Please read the full release with accompanying graphs,

sources and details here.

Summary of the release below.

ZimCal Asset Management, LLC, and its affiliates (collectively

“ZimCal”, “We”, “Our”) are one of the largest investors in

Medallion Financial Corp. (the “Company” or “MFIN”) and have been

invested in MFIN for over 3 ½ years. Our singular focus is on

making MFIN better and unlocking the tremendous potential of

Medallion Bank. See www.restoretheshine.com for details on the

recently ended proxy contest to replace 2 incumbent directors,

where, despite insider ownership that gave MFIN a 44% lead, ZimCal

still earned 22% of stockholder votes with

over 1 in 4 stockholders voting against MFIN’s compensation

plan. We believe that MFIN’s board of directors (the

“Board”) has shown weak governance and is beholden to the Murstein

family rather than to stockholders. We also believe that MFIN’s

management team is overpaid and must be improved. Until we see

positive changes, we will work to hold MFIN’s Board and management

team accountable.

Last October 2023, we first brought up our detailed concerns

about MFIN’s performance with the Board and Andrew Murstein, MFIN’s

President/COO. That extensive analysis formed the foundation of our

detailed, comprehensive “5 Steps to Improvement” white paper, a

version of which we shared with the Company during the proxy

contest. Last year we felt that the Company had adequate time to

course-correct and proactively mitigate high probability and high

impact risks and gave several suggestions on how to do so. However,

MFIN ignored our suggestions and none were implemented. During the

proxy contest MFIN unequivocally dismissed our ideas stating:

“[ZimCal’s] five-step plan” has no actionable benefits

for the Company. No change is needed and based on [its] statements

[ZimCal] would only bring negative change that could derail the

Company’s continued value creation…”

However, a majority of the issues we identified in our analysis

a year ago, and again in our 5 Steps to Improvement plan, appear to

be manifesting themselves. We will touch on a few of the major

concerns we identified in MFIN’s 2Q24 earnings below.

Please read the full release with accompanying graphs, sources

and analysis here.

1. Non-core

recoveries/gains disguised the decline in core (mostly consumer

loans) performance

- Taxi Medallion assets only

represented 0.5% of assets but recoveries distorted earnings and

disguised declines in core earnings and core returns after FYE21.

This was brought to MFIN’s attention in 2023.

- The combination of declining core

performance and non-core earnings distortion is why MFIN’s

quarterly net earnings decreased 50% and 35% year-over-year at 2Q24

and 1Q24.

- The executive team should have been

rewarded for core performance not non-recurring distortions.

- This also shows the unsustainability

of 2022 and 2023 earnings and ROAA/ROAE which MFIN did not

explicitly acknowledge as it touted its various financial

achievements in public filings and the proxy contest. See graphs

here.

- 2Q24 reported quarterly earnings of

$7.1 million were the lowest since 4Q20.

2. Recreation asset

quality is declining and charge-offs may cripple MFIN unless action

is taken NOW

- Recreation loans, and the $525

million in subprime Recreation loans, worry us the most.

- Subprime Recreation originations

doubled in 2Q24 over 1Q24 even though ZimCal believes we are

heading into a likely subprime consumer slowdown with discretionary

spending headwinds.

- In October 2023 and in our recent 5

Step plan, we suggested MFIN reduce exposure to subprime until it

had more clarity on the economy and end-markets and to avoid

“chasing” yield.

- The worsening asset quality trend we

predicted has materialized but of course our preferred outcome

would have been a proactive MFIN in 2023 with the disclosure of key

metrics for the Board and investors to monitor.

- Instead, subprime balances stayed

steady and net charge-offs for Recreation reached an 11-year high

of 4.3% at 4Q23 and worsened to 4.34% at 1Q24. See graphs

here.

- We expected, and saw, a seasonal

improvement in Recreation (and Home Improvement) at 2Q24 but net

charge-offs of 3.0% are still 60% worse than 2Q23 and 500% worse

than 2Q22.

Please read the full release with accompanying graphs, sources

and analysis here.

3. Margins and returns

(ROAE and ROAA) will remain under pressure without decisive

management action

- Net interest margin will remain

under pressure with MFIN having little protection from declining

rates due to its callable, long-maturity loans and brokered CD

funding.

- MFIN’s weighted average maturities

for its CDs was 22 months at 2Q24 and CD rates will be driven by

similar maturity (1 to 3 yr) treasuries. MFIN’s CD rates have

lagged treasuries on the way up and we believe they will lag them

on the way down which will pressure NIM. See graphs here.

- A lowered NIM would be manageable,

except MFIN has higher overhead expenses than it should, and we

believe that its worsening efficiency ratio of 39% at 2Q24 is well

above where it should be.

- Quarterly ROAA has deteriorated to a

3-year low of 1.1% as reported and 0.9% (core) at 2Q24; we warned

about this in October 2023 and in our 5 Step plan.

- This also means that MFIN, in our

view, will probably need to raise expensive debt to fund holding

company expenses that will likely be priced ABOVE MFIN’s

YTD ROAE.

All the issues we have identified are problematic for

MFIN but they are not insurmountable. It just requires

leaders that are willing to acknowledge the truth of the situation

and creatively seek solutions without being paralyzed by their

circumstances or avoiding near-term, but necessary, pain. Andrew

Murstein and the Board have given us no indication that they are

capable of doing so but we hope they prove us wrong. We urge MFIN

to act now to mitigate risk.

Visit www.restoretheshine.com for more information or read our 5

Steps to Improvement.

ZimCal will issue ongoing press releases with updates and

details on its plan to “Restore the Shine” to Medallion Financial

Corp.

About ZimCal Asset Management, LLC

ZimCal Asset Management is an alternative investment firm

focused primarily on niche, illiquid and complex credit investment

opportunities.

ZimCal Asset Management partners with both healthy and

distressed borrowers or issuers and provides customized solutions

that meet their unique needs and circumstances. Over the last 15

years, the founder of ZimCal Asset Management has developed a

specialization investing in FDIC-insured institutions and has

partnered with over 120 bank lenders through investments on both

sides of the balance sheet.

ZimCal usually works in collaboration with bank leadership teams

if required, but on very rare occasions, must insert itself more

forcefully if it believes that leadership is underwhelming and

threatens to undermine stakeholder investments. ZimCal prides

itself on performing extensive, rigorous financial analysis and

research to fully understand the risks of any investment.

Important Information and

Disclaimer

ZimCal Asset Management, LLC, and its affiliates

BIMIZCI Fund, LLC, Warnke Investments LLC and Stephen Hodges

(collectively, “ZimCal” or “we”), are, directly or indirectly,

owners of securities of Medallion Financial Corp. (the “Company”).

ZimCal currently has combined investment exposure of $15,604,000

million to the Company, comprised of $15 million par value of Trust

Preferred Securities (backed by the Company’s issued debt), and

76,112 shares of the Company. We are not currently engaged in

any solicitation of proxies from stockholders of the Company.

ZimCal intends to monitor the performance and corporate governance

of the Company, as well as the actions of the Company’s management

and board. As ZimCal deems necessary, ZimCal will assert its

stockholder rights.

Except as otherwise set forth herein, the views

expressed reflect ZimCal’s opinions and are based on publicly

available information with respect to the Company. We recognize

that there may be confidential information in the possession of the

Company that could lead it or others to disagree with our

conclusions. ZimCal reserves the right to change any of its

opinions expressed herein at any time as it deems appropriate and

disclaims any obligation to notify the market or any other party of

any such change, except as required by law. We disclaim any

obligation to update the information or opinions contained

herein.

The information herein is being provided merely

as information and is not intended to be, nor should it be

construed as, an offer to sell or a solicitation of an offer to buy

any security.

Some of the information herein may contain

forward-looking statements. All statements contained herein that

are not clearly historical in nature or that depend on future

events are forward-looking. The words “anticipate,” “believe,”

“expect,” “potential,” “could,” “opportunity,” “estimate,” “plan,”

and similar expressions are generally intended to identify

forward-looking statements. There can be no assurance that any

forward-looking statements will prove to be accurate and therefore

actual results could differ materially from those set forth in,

contemplated by, or underlying these forward-looking statements. In

light of the significant uncertainties inherent in forward-looking

statements, the inclusion of such information should not be

regarded as a representation as to future results or that the

objectives and strategic initiatives expressed or implied by such

forward-looking statements will be achieved.

Media contact: nicole@nh-consult.com

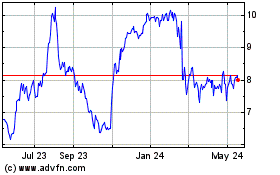

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

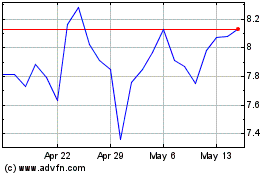

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Jan 2024 to Jan 2025