As filed with the Securities and Exchange Commission

on February 25, 2025

Registration No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Kiniksa

Pharmaceuticals International, plc

(Exact name of registrant as specified in its

charter)

| England and Wales |

|

98-1795578 |

(State or other jurisdiction of incorporation or

organization) |

|

(I.R.S. Employer Identification No.) |

23 Old Bond Street, Floor 3

London, W1S 4PZ

England, United Kingdom

(Address of Principal Executive Offices) (Zip Code)

Kiniksa

Pharmaceuticals International, plc 2018 Incentive Award Plan

Kiniksa Pharmaceuticals International, plc 2018 Employee Share Purchase Plan

(Full title of the plan)

Kiniksa

Pharmaceuticals Corp.

100

Hayden Avenue

Lexington,

MA 02421

(Name and address for agent for service)

(781)

431-9100

(Telephone number, including area code, of agent

for service)

Copies to:

Paul

M. Kinsella

Marko

S. Zatylny

Ropes

& Gray LLP

Prudential

Tower

800

Boylston Street

Boston,

Massachusetts 02199

(617) 951-7000

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

x |

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ |

| |

|

Emerging growth company |

¨ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

PART I

EXPLANATORY NOTE

This Registration Statement on Form S-8 is being filed for the purpose

of registering an additional 2,900,642 Class A ordinary shares, nominal value $0.000273235 per share (“Class A ordinary shares”)

of Kiniksa Pharmaceuticals International, plc (the “Registrant”) to be issued pursuant to the Registrant’s 2018 Incentive

Award Plan (the “2018 Plan”) and an additional 90,000 Class A ordinary shares of the Registrant to be issued pursuant to the

Registrant’s 2018 Employee Share Purchase Plan (the “2018 ESPP”). Registration Statements of the Registrant on Forms

S-8 relating to the same employee benefit plans are effective.

INCORPORATION BY REFERENCE OF CONTENTS OF

REGISTRATION STATEMENTS ON FORM S-8

Except as set forth below, the contents of the Registration Statements

on Form S-8 (Reg. Nos. 333-277480, 333-270226, 333-262971, 333-253514, 333-237589, 333-225196) filed with the Securities and Exchange

Commission (the “Commission”) relating to the 2018 Plan and the 2018 ESPP, each as amended by a post-effective amendment number

one, filed with the Commission on June 28, 2024, are incorporated by reference herein.

PART II

INFORMATION REQUIRED IN REGISTRATION STATEMENT

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form

S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, on this

25th day of February 2025.

| KINIKSA PHARMACEUTICALS INTERNATIONAL, PLC |

|

| |

|

|

| By: |

/s/ Sanj K. Patel |

|

| |

Sanj K. Patel |

|

| |

Chief Executive Officer and Chairman of the Board |

|

POWER OF ATTORNEY

KNOW ALL BY THESE PRESENTS, that each person whose

signature appears below constitutes and appoints Sanj K. Patel and Mark Ragosa, or either of them, as his or her true and lawful attorneys-in-fact

and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all

capacities, to file and sign any and all amendments, including post-effective amendments, to this registration statement, with the Securities

and Exchange Commission, granting unto said attorneys-in-fact and agents, full power and authority to do and perform each and every act

and thing requisite and necessary to be done in connection therewith as fully to all intents and purposes as he or she might or could

do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or their substitute or substitutes may lawfully

do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| SIGNATURE |

|

TITLE |

|

DATE |

| |

|

|

|

|

| /s/ Sanj K. Patel |

|

Chief Executive Officer and Chairman of the Board |

|

February 25, 2025 |

| Sanj K. Patel |

|

(principal executive officer) |

|

|

| |

|

|

|

|

| /s/ Mark Ragosa |

|

SVP, Chief Financial

Officer |

|

February 25, 2025 |

| Mark Ragosa |

|

(principal financial officer) |

|

|

| |

|

|

|

|

| /s/ Michael R. Megna |

|

Group VP, Finance and

Chief Accounting Officer |

|

February 25, 2025 |

| Michael R. Megna |

|

(principal accounting officer) |

|

|

| |

|

|

|

| /s/ Felix J. Baker |

|

Lead Independent Director |

|

February 25, 2025 |

| Felix J. Baker |

|

|

|

|

| |

|

|

|

|

| /s/ Stephen R. Biggar |

|

Director |

|

February 25, 2025 |

| Stephen R. Biggar |

|

|

|

|

| |

|

|

|

|

| /s/ M. Cantey Boyd |

|

Director |

|

February 25, 2025 |

| M. Cantey Boyd |

|

|

| |

|

|

|

|

| /s/ G. Bradley Cole |

|

Director |

|

February 25, 2025 |

| G. Bradley Cole |

|

|

|

|

| |

|

|

|

|

| /s/ Richard S. Levy |

|

Director |

|

February 25, 2025 |

| Richard S. Levy |

|

|

|

|

| |

|

|

| /s/ Thomas R. Malley |

|

Director |

|

February 25, 2025 |

| Thomas R. Malley |

|

|

|

|

| |

|

|

| /s/ Tracey L. McCain |

|

Director |

|

February 25, 2025 |

| Tracey L. McCain |

|

|

|

|

| |

|

|

| /s/ Kimberly J. Popovits |

|

Director |

|

February 25, 2025 |

| Kimberly J. Popovits |

|

|

|

|

| |

|

|

| /s/ Barry D. Quart |

|

Director |

|

February 25, 2025 |

| Barry D. Quart |

|

|

|

|

U.S. AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of the Securities

Act of 1933, as amended, the duly authorized representative in the United States of the Registrant has signed this registration statement,

on this 25th day of February 2025.

| KINIKSA PHARMACEUTICALS CORP. |

|

| |

|

| By: |

/s/ Sanj K. Patel |

|

| |

Sanj K. Patel |

|

| |

Chief Executive Officer |

|

Exhibit 5.1

25 February 2025

Kiniksa Pharmaceuticals International, plc

Third Floor, 23 Old Bond Street,

London, United Kingdom, W1S 4PZ

| Re: | Registration Statement on Form S-8 |

Ladies and Gentlemen:

We have acted as English law

legal advisers to Kiniksa Pharmaceuticals International, plc, a public limited company incorporated under the laws of England and Wales

with company number 15630565 (the “Company”), in connection with the registration statement on Form S-8 (the “Registration

Statement”) to be filed on or about 25 February 2025 by the Company with the Securities and Exchange Commission under the

Securities Act of 1933, as amended (the “Securities Act”), and the rules and regulations promulgated thereunder,

relating to the registration of: (i) 2,900,642 A ordinary shares of $0.000273235 each in the capital of the Company (the “A

Ordinary Shares”) issuable under the Company’s 2018 Incentive Award Plan (the “2018 Plan Shares”);

and (ii) an additional 90,000 A Ordinary Shares issuable under the Company’s 2018 Employee Share Purchase Plan (together with

the Company’s 2018 Incentive Award Plan, the “Kiniksa Equity Incentive Plans”) (the “2018 ESPP Shares”

and together with the 2018 Plan Shares, the “Shares”).

We understand that no Shares

are, or are intended to be, admitted to trading on any market or exchange, or otherwise listed in, the United Kingdom.

| 2. | Documents Examined and Searches conducted |

2.1 For

the purpose of giving this opinion, we have examined the following documents and records, and made the following searches and enquiries:

| (a) | a copy of the Registration Statement to be filed with the Securities and Exchange Commission on 25 February 2025,

as amended; |

| (b) | copies of the Company’s certificate of incorporation and articles of association, each existing

as at the date of this opinion; |

| (c) | the results of our online search on 25 February 2025 at 9.30 a.m. (UK) of the Company’s

public records held by the UK Registrar of Companies (the “Company Search”); and |

| (d) | the results of our enquiry by telephone at the Companies Court in London of the Central Index of Winding

Up Petitions on 25 February 2025 at 11.22 a.m. (UK) with respect to the Company (the “Winding up Search”). |

Ropes & Gray International LLP

is a limited liability partnership registered in Delaware, United States of America and is a recognised body authorised and regulated

by the Solicitors Regulation Authority (with registered number 521000).

2.2 The

documents, records, searches and enquiries referred to above are the only documents and records we have examined and the only searches

and enquiries we have carried out for the purposes of giving this opinion.

3.1 This

opinion is limited to (i) the laws of England and Wales as applied by the English courts as at the date of this letter; and (ii) those

facts and circumstances which exist as at the date of this letter and we do not undertake to update or supplement this letter to reflect

any facts or circumstances which may subsequently come to our attention, any changes in law or HM Revenue & Customs practice

which may occur after the date of this letter, or to inform the addressees of any change in circumstances happening after the date of

this letter which would alter the opinions expressed in this letter. We have not investigated, and do not express or imply any opinion

in relation to, the laws of any other jurisdiction and we do not express any opinion on European Community law as it affects any jurisdiction

other than England and Wales.

3.2 We

expressly disclaim any responsibility to advise you of any development or circumstance of any kind, including any change of law or fact,

that may occur after the date of this letter that may affect the opinion expressed herein.

3.3 The

opinion given in this letter is strictly limited to the matters stated in paragraph 5 and does not extend to, and is not to be read as

extended by implication to, any other matters. We have not been responsible for verifying whether statements of fact (including, without

limitation, foreign law), opinion or intention in the documents referred to in paragraph 2.1 above or any related documents are accurate,

complete or reasonable. We express no opinion as to whether a foreign court (applying its own conflict law) will act in accordance with

any agreement by the Company in connection with the issuance of the Shares as to jurisdiction and/or law. To the extent that the laws

of any foreign jurisdictions may be relevant, we have made no independent investigation of such laws, and this opinion is subject to the

effect of such laws. We express no opinion as to matters of fact.

3.4 This

opinion shall be governed by and construed in accordance with English law.

In giving this opinion, we

have assumed:

4.1 the

genuineness of all signatures, stamps and seals on, and the authenticity, accuracy and completeness of, all documents submitted to us

(whether as originals or copies and whether in electronic form or otherwise) and that such documents remain accurate, up to date and have

not been amended or any provision thereof varied or waived since the date of submission to us;

4.2 that

all copy documents submitted to us are complete and conform to the originals;

4.3 that

on each date of the allotment and issue of the Shares (each an “Allotment Date”) the Company has complied with all

applicable laws to allot and issue the Shares and the Company has received such amounts as are necessary to fully pay the nominal value

of the Shares and any applicable share premium;

4.4 that

the information revealed by the Company Search was and remains complete, accurate and up to date in all respects as at the date of this

letter and will so remain as at the Allotment Dates;

4.5 that

the information revealed by our Winding up Search was accurate in all respects and has not since the time of such enquiry been altered;

4.6 that

no additional matters would have been disclosed by company searches at the UK Registrar of Companies or the Companies Court being carried

out since the carrying out of the searches and enquiries referred to in paragraph 2.1 above which would affect the opinion stated below

and that the particulars disclosed by our searches and enquiries are true, accurate, complete and up to date;

4.7 that

no step has been taken to wind up, strike off or dissolve the Company or appoint an administrator or receiver or nominee or supervisor

in respect of a company voluntary arrangement or similar official in respect of the Company or any of its assets or revenues or to obtain

a moratorium which has not been revealed by our searches referred to above;

4.8 that

the term “non-assessable”, which has no recognised meaning in English law, for the purposes of this letter means that, under

the Companies Act 2006 (as amended), the articles of association of the Company and any resolution taken under the articles of association

of the Company approving the issuance of the Shares, no holder of such Shares is liable, solely because of such holder’s status

as a holder of such Shares, for additional assessments or calls for further funds by the Company or any other person; and

4.9 that

the directors as at the time of the Allotment Dates will be duly authorised pursuant to the articles of association of the Company as

in force at the time of the Allotment Dates, the Companies Act 2006 and any relevant authority given by the members of the Company in

a general meeting to allot and issue Shares on a non pre-emptive basis and that as at each date on which the Company allots and issues

Shares, the board of directors of the Company, a duly authorised committee of the board of directors or a duly authorised director will

have validly resolved to allot and issue the relevant Shares.

Based upon the foregoing and

subject to any matters not disclosed to us and to the assumptions and qualifications set out in this letter, we are of the opinion that

the Shares will be duly authorised, validly issued, fully paid and non-assessable when: (i) the Registration Statement becomes effective

under the Securities Act; (ii) the Shares are paid for in accordance with the rules of the applicable Kiniksa Equity Incentive

Plan and (iii) valid entries in the books and registers of the Company have been made.

The opinion given in this

letter is subject to the qualifications and reservations set out below.

| 6.1 | The Company Search is not capable of revealing conclusively whether or not: |

| (a) | a winding-up order has been made or a resolution passed for the winding up of the Company; |

| (b) | an administration order has been made; |

| (c) | a receiver, administrative receiver, administrator or liquidator has been appointed; or |

| (d) | a court order has been made under the Cross Border Insolvency Regulations 2006, |

since notice of these matters

may not be filed with the Registrar of Companies immediately and, when filed, there may be a delay in the relevant notice appearing on

the file of the company concerned.

In addition, the Company Search

is not capable of revealing, prior to the making of the relevant order or the appointment of an administrator otherwise taking effect,

whether or not a winding-up petition or an application for an administration order has been presented, or whether or not any documents

for the appointment of, or notice of intention to appoint, an administrator under paragraphs 14 or 22 of Schedule B1 to the Insolvency

Act 1986 has been filed with the court.

6.2 The

Winding up Search relates only to the presentation of (i) a petition for the making of a winding-up order or the making of a winding-up

order by a court, (ii) an application to the High Court of Justice in London for the making of an administration order and the making

by such court of an administration order, and (iii) a notice of intention to appoint an administrator or a notice of appointment

of an administrator filed at the High Court of Justice in London. It is not capable of revealing conclusively whether or not such a winding-up

petition, application for an administration order, notice of intention or notice of appointment has been presented or winding-up or administration

order granted, because:

| (a) | details of a winding-up petition or application for an administration order may not have been entered

on the records of the Central Index of Winding Up Petitions immediately; |

| (b) | in the case of an application for the making of an administration order and such order and the presentation

of a notice of intention to appoint or notice of appointment, if such application is made to, order made by or notice filed with, a court

other than the High Court of Justice in London, no record of such application, order or notice will be kept by the Central Index of Winding

Up Petitions; |

| (c) | a winding-up order or administration order may be made before the relevant petition or application has

been entered on the records of the Central Index of Winding Up Petitions, and the making of such order may not have been entered on the

records immediately; |

| (d) | details of a notice of intention to appoint an administrator or a notice of appointment of an administrator

under paragraphs 14 and 22 of Schedule B1 of the Insolvency Act 1986 may not be entered on the records immediately (or, in the case of

a notice of intention to appoint, at all); and |

| (e) | with regard to winding-up petitions, the Central Index of Winding Up Petitions may not have records of

winding-up petitions issued prior to 1994. |

6.3 We

express no opinion as to matters of United Kingdom taxation or any liability to tax which may arise or be incurred as a result of or in

connection with the Shares or the Kiniksa Equity Incentive Plans (or the transactions contemplated thereby), or as to tax matters generally.

6.4 The

opinion set out in paragraph 5 relates only to Shares contemplated by the Registration Statement that are new ordinary shares issued by

the Company from time to time pursuant to the Kiniksa Equity Incentive Plans following the date of the Registration Statement. We express

no opinion in respect of any other securities of the Company.

We hereby consent to your

filing this opinion as an exhibit to the Registration Statement and to the use of our name therein and in the related prospectus under

the caption “Legal matters.” In giving such consent, we do not thereby admit that we are in the category of persons whose

consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

| |

Very truly yours, |

| |

|

| |

/s/ Ropes & Gray International LLP |

| |

|

| |

Ropes & Gray International LLP |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference in this Registration

Statement on Form S-8 of Kiniksa Pharmaceuticals International, plc of our report dated February 25, 2025 relating to the financial

statements and the effectiveness of internal control over financial reporting, which appears in Kiniksa Pharmaceuticals International,

plc’s Annual Report on Form 10-K for the year ended December 31, 2024.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

February 25, 2025

Exhibit 107

Calculation of Filing Fee Tables

S-8

(Form Type)

Kiniksa

Pharmaceuticals International, plc

(Exact Name of Registrant as Specified in its Charter)

Newly Registered Securities

| Security

Type |

|

Security

Class Title |

|

Fee

Calculation

Rule |

|

Amount

Registered(1) |

|

|

Proposed

Maximum Offering

Price Per Unit |

|

|

Maximum

Aggregate

Offering Price |

|

Fee

Rate |

|

Amount

of

Registration Fee |

|

| Equity |

|

Class

A ordinary shares, nominal value $0.000273235 per share |

|

Rule

457(c) and Rule 457(h) |

|

|

2,900,642 |

(2) |

|

$ |

19.80 |

(4) |

|

$ |

57,418,208.39 |

|

|

0.0001531 |

|

$ |

8,790.73 |

|

| Equity |

|

Class A ordinary

shares, nominal value $0.000273235 per share |

|

Rule 457(c)

and Rule 457(h) |

|

|

90,000 |

(3) |

|

$ |

19.80 |

(4) |

|

$ |

1,781,550.00 |

|

|

0.0001531 |

|

$ |

272.76 |

|

| |

|

Total

Offering Amounts |

|

|

|

|

|

|

|

|

|

|

|

$ |

59,199,758.39 |

|

|

|

|

$ |

9,063.48 |

|

| |

|

Total

Fee Offsets(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

| |

|

Net

Fee Due |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

9,063.48 |

|

| (1) |

In accordance with Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall be deemed to cover any additional securities that may from time to time be offered or issued under the Kiniksa Pharmaceuticals International, plc 2018 Incentive Award Plan (the “2018 Plan”) and the Kiniksa Pharmaceuticals International, plc 2018 Employee Share Purchase Plan (the “2018 ESPP”) to prevent dilution resulting from stock splits, stock dividends or similar transactions. In addition, pursuant to Rule 416(c) under the Securities Act of 1933, this registration statement also covers an indeterminate amount of interests to be offered or sold pursuant to the employee benefit plans described herein. |

| |

|

| (2) |

Consists of 2,900,642 Class A ordinary shares, nominal value $0.000273235 per share of the Registrant (“Class A ordinary shares”) that may become issuable under the 2018 Plan pursuant to its terms. |

| |

|

| (3) |

Consists of 90,000 Class A ordinary shares that may become issuable under the 2018 ESPP pursuant to its terms. |

| |

|

| (4) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rules 457(c) and 457(h) of the Securities Act, and based upon the average of the high and low prices of the Class A ordinary shares as reported on the Nasdaq Global Select Market on February 21, 2025. |

| |

|

| (5) |

The Registrant does not have any fee offsets. |

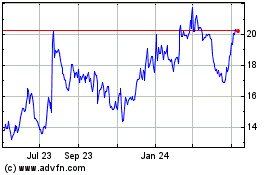

Kiniksa Pharmaceuticals (NASDAQ:KNSA)

Historical Stock Chart

From Jan 2025 to Feb 2025

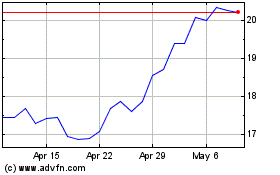

Kiniksa Pharmaceuticals (NASDAQ:KNSA)

Historical Stock Chart

From Feb 2024 to Feb 2025