0000706129false00007061292025-01-222025-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2025

HORIZON BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Indiana | 000-10792 | 35-1562417 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

515 Franklin Street

Michigan City, IN 46360

(Address of principal executive offices, including zip code)

(219) 879-0211

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered |

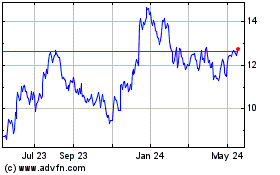

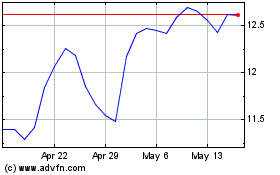

| Common stock, no par value | HBNC | The NASDAQ Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On January 22, 2025, Horizon Bancorp, Inc. (the “Company”) issued a press release announcing earnings and other financial results for the three–months and year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated here by reference.

Item 7.01 Regulation FD Disclosure

Investor Presentation

The Company has prepared presentation materials (the “Investor Presentation”) that management intends to use during its previously announced Earnings Conference Call on Thursday, January 23, 2025 at 7:30 a.m. Central Time, and from time to time thereafter in presentations about the Company’s operations and performance. The Company may use the Investor Presentation, possibly with modifications, in presentations to current and potential investors, analysts, lenders, business partners, acquisition candidates, customers, employees and others with an interest in the Company and its business.

A copy of the Investor Presentation is furnished as Exhibit 99.2 to this report and incorporated here by reference. The Investor Presentation is also available on the Company’s investor website at www.horizonbank.com. Materials on the Company’s investor website are not part of or incorporated by reference into this report.

In accordance with General Instruction B.2 of Form 8–K, the information in this Current Report on Form 8–K, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events

As disclosed in its earnings report filed October 23, 2024, the Company was engaged in a process to sell its mortgage warehouse line of business. Effective January 17, 2025, the sale has closed and is expected to be roughly neutral to operating income, while generating a gain-on-sale to be recognized in the first quarter of 2025. The liquidity created is expected to be redeployed into core business activities.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | |

| (d) Exhibits | | |

| EXHIBIT INDEX |

| Exhibit No. | Description | Location |

| 99.1 | | Attached |

| 99.2 | | Attached |

| 104 | Cover Page Interactive Data File (Embedded within the Inline XBRL document) | Within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | January 22, 2025 | HORIZON BANCORP, INC. |

| | | |

| | | |

| | By: | /s/ John R. Stewart, CFA |

| | | John R. Stewart, CFA |

| | | Executive Vice President & Chief Financial Officer |

| | | |

| | | |

| | | |

| | | |

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

| | | | | |

| Contact: | John R. Stewart, CFA |

| EVP, Chief Financial Officer |

| Phone: | (219) 814–5833 |

| Fax: | (219) 874–9280 |

| Date: | January 22, 2025 |

FOR IMMEDIATE RELEASE

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results and Successful Execution of Several Key Strategic Initiatives

Michigan City, Indiana, January 22, 2025 (GLOBE NEWSWIRE) – (NASDAQ GS: HBNC) – Horizon Bancorp, Inc. (“Horizon” or the “Company”), the parent company of Horizon Bank (the “Bank”), announced its unaudited financial results for the three months and year ended December 31, 2024.

“We are very pleased with Horizon’s fourth quarter results, which displayed a significantly more profitable core business model and the successful completion of several major initiatives aimed at continuing this positive trajectory throughout 2025. During the quarter, the team exited lower-yielding securities at a favorable time, and capitalized on the opportunity to redeploy this liquidity into higher yielding loans and to exit higher-cost funding. These actions, combined with an impressive 22.4% annualized growth rate in commercial loans, increased the margin by 31 basis points from the third quarter. Additionally, the team completed its previously communicated fourth quarter initiatives aimed at restructuring its expense base to create greater efficiency in 2025”, President and CEO, Thomas Prame said. “The core franchise continues to have strong momentum, and we are positioned well to create greater returns for our shareholders in 2025.”

Net loss for the three months ended December 31, 2024 was $10.9 million, or a loss of $0.25 per diluted share, compared to net income of $18.2 million, or $0.41, for the third quarter of 2024 and compared to a net loss of $25.2 million, or a loss of $0.58 per diluted share, for the fourth quarter of 2023. Net income for the three months ended December 31, 2024 was negatively impacted by the $39.1 million pre-tax loss on the sale of investment securities, and expenses directly related to the previously announced strategic initiatives. Partially offsetting these items was the reversal of the $5.1 million tax valuation allowance, which served to reduce the Company's tax liability in the fourth quarter of 2024. Net income for the three months ended December 31, 2023 was negatively impacted by the $31.6 million pre-tax loss on the sale of investment securities, tax expense of $8.6 million related to the termination of BOLI policies and the establishment of the tax valuation allowance.

Net income for the twelve months ended December 31, 2024 was $35.4 million or $0.80 per diluted share, compared to net income of $28.0 million, or $0.64, for the twelve months ended December 31, 2023.

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

Fourth Quarter 2024 Highlights

•Net interest income increased for the fifth consecutive quarter to $53.1 million for the three months ended December 31, 2024, compared to $46.9 million for the three months ended September 30, 2024. The net interest margin, on a fully taxable equivalent ("FTE") basis1, also expanded for the fifth consecutive quarter, to 2.97% compared with 2.66% for the three months ended September 30, 2024.

•As previously disclosed, the Company completed the repositioning of $332.2 million of available-for-sale securities during the fourth quarter. While the sale resulted in a pre-tax loss of $39.1 million, the Company redeployed the proceeds received into higher-yielding loans and continued to manage down higher cost funding sources.

•Total loans were $4.91 billion at December 31, 2024, up $108.6 million from September 30, 2024 balances. Consistent with the Company's stated growth strategy, the commercial portfolio showed continued organic growth momentum during the quarter, which was offset with planned run-off of lower-yielding indirect auto loans in the consumer loan portfolio. Loans held for sale (“HFS”) increased $65.5 million as a result of the Company’s transfer of its mortgage warehouse loan balances of $64.8 million at December 31, 2024.

•Total deposits declined by $126.4 million during the quarter, to $5.60 billion at period end, with the majority of the decline in time deposits, which declined by $131.5 million. The Company's non-maturity deposit base continued to display strength, growing for the third consecutive quarter, including another quarter of relatively stable non-interest bearing deposit balances and growth in core relationship consumer and commercial portfolios.

•Credit quality remained strong, with annualized net charge offs of 0.05% of average loans during the fourth quarter. Non-performing assets to total assets of 0.35% remains well within expected ranges, with no material change from the prior quarter. Provision for loan losses of $1.2 million reflects increased provision for unfunded commitments and net growth in commercial loans held for investment ("HFI"), partially offset by the elimination of the reserve associated with mortgage warehouse and the reduction of reserve related to the planned runoff of indirect auto in the current quarter, when compared with the prior quarter.

•Continued the process for the sale of the mortgage warehouse division during the quarter. Sold the business for a gain, effective January 17th, which will be recognized in Q1 2025 results.

1 Non-GAAP financial metric. See non-GAAP reconciliation included herein for the most directly comparable GAAP measure.

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Highlights |

| (Dollars in Thousands Except Share and Per Share Data and Ratios) |

| Three Months Ended |

| December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| Income statement: | | | | | | | | | |

| Net interest income | $ | 53,127 | | | $ | 46,910 | | | $ | 45,279 | | | $ | 43,288 | | | $ | 42,257 | |

| Credit loss expense | 1,171 | | | 1,044 | | | 2,369 | | | 805 | | | 1,274 | |

| Non-interest (loss) income | (28,954) | | | 11,511 | | | 10,485 | | | 9,929 | | | (20,449) | |

| Non-interest expense | 44,935 | | | 39,272 | | | 37,522 | | | 37,107 | | | 39,330 | |

| Income tax (benefit) expense | (11,051) | | | (75) | | | 1,733 | | | 1,314 | | | 6,419 | |

| Net (loss) income | $ | (10,882) | | | $ | 18,180 | | | $ | 14,140 | | | $ | 13,991 | | | $ | (25,215) | |

| | | | | | | | | |

| Per share data: | | | | | | | | | |

| Basic (loss) earnings per share | $ | (0.25) | | | $ | 0.42 | | | $ | 0.32 | | | $ | 0.32 | | | $ | (0.58) | |

| Diluted (loss) earnings per share | (0.25) | | | 0.41 | | | 0.32 | | | 0.32 | | | (0.58) | |

| Cash dividends declared per common share | 0.16 | | 0.16 | | 0.16 | | | 0.16 | | | 0.16 | |

| Book value per common share | 17.46 | | 17.27 | | 16.62 | | | 16.49 | | | 16.47 | |

| Market value - High | 18.76 | | 16.57 | | 12.74 | | | 14.44 | | | 14.65 | |

| Market value - Low | 14.57 | | 11.89 | | 11.29 | | | 11.75 | | | 9.33 | |

| Weighted average shares outstanding - Basic | 43,721,211 | | | 43,712,059 | | 43,712,059 | | 43,663,610 | | 43,649,585 |

| Weighted average shares outstanding - Diluted | 43,721,211 | | | 44,112,321 | | 43,987,187 | | 43,874,036 | | 43,649,585 |

| Common shares outstanding (end of period) | 43,722,086 | | | 43,712,059 | | 43,712,059 | | 43,726,380 | | 43,652,063 |

| | | | | | | | | |

| Key ratios: | | | | | | | | | |

| Return on average assets | (0.55) | % | | 0.92 | % | | 0.73 | % | | 0.72 | % | | (1.27) | % |

| Return on average stockholders' equity | (5.73) | | | 9.80 | | | 7.83 | | | 7.76 | | | (14.23) | |

| Total equity to total assets | 9.79 | | | 9.52 | | | 9.18 | | | 9.18 | | | 9.06 | |

| Total loans to deposit ratio | 87.75 | | | 83.92 | | | 85.70 | | | 82.78 | | | 78.01 | |

| Allowance for credit losses to HFI loans | 1.07 | | | 1.10 | | | 1.08 | | | 1.09 | | | 1.13 | |

Annualized net charge-offs of average total loans(1) | 0.05 | | | 0.03 | | | 0.05 | | | 0.04 | | | 0.07 | |

| Efficiency ratio | 185.89 | | | 67.22 | | | 67.29 | | | 69.73 | | | 180.35 | |

| | | | | | | | | |

Key metrics (Non-GAAP)(2) : | | | | | | | | | |

| Net FTE interest margin | 2.97 | % | | 2.66 | % | | 2.64 | % | | 2.50 | % | | 2.42 | % |

| Return on average tangible common equity | (7.35) | | | 12.65 | | | 10.18 | | | 10.11 | | | (18.76) | |

| Tangible common equity to tangible assets | 7.83 | | | 7.58 | | | 7.22 | | | 7.20 | | | 7.08 | |

| Tangible book value per common share | $ | 13.68 | | | $ | 13.46 | | | $ | 12.80 | | | $ | 12.65 | | | $ | 12.60 | |

| | | | | | | | | |

| | | | | | | | | |

(1) Average total loans includes loans held for investment and held for sale. |

(2) Non-GAAP financial metrics. See non-GAAP reconciliation included herein for the most directly comparable GAAP measures. |

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

Income Statement Highlights

Net Interest Income

Net interest income was $53.1 million in the fourth quarter of 2024, compared to $46.9 million in the third quarter of 2024, driven by strong expansion of the Company's net FTE interest margin, while average interest earning assets increased by $65.9 million, or 0.9% from the prior quarter. Horizon’s net FTE interest margin1 was 2.97% for the fourth quarter of 2024, compared to 2.66% for the third quarter of 2024, attributable to the favorable mix shift in average interest earning assets toward higher-yielding loans and in the average funding mix toward lower-cost deposit balances, in addition to disciplined pricing strategies on both sides of the balance sheet. The fourth quarter net FTE interest margin did benefit by approximately five basis points related to interest recoveries on specific commercial loans.

Provision for Credit Losses

During the fourth quarter of 2024, the Company recorded a provision for credit losses of $1.2 million. This compares to a provision for credit losses of $1.0 million during the third quarter of 2024, and $1.3 million during the fourth quarter of 2023. The increase in the provision for credit losses during the fourth quarter of 2024 when compared with the third quarter of 2024 was primarily attributable to increased provision for unfunded commitments and net growth in commercial loans, partially offset by the elimination of the reserve associated with mortgage warehouse balances moved to HFS and the reduction of reserve related to the planned runoff of indirect auto in the current quarter, when compared with the prior quarter.

For the fourth quarter of 2024, the allowance for credit losses included net charge-offs of $0.6 million, or an annualized 0.05% of average loans outstanding, compared to net charge-offs of $0.4 million, or an annualized 0.03% of average loans outstanding for the third quarter of 2024, and net charge-offs of $0.8 million, or an annualized 0.07% of average loans outstanding, in the fourth quarter of 2023.

The Company’s allowance for credit losses as a percentage of period-end loans HFI was 1.07% at December 31, 2024, compared to 1.10% at September 30, 2024 and 1.13% at December 31, 2023.

Non-Interest Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| (Dollars in Thousands) | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| Non-interest Income | | | | | | | | | |

| Service charges on deposit accounts | 3,276 | | | 3,320 | | | 3,130 | | | 3,214 | | | 3,092 | |

| Wire transfer fees | 124 | | | 123 | | | 113 | | | 101 | | | 103 | |

| Interchange fees | 3,353 | | | 3,511 | | | 3,826 | | | 3,109 | | | 3,224 | |

| Fiduciary activities | 1,313 | | | 1,394 | | | 1,372 | | | 1,315 | | | 1,352 | |

| Loss on sale of investment securities | (39,140) | | | — | | | — | | | — | | | (31,572) | |

| Gain on sale of mortgage loans | 1,071 | | | 1,622 | | | 896 | | | 626 | | | 951 | |

| Mortgage servicing income net of impairment | 376 | | | 412 | | | 450 | | | 439 | | | 724 | |

| Increase in cash value of bank owned life insurance | 335 | | | 349 | | | 318 | | | 298 | | | 658 | |

| Other income | 338 | | | 780 | | | 380 | | | 827 | | | 1,019 | |

| Total non-interest (loss) income | (28,954) | | | 11,511 | | | 10,485 | | | 9,929 | | | (20,449) | |

| | | | | | | | | |

Total non-interest loss was $29.0 million in the fourth quarter of 2024, compared to non-interest income of $11.5 million in the third quarter of 2024. As previously disclosed, the Company completed the repositioning of $332.2 million of available-for-sale securities during the quarter resulting in a pre-tax loss on sale of investment securities of $39.1 million.

1 Non-GAAP financial metric. See non-GAAP reconciliation included herein for the most directly comparable GAAP measure.

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

Non-Interest Expense

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| (Dollars in Thousands) | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| Non-interest Expense | | | | | | | | | |

| Salaries and employee benefits | 25,564 | | | 21,829 | | | 20,583 | | | 20,268 | | | 21,877 | |

| Net occupancy expenses | 3,431 | | | 3,207 | | | 3,192 | | | 3,546 | | | 3,260 | |

| Data processing | 2,841 | | | 2,977 | | | 2,579 | | | 2,464 | | | 2,942 | |

| Professional fees | 736 | | | 676 | | | 714 | | | 607 | | | 772 | |

| Outside services and consultants | 4,470 | | | 3,677 | | | 3,058 | | | 3,359 | | | 2,394 | |

| Loan expense | 1,285 | | | 1,034 | | | 1,038 | | | 719 | | | 1,345 | |

| FDIC insurance expense | 1,193 | | | 1,204 | | | 1,315 | | | 1,320 | | | 1,200 | |

| Core deposit intangible amortization | 843 | | | 844 | | | 844 | | | 872 | | | 903 | |

| Other losses | 371 | | | 297 | | | 515 | | | 16 | | | 508 | |

| Other expense | 4,201 | | | 3,527 | | | 3,684 | | | 3,936 | | | 4,129 | |

| Total non-interest expense | 44,935 | | | 39,272 | | | 37,522 | | | 37,107 | | | 39,330 | |

Total non-interest expense was $44.9 million in the fourth quarter of 2024, compared with $39.3 million in the third quarter of 2024. The increase in non-interest expense during the fourth quarter of 2024 was primarily driven by a $3.7 million increase in salaries and employee benefits expense, which is mainly attributable to the acceleration of stock compensation expense and the expenses related to the termination of a legacy benefits program, in addition to increased incentive compensation accruals and higher medical benefit claims expense. Outside services and consultants expense increased by $793 thousand related to direct expenses for strategic initiatives executed in the fourth quarter and additional expense accruals.

Income Taxes

Horizon recorded a net tax benefit for the fourth quarter of 2024, which is reflective of the reduction to full-year pre-tax income, attributable to the realized securities loss, and the reversal of the $5.1 million tax valuation allowance.

Balance Sheet Highlights

Total assets decreased by $126.3 million, or 1.6%, to $7.80 billion as of December 31, 2024, from $7.93 billion as of September 30, 2024. The decrease in total assets is primarily due to proceeds from the sale of investment securities being partially utilized to pay down higher-cost time deposits, as the remaining proceeds from the sale were either reinvested in commercial loans or held in interest-bearing cash accounts.

Total investment securities decreased by $328.2 million, or 13.5%, to $2.1 billion as of December 31, 2024, from $2.4 billion as of September 30, 2024. As previously disclosed, the Company sold $332.2 million in book value of available-for-sale securities during the fourth quarter at a loss of $39.1 million. There were no purchases of investment securities during the fourth quarter of 2024.

Total loans were $4.91 billion at December 31, 2024, up $108.6 million from September 30, 2024 balances. Consistent with the Company's stated growth strategy, the commercial portfolio showed continued organic growth momentum during the quarter, which was offset with planned run-off of lower-yielding indirect auto loans in the consumer loan portfolio. Loans held for sale (“HFS”) increased $65.5 million as a result of the Company’s transfer of its mortgage warehouse loan balances of $64.8 million at December 31, 2024.

Total deposits decreased by $126.4 million, or 2.2%, to $5.6 billion as of December 31, 2024 when compared to balances as of September 30, 2024. Non-interest bearing deposits were relatively unchanged during the quarter, while savings and money market accounts grew by $25.9 million, or 0.8%. Time deposits declined by $131.5 million, or 10.8%, as the Company elected to use certain proceeds from the sale of investment securities to reduce higher-cost balances. Total borrowings remained essentially unchanged during the quarter, at $1.1 billion as of December 31, 2024, while balances subject to repurchase agreements declined by $32.5 million, to $89.9 million.

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

Capital

The following table presents the consolidated regulatory capital ratios of the Company for the previous three quarters, and the Company’s preliminary estimate of its consolidated regulatory capital ratios for the quarter ended December 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | | December 31, | | September 30, | | June 30, | | March 31, |

| | 2024* | | 2024 | | 2024 | | 2024** |

| Consolidated Capital Ratios | | | | | | | | |

| Total capital (to risk-weighted assets) | | 13.84 | % | | 13.45 | % | | 13.41 | % | | 13.75 | % |

| Tier 1 capital (to risk-weighted assets) | | 11.96 | % | | 11.63 | % | | 11.59 | % | | 11.89 | % |

| Common equity tier 1 capital (to risk-weighted assets) | | 10.96 | % | | 10.68 | % | | 10.63 | % | | 10.89 | % |

| Tier 1 capital (to average assets) | | 8.87 | % | | 9.02 | % | | 9.02 | % | | 8.91 | % |

| *Preliminary estimate - may be subject to change | | |

| ** Prior period was previously revised (see disclosure in Form 10-Q for the quarterly period ending June 30, 2024) | | |

As of December 31, 2024, the ratio of total stockholders’ equity to total assets is 9.79%. Book value per common share was $17.46, increasing $0.19 during the fourth quarter of 2024.

Tangible common equity1 totaled $598.1 million at December 31, 2024, and the ratio of tangible common equity to tangible assets1 was 7.83% at December 31, 2024, up from 7.58% at September 30, 2024. Tangible book value, which excludes intangible assets from total equity, per common share1 was $13.68, increasing $0.22 during the fourth quarter of 2024 behind the growth in retained earnings, excluding the securities loss that was previously in accumulated other comprehensive income, the recovery of the tax valuation allowance and a credit to additional paid-in capital from the closing out of the previously noted legacy benefits program.

Credit Quality

As of December 31, 2024, total non-accrual loans increased by $2.2 million, or 9%, from September 30, 2024, to 0.53% of total loans HFI. Total non-performing assets increased $1.8 million, or 7%, to $27.4 million, compared to $25.6 million as of September 30, 2024. The ratio of non-performing assets to total assets increased to 0.35% compared to 0.32% as of September 30, 2024.

As of December 31, 2024, net charge-offs increased by $243 thousand to $621 thousand, compared to $378 thousand as of September 30, 2024 and remain just 0.05% annualized of average loans.

1 Non-GAAP financial metric. See non-GAAP reconciliation included herein for the most directly comparable GAAP measure.

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

Earnings Conference Call

As previously announced, Horizon will host a conference call to review its fourth quarter financial results and operating performance.

Participants may access the live conference call on January 23, 2025 at 7:30 a.m. CT (8:30 a.m. ET) by dialing 833-974-2379 from the United States, 866-450-4696 from Canada or 1-412-317-5772 from international locations and requesting the “Horizon Bancorp Call.” Participants are asked to dial in approximately 10 minutes prior to the call.

A telephone replay of the call will be available approximately one hour after the end of the conference through February 1, 2025. The replay may be accessed by dialing 877-344-7529 from the United States, 855-669-9658 from Canada or 1–412–317-0088 from other international locations, and entering the access code 9847279.

About Horizon Bancorp, Inc.

Horizon Bancorp, Inc. (NASDAQ GS: HBNC) is the $7.8 billion-asset commercial bank holding company for Horizon Bank, which serves customers across diverse and economically attractive Midwestern markets through convenient digital and virtual tools, as well as its Indiana and Michigan branches. Horizon's retail offerings include prime residential and other secured consumer lending to in-market customers, as well as a range of personal banking and wealth management solutions. Horizon also provides a comprehensive array of in-market business banking and treasury management services, as well as equipment financing solutions for customers regionally and nationally, with commercial lending representing over half of total loans. More information on Horizon, headquartered in Northwest Indiana's Michigan City, is available at horizonbank.com and investor.horizonbank.com.

Use of Non-GAAP Financial Measures

Certain information set forth in this press release refers to financial measures determined by methods other than in accordance with GAAP. Specifically, we have included non-GAAP financial measures relating to net income, diluted earnings per share, pre-tax, pre-provision net income, net interest margin, tangible stockholders’ equity and tangible book value per share, efficiency ratio, the return on average assets, the return on average common equity, and return on average tangible equity. In each case, we have identified special circumstances that we consider to be non-recurring and have excluded them. We believe that this shows the impact of such events as acquisition-related purchase accounting adjustments and swap termination fees, among others we have identified in our reconciliations. Horizon believes these non-GAAP financial measures are helpful to investors and provide a greater understanding of our business and financial results without giving effect to the purchase accounting impacts and one-time costs of acquisitions and non–recurring items. These measures are not necessarily comparable to similar measures that may be presented by other companies and should not be considered in isolation or as a substitute for the related GAAP measure. See the tables and other information below and contained elsewhere in this press release for reconciliations of the non-GAAP information identified herein and its most comparable GAAP measures.

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

Forward Looking Statements

This press release may contain forward–looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this press release should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission (the “SEC”). Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance.

Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: current financial conditions within the banking industry; changes in the level and volatility of interest rates, changes in spreads on earning assets and changes in interest bearing liabilities; increased interest rate sensitivity; the aggregate effects of elevated inflation levels in recent years; loss of key Horizon personnel; increases in disintermediation; potential loss of fee income, including interchange fees, as new and emerging alternative payment platforms take a greater market share of the payment systems; estimates of fair value of certain of Horizon’s assets and liabilities; changes in prepayment speeds, loan originations, credit losses, market values, collateral securing loans and other assets; changes in sources of liquidity; macroeconomic conditions and their impact on Horizon and its customers; legislative and regulatory actions and reforms; changes in accounting policies or procedures as may be adopted and required by regulatory agencies; litigation, regulatory enforcement, and legal compliance risk and costs; rapid technological developments and changes; cyber terrorism and data security breaches; the rising costs of cybersecurity; the ability of the U.S. federal government to manage federal debt limits; climate change and social justice initiatives; the inability to realize cost savings or revenues or to effectively implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; acts of terrorism, war and global conflicts, such as the Russia and Ukraine conflict and the Israel and Hamas conflict; and supply chain disruptions and delays. These and additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Horizon’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s website (www.sec.gov). Undue reliance should not be placed on the forward–looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward–looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law.

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Statements of Income |

| (Dollars in Thousands Except Per Share Data, Unaudited) |

| Three Months Ended | | Year Ended |

| December 31, | | September 30, | | June 30, | | March 31, | | December 31, | | December 31, | | December 31, |

| 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Interest Income | | | | | | | | | | | | | |

| Loans receivable | $ | 76,747 | | | $ | 75,488 | | | $ | 71,880 | | | $ | 66,954 | | | $ | 65,583 | | | $ | 291,069 | | | $ | 244,544 | |

| Investment securities - taxable | 6,814 | | | 8,133 | | | 7,986 | | | 7,362 | | | 8,157 | | | 30,295 | | | 34,410 | |

| Investment securities - tax-exempt | 6,301 | | | 6,310 | | | 6,377 | | | 6,451 | | | 6,767 | | | 25,439 | | | 28,384 | |

| Other | 3,488 | | | 957 | | | 738 | | | 4,497 | | | 3,007 | | | 9,680 | | | 4,967 | |

| Total interest income | 93,350 | | | 90,888 | | | 86,981 | | | 85,264 | | | 83,514 | | | 356,483 | | | 312,305 | |

| Interest Expense | | | | | | | | | | | | | |

| Deposits | 27,818 | | | 30,787 | | | 28,447 | | | 27,990 | | | 27,376 | | | 115,042 | | | 85,857 | |

| Borrowed funds | 10,656 | | | 11,131 | | | 11,213 | | | 11,930 | | | 11,765 | | | 44,930 | | | 42,478 | |

| Subordinated notes | 829 | | | 830 | | | 829 | | | 831 | | | 870 | | | 3,319 | | | 3,511 | |

| Junior subordinated debentures issued to capital trusts | 920 | | | 1,230 | | | 1,213 | | | 1,225 | | | 1,246 | | | 4,588 | | | 4,715 | |

| Total interest expense | 40,223 | | | 43,978 | | | 41,702 | | | 41,976 | | | 41,257 | | | 167,879 | | | 136,561 | |

| Net Interest Income | 53,127 | | | 46,910 | | | 45,279 | | | 43,288 | | | 42,257 | | | 188,604 | | | 175,744 | |

| Provision for loan losses | 1,171 | | | 1,044 | | | 2,369 | | | 805 | | | 1,274 | | | 5,389 | | | 2,459 | |

| Net Interest Income after Provision for Loan Losses | 51,956 | | | 45,866 | | | 42,910 | | | 42,483 | | | 40,983 | | | 183,215 | | | 173,285 | |

| Non-interest Income | | | | | | | | | | | | | |

| Service charges on deposit accounts | 3,276 | | | 3,320 | | | 3,130 | | | 3,214 | | | 3,092 | | | 12,940 | | | 12,227 | |

| Wire transfer fees | 124 | | | 123 | | | 113 | | | 101 | | | 103 | | | 461 | | | 448 | |

| Interchange fees | 3,353 | | | 3,511 | | | 3,826 | | | 3,109 | | | 3,224 | | | 13,799 | | | 12,861 | |

| Fiduciary activities | 1,313 | | | 1,394 | | | 1,372 | | | 1,315 | | | 1,352 | | | 5,394 | | | 5,080 | |

| Loss on sale of investment securities | (39,140) | | | — | | | — | | | — | | | (31,572) | | | (39,140) | | | (32,052) | |

| Gain on sale of mortgage loans | 1,071 | | | 1,622 | | | 896 | | | 626 | | | 951 | | | 4,215 | | | 4,323 | |

| Mortgage servicing income net of impairment | 376 | | | 412 | | | 450 | | | 439 | | | 724 | | | 1,677 | | | 2,708 | |

| Increase in cash value of bank owned life insurance | 335 | | | 349 | | | 318 | | | 298 | | | 658 | | | 1,300 | | | 3,709 | |

| Other income | 338 | | | 780 | | | 380 | | | 827 | | | 1,019 | | | 2,325 | | | 2,694 | |

| Total non-interest (loss) income | (28,954) | | | 11,511 | | | 10,485 | | | 9,929 | | | (20,449) | | | 2,971 | | | 11,998 | |

| Non-interest Expense | | | | | | | | | | | | | |

| Salaries and employee benefits | 25,564 | | | 21,829 | | | 20,583 | | | 20,268 | | | 21,877 | | | 88,244 | | | 80,809 | |

| Net occupancy expenses | 3,431 | | | 3,207 | | | 3,192 | | | 3,546 | | | 3,260 | | | 13,376 | | | 13,355 | |

| Data processing | 2,841 | | | 2,977 | | | 2,579 | | | 2,464 | | | 2,942 | | | 10,861 | | | 11,626 | |

| Professional fees | 736 | | | 676 | | | 714 | | | 607 | | | 772 | | | 2,733 | | | 2,645 | |

| Outside services and consultants | 4,470 | | | 3,677 | | | 3,058 | | | 3,359 | | | 2,394 | | | 14,564 | | | 9,942 | |

| Loan expense | 1,285 | | | 1,034 | | | 1,038 | | | 719 | | | 1,345 | | | 4,076 | | | 4,980 | |

| FDIC insurance expense | 1,193 | | | 1,204 | | | 1,315 | | | 1,320 | | | 1,200 | | | 5,032 | | | 3,880 | |

| Core deposit intangible amortization | 843 | | | 844 | | | 844 | | | 872 | | | 903 | | | 3,403 | | | 3,612 | |

| Other losses | 371 | | | 297 | | | 515 | | | 16 | | | 508 | | | 1,199 | | | 1,051 | |

| Other expense | 4,201 | | | 3,527 | | | 3,684 | | | 3,936 | | | 4,129 | | | 15,348 | | | 14,384 | |

| Total non-interest expense | 44,935 | | | 39,272 | | | 37,522 | | | 37,107 | | | 39,330 | | | 158,836 | | | 146,284 | |

| (Loss) Income Before Income Taxes | (21,933) | | | 18,105 | | | 15,873 | | | 15,305 | | | (18,796) | | | 27,350 | | | 38,999 | |

| Income tax (benefit) expense | (11,051) | | | (75) | | | 1,733 | | | 1,314 | | | 6,419 | | | (8,079) | | | 11,018 | |

| Net (Loss) Income | $ | (10,882) | | | $ | 18,180 | | | $ | 14,140 | | | $ | 13,991 | | | $ | (25,215) | | | $ | 35,429 | | | $ | 27,981 | |

| Basic (Loss) Earnings Per Share | $ | (0.25) | | | $ | 0.42 | | | $ | 0.32 | | | $ | 0.32 | | | $ | (0.58) | | | $ | 0.81 | | | $ | 0.64 | |

| Diluted (Loss) Earnings Per Share | (0.25) | | | 0.41 | | | 0.32 | | | 0.32 | | | (0.58) | | | 0.80 | | | 0.64 | |

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Condensed Consolidated Balance Sheet |

| (Dollar in Thousands) |

| December 31,

2024 | | September 30,

2024 | | June 30,

2024 | | March 31,

2024 | | December 31,

2023 |

| Assets | | | | | | | | | |

| Interest earning assets | | | | | | | | | |

| Federal funds sold | $ | — | | | $ | — | | | $ | 453 | | | $ | — | | | $ | 215 | |

| Interest earning deposits | 201,131 | | | 126,019 | | | 38,957 | | | 170,882 | | | 413,528 | |

| Interest earning time deposits | 735 | | | 735 | | | 1,715 | | | 1,715 | | | 2,205 | |

| Federal Home Loan Bank stock | 53,826 | | | 53,826 | | | 53,826 | | | 53,826 | | | 34,509 | |

| Investment securities, available for sale | 233,677 | | | 541,170 | | | 527,054 | | | 535,319 | | | 547,251 | |

| Investment securities, held to maturity | 1,867,690 | | | 1,888,379 | | | 1,904,281 | | | 1,925,725 | | | 1,945,638 | |

| Loans held for sale | 67,597 | | | 2,069 | | | 2,440 | | | 922 | | | 1,418 | |

| Gross loans held for investment (HFI) | 4,847,040 | | | 4,803,996 | | | 4,822,840 | | | 4,618,175 | | | 4,417,630 | |

| Total Interest earning assets | 7,271,696 | | | 7,416,194 | | | 7,351,566 | | | 7,306,564 | | | 7,362,394 | |

| Non-interest earning assets | | | | | | | | | |

| Allowance for credit losses | (51,980) | | | (52,881) | | | (52,215) | | | (50,387) | | | (50,029) | |

| Cash | 92,300 | | | 108,815 | | | 106,691 | | | 100,206 | | | 112,772 | |

| Cash value of life insurance | 37,450 | | | 37,115 | | | 36,773 | | | 36,455 | | | 36,157 | |

| Other assets | 152,635 | | | 119,026 | | | 165,656 | | | 160,593 | | | 177,061 | |

| Goodwill | 155,211 | | | 155,211 | | | 155,211 | | | 155,211 | | | 155,211 | |

| Other intangible assets | 10,223 | | | 11,067 | | | 11,910 | | | 12,754 | | | 13,626 | |

| Premises and equipment, net | 93,864 | | | 93,544 | | | 93,695 | | | 94,303 | | | 94,583 | |

| Interest receivable | 39,747 | | | 39,366 | | | 43,240 | | | 40,008 | | | 38,710 | |

| Total non-interest earning assets | 529,450 | | | 511,263 | | | 560,961 | | | 549,143 | | | 578,091 | |

| Total assets | $ | 7,801,146 | | | $ | 7,927,457 | | | $ | 7,912,527 | | | $ | 7,855,707 | | | $ | 7,940,484 | |

| Liabilities | | | | | | | | | |

| Savings and money market deposits | $ | 3,446,681 | | | $ | 3,420,827 | | | $ | 3,364,726 | | | $ | 3,350,673 | | | $ | 3,369,149 | |

| Time deposits | 1,089,153 | | | 1,220,653 | | | 1,178,389 | | | 1,136,121 | | | 1,179,739 | |

| Borrowings | 1,142,340 | | | 1,142,744 | | | 1,229,165 | | | 1,219,812 | | | 1,217,020 | |

| Repurchase agreements | 89,912 | | | 122,399 | | | 128,169 | | | 139,309 | | | 136,030 | |

| Subordinated notes | 55,738 | | | 55,703 | | | 55,668 | | | 55,634 | | | 55,543 | |

| Junior subordinated debentures issued to capital trusts | 57,477 | | | 57,423 | | | 57,369 | | | 57,315 | | | 57,258 | |

| Total interest earning liabilities | 5,881,301 | | | 6,019,749 | | | 6,013,486 | | | 5,958,864 | | | 6,014,739 | |

| Non-interest bearing deposits | 1,064,818 | | | 1,085,535 | | | 1,087,040 | | | 1,093,076 | | | 1,116,005 | |

| Interest payable | 11,137 | | | 11,400 | | | 11,240 | | | 7,853 | | | 22,249 | |

| Other liabilities | 80,308 | | | 55,951 | | | 74,096 | | | 74,664 | | | 68,680 | |

| Total liabilities | $ | 7,037,564 | | | $ | 7,172,635 | | | $ | 7,185,862 | | | $ | 7,134,457 | | | $ | 7,221,673 | |

| Stockholders’ Equity | | | | | | | | | |

| Preferred stock | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Common stock | — | | | — | | | — | | | — | | | — | |

| Additional paid-in capital | 363,761 | | | 358,453 | | | 357,673 | | | 356,599 | | | 356,400 | |

| Retained earnings | 436,122 | | | 454,050 | | | 442,977 | | | 435,927 | | | 429,021 | |

| Accumulated other comprehensive (loss) | (36,301) | | | (57,681) | | | (73,985) | | | (71,276) | | | (66,609) | |

| Total stockholders’ equity | $ | 763,582 | | | $ | 754,822 | | | $ | 726,665 | | | $ | 721,250 | | | $ | 718,812 | |

| Total liabilities and stockholders’ equity | $ | 7,801,146 | | | $ | 7,927,457 | | | $ | 7,912,527 | | | $ | 7,855,707 | | | $ | 7,940,485 | |

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Loans and Deposits | | | | |

| (Dollars in Thousands) | | | | |

| December 31, | | September 30, | | June 30, | | March 31, | | December 31, | | % Change |

| 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | Q4'24 vs Q3'24 | | Q4'24 vs Q4'23 |

| Commercial: | | | | | | | | | | | | | |

| Commercial real estate | $ | 2,202,858 | | | $ | 2,105,459 | | | $ | 2,117,772 | | | $ | 1,984,723 | | | $ | 1,962,097 | | | 5 | % | | 12 | % |

| Commercial & Industrial | 875,297 | | | 808,600 | | | 786,788 | | | 765,043 | | | 712,863 | | | 8 | % | | 23 | % |

| Total commercial | 3,078,155 | | | 2,914,059 | | | 2,904,560 | | | 2,749,766 | | | 2,674,960 | | | 6 | % | | 15 | % |

| Residential Real estate | 802,909 | | | 801,356 | | | 797,956 | | | 782,071 | | | 681,136 | | | — | % | | 18 | % |

| Mortgage warehouse | — | | | 80,437 | | | 68,917 | | | 56,548 | | | 45,078 | | | (100) | % | | (100) | % |

| Consumer | 965,976 | | | 1,008,144 | | | 1,051,407 | | | 1,029,790 | | | 1,016,456 | | | (4) | % | | (5) | % |

| Total loans held for investment | 4,847,040 | | | 4,803,996 | | | 4,822,840 | | | 4,618,175 | | | 4,417,630 | | | 1 | % | | 10 | % |

| Loans held for sale | 67,597 | | | 2,069 | | | 2,440 | | | 922 | | | 1,418 | | | 3167 | % | | 4667 | % |

| Total loans | 4,914,637 | | | 4,806,065 | | | 4,825,280 | | | 4,619,097 | | | 4,419,048 | | | 2 | % | | 11 | % |

| | | | | | | | | | | | | |

| Deposits: | | | | | | | | | | | | | |

| Interest bearing deposits | | | | | | | | | | | | | |

| Savings and money market deposits | $ | 3,446,681 | | | $ | 3,420,827 | | | $ | 3,364,726 | | | $ | 3,350,673 | | | $ | 3,369,149 | | | 1 | % | | 2 | % |

| Time deposits | $ | 1,089,153 | | | $ | 1,220,653 | | | $ | 1,178,389 | | | $ | 1,136,121 | | | $ | 1,179,739 | | | (11) | % | | (8) | % |

| Total Interest bearing deposits | 4,535,834 | | | 4,641,480 | | | 4,543,115 | | | 4,486,794 | | | 4,548,888 | | | (2) | % | | — | % |

| Non-interest bearing deposits | | | | | | | | | | | | | |

| Non-interest bearing deposits | $ | 1,064,818 | | | $ | 1,085,535 | | | $ | 1,087,040 | | | $ | 1,093,076 | | | $ | 1,116,005 | | | (2) | % | | (5) | % |

| Total deposits | $ | 5,600,652 | | | $ | 5,727,015 | | | $ | 5,630,155 | | | $ | 5,579,870 | | | $ | 5,664,893 | | | (2) | % | | (1) | % |

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Balance Sheet |

| (Dollars in Thousands, Unaudited) |

| Three Months Ended |

| December 31, 2024 | September 30, 2024 | December 31, 2023 |

| Average Balance (8) | Interest(4)(6) | Average Rate(4) | Average Balance (8) | Interest(4)(6) | Average Rate(4) | Average Balance (8) | Interest(4)(6) | Average Rate(4) |

| Assets |

| Interest earning assets | | | | | | | | | |

| Interest earning deposits (incl. Fed Funds Sold) | $ | 290,693 | | $ | 3,488 | | 4.77 | % | $ | 73,524 | | $ | 957 | | 5.18 | % | 221,375 | | 3,007 | | 5.39 | % |

| Federal Home Loan Bank stock | 53,826 | | 1,516 | | 11.20 | % | 53,826 | | 1,607 | | 11.88 | % | 34,509 | | 719 | | 8.27 | % |

Investment securities - taxable (1) | 1,079,377 | | 5,298 | | 1.95 | % | 1,301,830 | | 6,526 | | 1.99 | % | 1,517,572 | | 7,438 | | 1.94 | % |

Investment securities - non-taxable (1) | 1,129,622 | | 7,976 | | 2.81 | % | 1,125,295 | | 7,987 | | 2.82 | % | 1,172,157 | | 8,566 | | 2.90 | % |

| Total investment securities | 2,208,999 | | 13,274 | | 2.39 | % | 2,427,125 | | 14,513 | | 2.38 | % | 2,689,729 | | 16,004 | | 6.04 | % |

Loans receivable (2) (3) | 4,842,660 | | 77,142 | | 6.34 | % | 4,775,788 | | 75,828 | | 6.32 | % | 4,327,930 | | 65,897 | | 6.04 | % |

| Total interest earning assets | 7,396,178 | | 95,420 | | 5.13 | % | 7,330,263 | | 92,905 | | 5.04 | % | 7,273,543 | | 85,627 | | 4.67 | % |

| Non-interest earning assets | | | | | | | | | |

| Cash and due from banks | 85,776 | | | | 108,609 | | | | 103,255 | | | |

| Allowance for credit losses | (52,697) | | | | (52,111) | | | | (49,586) | | | |

| Other assets | 409,332 | | | | 471,259 | | | | 553,604 | | | |

| Total average assets | $ | 7,838,589 | | | | $ | 7,858,020 | | | | $ | 7,880,816 | | | |

| | | | | | | | | |

| Liabilities and Stockholders' Equity |

| Interest bearing liabilities | | | | | | | | | |

| Interest bearing deposits | $ | 3,417,610 | | $ | 16,197 | | 1.89 | % | $ | 3,386,177 | | $ | 18,185 | | 2.14 | % | 3,303,469 | | 15,116 | | 1.82 | % |

| Time deposits | 1,160,527 | | 11,621 | | 3.98 | % | 1,189,148 | | 12,602 | | 4.22 | % | 1,205,799 | | 12,260 | | 4.03 | % |

| Borrowings | 1,130,301 | | 10,138 | | 3.57 | % | 1,149,952 | | 10,221 | | 3.54 | % | 1,206,462 | | 10,812 | | 3.56 | % |

| Repurchase agreements | 91,960 | | 518 | | 2.24 | % | 123,524 | | 910 | | 2.93 | % | 132,524 | | 953 | | 2.85 | % |

| Subordinated notes | 55,717 | | 829 | | 5.92 | % | 55,681 | | 830 | | 5.93 | % | 58,221 | | 870 | | 5.93 | % |

| Junior subordinated debentures issued to capital trusts | 57,443 | | 920 | | 6.37 | % | 57,389 | | 1,230 | | 8.53 | % | 57,222 | | 1,246 | | 8.64 | % |

| Total interest bearing liabilities | 5,913,558 | | 40,223 | | 2.71 | % | 5,961,871 | | 43,978 | | 2.93 | % | 5,963,697 | | 41,257 | | 2.74 | % |

| Non-interest bearing liabilities |

| Demand deposits | 1,099,574 | | | | 1,083,214 | | | | 1,125,164 | | | |

| Accrued interest payable and other liabilities | 70,117 | | | | 74,563 | | | | 89,162 | | | |

| Stockholders' equity | 755,340 | | | | 738,372 | | | | 702,793 | | | |

| Total average liabilities and stockholders' equity | $ | 7,838,589 | | | | $ | 7,858,020 | | | | $ | 7,880,816 | | | |

Net FTE interest income (non-GAAP) (5) | | $ | 55,197 | | | | $ | 48,927 | | | | $ | 44,370 | | |

Less FTE adjustments (4) | | 2,070 | | | | 2,017 | | | | 2113 | |

| Net Interest Income | | $ | 53,127 | | | | $ | 46,910 | | | | $ | 42,257 | | |

Net FTE interest margin (Non-GAAP) (4)(5) | | | 2.97 | % | | | 2.66 | % | | | 2.42 | % |

(1) Securities balances represent daily average balances for the fair value of securities. The average rate is calculated based on the daily average balance for the amortized cost of securities. |

(2) Includes fees on loans held for sale and held for investment. The inclusion of loan fees does not have a material effect on the average interest rate. |

(3) Non-accruing loans for the purpose of the computation above are included in the daily average loan amounts outstanding. Loan totals are shown net of unearned income and deferred loan fees. |

(4) Management believes fully taxable equivalent, or FTE, interest income is useful to investors in evaluating the Company's performance as a comparison of the returns between a tax-free investment and a taxable alternative. The Company adjusts interest income and average rates for tax-exempt loans and securities to an FTE basis utilizing a 21% tax rate. |

(5) Non-GAAP financial metric. See non-GAAP reconciliation included herein for the most directly comparable GAAP measure. |

(6) Includes dividend income on Federal Home Loan Bank stock |

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Credit Quality | | | | |

| (Dollars in Thousands Except Ratios) | | | | |

| Quarter Ended | | | | |

| December 31, | | September 30, | | June 30, | | March 31, | | December 31, | | % Change |

| 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | 4Q24 vs 3Q24 | | 4Q24 vs 4Q23 |

| Non-accrual loans | | | | | | | | | | | | | |

| Commercial | 5,658 | | | $ | 6,830 | | | $ | 4,321 | | | $ | 5,493 | | | $ | 7,362 | | | (17) | % | | (23) | % |

| Residential Real estate | 11,215 | | | 9,529 | | | 8,489 | | | 8,725 | | | 8,058 | | | 18 | % | | 39 | % |

| Mortgage warehouse | — | | | — | | | — | | | — | | | — | | | — | % | | — | % |

| Consumer | 8,919 | | | 7,208 | | | 5,453 | | | 4,835 | | | 4,290 | | | 24 | % | | 108 | % |

| Total non-accrual loans | $ | 25,792 | | | $ | 23,567 | | | $ | 18,263 | | | $ | 19,053 | | | $ | 19,710 | | | 9 | % | | 31 | % |

| 90 days and greater delinquent - accruing interest | 1,166 | | | $ | 819 | | | $ | 1,039 | | | 108 | | | 559 | | | 42 | % | | 109 | % |

| Total non-performing loans | $ | 26,958 | | | $ | 24,386 | | | $ | 19,302 | | | $ | 19,161 | | | $ | 20,269 | | | 11 | % | | 33 | % |

| | | | | | | | | | | | | |

| Other real estate owned | | | | | | | | | | | | | |

| Commercial | 407 | | | $ | 1,158 | | | $ | 1,111 | | | $ | 1,124 | | | $ | 1,124 | | | (65) | % | | (64) | % |

| Residential Real estate | — | | | — | | | — | | | — | | | 182 | | | — | % | | (100) | % |

| Mortgage warehouse | — | | | — | | | — | | | — | | | — | | | — | % | | — | % |

| Consumer | 17 | | | 36 | | | 57 | | | 50 | | | 205 | | | (52) | % | | (92) | % |

| Total other real estate owned | $ | 424 | | | $ | 1,194 | | | $ | 1,168 | | | $ | 1,174 | | | $ | 1,511 | | | (64) | % | | (72) | % |

| | | | | | | | | | | | | |

| Total non-performing assets | $ | 27,382 | | | $ | 25,580 | | | $ | 20,470 | | | $ | 20,335 | | | $ | 21,780 | | | 7 | % | | 26 | % |

| | | | | | | | | | | | | |

| Loan data: | | | | | | | | | | | | | |

| Accruing 30 to 89 days past due loans | 23,075 | | | 18,087 | | | $ | 19,785 | | | $ | 15,154 | | | $ | 16,595 | | | 28 | % | | 39 | % |

| Substandard loans | 43,235 | | | 59,775 | | | 51,221 | | | 47,469 | | | 49,526 | | | (28) | % | | (13) | % |

| Net charge-offs (recoveries) | | | | | | | | | | | | | |

| Commercial | (37) | | | (52) | | | 57 | | | (57) | | | 233 | | | (29) | % | | (116) | % |

| Residential Real estate | (10) | | | (9) | | | (4) | | | (5) | | | 21 | | | 11 | % | | (148) | % |

| Mortgage warehouse | — | | | — | | | — | | | — | | | — | | | — | % | | — | % |

| Consumer | 668 | | | 439 | | | 534 | | | 488 | | | 531 | | | 52 | % | | 26 | % |

| Total net charge-offs | $ | 621 | | | $ | 378 | | | $ | 587 | | | $ | 426 | | | $ | 785 | | | 64 | % | | (21) | % |

| | | | | | | | | | | | | |

| Allowance for credit losses | | | | | | | | | | | | | |

| Commercial | 31,029 | | | 32,854 | | | 31,941 | | | 30,514 | | | 29,736 | | | (6) | % | | 4 | % |

| Residential Real estate | 3,115 | | | 2,675 | | | 2,588 | | | 2,655 | | | 2,503 | | | 16 | % | | 24 | % |

| Mortgage warehouse | — | | | 862 | | | 736 | | | 659 | | | 481 | | | (100) | % | | (100) | % |

| Consumer | 17,837 | | | 16,490 | | | 16,950 | | | 16,559 | | | 17,309 | | | 8 | % | | 3 | % |

| Total allowance for credit losses | $ | 51,981 | | | $ | 52,881 | | | $ | 52,215 | | | $ | 50,387 | | | $ | 50,029 | | | (2) | % | | 4 | % |

| | | | | | | | | | | | | |

| Credit quality ratios | | | | | | | | | | | | | |

| Non-accrual loans to HFI loans | 0.53 | % | | 0.49 | % | | 0.38 | % | | 0.41 | % | | 0.45 | % | | | | |

| Non-performing assets to total assets | 0.35 | % | | 0.32 | % | | 0.26 | % | | 0.26 | % | | 0.27 | % | | | | |

| Annualized net charge-offs of average total loans | 0.05 | % | | 0.03 | % | | 0.05 | % | | 0.04 | % | | 0.07 | % | | | | |

| Allowance for credit losses to HFI loans | 1.07 | % | | 1.10 | % | | 1.08 | % | | 1.09 | % | | 1.13 | % | | | | |

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non–GAAP Reconciliation of Net Fully-Taxable Equivalent ("FTE") Interest Margin |

| (Dollars in Thousands, Unaudited) |

| | Three Months Ended |

| | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| Interest income (GAAP) | (A) | $ | 93,350 | | | $ | 90,888 | | | $ | 86,981 | | | $ | 85,264 | | | $ | 83,514 | |

| Taxable-equivalent adjustment: | | | | | | | | | | |

Investment securities - tax exempt (1) | | 1,675 | | | $ | 1,677 | | | $ | 1,695 | | | $ | 1,715 | | | $ | 1,799 | |

Loan receivable (2) | | 395 | | | $ | 340 | | | $ | 328 | | | $ | 353 | | | $ | 314 | |

| Interest income (non-GAAP) | (B) | 95,420 | | | $ | 92,905 | | | $ | 89,004 | | | $ | 87,332 | | | $ | 85,627 | |

| Interest expense (GAAP) | (C) | 40,223 | | | $ | 43,978 | | | $ | 41,702 | | | $ | 41,976 | | | $ | 41,257 | |

| Net interest income (GAAP) | (D) =(A) - (C) | 53,127 | | | $ | 46,910 | | | $ | 45,279 | | | $ | 43,288 | | | $ | 42,257 | |

| Net FTE interest income (non-GAAP) | (E) = (B) - (C) | 55,197 | | | $ | 48,927 | | | $ | 47,302 | | | $ | 45,356 | | | $ | 44,370 | |

| Average interest earning assets | (F) | 7,396,178 | | | 7,330,263 | | | 7,212,788 | | | 7,293,559 | | | 7,239,034 | |

| Net FTE interest margin (non-GAAP) | (G) = (E*) / (F) | 2.97 | % | | 2.66 | % | | 2.64 | % | | 2.50 | % | | 2.43 | % |

| | | | | | | | | | |

(1) The following represents municipal securities interest income for investment securities classified as available-for-sale and held-to-maturity |

(2) The following represents municipal loan interest income for loan receivables classified as held for sale and held for investment |

| *Annualized |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non–GAAP Reconciliation of Return on Average Tangible Common Equity |

| (Dollars in Thousands, Unaudited) |

| | Three Months Ended | | |

| | December 31, | | September 30, | | June 30, | | March 31, | | December 31, | | | | |

| | 2024 | | 2024 | | 2024 | | 2024 | | 2023 | | | | |

| | | | | | | | | | | | | | |

| Net income (loss) (GAAP) | (A) | $ | (10,882) | | | $ | 18,180 | | | $ | 14,140 | | | $ | 13,991 | | | $ | (25,215) | | | | | |

| | | | | | | | | | | | | | |

| Average stockholders' equity | (B) | $ | 755,340 | | | $ | 738,372 | | | $ | 726,332 | | | $ | 725,083 | | | $ | 702,793 | | | | | |

| Average intangible assets | (C) | 165,973 | | | 166,819 | | | 167,659 | | | 168,519 | | | 169,401 | | | | | |

| Average tangible equity (Non-GAAP) | (D) = (B) - (C) | $ | 589,367 | | | $ | 571,553 | | | $ | 558,673 | | | $ | 556,564 | | | $ | 533,392 | | | | | |

| Return on average tangible common equity ("ROACE") (non-GAAP) | (E) = (A*) / (D) | (7.35) | % | | 12.65 | % | | 10.18 | % | | 10.11 | % | | (18.76) | % | | | | |

| *Annualized | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non–GAAP Reconciliation of Tangible Common Equity to Tangible Assets |

| (Dollars in Thousands, Unaudited) |

| | Three Months Ended |

| | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| Total stockholders' equity (GAAP) | (A) | $ | 763,582 | | | $ | 754,822 | | | $ | 726,665 | | | $ | 721,250 | | | $ | 718,812 | |

| Intangible assets (end of period) | (B) | 165,434 | | | 166,278 | | | 167,121 | | | 167,965 | | | 168,837 | |

| Total tangible common equity (non-GAAP) | (C) = (A) - (B) | $ | 598,148 | | | $ | 588,544 | | | $ | 559,544 | | | $ | 553,285 | | | $ | 549,975 | |

| | | | | | | | | | |

| Total assets (GAAP) | (D) | 7,801,146 | | | 7,927,457 | | | 7,912,527 | | | 7,855,707 | | | 7,940,485 | |

| Intangible assets (end of period) | (B) | 165,434 | | | 166,278 | | | 167,121 | | | 167,965 | | | 168,837 | |

| Total tangible assets (non-GAAP) | (E) = (D) - (B) | $ | 7,635,712 | | | $ | 7,761,179 | | | $ | 7,745,406 | | | $ | 7,687,742 | | | $ | 7,771,648 | |

| | | | | | | | | | |

| Tangible common equity to tangible assets (Non-GAAP) | (G) = (C) / (E) | 7.83 | % | | 7.58 | % | | 7.22 | % | | 7.20 | % | | 7.08 | % |

Horizon Bancorp, Inc. Reports Fourth Quarter 2024 Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non–GAAP Reconciliation of Tangible Book Value Per Share |

| (Dollars in Thousands, Unaudited) |

| | Three Months Ended |

| | December 31, | | September 30, | | June 30, | | March 31, | | December 31, |

| | 2024 | | 2024 | | 2024 | | 2024 | | 2023 |

| Total stockholders' equity (GAAP) | (A) | $ | 763,582 | | | $ | 754,822 | | | $ | 726,665 | | | $ | 721,250 | | | $ | 718,812 | |

| Intangible assets (end of period) | (B) | 165,434 | | | 166,278 | | | 167,121 | | | 167,965 | | | 168,837 | |

| Total tangible common equity (non-GAAP) | (C) = (A) - (B) | $ | 598,148 | | | $ | 588,544 | | | $ | 559,544 | | | $ | 553,285 | | | $ | 549,975 | |

| Common shares outstanding | (D) | 43,722,086 | | | 43,712,059 | | | 43,712,059 | | | 43,726,380 | | | 43,652,063 | |

| | | | | | | | | | |

| Tangible book value per common share (non-GAAP) | (E) = (C) / (D) | $ | 13.68 | | | $ | 13.46 | | | $ | 12.80 | | | $ | 12.65 | | | $ | 12.60 | |

Beyond ordinary banking Investor Presentation H o r i z o n B a n c o r p , I n c . ( N A S D A Q : H B N C ) F o u r t h Q u a r t e r E n d e d D e c e m b e r 3 1 , 2 0 2 4 J a n u a r y 2 3 , 2 0 2 5

Important Information Forward-Looking Statements This press release may contain forward–looking statements regarding the financial performance, business prospects, growth and operating strategies of Horizon Bancorp, Inc. and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Statements in this press release should be considered in conjunction with the other information available about Horizon, including the information in the filings we make with the Securities and Exchange Commission (the “SEC”). Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions in connection with any discussion of future operating or financial performance. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include: current financial conditions within the banking industry; changes in the level and volatility of interest rates, changes in spreads on earning assets and changes in interest bearing liabilities; increased interest rate sensitivity; the aggregate effects of elevated inflation levels in recent years; loss of key Horizon personnel; increases in disintermediation; potential loss of fee income, including interchange fees, as new and emerging alternative payment platforms take a greater market share of the payment systems; estimates of fair value of certain of Horizon’s assets and liabilities; changes in prepayment speeds, loan originations, credit losses, market values, collateral securing loans and other assets; changes in sources of liquidity; macroeconomic conditions and their impact on Horizon and its customers; legislative and regulatory actions and reforms; changes in accounting policies or procedures as may be adopted and required by regulatory agencies; litigation, regulatory enforcement, and legal compliance risk and costs; rapid technological developments and changes; cyber terrorism and data security breaches; the rising costs of cybersecurity; the ability of the U.S. federal government to manage federal debt limits; climate change and social justice initiatives; the inability to realize cost savings or revenues or to effectively implement integration plans and other consequences associated with mergers, acquisitions, and divestitures; acts of terrorism, war and global conflicts, such as the Russia and Ukraine conflict and the Israel and Hamas conflict; and supply chain disruptions and delays. These and additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Horizon’s reports (such as the Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K) filed with the SEC and available at the SEC’s website (www.sec.gov). Undue reliance should not be placed on the forward–looking statements, which speak only as of the date hereof. Horizon does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward–looking statement is made, or reflect the occurrence of unanticipated events, except to the extent required by law. 2

Executive Management Team Kathie A. DeRuiter EVP & Senior Operations Officer Todd A. Etzler EVP & Corporate Secretary & General Counsel Lynn M. Kerber EVP & Chief Commercial Banking Officer Thomas M. Prame President & Chief Executive Officer Mark E. Secor EVP & Chief Administration Officer John R. Stewart, CFA® EVP & Chief Financial Officer 3

Fourth Quarter 2024 * Net Fully-Taxable Equivalent Interest Margin is a Non-GAAP measure. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures. ** The tangible common equity to tangible common assets (TCE/TA) ratio and tangible book value per share (TBVPS) are non-GAAP measures. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures. 4 H I G H L I G H T S & D E V E L O P M E N T S • Fifth consecutive quarter of FTE NIM* expansion to 2.97%, from a favorable mix shift in both average earning assets and interest-bearing deposits • Quality loan growth o Strong loan growth in the quarter, with total loans excluding Mortgage Warehouse growing 10% linked quarter annualized (LQA) o Commercial loan growth of 22% LQA, coupled with planned runoff in lower yielding indirect loans • Strong funding base o Stability in core transactional balances offset by intentional run-off of higher-cost CD balances o Realizing tangible benefits of commercial and consumer deposit gathering efforts • Excellent credit metrics o Low NPAs and minimal NCOs • $5MM in Tax Valuation Allowance was reversed, accretive to TCE/TA and TBVPS** ($000S EXCEPT PER SHARE DATA) 4Q24 3Q24 INCOME STATEMENT Net interest income $53,127 $46,910 NIM (FTE)* 2.97% 2.66% Provision $1,171 $1,044 Non-interest (loss) income ($28,954) $11,511 Non-interest expense $44,935 $39,272 Net (loss) income ($10,882) $18,180 Diluted (loss) EPS ($0.25) $0.41 BALANCE SHEET (period end) Total loans held for investment $4,847,040 $4,803,996 Total deposits $5,600,652 $5,727,015 CREDIT QUALITY NPA/total assets ratio 0.35% 0.32% Annualized net charge-offs to avg. loans 0.05% 0.03%

Balanced Loan Growth Data as of most-recent quarter (MRQ) end unless stated otherwise. *Total Gross loans, including Loans Held for Investment (HFI) and Loans Held for Sale (HFS) **Mortgage Warehouse balances moved from HFI to HFS $4,806MM $97MM $67MM $2MM -$15MM -$4MM -$38MM $4,915MM 3Q24 Loans* CRE C&I Residential Warehouse & HFS** Consumer Indirect 4Q24 Loans* 4 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • Robust loan growth with quarter end Total LHI, excluding Mortgage Warehouse, increasing $123.5MM, to $4.9 Billion o Continuing to maintain highly diverse residential, consumer, C&I and CRE portfolios • New production continues shift of loan mix to more profitable portfolios o Increases in Commercial & Real Estate offset by planned reduction in Indirect Auto • Seasonal fluctuation of mortgage warehouse balances 5 20% 17% 63% Total Loans* $4.9B MRQ end Consumer Residential Commercial

31% 13% 19% 15% 8% 9% 5% Geography $3.1B MRQ end Central Indiana Northern Indiana Western Michigan Southwest Michigan Northern Michigan Eastern Michigan Other Diversified Commercial Portfolio 49% 22% 28% 1% Mix $3.1B MRQ end CRE (non-owner occ.) CRE (owner occ.) C&I Other*** 4 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S * The sum of construction & land development loans, multifamily property loans, non-owner-occupied non-farm non-residential property loans and loans to finance CRE not secured by real estate divided by Tier 1 Capital plus Allowance, as of September 30, 2024 ** UBPR Peer Group 3, as of September 30, 2024 *** Land development and spec home loans • Commercial loan balances grew organically (22% LQA). o Quarter end up $164MM • Well balanced geographies, product mix and industry o No segment exceeds 6.5% of total loans o CRE represents 197%* of RBC versus 239% for peers** Data represents total loans HFI as of MRQ unless stated otherwise 6 $47.5 $44.1 $46.1 $46.7 $34.2 $712.9 $765.0 $786.8 $808.6 $875.3 $640.7 $653.1 $632.2 $634.5 $667.2 $1,273.8 $1,287.5 $1,439.5 $1,424.3 $1,501.5 $2,675.0 $2,749.8 $2,904.6 $2,914.1 $3,078.2 4Q23 1Q24 2Q24 3Q24 4Q24 Commercial Loans (period end) Other*** C&I CRE (owner occ.) CRE (non-owner occ.) $m ill io ns

Prime Consumer & Residential Lending 4 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 7 • Consumer portfolio and Mortgage portfolio relatively flat • Indirect Auto declined $38MM from planned run-offs • Home lending portfolios composed of higher quality borrowers, significant capacity to pay and low LTV Data represents total loans HFI as of MRQ unless stated otherwise 45% 32% 17% 5% Mix $1.8B MRQ end Mortgage Home Equity Indirect Auto Direct Installment $681.1 $782.1 $798.0 $801.4 $802.9 $1,016.5 $1,029.8 $1,051.4 $1,008.1 $966.0 $1,697.6 $1,811.9 $1,849.4 $1,809.5 $1,768.9 4Q23 1Q24 2Q24 3Q24 4Q24 Residential Consumer $m ill io ns Consumer & Residential Loans (period end) HOME EQUITY MORTGAGE CREDIT SCORE 712 759 DEBT-TO-INCOME 27% 35% LOAN-TO-VALUE 85% 70%

Strong Asset Quality Metrics 8 $m ill io ns $50.0 $50.4 $52.2 $52.9 $52.0 1.13% 1.09% 1.08% 1.10% 1.07% 4Q23 1Q24 2Q24 3Q24 4Q24 ACL ACL / Loans HFI Allowance for Credit Losses (period end) $20.3 $19.2 $19.3 $24.4 $27.0 0.46% 0.41% 0.40% 0.51% 0.56% 4Q23 1Q24 2Q24 3Q24 4Q24 Non-Performing Loans (period end) Commercial Resi Real Estate Consumer Total NPLs / Loans HFI $m ill io ns $0.8 $0.4 $0.6 $0.4 $0.6 0.07% 0.04% 0.05% 0.03% 0.05% 4Q23 1Q24 2Q24 3Q24 4Q24 Net Charge Offs Commercial Resi Real Estate Consumer Total Annualized NCOs/ Av. Loans $m ill io ns $m ill io ns $49.5 $47.5 $51.2 $59.8 $43.2 1.12% 1.03% 1.06% 1.24% 0.89% 4Q23 1Q24 2Q24 3Q24 4Q24 Substandard Loans Substandard Loans (period end)

Data as of period end unless stated otherwise Relationship Based Core Deposits 9 4 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • Consumer and Commercial Deposits o Positive momentum in core relationships and balances o Treasury management team investments making a positive impact • Public Deposits o Focusing on primary bank relationships o Positioned well to create additional value with continued rate reductions o Planned runoff of higher cost CDs $m ill io ns $5,665 $5,580 $5,630 $5,727 $5,601 78.0% 82.8% 85.7% 83.9% 86.5% 4Q23 1Q24 2Q24 3Q24 4Q24 Deposits Loans/Deposits Deposits 19.7% 19.6% 19.3% 19.0% 19.0% 59.5% 60.1% 59.8% 59.7% 61.5% 20.8% 20.4% 20.9% 21.3% 19.4% $1,116 $1,093 $1,087 $1,086 $1,065 $3,369 $3,351 $3,365 $3,420 $3,447 $1,180 $1,136 $1,178 $1,221 $1,089 4Q23 1Q24 2Q24 3Q24 4Q24 Stable Consumer and Commercial Deposits Non-Int Bearing% Interest Bearing% Time % % of Total Deposits $m ill io ns

NIM Expansion Net Fully-Taxable Equivalent Interest Margin is a Non-GAAP measure. ** Commercial lending fees recognized in interest income. 4 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • Strong NIM expansion driven by accelerated repositioning of securities sale proceeds into commercial loans, strategic run-off of higher cost term deposits and modest benefit of non-recurring income • Continuation of improved balance sheet profitability from the strategic mix shift in both assets and liabilities, as well as the modest favorable impact of declining Fed Funds rate 10 2.97% 2.66% 0.08% 0.00% 0.23% 3Q24 NIM (FTE)* Interest Earning Asset Yield ∆ Loan fees** Total Liability Cost ∆ 4Q24 NIM (FTE)*

4 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S • No new investments in the quarter • High credit quality treasuries, agencies, municipals and mortgage-backed securities • ~$332MM of securities sold in early October as part of balance sheet optimization • ~$234MM remaining AFS carry a weighted average duration of 7.96 years * The Company adjusts average rates for tax-exempt securities to an FTE basis utilizing a 21% tax rate. 11 Investment Securities Detail All dollar amounts in millions 4Q23 1Q24 2Q24 3Q24 4Q24 ROLL-OFF/CASH FLOW $28 $27 $26 $23 $23 SALES $383 – – – $332 DURATION (YEARS) 7.0 6.9 6.8 6.8 7.1 AVERAGE RATE ON INVESTMENT SECURITIES (FTE)* 2.39% 2.39% 2.39% 2.38% 2.39% $22 $22 $40 $27 2.89% 2.33% 1.93% 1.82% 1Q25 2Q25 3Q25 4Q25 Projected Cash Flows and Roll-Off Yield Cash Flows Yield Roll-Off (FTE)*$m ill io ns

Non-Interest Income 4 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 12 Data as of MRQ unless stated otherwise. • 4Q24 includes the pre-tax loss of $39.1MM on the sale of $332.2MM in available-for-sale (“AFS”) securities as part of a balance sheet repositioning in October 2024. • 4Q23 includes the pre-tax loss of $31.6MM on the sale of $382.7MM in available-for-sale (“AFS”) securities as part of a balance sheet repositioning in December 2023. • Non-interest income impacted by a $39.1MM loss from securities sale • Realizing benefits from Treasury Management and Wealth investments • New Mortgage leadership implementing a more effective sales program and secondary market platform • Well diversified income stream aligned with core community banking model $3.2 $3.3 $3.2 $3.4 $3.4 $3.2 $3.1 $3.8 $3.5 $3.4 $1.4 $1.3 $1.4 $1.4 $1.3 $1.7 $1.1 $1.3 $2.0 $1.4 $1.7 $1.1 $0.7 $1.1 $0.7 $9.9 $11.5 4Q23* 1Q24 2Q24 3Q24 4Q24* Gain (loss) on securities sales All Other Mortgage related income Fiduciary activities Interchange fees Service & wire transfer fees $10.5 $m ill io ns Non-interest Income -$29.0-$20.4

Non-Interest Expense 4 Q 2 4 H I G H L I G H T S & D E V E L O P M E N T S 13 Data as of MRQ unless stated otherwise. • Elevated non-interest expense in Q4, impacted by successful execution of strategic plans to improved go-forward profitability: o $1.8MM accelerated stock vesting expense to exit legacy compensation plan o $0.6MM increase related to previously discussed legacy benefits program, which was resolved in Q4 o $0.5MM in direct outside services related to strategic initiatives concluded in Q4 • Additional impact related to elevated medical expense and performance-based incentive comp, an OREO property write-down and certain accruals $21.9 $20.3 $20.6 $21.8 $25.6 $17.5 $16.8 $16.9 $17.4 $19.4$39.3 $37.1 $37.5 $39.3 $44.9 4Q23 1Q24 2Q24 3Q24 4Q24 All Other Non-interest Expense Salaries & Employee Benefits Non-interest Expense $m ill io ns

CET1 Ratio Capital Position Provides Flexibility * The tangible common equity to tangible common assets (TCE/TA) ratio and tangible book value per share (TBVPS) are non-GAAP measures. Please see appendix for reconciliations of non-GAAP information to its most comparable GAAP measures. ** Prior periods have been previously revised (see disclosure in Form 10-Q for the quarterly period ending June 30, 2024) *** Preliminary estimate – may be subject to change Leverage Ratio Total RBC Ratio 14 TCE/TA* 8.91% 9.02% 9.02% 8.87% 1Q24** 2Q24 3Q24 4Q24*** 13.75% 13.41% 13.45% 13.84% 1Q24** 2Q24 3Q24 4Q24*** 10.89% 10.63% 10.68% 10.96% 1Q24 2Q24 3Q24 4Q24*** 7.20% 7.22% 7.58% 7.83% $12.65 $12.80 $13.46 $13.68 1Q24 2Q24 3Q24 4Q24 TCE/TA Ratio TBVPS

Successful Execution of Strategic Actions • Repositioned ~$330MM AFS Securities (Book Value) o Sales completed in early October o Net proceeds were leveraged to fund commercial loan growth and to selectively pay down higher-cost term deposits in Q4 • Released $5MM Tax Valuation Allowance o Executed strategic tax planning in Q4, recovering $5MM of capital by reducing tax expense • Higher Q4 Expenses to Benefit Future Run-Rate o Executed strategic acceleration of certain compensation-related expenses to sun-set expensive legacy programs o Realized specific expense related to Q4 strategic actions with significant ROI • Q1 2025 Sale of Mortgage Warehouse Business o Sale of the business closed on January 17th o No material impact on deposit balances o Liquidity created to be redeployed into core business activities S i m p l i f y i n g B u s i n e s s M o d e l , S t r e n g t h e n i n g B a l a n c e S h e e t & I m p r o v i n g P r o f i t a b i l i t y 15 Securities Sale Expected Financial Impact: • Less than 4.0 year earn-back on realized net after-tax loss for these transactions • Previously announced EPS accretion of $0.12 annually will be exceeded Q4 2024 : • $39.1MM pre-tax loss on sale of securities • $2.4MM of direct compensation expense for legacy programs • $0.5MM of outside services expense related to specific Q4 strategic actions • $5.1MM reduction of tax expense for VA release 2025 • Warehouse gain to be recognized in Q1 • Anticipated repayment of $200MM FHLB maturities at 4.02% in March and April

Full-Year 2025 Guidance Summary Loans (HFI) • Period-end total loans HFI to grow mid-single-digits off stronger fourth quarter results • Growth primarily in higher-yielding commercial loans; Offset by continued planned runoff in indirect auto loans (~$100MM) • Loans HFS will decline from the sale of the warehouse balances in Q1 (~$65MM) Deposits & Funding • Period-end total deposit balances to grow low-single-digits • Deposit mix to remain relatively stable over the year • Total funding mix to improve with anticipated reduction in Borrowings NII & NIM • Mid-teens full-year net interest income growth • Net interest margin to show sequential quarterly increases over the year • Assumes one 25 basis point reduction at the end of July Non-Interest Income • Full-year 2025 to grow low-single-digits over full-year 2024, excluding the Q4 securities loss • Growth anticipated in Treasury Management, Wealth & Mortgage Non-Interest Expense • Full-year 2025 to be flat to up low-single-digits over reported full-year 2024 • Management focused on prudent expense control and positive operating leverage Effective Tax Rate • Preliminary outlook for full-year 2025 effective tax rate in the mid-teens, reflecting a stronger outlook for pre-tax income and management’s decision to discontinue investments in additional solar tax credits 16