0001045810false00010458102025-03-032025-03-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 3, 2025

NVIDIA CORPORATION | | |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Delaware | 0-23985 | 94-3177549 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

2788 San Tomas Expressway, Santa Clara, CA 95051

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (408) 486-2000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | NVDA | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Adoption of Fiscal Year 2026 Variable Compensation Plan

On March 3, 2025, the Compensation Committee of the Board of Directors, or the Board, of NVIDIA Corporation, or the Company, adopted the Variable Compensation Plan for Fiscal Year 2026, or the 2026 Plan, which provides eligible executive officers the opportunity to earn a variable cash payment based on the level of achievement by the Company of certain corporate performance goals, or the Performance Goals, during fiscal year 2026. The Company operates on a fiscal year ending on the last Sunday in January and designates its fiscal year by the year in which that fiscal year ends. Fiscal year 2026 refers to the Company’s fiscal year ending January 25, 2026.

The Compensation Committee has set the Performance Goals for fiscal year 2026 based upon the achievement of specified fiscal year 2026 revenue and has established threshold compensation plan, base compensation plan, and stretch compensation plan levels.

Unless otherwise determined by the Compensation Committee, a participant must remain an employee through the payment date under the 2026 Plan to be eligible to earn an award.

The following table sets forth the respective target award opportunities for base compensation plan achievement for the Company’s named executive officers under the 2026 Plan:

| | | | | | | | | | | | | | |

Named Executive Officer | | Target Award Opportunity for Base Compensation Plan Achievement | | Target Award Opportunity for Base Compensation Plan Achievement as a % of Fiscal Year 2026 Base Salary |

Jen-Hsun Huang President and Chief Executive Officer | | $3,000,000 | | 200% |

Colette M. Kress Executive Vice President and Chief Financial Officer | | $300,000 | | 33% |

Ajay K. Puri Executive Vice President, Worldwide Field Operations | | $650,000 | | 68% |

Debora Shoquist Executive Vice President, Operations | | $250,000 | | 29% |

Timothy S. Teter Executive Vice President, General Counsel and Secretary | | $250,000 | | 29% |

The foregoing description is subject to, and qualified in its entirety by, the 2026 Plan, which is filed with this report as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1 | | |

| 104 | | The cover page of this Current Report on Form 8-K, formatted in inline XBRL (included as Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | NVIDIA Corporation |

| Date: March 7, 2025 | | By: /s/ Rebecca Peters |

| | | Rebecca Peters |

| | | Vice President, Deputy General Counsel and Assistant Secretary |

Exhibit 10.1

VARIABLE COMPENSATION PLAN – FISCAL YEAR 2026

Overview

The compensation philosophy of NVIDIA Corporation (the “Company”) is to attract, motivate, retain and reward its management through a combination of base salary and performance based compensation. Certain Senior Officers, as defined below (collectively, the “Participants”), who are employed at the Company during fiscal year 2026 and, unless otherwise determined by the Compensation Committee (the “Committee”) of the Company’s Board of Directors (the “Board”), are employees of the Company through the date that any amounts earned hereunder are paid, will be eligible to earn compensation under this Fiscal Year 2026 Variable Compensation Plan (the “Plan”). The Plan is designed to award compensation for performance in fiscal year 2026 to a Participant if the Company achieves certain corporate performance goals (the “Performance Goals”).

For purposes of the Plan, only the Company’s chief executive officer, chief financial officer and other named executive officers shall be considered “Senior Officers.” The Committee shall determine the persons to be specified as Senior Officers for purposes of this Plan and the Senior Officers who may be Participants hereunder.

Determination of Fiscal Year 2026 Payments

Each Participant is eligible to earn compensation under the Plan at a specified base amount (the “Base Payment Amount”) if the Company achieves its Performance Goals at a specified base level. A Participant’s Base Payment Amount is based on the difficulty and responsibility of each position. Each Participant’s Base Payment Amount will be entirely allocated to the achievement of the Performance Goals. The actual amount of compensation that may be earned by and paid to each Participant under this Plan (the “Actual Payment Amount”) may be more or less than his or her Base Payment Amount as described more fully below.

The Committee has set the Performance Goals for the Participants based on achievement of fiscal year 2026 revenue at specified threshold, base and stretch levels (the “Threshold Compensation Plan,” “Base Compensation Plan” and “Stretch Compensation Plan,” respectively). For purposes of the Plan, the “Actual Result” is defined as revenue, as reported on the Company’s income statement for fiscal year 2026, subject to adjustments if and to the extent determined appropriate by the Committee to reflect the exclusion of revenue from mergers with or acquisitions by the Company completed during fiscal year 2026.

The Actual Payment Amount for each Participant shall be determined pursuant to the following:

•If the Actual Result is less than the Threshold Compensation Plan, a Participant will not earn any Actual Payment Amount.

•If the Actual Result equals the Threshold Compensation Plan, each Participant may earn an Actual Payment Amount equal to 50% of his or her Base Payment Amount.

•If the Actual Result exceeds the Threshold Compensation Plan but is less than the Base Compensation Plan, each Participant may earn an Actual Payment Amount pursuant to the formula set forth below:

Actual Payment Amount = [((Actual Result – Threshold Compensation Plan) / (Base Compensation Plan – Threshold Compensation Plan)) * 50%) + 50%] * Base Payment Amount

•If the Actual Result equals the Base Compensation Plan, each Participant may earn an Actual Payment Amount equal to 100% of his or her Base Payment Amount.

•If the Actual Result exceeds the Base Compensation Plan but is less than the Stretch Compensation Plan, each Participant may earn an Actual Payment Amount pursuant to the formula set forth below:

Actual Payment Amount = [((Actual Result – Base Compensation Plan) / (Stretch Compensation Plan – Base Compensation Plan)) + 1] * Base Payment Amount

•If the Actual Result equals or exceeds the Stretch Compensation Plan, each Participant may earn an Actual Payment Amount equal to two (2) times his or her Base Payment Amount. In no event may any Participant earn an Actual Payment Amount in excess of two (2) times his or her Base Payment Amount.

Miscellaneous Provisions

Any payments under this Plan shall be made in the form of cash following the end of fiscal year 2026, on such schedule as may be approved by the Committee in its discretion, but in all cases in compliance with the short-term deferral exemption from Section 409A of the Internal Revenue Code of 1986, as amended. Any payments under this Plan shall be subject to any required payroll deductions and tax withholdings.

Participation in the Plan shall not alter in any way the at will nature of the Company’s employment of a Participant, and such employment may be terminated at any time for any reason, with or without cause and with or without prior notice.

Notwithstanding whether this Plan is referenced in another agreement, policy, arrangement or other document, only the Board or the Committee may amend or terminate this Plan at any time.

Any payments or other benefits under this Plan shall be subject to recoupment in accordance with (i) the Company’s Compensation Recovery Policy, as amended from time to time, and (ii) any clawback policy that the Company is required to adopt pursuant to applicable law or listing standards or otherwise adopts, to the extent applicable and permissible under applicable law.

This Plan shall be governed by and construed in accordance with the laws of the State of California, without regard to its principles of conflicts of laws.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

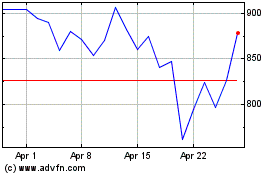

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Feb 2025 to Mar 2025

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Mar 2025