Locafy Reports Fiscal Fourth Quarter and Full Year 2023 Results

12 October 2023 - 7:10AM

Locafy Limited (Nasdaq: LCFY, LCFYW)

(“Locafy” or the “Company”), a globally recognized

software-as-a-service technology company specializing in local

search engine marketing, today reported financial results for the

2023 fiscal fourth quarter and full year ended June 30, 2023. All

financial results are reported in Australian Dollars (AUD).

Recent Operational Highlights

- Completed migration of Locafy customers to its

upgraded SEO Platform (“Platform”) incorporating Locafy’s

proprietary “Entity-Based” software, providing Locafy customers

with a high-end technology stack, in-depth analytics and insights,

enhanced website templates, and improved customer support tools,

among other new features.

- Further consolidated sales, technology, and

operational costs as a result of efficiencies gained through the

recently upgraded Platform. A continuation of a series of cost

reduction initiatives drove a 52% year-over-year decrease in cost

of sales in the fiscal fourth quarter.

- Signed an agreement with a

prominent U.S.-based diversified media company to sell Locafy’s

Keystone technology. Locafy management believes that this publisher

will be the perfect partner for accelerating their Keystone

rollout. The first Keystone sales to end-users have delivered

outstanding ranking performance for high-value keywords in

competitive markets.

- Granted an exception to Nasdaq Listing Rule

5550(b)(1) by the Nasdaq Hearings Panel regarding the minimum

stockholders' equity required for continued listing on Nasdaq (the

"Stockholders' Equity Requirement") until October 31, 2023. The

exception is subject to certain conditions, including that the

Company files its Annual Report on Form 20-F for the year ended

June 30, 2023 with the Securities and Exchange Commission by

October 31, 2023, demonstrating compliance with the Stockholders'

Equity Requirement.

Management Commentary“In a constantly changing

SEO landscape, we believe that our products displayed excellent

results for our customers in our fiscal 2023,” said Locafy CEO

Gavin Burnett. “In addition to 27% full-year revenue growth to $5.3

million, we drove significant progress towards our growth strategy,

including robust technological advancements across our products and

several meaningful strategic partnerships. We continue to improve

our profitability as well, and believe that our cost-reduction

initiatives have us poised for high-margin, profitable growth in

the coming quarters.

“Since this past June, we’ve hit the ground running in our

fiscal 2024. We released our Platform and cutting-edge Keystone and

Entity-Based SEO technologies, all significant upgrades to our

software suite. Especially as our industry faces an influx of

AI-generated content, we are confident that our technology is

positioned to help our clients’ brands thrive in online search.

Also, our business development efforts resulted in several

strategic partnerships, including with media publishers and

marketing and advertising agencies. These reseller agreements

enable our technology to be sold across several large customer

bases, providing a clear roadmap for continued monthly recurring

revenue and gross margin expansion. We look forward to providing

additional updates in the months ahead.”

Fiscal Fourth Quarter 2023 Financial

ResultsResults compare the 2023 fiscal fourth quarter end

(June 30, 2023) to the 2022 fiscal fourth quarter end (June 30,

2022) unless otherwise indicated.

- Total operating revenue remained steady at

$1.3 million in both the current and comparable year-ago period.

- Subscription revenue decreased 8.1% to

$908,000 from $988,000 in the comparable year-ago period. Compared

to the 2023 fiscal third quarter, subscription revenue decreased

3.6%. The decrease in subscription revenue was primarily

attributable to the Company providing billing relief to many

customers as their campaigns were transitioned onto Locafy’s

upgraded Platform. This transition was a one-time action and was

completed in June 2023.

- Advertising revenue decreased 5.5% to $77,000

from $81,000 in the comparable year-ago period. Compared to the

2023 fiscal third quarter, advertising revenue increased 6.6%.

- Data revenue increased 22.7% to $210,000 from

$171,000 in the comparable year-ago period. The increase was

primarily attributable to sales to new data partners. Compared to

the 2023 fiscal third quarter, data revenue remained steady.

- Services revenue increased 110.8% to $69,000

from $33,000 in the comparable year-ago period. The increase is due

to the migration of websites from the Company’s existing platform

to its new technology Platform.

- Cost of sales decreased 52.4% to $230,000 from

$484,000 in the comparable year-ago period. Compared to the 2023

fiscal third quarter, cost of sales decreased 19.3% due to a

reduction in our use of third-party software. The Company is

engaged in ongoing efforts to drive further cost savings and

expects to realize these savings in the 2024 fiscal second

quarter.

- Gross margin for the 2023 fiscal fourth

quarter increased to 81.8% compared to 77.6% for the 2023 fiscal

third quarter and 62.0% for the comparable year-ago period. In

addition to completing the Company’s Platform upgrade, management’s

focus on reducing cost of sales drove increased gross margin.

- Net profit was $1.2 million, or $1.03 per

diluted share, compared to a net loss of $1.4 million, or $1.40 per

diluted share, in the comparable year-ago period. The net profit in

2023 fiscal fourth quarter included the reversal of contractor

termination expense provisions totaling $633,000 that had

previously been expensed in 2023 fiscal second quarter. These

provisions were reversed following management’s formal assessment

as to the likelihood of those expenses being realized. The net

profit in 2023 fiscal fourth quarter also included $1.1 million in

annual capitalized R&D expenses compared to $1.1 million in the

comparable year-ago period. Adjusting for the termination expense

provision and the annual capitalized R&D expenses, the

Company’s underlying net loss for the 2023 fiscal fourth quarter

was $540,000, or $0.48 per diluted share, compared to a net loss of

$2.6 million, or $2.51 per diluted share, in the comparable

year-ago period.

Fiscal Full Year 2023 Financial ResultsResults

compare the 2023 fiscal year end (June 30, 2023) to the 2022 fiscal

year end (June 30, 2022) unless otherwise indicated. All financial

results are reported in Australian Dollars (AUD).

- Total operating revenue increased 27.3% to

$5.4 million from $4.2 million in the comparable year-ago period.

The increase in total revenue was mainly driven by increases in

subscription sales and revenues derived from data partners.

- Subscription revenue increased 26.9% to $4.0

million from $3.2 million in the comparable year-ago period. The

increase in subscription revenue was primarily attributable to the

growth in the Company’s reseller customer base, particularly in

North America, together with revenues associated with new

products.

- Advertising revenue remained steady at

approximately $316,000 in both the current and comparable year-ago

period.

- Data revenue increased 34.1% to $872,000 from

$650,000 in the comparable year-ago period. The increase was

primarily attributable to sales to new data partners.

- Services revenue increased 94.9% to $169,000

from $87,000 in the comparable year-ago period. The increase is due

to the migration of websites from the Company’s existing platform

to its new technology platform which was completed in June

2023.

- Cost of sales decreased 16.0% to $1.4 million

from $1.7 million in the comparable year-ago period. This decrease

is primarily attributed to a reduction in expenses related to

third-party “signals” software required in the delivery of our

solutions.

- Gross margin for the 2023 fiscal year

increased to 73.9% compared to 60.4% for the 2022 fiscal year. The

increase in gross margin was mainly due to an increase in

subscription and data revenues combined with a reduction in the

costs of third-party software used in the delivery of our

solutions.

- Net loss was $3.9 million, or $3.69 per

diluted share, compared to a net loss of $5.1 million, or $4.94 per

diluted share, in the comparable year-ago period.

- As of June 30, 2023, the Company had $3.2 million in

cash and cash equivalents,

compared to $611,000 as of March 31, 2023 and $1.0 million as of

December 30, 2022.

Key Performance Indicators (KPIs)Unless

otherwise specified, KPI data has been recorded as of the 2023

fiscal year end (June 30, 2023). All financial results are reported

in Australian Dollars (AUD).

- Monthly recurring revenue (MRR) for the 2023

fiscal year was $434,000, a 25.9% increase compared to $345,000 for

the 2022 fiscal year. MRR for the 2023 fiscal fourth quarter was

$398,000, a 3.7% decrease compared to $413,000 for the comparable

year-ago period and a 2.5% decrease compared to $407,000 for the

2023 fiscal third quarter. The decreases in MRR over the prior year

and quarter are due to the Company providing billing relief to

customers during its broad upgrade to the Platform.

- Total active reseller count for the 2023

fiscal year was 107 resellers, a 13.0% decrease compared to 123

resellers as of June 30, 2022, and a 14.4% decrease compared to 125

resellers as of March 31, 2023. While the total number of resellers

has decreased, the Company has shifted its reseller focus to larger

resellers in recent months, and expects to continue prioritizing

high-volume resellers moving forward.

- Total end user count for the 2023 fiscal year

was 1,129 end users, an 8.7% increase compared to 1,039 end users

as of June 30, 2022, and a 10.4% decrease compared to 1,260 end

users as of March 31, 2023.

For more information, please see Locafy’s investor relations

website at investors.locafy.com.

About LocafyFounded in 2009, Locafy's (Nasdaq:

LCFY, LCFYW) mission is to revolutionize the US$700 billion SEO

sector. We help businesses and brands increase search engine

relevance and prominence in a specific proximity using a fast,

easy, and automated approach. For more information, please visit

www.locafy.com.

About Key Performance IndicatorsLocafy defines

MRR as the value of all recurring subscription contracts with

active entitlements as at the end of each month. MRR across a

period is the average of each month’s MRR within that period.

Locafy’s recent Platform upgrade caused a significant change to

the calculation of average page metrics, and Locafy management no

longer views these metrics as relevant indicators of the

performance of Locafy technology. The Company may introduce

additional KPIs in future quarters if deemed relevant long-term

indicators of performance.

Forward-Looking StatementsThis press release

contains “forward-looking statements” that are subject to

substantial risks and uncertainties. All statements, other than

statements of historical fact, contained in this press release are

forward-looking statements. Forward-looking statements contained in

this press release may be identified by the use of words such as

“subject to”, “believe,” “anticipate,” “plan,” “expect,” “intend,”

“estimate,” “project,” “may,” “will,” “should,” “would,” “could,”

“can,” the negatives thereof, variations thereon and similar

expressions, or by discussions of strategy, although not all

forward-looking statements contain these words. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, they do involve

assumptions, risks, and uncertainties, and these expectations may

prove to be incorrect. You should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company’s actual results could differ materially

from those anticipated in these forward-looking statements as a

result of a variety of factors and risk factors, including those

discussed in the Company’s filings with the Securities and Exchange

Commission (the “SEC”), including the Company’s Annual Report on

Form 20-F filed with the SEC on October 11, 2023, and available on

its website (http://www.sec.gov). All forward-looking statements

attributable to the Company or persons acting on its behalf are

expressly qualified in their entirety by these factors. Other than

as required under the securities laws, the Company does not assume

a duty to update these forward-looking statements.

Investor Relations ContactTom Colton or Chris

Adusei-PokuGateway Investor Relations(949)

574-3860LCFY@gateway-grp.com

-Financial Tables to Follow-

Locafy Limited

Consolidated Statement of Profit or Loss and Other

Comprehensive Income

|

|

|

3 months to30 Jun 2023AUD

$(unaudited) |

|

|

FY2023AUD

$(audited) |

|

|

FY2022AUD

$(audited) |

|

| Revenue |

|

1,263,208 |

|

|

5,376,693 |

|

|

4,222,689 |

|

| Other income |

|

708,676 |

|

|

993,493 |

|

|

1,298,499 |

|

| Technology expense |

|

(314,928 |

) |

|

(1,718,974 |

) |

|

(1,805,432 |

) |

| Employee benefits expense |

|

401,027 |

|

|

(5,267,246 |

) |

|

(4,411,926 |

) |

| Occupancy expense |

|

(28,943 |

) |

|

(113,572 |

) |

|

(66,365 |

) |

| Advertising expense |

|

(58,666 |

) |

|

(318,492 |

) |

|

(414,012 |

) |

| Consultancy expense |

|

(179,222 |

) |

|

(874,638 |

) |

|

(1,691,544 |

) |

| Depreciation and amortization

expense |

|

(460,655 |

) |

|

(1,355,170 |

) |

|

(852,361 |

) |

| Other expenses |

|

(99,561 |

) |

|

(213,051 |

) |

|

(245,079 |

) |

| Impairment of financial

assets |

|

(29,477 |

) |

|

(295,262 |

) |

|

(376,606 |

) |

| Operating

profit/(loss) |

|

1,201,459 |

|

|

(3,786,219 |

) |

|

(4,342,137 |

) |

| Financial cost |

|

(28,312 |

) |

|

(105,367 |

) |

|

(748,190 |

) |

| Loss before income

tax |

|

(1,173,147 |

) |

|

(3,891,586 |

) |

|

(5,090,327 |

) |

| Income tax expense |

|

- |

|

|

- |

|

|

- |

|

| Loss for the

period |

|

(1,173,147 |

) |

|

(3,891,586 |

) |

|

(5,090,327 |

) |

| |

|

|

|

|

|

|

|

|

|

| Other comprehensive

income |

|

|

|

|

|

|

|

|

|

| Items that will be

reclassified subsequently to profit and loss |

|

|

|

|

|

|

|

|

|

| Exchange differences on

translating foreign operations |

|

(37,905 |

) |

|

(23,010 |

) |

|

(48,453 |

) |

| Total comprehensive

loss for the period |

|

1,135,242 |

|

|

(3,914,596 |

) |

|

(5,138,780 |

) |

| |

|

|

|

|

|

|

|

|

|

| Earnings per

share |

|

|

|

|

|

|

|

|

|

| Basic loss per share |

|

1.03 |

|

|

(3.69 |

) |

|

(4.94 |

) |

| Diluted loss per share |

|

1.03 |

|

|

(3.69 |

) |

|

(4.94 |

) |

| |

|

|

|

|

|

|

|

|

|

Locafy Limited

Consolidated Statement of Financial Position

|

|

As at30 Jun 2023AUD

$(audited) |

|

|

As at31 Dec 2022AUD

$(audited) |

|

|

As at30 Jun 2022AUD

$(audited) |

|

| Assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

3,174,700 |

|

|

1,005,191 |

|

|

4,083,735 |

|

| Trade and other

receivables |

1,288,513 |

|

|

1,100,346 |

|

|

1,203,249 |

|

| Other assets |

356,782 |

|

|

204,406 |

|

|

230,094 |

|

| Current

assets |

4,819,995 |

|

|

2,309,943 |

|

|

5,517,078 |

|

| Property, plant and

equipment |

380,018 |

|

|

347,943 |

|

|

395,999 |

|

| Right of use assets |

314,596 |

|

|

360,635 |

|

|

406,673 |

|

| Intangible assets |

3,720,272 |

|

|

2,997,804 |

|

|

2,235,180 |

|

| Non-current

assets |

4,414,886 |

|

|

3,706,382 |

|

|

3,037,852 |

|

| Total

assets |

9,234,881 |

|

|

6,016,325 |

|

|

8,554,930 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

| Trade and other payables |

2,507,573 |

|

|

1,986,464 |

|

|

1,454,241 |

|

| Borrowings |

301,600 |

|

|

301,600 |

|

|

308,100 |

|

| Provisions |

214,465 |

|

|

504,302 |

|

|

473,006 |

|

| Accrued expenses |

512,611 |

|

|

1,103,260 |

|

|

511,848 |

|

| Lease liabilities |

85,165 |

|

|

49,693 |

|

|

32,672 |

|

| Contract and other

liabilities |

152,211 |

|

|

165,826 |

|

|

137,342 |

|

| Current

liabilities |

3,773,625 |

|

|

4,111,145 |

|

|

2,917,209 |

|

| Trade and other payables |

- |

|

|

128,268 |

|

|

- |

|

| Lease liabilities |

332,578 |

|

|

389,787 |

|

|

417,744 |

|

| Provisions |

48,271 |

|

|

35,387 |

|

|

25,988 |

|

| Accrued expenses |

90,450 |

|

|

76,504 |

|

|

76,504 |

|

| Non-current

liabilities |

471,299 |

|

|

629,946 |

|

|

520,236 |

|

| Total

liabilities |

4,244,924 |

|

|

4,741,091 |

|

|

3,437,445 |

|

| Net assets /

(liabilities) |

4,989,957 |

|

|

1,275,234 |

|

|

5,117,485 |

|

| |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

| Issued capital |

47,930,486 |

|

|

45,038,037 |

|

|

45,038,037 |

|

| Reserves |

2,404,933 |

|

|

5,508,912 |

|

|

5,306,475 |

|

| Accumulated losses |

(5,345,462 |

) |

|

(49,271,715 |

) |

|

(45,227,027 |

) |

| Total equity /

(deficiency) |

4,989,957 |

|

|

1,275,234 |

|

|

5,117,485 |

|

| |

|

|

|

|

|

|

|

|

Locafy Limited

Consolidated Statement of Cash

Flows(Unaudited)

|

|

|

3 months to30 Jun 2023AUD

$(unaudited) |

|

|

FY2023AUD

$(audited) |

|

|

FY2022AUD

$(audited) |

|

| Cash flows from

operating activities |

|

|

|

|

|

|

|

|

|

| Receipts from customers

(inclusive of GST) |

|

814,747 |

|

|

4,463,725 |

|

|

3,038,044 |

|

| Payments to suppliers and

employees (inclusive of GST) |

|

(1,103,133 |

) |

|

(7,005,510 |

) |

|

(7,999,866 |

) |

| R&D Tax Incentive and

government grants |

|

- |

|

|

386,181 |

|

|

803,042 |

|

| Financial cost |

|

(28,312 |

) |

|

(105,367 |

) |

|

(81,656 |

) |

| Net cash used by

operating activities |

|

(316,698 |

) |

|

(2,260,971 |

) |

|

(4,240,436 |

) |

| |

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

|

|

|

|

| Purchase of intellectual

property |

|

(134,527 |

) |

|

(1,617,446 |

) |

|

(1,615,192 |

) |

| Purchase of property, plant

and equipment |

|

- |

|

|

(2,170 |

) |

|

(390,339 |

) |

| Net cash used by

investing activities |

|

(134,527 |

) |

|

(1,619,616 |

) |

|

(2,005,531 |

) |

| |

|

|

|

|

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

|

|

|

|

| Proceeds from issue of

shares |

|

3,295,822 |

|

|

3,295,822 |

|

|

9,979,861 |

|

| Payment for share issue

costs |

|

(403,373 |

) |

|

(403,373 |

) |

|

(639,429 |

) |

| Repayment of borrowings |

|

- |

|

|

(6,500 |

) |

|

(97,500 |

) |

| Leasing liabilities |

|

(10,971 |

) |

|

(32,673 |

) |

|

(59,419 |

) |

| Net cash from

financing activities |

|

2,881,478 |

|

|

2,853,276 |

|

|

9,183,513 |

|

| |

|

|

|

|

|

|

|

|

|

| Net (decrease)/increase in

cash and cash equivalents |

|

2,430,253 |

|

|

(1,027,311 |

) |

|

2,937,546 |

|

| Net foreign exchange

difference |

|

133,174 |

|

|

118,276 |

|

|

495,458 |

|

| Cash and cash equivalents at

the beginning of the period |

|

611,273 |

|

|

4,083,735 |

|

|

650,731 |

|

| Cash and cash

equivalents at the end of the period |

|

3,174,700 |

|

|

3,174,700 |

|

|

4,083,735 |

|

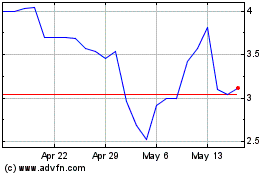

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Nov 2023 to Nov 2024