iRhythm Technologies, Inc. (NASDAQ: IRTC), a leading digital health

care company focused on creating trusted solutions that detect,

predict, and prevent disease, today reported financial results for

the three months and full year ended December 31, 2024.

Fourth Quarter 2024 Financial

Highlights

- Revenue of $164.3 million, a 24.0%

increase compared to fourth quarter 2023

- Gross margin of 70.0%, a 410-basis

point increase compared to fourth quarter 2023

- Net loss of $1.3 million, a $37.4

million improvement compared to fourth quarter 2023

- Adjusted EBITDA of $19.3 million, a

$16.9 million improvement compared to fourth quarter 2023

- Cash, cash equivalents and marketable

securities of $535.6 million at December 31, 2024, a $13.6 million

increase from September 30, 2024

Full Year 2024 Financial

Highlights

- Revenue of $591.8 million, a 20.1%

increase compared to full year 2023

- Gross margin of 68.9%, a 160-basis

point increase compared to full year 2023

- Net loss of $113.3 million, a $10.1

million improvement compared to full year 2023

- Adjusted EBITDA of $(7.7) million, a

decline of $2.9 million compared to full year 2023

Recent Operational Highlights

- Fourth quarter 2024 capped a year of

progressively accelerating year-over-year volume growth every

quarter, with full year 2024 revenue driven by sustained volume

demand across all customer channels

- Analysis of real-world claims data

conducted by Eversana and presented at AHA in November 2024

suggested that early detection with arrhythmia monitoring devices

could have the combined potential to help prevent serious outcomes

like stroke and heart failure while also significantly reducing

acute care utilization and related costs in patients with type 2

diabetes and chronic obstructive pulmonary disease

- Upcoming data presentations at the

American College of Cardiology's Annual Scientific Session &

Expo in Chicago, IL, from March 29 – 31, 2025

"Our fourth quarter capped a transformative year

for iRhythm, marked by 24% revenue growth and significant

operational achievements," said Quentin Blackford, President and

CEO of iRhythm. "We achieved record new account onboarding, with

balanced volume contributions across multiple channels,

particularly in risk-bearing, primary care settings where Zio's

value as a population health management tool has resonated

strongly. Throughout 2024, we enhanced our quality systems,

improved customer experience through EHR integration and innovative

product launches, expanded into multiple international markets, and

secured strategic technology licensing agreements to advance

connected patient care. Our commitment to operational discipline

has yielded positive cash flow for three consecutive quarters,

while our extensive scientific publications have further validated

our approach. Looking ahead, we remain focused on delivering a

best-in-class quality system while creating shareholder value

through our strategies of expanding our core U.S. market presence,

accelerating international growth, advancing product innovation,

and further advancing operational efficiencies. As we scale the Zio

platform globally, we're uniquely positioned to shape the future of

healthcare while driving value for patients, physicians, health

systems, and shareholders."

Fourth Quarter 2024 Financial

ResultsRevenue for the three months ended December 31,

2024, increased 24.0% to $164.3 million, from $132.5 million during

the same period in 2023. The increase was primarily attributable to

increases in the volume of Zio Services resulting from increased

demand, partially offset by a slight decline in average selling

price.

Gross profit for the fourth quarter of 2024 was

$115.1 million, up from $87.4 million during the same period in

2023, while gross margins were 70.0% as compared to 66.0% during

the same period in 2023. The improvement in gross margin was

primarily driven by operational efficiencies leading to lower costs

per unit to serve a higher volume of patients compared to the prior

year.

Operating expenses for the fourth quarter of 2024

were $119.2 million, compared to $126.6 million for the same period

in 2023 and $151.8 million in the third quarter of 2024. The fourth

quarter of 2023 included $11.1 million of higher operating expenses

due to an impairment charge for our right-of-use capitalized leased

asset value of our San Francisco office. The decrease in operating

expenses compared to the third quarter 2024 was due primarily to a

$32.1 million charge in the third quarter of 2024 for in-process

research and development charges related to technology license

consideration.

Net loss for the fourth quarter of 2024 was $1.3

million, or a diluted loss of $0.04 per share, compared with net

loss of $38.7 million, or a diluted loss of $1.26 per share, for

the same period in 2023.

Full Year 2024 Financial

ResultsRevenue for the year ended December 31, 2024,

increased 20.1% to $591.8 million, from $492.7 million in 2023. The

increase in revenue was primarily due to increased volume of Zio

services provided as a result of increased demand.

Gross profit for the year was $407.5 million, up

from $331.8 million in 2023, while gross margin was 68.9%, an

improvement from 67.3% in 2023. The improvement in gross margin was

primarily driven by operational efficiencies leading to lower costs

per unit to serve a higher volume of patients compared to the prior

year.

Operating expenses for the year were $523.0

million, an increase of 14.5% compared to 2023. The increase was

mainly due to acquired IPR&D expenses related to license

consideration, along with an increase in headcount-related costs

and professional fees to support the growth in our business.

Net loss for 2024 was $113.3 million, or a diluted

loss of $3.63 per share, compared with net loss of $123.4 million,

or a diluted loss of $4.04 per share in 2023.

Cash, cash equivalents and marketable securities

were $535.6 million as of December 31, 2024.

2025 Guidance iRhythm projects

revenue for the full year 2025 between $675 million to $685

million. Adjusted EBITDA margin for the full year 2025 is expected

to range from approximately 7.0% to 8.0% of revenues.

Webcast and Conference Call

InformationiRhythm’s management team will host a

conference call today beginning at 1:30 p.m. PT/4:30 p.m. ET.

Investors interested in listening to the conference call may do so

by accessing the live and archived webcast of the event, which will

be available on the investors section of the Company’s website at

investors.irhythmtech.com.

About iRhythm Technologies,

Inc.iRhythm is a leading digital health care company that

creates trusted solutions that detect, predict, and prevent

disease. Combining wearable biosensors and cloud-based data

analytics with powerful proprietary algorithms, iRhythm distills

data from millions of heartbeats into clinically actionable

information. Through a relentless focus on patient care, iRhythm’s

vision is to deliver better data, better insights, and better

health for all.

Use of Non-GAAP Financial

MeasuresWe refer to certain financial measures that are

not recognized under U.S. generally accepted accounting principles

(GAAP) in this press release, including adjusted EBITDA, adjusted

net loss, adjusted net loss per share and adjusted operating

expenses. We use these non-GAAP financial measures for financial

and operational decision-making and as a means to evaluate

period-to-period comparisons. See the schedules attached to this

press release for additional information and reconciliations of

such non-GAAP financial measures. We have not reconciled our

adjusted operating expenses and adjusted EBITDA estimates for full

year 2025 because certain items that impact these figures are

uncertain or out of our control and cannot be reasonably predicted.

Accordingly, a reconciliation of adjusted operating expenses and

adjusted EBITDA estimates is not available without unreasonable

effort.

Adjusted EBITDA excludes non-cash operating charges

for stock-based compensation expense, changes in fair value of

strategic investments, impairment and restructuring charges,

business transformation costs, and loss on extinguishment of debt.

Business transformation costs include costs associated with

professional services, employee termination and relocation,

third-party merger and acquisition, integration, and other costs to

augment and restructure the organization, inclusive of both

outsourced and offshore resources.

Forward-Looking StatementsThis

news release contains forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995. An investor can identify

these statements by the fact that they do not relate strictly to

historical or current facts. They use words such as ‘anticipate’,

‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’,

‘believe’, ‘target’ and other words and terms of similar meaning in

connection with any discussion of future actions or operating or

financial performance. In particular these statements include

statements regarding financial guidance, market opportunity,

ability to penetrate the market, international market expansion,

anticipated productivity and quality improvements, and expectations

for growth. Such statements are based on current assumptions that

involve risks and uncertainties that could cause actual outcomes

and results to differ materially. These risks and uncertainties,

many of which are beyond our control, include risks described in

the section entitled “Risk Factors” and elsewhere in our filings

made with the Securities and Exchange Commission, including those

on the Form 10-K expected to be filed on or about February 20,

2025. These forward-looking statements speak only as of the date

hereof and should not be unduly relied upon. iRhythm disclaims any

obligation to update these forward-looking statements.

Investor ContactStephanie

Zhadkevichinvestors@irhythmtech.com

Media ContactKassandra

Perryirhythm@highwirepr.com

|

IRHYTHM TECHNOLOGIES, INC.Consolidated

Balance Sheets(In thousands, except par

value) |

| |

| |

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

419,597 |

|

|

$ |

36,173 |

|

|

Marketable securities |

|

115,956 |

|

|

|

97,591 |

|

|

Accounts receivable, net |

|

79,941 |

|

|

|

61,484 |

|

|

Inventory |

|

14,039 |

|

|

|

13,973 |

|

|

Prepaid expenses and other current assets |

|

16,286 |

|

|

|

21,591 |

|

|

Total current assets |

|

645,819 |

|

|

|

230,812 |

|

| Property and equipment, net |

|

125,092 |

|

|

|

104,114 |

|

| Operating lease right-of-use

assets |

|

47,564 |

|

|

|

49,317 |

|

| Restricted cash |

|

8,358 |

|

|

|

— |

|

| Goodwill |

|

862 |

|

|

|

862 |

|

| Long-term strategic

investments |

|

61,902 |

|

|

|

3,000 |

|

| Other assets |

|

41,852 |

|

|

|

45,039 |

|

|

Total assets |

$ |

931,449 |

|

|

$ |

433,144 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

7,221 |

|

|

$ |

5,543 |

|

|

Accrued liabilities |

|

84,900 |

|

|

|

83,362 |

|

|

Deferred revenue |

|

2,932 |

|

|

|

3,306 |

|

|

Operating lease liabilities, current portion |

|

15,867 |

|

|

|

15,159 |

|

|

Total current liabilities |

|

110,920 |

|

|

|

107,370 |

|

| Long-term senior convertible

notes |

|

646,443 |

|

|

|

— |

|

| Debt, noncurrent portion |

|

— |

|

|

|

34,950 |

|

| Other noncurrent liabilities |

|

8,579 |

|

|

|

1,012 |

|

| Operating lease liabilities,

noncurrent portion |

|

74,599 |

|

|

|

79,715 |

|

| Total liabilities |

|

840,541 |

|

|

|

223,047 |

|

| Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.001 par value – 5,000 shares authorized; none

issued and outstanding at December 31, 2024 and 2023 |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value – 100,000 shares authorized; 31,621

shares issued and 31,392 shares outstanding at December 31,

2024, respectively; and 30,954 shares issued and outstanding at

December 31, 2023 |

|

31 |

|

|

|

31 |

|

|

Additional paid-in capital |

|

874,607 |

|

|

|

855,784 |

|

|

Accumulated other comprehensive income (loss) |

|

165 |

|

|

|

(112 |

) |

|

Accumulated deficit |

|

(758,895 |

) |

|

|

(645,606 |

) |

|

Treasury stock, at cost; 229 and 0 shares at December 31, 2024

and 2023, respectively |

|

(25,000 |

) |

|

|

— |

|

|

Total stockholders’ equity |

|

90,908 |

|

|

|

210,097 |

|

|

Total liabilities and stockholders’ equity |

$ |

931,449 |

|

|

$ |

433,144 |

|

| |

|

|

|

|

IRHYTHM TECHNOLOGIES, INC.Consolidated

Statements of Operations(In thousands, except per

share data) |

| |

| |

(Unaudited)Three Months Ended December

31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue, net |

$ |

164,325 |

|

|

$ |

132,511 |

|

|

$ |

591,839 |

|

|

$ |

492,681 |

|

| Cost of revenue |

|

49,257 |

|

|

|

45,085 |

|

|

|

184,308 |

|

|

|

160,875 |

|

| Gross profit |

|

115,068 |

|

|

|

87,426 |

|

|

|

407,531 |

|

|

|

331,806 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

19,081 |

|

|

|

15,416 |

|

|

|

71,459 |

|

|

|

60,244 |

|

|

Acquired in-process research and development |

|

302 |

|

|

|

— |

|

|

|

32,371 |

|

|

|

— |

|

|

Selling, general and administrative |

|

99,768 |

|

|

|

100,114 |

|

|

|

418,565 |

|

|

|

385,645 |

|

|

Impairment and restructuring charges |

|

— |

|

|

|

11,078 |

|

|

|

641 |

|

|

|

11,078 |

|

|

Total operating expenses |

|

119,151 |

|

|

|

126,608 |

|

|

|

523,036 |

|

|

|

456,967 |

|

| Loss from operations |

|

(4,083 |

) |

|

|

(39,182 |

) |

|

|

(115,505 |

) |

|

|

(125,161 |

) |

| Interest and other income

(expense), net: |

|

|

|

|

|

|

|

|

Interest income |

|

5,740 |

|

|

|

1,734 |

|

|

|

21,938 |

|

|

|

6,353 |

|

|

Interest expense |

|

(3,320 |

) |

|

|

(941 |

) |

|

|

(12,821 |

) |

|

|

(3,650 |

) |

|

Loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(7,589 |

) |

|

|

— |

|

|

Other income (expense), net |

|

481 |

|

|

|

(55 |

) |

|

|

1,253 |

|

|

|

(198 |

) |

|

Total interest and other income (expense), net |

|

2,901 |

|

|

|

738 |

|

|

|

2,781 |

|

|

|

2,505 |

|

|

Loss before income taxes |

|

(1,182 |

) |

|

|

(38,444 |

) |

|

|

(112,724 |

) |

|

|

(122,656 |

) |

| Income tax provision |

|

151 |

|

|

|

255 |

|

|

|

565 |

|

|

|

750 |

|

| Net loss |

$ |

(1,333 |

) |

|

$ |

(38,699 |

) |

|

$ |

(113,289 |

) |

|

$ |

(123,406 |

) |

| Net loss per common share,

basic and diluted |

$ |

(0.04 |

) |

|

$ |

(1.26 |

) |

|

$ |

(3.63 |

) |

|

$ |

(4.04 |

) |

| Weighted-average shares, basic

and diluted |

|

31,343 |

|

|

|

30,702 |

|

|

|

31,196 |

|

|

|

30,528 |

|

|

IRHYTHM TECHNOLOGIES, INC.Reconciliation

of GAAP to Non-GAAP Financial Information(In

thousands, except per share

data)(Unaudited) |

|

|

|

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Adjusted EBITDA

reconciliation* |

|

|

|

|

|

|

|

| Net loss1 |

$ |

(1,333 |

) |

|

$ |

(38,699 |

) |

|

$ |

(113,289 |

) |

|

$ |

(123,406 |

) |

| Interest expense |

|

3,320 |

|

|

|

941 |

|

|

|

12,821 |

|

|

|

3,650 |

|

| Interest income |

|

(5,740 |

) |

|

|

(1,734 |

) |

|

|

(21,938 |

) |

|

|

(6,353 |

) |

| Changes in fair value of

strategic investments |

|

(843 |

) |

|

|

— |

|

|

|

(1,902 |

) |

|

|

— |

|

| Income tax provision |

|

151 |

|

|

|

255 |

|

|

|

565 |

|

|

|

750 |

|

| Depreciation and

amortization |

|

5,289 |

|

|

|

4,914 |

|

|

|

20,715 |

|

|

|

16,348 |

|

| Stock-based compensation |

|

16,008 |

|

|

|

23,846 |

|

|

|

75,978 |

|

|

|

77,204 |

|

| Impairment charges |

|

— |

|

|

|

11,078 |

|

|

|

641 |

|

|

|

11,078 |

|

| Business transformation

costs |

|

2,416 |

|

|

|

1,772 |

|

|

|

11,072 |

|

|

|

15,866 |

|

| Loss on extinguishment of

debt |

|

— |

|

|

|

— |

|

|

|

7,589 |

|

|

|

— |

|

| Adjusted EBITDA |

$ |

19,268 |

|

|

$ |

2,373 |

|

|

$ |

(7,748 |

) |

|

$ |

(4,863 |

) |

| |

|

|

|

|

|

|

|

| *Certain numbers

expressed may not sum due to rounding.1Net loss for the three and

twelve months ended December 31, 2024, includes acquired in-process

research and development expense of $0.3 million and $32.4 million,

respectively. |

| Adjusted net income

(loss) reconciliation* |

|

|

|

|

|

|

|

|

Net loss, as reported1 |

$ |

(1,333 |

) |

|

$ |

(38,699 |

) |

|

$ |

(113,289 |

) |

|

$ |

(123,406 |

) |

| Impairment charges |

|

— |

|

|

|

11,078 |

|

|

|

641 |

|

|

|

11,078 |

|

| Business transformation

costs |

|

2,416 |

|

|

|

1,772 |

|

|

|

11,072 |

|

|

|

15,866 |

|

| Changes in fair value of

strategic investments |

|

(843 |

) |

|

|

— |

|

|

|

(1,902 |

) |

|

|

— |

|

| Loss on extinguishment of

debt |

|

— |

|

|

|

— |

|

|

|

7,589 |

|

|

|

— |

|

| Adjusted net income

(loss) |

$ |

240 |

|

|

$ |

(25,849 |

) |

|

$ |

(95,889 |

) |

|

$ |

(96,462 |

) |

| |

|

|

|

|

|

|

|

| Adjusted net income

(loss) per share reconciliation:* |

|

|

|

|

|

|

|

| Diluted net loss per share, as

reported1 |

$ |

(0.04 |

) |

|

$ |

(1.26 |

) |

|

$ |

(3.63 |

) |

|

$ |

(4.04 |

) |

| Impairment charges per

share |

|

— |

|

|

|

0.36 |

|

|

|

0.02 |

|

|

|

0.36 |

|

| Business transformation costs

per share |

|

0.08 |

|

|

|

0.06 |

|

|

|

0.35 |

|

|

|

0.52 |

|

| Changes in fair value of

strategic investments per share |

|

(0.03 |

) |

|

|

— |

|

|

|

(0.06 |

) |

|

|

— |

|

| Loss on extinguishment of debt

per share |

|

— |

|

|

|

— |

|

|

|

0.24 |

|

|

|

— |

|

| Adjusted diluted net income

(loss) per share |

$ |

0.01 |

|

|

$ |

(0.84 |

) |

|

$ |

(3.08 |

) |

|

$ |

(3.16 |

) |

| |

|

|

|

|

|

|

|

| Weighted-average shares,

basic |

|

31,343 |

|

|

|

30,702 |

|

|

|

31,196 |

|

|

|

30,528 |

|

| Weighted-average shares,

diluted |

|

31,710 |

|

|

|

30,702 |

|

|

|

31,196 |

|

|

|

30,528 |

|

| |

|

|

|

|

|

|

|

| Adjusted operating

expenses reconciliation* |

|

|

|

|

|

|

|

| Operating expenses, as

reported |

$ |

119,151 |

|

|

$ |

126,608 |

|

|

$ |

523,036 |

|

|

$ |

456,967 |

|

| Impairment charges |

|

— |

|

|

|

(11,078 |

) |

|

|

(641 |

) |

|

|

(11,078 |

) |

| Business transformation

costs |

|

(2,416 |

) |

|

|

(1,772 |

) |

|

|

(11,072 |

) |

|

|

(15,866 |

) |

| Adjusted operating

expenses |

$ |

116,735 |

|

|

$ |

113,758 |

|

|

$ |

511,323 |

|

|

$ |

430,023 |

|

| |

| *Certain numbers

expressed may not sum due to rounding.1Net loss for the three and

twelve months ended December 31, 2024, includes acquired in-process

research and development expense of $0.3 million and $32.4 million,

respectively. |

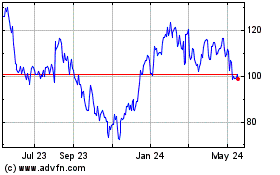

iRhythm Technologies (NASDAQ:IRTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

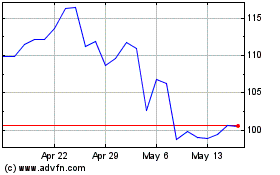

iRhythm Technologies (NASDAQ:IRTC)

Historical Stock Chart

From Feb 2024 to Feb 2025