Locafy Reports Fiscal First Half 2024 Results

03 April 2024 - 7:10AM

Locafy Limited (Nasdaq: LCFY, LCFYW)

(“Locafy” or the “Company”), a globally recognized

software-as-a-service technology company specializing in local

search engine marketing, today reported financial results for the

2024 fiscal first half ended December 31, 2023. All financial

results are reported in Australian Dollars (AUD).

Recent Operational Highlights

- Announced a partnership agreement with diDNA,

a leading ad tech provider for the publisher ecosystem. With this

partnership, diDNA will implement Locafy’s Article Accelerator

alongside diDNA’s existing advertising software to allow diDNA’s

publishers to increase the prominence of advertorials within online

search results for competitive keywords. The agreement will begin

with a paid trial for 10-15 publishers in diDNA’s network and, if

successful, will be expanded to their broader set of

publishers.

- Signed a series of commercial agreements with

Localista, the largest lifestyle and travel directory in Australia

and New Zealand. Through these agreements, Locafy acquired Scoop’s

digital assets, agreed to provide SEO consulting services to

Localista’s retained asset, and added Localista’s sales team as a

reseller of Locafy’s Article Accelerator.

- Launched Hotfrog Proximity Page, an

application built in partnership with Yext. Hotfrog Proximity Page

is a unique application that combines Yext’s extensive business

listing database network with Locafy’s SEO technology to empower

local businesses to effortlessly create for themselves one or more

dynamic landing pages that are optimized for SEO performance.

Hotfrog Proximity Page is expected to allow users to enhance their

online presences and drive traffic to their main websites.

Management Commentary“Our 2024 fiscal first

half presented several promising opportunities for our business

that inform our optimism for the rest of the fiscal year,” said

Locafy CEO Gavin Burnett. “Recent search engine algorithm updates

created persistent headwinds for both the existing online search

ecosystem and our traditional business. Content-based sites drive

revenue from advertising and affiliate commissions, and dramatic

website traffic losses caused by these algorithm updates, sometimes

in excess of 90% in the past 18 months, materially impacted our

partners’ advertising income and budgets. These challenges reached

our top resellers, dampening the expected upside from recent

reseller partnerships.”

“Our Article Accelerator technology has proven very successful

for media brands hoping to rapidly combat the effects of these

algorithmic changes,” continued Burnett. “As we move into the

second half of the year, we’ve effectively reduced our expenses and

managed our lean cost structure to give us the flexibility to shift

our strategy. By deploying our proprietary SEO technology and

expertise, we are confident that we can reverse the fortunes of

struggling content-based websites under our control. We have

already started diversifying our go-to-market strategy to acquire

additional digital properties and expand our publishing reach, as

highlighted by our partnerships with diDNA and Localista. We

believe we are on a path to becoming a global publisher and media

organization that specializes in content-rich websites in

high-value advertising categories. We look forward to providing

updates in the coming quarters.”

2024 Fiscal First Half Financial ResultsResults

compare the 2024 fiscal first half end (December 31, 2023) to the

2023 fiscal first half end (December 31, 2022) unless otherwise

indicated. All financial results are reported in Australian Dollars

(AUD).

- Total operating revenue decreased 28.3% to

$2.0 million from $2.8 million in the comparable year-ago period.

- Subscription revenue decreased 34.4% to $1.4

million from $2.1 million in the comparable year-ago period.

Compared to the 2024 fiscal first quarter, subscription revenue

decreased 19.0%. The decrease in subscription revenue was

attributable to the Company continuing to extend billing relief to

customers whose campaigns on our Proximity product were affected by

the transition onto Locafy’s upgraded technology platform (the

“Platform”), together with a higher rate of customer churn compared

to previous periods.

- Advertising revenue remained steady at

$167,000 in both the current and comparable year-ago period.

Compared to the 2024 fiscal first quarter, advertising revenue

decreased 28.0%.

- Data revenue decreased 4.6% to $430,000 from

$451,000 in the comparable year-ago period. Compared to the 2024

fiscal first quarter, data revenue increased 1.4%.

- Services revenue decreased 74.3% to $12,000

from $49,000 in the comparable year-ago period. Compared to the

2024 fiscal first quarter, services revenue decreased 56.9%. These

decreases are due to comparatively lower custom website builds in

each respective period.

- Other income decreased 96.0% to $7,000 from

$165,000 in the comparable year-ago period. The variance is

attributed to the Company’s assessment (as at the respective

reporting period) of the extent and likelihood of its ability to

claim a Research & Development tax incentive.

- Cost of sales decreased 64.1% to $318,000 from

$888,000 in the comparable year-ago period.

- Gross margin for the 2024 fiscal second

quarter increased to 81.4% from 68.7% for the comparable year-ago

period.

- Operating expenses decreased 51.6% to $3.3

million from $7.0 million in the comparable year-ago period. This

included a 56.5% decrease in technology expenses to $450,000 from

$1.0 million in the comparable year ago period as a result of the

Company’s ongoing efforts to upgrade its Platform, including

changes to its technology stack and the reduction of third-party

product subscriptions. Employee benefits expense decreased 63.6% to

$1.6 million from $4.3 million in the comparable year ago period.

The Company has in the intervening period significantly reduced

headcount, particularly in underperforming sales regions and across

all business units. New hires have predominantly been made in more

“cost efficient” regions. Depreciation and amortization expense

increased 45.4% to $719,000 from $494,000 in the comparable year

ago period. This increase is mainly due to the higher starting cost

base of capitalized development cost for fiscal 2024 compared to

fiscal 2023.

- Net loss was $1.4 million, or $1.12 per

diluted share, compared to a net loss of $4.0 million, or $3.93 per

diluted share, in the comparable year-ago period.

Key Performance Indicators (KPIs)Unless

otherwise specified, KPI data has been recorded as of the 2024

fiscal second quarter end (December 31, 2023).

- Monthly recurring revenue (MRR) for the 2024

fiscal second quarter was $314,000, a 32.2% decrease compared to

$464,000 for the comparable year-ago period, and a 12.5% decrease

compared to $360,000 for the 2024 fiscal first quarter.

- Total active reseller count for the 2024

fiscal second quarter was 87 resellers, a 35.1% decrease compared

to 134 resellers for the comparable year-ago period, and a 12.1%

decrease compared to 99 resellers as of September 30, 2023.

- Total end user count for the 2024 fiscal

second quarter was 947 end users, a 25.3% decrease compared to

1,268 end users for the comparable year-ago period, and a 9.6%

decrease compared to 1,048 end users as of September 30, 2023.

For more information, please see Locafy’s investor relations

website at investors.locafy.com.

About LocafyFounded in 2009, Locafy's (Nasdaq:

LCFY, LCFYW) mission is to revolutionize the US$700 billion SEO

sector. We help businesses and brands increase search engine

relevance and prominence in a specific proximity using a fast,

easy, and automated approach. For more information, please visit

www.locafy.com.

About Key Performance IndicatorsLocafy defines

MRR as the value of all recurring subscription contracts with

active entitlements as at the end of each month. MRR across a

period is the average of each month’s MRR within that period.

Locafy’s recent Platform upgrade caused a significant change to

the calculation of average page metrics, and Locafy management no

longer views these metrics as relevant indicators of the

performance of Locafy technology. The Company may introduce

additional KPIs in future quarters if deemed relevant long-term

indicators of performance.

Forward-Looking StatementsThis press release

contains “forward-looking statements” that are subject to

substantial risks and uncertainties. All statements, other than

statements of historical fact, contained in this press release are

forward-looking statements. Forward-looking statements contained in

this press release may be identified by the use of words such as

“subject to”, “believe,” “anticipate,” “plan,” “expect,” “intend,”

“estimate,” “project,” “may,” “will,” “should,” “would,” “could,”

“can,” the negatives thereof, variations thereon and similar

expressions, or by discussions of strategy, although not all

forward-looking statements contain these words. Although the

Company believes that the expectations reflected in such

forward-looking statements are reasonable, they do involve

assumptions, risks, and uncertainties, and these expectations may

prove to be incorrect. You should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

press release. The Company’s actual results could differ materially

from those anticipated in these forward-looking statements as a

result of a variety of factors and risk factors, including those

discussed in the Company’s filings with the Securities and Exchange

Commission (the “SEC”), including the Company’s Annual Report on

Form 20-F filed with the SEC on October 11, 2023, and available on

its website (http://www.sec.gov). All forward-looking statements

attributable to the Company or persons acting on its behalf are

expressly qualified in their entirety by these factors. Other than

as required under the securities laws, the Company does not assume

a duty to update these forward-looking statements.

Investor Relations ContactTom Colton or Chris

Adusei-PokuGateway Investor Relations(949)

574-3860LCFY@gateway-grp.com

-Financial Tables to Follow-

Locafy Limited

Consolidated Statement of Profit or Loss and Other

Comprehensive Income

|

|

|

6 months to31 Dec 2023AUD

$ |

|

|

6 months to31 Dec 2022AUD

$ |

|

| Revenue |

|

2,035,683 |

|

|

2,839,089 |

|

| Other income |

|

6,600 |

|

|

164,817 |

|

| Technology expense |

|

(450,614 |

) |

|

(1,036,224 |

) |

| Employee benefits expense |

|

(1,600,837 |

) |

|

(4,396,441 |

) |

| Occupancy expense |

|

(47,096 |

) |

|

(60,586 |

) |

| Advertising expense |

|

(132,864 |

) |

|

(158,891 |

) |

| Consultancy expense |

|

(464,789 |

) |

|

(530,086 |

) |

| Depreciation and amortization

expense |

|

(719,278 |

) |

|

(494,786 |

) |

| Other expenses |

|

(42,334 |

) |

|

(65,792 |

) |

| Reversal/(Impairment) of

financial assets |

|

67,146 |

|

|

(259,888 |

) |

| Operating

loss |

|

(1,348,383 |

) |

|

(3,998,788 |

) |

| Financial cost |

|

(78,288 |

) |

|

(45,900 |

) |

| Loss before income

tax |

|

(1,426,671 |

) |

|

(4,044,688 |

) |

| Income tax expense |

|

- |

|

|

- |

|

| Loss for the period

after tax |

|

(1,426,671 |

) |

|

(4,044,688 |

) |

| |

|

|

|

|

|

|

| Other comprehensive

income |

|

|

|

|

|

|

| Items that will be

reclassified subsequently to profit and loss |

|

|

|

|

|

|

| Exchange differences on

translating foreign operations |

|

17,644 |

|

|

(7,438 |

) |

| Total comprehensive

profit/(loss) for the period |

|

(1,409,027 |

) |

|

(4,052,126 |

) |

| |

|

|

|

|

|

|

| Earnings per

share |

|

|

|

|

|

|

| Basic loss per share |

|

(1.12 |

) |

|

(3.93 |

) |

| Diluted loss per share |

|

(1.12 |

) |

|

(3.93 |

) |

| |

|

|

|

|

|

|

Locafy Limited

Consolidated Statement of Financial Position

|

|

6 months to31 Dec 2023AUD

$ |

|

|

Year to30 Jun 2023AUD

$ |

|

| Assets |

|

|

|

|

|

| Current

assets |

|

|

|

|

|

| Cash and cash equivalents |

724,581 |

|

|

3,174,700 |

|

| Trade and other

receivables |

868,492 |

|

|

1,288,513 |

|

| Other assets |

453,763 |

|

|

356,782 |

|

| Total current

assets |

2,046,836 |

|

|

4,819,995 |

|

| Non-current

assets |

|

|

|

|

|

| Property, plant and

equipment |

317,618 |

|

|

380,018 |

|

| Right of use assets |

268,558 |

|

|

314,596 |

|

| Intangible assets |

4,022,887 |

|

|

3,720,272 |

|

| Total non-current

assets |

4,609,063 |

|

|

4,414,886 |

|

| Total

assets |

6,655,899 |

|

|

9,234,881 |

|

| |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

| Trade and other payables |

1,289,251 |

|

|

2,507,573 |

|

| Borrowings |

271,600 |

|

|

301,600 |

|

| Provisions |

226,547 |

|

|

214,465 |

|

| Accrued expenses |

357,776 |

|

|

512,611 |

|

| Lease liabilities |

120,287 |

|

|

85,165 |

|

| Contract and other

liabilities |

139,120 |

|

|

152,211 |

|

| Total current

liabilities |

2,404,581 |

|

|

3,773,625 |

|

| Non-current

liabilities |

|

|

|

|

|

| Lease liabilities |

269,500 |

|

|

332,578 |

|

| Provisions |

33,559 |

|

|

48,271 |

|

| Accrued expenses |

90,450 |

|

|

90,450 |

|

| Total non-current

liabilities |

393,509 |

|

|

471,299 |

|

| Total

liabilities |

2,798,090 |

|

|

4,244,924 |

|

| Net

assets |

3,857,809 |

|

|

4,989,957 |

|

| |

|

|

|

|

|

| Equity |

|

|

|

|

|

| Issued capital |

47,805,798 |

|

|

47,930,486 |

|

| Reserves |

2,696,635 |

|

|

2,404,933 |

|

| Accumulated losses |

(46,644,624 |

) |

|

(45,345,462 |

) |

| Total

equity |

3,857,809 |

|

|

4,989,957 |

|

| |

|

|

|

|

|

Locafy Limited

Consolidated Statement of Cash Flows

|

|

6 months to31 Dec 2023AUD

$ |

|

|

6 months to31 Dec 2022AUD

$ |

|

| Cash flows from

operating activities |

|

|

|

|

|

| Receipts from customers

(inclusive of GST) |

1,837,481 |

|

|

2,743,777 |

|

| Payments to suppliers and

employees (inclusive of GST) |

(3,312,368 |

) |

|

(4,753,048 |

) |

| R&D Tax Incentive and

government grants |

561,501 |

|

|

164,817 |

|

| Financial cost |

(78,288 |

) |

|

(45,900 |

) |

| Net cash used by

operating activities |

(991,674 |

) |

|

(1,890,354 |

) |

| |

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

| Purchase of intellectual

property |

(1,190,222 |

) |

|

(1,161,145 |

) |

| Purchase of property, plant

and equipment |

- |

|

|

(2,171 |

) |

| Maturity of term deposit |

40,000 |

|

|

- |

|

| Net cash used by

investing activities |

(1,150,222 |

) |

|

(1,163,316 |

) |

| |

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

| Payment for share issue

costs |

(245,586 |

) |

|

- |

|

| Repayment of borrowings |

(30,000 |

) |

|

(6,500 |

) |

| Leasing liabilities |

(27,956 |

) |

|

(10,936 |

) |

| Net cash from

financing activities |

(303,542 |

) |

|

(17,436 |

) |

| |

|

|

|

|

|

| Net decrease in cash and cash

equivalents |

(2,445,438 |

) |

|

(3,071,106 |

) |

| Net foreign exchange

difference |

(4,681 |

) |

|

(7,438 |

) |

| Cash and cash equivalents at

the beginning of the period |

3,174,700 |

|

|

4,083,735 |

|

| Cash and cash

equivalents at the end of the period |

724,581 |

|

|

1,005,191 |

|

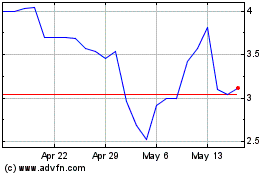

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Locafy (NASDAQ:LCFY)

Historical Stock Chart

From Jan 2024 to Jan 2025