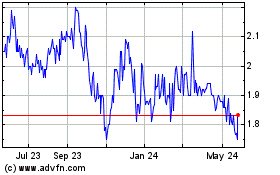

Great Elm (NASDAQ:GEG)

Historical Stock Chart

From Feb 2025 to Mar 2025

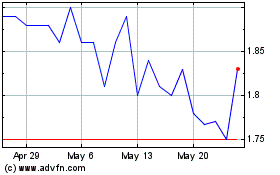

Great Elm (NASDAQ:GEG)

Historical Stock Chart

From Mar 2024 to Mar 2025