UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 5)*

| LIPELLA

PHARMACEUTICALS INC. |

| (Name

of Issuer) |

| Common

Stock, par value $0.0001 per share |

| (Title

of Class of Securities) |

David

E. Danovitch, Esq.

Sullivan

& Worcester LLP

1251

Avenue of the Americas

New

York, NY 10020

(212)

660-3000 |

| (Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications) |

| |

| October

15, 2024 |

| (Date

of Event which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D,

and is filing this Schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See 240.13d-7(b)

for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section

of the Exchange Act but shall be subject to all other provisions of the Exchange Act (however, see the Notes).

| CUSIP

No. 53630L100 |

Amendment

No. 5 to Schedule 13D |

Page

2 of 5 Pages |

| 1 |

name

of reporting persons

Michael

B. Chancellor |

|

| 2 |

check

the appropriate box if a member of a group*

|

(a)

☐

(b) ☐ |

| 3 |

sec

use only

|

|

| 4 |

source

of funds*

PF,

OO (1) |

|

| 5 |

check

if disclosure of legal proceedings is required pursuant to items 2(d) or 2(e)

|

☐ |

| 6 |

citizenship

or place of organization

United

States |

|

number

of

shares

beneficially

owned by

each

reporting

person

with |

|

7 |

sole

voting power

1,677,136

(1) |

|

| 8 |

shared

voting power

0 |

|

| 9 |

sole

dispositive power

1,677,136

(1) |

|

| 10 |

shared

dispositive power

0 |

|

| 11 |

aggregate

amount beneficially owned by each reporting person

1,677,136

(1) |

|

| 12 |

check

box if the aggregate amount in row (11) excludes certain shares*

|

☐ |

| 13 |

percent

of class represented by amount in row (11)

16.0%

(2) |

|

| 14 |

type

of reporting person*

IN |

|

*

SEE INSTRUCTIONS

(1)

Consists of (i) 877,637 shares of common stock, par value $0.0001 per share, of the issuer (“Common Stock”) purchased by

Dr. Michael Chancellor (the “Reporting Person”) with personal funds and (ii) 799,499 shares of Common Stock that may be issued

upon the exercise of stock options awarded by the issuer (the “Issuer”) to the Reporting Person in his capacity as an officer

and director of the Issuer, which are vested and exercisable within 60 days of the filing of this Amendment No. 5 to Statement on Schedule

13D (this “Amendment No. 5”).

(2)

Calculated based on 9,671,636 shares of Common Stock outstanding as of October 16, 2024, as verified with the Issuer. The 799,499 shares

of Common Stock that the Reporting Person has the right to acquire within 60 days of the filing of this Amendment No. 5 are deemed to

be outstanding for purposes of calculating such beneficial ownership percentage.

| CUSIP

No. 53630L100 |

Amendment

No. 5 to Schedule 13D |

Page

3 of 5 Pages |

This

Amendment No. 5 amends and supplements the Statement on Schedule 13D initially filed by the Reporting Person with the SEC on December

29, 2022, as amended by Amendment No. 1 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on June 21, 2023,

as amended by Amendment No. 2 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on March 6, 2024, as amended

by Amendment No. 3 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on March 15, 2024, and as amended by

Amendment No. 4 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on August 19, 2024 (collectively, the “Schedule

13D”). Capitalized terms used but not defined herein shall have the meanings attributed to them in the Schedule 13D. Except as

otherwise set forth herein, this Amendment No. 5 does not modify any of the information previously reported by the Reporting Person in

the Schedule 13D.

The

purpose of this Amendment No. 5 is to update the Reporting Person’s beneficial ownership percentage in the Schedule 13D.

Except

as specifically amended below, all other provisions of the Schedule 13D remain in effect.

Item

1. Security and Issuer.

The

information contained in “Item 1. Security and Issuer.” of the Schedule 13D is not being amended by this Amendment No. 5.

Item

2. Identity and Background.

The

information contained in “Item 2. Identity and Background.” of the Schedule 13D is not being amended by this Amendment No.

5.

Item

3. Source or Amount of Funds or Other Consideration.

The

information contained in “Item 3. Source or Amount of Funds or Other Consideration.” of the Schedule 13D is not being amended

by this Amendment No. 5.

Item

4. Purpose of Transaction.

The

information contained in rows (7), (8), (9), (10), (11) and (13) of the cover page of this Amendment No. 5 and the corresponding footnotes,

and the information set forth in or incorporated by reference in Item 2, Item 3, Item 5 and Item 6 of this Amendment No. 5 is hereby

incorporated by reference in its entirety into this Item 4.

Except

as described above, the information contained in “Item 4. Purpose of Transaction.” of the Schedule 13D is not being amended

by this Amendment No. 5.

Item

5. Interest in Securities of the Issuer.

The

responses to rows (7) through (13) of the cover page of this Amendment No. 5 and the corresponding footnotes are hereby incorporated

by reference in their entirety in this Item 5.

(a) See

responses to Items 11 and 13 on the cover page.

(b) See

response to Rows (7), (8), (9) and (10) on the cover page.

| CUSIP

No. 53630L100 |

Amendment

No. 5 to Schedule 13D |

Page

4 of 5 Pages |

(c) The

Reporting Person has not, to the best of his knowledge, engaged in any transaction with respect to the Common Stock of the Issuer during

the sixty days prior to the date of filing this Amendment No. 5.

Except

as described above, the information contained in “Item 5. Interest in Securities of the Issuer.” of the Schedule 13D is not

being amended by this Amendment No. 5.

Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

The

information contained in “Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.”

of the Schedule 13D is not being amended by this Amendment No. 5.

Item

7. Material to be filed as Exhibits.

The

information contained in “Item 7. Material to be filed as Exhibits.” of the Schedule 13D is not being amended by this Amendment

No. 5.

| CUSIP

No. 53630L100 |

Amendment

No. 5 to Schedule 13D |

Page

5 of 5 Pages |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

| Date:

October 17, 2024 |

|

| |

/s/

Michael B. Chancellor |

| |

Name:

Michael B. Chancellor |

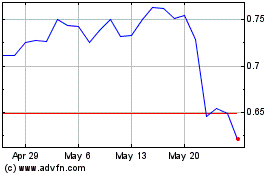

Lipella Pharmaceuticals (NASDAQ:LIPO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Lipella Pharmaceuticals (NASDAQ:LIPO)

Historical Stock Chart

From Nov 2023 to Nov 2024