false000115846300011584632024-09-052024-09-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 5, 2024

JETBLUE AIRWAYS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 000-49728 | 87-0617894 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

27-01 Queens Plaza North | Long Island City | New York | 11101 |

| (Address of principal executive offices) | (Zip Code) |

(718) 286-7900

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value | JBLU | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

JetBlue Airways Corporation ("JetBlue" or the "Company") announced today an operational and financial update of its expected third quarter 2024 results.

The Company's operational performance over the summer travel season improved year-over-year, as evidenced by an improvement to on-time performance by approximately ten points year-over-year. This was enabled by JetBlue's heightened focus on offering reliable and caring service as a core pillar of its JetForward strategy.

JetBlue's revenue performance quarter-to-date was benefited by several factors, including improving in-month bookings, particularly in the Latin region, and continued progress from its previously announced $300 million worth of revenue initiatives. The Company also recognized revenue uplift from the re-accommodation of customers affected by other airlines' cancellations due to technology outages in July.

JetBlue's quarter-to-date expenses declined due to moderating fuel prices since the start of the third quarter. Non-fuel unit costs improved by one point versus expectations as benefits from focused efforts on cost control and operational reliability were partially offset by weather-related disruption costs in August.

In August 2024, JetBlue issued $2,000 million aggregate principal amount of senior secured notes due 2031 and entered into a $765 million term loan credit and guaranty agreement, maturing in 2029. The Company also issued $460 million aggregate principal amount of its 2.50% Convertible Senior Notes due 2029, and used the net proceeds from the initial offering to repurchase a portion of its existing 0.50% senior convertible notes due 2026. These transactions were previously described in the Company's Current Reports on Form 8-K (collectively, the "Financing Transactions"). As a result of the Financing Transactions, the Company now expects interest expense to be in the range of $370 million to $380 million for the full year, as compared to a previous management assumption (1) of $320 to $330 million.

The table below provides JetBlue’s updated investor guidance for the third quarter ending September 30, 2024.

| | | | | | | | |

Third Quarter 2024 Outlook | Current Guidance | Previous Guidance (2) |

| | |

| Capacity and Revenue | | |

| Available Seat Miles ("ASMs") Year-Over-Year | (5.0%) - (3.0%) | (6.0%) - (3.0%) |

| Revenue Year-Over-Year | (2.5%) - 1.0% | (5.5%) - (1.5%) |

| Expense | | |

CASM Ex-Fuel (3) Year-Over-Year | 5.0% - 7.0% | 6.0% - 8.0% |

Fuel Price per Gallon (4), (5) | $2.70 - $2.80 | $2.82 - $2.97 |

| Interest Expense | $100 - $110 million | - |

| | |

| Capital Expenditures | Unchanged | ~$365 million |

The table below provides JetBlue’s updated interest expense guidance for the full year ending December 31, 2024.

| | | | | | | | |

Full Year 2024 Outlook | Current Guidance | Previous Guidance (1) |

| | |

| Interest Expense | $370 - $380 million | - |

(1) Management previously assumed full year interest expense of $320 to $330 million as of January 30, 2024. Full year 2024 interest expense was not previously guided.

(2) Previous guidance as of July 30, 2024. Third quarter 2024 interest expense was not previously guided.

(3) Non-GAAP financial measure; refer to Note A for further details on non-GAAP forward looking information.

(4) Includes fuel taxes, hedges and other fuel fees.

(5) JetBlue utilizes the forward Brent crude curve and the forward Brent crude to jet crack spread to calculate the unhedged portion of its current quarter. Fuel price is based on forward curve as of August 23, 2024.

In addition, today JetBlue provided investors with an update regarding the Company’s business and business strategy, including the Financing Transactions, which is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information included under Item 7.01 of this report (including Exhibit 99.1) is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Forward Looking Information

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Securities Act and Section 21E of the Exchange Act. All statements other than statements of historical facts contained in this Current Report on Form 8-K are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as "expects," "plans," "intends," "anticipates," "indicates," "remains," "believes," "estimates," "forecast," "guidance," "outlook," "may," "will," "should," "seeks," "goals," "targets" or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements contained in this Current Report on Form 8-K include, without limitation, statements regarding our outlook and underlying expectations, including with respect to fuel prices and interest expense. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the risk associated with the execution of our strategic operating plans in the near-term and long-term; our extremely competitive industry; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to the NEA and our wind-down of the NEA; risks associated with cybersecurity and privacy, including information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; our substantial indebtedness and impact on our ability to meet future financing needs; financial risks associated with credit card processors; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing attention to, and evolving expectations regarding, environmental, social and governance matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year.

Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Current Report on Form 8-K, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue's filings with the U.S. Securities and Exchange Commission (the "SEC"), including but not limited to in our Annual Report on Form 10-K for the year ended December 31, 2023, as may be updated by our other SEC filings. In light of these risks and uncertainties, the forward-looking events discussed in this Current Report on Form 8-K might not occur. Our forward-looking statements speak only as of the date

of this Current Report on Form 8-K. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise.

Note A - Non-GAAP Financial Measures

We report our financial results in accordance with GAAP; however, we present certain non-GAAP financial measures in this Current Report on Form 8-K. Non-GAAP financial measures are financial measures that are derived from the condensed consolidated financial statements, but that are not presented in accordance with GAAP. We present these non-GAAP financial measures because we believe they provide useful supplemental information that enables a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies.

With respect to JetBlue’s CASM Ex-Fuel guidance (1), we are not able to provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measures cannot be calculated or predicted at this time without unreasonable efforts. In these cases, the reconciling information that is unavailable includes a forward-looking range of financial performance measures beyond our control, such as fuel costs, which are subject to many economic and political factors beyond our control. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on our future GAAP financial results.

(1) CASM Ex-Fuel is a non-GAAP measure that excludes fuel, other non-airline operating expenses, and special items.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | JETBLUE AIRWAYS CORPORATION |

| | | (Registrant) |

| | | |

| Date: | September 5, 2024 | By: | /s/ Dawn Southerton |

| | | Dawn Southerton |

| | | Vice President, Controller |

| | | (Principal Accounting Officer) | |

1 Hello, I’m your cover option 2.September 2024 JetForward St ategy

2 Safe Harbor This Presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts contained in this Presentation are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “expects,” “plans,” “intends,” “anticipates,” “indicates,” “remains,” “believes,” “estimates,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “goals,” “targets” or the negative of these terms or other similar expressions. Additionally, forward-looking statements include statements that do not relate solely to historical facts, such as statements which identify uncertainties or trends, discuss the possible future effects of current known trends or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed, or assured. Forward-looking statements contained in this Presentation include, without limitation, statements regarding our outlook and future results of operations and financial position, including our expected return to profitability, expectations with respect to our headwinds, our business strategy and plans and objectives for future operations, including our refreshed standalone strategies, such as JetForward, and recent debt transactions and expected use of proceeds therefrom. Forward-looking statements involve risks, uncertainties and assumptions, and are based on information currently available to us. Actual results may differ materially from those expressed in the forward-looking statements due to many factors, including, without limitation, the risk associated with the execution of our strategic operating plans in the near-term and long-term; our extremely competitive industry; risks related to the long-term nature of our fleet order book; volatility in fuel prices and availability of fuel; increased maintenance costs associated with fleet age; costs associated with salaries, wages and benefits; risks associated with a potential material reduction in the rate of interchange reimbursement fees; risks associated with doing business internationally; our reliance on high daily aircraft utilization; our dependence on the New York metropolitan market; risks associated with extended interruptions or disruptions in service at our focus cities; risks associated with airport expenses; risks associated with seasonality and weather; our reliance on a limited number of suppliers for our aircraft, engines, and our Fly-Fi® product; risks related to new or increased tariffs imposed on commercial aircraft and related parts imported from outside the United States; the outcome of legal proceedings with respect to the NEA and our wind-down of the NEA; risks associated with cybersecurity and privacy, including information security breaches; heightened regulatory requirements concerning data security compliance; risks associated with reliance on, and potential failure of, automated systems to operate our business; our inability to attract and retain qualified crewmembers; our being subject to potential unionization, work stoppages, slowdowns or increased labor costs; reputational and business risk from an accident or incident involving our aircraft; risks associated with damage to our reputation and the JetBlue brand name; our significant amount of fixed obligations and the ability to service such obligations; our substantial indebtedness and impact on our ability to meet future financing needs; financial risks associated with credit card processors; risks associated with seeking short-term additional financing liquidity; failure to realize the full value of intangible or long-lived assets, causing us to record impairments; risks associated with disease outbreaks or environmental disasters affecting travel behavior; compliance with environmental laws and regulations, which may cause us to incur substantial costs; the impacts of federal budget constraints or federally imposed furloughs; impact of global climate change and legal, regulatory or market response to such change; increasing attention to, and evolving expectations regarding, environmental, social and governance matters; changes in government regulations in our industry; acts of war or terrorism; and changes in global economic conditions or an economic downturn leading to a continuing or accelerated decrease in demand for air travel. It is routine for our internal projections and expectations to change as the year or each quarter in the year progresses, and therefore it should be clearly understood that the internal projections, beliefs, and assumptions upon which we base our expectations may change prior to the end of each quarter or year. Given the risks and uncertainties surrounding forward-looking statements, you should not place undue reliance on these statements. You should understand that many important factors, in addition to those discussed or incorporated by reference in this Presentation, could cause our results to differ materially from those expressed in the forward-looking statements. Further information concerning these and other factors is contained in JetBlue's filings with the U.S. Securities and Exchange Commission (the “SEC”), including but not limited to in our Annual Report on Form 10-K for the year ended December 31, 2023, as may be updated by our other SEC filings. In light of these risks and uncertainties, the forward-looking events discussed in this presentation might not occur. Our forward-looking statements speak only as of the date of this Presentation. Other than as required by law, we undertake no obligation to update or revise forward-looking statements, whether as a result of new information, future events, or otherwise. 2

3 Embarking on business and structural cost transformation • Rapid cost inflation driven by labor, maintenance, and fuel Costs Addressing product gaps and better merchandising existing offerings • Value carrier revenue growth has not matched pace of inflation Revenue Re-investing in core geographies and thoughtfully closing underperforming BlueCities • Strategic pursuits (Northeast Alliance and Spirit) consumed resources and slowed response to demand changes Network Improving reliability by investing in on-time performance and delivering consistent customer experience • ATC (1) understaffing is severely impacting highly congested airports, while customers are ascribing more value to reliability Reliability Pursuing “capital light” levers for growth• Grounded aircraft due to Pratt & Whitney (P&W) impeding growth and exacerbating unit cost inflation Fleet Deferred ~$3.0B of capital expenditures to 2030 and beyond, giving JetForward runway to deliver benefits • Pressured profitability hampering multi-year free cash flow generation potential Balance Sheet Solutions (1) Air Traffic Control. Core Strategic Headwinds Acting With Urgency to Address Headwinds JetForward | Financial Guidance

4 Enhancing Our Strengths to Drive Our Path Forward Low Cost Structure Highly Engaged Crewmembers & Distinct Culture High-Value Geography Differentiated Product & Services JetForward | Financial Guidance

56 JetForward | Financial Guidance

6 JetForward: Our Path to Sustained Profitability Targeting $800-900M (1) in incremental EBIT (2) from 2025 – 2027 ~$175M ~$400M ~$100M ~$175M Reliable & caring service drives choice, satisfaction and cost savings Best East Coast leisure network where our value proposition is positioned to win Products and perks customers value to capture growing share of premium customers A secure financial future that sustains our cost advantage to our peers & restores our balance sheet EBIT Uplift 2025 - 2027 $800 - $900M Four Priority Moves (1) Stated EBIT initiative range is forecasted to include ~$25M of incremental depreciation, amortization and aircraft rent expense from 2025 - 2027. (2) Earnings before interest and income taxes. See Appendix A for further details on Non-GAAP measures. 6 JetForward | Financial Guidance

7 Priority Moves Anchor Our Path to Sustained Profitability Product Reliability Financial Future Introduced preferred seating Enhancing Blue Basic with free carry-on bag Goes live Sept. 6th Added new loyalty partners Four Priority Moves ~$175M ~$400M ~$100M 2027 Targets Smoothed aircraft delivery stream Multi-year investment in improving on- time performance Deferred ~$3B of capex to 2030s Targeting $800-900M EBIT (2) uplift, evenly realized from 2025 – 2027 Initial organizational & real-estate optimization driving structural cost savings Announced Implemented Illustrative upcoming announcements Network Refocused LAX footprint & exited unprofitable routes ~$175M Puerto Rico growth & new Mint cities Rightsized LGA & redeployed to high performing leisure & VFR (1) Reinvesting in core Northeast & Florida franchises Business & cost transformation program (1) VFR – visiting friends and relatives. (2) See Appendix A for further details on Non-GAAP measures. Note: Timeline is illustrative. As of September 5, 2024. Executed $3B+ financings JetForward | Financial Guidance ~$800-900M

8 Redeploying ~20% of Flying to Optimize East Coast Leisure Network JetForward | Financial Guidance Best East Coast Leisure Network Note: Not exhaustive. Fort Lauderdale Los Angeles & Intra-California Network actions expected to reduce unprofitable routes while redeploying aircraft to bolster East Coast leisure network Northeast to Midcontinent LGA & EWR Optimization Illustrative Route Exits

9 Areas of focus Journey to Optimize Controllable Costs Has Evolved Over Time Targeted Savings Business & Cost Transformation Program (2025 – 2027) Structural Cost Program 1.0 (2018 – 2020) Structural Cost Program 2.0 (2022 – 2024) $250M - $300M Original Target $150M - $200M Original Target Business partner contracts and agreements Maintenance contract optimization Network scheduling Frontline planning (via enterprise planning team) Maintenance timing optimization Data-science driven optimization Enterprise efficiency and automation Labor productivity and infrastructure strategy ~$175M Preliminary Target On-track to achieve revised target of $175M - $200M Outcome Run-rate savings were on-track to exceed target pre- COVID Goal of sustaining our competitive cost advantage vs. other airlines Complete Complete by EOY 2024 Announced JetForward | Financial Guidance A Secure Financial Future

10 Taking Active Steps to Improve Balance Sheet, while Mitigating Pratt & Whitney Impact to Growth Pratt & Whitney A320 Extensions E190 Retirements A220 Deliveries Consideration Fleet Impact • Average of 11 aircraft on ground in 2024 due to geared turbofan (GTF) powdered metal and other engine availability issues • Expect grounded aircraft, on average, to be in the mid-to-high teens in 2025 • Extended leases on, or purchased off lease, 12 aircraft to drive capital light growth – plan for ~30 total • E190 to exit fleet by end of 2025, simplifying to two fleet types – A220 & A320 family • Prioritizing A220 deliveries, which have 90% more premium seats and deliver 30% lower unit costs, on average, vs. E190s exiting our fleet Impact Delivery Assumption A220 A321neo Total (1) 2024 (2) 20 7 27 2025 20 4 24 2026 20 - 20 2027 5 - 5 2028 7 - 7 Contractual Returns A320 Embraer E190 Total 2024 (2) (3) (16) (18) 2025 (5) (7) (12) JetBlue’s contractual aircraft return schedule as of July 30, 2024: JetBlue’s contractual aircraft delivery assumption for full year as of July 30, 2024: Expecting ~flat YoY capacity growth in 2025 Fleet Detail (1) In addition, we have options to purchase 20 A220-300 aircraft between 2027 and 2028. See Appendix of Second Quarter 2024 Earnings Presentation for more information. (2) Includes eight aircraft delivered in 1Q 2024 & six delivered in 2Q 2024. (3) Does not include aircraft purchased off lease. Aircraft Deferral • In January 2024, smoothed upcoming delivery stream • In July 2024, deferred 44 A321neo aircraft from 2025 – 2029 to 2030+ totaling ~$3.0B of capex savings, to help restore balance sheet and improve cash flow JetForward | Financial Guidance A Secure Financial Future

11 Senior Secured Notes ~$3.2B Financing Supports JetFoward’s Runway to Generate Benefits JetForward | Financial Guidance A Secure Financial Future In August 2024, JetBlue closed three financing transactions, with gross proceeds totaling ~$3.2B Proceeds planned to be used to fund capital expenditures in 2024 & 2025, repurchase a portion of existing 0.5% $750M senior convertible notes due 2026 and provide additional liquidity Offering Size $2.0 billion $765 million $460 million Includes $60M additional purchase option Coupon Fixed | 9.875% Floating | SOFR + 5.50% Fixed | 2.5% Maturity September 20, 2031 August 27, 2029 September 1, 2029 Collateral TrueBlue Program Assets TrueBlue Program Assets Unsecured Call Feature Non-callable until 2027, callable at par in 2029 Flexible pre-payment provisions Soft call trigger in 2027 if market price is 130% of strike for 20 trading days Use of Proceeds General corporate purposes General corporate purposes Repurchase portion of existing 0.50% senior convertible notes due 2026 and general corporate purposes Settlement Bullet maturity Quarterly amortization with bullet maturity • Upon conversion, the principal amount of the notes will be settled in cash • The Company’s remaining conversion obligation, if any, can be settled through common stock, cash or a combination of cash and shares of the Company’s common stock, at the Company’s discretion Please see 8-K for more detail Term Loan Credit & Guaranty Agreement Senior Convertible Notes Terms offer flexibility to prepay if desired, while providing a liquidity backstop for goal of generating $800 - $900M of incremental EBIT under JetForward strategy Note: See previously filed Form 8-Ks on 8/21/24 and 9/3/24 for more information.

12 (1) Previous third quarter guidance as of July 30, 2024. Third quarter 2024 interest expense was not previously guided. (2) See Appendix A for further details on Non-GAAP measures. (3) Includes the impact from labor agreements of approximately two points for the third quarter. (4) Fuel price based on forward curve as of August 23, 2024. Includes fuel taxes, hedges, and other fuel fees. (5) Management previously assumed full year interest expense of $320 to $330 million as of January 30, 2024. Full year 2024 interest expense was not previously guided. Guidance Current 3Q 2024 Previous 3Q 2024 (1) Available Seat Miles (ASMs) Year-over-Year (5.0%) - (3.0%) (6.0%) - (3.0%) Revenue Year-over-Year (2.5%) - 1.0% (5.5%) - (1.5%) CASM ex-Fuel(2), (3) Year-over-Year 5.0% - 7.0% 6.0% - 8.0% Fuel Price per Gallon (4) $2.70 - $2.80 $2.82 - $2.97 Interest Expense $100 - $110 million - Capital Expenditures Unchanged ~$365 million Outlook Summary JetForward | Financial Guidance Guidance Current FY 2024 Previous FY 2024 (5) Interest Expense $370 - $380 million -

13 Non-GAAP Financial Measures We report our financial results in accordance with GAAP; however, we present certain non-GAAP financial measures in this Presentation. Non-GAAP financial measures are financial measures that are derived from the condensed consolidated financial statements, but that are not presented in accordance with GAAP. We present these non-GAAP financial measures because we believe they provide useful supplemental information that enables a meaningful comparison of our results to others in the airline industry and our prior year results. Investors should consider these non-GAAP financial measures in addition to, and not as a substitute for, our financial performance measures prepared in accordance with GAAP. Further, our non-GAAP information may be different from the non-GAAP information provided by other companies. With respect to JetBlue’s CASM Ex-Fuel guidance (1) and EBIT (2) targets, we are not able to provide a reconciliation of forward-looking measures where the quantification of certain excluded items reflected in the measures cannot be calculated or predicted at this time without unreasonable efforts. In these cases, the reconciling information that is unavailable includes a forward-looking range of financial performance measures beyond our control, such as interest rates and fuel costs, which are subject to many economic and political factors beyond our control. For the same reasons, we are unable to address the probable significance of the unavailable information, which could have a potentially unpredictable and potentially significant impact on our future GAAP financial results. (1) CASM Ex-Fuel is a non-GAAP measure that excludes fuel, other non-airline operating expenses, and special items. (2) EBIT is a non-GAAP measure that excludes interest and income taxes from net income. Appendix A

14 15 BlueCity Closures Planned Through End of Year 2024 Announced BlueCity Closures BlueCity Exit Date (1) Burlington (BTV) January 4, 2024 Baltimore-Washington (BWI) April 30, 2024 Kansas City (MCI) June 12, 2024 Bogota (BOG) June 12, 2024 Lima (LIM) June 12, 2024 Quito (UIO) June 12, 2024 Puerto Vallarta (PVR) June 12, 2024 Charlotte (CLT) October 26, 2024 Minneapolis (MSP) October 26, 2024 San Antonio (SAT) October 26, 2024 Burbank (BUR) October 26, 2024 Tallahassee (TLH) October 27, 2024 Palm Springs (PSP) Already suspended Pointe-a-Pitre (PTP) Already suspended Stewart (SWF) Already suspended 15 BlueCity Closures (1) Represent final day of service. Best East Coast Leisure NetworkJetForward | Financial Guidance

15 Over 50 Route Exits Planned Through January 2025 50+ Route Exits Route Exits Route Exit Date (1) Los Angeles / Cancun – (LAX / CUN) 3-Jan-24 Newark / Miami – (EWR / MIA) 3-Jan-24 New York LaGuardia / Charleston – (LGA / CHS) 3-Jan-24 New York LaGuardia / Nashville – (LGA / BNA) 3-Jan-24 New York LaGuardia / Jacksonville – (LGA / JAX) 4-Jan-24 New York JFK / Burlington – (JFK / BTV) 4-Jan-24 New York LaGuardia / Denver – (LGA / DEN) 30-Mar-24 New York LaGuardia / Sarasota – (LGA / SRQ) 30-Mar-24 Boston / Baltimore-Washington – (BOS / BWI) 30-Apr-24 Fort Lauderdale / Austin – (FLL / AUS) 30-Apr-24 New York JFK / Portland – (JFK / PDX) 30-Apr-24 New York JFK / Puerto Vallarta – (JFK / PVR) 30-Apr-24 New York JFK / San Jose – (JFK / SJC) 30-Apr-24 New York LaGuardia / Fort Myers – (LGA / RSW) 30-Apr-24 Fort Lauderdale / Salt Lake City – (FLL / SLC) 10-Jun-24 Orlando / Salt Lake City – (MCO / SLC) 10-Jun-24 Fort Lauderdale / Atlanta – (FLL / ATL) 12-Jun-24 Fort Lauderdale / Nashville – (FLL / BNA) 12-Jun-24 Fort Lauderdale / Bogota – (FLL / BOG) 12-Jun-24 Fort Lauderdale / Lima – (FLL / LIM) 12-Jun-24 Fort Lauderdale / New Orleans – (FLL / MSY) 12-Jun-24 Fort Lauderdale / Quito – (FLL / UIO) 12-Jun-24 Los Angeles / Las Vegas – (LAX / LAS) 12-Jun-24 Los Angeles / Liberia, CR – (LAX / LIR) 12-Jun-24 Los Angeles / Miami – (LAX / MIA) 12-Jun-24 Los Angeles / Reno – (LAX / RNO) 12-Jun-24 Los Angeles / San Francisco – (LAX / SFO) 12-Jun-24 Route Exits Cont. Route Exit Date (1) Los Angeles / Puerto Vallarta – (LAX / PVR) 12-Jun-24 New York JFK / Detroit – (JFK / DTW) 12-Jun-24 New York JFK / Kansas City – (JFK / MCI) 12-Jun-24 Tampa Bay / Aguadilla, PR – (TPA / BQN) 12-Jun-24 New York LaGuardia / Nassau – (LGA / NAS) 3-Sep-24 Orlando / Los Angeles – (MCO / LAX) 3-Sep-24 Los Angeles / Nassau – (LAX / NAS) 7-Sep-24 Boston / Charlotte – (BOS / CLT) 26-Oct-24 Boston / Minneapolis St Paul – (BOS / MSP) 26-Oct-24 Boston / San Antonio – (BOS / SAT) 26-Oct-24 Los Angeles / Los Cabos – (LAX / SJD) 26-Oct-24 Los Angeles / Salt Lake City – (LAX / SLC) 26-Oct-24 Newark / Los Angeles – (EWR / LAX) 26-Oct-24 Newark / Montego Bay – (EWR / MBJ) 26-Oct-24 New York JFK / San Antonio – (JFK / SAT) 26-Oct-24 New York JFK / Burbank – (JFK / BUR) 26-Oct-24 New York LaGuardia / Atlanta – (LGA / ATL) 26-Oct-24 New York LaGuardia / Tampa Bay – (LGA / TPA) 26-Oct-24 Raleigh Durham / Cancun – (RDU / CUN) 26-Oct-24 Raleigh Durham / Orlando – (RDU / MCO) 26-Oct-24 Fort Lauderdale / Tallahassee – (FLL / TLH) 27-Oct-24 Fort Lauderdale / Guayaquil, EC – (FLL / GYE) 6-Jan-25 Fort Lauderdale / San Diego – (FLL / SAN) 6-Jan-25 Newark / Santo Domingo – (EWR / SDQ) 6-Jan-25 Hartford / Miami – (BDL / MIA) NA New York JFK / Palm Springs – (JFK / PSP) NA New York JFK / Pointe-a-Pitre – (JFK / PTP) NA (1) Represent final day of service. Best East Coast Leisure NetworkJetForward | Financial Guidance

16

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

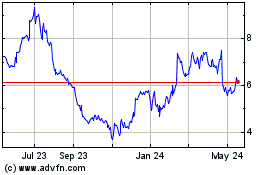

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Oct 2024 to Nov 2024

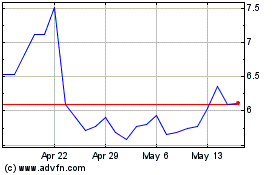

JetBlue Airways (NASDAQ:JBLU)

Historical Stock Chart

From Nov 2023 to Nov 2024