Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-267921

PROSPECTUS

SUPPLEMENT

(To Prospectus Dated October 26, 2022)

Up

to $2,100,000

Common Stock

Netcapital

Inc.

We

have entered into an At The Market Offering Agreement (the “Offering Agreement”) with H.C. Wainwright & Co., LLC (the

“Sales Agent” or “Wainwright”), relating to the sale of our common stock, par value $0.001 per share, offered

by this prospectus supplement and the accompanying prospectus. In accordance with the terms of the Offering Agreement, we may offer and

sell shares of our common stock having an aggregate offering price of up to $2,100,000 from time to time through Wainwright acting

as our sales agent.

Sales

of common stock, if any, under this prospectus supplement and the accompanying prospectus may be made in transactions that are deemed

to be “at-the-market” offerings as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities

Act”), including sales made directly on or through The Nasdaq Capital Market LLC (the “Nasdaq”), the existing trading

market for our common stock, or any other existing trading market in the Unites States for our common stock, sales made to or through

a market maker other than on an exchange or otherwise, directly to the Sales Agent as principal, in negotiated transactions at market

prices prevailing at the time of sale or at prices related to such prevailing market prices, and/or in any other method permitted by

law. Wainwright is not required to sell any specific number or dollar amount of shares, but will act as sales agent on a commercially

reasonable efforts basis consistent with its normal trading and sales practices. There is no arrangement for funds to be received in

any escrow, trust or similar arrangement.

We

will pay Wainwright a commission of 3.0% of the gross sales price per share of common stock issued by us and sold through it as our sales

agent under the Offering Agreement. In connection with the sale of common stock on our behalf, Wainwright will be deemed to be an “underwriter”

within the meaning of the Securities Act and the compensation of Wainwright will be deemed to be underwriting commissions or discounts.

We provide more information about how the shares of common stock will be sold in the section entitled “Plan of Distribution.”

Our

common stock is traded on Nasdaq under the symbol “NCPL.” On August 19, 2024, the last reported sale price of our

common stock was $3.65 per share.

As

of the date of this prospectus supplement, the aggregate market value of our common stock held by non-affiliates, or our public float,

was approximately $6,410,641 based on a total number of 718,934 shares of common stock outstanding, of which 688,783 shares

of common stock were held by non-affiliates, at a price of $9.3072 per share, the closing sales price of our common stock on June

25, 2024, which is the highest closing price of our common stock on the Nasdaq within the prior 60 days. We have not sold

any securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12-calendar month period that ends on and includes

the date of this prospectus supplement (excluding this offering). Accordingly, based on the foregoing, we are currently eligible under

General Instruction I.B.6 of Form S-3 to offer and sell shares of our Common Stock having an aggregate offering price of up to approximately

$2,136,880. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in a public primary offering

with a value exceeding one-third of our public float in any 12-month period so long as our public float remains below $75.0 million.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-11 of this prospectus supplement,

page 11 of the accompanying base prospectus and under similar headings in the documents incorporated by reference into this prospectus

supplement and the accompanying base prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus supplement or the accompanying base prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

H.C.

Wainwright & Co.

The

date of this prospectus supplement is August 23, 2024

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying base prospectus form a part of a registration statement on Form S-3 (File No. 333-267921),

which was declared effective on October 26, 2022, that we filed with the Securities Exchange Commission (“SEC”) utilizing

a “shelf’ registration process. This document is in two parts. The first part is the prospectus supplement, which describes

the specific terms of this offering. The second part, the accompanying base prospectus, provides more general information about the securities

we may offer from time to time, some of which may not apply to the securities offered by this prospectus supplement. Generally, when

we refer to this prospectus, we are referring to both parts of this document combined. Before you invest, you should carefully read this

prospectus supplement, the accompanying base prospectus, all information incorporated by reference herein and therein, and the additional

information described under “Where You Can Find More Information” in this prospectus supplement. These documents contain

information you should consider when making your investment decision. This prospectus supplement may add, update or change information

contained in the accompanying base prospectus. To the extent that any statement that we make in this prospectus supplement is inconsistent

with statements made in the accompanying base prospectus or any documents incorporated by reference therein, the statements made in this

prospectus supplement will be deemed to modify or supersede those made in the accompanying base prospectus and such documents incorporated

by reference therein.

You

should rely only on the information contained or incorporated herein by reference in this prospectus supplement and contained or incorporated

therein by reference in the accompanying base prospectus. We have not authorized any other person to provide you with any information

that is different. If anyone provides you with different, additional or inconsistent information, you should not rely on it.

We

are offering to sell our securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement

and the accompanying base prospectus and the offering of the securities in certain jurisdictions may be restricted by law. This prospectus

supplement and the accompanying base prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation

of an offer to buy, any securities offered by this prospectus supplement and the accompanying base prospectus by any person in any jurisdiction

in which it is unlawful for such person to make such an offer or solicitation.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in the prospectus supplement and the accompanying base prospectus were made solely for the benefit

of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements,

and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants

were accurate only as of the date when made.

Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless

the context otherwise requires, references in this prospectus supplement to the “Company,” “we,” “us”

and “our” refer to Netcapital Inc. and its subsidiaries.

We

have authorized only the information contained or incorporated by reference in this prospectus supplement, the accompanying base prospectus,

and any free writing prospectus prepared by or on behalf of us or to which we have referred you. We have not, and Wainwright has not, authorized anyone to provide you with information that is different. We and Wainwright take no responsibility

for, and can provide no assurance as to the reliability of, any information that others may give you. We are offering to sell, and seeking

offers to buy, our common stock only in jurisdictions where offers and sales are permitted. The information contained in or incorporated

by reference in this document is accurate only as of the date such information was issued, regardless of the time of delivery of this

prospectus supplement or the date of any sale of our common stock.

CAUTIONARY

NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying base prospectus and the documents that we incorporate by reference, contains forward-looking

statements as that term is defined in the federal securities laws. The events described in forward-looking statements contained in this

prospectus supplement and the accompanying base prospectus, including the documents that we incorporate by reference, may not occur.

Generally, these statements relate to our business plans or strategies, projected or anticipated benefits or other consequences of our

plans or strategies, financing plans, projected or anticipated benefits from acquisitions that we may make, or projections involving

anticipated revenues, earnings or other aspects of our operating results or financial position, and the outcome of any contingencies.

Any such forward-looking statements are based on current expectations, estimates and projections of management. We intend for these forward-looking

statements to be covered by the safe-harbor provisions for forward-looking statements. Words such as “may,” “expect,”

“believe,” “anticipate,” “project,” “plan,” “intend,” “estimate,”

and “continue,” and their opposites and similar expressions are intended to identify forward-looking statements. We caution

you that these statements are not guarantees of future performance or events and are subject to a number of uncertainties, risks and

other influences, many of which are beyond our control that may influence the accuracy of the statements and the projections upon which

the statements are based. Factors that may affect our results include, but are not limited to, the risks and uncertainties discussed

in the “Risk Factors” section on page S-11 of this prospectus supplement, in our Annual Report on Form 10-K for the fiscal

year ended April 30, 2023 or in other reports we file

with the SEC.

Any

one or more of these uncertainties, risks and other influences could materially affect our results of operations and whether forward-looking

statements made by us ultimately prove to be accurate. Our actual results, performance and achievements could differ materially from

those expressed or implied in these forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking

statements, whether from new information, future events or otherwise.

You

should rely only on the information in this prospectus supplement, the accompanying prospectus and the documents that we incorporate

by reference herein and therein. We have not authorized any other person to provide you with different information. If anyone provides

you with different or inconsistent information, you should not rely upon it.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights selected information contained elsewhere in this prospectus supplement, the accompanying base prospectus and in the

documents we incorporate by reference. This summary does not contain all of the information you should consider before investing in our

common stock. You should read this entire prospectus supplement and the accompanying base prospectus carefully, especially the risks

of investing in our common stock discussed under “Risk Factors” beginning on page S-11 of this prospectus supplement and

under similar sections of the accompanying base prospectus and other periodic reports incorporated herein and therein by reference, along

with our consolidated financial statements and notes to those consolidated financial statements, before making an investment decision.

On August 1,

2024, we effectuated a 1-for-70 reverse split of our outstanding shares of common stock. No fractional shares were issued in connection

with the reverse stock split and all such fractional interests were rounded up to the nearest whole number of shares of common stock.

The exercise prices of our issued and outstanding convertible securities, including shares issuable upon exercise of outstanding stock

options and warrants, have been adjusted accordingly. All information presented in this prospectus supplement has been retroactively

restated to give effect to our 1-for-70 reverse split of our outstanding shares of common stock and unless otherwise indicated, all such

amounts and corresponding exercise price data set forth in this prospectus supplement have been adjusted to give effect to the reverse

stock split.

Company

Overview

Netcapital

Inc. is a fintech company with a scalable technology platform that allows private companies to raise capital online from accredited and

non-accredited investors. We give all investors the opportunity to access investments in private companies. Our model is disruptive to

traditional private equity investing and is based on Title III, Regulation Crowdfunding (“Reg CF”) of the Jumpstart Our Business

Startups Act (“JOBS Act”). In addition, we have recently expanded our model to include Regulation A (“Reg A”)

offerings. We generate fees from listing private companies on our funding portal located at www.netcapital.com. We also generate fees

from advising companies with respect to their Reg A offerings posted on www.netcapital.com. Our consulting group, Netcapital Advisors

Inc. (“Netcapital Advisors”), which is a wholly-owned subsidiary, provides marketing and strategic advice to companies in

exchange for cash fees and/or equity positions. The Netcapital funding portal is registered with the SEC, is a member of the Financial

Industry Regulatory Authority (“FINRA”), a registered national securities association, and provides investors with opportunities

to invest in private companies. Neither Netcapital Advisors, nor any Netcapital entity or subsidiary, is a broker- dealer, nor do any

of such entities operate as a broker-dealer with respect to any Reg A offering listed on the www.netcapital.com website.

Our

Business

We

provide private companies with access to investments from accredited and non-accredited investors through our online portal located at

www.netcapital.com, which is operated by our wholly-owned subsidiary, Netcapital Funding Portal, Inc. The Netcapital funding portal charges

a $5,000 listing fee and a 4.9% success fee for capital raised at closing. In addition, the portal generates fees for other ancillary

services, such as rolling closes. Netcapital Advisors generates fees and equity stakes from consulting in select portfolio (“Portfolio

Companies”) and non-portfolio clients. With respect to its services for Reg A offerings, Netcapital Advisors charges a monthly

flat fee for each month the offering is listed on the netcapital.com website as well as a nominal administrative flat fee for each investor

that is processed to cover out-of-pocket costs.

We generated revenues of $4,951,435,

with costs of service of $108,060, in the year ended April 30, 2024 for a gross profit of $4,843,375 (consisting of $3,537,700 in equity

securities for payment of services and $1,413,736 in cash-based revenues, offset by $108,060 for costs of services) as compared to revenues

of $8,493,985 with costs of service of $85,038 in the year ended April 30, 2023 for a gross profit of $8,408,947 (consisting of $7,105,000

in equity securities for the payment of services and $1,388,985 in cash-based revenues, offset by $85,038 for costs of services). We

provided additional services for two (2) and four (4) of our Portfolio Companies during the years ended April 30, 2024 and 2023, respectively,

and our cash-based gross profits as a percentage of gross profits were approximately 1% in both fiscal years.

In fiscal 2024 and 2023, the average

amount raised in an offering on the Netcapital funding portal was $280,978 and $128,170, respectively. The total number of offerings

on the Netcapital funding portal in fiscal 2024 and 2023 that closed was 70 and 63, respectively, of which 17 and 13 offerings hosted

on the Netcapital funding platform in fiscal 2024 and 2023, respectively, terminated their listings without raising the required minimum

dollar amount of capital. As of the date of this report, we own minority equity positions in 20 Portfolio Companies that have utilized

the funding portal to facilitate their offerings, for which equity was received as payment for services.

Funding

Portal

Netcapital

Funding Portal, Inc. is an SEC-registered funding portal that enables private companies to raise capital online, while investors are

able to invest from anywhere in the world, at any time, with just a few clicks. Securities offerings on the Netcapital funding portal

are accessible through individual offering pages, where companies include product or service details, market size, competitive advantages,

and financial documents. Companies can accept investment from anyone, including friends, family, customers, and employees. Customer accounts

on our platform will not be permitted to hold digital securities.

In

addition to access to the funding portal, the Netcapital funding portal provides the following services:

●

a fully automated onboarding process;

●

automated filing of required regulatory documents;

●

compliance review;

●

custom-built offering page on our portal website;

●

third party transfer agent and custodial services;

●

email marketing to our proprietary list of investors;

●

rolling closes, which provide potential access to liquidity before final close date of offering;

●

assistance with annual filings; and

●

direct access to our team for ongoing support.

Consulting

Business

Our

consulting group, Netcapital Advisors, helps companies at all stages to raise capital. Netcapital Advisors provides strategic advice,

technology consulting and online marketing services to assist with fundraising campaigns on the Netcapital platform. We also act as an

incubator and accelerator, taking equity stakes in select disruptive start-ups. In the instances where we take equity stakes in a company,

such interests are of the same class of securities that are offered on the Netcapital platform.

Netcapital

Advisors’ services include:

| |

● |

incubation

of technology start-ups; |

| |

● |

investor

introductions; |

| |

● |

online

marketing; |

| |

● |

website

design, software and software development; |

| |

● |

message

crafting, including pitch decks, offering pages, and ad creation; |

| |

● |

strategic

advice; and |

| |

● |

technology

consulting. |

Proposed

Broker-Dealer Business

Our

recently formed wholly owned subsidiary, Netcapital Securities Inc. has applied for broker-dealer registration with the Financial Industry

Regulatory Authority (“FINRA”). We that by having a registered broker-dealer, it will create opportunities to expand revenue

base by hosting and generating additional fees from Reg A+ and Reg D offerings on the Netcapital platform;, earning additional fees in

connection with offerings that may result from the introduction of clients to other FINRA broker-dealers and expanding our distribution

capabilities by leveraging strategic partnerships with other broker-dealers to distribute offerings of issuers that utilize the Netcapital

platform to a wider range of investors in order to maximize market penetration and optimize capital raising efforts. Netcapital Securities

Inc.’s application to become a registered broker-dealer remains subject to regulatory approval and/or licensing from the Financial

Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). No assurance can be given as to when or if such approvals

may be granted or when, if at all, Netcapital will be able to expand the services it offers. As of the date of this Annual Report, Netcapital

Securities Inc. has not conducted any business activities

Regulatory

Overview

In

an effort to enhance economic growth and to democratize access to private investment opportunities, Congress finalized the JOBS Act in

2016. Title III of the JOBS Act enabled early-stage companies to offer and sell securities to the general public for the first time.

The SEC then adopted Reg CF, in order to implement the JOBS Act’s crowdfunding provisions.

Reg

CF has several important features that changed the landscape for private capital raising and investment. For the first time, this regulation:

| |

● |

Allowed

the general public to invest in private companies, no longer limiting early-stage investment opportunities to less than 10% of the

population; |

| |

|

|

| |

● |

Enabled

private companies to advertise their securities offerings to the public (general solicitation); and |

| |

|

|

| |

● |

Conditionally

exempted securities sold under Section 4(a)(6) from the registration requirements of the Securities and Exchange Act of 1934, as

amended (the “Exchange Act”). |

The

SEC had also adopted rules to implement Section 401 of the Jumpstart Our Business Startups (JOBS) Act by expanding Reg A into two tiers

| |

● |

Tier

1, for securities offerings of up to $20 million in a 12-month period; and |

| |

|

|

| |

● |

Tier

2, for securities offerings of up to $75 million in a 12-month period. |

In

addition, Reg A allows companies that are subject to the ongoing reporting requirements of Section 13 or 15(d) of the Exchange Act to

use Reg A. Further, Reg A also enables issuers to raise funds from non-accredited investors and accredited investors.

We

are subject, both directly and indirectly, to various laws and regulations relating to our business. If any of the laws are amended,

compliance could become more expensive and directly affect our income. We intend to comply with such laws, but new restrictions may arise

that could materially adversely affect our Company. Specifically, the SEC regulates our funding portal business, and our funding portal

is also a member of FINRA and is regulated by FINRA. We are also subject to the USA Patriot Act of 2001, which contains anti-money laundering

and financial transparency laws and mandates various regulations applicable to financial services companies, including standards for

verifying client identification at account opening, and obligations to monitor client transactions and report suspicious activities.

Anti-money laundering laws outside of the United States contain some similar provisions. In the event that our wholly-owned subsidiary

receives a broker-dealer license, we will become subject to additional regulation and supervision of the SEC and FINRA, including without

limitation Rule 15c3-1 under the Securities Exchange Act of 1934 (the Uniform Net Capital Rule). The Uniform Net Capital Rule specifies

minimum capital requirements intended to ensure the general financial soundness and liquidity of broker-dealers. The Uniform Net Capital

Rule prohibits broker-dealers from paying cash dividends, making unsecured advances or loans or repaying subordinated loans if such payment

would result in a net capital amount of less than 5% of aggregate debit balances or less than 120% of its minimum dollar requirement.

Our failure to comply with these requirements as applicable to us could have a material adverse effect on us.

Our

Market

The

traditional funding model restricts access to capital, investments and liquidity. According to Harvard Business Review, venture capital

firms (“VCs”) invest in fewer than 1% of the companies they consider and only 10% of VC meetings are obtained through cold

outreach. In addition, only 2% of VC funding went to women-owned firms in 2022, according to PitchBook, while only 1% went to black-owned

firms, according to TechCrunch.

Furthermore,

under the traditional model, the average investor lacked access to early-stage investments. Prior to the JOBS Act, almost 90% of U.S.

households were precluded from investing in private deals, per dqydj.com. Liquidity has also been an issue, as private investments are

generally locked up until IPO or takeout.

The

JOBS Act helped provide a solution to these issues by establishing the funding portal industry, which is currently in its infancy. Title

III of the JOBS Act outlines Reg CF, which traditionally allowed private companies to raise up to $1.07 million. In March 2021, regulatory

enhancements by the SEC went into effect and increased the limit to $5 million. These amendments increased the offering limits for Reg

CF, Reg A and Regulation D, Rule 504 offerings as follows: Reg CF increased to $5 million; Regulation D, Rule 504 increased to $10 million

from $5 million; and Reg A Tier 2 increased to $75 million from $50 million.

There

was $494 million raised via Reg CF in 2022, according to Crowdwise. We believe a significant opportunity exists to disrupt private capital

markets via the Netcapital funding portal.

Private

capital markets reached $12 trillion by the first half of 2022, per McKinsey. Within this market, private equity represents the largest

share, with assets in excess of $3 trillion and a 10-year compound annual growth rate (CAGR) of 10%. Since 2000, global private equity

(“PE”), net asset value has increased almost tenfold, nearly three times faster than the size of the public equity market.

Both McKinsey and Boston Consulting Group predict that this strong growth will continue, as investors allocate increasing amounts to

private equity, due to historically higher returns and lower volatility than public markets. In addition, Boston Consulting Group estimates

that there are $42 trillion held in retail investment accounts, which we believe represents a large pool of potential account holders

for us.

Our

Technology

The

Netcapital platform is a scalable, real-time, transaction-processing engine that runs 24 hours a day, seven days a week.

For

companies raising capital, the technology provides fully automated onboarding with integrated regulatory filings. Funds are collected

from investors and held in escrow until the offering closes. For entrepreneurs, the technology facilitates access to capital at low cost.

For investors, the platform provides access to investments in private, early-stage companies that were previously unavailable to the

general public. Both entrepreneurs and investors can track and view their investments through their dashboard on netcapital.com. As of

the date of this prospectus, the platform currently has approximately 116,000 users.

Scalability

was demonstrated in November 2021, when the platform processed more than 2,000 investments in less than two hours, totaling more than

$2 million.

Our

infrastructure is designed in a way that can horizontally scale to meet our capacity needs. Using Docker containers and Amazon Elastic

Container Service (“Amazon ECS”), we are able to automate the creation and launch of our production web and application programming

interface (“API”), endpoints in order to replicate them as needed behind Elastic Load Balancers (ELBs).

Additionally,

all of our public facing endpoints live behind CloudFlare to ensure protection from large scale traffic fluctuations (including distributed

denial of service (“DdoS”) attacks).

Our

main database layer is built on Amazon RDS and features a Multi-AZ deployment that can also be easily scaled up or down as needed. General

queries are cached in our API layer, and we monitor to optimize very complex database queries that are generated by the API. Additionally,

we cache the most complex queries (such as analytics data) in our NoSQL (Mongo) data store for improved performance.

Most

of our central processing unit (“CPU”), intensive data processing happens asynchronously through a worker/jobs system managed

by AWS ElastiCache’s Redis endpoint. This component can be easily fine-tuned for any scale necessary.

The

technology necessary to operate our funding portal is licensed from Netcapital Systems LLC, a Delaware limited liability company (“Netcapital

DE LLC”), of which Jason Frishman, Founder and former CEO of Netcapital Funding Portal Inc., owns a 29% interest, under a license

agreement with Netcapital Funding Portal, Inc., for an annual license fee of $380,000, paid in quarterly installments.

Proposed

Alternative Trading (“ATS”) Relationship

We

believe that lack of liquidity is a key issue for investors in private companies in our targeted market. We also recognize that secondary

trading of securities in private companies is subject to extensive regulation and oversight. Such regulation and oversight includes,

but is not limited to, the need to be a registered broker-dealer that is licensed to operate an ATS, or to partner with an entity that

is licensed to do so. In order to try to address what we believe is a large, unmet need, our wholly-owned subsidiary, Netcapital Systems

LLC, a Utah limited liability company (“Netcapital UT LLC”), entered into a software license and services agreement on January

2, 2023 (the “Templum License Agreement”) with Templum Markets LLC (“Templum”), to provide issuers and investors

on the Netcapital platform with the potential for greater distribution and liquidity. Templum is a company that provides capital markets

infrastructure for trading private equity securities, and operates an ATS with approval in 53 U.S. states and territories for the trading

of unregistered or private securities. We are currently working with Templum to design the software required to allow issuers and investors

on the Netcapital platform to access the Templum ATS in order to engage in secondary trading of securities in a regulatorily compliant

manner. The operation of the Templum ATS, however, remains subject to extensive regulation and oversight. Accordingly, any regulatory

delays or objections will result in delays in our ability to launch the proposed platform. While we are currently working with Templum

on the design of the required software to enable the access to secondary trading on the Templum ATS, no assurance can be given as to

when, or if, we will be able to successfully complete this project in order to enable access to a secondary trading feature beta (testing)

version to a closed group of users for testing before any final launch is made to the public, and Templum’s approval. Milestones

required to launch the platform include, but are not limited to, plug-in of Templum’s KYC and AML requirements to enable interested

users to directly send to the Templum ATS any KYC/AML information required by Templum for review and approval, as well as the launch

of a beta version to a closed group of users. In July 2024, we announced the launch of our beta version for this secondary trading

platform and our goal is to offer such secondary trading platform through the Templum ATS to all issuers and investors on the

Netcapital funding portal before the end of 2024 subject to compliance with all regulatory requirements, however, we do not

know when, or if, this feature will be fully completed and launched, as there are many details that remain to be completed.

The

operation of the Templum ATS is subject to extensive regulation and oversight. Accordingly, any regulatory delays or objections will

result in delays in our ability to launch the proposed platform. In addition, because we cannot easily switch between operators of secondary

trading platforms of this nature, any disruption of or interference, whether due to regulatory issues or natural disasters, cyber-attacks,

terrorist attacks, power losses, telecommunications failures, or other similar events, would impact our operations and may adversely

affect the ability of issuers and investors to utilize this platform. There is no obligation for Templum to renew its agreements with

us on commercially reasonable terms or at all.

Institutions

and individual investors may face significant risk when buying securities on our proposed secondary trading platform. These risks include

the following:

| |

● |

private

companies are not required to make periodic public filings, and therefore certain capitalization, operational and financial information

may not be available for evaluation; |

| |

|

|

| |

● |

an

investment may only be appropriate for investors with a long-term investment horizon and a capacity to absorb a loss of some or all

of their investment; |

| |

|

|

| |

● |

the

securities, when purchased, are generally highly illiquid, are often subject to further transfer restrictions, and no public market

exists for such securities; and |

| |

|

|

| |

● |

transactions

may fail to settle, which could harm our reputation. |

Further,

we may become involved in disputes and litigation matters between customers with respect to transactions on our proposed secondary trading

platform. There is a risk that clients may increasingly look to us to make them whole for delayed and/or broken trades. Customers may

litigate over a failure of sellers to deliver securities or over the untimely deliveries of securities. Any litigation to which we are

a party could be expensive and time consuming, regardless of the ultimate outcome, and the potential costs and risks of such litigation

may incentivize us to settle, which could harm our reputation or have a material adverse effect on our business or results or operations.

We

estimate that the cost for developing this platform will not exceed $1.0 million, most of which has already been incurred and consists

of salaries or fees paid to engineers and consultants. We have and continue to pay these expenses from our working capital. We do not

currently have a revenue model associated with the sales of securities on the proposed ATS. However, we may seek incorporate this revenue

model in the future, provided that we determine any such revenue model is in strict compliance with all regulatory guidelines.

We

currently anticipate that we will also be able to sell our interests in any portfolio company using the Templum ATS provided such sales

are made in a regulatorily compliant matter. We expect to place a restriction on any sales during any period in which an issuer is offering

its securities for sale on the Netcapital funding platform. In addition, securities issued in a Reg CF transaction generally cannot be

resold for a period of one year, unless the securities are transferred: (1) to the issuer of the securities; (2) to an “accredited

investor”; (3) as part of an offering registered with the SEC; or (4) to a member of the family of the purchaser or the equivalent,

to a trust controlled by the purchaser, to a trust created for the benefit of a member of the family of the purchaser or the equivalent,

or in connection with the death or divorce of the purchaser or other similar circumstance.. Accordingly, any shares owned by us would

also be subject to these restrictions. Additional restrictions may be implemented, and there can be no assurance that we will ever sell

any of our interests in any portfolio company using the Templum ATS. Further, our insider trading policy prohibits all of our employees,

officers, consultants and directors from buying or selling securities while in possession of material non-public information and all

such parties are also required to maintain strict confidentiality of all such information. In addition, in order to maintain compliance

with our insider trading policies, any affiliate or employee seeking to trade securities in any issuer listed on the funding portal must

receive prior approval and clearance from our Chief Financial Officer and all such requests for clearance will be documented and maintained

with our compliance department.

Our

Netcapital funding portal is currently registered with the SEC and is a member of FINRA. For so long as we continue to operate our Netcapital

platform solely for primary offerings by issuers under Reg CF, we believe that we are not required to register under Regulation ATS.

Competitive

Advantages

Based

upon publicly available information either published on the websites of our peer group (StartEngine Crowdfunding, Inc., Wefunder Inc.

and Republic Core LLC) or included in offering statements of issuers hosted on such offering platforms, we believe that we provide the

lowest cost solution for online capital raising. We also believe, based upon our facilitated technology platforms, our strong emphasis

on customer support, and feedback received from clients that have onboarded to our platform, that our access and onboarding of new clients

are superior due to our facilitated technology platforms. Our network continues to rapidly expand as a result of our enhanced marketing

and broad distribution to reach new investors.

Our

competitors include StartEngine Crowdfunding, Inc., Wefunder Inc. and Republic Core LLC . Given the rapid growth in the industry and

its potential to disrupt the multi-billion dollar private capital market, we believe there is sufficient room for multiple players.

Our

Strategy

Two

major tailwinds are driving accelerated growth in the shift to the use of online funding portals: (i) the COVID-19 pandemic and (ii)

the increase in funding limits under Reg CF. The pandemic drove a rapid need to bring as many processes as possible online. With travel

restrictions in place and most people in lockdown, entrepreneurs were no longer able to fundraise in person and have increasingly turned

to online capital raising through funding portals.

There

are numerous industry drivers and tailwinds that complement investor demand for access to investments in private companies. To capitalize

on these, our strategy is to:

| |

● |

Generate

New Investor Accounts. Growing the number of investor accounts on our platform is a top priority. Investment dollars that continue

to flow through our platform are the key revenue driver. When issuers advertise their offerings, they are generating new investor

accounts for the Netcapital funding platform at no cost to us. We plan to supplement our issuers’ spend on advertising by increasing

our online marketing spend as well, which may include virtual conferences going forward. |

| |

|

|

| |

● |

Hire

Additional Business Development Staff. We seek to hire additional business development staff that is technology advanced and financially

passionate about capital markets to handle our growing backlog of potential customers. |

| |

|

|

| |

● |

Increase

the Number of Companies on Our Platform via Marketing. When a new company lists on our platform, they bring their customers, supporters,

and brand ambassadors as new investors to Netcapital. We plan to increase our marketing budget to help grow our portal and advisory

clients. |

| |

|

|

| |

● |

Invest

in Technology. Technology is critical to everything that we do. We plan to invest in developing innovative technologies that enhance

our platform and allow us to pursue additional service offerings.. |

| |

|

|

| |

● |

Incubate

and accelerate our advisory clients. The advisory clients and our equity interests in select advisory clients represent potential

upside for our shareholders. We seek to grow this model of advisory clients. |

| |

|

|

| |

● |

Expand

Internationally. We believe there is a significant opportunity to expand the marketing of Netcapital funding platform and the services

we offer into Europe and Asia as an appetite abroad grows for U.S. stocks. |

| |

|

|

| |

● |

Provide

a secondary trading feature. We believe that lack of liquidity is a key issue for investors in private companies in our targeted

market. Accordingly, we are exploring ways in which we can provide our clients with the ability to access a secondary trading feature.

In January 2023, we entered into the Templum License Agreement to provide issuers and investors on the Netcapital platform with the

potential for greater distribution and liquidity. Templum is an operator of an ATS with approval in 53 U.S. states and territories

for the trading of unregistered or private securities to provide issuers and investors on the Netcapital platform with the potential

for greater distribution and liquidity. We are currently working with Templum on the design of the required software to enable issuers

and investors on the Netcapital platform the ability to access the Templum ATS in order to engage in secondary trading of securities.

In July 2024, we announced the launch of our beta version for this secondary trading platform and our goal is to offer such secondary

trading platform through the Templum ATS to all issuers and investors on the Netcapital funding portal before the end of 2024 subject

to compliance with all regulatory requirements, however, we do not know when, or if, this feature will be fully completed and launched,

as there are many details that remain to be completed. |

| |

|

|

| |

● |

New

Verticals Represent a Significant Opportunity. We operate in a regulated market supported by the JOBS Act. We are pursuing expanding

our model to include Reg A and Regulation D offerings. |

| |

|

|

| |

● |

Secure

Broker-Dealer License. In May 2024, we announced that our wholly-owned subsidiary, Netcapital Securities Inc. applied for broker-dealer

registration with the Financial Industry Regulatory Authority (“FINRA”). We that by having a registered broker-dealer,

it will create opportunities to expand revenue base by hosting and generating additional fees from Reg A+ and Reg D offerings on

the Netcapital platform;, earning additional fees in connection with offerings that may result from the introduction of clients to

other FINRA broker-dealers and expanding our distribution capabilities by leveraging strategic partnerships with other broker-dealers

to distribute offerings of issuers that utilize the Netcapital platform to a wider range of investors in order to maximize market

penetration and optimize capital raising efforts. Netcapital Securities Inc.’s application to become a registered broker-dealer

remains subject to regulatory approval and/or licensing from the Financial Regulatory Authority (FINRA) and the Securities and Exchange

Commission (SEC). No assurance can be given as to when or if such approvals may be granted or when, if at all, Netcapital will be

able to expand the services it offers. |

Our

Management

Our

management team is experienced in finance, technology, entrepreneurship, and marketing.

Martin

Kay is our Chief Executive Officer (“CEO”) and a director. He previously served as Managing Director at Accenture Strategy,

from October 2015 to December 2022 and holds a BA in physics from Oxford University and an MBA from Stanford University Graduate School

of Business. Mr. Kay is an experienced C-suite advisor and digital media entrepreneur, working at the intersection of business and technology.

His experience includes oversight of our funding portal when he served on the board of managers of Netcapital DE LLC from 2017 to 2021.

Coreen

Kraysler, CFA, is our Chief Financial Officer (“CFO”). With over 30 years of investment experience, she was formerly a Senior

Vice President and Principal at Independence Investments, where she managed several 5-star rated mutual funds and served on the Investment

Committee. She also worked at Eaton Vance as a Vice President, Equity Analyst on the Large and Midcap Value teams. She received a B.A.

in Economics and French, cum laude from Wellesley College and a Master of Science in Management from MIT Sloan.

Jason

Frishman is our Founder and former chief executive officer of our funding portal subsidiary, Netcapital Funding Portal Inc. Mr. Frishman

founded Netcapital Funding Portal Inc. to help reduce the systemic inefficiencies that early-stage companies face in securing capital.

He currently holds advisory positions at leading organizations in the financial technology ecosystem and has spoken as an external expert

at Morgan Stanley, University of Michigan, Young Presidents’ Organization (YPO), and others. Mr. Frishman has a background in the

life sciences and previously conducted research in medical oncology at the Dana Farber Cancer Institute and cognitive neuroscience at

the University of Miami, where he graduated summa cum laude with a B.S. in Neuroscience.

Corporate

Information

The

Company was incorporated in Utah in 1984 as DBS Investments, Inc. (“DBS”). DBS merged with Valuesetters L.L.C. in December

2003 and changed its name to Valuesetters, Inc. In November 2020, the Company purchased Netcapital Funding Portal Inc. from Netcapital

DE LLC and changed the name of the Company from Valuesetters, Inc. to Netcapital Inc. In November 2021, the Company purchased MSG Development

Corp.

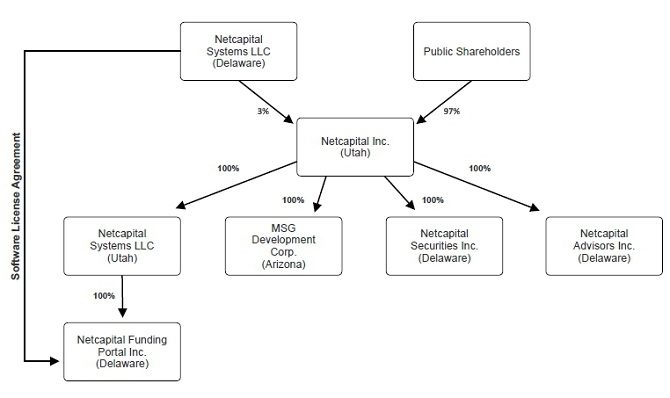

Attached

below is an organization chart for the Company as of the date of this prospectus:

Implications

of Being a Smaller Reporting Company

We

have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of

other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different

than you might receive from other public reporting companies in which you hold equity interests.

We

are a “smaller reporting company,” meaning that the market value of our stock held by non-affiliates plus the proposed aggregate

amount of gross proceeds to us as a result of this offering is less than $700 million and our annual revenue was less than $100 million

during the most recently completed fiscal year. We may continue to be a smaller reporting company after this offering if either (i) the

market value of our common stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million

during the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million. As

a smaller reporting company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller

reporting companies. Specifically, as a smaller reporting company we may choose to present only the two most recent fiscal years of audited

financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced

disclosure obligations regarding executive compensation.

Recent

Developments

Regained Compliance with Nasdaq

Continued Listing Requirements

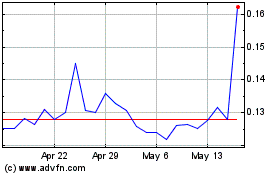

On August 19, 2024, we received a

notice from The Nasdaq Stock Market, LLC (“Nasdaq”), dated August 19, 2024, informing us that we had regained compliance

with Nasdaq’s Listing Rule 5550(a)(2) (the “Bid Price Rule”) for continued listing on The Nasdaq Capital Market, as

the bid price of our common stock closed at or above $1.00 per share for a minimum of 10 consecutive business days since August 2, 2024.

As previously disclosed on a

Current Report on Form 8-K filed by us, Nasdaq had previously notified us on September 1, 2023 that we were not in compliance with

the Bid Price Rule because our common stock failed to maintain a minimum bid price of $1.00 per share for 30 consecutive business

days. Further as of July 22, 2024, Nasdaq determined that that our securities had a closing bid price of $0.10 or less for ten

consecutive trading days and as a result, Nasdaq delivered written notice to the Company on July 23, 2024 under which it advised us

that Nasdaq has determined to delist our securities from The Nasdaq Capital Market. We requested a hearing to appeal Nasdaq’s

delisting determination, but since the Company has regained compliance with Nasdaq’s continued listing requirements as

described above, the hearing was cancelled.

Reverse Stock Split

On July 29, 2024, following

shareholder approval we filed articles of amendment (the “Articles of Amendment”) to our Articles of Incorporation, as

amended, with the Utah Department of Commerce, Division of Corporations and Commercial Code to effectuate a 1-for-70 reverse stock

split (the “Reverse Stock Split”) of our issued and outstanding shares of common stock, which Articles of Amendment

became effective on August 1, 2024. The Reverse Stock Split became effective at 4:01pm Eastern Time on August 1, 2024, and our

common stock began trading on a split-adjusted basis at the open of trading on The Nasdaq Capital Market on August 2, 2024. Upon

effectiveness of the Reverse Stock Split, every seventy (70) shares of our common stock issued and outstanding were automatically

reclassified and combined into one share of our common stock, without any change in the par value per share. Following the Reverse

Stock Split, we had 718,934 shares of our common stock outstanding, which includes 139,781 shares of our common stock that were

issued for rounding up fractional shares resulting from the Reverse Stock Split.

Launch of Beta Version for Secondary

Trading Platform

In July 2024, we announced the launch

of our beta version of a secondary trading platform through the Templum ATS to a closed group of users. This secondary trading platform

has been designed to provide investors who purchase stock through the Netcapital funding portal with the potential for secondary trading

through access to the Templum ATS.

May

2024 Warrant Inducement

On

May 24, 2024, we entered into inducement offer letter agreements with certain investors that held certain outstanding Series A-2

warrants to purchase up to an aggregate of 204,572 shares of our common stock with an exercise price of $17.50 per share,

originally issued in December 2023 at a reduced exercise price of $10.75 per share in partial consideration for the Company’s

agreement to issue in a private placement (i) new Series A-3 common stock purchase warrants to purchase up to 253,947 shares of

our common stock at an exercise price of $8.74 per share and (ii) new Series A-4 common stock purchase warrants to purchase up

to 253,947 shares of our common stock at an exercise price of $8.74 per share for aggregate gross proceeds of approximately

$2.2 million from the exercise of the existing warrants, before deducting placement agent fees and other expenses payable by the Company.

The Series A-3 Warrants and Series A-4 Warrants are exercisable beginning on the effective dates of stockholder approval of the issuance

with such warrants expiring on (i) the five year anniversary of the initial exercise date for the Series A-3 Warrants and (ii) the eighteen

month anniversary of the initial exercise date for the Series A-4 Warrants. This transaction closed on May 29, 2024. H.C. Wainwright

was the exclusive agent for transaction for which we paid them a cash fee equal to 7.5% from the exercise of the Series A-2 warrant at

the reduced exercise price and a management fee equal to 1.0% of such aggregate gross proceeds. We also issued warrants to designees

of H.C. Wainwright to purchase up to 19,048 shares of our common stock at an exercise price of $10.93 per share.

OFFERING

SUMMARY

| Common

Stock to be offered by us |

|

Shares

of our common stock having an aggregate offering price of up to $2,100,000. |

| |

|

|

| Common

Stock outstanding after this offering (1) |

|

Up

to 1,294,276 shares of common stock, assuming sales of 575,342 shares of common stock at a price of $3.65 per

share, which was the closing price of our common stock on the Nasdaq Capital Market on August 19, 2024. The actual number

of shares of our common stock issued will vary depending on the sales price under this offering. |

| |

|

|

| Market

for Common Stock |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “NCPL.” |

| |

|

|

| Form

of offering |

|

The

Sales Agent may, according to the terms of the Offering Agreement, sell the shares of our common stock offered under this prospectus

supplement in an “at-the-market” offering. See “Plan of Distribution” on page S-15 of this prospectus supplement. |

| |

|

|

| Use

of Proceeds |

|

We

plan to use the net proceeds from this offering, if any, for general working capital and general corporate purposes. See “Use

of Proceeds.” |

| |

|

|

| Risk

factors |

|

See

“Risk Factors” beginning on page S-11 of this prospectus supplement, as well as the other information included in

or incorporated by reference in this prospectus supplement and the accompanying base prospectus, for a discussion of risks you

should carefully consider before investing in our securities. |

(1)

The number of shares of Common Stock to be outstanding after this offering is based on 718,934 shares of our Common Stock outstanding

as of August 23, 2024, and excludes:

| ● |

48,222

shares of common stock reserved for future issuance

under our 2021 Equity Incentive Plan and our 2023 Omnibus Equity Incentive Plan; |

| |

|

| ● |

29,714

shares of common stock issuable upon exercise

of outstanding options with a weighted average exercise price of $157.11 per share; |

| |

|

| |

|

| ● |

885,727

shares of common stock issuable upon the exercise

of stock warrants outstanding at a weighted average exercise price of $22.27 per share; and |

| |

|

| ● |

180

shares of common stock to be issued in connection

with our acquisition of MSG Development Corp., of which 90 shares will be issued on each of October 31, 2024 and October

31, 2025. |

Unless

otherwise indicated, all information in this prospectus supplement assumes no exercise of the outstanding options or warrants, described

above.

RISK

FACTORS

Before

you make a decision to invest in our securities, you should consider carefully the risks described below, together with other information

in this prospectus supplement, the accompanying base prospectus and the information incorporated by reference herein and therein, including

any risk factors contained in our annual and other reports filed with the SEC. if any of the following events actually occur, our business,

operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of

our common stock to decline and you may lose all or part of your investment. The risks described below are not the only ones that we

face. Additional risks not presently known to us or that we currently deem immaterial may also significantly impair our business operations

and could result in a complete loss of your investment.

Risks

Related to Our Need for Additional Capital

Our

financial situation creates doubt whether we will continue as a going concern.

As of April

30, 2024, the Company had negative working capital of $2,074,163 and for the year ended April 30 2024, the Company had an operating loss

of $3,442,388 and net cash used in operating activities amounted to $4,879,838.There can be no assurances that we will be able to achieve

a level of revenues adequate to generate sufficient cash flow from operations or additional financing through private placements, public

offerings and/or bank financing necessary to support our working capital requirements. Our management has recently reduced its operating

expenses and we have turned our focus to our funding portal business, which generates cash revenues and has seen a growth in revenues

on a year-to-year basis. We plan to continue operating with lower fixed overhead amounts and seek to raise money from private placements,

public offerings and/or bank financing. Our management has determined, based on its recent history and the negative cash flow from operations,

that it is unlikely that its plan will sufficiently alleviate or mitigate, to a sufficient level, the relevant conditions or events noted

above. To the extent that funds generated from any private placements, public offerings and/or bank financing, if available, are insufficient,

we will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available,

will be on acceptable terms. Accordingly, our management has concluded that these conditions raise substantial doubt about our ability

to continue as a going concern. There can be no assurance that we will be able to achieve its business plan objectives or be able to

achieve or maintain cash-flow-positive operating results. If we are unable to generate adequate funds from operations or raise sufficient

additional funds, we may not be able to repay our existing debt, continue to operate our business network, respond to competitive pressures

or fund our operations. As a result, we may be required to significantly reduce, reorganize, discontinue, or shut down our operations.

Risks

Related to our Business

Our

business and operations could be negatively affected if we become subject to any securities litigation or shareholder activism, which

could cause us to incur significant expense, hinder execution of business and growth strategy and impact our stock price.

In the past,

following periods of volatility in the market price of a company’s securities, securities class action litigation has often been

brought against that company. Shareholder activism, which could take many forms or arise in a variety of situations, has been increasing

recently. Volatility in the stock price of our Common Stock or other reasons may in the future cause us to become the target of securities

litigation or shareholder activism. Securities litigation and shareholder activism, including potential proxy contests, could result

in substantial costs and divert management’s and the attention and resources of our board of directors (our “Board”)

from our business. Additionally, such securities litigation and shareholder activism could give rise to perceived uncertainties as to

our future, adversely affect our relationships with service providers and make it more difficult to attract and retain qualified personnel.

Also, we may be required to incur significant legal fees and other expenses related to any securities litigation and activist shareholder matters.

Further, our stock price could be subject to significant fluctuation or otherwise be adversely affected by the events, risks and uncertainties

of any securities litigation and shareholder activism

Risks

Related to Receipt of Securities for Services

A

significant portion of our total assets are held in equity securities of early-stage companies, which securities are illiquid and subject

to volatility, which factors could have a material adverse effect on our financial condition and results of operations.

Payment

related to the consulting and advisory services provided by Netcapital Advisors is often made through equity stakes from such customers.

As of April 30, 2024, approximately $25.2 million of our holdings are issued by companies whose securities do not trade on public markets.

The securities issued are typically in private companies with no established trading market for their securities, that often have limited

operating histories, limited operating cash, and negative cash flows. Additionally, these securities are primarily restricted, and are

subject to legal holding periods pursuant to Rule 144 or other applicable exemptions. The stock price of such issuers is often volatile,

unpredictable, and with limited liquidity, and the value of such securities on the date of receipt compared to the date when we are able

to legally sell the securities may decrease significantly. The value ascribed to our assets in our financial statements as of a particular

date may be materially greater than or less than the value that would be realized if our assets were to be liquidated as of such date.

Accordingly, the value of such holdings may change over time due to factors that we do not control, such as issuance of securities by

such companies at lower prices or other market factors. During the year ended April 30, 2024, we recognized an unrealized loss of approximately

$2.7 million on the value of our equity securities due to the decline in value of a single issuer, which represented an impairment of

more than 80% of the previous value of our holdings in such issuer, which resulted in a reduction of our retained earnings. Changes to

the value of our holdings could have a material adverse effect on our financial condition and results of operations.

Risks

Related to this Offering and our Common Stock

Our

ability to have our securities traded on the Nasdaq Capital Market is subject to us meeting applicable listing criteria.

We

are currently listed on the Nasdaq Stock Market, LLC (“Nasdaq”), a national securities exchange. The Nasdaq requires companies

desiring to list their common stock to meet certain listing criteria including total number of shareholders: minimum stock price, total

value of public float, and in some cases total shareholders’ equity and market capitalization. Our failure to meet such applicable

listing criteria could prevent us from continuing to list our common stock on the Nasdaq. In the event we are unable to have our shares

listed on Nasdaq, our common stock could potentially quote on the OTCQX or the OTCQB, each of which is generally considered less liquid

and more volatile than the Nasdaq. Our failure to have our shares listed on the Nasdaq could make it more difficult for you to trade

our shares, could prevent our common stock trading on a frequent and liquid basis and could result in the value of our common stock being

less than it would be if we were able to list our shares on the Nasdaq.

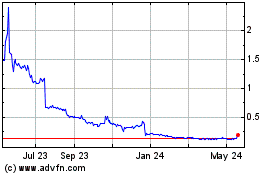

As previously

disclosed on a Current Report on Form 8-K filed by us, Nasdaq had previously notified us on September 1, 2023 that we were not in compliance

with the Nasdaq’s Listing Rule 5550(a)(2) the “Bid Price Rule”) because it failed to maintain a minimum bid price of

$1.00 per share for 30 consecutive business days. Further as of July 22, 2024, Nasdaq determined that that our securities had a closing

bid price of $0.10 or less for ten consecutive trading days and as a result, Nasdaq delivered written notice to the Company on July 23,

2024 under which it advised us that Nasdaq has determined to delist our securities from The Nasdaq Capital Market. We

requested a hearing to appeal Nasdaq’s delisting determination. On August 19, 2024, we received a notice from The Nasdaq Stock

Market, LLC (“Nasdaq”), dated August 19, 2024, informing us that we had regained compliance with the “Bid Price Rule

for continued listing on The Nasdaq Capital Market, as the bid price of our common stock closed at or above $1.00 per share for a minimum

of 10 consecutive business days since August 2, 2024. As a result of our demonstrated compliance with Nasdaq’s continued listing

requirements, such aforementioned hearing was cancelled

Although our common stock is currently listed on Nasdaq, we may not be able to continue to meet the exchange’s

minimum listing requirements or those of any other national exchange. The Listing Rules of Nasdaq require listing issuers to comply with

certain standards in order to remain listed on its exchange. If, for any reason, we should fail to maintain compliance with these listing

standards and Nasdaq should delist our securities from trading on its exchange and we are unable to obtain listing on another national

securities exchange, a reduction in some or all of the following may occur, each of which could have a material adverse effect on our

shareholders:

| |

● |

the

liquidity of our common stock; |

| |

|

|

| |

● |

the

market price of our common stock; |

| |

|

|

| |

● |

our

ability to obtain financing for the continuation of our operations; |

| |

|

|

| |

● |

the

number of institutional and general investors that will consider investing in our common stock; |

| |

|

|

| |

● |

the

number of investors in general that will consider investing in our common stock; |

| |

|

|

| |

● |

the

number of market makers in our common stock; |

| |

|

|

| |

● |

the

availability of information concerning the trading prices and volume of our common stock; and |

| |

|

|

| |

● |

the

number of broker-dealers willing to execute trades in shares of our common stock. |

The

actual number of shares we will issue under the Offering Agreement, at any one time or in total, is uncertain.

Subject

to certain limitations in the Offering Agreement and compliance with applicable law, we have the discretion to deliver instruction to

the Sales Agent to sell shares of our common stock at any time throughout the term of the Offering Agreement. The number of shares that

are sold through the Sales Agent after our instruction will fluctuate based on a number of factors, including the market price of our

common stock during the sales period, the limits we set with the Sales Agent in any instruction to sell shares, and the demand for our

common stock during the sales period. Because the price per share of each share sold will fluctuate during this offering, it is not currently

possible to predict the number of shares that will be sold or the gross proceeds to be raised in connection with those sales.

The

common stock offered hereby will be sold in “at the market offerings,” and investors who buy shares at different times will

likely pay different prices.

Investors

who purchase shares in this offering at different times will likely pay different prices, and so may experience different levels of dilution,

and different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and

numbers of shares sold in this offering. Investors may experience a decline in the value of the shares they purchase in this offering

as a result of sales made at prices lower than the prices they paid.

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds,

and the proceeds may not be invested successfully.

Our

management will have broad discretion in the application of the net proceeds from this offering, and our stockholders will not have the

opportunity as part of their investment decision to assess whether the net proceeds are being used appropriately. Because of the number

and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially

from their currently intended use. The failure by our management to apply these funds effectively could harm our business. See “Use

of Proceeds” on page S-14 of this prospectus supplement for a description of our proposed use of proceeds from this offering.

Our

common stock price may be volatile and could decline substantially.

The

trading price of our common stock may experience wide fluctuations. The price of the common stock that will prevail in the market may

be higher or lower than that of this offering depending on numerous factors, some of which are beyond our control and may not be directly

related to our operating performance. These factors include, but are not limited to, the following:

| |

● |

actual

or anticipated fluctuations in our operating results; |

| |

|

|

| |

● |

the

absence of securities analysts covering us and distributing research and recommendations about us; |

| |

|

|

| |

● |

we

may have a low trading volume for a number of reasons, including that a large portion of our stock is closely held; overall stock

market fluctuations; |

| |

|

|

| |

● |

announcements

concerning our business or those of our competitors; |

| |

|

|

| |

● |

actual

or perceived limitations on our ability to raise capital when we require it, and to raise such capital on favorable terms; conditions

or trends in the industry; |

| |

|

|

| |

● |

litigation; |

| |

● |

changes

in market valuations of other similar companies; future sales of common stock; |

| |

|

|

| |

● |

departure

of key personnel or failure to hire key personnel; and general market conditions. |

Any

of these factors could have a significant and adverse impact on the market price of our common stock. In addition, the stock market in

general has at times experienced extreme volatility and rapid decline that has often been unrelated or disproportionate to the operating

performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock and/or

warrants, regardless of our actual operating performance.

We

cannot assure you that the market price of our common stock will not decline. Accordingly, we cannot assure you that you will be able

to sell your common stock at a price equal to or greater than the purchase price.

We

do not anticipate paying any dividends on our common stock for the foreseeable future.

We

have not paid any dividends on our common stock to date, and we do not anticipate paying any such dividends in the foreseeable future.

We anticipate that any earnings experienced by us will be retained to finance the implementation of our operational business plan and

expected future growth.

USE

OF PROCEEDS

We

may offer and sell shares of our common stock having aggregate sales proceeds of up to $2,100,000 from time to time. The amount

of proceeds we receive, if any, will depend on the actual number of shares of our common stock sold and the market price at which such

shares are sold. There can be no assurance that we will be able to sell any shares or fully utilize the Offering Agreement with Wainwright

as a source of financing. Because there is no minimum offering amount required as a condition of this offering, the net proceeds to us,

if any, are not determinable at this time.

We

currently intend to use the net proceeds from this offering, if any, for general corporate purposes, capital expenditures, working capital

and general and administrative expenses. We do not currently have more specific plans or commitments with respect to the net proceeds

from this offering and, accordingly, are unable to quantify the allocation of such proceeds among the various potential issues..

We

have broad discretion in determining how the proceeds of this offering will be used, and our discretion is not limited by the aforementioned

possible uses. Our board of directors believes the flexibility in application of the net proceeds is prudent. See the section entitled

“Risk Factors-Risks Relating to this Offering and our Common Stock- Our management will have broad discretion over the use of

the net proceeds from this offering, you may not agree with how we use the proceeds, and the proceeds may not be invested successfully.”

PLAN

OF DISTRIBUTION

We

have entered into the Offering Agreement, dated as of August 23, 2024, with Wainwright as sales agent, under which we may issue

and sell shares of our common stock having an aggregate offering price of up to $2,100,000 from time to time through Wainwright

acting as our sales agent.

The

Offering Agreement provides that sales of our common stock, if any, under this prospectus supplement and the accompanying prospectus

may be made in in transactions that are deemed to be “at-the-market” offerings as defined in Rule 415 under the Securities

Act of 1933, as amended (the “Securities Act”), including sales made directly on or through Nasdaq, the existing trading

market for our common stock, or any other existing trading market in the Unites States for our common stock, sales made to or through

a market maker other than on an exchange or otherwise, directly to the Sales Agent as principal, in negotiated transactions at market

prices prevailing at the time of sale or at prices related to such prevailing market prices, and/or in any other method permitted by

law.

Wainwright

will offer shares of our common stock subject to the terms and conditions of the Offering Agreement as agreed upon by us and Wainwright.

We will designate the number of shares which we desire to sell, the time period during which sales are requested to be made, any limitation

on the number of shares that may be sold in one day and any minimum price below which sales may not be made. Subject to the terms and

conditions of the Offering Agreement, Wainwright will use its commercially reasonable efforts consistent with its normal trading and

sales practices and applicable laws and regulations to sell on our behalf all of the shares requested to be sold by us. We or Wainwright

may suspend the offering of the shares of common stock being made through Wainwright under the Offering Agreement at any time upon proper

notice to the other party.

Settlement

for sales of common stock will occur on the first trading day (or any such other shorter settlement cycle as may be in effect pursuant

to Rule 15c6-1 under the Exchange Act from time to time) following the date on which any sales are made in return for payment of the

net proceeds to us. Sales of shares of our common stock as contemplated in this prospectus supplement and the accompanying base prospectus

will be settled through the facilities of The Depository Trust Company or by such other means as we and Wainwright may agree upon. There

is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We

will pay Wainwright a cash commission of 3.0% of the gross sales price of the shares of our common stock that Wainwright sells pursuant

to the Offering Agreement. Because there is no minimum offering amount required as a condition to this offering, the actual total offering