Medallion Bank Announces Fintech Strategic Partnership With Kashable

30 September 2024 - 8:00PM

Medallion Bank (Nasdaq: MBNKP), an FDIC-insured bank specializing

in consumer loans for the purchase of recreational vehicles, boats,

and home improvements, as well as loan products and services

offered through fintech strategic partners, today announced a

strategic partnership with Kashable, a leading fintech company

dedicated to providing socially responsible credit and financial

wellness solutions. This collaboration builds on Medallion Bank’s

existing nationwide financing footprint while expanding Kashable’s

services to a broader audience, offering working Americans access

to affordable personal loans.

“Adding Kashable to our growing strategic

partnership program expands Medallion Bank’s consumer finance reach

while supporting Kashable’s mission to improve the financial

well-being of its customers” stated Donald Poulton, President and

Chief Executive Officer of Medallion Bank. “Medallion Bank is proud

to leverage our expertise in lending and partnerships to help

extend Kashable’s services to a broader audience of working

Americans.”

Medallion Bank will originate personal loans on

the Kashable platform, enhancing Kashable’s ability to introduce

its services to employers, benefit administration platforms,

marketplaces, and industry brokers, further solidifying its

leadership in the financial wellness industry.

“Our relationship with Medallion Bank provides

Kashable with a strong financial partner that will support us on

our journey to expand financial wellness into new communities,

employers, and their employees. This partnership enables us to

leverage our patented proprietary system and demonstrate an

unparalleled ability to look beyond credit scores alone to reward

long-term, stable employees,” added Einat Steklov, Co-Founder and

Co-CEO of Kashable. “The opportunities this partnership unlocks

advance our mission of providing access to affordable credit with

the convenience of automated repayments through deep integrations

with HRIS and payroll systems.”

About Medallion Bank

Medallion Bank specializes in providing consumer

loans for the purchase of recreational vehicles, boats, and home

improvements, along with loan origination services to fintech

strategic partners. The Bank works directly with thousands of

dealers, contractors and financial service providers serving their

customers throughout the United States. Medallion Bank is a

Utah-chartered, FDIC-insured industrial bank headquartered in Salt

Lake City and is a wholly owned subsidiary of Medallion Financial

Corp. (Nasdaq: MFIN).

For more information, visit

www.medallionbank.com.

About Kashable, LLC

Kashable is a financial technology company that

provides access to Socially Responsible Credit™ and financial

wellness solutions for employees, offered as an employer-sponsored

voluntary benefit. By partnering with hundreds of employers,

Kashable helps to provide access to financial health and wellness

tools to millions of employees.

Founded in 2013, Kashable deploys innovative

technology to improve the financial well-being of working Americans

with a commitment to both reliability and affordability. Offering a

smart, economical, and fast alternative for employees who may

otherwise be driven to borrow from retirement plans, high-rate

credit cards, or other high-cost loans to bridge short-term gaps in

their finances, Kashable focuses on providing a path to financial

security.

For more information, visit Kashable.com.

Forward-Looking Statements

Please note that this press release contains

forward-looking statements that involve risks and uncertainties

relating to business performance, cash flow, costs, sales, net

investment income, earnings, returns and growth. These statements

are often, but not always, made through the use of words or phrases

such as “remain,” “anticipate” or the negative version of this word

or other comparable words or phrases of a future or forward-looking

nature, such as “look forward.” These statements may relate to our

future earnings, returns, capital levels, sources of funding,

growth prospects, asset quality and pursuit and execution of our

strategy. Medallion Bank’s actual results may differ significantly

from the results discussed in such forward-looking statements. For

a description of certain risks to which Medallion Bank is or may be

subject, please refer to the factors discussed under the captions

“Cautionary Note Regarding Forward-Looking Statements” and “Risk

Factors” included in Medallion Bank’s Form 10-K for the year ended

December 31, 2023, and in its Quarterly Reports on Form 10-Q, filed

with the FDIC. Medallion Bank’s Form 10-K, Form 10-Qs and other

FDIC filings are available in the Investor Relations section of

Medallion Bank’s website. Medallion Bank’s financial results for

any period are not necessarily indicative of Medallion Financial

Corp.’s results for the same period.

Medallion Bank Contact:Investor

Relations212-328-2176InvestorRelations@medallion.com

Kashable

Contact:Kashable@mww.com

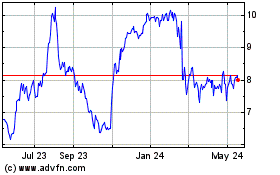

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

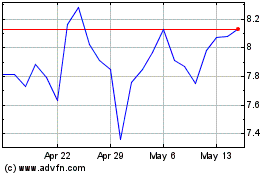

Medallion Financial (NASDAQ:MFIN)

Historical Stock Chart

From Jan 2024 to Jan 2025