FALSE000166839700016683972024-10-212024-10-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________________________________________

FORM 8-K

______________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 21, 2024

______________________________________________________

Medpace Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

______________________________________________________

| | | | | | | | |

| Delaware | 001-37856 | 32-0434904 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| | |

| 5375 Medpace Way | | |

Cincinnati, Ohio | | 45227 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 513 579-9911

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

______________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock $0.01 par value | | MEDP | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On October 21, 2024, Medpace Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the three and nine months ended September 30, 2024. The full text of the press release was posted on the Company’s internet website and is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information contained in, or incorporated into, Item 2.02, including the press release attached as Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference to such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | | MEDPACE HOLDINGS, INC. |

| | | |

| Date: | October 21, 2024 | By: | /s/ Kevin M. Brady |

| | | Kevin M. Brady, Chief Financial Officer |

Exhibit 99.1

Investor Contact:

Lauren Morris

513.579.9911 x11994

l.morris@medpace.com

FOR IMMEDIATE RELEASE

Media Contact:

Michael Maley

513.579.9911 x12831

m.maley@medpace.com

Medpace Holdings, Inc. Reports Third Quarter 2024 Results

•Revenue of $533.3 million in the third quarter of 2024 increased 8.3% from revenue of $492.5 million for the comparable prior-year period, representing a backlog conversion rate of 18.2%.

•Net new business awards were $533.7 million in the third quarter of 2024, representing a decrease of 12.7% from net new business awards of $611.5 million for the comparable prior-year period, which resulted in a net book-to-bill ratio of 1.00x.

•Third quarter of 2024 GAAP net income was $96.4 million, or $3.01 per diluted share, versus GAAP net income of $70.6 million, or $2.22 per diluted share, for the comparable prior-year period. Net income margin was 18.1% and 14.3% for the third quarter of 2024 and 2023, respectively.

•EBITDA was $118.8 million for the third quarter of 2024, an increase of 31.7% from EBITDA of $90.2 million for the comparable prior-year period, resulting in an EBITDA margin of 22.3%.

CINCINNATI, OHIO, October 21, 2024-- Medpace Holdings, Inc. (Nasdaq: MEDP) (“Medpace”) today announced financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial Results

Revenue for the three months ended September 30, 2024 increased 8.3% to $533.3 million, compared to $492.5 million for the comparable prior-year period. On a constant currency basis, revenue for the third quarter of 2024 increased 8.1% compared to the third quarter of 2023.

Backlog as of September 30, 2024 increased 8.8% to $2,927.4 million from $2,689.5 million as of September 30, 2023. Net new business awards were $533.7 million, representing a net book-to-bill ratio of 1.00x for the third quarter of 2024, as compared to $611.5 million for the comparable prior-year period. The Company calculates the net book-to-bill ratio by dividing net new business awards by revenue.

For the third quarter of 2024, total direct costs were $364.3 million, compared to total direct costs of $359.3 million in the third quarter of 2023. Selling, general and administrative (SG&A) expenses were $49.2 million in the third quarter of 2024, compared to SG&A expenses of $41.4 million in the third quarter of 2023.

GAAP net income for the third quarter of 2024 was $96.4 million, or $3.01 per diluted share, versus GAAP net income of $70.6 million, or $2.22 per diluted share, for the third quarter of 2023. This resulted in a net income margin of 18.1% and 14.3% for the third quarter of 2024 and 2023, respectively.

EBITDA for the third quarter of 2024 increased 31.7% to $118.8 million, or 22.3% of revenue, compared to $90.2 million, or 18.3% of revenue, for the comparable prior-year period. On a constant currency basis, EBITDA for the third quarter of 2024 increased 32.3% from the third quarter of 2023.

A reconciliation of the Company’s non-GAAP financial measures, including EBITDA and EBITDA margin to the corresponding GAAP measures is provided below.

Year-to-Date 2024 Financial Results

Revenue for the nine months ended September 30, 2024 was $1,572.5 million, and increased 13.3% on a reported basis and constant currency basis from the comparable prior-year period. Year-to-date 2024 GAAP net income was $287.4 million, or $8.96 per diluted share, compared to $204.5 million, or $6.42 per diluted share, for the comparable prior-year period. Year-to-date 2024 EBITDA was $346.7 million, or 22.0% of revenue, and increased 30.0% on a reported basis and 29.8% on a constant currency basis from the comparable prior-year period.

Balance Sheet and Liquidity

The Company’s Cash and cash equivalents were $656.9 million at September 30, 2024, and the Company generated $149.1 million in cash flow from operating activities during the third quarter of 2024. There were no share repurchases in the third quarter of 2024. As of September 30, 2024, the Company had $308.8 million remaining under its authorized share repurchase program.

2024 Financial Guidance

The Company forecasts 2024 revenue in the range of $2.090 billion to $2.130 billion, representing growth of 10.8% to 12.9% over 2023 revenue of $1.886 billion. GAAP net income for full year 2024 is forecasted in the range of $376.0 million to $388.0 million. Additionally, full year 2024 EBITDA is expected in the range of $450.0 million to $470.0 million. Based on forecasted 2024 revenue of $2.090 billion to $2.130 billion and GAAP net income of $376.0 million to $388.0 million, diluted earnings per share (GAAP) is forecasted in the range of $11.71 to $12.09. This guidance assumes a full year 2024 tax rate of 15.5% to 16.5%, interest income of $24.4 million, and 32.1 million diluted shares outstanding. This guidance does not include the potential impact of any share repurchases the Company may make pursuant to the share repurchase program after September 30, 2024.

Conference Call Details

Medpace will host a conference call at 9:00 a.m. ET, Tuesday, October 22, 2024, to discuss its third quarter 2024 results.

To participate in the conference call, interested parties must register in advance by clicking on this link. While it is not required, it is recommended you join 10 minutes prior to the event start. Upon registration, all telephone participants will receive a confirmation email detailing how to join the conference call, including the dial-in number along with a unique PIN that can be used to access the call.

To access the conference call via webcast, visit the “Investors” section of Medpace’s website at medpace.com. The webcast replay of the call will be available at the same site approximately one hour after the end of the call. A supplemental slide presentation will also be available at the “Investors” section of Medpace’s website prior to the start of the call.

About Medpace

Medpace is a scientifically-driven, global, full-service clinical contract research organization (CRO) providing Phase I-IV clinical development services to the biotechnology, pharmaceutical and medical device industries. Medpace’s mission is to accelerate the global development of safe and effective medical therapeutics through its high-science and disciplined operating approach that leverages regulatory and therapeutic expertise across all major areas including oncology, cardiology, metabolic disease, endocrinology, central nervous system and anti-viral and anti-infective. Headquartered in Cincinnati, Ohio, Medpace employs approximately 5,900 people across 43 countries as of September 30, 2024.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including without limitation, statements regarding our forecasted financial results and the effective tax rate used for non-GAAP adjustment purposes. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “guidance,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” “forecast,” “may,” “could,” “likely,” “anticipate,” “project,” “goal,” “objective,” “potential,” “range,” “estimate,” “preliminary,” “opportunity,” “outlook,” “trend,” “can,” “might,” “drives,” “hope,” “predict” and similar expressions, and variations or negatives of these words. However, the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements are largely based on management’s current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our financial condition, actual results, performance (including share price performance), or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the potential loss, delay or non-renewal of our contracts, or the non-payment by customers for services we have performed; the failure to convert backlog to revenue at our present or historical conversion rate(s); the failure to maintain or generate new business awards; fluctuation in our results between fiscal quarters and years; the risks and uncertainties related to disruptions to or reductions in business operations or prospects due to pandemics, epidemics, widespread health emergencies, or outbreaks of infectious diseases; decreased operating margins due to increased pricing pressure or other factors; our failure to perform our services in accordance with contractual requirements, government regulations and ethical considerations; the impact of underpricing our contracts, overrunning our cost estimates or failing to receive approval for or experiencing delays with documentation of change orders; our failure to increase our market share, grow our business, successfully execute our growth strategies or manage our growth effectively; the impact of a failure to retain key executives or other personnel or recruit experienced personnel; the risks associated with our information systems infrastructure, including potential cybersecurity breaches and other disruptions which could compromise patient information or our information; adverse results from customer or therapeutic area concentration; the risks associated with doing business internationally, including the effects of tariffs and trade wars; the risks associated with the Foreign Corrupt Practices Act and other anti-corruption laws; future net losses; the impact of changes in tax laws and regulations; our failure to attract suitable investigators and patients to our clinical trials; the liability risks associated with our research and development services, including risks of liability resulting from harm to patients; inadequate insurance coverage for our operations and indemnification obligations; fluctuations in exchange rates; general economic conditions, including inflation, in the markets in which we operate, including financial market conditions; the impact of unfavorable economic conditions, including conditions caused by the uncertain international economic environment and current and future international conflicts; the impact of a natural disaster or other catastrophic event; negative outsourcing trends in the biopharmaceutical industry and a reduction in aggregate expenditures and research and development budgets; our inability to compete effectively with other CROs; the impact of healthcare reform; the impact of consolidation in the biopharmaceutical industry; our failure to comply with federal, state and foreign healthcare laws; the effect of current and proposed laws and regulations regarding the protection of personal data; our potential involvement in costly intellectual property lawsuits; actions by regulatory authorities or customers to limit the scope of indications related to or withdraw an approved drug, biologic or medical device from the market; and the impact of industry-wide reputational harm to CROs. Moreover, we operate in a very competitive and rapidly changing environment in which new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all important factors on our business or the extent to which any factor, or combination of such factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make.

These and other important factors discussed under the caption “Risk Factors” in Item 1A, Part I of our Annual Report on Form 10-K filed with the Securities and Exchange Commission, or SEC, and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this press release. We cannot guarantee that any forward-looking statement will be realized. Achievement of anticipated results is subject to substantial risks, uncertainties and inaccurate assumptions. If known or unknown risks or uncertainties materialize or if underlying assumptions prove inaccurate, actual results could vary materially from past results and those anticipated, estimated or projected. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in our filings with the SEC. Any such forward-looking statements represent management’s estimates as of the date of this press release. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events, developments or circumstances cause our views to change. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this press release.

Non-GAAP Financial Measures

Certain financial measures presented in this press release, such as EBITDA and EBITDA margin, are not recognized under generally accepted accounting principles in the United States of America, or U.S. GAAP. Management uses EBITDA and EBITDA margin or comparable metrics as a measurement used in evaluating our operating performance on a consistent basis, as a consideration to assess incentive compensation for our employees, for planning purposes, including the preparation of our internal annual operating budget, and to evaluate the performance and effectiveness of our operational strategies.

EBITDA and EBITDA margin have important limitations as analytical tools and you should not consider them in isolation, or as a substitute for, analysis of our results as reported under U.S. GAAP. See the condensed consolidated financial statements included elsewhere in this release for our U.S. GAAP results. Additionally, for reconciliations of EBITDA and EBITDA margin to our closest reported U.S. GAAP measures, refer to the appendix of this press release.

We believe that EBITDA and EBITDA margin are useful to provide additional information to investors about certain material non-cash and non-recurring items. While we believe these financial measures are commonly used by investors to evaluate our performance and that of our competitors, because not all companies use identical calculations, this presentation of EBITDA and EBITDA margin may not be comparable to other similarly titled measures of other companies and should not be considered as an alternative to performance measures derived in accordance with U.S. GAAP. EBITDA is calculated as net income attributable to Medpace Holdings, Inc. before income tax expense, interest expense, net, depreciation and amortization. EBITDA margin is calculated by dividing EBITDA by Revenue, net for each period. Our presentation of EBITDA and EBITDA margin should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

MEDPACE HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands, except per share amounts) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue, net | $ | 533,317 | | | $ | 492,499 | | | $ | 1,572,465 | | | $ | 1,387,441 | |

| Operating expenses: | | | | | | | |

| Direct service costs, excluding depreciation and amortization | 171,540 | | | 164,364 | | | 514,573 | | | 473,958 | |

| Reimbursed out-of-pocket expenses | 192,769 | | | 194,942 | | | 579,904 | | | 525,784 | |

| Total direct costs | 364,309 | | | 359,306 | | | 1,094,477 | | | 999,742 | |

| Selling, general and administrative | 49,217 | | | 41,407 | | | 134,751 | | | 118,838 | |

| Depreciation | 7,158 | | | 6,329 | | | 20,663 | | | 17,707 | |

| Amortization | 360 | | | 549 | | | 1,082 | | | 1,649 | |

| Total operating expenses | 421,044 | | | 407,591 | | | 1,250,973 | | | 1,137,936 | |

| Income from operations | 112,273 | | | 84,908 | | | 321,492 | | | 249,505 | |

| Other income (expense), net: | | | | | | | |

| Miscellaneous (expense) income, net | (1,025) | | | (1,602) | | | 3,435 | | | (2,198) | |

| Interest income (expense), net | 7,528 | | | (105) | | | 17,113 | | | (2,332) | |

| Total other income (expense), net | 6,503 | | | (1,707) | | | 20,548 | | | (4,530) | |

| Income before income taxes | 118,776 | | | 83,201 | | | 342,040 | | | 244,975 | |

| Income tax provision | 22,350 | | | 12,651 | | | 54,672 | | | 40,463 | |

| Net income | $ | 96,426 | | | $ | 70,550 | | | $ | 287,368 | | | $ | 204,512 | |

| Net income per share attributable to common shareholders: | | | | | | | |

| Basic | $ | 3.11 | | | $ | 2.30 | | | $ | 9.28 | | | $ | 6.65 | |

| Diluted | $ | 3.01 | | | $ | 2.22 | | | $ | 8.96 | | | $ | 6.42 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 31,047 | | 30,629 | | 30,960 | | 30,723 |

| Diluted | 32,088 | | 31,762 | | 32,060 | | 31,839 |

MEDPACE HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| | | | | | | | | | | |

| (Amounts in thousands, except share amounts) | | | |

| As of |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 656,900 | | | $ | 245,449 | |

| Accounts receivable and unbilled, net | 311,466 | | | 298,400 | |

| Prepaid expenses and other current assets | 64,229 | | | 49,979 | |

| Total current assets | 1,032,595 | | | 593,828 | |

| Property and equipment, net | 124,058 | | | 120,589 | |

| Operating lease right-of-use assets | 130,547 | | | 144,801 | |

| Goodwill | 662,396 | | | 662,396 | |

| Intangible assets, net | 34,727 | | | 35,809 | |

| Deferred income taxes | 76,683 | | | 74,435 | |

| Other assets | 23,055 | | | 24,970 | |

| Total assets | $ | 2,084,061 | | | $ | 1,656,828 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 26,201 | | | $ | 31,869 | |

| Accrued expenses | 306,868 | | | 292,961 | |

| Advanced billings | 670,939 | | | 559,860 | |

| Other current liabilities | 37,346 | | | 40,441 | |

| Total current liabilities | 1,041,354 | | | 925,131 | |

| Operating lease liabilities | 128,277 | | | 142,122 | |

| Deferred income tax liability | 2,289 | | | 2,404 | |

| Other long-term liabilities | 30,702 | | | 28,221 | |

| Total liabilities | 1,202,622 | | | 1,097,878 | |

| Commitments and contingencies | | | |

| Shareholders’ equity: | | | |

Preferred stock - $0.01 par-value; 5,000,000 shares authorized; no shares issued and outstanding at September 30, 2024 and December 31, 2023 | — | | | — | |

Common stock - $0.01 par-value; 250,000,000 shares authorized at September 30, 2024 and December 31, 2023; 31,081,601 and 30,752,292 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively | 311 | | | 308 | |

Treasury stock - 70,073 and 70,573 shares at September 30, 2024 and December 31, 2023, respectively | (12,235) | | | (12,322) | |

| Additional paid-in capital | 836,903 | | | 802,681 | |

| Retained earnings (Accumulated deficit) | 65,636 | | | (221,645) | |

| Accumulated other comprehensive loss | (9,176) | | | (10,072) | |

| Total shareholders’ equity | 881,439 | | | 558,950 | |

| Total liabilities and shareholders’ equity | $ | 2,084,061 | | | $ | 1,656,828 | |

MEDPACE HOLDINGS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | | | | |

| (Amounts in thousands) | Nine Months Ended

September 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income | $ | 287,368 | | | $ | 204,512 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation | 20,663 | | | 17,707 | |

| Amortization | 1,082 | | | 1,649 | |

| Stock-based compensation expense | 19,625 | | | 15,351 | |

| Noncash lease expense | 17,305 | | | 14,579 | |

| Deferred income tax benefit | (2,433) | | | (11,308) | |

| Other | (3,836) | | | 821 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable and unbilled, net | (13,032) | | | (39,314) | |

| Prepaid expenses and other current assets | (11,108) | | | (8,954) | |

| Accounts payable | (3,029) | | | (921) | |

| Accrued expenses | 13,933 | | | 54,923 | |

| Advanced billings | 111,079 | | | 56,026 | |

| Lease liabilities | (15,417) | | | (14,433) | |

| Other assets and liabilities, net | (4,051) | | | (13,659) | |

| Net cash provided by operating activities | 418,149 | | | 276,979 | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Property and equipment expenditures | (28,905) | | | (26,662) | |

| Other | 8,159 | | | 30 | |

| Net cash used in investing activities | (20,746) | | | (26,632) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds from stock option exercises | 14,600 | | | 9,855 | |

| Repurchases of common stock | — | | | (144,020) | |

| Proceeds from revolving loan | — | | | 105,000 | |

| Payments on revolving loan | — | | | (155,000) | |

| Net cash provided by (used in) financing activities | 14,600 | | | (184,165) | |

EFFECT OF EXCHANGE RATES ON CASH, CASH EQUIVALENTS, AND

RESTRICTED CASH | (552) | | | 760 | |

| INCREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | 411,451 | | | 66,942 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH — Beginning of period | 245,449 | | | 28,265 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH — End of period | $ | 656,900 | | | $ | 95,207 | |

MEDPACE HOLDINGS, INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASURES (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in thousands) | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| RECONCILIATION OF GAAP NET INCOME TO EBITDA | | | | | | | |

| Net income (GAAP) | $ | 96,426 | | | $ | 70,550 | | | $ | 287,368 | | | $ | 204,512 | |

| Interest (income) expense, net | (7,528) | | | 105 | | | (17,113) | | | 2,332 | |

| Income tax provision | 22,350 | | | 12,651 | | | 54,672 | | | 40,463 | |

| Depreciation | 7,158 | | | 6,329 | | | 20,663 | | | 17,707 | |

| Amortization | 360 | | | 549 | | | 1,082 | | | 1,649 | |

| EBITDA (Non-GAAP) | $ | 118,766 | | | $ | 90,184 | | | $ | 346,672 | | | $ | 266,663 | |

| Net income margin (GAAP) | 18.1 | % | | 14.3 | % | | 18.3 | % | | 14.7 | % |

| EBITDA margin (Non-GAAP) | 22.3 | % | | 18.3 | % | | 22.0 | % | | 19.2 | % |

FY 2024 GUIDANCE RECONCILIATION (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| (Amounts in millions, except per share amounts) | Forecast 2024 |

| Net Income | | Net income per diluted share |

| Low | | High | | Low | | High |

| Net income and net income per diluted share (GAAP) | $ | 376.0 | | | $ | 388.0 | | | $ | 11.71 | | | $ | 12.09 | |

| Income tax provision | 68.6 | | | 76.6 | | | | | |

| Interest income, net | (24.4) | | | (24.4) | | | | | |

| Depreciation | 28.4 | | | 28.4 | | | | | |

| Amortization | 1.4 | | | 1.4 | | | | | |

| EBITDA (Non-GAAP) | $ | 450.0 | | | $ | 470.0 | | | | | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

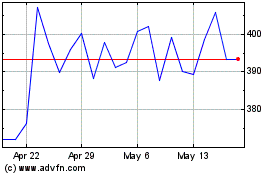

Medpace (NASDAQ:MEDP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Medpace (NASDAQ:MEDP)

Historical Stock Chart

From Feb 2024 to Feb 2025