false

0001280452

0001280452

2025-02-06

2025-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

February 6, 2025

MONOLITHIC POWER SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-51026

|

|

77-0466789

|

|

(State or other jurisdiction of

|

|

(Commission

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

File Number)

|

|

Identification Number)

|

|

5808 Lake Washington Blvd. NE,

Kirkland, Washington

(Address of principal executive offices)

|

98033

(Zip Code)

|

|

(425) 296-9956

|

|

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

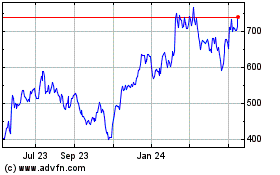

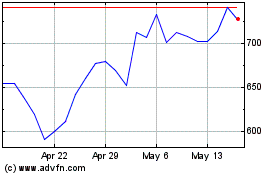

MPWR

|

The NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 6, 2025, Monolithic Power Systems, Inc. (the “Company”) issued a press release (the “Press Release”) regarding its financial results for the quarter and year ended December 31, 2024. The Press Release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Attached hereto as Exhibit 99.2 and incorporated by reference herein is financial information and commentary regarding results of the quarter and year ended December 31, 2024.

The information under Item 2.02 of this Current Report on Form 8-K and Exhibits 99.1 and 99.2 attached hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “1934 Act”), nor shall they be deemed incorporated by reference in any filing with the Securities and Exchange Commission under the 1934 Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

Increase in Quarterly Dividend

In the Press Release, the Company also announced that its Board of Directors approved an increase in its quarterly cash dividend from $1.25 per share to $1.56 per share. The first quarter dividend of $1.56 per share will be paid on April 15, 2025 to all stockholders of record as of the close of business on March 31, 2025. A copy of the Press Release is attached hereto as Exhibit 99.1.

Stock Repurchase Program

On February 6, 2025, the Company also announced that its Board of Directors has approved a new stock repurchase program of $500 million, which will expire on February 4, 2028. Shares of common stock repurchased under the program will be retired. A copy of the press release is attached hereto as Exhibit 99.3.

Stock repurchases under the program may be made through open market repurchases, privately negotiated transactions or other structures in accordance with applicable state and federal securities laws, at times and in amounts as management deems appropriate. The timing and the number of any repurchased common stock will be determined by the Company’s management based on its evaluation of market conditions, legal requirements, share price, and other factors. Repurchases of common stock may be made under a Rule 10b5-1 plan. The repurchase program does not obligate the Company to purchase any particular number of shares and may be suspended, modified, or discontinued at any time without prior notice.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: February 6, 2025

|

By:

|

/s/ T. Bernie Blegen

|

|

| |

|

T. Bernie Blegen

|

|

| |

|

Executive Vice President and Chief Financial Officer

|

|

Exhibit 99.1

|

PRESS RELEASE

|

|

For Immediate Release

|

Monolithic Power Systems Announces

Results for the Fourth Quarter and Year Ended December 31, 2024

and an Increase in Quarterly Cash Dividend

KIRKLAND, WASHINGTON, February 6, 2025-- Monolithic Power Systems, Inc. (“MPS”) (Nasdaq: MPWR), a fabless global company that provides high-performance, semiconductor-based power electronics solutions, today announced financial results for the quarter and year ended December 31, 2024. MPS also announced that its Board of Directors has approved an increase in the quarterly cash dividend from $1.25 per share to $1.56 per share. The first quarter dividend of $1.56 per share will be paid on April 15, 2025 to all stockholders of record as of the close of business on March 31, 2025.

The financial results for the quarter ended December 31, 2024 were as follows:

|

●

|

Revenue was $621.7 million for the quarter ended December 31, 2024, a 0.2% increase from $620.1 million for the quarter ended September 30, 2024 and a 36.9% increase from $454.0 million for the quarter ended December 31, 2023.

|

| |

|

|

●

|

GAAP gross margin was 55.4% for the quarter ended December 31, 2024, compared with 55.3% for the quarter ended December 31, 2023.

|

| |

|

|

●

|

Non-GAAP gross margin (1) was 55.8% for the quarter ended December 31, 2024, excluding the impact of $1.7 million for stock-based compensation and related expenses, $0.4 million for deferred compensation plan expense and $0.3 million for amortization of acquisition-related intangible assets, compared with 55.7% for the quarter ended December 31, 2023, excluding the impact of $1.2 million for stock-based compensation expense and $0.5 million for deferred compensation plan expense.

|

| |

|

|

●

|

GAAP operating expenses were $181.1 million for the quarter ended December 31, 2024, compared with $141.6 million for the quarter ended December 31, 2023.

|

| |

|

|

●

|

Non-GAAP operating expenses (1) were $126.1 million for the quarter ended December 31, 2024, excluding $54.6 million for stock-based compensation and related expenses, and $0.4 million for deferred compensation plan expense, compared with $96.7 million for the quarter ended December 31, 2023, excluding $39.9 million for stock-based compensation expense and $4.9 million for deferred compensation plan expense.

|

| |

|

|

●

|

GAAP operating income was $163.3 million for the quarter ended December 31, 2024, compared with $109.6 million for the quarter ended December 31, 2023.

|

| |

|

|

●

|

Non-GAAP operating income (1) was $220.7 million for the quarter ended December 31, 2024, excluding $56.3 million for stock-based compensation and related expenses, $0.8 million for deferred compensation plan expense and $0.3 million for amortization of acquisition-related intangible assets, compared with $156.1 million for the quarter ended December 31, 2023, excluding $41.1 million for stock-based compensation expense and $5.4 million for deferred compensation plan expense.

|

| |

|

|

●

|

GAAP other income, net was $6.2 million for the quarter ended December 31, 2024, compared with $10.0 million for the quarter ended December 31, 2023.

|

| |

|

|

●

|

Non-GAAP other income, net (1) was $6.0 million for the quarter ended December 31, 2024, excluding $0.2 million for deferred compensation plan income, compared with $4.9 million for the quarter ended December 31, 2023, excluding $5.1 million for deferred compensation plan income.

|

| |

|

|

●

|

GAAP income before income taxes was $169.5 million for the quarter ended December 31, 2024, compared with $119.5 million for the quarter ended December 31, 2023.

|

|

●

|

Non-GAAP income before income taxes (1) was $226.7 million for the quarter ended December 31, 2024, excluding $56.3 million for stock-based compensation and related expenses, $0.6 million for net deferred compensation plan expense and $0.3 million for amortization of acquisition-related intangible assets, compared with $161.0 million for the quarter ended December 31, 2023, excluding $41.1 million for stock-based compensation expense and $0.3 million for net deferred compensation plan expense.

|

| |

|

|

●

|

GAAP net income was $1.4 billion and $29.88 per diluted share for the quarter ended December 31, 2024. Comparatively, GAAP net income was $96.9 million and $1.98 per diluted share for the quarter ended December 31, 2023. GAAP net income and income per diluted share for the quarter ended December 31, 2024 included $1.3 billion for the recognition of a tax benefit granted to a foreign subsidiary.

|

| |

|

|

●

|

Non-GAAP net income (1) was $198.4 million and $4.09 per diluted share for the quarter ended December 31, 2024 excluding $1.3 billion for the recognition of a tax benefit granted to a foreign subsidiary. Non-GAAP net income (1) for the quarter ended December 31, 2024 also excluded $56.3 million for stock-based compensation and related expenses, $0.6 million for net deferred compensation plan expense, $0.3 million for amortization of acquisition-related intangible assets and $22.8 million for the related tax effects, compared with $140.9 million and $2.88 per diluted share for the quarter ended December 31, 2023, excluding $41.1 million for stock-based compensation expense, $0.3 million for net deferred compensation plan expense and $2.5 million for the related tax effects.

|

The financial results for the year ended December 31, 2024 were as follows:

|

●

|

Non-GAAP gross margin (1) was 55.8% for the year ended December 31, 2024, excluding the impact of $7.0 million for stock-based compensation and related expenses, $1.5 million for deferred compensation plan expense and $1.2 million for amortization of acquisition-related intangible assets, compared with 56.4% for the year ended December 31, 2023, excluding the impact of $4.5 million for stock-based compensation expense and $0.9 million for deferred compensation plan expense.

|

|

●

|

GAAP operating expenses were $681.5 million for the year ended December 31, 2024, compared with $539.4 million for the year ended December 31, 2023.

|

| |

|

|

●

|

Non-GAAP operating expenses (1) were $466.4 million for the year ended December 31, 2024, excluding $206.2 million for stock-based compensation and related expenses, $8.8 million for deferred compensation plan expense and $0.1 million for amortization of acquisition-related intangible assets, compared with $385.4 million for the year ended December 31, 2023, excluding $145.2 million for stock-based compensation expense, $8.7 million for deferred compensation plan expense and $0.1 million for amortization of acquisition-related intangible assets.

|

| |

|

|

●

|

GAAP operating income was $539.4 million for the year ended December 31, 2024, compared with $481.7 million for the year ended December 31, 2023.

|

| |

|

|

●

|

Non-GAAP operating income (1) was $764.1 million for the year ended December 31, 2024, excluding $213.2 million for stock-based compensation and related expenses, $10.3 million for deferred compensation plan expense and $1.3 million for amortization of acquisition-related intangible assets, compared with $641.1 million for the year ended December 31, 2023, excluding $149.7 million for stock-based compensation expense, $9.6 million for deferred compensation plan expense and $0.1 million for amortization of acquisition-related intangible assets.

|

| |

|

|

●

|

GAAP other income, net was $33.6 million for the year ended December 31, 2024, compared with $24.1 million for the year ended December 31, 2023.

|

| |

|

|

●

|

Non-GAAP other income, net (1) was $24.2 million for the year ended December 31, 2024, excluding $9.4 million for deferred compensation plan income, compared with $15.6 million for the year ended December 31, 2023, excluding $8.5 million for deferred compensation plan income.

|

| |

|

|

●

|

GAAP income before income taxes was $572.9 million for the year ended December 31, 2024, compared with $505.8 million for the year ended December 31, 2023.

|

|

●

|

Non-GAAP income before income taxes (1) was $788.3 million for the year ended December 31, 2024, excluding $213.2 million for stock-based compensation and related expenses, $1.3 million for amortization of acquisition-related intangible assets and $0.9 million for net deferred compensation plan expense, compared with $656.7 million for the year ended December 31, 2023, excluding $149.7 million for stock-based compensation expense, $1.1 million for net deferred compensation plan expense and $0.1 million for amortization of acquisition-related intangible assets.

|

| |

|

|

●

|

GAAP net income was $1.8 billion and $36.59 per diluted share for the year ended December 31, 2024. Comparatively, GAAP net income was $427.4 million and $8.76 per diluted share for the year ended December 31, 2023. GAAP net income and income per diluted share for the year ended December 31, 2024 included $1.3 billion for the recognition of a tax benefit granted to a foreign subsidiary.

|

| |

|

|

●

|

Non-GAAP net income (1) was $689.8 million and $14.12 per diluted share for the year ended December 31, 2024 excluding $1.3 billion for the recognition of a tax benefit granted to a foreign subsidiary. Non-GAAP net income (1) for the year ended December 31, 2024 also excluded $213.2 million for stock-based compensation and related expenses, $1.3 million for amortization of acquisition-related intangible assets, $0.9 million for net deferred compensation plan expense and $26.9 million for the related tax effects, compared with $574.6 million and $11.78 per diluted share for the year ended December 31, 2023, excluding $149.7 million for stock-based compensation expense, $1.1 million for net deferred compensation plan expense, $0.1 million for amortization of acquisition-related intangible assets and $3.6 million for the related tax effects.

|

The following is a summary of revenue by end market (in thousands):

| |

|

Three Months Ended December 31,

|

|

Year Ended December 31,

|

|

End Market

|

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Enterprise Data

|

|

$ |

194,867 |

|

|

$ |

128,897 |

|

|

$ |

716,264 |

|

|

$ |

322,980 |

|

|

Storage and Computing

|

|

|

136,507 |

|

|

|

117,312 |

|

|

|

501,576 |

|

|

|

491,139 |

|

|

Automotive

|

|

|

128,344 |

|

|

|

89,758 |

|

|

|

413,973 |

|

|

|

394,665 |

|

|

Communications

|

|

|

63,810 |

|

|

|

40,926 |

|

|

|

225,905 |

|

|

|

204,911 |

|

|

Consumer

|

|

|

57,311 |

|

|

|

43,741 |

|

|

|

202,015 |

|

|

|

234,660 |

|

|

Industrial

|

|

|

40,826 |

|

|

|

33,378 |

|

|

|

147,367 |

|

|

|

172,717 |

|

|

Total

|

|

$ |

621,665 |

|

|

$ |

454,012 |

|

|

$ |

2,207,100 |

|

|

$ |

1,821,072 |

|

“Our proven, long-term growth strategy remains intact as we continue our transformation from being a chip-only, semiconductor supplier to a full service, silicon-based solutions provider,” said Michael Hsing, CEO and founder of MPS.

Business Outlook

The following are MPS’s financial targets for the first quarter ending March 31, 2025:

| |

●

|

GAAP gross margin between 55.1% and 55.7%. Non-GAAP gross margin (1) between 55.4% and 56.0%, which excludes estimated stock-based compensation and related expenses of $1.7 million as well as the impact from amortization of acquisition-related intangible assets.

|

| |

●

|

GAAP operating expenses between $180.2 million and $186.2 million. Non-GAAP operating expenses (1) between $126.9 million and $130.9 million, which excludes estimated stock-based compensation and related expenses in the range of $53.3 million to $55.3 million. |

| |

●

|

Total stock-based compensation and related expenses of $55.0 million to $57.0 million including approximately $1.7 million that would be charged to cost of goods sold.

|

| |

●

|

Interest and other income in the range of $5.8 million to $6.2 million before foreign exchange gains or losses.

|

| |

●

|

Non-GAAP tax rate of 15.0% for 2025.

|

| |

●

|

Fully diluted shares outstanding between 47.8 million and 48.2 million.

|

(1) Non-GAAP net income, non-GAAP net income per share, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP other income, net, non-GAAP operating income and non-GAAP income before income taxes differ from net income, net income per share, gross margin, operating expenses, other income, net, operating income and income before income taxes determined in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”). Non-GAAP net income and non-GAAP net income per share exclude the effect of stock-based compensation and related expenses, which include stock-based compensation expense and employer payroll taxes in relation to the stock-based compensation, net deferred compensation plan expense, amortization of acquisition-related intangible assets and related tax effects. Non-GAAP net income and non-GAAP net income per share also exclude the recognition of a tax benefit granted to a foreign subsidiary. Non-GAAP gross margin excludes the effect of stock-based compensation and related expenses, amortization of acquisition-related intangible assets and deferred compensation plan expense. Non-GAAP operating expenses exclude the effect of stock-based compensation and related expenses, amortization of acquisition-related intangible assets and deferred compensation plan expense. Non-GAAP operating income excludes the effect of stock-based compensation and related expenses, amortization of acquisition-related intangible assets and deferred compensation plan expense. Non-GAAP other income, net excludes the effect of deferred compensation plan income. Non-GAAP income before income taxes excludes the effect of stock-based compensation and related expenses, amortization of acquisition-related intangible assets and net deferred compensation plan expense. Projected non-GAAP gross margin excludes the effect of stock-based compensation and related expenses, and amortization of acquisition-related intangible assets. Projected non-GAAP operating expenses exclude the effect of stock-based compensation and related expenses. These non-GAAP financial measures are not prepared in accordance with GAAP and should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. A schedule reconciling non-GAAP financial measures is included at the end of this press release. MPS utilizes both GAAP and non-GAAP financial measures to assess what it believes to be its core operating performance and to evaluate and manage its internal business and assist in making financial operating decisions. MPS believes that the inclusion of non-GAAP financial measures, together with GAAP measures, provides investors with an alternative presentation useful to investors’ understanding of MPS’s core operating results and trends. Additionally, MPS believes that the inclusion of non-GAAP measures, together with GAAP measures, provides investors with an additional dimension of comparability to similar companies. However, investors should be aware that non-GAAP financial measures utilized by other companies are not likely to be comparable in most cases to the non-GAAP financial measures used by MPS. See the GAAP to non-GAAP reconciliations in the tables set forth below.

Earnings Commentary

Earnings commentary on the results of operations for the quarter and year ended December 31, 2024 is available under the Investor Relations page on the MPS website.

Earnings Webinar

MPS plans to host a question-and-answer conference call covering its financial results at 2:00 p.m. PT / 5:00 p.m. ET, February 6, 2025. The live event will be held via a Zoom webcast, which can be accessed at: https://mpsic.zoom.us/j/96816578886. The Zoom webcast can also be accessed live over the phone by dialing (669) 444-9171; the webcast ID is 96816578886. A replay of the event will be archived and available for replay for one year under the Investor Relations page on the MPS website.

Safe Harbor Statement

This press release contains, and statements that will be made during the accompanying webinar will contain, forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, including under the “Business Outlook” section and the quote from our CEO herein, including, among other things, (i) projected revenue, GAAP and non-GAAP gross margin, GAAP and non-GAAP operating expenses, stock-based compensation and related expenses, amortization of acquisition-related intangible assets, other income before foreign exchange gains or losses, and fully diluted shares outstanding, (ii) our outlook for the first quarter of fiscal year 2025 and the near-term, medium-term and long-term prospects of MPS, including our ability to adapt to changing market conditions, performance against our business plan, our ability to grow despite the various challenges facing our business, our industry and the global economic environment, revenue growth in certain of our market segments, potential new business segments, our continued investment in research and development (“R&D”), expected revenue growth, customers’ acceptance of our new product offerings, the prospects of our new product development, our expectations regarding market and industry segment trends and prospects, and our projected expansion of capacity and the impact it may have on our business, (iii) our ability to penetrate new markets and expand our market share, (iv) the seasonality of our business, (v) our ability to reduce our expenses, and (vi) statements regarding the assumptions underlying or relating to any statement described in (i), (ii), (iii), (iv), or (v). These forward-looking statements are not historical facts or guarantees of future performance or events, are based on current expectations, estimates, beliefs, assumptions, goals, and objectives, and involve significant known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from the results expressed by these statements. Readers of this press release and listeners to the accompanying conference call are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. Factors that could cause actual results to differ include, but are not limited to, continued uncertainties in the global economy, including due to the Russia-Ukraine and Middle East conflicts, inflation, consumer sentiment and other factors; adverse events arising from orders or regulations of governmental entities, including such orders or regulations that impact our customers or suppliers, and adoption of new or amended accounting standards; adverse changes in laws and government regulations such as tariffs on imports of foreign goods, export regulations and export classifications, and tax laws or the interpretation of same, including in foreign countries where MPS has offices or operations; the effect of export controls, trade and economic sanctions regulations and other regulatory or contractual limitations on our ability to sell or develop our products in certain foreign markets, particularly in China; our ability to obtain governmental licenses and approvals for international trading activities or technology transfers, including export licenses; acceptance of, or demand for, our products, in particular the new products launched recently, being different than expected; our ability to increase market share in our targeted markets; difficulty in predicting or budgeting for future customer demand and channel inventories, expenses and financial contingencies (including as a result of any continuing impact from the Russia-Ukraine and Middle East conflicts); our ability to efficiently and effectively develop new products and receive a return on our R&D expense investment; our ability to attract new customers and retain existing customers; our ability to meet customer demand for our products due to constraints on our third-party suppliers’ ability to manufacture sufficient quantities of our products or otherwise; our ability to expand manufacturing capacity to support future growth; adverse changes in production and testing efficiency of our products; any political, cultural, military, regulatory, economic, foreign exchange and operational changes in China, where a significant portion of our manufacturing capacity comes from; any market disruptions or interruptions in our schedule of new product development releases; our ability to manage our inventory levels; adequate supply of our products from our third-party manufacturing partners; adverse changes or developments in the semiconductor industry generally, which is cyclical in nature, and our ability to adjust our operations to address such changes or developments; the ongoing consolidation of companies in the semiconductor industry; competition generally and the increasingly competitive nature of our industry; our ability to realize the anticipated benefits of companies and products that MPS acquires, and our ability to effectively and efficiently integrate these acquired companies and products into our operations; the risks, uncertainties and costs of litigation in which MPS is involved; the outcome of any upcoming trials, hearings, motions and appeals; the adverse impact on our financial performance if its tax and litigation provisions are inadequate; our ability to effectively manage our growth and attract and retain qualified personnel; the effect of epidemics and pandemics on the global economy and on our business; the risks associated with the financial market, economy and geopolitical uncertainties, including the collapse of certain banks in the U.S. and elsewhere and the Russia-Ukraine and Middle East conflicts; and other important risk factors identified under the caption “Risk Factors” and elsewhere in our Securities and Exchange Commission (“SEC”) filings, including, but not limited to, our Annual Report on Form 10-K filed with the SEC on February 29, 2024. MPS assumes no obligation to update the information in this press release or in the accompanying webinar.

About Monolithic Power Systems

Monolithic Power Systems, Inc. (“MPS”) is a fabless global company that provides high-performance, semiconductor-based power electronics solutions. MPS’s mission is to reduce energy and material consumption to improve all aspects of quality of life. Founded in 1997 by our CEO Michael Hsing, MPS has three core strengths: deep system-level knowledge, strong semiconductor expertise, and innovative proprietary technologies in the areas of semiconductor processes, system integration, and packaging. These combined advantages enable MPS to deliver reliable, compact, and monolithic solutions that are highly energy-efficient, cost-effective, and environmentally responsible while providing a consistent return on investment to our stockholders. MPS can be contacted through its website at www.monolithicpower.com or its support offices around the world.

Monolithic Power Systems, MPS, and the MPS logo are registered trademarks of Monolithic Power Systems, Inc. in the U.S. and trademarked in certain other countries.

Contact:

Bernie Blegen

Executive Vice President and Chief Financial Officer

Monolithic Power Systems, Inc.

408-826-0777

MPSInvestor.Relations@monolithicpower.com

Monolithic Power Systems, Inc.

Condensed Consolidated Balance Sheets

(Unaudited, in thousands, except par value)

| |

|

December 31,

|

|

December 31,

|

| |

|

2024

|

|

2023

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

691,816 |

|

|

$ |

527,843 |

|

|

Short-term investments

|

|

|

171,130 |

|

|

|

580,633 |

|

|

Accounts receivable, net

|

|

|

172,518 |

|

|

|

179,858 |

|

|

Inventories

|

|

|

419,611 |

|

|

|

383,702 |

|

|

Other current assets

|

|

|

109,978 |

|

|

|

147,463 |

|

|

Total current assets

|

|

|

1,565,053 |

|

|

|

1,819,499 |

|

|

Property and equipment, net

|

|

|

494,945 |

|

|

|

368,952 |

|

|

Acquisition-related intangible assets, net

|

|

|

9,938 |

|

|

|

- |

|

|

Goodwill

|

|

|

25,944 |

|

|

|

6,571 |

|

|

Deferred tax assets, net

|

|

|

1,326,840 |

|

|

|

28,054 |

|

|

Other long-term assets

|

|

|

194,377 |

|

|

|

211,277 |

|

|

Total assets

|

|

$ |

3,617,097 |

|

|

$ |

2,434,353 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

102,526 |

|

|

$ |

62,958 |

|

|

Accrued compensation and related benefits

|

|

|

63,918 |

|

|

|

56,286 |

|

|

Other accrued liabilities

|

|

|

128,123 |

|

|

|

115,791 |

|

|

Total current liabilities

|

|

|

294,567 |

|

|

|

235,035 |

|

|

Income tax liabilities

|

|

|

65,193 |

|

|

|

60,724 |

|

|

Other long-term liabilities

|

|

|

111,570 |

|

|

|

88,655 |

|

|

Total liabilities

|

|

|

471,330 |

|

|

|

384,414 |

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Common stock and additional paid-in capital: $0.001 par value; shares authorized: 150,000; shares issued and outstanding: 47,823 and 48,028, respectively

|

|

|

706,817 |

|

|

|

1,129,937 |

|

|

Retained earnings

|

|

|

2,487,461 |

|

|

|

947,064 |

|

|

Accumulated other comprehensive loss

|

|

|

(48,511 |

) |

|

|

(27,062 |

) |

|

Total stockholders’ equity

|

|

|

3,145,767 |

|

|

|

2,049,939 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

3,617,097 |

|

|

$ |

2,434,353 |

|

Monolithic Power Systems, Inc.

Condensed Consolidated Statements of Operations

(Unaudited, in thousands, except per share amounts)

| |

|

Three Months Ended December 31,

|

|

Year Ended December 31,

|

| |

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Revenue

|

|

$ |

621,665 |

|

|

$ |

454,012 |

|

|

$ |

2,207,100 |

|

|

$ |

1,821,072 |

|

|

Cost of revenue

|

|

|

277,257 |

|

|

|

202,889 |

|

|

|

986,230 |

|

|

|

799,953 |

|

|

Gross profit

|

|

|

344,408 |

|

|

|

251,123 |

|

|

|

1,220,870 |

|

|

|

1,021,119 |

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

85,762 |

|

|

|

71,459 |

|

|

|

324,748 |

|

|

|

263,643 |

|

|

Selling, general and administrative

|

|

|

95,339 |

|

|

|

70,095 |

|

|

|

356,764 |

|

|

|

275,740 |

|

|

Total operating expenses

|

|

|

181,101 |

|

|

|

141,554 |

|

|

|

681,512 |

|

|

|

539,383 |

|

|

Operating income

|

|

|

163,307 |

|

|

|

109,569 |

|

|

|

539,358 |

|

|

|

481,736 |

|

|

Other income, net

|

|

|

6,224 |

|

|

|

9,976 |

|

|

|

33,554 |

|

|

|

24,105 |

|

|

Income before income taxes

|

|

|

169,531 |

|

|

|

119,545 |

|

|

|

572,912 |

|

|

|

505,841 |

|

|

Income tax expense (benefit), net

|

|

|

(1,279,832 |

) |

|

|

22,640 |

|

|

|

(1,213,788 |

) |

|

|

78,467 |

|

|

Net income

|

|

$ |

1,449,363 |

|

|

$ |

96,905 |

|

|

$ |

1,786,700 |

|

|

$ |

427,374 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

30.00 |

|

|

$ |

2.02 |

|

|

$ |

36.76 |

|

|

$ |

8.98 |

|

|

Diluted

|

|

$ |

29.88 |

|

|

$ |

1.98 |

|

|

$ |

36.59 |

|

|

$ |

8.76 |

|

|

Weighted-average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

48,317 |

|

|

|

47,936 |

|

|

|

48,599 |

|

|

|

47,610 |

|

|

Diluted

|

|

|

48,506 |

|

|

|

48,881 |

|

|

|

48,835 |

|

|

|

48,771 |

|

|

SUPPLEMENTAL FINANCIAL INFORMATION

|

|

STOCK-BASED COMPENSATION EXPENSE

|

|

(Unaudited, in thousands)

|

| |

|

Three Months Ended December 31,

|

|

Year Ended December 31,

|

| |

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Cost of revenue

|

|

$ |

1,720 |

|

|

$ |

1,228 |

|

|

$ |

6,305 |

|

|

$ |

4,545 |

|

|

Research and development

|

|

|

12,166 |

|

|

|

10,204 |

|

|

|

45,626 |

|

|

|

36,611 |

|

|

Selling, general and administrative

|

|

|

42,124 |

|

|

|

29,675 |

|

|

|

153,709 |

|

|

|

108,555 |

|

|

Total stock-based compensation expense

|

|

$ |

56,010 |

|

|

$ |

41,107 |

|

|

$ |

205,640 |

|

|

$ |

149,711 |

|

|

RECONCILIATION OF NET INCOME TO NON-GAAP NET INCOME

|

|

(Unaudited, in thousands, except per share amounts)

|

| |

|

Three Months Ended December 31,

|

|

Year Ended December 31,

|

| |

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Net income

|

|

$ |

1,449,363 |

|

|

$ |

96,905 |

|

|

$ |

1,786,700 |

|

|

$ |

427,374 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income to non-GAAP net income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation and related expenses*

|

|

|

56,320 |

|

|

|

41,107 |

|

|

|

213,209 |

|

|

|

149,711 |

|

|

Amortization of acquisition-related intangible assets

|

|

|

320 |

|

|

|

33 |

|

|

|

1,303 |

|

|

|

132 |

|

|

Deferred compensation plan expense, net

|

|

|

573 |

|

|

|

288 |

|

|

|

867 |

|

|

|

1,055 |

|

|

Tax effect of non-GAAP adjustments

|

|

|

(22,773 |

) |

|

|

2,519 |

|

|

|

(26,922 |

) |

|

|

(3,625 |

) |

|

Recognition of a tax benefit granted to a foreign subsidiary

|

|

|

(1,285,402 |

) |

|

|

- |

|

|

|

(1,285,402 |

) |

|

|

- |

|

|

Non-GAAP net income

|

|

$ |

198,401 |

|

|

$ |

140,852 |

|

|

$ |

689,755 |

|

|

$ |

574,647 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

4.11 |

|

|

$ |

2.94 |

|

|

$ |

14.19 |

|

|

$ |

12.07 |

|

|

Diluted

|

|

$ |

4.09 |

|

|

$ |

2.88 |

|

|

$ |

14.12 |

|

|

$ |

11.78 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in the calculation of non-GAAP net income per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

48,317 |

|

|

|

47,936 |

|

|

|

48,599 |

|

|

|

47,610 |

|

|

Diluted

|

|

|

48,506 |

|

|

|

48,881 |

|

|

|

48,835 |

|

|

|

48,771 |

|

*Prior periods exclude stock-based compensation related employer payroll taxes from non-GAAP measures due to immateriality.

|

RECONCILIATION OF GROSS MARGIN TO NON-GAAP GROSS MARGIN

|

|

(Unaudited, in thousands)

|

| |

|

Three Months Ended December 31,

|

|

Year Ended December 31,

|

| |

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Gross profit

|

|

$ |

344,408 |

|

|

$ |

251,123 |

|

|

$ |

1,220,870 |

|

|

$ |

1,021,119 |

|

|

Gross margin

|

|

|

55.4 |

% |

|

|

55.3 |

% |

|

|

55.3 |

% |

|

|

56.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile gross profit to non-GAAP gross profit:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation and related expenses*

|

|

|

1,745 |

|

|

|

1,228 |

|

|

|

6,975 |

|

|

|

4,545 |

|

|

Amortization of acquisition-related intangible assets

|

|

|

287 |

|

|

|

- |

|

|

|

1,171 |

|

|

|

- |

|

|

Deferred compensation plan expense

|

|

|

417 |

|

|

|

486 |

|

|

|

1,500 |

|

|

|

871 |

|

|

Non-GAAP gross profit

|

|

$ |

346,857 |

|

|

$ |

252,837 |

|

|

$ |

1,230,516 |

|

|

$ |

1,026,535 |

|

|

Non-GAAP gross margin

|

|

|

55.8 |

% |

|

|

55.7 |

% |

|

|

55.8 |

% |

|

|

56.4 |

% |

*Prior periods exclude stock-based compensation related employer payroll taxes from non-GAAP measures due to immateriality.

|

RECONCILIATION OF OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES

|

|

(Unaudited, in thousands)

|

| |

|

Three Months Ended December 31,

|

|

Year Ended December 31,

|

| |

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Total operating expenses

|

|

$ |

181,101 |

|

|

$ |

141,554 |

|

|

$ |

681,512 |

|

|

$ |

539,383 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile total operating expenses to non-GAAP total operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation and related expenses*

|

|

|

(54,575 |

) |

|

|

(39,879 |

) |

|

|

(206,234 |

) |

|

|

(145,166 |

) |

|

Amortization of acquisition-related intangible assets

|

|

|

(33 |

) |

|

|

(33 |

) |

|

|

(132 |

) |

|

|

(132 |

) |

|

Deferred compensation plan expense

|

|

|

(376 |

) |

|

|

(4,897 |

) |

|

|

(8,767 |

) |

|

|

(8,690 |

) |

|

Non-GAAP operating expenses

|

|

$ |

126,117 |

|

|

$ |

96,745 |

|

|

$ |

466,379 |

|

|

$ |

385,395 |

|

*Prior periods exclude stock-based compensation related employer payroll taxes from non-GAAP measures due to immateriality.

|

RECONCILIATION OF OPERATING INCOME TO NON-GAAP OPERATING INCOME

|

|

(Unaudited, in thousands)

|

| |

|

Three Months Ended December 31,

|

|

Year Ended December 31,

|

| |

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Total operating income

|

|

$ |

163,307 |

|

|

$ |

109,569 |

|

|

$ |

539,358 |

|

|

$ |

481,736 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile total operating income to non-GAAP total operating income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation and related expenses*

|

|

|

56,320 |

|

|

|

41,107 |

|

|

|

213,209 |

|

|

|

149,711 |

|

|

Amortization of acquisition-related intangible assets

|

|

|

320 |

|

|

|

33 |

|

|

|

1,303 |

|

|

|

132 |

|

|

Deferred compensation plan expense

|

|

|

793 |

|

|

|

5,383 |

|

|

|

10,267 |

|

|

|

9,561 |

|

|

Non-GAAP operating income

|

|

$ |

220,740 |

|

|

$ |

156,092 |

|

|

$ |

764,137 |

|

|

$ |

641,140 |

|

*Prior periods exclude stock-based compensation related employer payroll taxes from non-GAAP measures due to immateriality.

|

RECONCILIATION OF OTHER INCOME, NET, TO NON-GAAP OTHER INCOME, NET

|

|

(Unaudited, in thousands)

|

| |

|

Three Months Ended December 31,

|

|

Year Ended December 31,

|

| |

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Total other income, net

|

|

$ |

6,224 |

|

|

$ |

9,976 |

|

|

$ |

33,554 |

|

|

$ |

24,105 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile other income, net to non-GAAP other income, net:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred compensation plan income

|

|

|

(220 |

) |

|

|

(5,095 |

) |

|

|

(9,400 |

) |

|

|

(8,506 |

) |

|

Non-GAAP other income, net

|

|

$ |

6,004 |

|

|

$ |

4,881 |

|

|

$ |

24,154 |

|

|

$ |

15,599 |

|

|

RECONCILIATION OF INCOME BEFORE INCOME TAXES TO NON-GAAP INCOME BEFORE INCOME TAXES

|

|

|

(Unaudited, in thousands)

|

|

| |

|

Three Months Ended December 31,

|

|

Year Ended December 31,

|

| |

|

2024

|

|

2023

|

|

2024

|

|

2023

|

|

Total income before income taxes

|

|

$ |

169,531 |

|

|

$ |

119,545 |

|

|

$ |

572,912 |

|

|

$ |

505,841 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile income before income taxes to non-GAAP income before income taxes:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation and related expenses*

|

|

|

56,320 |

|

|

|

41,107 |

|

|

|

213,209 |

|

|

|

149,711 |

|

|

Amortization of acquisition-related intangible assets

|

|

|

320 |

|

|

|

33 |

|

|

|

1,303 |

|

|

|

132 |

|

|

Deferred compensation plan expense, net

|

|

|

573 |

|

|

|

288 |

|

|

|

867 |

|

|

|

1,055 |

|

|

Non-GAAP income before income taxes

|

|

$ |

226,744 |

|

|

$ |

160,973 |

|

|

$ |

788,291 |

|

|

$ |

656,739 |

|

*Prior periods exclude stock-based compensation related employer payroll taxes from non-GAAP measures due to immateriality.

|

2025 FIRST QUARTER OUTLOOK

|

|

RECONCILIATION OF GROSS MARGIN TO NON-GAAP GROSS MARGIN

|

|

(Unaudited)

|

| |

|

Three Months Ending

|

| |

|

March 31, 2025

|

| |

|

Low

|

|

High

|

|

Gross margin

|

|

|

55.1 |

% |

|

|

55.7 |

% |

|

Adjustment to reconcile gross margin to non-GAAP gross margin:

|

|

|

|

|

|

|

|

|

|

Stock-based compensation and other expenses

|

|

|

0.3 |

% |

|

|

0.3 |

% |

|

Non-GAAP gross margin

|

|

|

55.4 |

% |

|

|

56.0 |

% |

| RECONCILIATION OF OPERATING EXPENSES TO NON-GAAP OPERATING EXPENSES |

|

(Unaudited, in thousands)

|

| |

|

Three Months Ending

|

| |

|

March 31, 2025

|

| |

|

Low

|

|

High

|

|

Operating expenses

|

|

$ |

180,200 |

|

|

$ |

186,200 |

|

|

Adjustments to reconcile operating expenses to non-GAAP operating expenses:

|

|

|

|

|

|

|

|

|

|

Stock-based compensation and other expenses

|

|

|

(53,300 |

) |

|

|

(55,300 |

) |

|

Non-GAAP operating expenses

|

|

$ |

126,900 |

|

|

$ |

130,900 |

|

Exhibit 99.2

Monolithic Power Systems

Full Year 2024 and Q4’24 Earnings Commentary

The highest quality power solutions for

Industrial Applications, Telecom Infrastructures,

Cloud Computing, Automotive, and Consumer Applications

|

Monolithic Power Systems to Report Fourth Quarter and Full Year 2024 Results on February 6, 2025

MPS will report its results after the market closes on February 6, 2025 and host a question-and-answer webinar at 2:00 p.m. PT / 5:00 p.m. ET. The live event will be held via a Zoom webcast, which can be accessed at https://mpsic.zoom.us/j/96816578886.

|

| 2024 Financial Summary |

(Unaudited) |

| |

|

2024

|

|

|

2023

|

|

YoY Change

|

YoY Change (%)

|

|

Revenue ($k)

|

|

|

$ 2,207,100 |

|

|

|

$ 1,821,072 |

|

Up $ 386,028

|

Up 21.2%

|

|

Gross Margin

|

|

|

55.3% |

|

|

|

56.1% |

|

Down 0.8 pts

|

Down 1.4%

|

|

Opex ($k)

|

|

|

$ 681,512 |

|

|

|

$ 539,383 |

|

Up $ 142,129

|

Up 26.4%

|

|

Operating Margin

|

|

|

24.4% |

|

|

|

26.5% |

|

Down 2.1 pts

|

Down 7.9%

|

|

Net income ($k)

|

|

|

$ 1,786,700 |

|

|

|

$ 427,374 |

|

Up $ 1,359,326

|

Up 318.1%

|

|

Diluted EPS

|

|

|

$ 36.59 |

|

|

|

$ 8.76 |

|

Up $ 27.83

|

Up 317.7%

|

| |

|

2024

|

|

|

2023

|

|

YoY Change

|

YoY Change (%)

|

|

Revenue ($k)

|

|

|

$ 2,207,100 |

|

|

|

$ 1,821,072 |

|

Up $ 386,028

|

Up 21.2%

|

|

Gross Margin

|

|

|

55.8% |

|

|

|

56.4% |

|

Down 0.6 pts

|

Down 1.1%

|

|

Opex ($k)

|

|

|

$ 466,379 |

|

|

|

$ 385,395 |

|

Up $ 80,984

|

Up 21.0%

|

|

Operating Margin

|

|

|

34.6% |

|

|

|

35.2% |

|

Down 0.6 pts

|

Down 1.7%

|

|

Net income ($k)

|

|

|

$ 689,755 |

|

|

|

$ 574,647 |

|

Up $ 115,108

|

Up 20.0%

|

|

Diluted EPS

|

|

|

$ 14.12 |

|

|

|

$ 11.78 |

|

Up $ 2.34

|

Up 19.9%

|

| |

|

Revenue

|

|

|

YoY Change

|

|

|

% of Total Rev

|

|

|

End Market ($M)

|

|

2024

|

|

|

2023

|

|

|

$

|

|

|

%

|

|

|

2024

|

|

|

2023

|

|

|

Enterprise Data

|

|

|

$ 716.2 |

|

|

|

$ 323.0 |

|

|

|

$ 393.2 |

|

|

|

121.7% |

|

|

|

32.5% |

|

|

|

17.7% |

|

|

Storage & Computing

|

|

|

501.6 |

|

|

|

491.1 |

|

|

|

10.5 |

|

|

|

2.1% |

|

|

|

22.7 |

|

|

|

27.0 |

|

|

Automotive

|

|

|

414.0 |

|

|

|

394.7 |

|

|

|

19.3 |

|

|

|

4.9% |

|

|

|

18.8 |

|

|

|

21.7 |

|

|

Communications

|

|

|

225.9 |

|

|

|

204.9 |

|

|

|

21.0 |

|

|

|

10.2% |

|

|

|

10.2 |

|

|

|

11.3 |

|

|

Consumer

|

|

|

202.0 |

|

|

|

234.7 |

|

|

|

(32.7 |

) |

|

|

(13.9%) |

|

|

|

9.1 |

|

|

|

12.9 |

|

|

Industrial

|

|

|

147.4 |

|

|

|

172.7 |

|

|

|

(25.3 |

) |

|

|

(14.6%) |

|

|

|

6.7 |

|

|

|

9.4 |

|

|

Total

|

|

|

$ 2,207.1 |

|

|

|

$ 1,821.1 |

|

|

|

$ 386.0 |

|

|

|

21.2% |

|

|

|

100% |

|

|

|

100% |

|

| Q4 2024 Financial Summary |

(Unaudited) |

| |

|

Q4'24

|

|

|

Q3'24

|

|

|

Q4'23

|

|

QoQ Change

|

YoY Change

|

|

Revenue ($k)

|

|

|

$ 621,665 |

|

|

|

$ 620,119 |

|

|

|

$ 454,012 |

|

Up 0.2%

|

Up 36.9%

|

|

Gross Margin

|

|

|

55.4% |

|

|

|

55.4% |

|

|

|

55.3% |

|

Flat

|

Up 0.1 pts

|

|

Opex ($k)

|

|

|

$ 181,101 |

|

|

|

$ 179,415 |

|

|

|

$ 141,554 |

|

Up 0.9%

|

Up 27.9%

|

|

Operating Margin

|

|

|

26.3% |

|

|

|

26.5% |

|

|

|

24.1% |

|

Down 0.2 pts

|

Up 2.2 pts

|

|

Net income ($k)

|

|

|

$ 1,449,363 |

|

|

|

$ 144,430 |

|

|

|

$ 96,905 |

|

Up 903.5%

|

Up 1395.7%

|

|

Diluted EPS

|

|

|

$ 29.88 |

|

|

|

$ 2.95 |

|

|

|

$ 1.98 |

|

Up 912.9%

|

Up 1409.1%

|

| |

|

Q4'24

|

|

|

Q3'24

|

|

|

Q4'23

|

|

QoQ Change

|

YoY Change

|

|

Revenue ($k)

|

|

|

$ 621,665 |

|

|

|

$ 620,119 |

|

|

|

$ 454,012 |

|

Up 0.2%

|

Up 36.9%

|

|

Gross Margin

|

|

|

55.8% |

|

|

|

55.8% |

|

|

|

55.7% |

|

Flat

|

Up 0.1 pts

|

|

Opex ($k)

|

|

|

$ 126,117 |

|

|

|

$ 125,169 |

|

|

|

$ 96,745 |

|

Up 0.8%

|

Up 30.4%

|

|

Operating Margin

|

|

|

35.5% |

|

|

|

35.6% |

|

|

|

34.4% |

|

Down 0.1 pts

|

Up 1.1 pts

|

|

Net income ($k)

|

|

|

$ 198,401 |

|

|

|

$ 198,786 |

|

|

|

$ 140,852 |

|

Down 0.2%

|

Up 40.9%

|

|

Diluted EPS

|

|

|

$ 4.09 |

|

|

|

$ 4.06 |

|

|

|

$ 2.88 |

|

Up 0.7%

|

Up 42.0%

|

| |

|

Revenue

|

|

|

YoY Change

|

|

|

% of Total Rev

|

|

|

End Market ($M)

|

|

Q4’24

|

|

|

Q4’23

|

|

|

$

|

|

|

%

|

|

|

Q4’24

|

|

|

Q4’23

|

|

|

Enterprise Data

|

|

|

$ 194.9 |

|

|

|

$ 128.9 |

|

|

|

$ 66.0 |

|

|

|

51.2% |

|

|

|

31.3% |

|

|

|

28.4% |

|

|

Storage & Computing

|

|

|

136.5 |

|

|

|

117.3 |

|

|

|

19.2 |

|

|

|

16.4% |

|

|

|

22.0 |

|

|

|

25.8 |

|

|

Automotive

|

|

|

128.4 |

|

|

|

89.8 |

|

|

|

38.6 |

|

|

|

43.0% |

|

|

|

20.6 |

|

|

|

19.8 |

|

|

Communications

|

|

|

63.8 |

|

|

|

40.9 |

|

|

|

22.9 |

|

|

|

55.9% |

|

|

|

10.3 |

|

|

|

9.0 |

|

|

Consumer

|

|

|

57.3 |

|

|

|

43.7 |

|

|

|

13.6 |

|

|

|

31.0% |

|

|

|

9.2 |

|

|

|

9.6 |

|

|

Industrial

|

|

|

40.8 |

|

|

|

33.4 |

|

|

|

7.4 |

|

|

|

22.3% |

|

|

|

6.6 |

|

|

|

7.4 |

|

|

Total

|

|

|

$ 621.7 |

|

|

|

$ 454.0 |

|

|

|

$ 167.7 |

|

|

|

36.9% |

|

|

|

100% |

|

|

|

100% |

|

Ongoing Business Conditions

In 2024, MPS’s revenue grew 21.2% year-over-year and achieved record revenue of $2.2 billion. This is our 13th consecutive year of revenue growth driven by consistent execution, continued innovation, and strong customer focus.

Highlights from 2024 include:

| |

●

|

We introduced a Silicon Carbide inverter for high power clean energy applications. Initial revenue is expected to ramp in late 2025. Other Silicon Carbide-based applications are expected to be introduced in multiple geographies during 2025 and 2026.

|

| |

●

|

We developed a family of high quality, cost efficient automotive audio products utilizing DSP technology from our 2024 Axign acquisition powered by MPS solutions.

|

| |

●

|

For enterprise notebooks, we launched a battery management solution and are sampling our new mini-phase power stage. These products enable faster charge time and significantly improve notebook battery life.

|

| |

●

|

Building on our first analog to digital converter design win in 2024, we are developing new high accuracy 24-bit converters which are expected to ramp in the second half of 2025.

|

| |

●

|

We executed a $640M stock repurchase program offsetting dilution for our shareholders.

|

In Q4 2024, MPS achieved record quarterly revenue of $621.7 million, slightly higher than revenue in the third quarter of 2024 and 36.9% higher than revenue in the fourth quarter of 2023. Our performance during the quarter reflected the continued strength of our diversified market strategy and a continued trend of the improved ordering patterns we saw in Q3 2024.

MPS continues to focus on innovation, solving our customers’ most challenging problems, and maintaining the highest level of quality. We continue to invest in new technology, expand into new markets, and to diversify our end-market applications and global supply chain. This will allow us to capture future growth opportunities, maintain supply stability, and swiftly adapt to market changes as they occur.

“Our proven, long-term growth strategy remains intact as we continue our transformation from being a chip-only, semiconductor supplier to a full service, silicon-based solutions provider,” said Michael Hsing, CEO and founder of MPS.

2024 Full Year Revenue Results

Our full year 2024 revenue by market segment was as follows:

Full year 2024 Enterprise Data revenue grew $393.2 million to $716.2 million. This 121.7% increase was due to higher sales of our power management solutions for AI and server applications. Enterprise Data revenue represented 32.5% of MPS’s total revenue in 2024 compared with 17.7% in 2023.

Communications revenue grew by $21.0 million in 2024 to $225.9 million. This 10.2% increase was a result of higher sales of power solutions for optical modules and routers, partially offset by lower sales of networking solutions. Communications revenue represented 10.2% of our 2024 revenue compared with 11.3% in 2023.

Automotive revenue grew $19.3 million year-over-year to $414.0 million in 2024. This 4.9% gain was driven by increased sales of our highly integrated applications supporting advanced driver assistance systems. Automotive revenue represented 18.8% of MPS’s full year 2024 revenue compared with 21.7% in 2023.

Storage and Computing revenue for 2024 grew $10.5 million over the prior year to $501.6 million. This 2.1% increase was primarily driven by increased sales of products for notebooks. Storage and Computing revenue represented 22.7% of MPS’s total revenue in 2024 compared with 27.0% in 2023.

Consumer revenue decreased $32.7 million to $202.0 million in 2024. This 13.9% year-over-year decrease was a result of broad market weakness. Consumer revenue represented 9.1% of MPS’s full year 2024 revenue compared with 12.9% in 2023.

Industrial revenue fell by $25.3 million to $147.4 million in 2024. This 14.6% decrease was due to general market weakness across all industrial segments. Industrial revenue represented 6.7% of MPS’s full year 2024 revenue compared with 9.4% in 2023.

Q4’24 Revenue Results

MPS reported fourth quarter revenue of $621.7 million, slightly higher than the third quarter of 2024 and 36.9% higher than the fourth quarter of 2023. Compared with the third quarter of 2024, sales in Automotive and Enterprise Data improved sequentially.

Fourth quarter Automotive revenue of $128.4 million increased 15.3% from the third quarter of 2024 primarily from higher sales in ADAS and infotainment power solutions. Fourth quarter 2024 Automotive revenue was up 43.0% year over year. Automotive revenue represented 20.6% of MPS’s fourth quarter 2024 revenue compared with 19.8% in the fourth quarter of 2023.

In our Enterprise Data market, fourth quarter 2024 revenue of $194.9 million increased 5.6% from the third quarter of 2024. Fourth quarter 2024 Enterprise Data revenue was up 51.2% year over year. Enterprise Data revenue represented 31.3% of MPS’s fourth quarter 2024 revenue compared with 28.4% in the fourth quarter of 2023.

Fourth quarter 2024 Storage and Computing revenue of $136.5 million decreased 5.2% from the third quarter of 2024. The sequential decrease was primarily driven by lower sales in notebooks, partially offset by stronger sales in graphic cards. Fourth quarter 2024 Storage and Computing revenue was up 16.4% year over year. Storage and Computing revenue represented 22.0% of MPS’s fourth quarter 2024 revenue compared with 25.8% in the fourth quarter of 2023.

Fourth quarter 2024 Industrial revenue of $40.8 million decreased 7.3% from the third quarter of 2024 due to lower sales for security and power sources. Fourth quarter 2024 Industrial revenue was up 22.3% year over year. Industrial revenue represented 6.6% of our total fourth quarter 2024 revenue compared with 7.4% in the fourth quarter of 2023.

Fourth quarter Consumer revenue of $57.3 million decreased 11.0% from the third quarter of 2024 primarily from lower sales in smart TVs, home appliance and gaming solutions. Fourth quarter 2024 Consumer revenue was up 31.0% year over year. Consumer revenue represented 9.2% of MPS’s fourth quarter 2024 revenue compared with 9.6% in the fourth quarter of 2023.

Fourth quarter 2024 Communications revenue of $63.8 million was down 11.2% from the third quarter of 2024 reflecting lower sales in networking solutions, partially offset by higher sales in optical solutions. Fourth quarter 2024 Communications revenue was up 55.9% year over year. Communications sales represented 10.3% of our total fourth quarter 2024 revenue compared with 9.0% in the fourth quarter of 2023.

Q4’24 Gross Margin & Operating Income

GAAP gross margin was 55.4%, flat to the third quarter of 2024. Our GAAP operating income was approximately $163.3 million compared to $164.0 million reported in the third quarter of 2024.

Non-GAAP gross margin for the fourth quarter of 2024 was 55.8%, flat to the third quarter of 2024. Our non-GAAP operating income was $220.7 million compared to $220.8 million reported in the third quarter of 2024.

Q4’24 Operating Expenses

Our GAAP operating expenses were $181.1 million in the fourth quarter of 2024 compared with $179.4 million in the third quarter of 2024.

Our Non-GAAP operating expenses were approximately $126.1 million, up from $125.2 million in the third quarter of 2024.

The differences between non-GAAP operating expenses and GAAP operating expenses for the quarters discussed here are primarily stock-based compensation and related expense and deferred compensation plan expense.

Total stock-based compensation and related expenses, including approximately $1.7 million charged to cost of goods sold, was $56.3 million compared with $52.4 million recorded in the third quarter of 2024.

The Bottom Line

Fourth quarter 2024 GAAP net income was $1.4 billion or $29.88 per fully diluted share, compared with $144.4 million or $2.95 per share in the third quarter of 2024. Fourth quarter GAAP net income and EPS included the recognition of a tax benefit granted to a foreign subsidiary.

Fourth quarter 2024 non-GAAP net income was $198.4 million or $4.09 per fully diluted share, compared with $198.8 million or $4.06 per fully diluted share in the third quarter of 2024.

There were 48.5 million fully diluted shares outstanding at the end of the fourth quarter of 2024. MPS repurchased $622M in stock during the fourth quarter of 2024.

Balance Sheet and Cash Flow

Cash, cash equivalents and short-term investments were $862.9 million at the end of the fourth quarter of 2024 compared to $1.46 billion at the end of the third quarter of 2024. The change was driven primarily by the share repurchases made in the fourth quarter. For the fourth quarter of 2024, MPS generated operating cash flow of approximately $167.7 million compared with the third quarter of 2024 operating cash flow of $231.7 million.

Accounts receivable at the end of the fourth quarter of 2024 at $172.5 million, representing 25 days of sales outstanding, which was 1 day higher than the 24 days reported at the end of the third quarter of 2024.

Our internal inventories at the end of the fourth quarter of 2024 were $419.6 million, down from $424.9 million at the end of the third quarter of 2024. Days of inventory of 138 days at the end of the fourth quarter of 2024 was 2 days lower than at the end of the third quarter of 2024.

We have carefully managed our internal inventories throughout the year, balancing the uncertainty in the market with being prepared to capture market upturns when they occur. Comparing current inventory levels using next quarter’s projected revenue, days of inventory at the end of the fourth quarter of 138 days was 2 days lower than at the end of the third quarter of 2024.

|

Selected Balance Sheet and Inventory Data

|

(Unaudited)

|

| |

|

Q4'24

|

|

|

Q3'24

|

|

|

Q4'23

|

|

|

Cash, Cash Equivalents, and Short-Term Investments

|

|

$ |

862.9 M |

|

|

$ |

1,462.4 M |

|

|

$ |

1,108.5 M |

|

|

Operating Cash Flow

|

|

$ |

167.7 M |

|

|

$ |

231.7 M |

|

|

$ |

153.3 M |

|

|

Accounts Receivable

|

|

$ |

172.5 M |

|

|

$ |

164.7 M |

|

|

$ |

179.9 M |

|

|

Days of Sales Outstanding

|

|

25 Days

|

|

|

24 Days

|

|

|

36 Days

|

|

|

Internal Inventories

|

|

$ |

419.6 M |

|

|

$ |

424.9 M |

|

|

$ |

383.7 M |

|

|

Days of Inventory (current quarter revenue)

|

|

138 Days

|

|

|

140 Days

|

|

|

172 Days

|