The Children’s Place, Inc. (Nasdaq: PLCE), an

omni-channel children’s specialty portfolio of brands, today

announced financial results for the second quarter ended August 3,

2024.

Muhammad Umair, President and Interim Chief Executive Officer

said, “During the second quarter we proactively made certain

strategic and operational changes to improve the profitability of

the business and provide a foundation for future growth and we were

pleased with the results. While we anticipated that these efforts

would provide pressure to topline sales, we drove significant

improvements in gross profit margin versus the prior year’s second

quarter and sequential improvement in margin for two quarters,

which is particularly important moving from the first quarter to

the second quarter. In addition, we were also able to significantly

decrease Adjusted SG&A expenses as we reduced payroll costs and

eliminated unprofitable marketing spend, all of which has combined

to show more than a $39 million improvement in Adjusted operating

income despite the lower top line sales. While these first steps to

improve operating results have been promising, we still believe

that we have significant work ahead of us in future quarters as we

rationalize profitability.”

Second Quarter 2024 ResultsNet sales decreased

$25.9 million, or 7.5%, to $319.7 million in the three months

ended August 3, 2024, compared to $345.6 million in the three

months ended July 29, 2023. The decrease in net sales was primarily

driven by an anticipated decrease in ecommerce revenue, as the

Company proactively rationalized its unprofitable promotional

strategies, inflated marketing spend and “free shipping” offers to

significantly improve profitability, which was successful during

the second quarter. These efforts not only improved the

profitability of the Company’s ecommerce business, despite the

lower revenue, but also benefited the brick-and-mortar channel, as

the stores business experienced positive comparable store sales for

the first time in ten quarters. The wholesale business also

rebounded with double-digit growth after a decline in the first

quarter.

Comparable retail sales decreased 7.2% for the quarter, largely

driven by the planned decrease in ecommerce as this business

decreased by a double-digit percentage as the Company proactively

sacrificed unprofitable sales to improve profitability. Stores

experienced a positive comparable store sales result for the first

time since the post COVID-19 period of 2021, driven by stronger

units per transaction and conversion metrics, and improving traffic

trends.

Gross profit increased $24.0 million to $111.8 million in the

three months ended August 3, 2024, compared to $87.8 million in the

three months ended July 29, 2023. The gross margin rate increased

by 960 basis points to 35.0% during the three months ended August

3, 2024, compared to 25.4% in the prior year period. The increase

was caused by a combination of factors, including reductions in

product input costs, including cotton and supply chain costs, which

negatively impacted margins in the prior year. These improvements

were combined with the success of the Company’s rationalization of

profit-draining promotional strategies and shipping offers, which

resulted in a significant improvement in the leverage of ecommerce

freight costs due to the Company’s new shipping threshold for free

shipping.

Selling, general, and administrative expenses were well

controlled at $96.1 million in the three months ended August 3,

2024, compared to $112.0 million in the three months ended July 29,

2023. Adjusted selling, general & administrative expenses were

$88.3 million in the three months ended August 3, 2024, compared to

$101.7 million in the comparable period last year, and leveraged

180 basis points to 27.6% of net sales, primarily as a result of

significant reductions in store payroll and home office payroll,

and the elimination of inflated and unprofitable marketing costs.

This represents the lowest level of Adjusted selling, general, and

administrative expenses in over 15 years for the second

quarter.

Operating loss was $(21.8) million in the three months ended

August 3, 2024, compared to $(36.9) million in the three months

ended July 29, 2023. Operating loss was impacted by incremental

expenses of $36.0 million, which included an impairment charge

of $28.0 million on the Gymboree tradename,

primarily due to reductions in Gymboree sales forecasts and a

reduction in the royalty rate used to value the tradename, and

restructuring costs of $6.1 million due to recent changes in the

senior leadership team. These charges have been classified as

non-GAAP adjustments, leading to a shift back to profitability with

an adjusted operating income of $14.2 million in the three months

ended August 3, 2024, or an improvement of $39.2 million compared

to an adjusted operating loss of $(25.0) million in the comparable

period last year, and leveraged 1,170 basis points to 4.5% of net

sales.

Net interest expense was $9.2 million in the three months ended

August 3, 2024, compared to $7.6 million in the three months ended

July 29, 2023. The increase in interest expense was primarily

driven by higher average interest rates associated with the

Company’s revolving credit facility due to the impact of

refinancings and continued market-based rate increases, partially

offset by continued benefits associated with certain non-interest

bearing loans from the Company’s majority shareholder, Mithaq

Capital SPC (“Mithaq”).

As previously announced, in the three months ended February 3,

2024, the Company established a valuation allowance against its net

deferred tax assets and, as such, continues to adjust the allowance

based upon the ongoing operating results. The provision for income

taxes, which is reflected net of these adjustments, was $1.1

million in the three months ended August 3, 2024, compared to a

benefit for income taxes of $(9.2) million during the three months

ended July 29, 2023. The change in the provision (benefit) for

income taxes was primarily driven by the establishment of the

valuation allowance against the Company’s net deferred tax

assets.

Net loss, which included certain non-cash impairment charges and

non-operating restructuring charges, was $(32.1) million, or

$(2.51) per diluted share, in the three months ended August 3,

2024, compared to $(35.4) million, or $(2.82) per diluted share, in

the three months ended July 29, 2023. Adjusted net income shifted

back to profitability after two years of losses during the second

quarter, improving by $30.4 million versus the prior year to $3.9

million, or $0.30 per diluted share, compared to an adjusted net

loss of $(26.5) million, or $(2.12) per diluted share, in the

comparable period last year.

Fiscal Year-To-Date 2024 ResultsNet sales

decreased $79.7 million, or 11.9%, to $587.5 million in the six

months ended August 3, 2024, compared to $667.2 million in the six

months ended July 29, 2023. The decrease in net sales was primarily

due to reductions in retail sales due to lower store count, and

anticipated declines in ecommerce demand due to the rationalization

of promotions, reductions in inflated and unprofitable marketing

spend and the strategic decision to change “free shipping” offers,

as the Company proactively sacrificed unprofitable sales in an

effort to improve profitability. Comparable retail sales decreased

9.4% for the six months ended August 3, 2024.

Gross profit increased $20.3 million to $204.5 million in the

six months ended August 3, 2024, compared to $184.2 million in the

six months ended July 29, 2023. The gross margin rate increased by

720 basis points to 34.8% during the six months ended August 3,

2024 compared to 27.6% in the prior year period. The increase was

primarily due to reductions in product input costs, including

cotton and supply chain costs, which negatively impacted margins in

the prior year. These improvements were combined with the success

of the Company’s rationalization of profit-draining promotional

strategies and shipping offers, which resulted in a significant

improvement in the leverage of ecommerce freight costs due to the

Company’s new shipping threshold for free shipping.

Selling, general, and administrative expenses were $205.2

million in the six months ended August 3, 2024, compared to $224.9

million in the six months ended July 29, 2023. Adjusted selling,

general & administrative expenses were $177.0 million in the

six months ended August 3, 2024, compared to $210.8 million in the

comparable period last year, and leveraged 150 basis points to

30.1% of net sales, primarily as a result of significant reductions

in store payroll and home office payroll, and the elimination of

inflated and unprofitable marketing costs. This represents the

lowest level of Adjusted selling, general and administrative

expenses in over 15 years for the first two quarters of a fiscal

year.

Operating loss was $(49.8) million in the six months ended

August 3, 2024, compared to $(67.0) million in the six months ended

July 29, 2023. Operating loss was impacted by incremental expenses

of $58.9 million, which included an impairment charge

of $28.0 million on the Gymboree tradename,

primarily due to reductions in Gymboree sales forecasts and a

reduction in the royalty rate used to value the tradename,

restructuring costs of $6.4 million primarily due to recent changes

in the senior leadership team, and several charges due to the

Company’s recent change of control, due to the investment in the

Company by Mithaq, and several new financing initiatives, which

include $10.8 million of non-cash equity compensation

charges and $3.8 million in other fees associated with

the change of control, and $6.7 million of

financing-related charges. These charges have been classified as

non-GAAP adjustments leading to a shift back to profitability with

an adjusted operating income of $9.2 million for year-to-date 2024,

or an improvement of $58.7 million compared to an adjusted

operating loss of $(49.5) million in the comparable period last

year, and leveraged 900 basis points to 1.6% of net sales.

Net interest expense was $17.0 million in the six months ended

August 3, 2024, compared to $13.5 million in the six months ended

July 29, 2023. The increase in interest expense was primarily

driven by higher average interest rates associated with the

Company’s revolving credit facility due to the impact of

refinancings and continued market-based rate increases, partially

offset by continued benefits associated with certain non-interest

bearing loans from Mithaq.

The provision for income taxes was $3.2 million in the six

months ended August 3, 2024, compared to a benefit for income taxes

of $(16.4) million during the six months ended July 29, 2023. The

change in the provision (benefit) for income taxes was primarily

driven by the establishment of a valuation allowance against the

Company’s net deferred tax assets in the Company’s fiscal year for

2023.

Net loss, which included certain non-cash impairment charges and

non-operating restructuring charges, was $(69.9) million, or

$(5.50) per diluted share, in the six months ended August 3, 2024,

compared to $(64.2) million, or $(5.16) per diluted share, in the

six months ended July 29, 2023. Adjusted net loss, which was driven

by losses in the first quarter and partially offset by profits in

the second quarter, was $(11.0) million, or $(0.87) per diluted

share, compared to $(51.2) million, or $(4.12) per diluted share,

in the comparable period last year.

Store Update The Company closed 3

stores in the three months ended August 3, 2024 and ended

the quarter with 515 stores and square footage of 2.5 million.

Balance Sheet and Cash FlowAs of August 3,

2024, the Company had $9.6 million of cash and cash equivalents and

$316.7 million outstanding on its revolving credit facility.

Additionally, the Company used $194.7 million in operating cash

flows in the six months ended August 3, 2024.

Inventories were $520.6 million as of August 3, 2024, compared

to $537.0 million as of July 29, 2023.

Non-GAAP ReconciliationThe Company’s results

are reported in this press release on a GAAP and as adjusted,

non-GAAP basis. Adjusted net income (loss), adjusted net income

(loss) per diluted share, adjusted gross profit, adjusted selling,

general, and administrative expenses, adjusted operating income

(loss) and adjusted EBITDA are non-GAAP measures, and are not

intended to replace GAAP financial information, and may be

different from non-GAAP measures reported by other companies. The

Company believes the income and expense items excluded as non-GAAP

adjustments are not reflective of the performance of its core

business, and that providing this supplemental disclosure to

investors will facilitate comparisons of the past and present

performance of its core business.

Please refer to the “Reconciliation of Non-GAAP Financial

Information to GAAP” later in this press release, which sets forth

the non-GAAP operating adjustments for the 13-week periods and

26-week periods ended August 3, 2024, and July 29, 2023.

About The Children’s PlaceThe Children’s Place

is an omni-channel children’s specialty portfolio of brands. Its

global retail and wholesale network includes two digital

storefronts, more than 500 stores in North America, wholesale

marketplaces and distribution in 15 countries through five

international franchise partners. The Children’s Place designs,

contracts to manufacture, and sells fashionable, high-quality

apparel, accessories and footwear predominantly at value prices,

primarily under its proprietary brands: “The Children’s Place”,

“Gymboree”, “Sugar & Jade”, and “PJ Place”. For more

information, visit: www.childrensplace.com and www.gymboree.com, as

well as the Company’s social media channels on Instagram, Facebook,

X, formerly known as Twitter, YouTube and Pinterest.

Forward-Looking StatementsThis press release

contains or may contain forward-looking statements made pursuant to

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, including but not limited to statements

relating to the Company’s strategic initiatives and results of

operations, including adjusted net income (loss) per diluted share.

Forward-looking statements typically are identified by use of terms

such as “may,” “will,” “should,” “plan,” “project,” “expect,”

“anticipate,” “estimate” and similar words, although some

forward-looking statements are expressed differently. These

forward-looking statements are based upon the Company’s current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results and performance to

differ materially. Some of these risks and uncertainties are

described in the Company’s filings with the Securities and Exchange

Commission, including in the “Risk Factors” section of its annual

report on Form 10-K for the fiscal year ended February 3, 2024.

Included among the risks and uncertainties that could cause actual

results and performance to differ materially are the risk that the

Company will be unable to achieve operating results at levels

sufficient to fund and/or finance the Company’s current level of

operations and repayment of indebtedness, the risk that the Company

will be unsuccessful in gauging fashion trends and changing

consumer preferences, the risks resulting from the highly

competitive nature of the Company’s business and its dependence on

consumer spending patterns, which may be affected by changes in

economic conditions (including inflation), the risk that changes in

the Company’s plans and strategies with respect to pricing, capital

allocation, capital structure, investor communications and/or

operations may have a negative effect on the Company’s business,

the risk that the Company’s strategic initiatives to increase sales

and margin, improve operational efficiencies, enhance operating

controls, decentralize operational authority and reshape the

Company’s culture are delayed or do not result in anticipated

improvements, the risk of delays, interruptions, disruptions and

higher costs in the Company’s global supply chain, including

resulting from disease outbreaks, foreign sources of supply in less

developed countries, more politically unstable countries, or

countries where vendors fail to comply with industry standards or

ethical business practices, including the use of forced, indentured

or child labor, the risk that the cost of raw materials or energy

prices will increase beyond current expectations or that the

Company is unable to offset cost increases through value

engineering or price increases, various types of litigation,

including class action litigations brought under securities,

consumer protection, employment, and privacy and information

security laws and regulations, the imposition of regulations

affecting the importation of foreign-produced merchandise,

including duties and tariffs, risks related to the existence of a

controlling shareholder, and the uncertainty of weather patterns.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date they

were made. The Company undertakes no obligation to release publicly

any revisions to these forward-looking statements that may be made

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events.

Contact: Investor Relations (201) 558-2400

ext. 14500

| |

|

|

|

|

THE CHILDREN’S PLACE, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(In

thousands, except per share

amounts)(Unaudited) |

| |

|

|

|

| |

Second Quarter Ended |

|

Year-to-Date Ended |

| |

August 3,2024 |

|

July 29,2023 |

|

August 3,2024 |

|

July 29,2023 |

| |

|

|

|

|

|

|

|

|

Net sales |

$ |

319,655 |

|

|

$ |

345,599 |

|

|

$ |

587,533 |

|

|

$ |

667,239 |

|

| Cost of sales |

|

207,861 |

|

|

|

257,840 |

|

|

|

382,998 |

|

|

|

483,019 |

|

| Gross profit |

|

111,794 |

|

|

|

87,759 |

|

|

|

204,535 |

|

|

|

184,220 |

|

| Selling, general and

administrative expenses |

|

96,065 |

|

|

|

111,965 |

|

|

|

205,159 |

|

|

|

224,895 |

|

| Depreciation and

amortization |

|

9,505 |

|

|

|

11,953 |

|

|

|

21,140 |

|

|

|

23,801 |

|

| Asset impairment charges |

|

28,000 |

|

|

|

782 |

|

|

|

28,000 |

|

|

|

2,532 |

|

| Operating loss |

|

(21,776 |

) |

|

|

(36,941 |

) |

|

|

(49,764 |

) |

|

|

(67,008 |

) |

| Interest expense, net |

|

(9,231 |

) |

|

|

(7,641 |

) |

|

|

(16,952 |

) |

|

|

(13,543 |

) |

| Loss before provision

(benefit) for income taxes |

|

(31,007 |

) |

|

|

(44,582 |

) |

|

|

(66,716 |

) |

|

|

(80,551 |

) |

| Provision (benefit) for income

taxes |

|

1,107 |

|

|

|

(9,227 |

) |

|

|

3,193 |

|

|

|

(16,363 |

) |

| Net loss |

$ |

(32,114 |

) |

|

$ |

(35,355 |

) |

|

$ |

(69,909 |

) |

|

$ |

(64,188 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Loss per common share |

|

|

|

|

|

|

|

| Basic |

$ |

(2.51 |

) |

|

$ |

(2.82 |

) |

|

$ |

(5.50 |

) |

|

$ |

(5.16 |

) |

| Diluted |

$ |

(2.51 |

) |

|

$ |

(2.82 |

) |

|

$ |

(5.50 |

) |

|

$ |

(5.16 |

) |

| |

|

|

|

|

|

|

|

| Weighted average common shares

outstanding |

|

|

|

|

|

|

|

| Basic |

|

12,772 |

|

|

|

12,522 |

|

|

|

12,707 |

|

|

|

12,448 |

|

| Diluted |

|

12,772 |

|

|

|

12,522 |

|

|

|

12,707 |

|

|

|

12,448 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

THE CHILDREN’S PLACE, INC.RECONCILIATION

OF NON-GAAP FINANCIAL INFORMATION TO GAAP(In

thousands, except per share

amounts)(Unaudited) |

| |

|

|

|

| |

Second Quarter Ended |

|

Year-to-Date Ended |

| |

August 3,2024 |

|

July 29,2023 |

|

August 3,2024 |

|

July 29,2023 |

| |

|

|

|

|

|

|

|

|

Net loss |

$ |

(32,114 |

) |

|

$ |

(35,355 |

) |

|

$ |

(69,909 |

) |

|

$ |

(64,188 |

) |

| |

|

|

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

| Asset impairment charges |

|

28,000 |

|

|

|

782 |

|

|

|

28,000 |

|

|

|

2,532 |

|

| Restructuring costs |

|

6,104 |

|

|

|

9,659 |

|

|

|

6,367 |

|

|

|

9,928 |

|

| Credit

agreement/lender-required consulting |

|

1,102 |

|

|

|

— |

|

|

|

1,852 |

|

|

|

— |

|

| Professional and consulting

fees |

|

422 |

|

|

|

— |

|

|

|

422 |

|

|

|

— |

|

| Accelerated depreciation |

|

256 |

|

|

|

907 |

|

|

|

1,813 |

|

|

|

907 |

|

| Fleet optimization |

|

123 |

|

|

|

81 |

|

|

|

708 |

|

|

|

1,168 |

|

| Change of control |

|

— |

|

|

|

— |

|

|

|

14,589 |

|

|

|

— |

|

| Broken financing and

restructuring fees |

|

— |

|

|

|

— |

|

|

|

6,661 |

|

|

|

— |

|

| Canada distribution center

closure |

|

— |

|

|

|

— |

|

|

|

781 |

|

|

|

— |

|

| Reversal of legal settlement

accrual |

|

— |

|

|

|

— |

|

|

|

(2,279 |

) |

|

|

— |

|

| Contract termination

costs |

|

— |

|

|

|

546 |

|

|

|

— |

|

|

|

2,962 |

|

| Aggregate impact of non-GAAP

adjustments |

|

36,007 |

|

|

|

11,975 |

|

|

|

58,914 |

|

|

|

17,497 |

|

| Income tax effect (1) |

|

— |

|

|

|

(3,113 |

) |

|

|

— |

|

|

|

(4,549 |

) |

| Net impact of non-GAAP

adjustments |

|

36,007 |

|

|

|

8,862 |

|

|

|

58,914 |

|

|

|

12,948 |

|

| |

|

|

|

|

|

|

|

| Adjusted net income

(loss) |

$ |

3,893 |

|

|

$ |

(26,493 |

) |

|

$ |

(10,995 |

) |

|

$ |

(51,240 |

) |

| |

|

|

|

|

|

|

|

| GAAP net loss per common

share |

$ |

(2.51 |

) |

|

$ |

(2.82 |

) |

|

$ |

(5.50 |

) |

|

$ |

(5.16 |

) |

| |

|

|

|

|

|

|

|

| Adjusted net income (loss) per

common share |

$ |

0.30 |

|

|

$ |

(2.12 |

) |

|

$ |

(0.87 |

) |

|

$ |

(4.12 |

) |

(1) The tax effects of the non-GAAP items are calculated based

on the statutory rate of the jurisdiction in which the discrete

item resides, adjusted for the impact of any valuation

allowance.

| |

|

|

|

|

THE CHILDREN’S PLACE, INC.RECONCILIATION

OF NON-GAAP FINANCIAL INFORMATION TO GAAP(In

thousands, except per share

amounts)(Unaudited) |

| |

|

|

|

| |

Second Quarter Ended |

|

Year-to-Date Ended |

| |

August 3,2024 |

|

July 29,2023 |

|

August 3,2024 |

|

July 29,2023 |

| |

|

|

|

|

|

|

|

|

Operating loss |

$ |

(21,776 |

) |

|

$ |

(36,941 |

) |

|

$ |

(49,764 |

) |

|

$ |

(67,008 |

) |

| |

|

|

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

| Asset impairment charges |

|

28,000 |

|

|

|

782 |

|

|

|

28,000 |

|

|

|

2,532 |

|

| Restructuring costs |

|

6,104 |

|

|

|

9,659 |

|

|

|

6,367 |

|

|

|

9,928 |

|

| Credit

agreement/lender-required consulting |

|

1,102 |

|

|

|

— |

|

|

|

1,852 |

|

|

|

— |

|

| Professional and consulting

fees |

|

422 |

|

|

|

— |

|

|

|

422 |

|

|

|

— |

|

| Accelerated depreciation |

|

256 |

|

|

|

907 |

|

|

|

1,813 |

|

|

|

907 |

|

| Fleet optimization |

|

123 |

|

|

|

81 |

|

|

|

708 |

|

|

|

1,168 |

|

| Change of control |

|

— |

|

|

|

— |

|

|

|

14,589 |

|

|

|

— |

|

| Broken financing and

restructuring fees |

|

— |

|

|

|

— |

|

|

|

6,661 |

|

|

|

— |

|

| Canada distribution center

closure |

|

— |

|

|

|

— |

|

|

|

781 |

|

|

|

— |

|

| Reversal of legal settlement

accrual |

|

— |

|

|

|

— |

|

|

|

(2,279 |

) |

|

|

— |

|

| Contract termination

costs |

|

— |

|

|

|

546 |

|

|

|

— |

|

|

|

2,962 |

|

| Aggregate impact of non-GAAP

adjustments |

|

36,007 |

|

|

|

11,975 |

|

|

|

58,914 |

|

|

|

17,497 |

|

| |

|

|

|

|

|

|

|

| Adjusted operating income

(loss) |

$ |

14,231 |

|

|

$ |

(24,966 |

) |

|

$ |

9,150 |

|

|

$ |

(49,511 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

THE CHILDREN’S PLACE, INC.RECONCILIATION

OF NON-GAAP FINANCIAL INFORMATION TO GAAP(In

thousands, except per share

amounts)(Unaudited) |

| |

|

|

|

|

| |

Second Quarter Ended |

|

|

Year-to-Date Ended |

| |

August 3,2024 |

|

|

July 29,2023 |

|

|

August 3,2024 |

|

|

July 29,2023 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

$ |

111,794 |

|

|

$ |

87,759 |

|

|

$ |

204,535 |

|

|

$ |

184,220 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

| Change of control |

|

— |

|

|

|

— |

|

|

|

905 |

|

|

|

— |

|

| Aggregate impact of non-GAAP

adjustments |

|

— |

|

|

|

— |

|

|

|

905 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

|

| Adjusted gross profit |

$ |

111,794 |

|

|

$ |

87,759 |

|

|

$ |

205,440 |

|

|

$ |

184,220 |

|

| |

Second Quarter Ended |

|

Year-to-Date Ended |

| |

August 3,2024 |

|

July 29,2023 |

|

August 3,2024 |

|

July 29,2023 |

| |

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

$ |

96,065 |

|

|

$ |

111,965 |

|

|

$ |

205,159 |

|

|

$ |

224,895 |

|

| |

|

|

|

|

|

|

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

| Restructuring costs |

|

(6,104 |

) |

|

|

(9,659 |

) |

|

|

(6,367 |

) |

|

|

(9,928 |

) |

| Credit

agreement/lender-required consulting |

|

(1,102 |

) |

|

|

— |

|

|

|

(1,852 |

) |

|

|

— |

|

| Professional and consulting

fees |

|

(422 |

) |

|

|

— |

|

|

|

(422 |

) |

|

|

— |

|

| Fleet optimization |

|

(123 |

) |

|

|

(81 |

) |

|

|

(708 |

) |

|

|

(1,168 |

) |

| Change of control |

|

— |

|

|

|

— |

|

|

|

(13,684 |

) |

|

|

— |

|

| Broken financing deal |

|

— |

|

|

|

— |

|

|

|

(6,661 |

) |

|

|

— |

|

| Canada distribution center

closure |

|

— |

|

|

|

— |

|

|

|

(781 |

) |

|

|

— |

|

| Reversal of legal settlement

accrual |

|

— |

|

|

|

— |

|

|

|

2,279 |

|

|

|

— |

|

| Contract termination

costs |

|

— |

|

|

|

(546 |

) |

|

|

|

|

(2,962 |

) |

| Aggregate impact of non-GAAP

adjustments |

|

(7,751 |

) |

|

|

(10,286 |

) |

|

|

(28,196 |

) |

|

|

(14,058 |

) |

| |

|

|

|

|

|

|

|

| Adjusted selling, general and

administrative expenses |

$ |

88,314 |

|

|

$ |

101,679 |

|

|

$ |

176,963 |

|

|

$ |

210,837 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

THE CHILDREN’S PLACE, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(In

thousands)(Unaudited) |

| |

|

|

|

|

|

| |

August 3,2024 |

|

February 3,2024* |

|

July 29,2023 |

| |

|

|

| Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

9,573 |

|

|

$ |

13,639 |

|

|

$ |

18,846 |

|

| Accounts receivable |

|

61,926 |

|

|

|

33,219 |

|

|

|

33,073 |

|

| Inventories |

|

520,593 |

|

|

|

362,099 |

|

|

|

536,980 |

|

| Prepaid expenses and other

current assets |

|

35,251 |

|

|

|

43,169 |

|

|

|

65,108 |

|

| Total current assets |

|

627,343 |

|

|

|

452,126 |

|

|

|

654,007 |

|

| |

|

|

|

|

|

| Property and equipment,

net |

|

111,296 |

|

|

|

124,750 |

|

|

|

141,244 |

|

| Right-of-use assets |

|

163,539 |

|

|

|

175,351 |

|

|

|

112,325 |

|

| Tradenames, net |

|

13,000 |

|

|

|

41,123 |

|

|

|

70,491 |

|

| Other assets, net |

|

6,236 |

|

|

|

6,958 |

|

|

|

45,018 |

|

| Total assets |

$ |

921,414 |

|

|

$ |

800,308 |

|

|

$ |

1,023,085 |

|

| |

|

|

|

|

|

| Liabilities and

Stockholders' (Deficit) Equity: |

|

|

|

|

|

| Revolving loan |

$ |

316,655 |

|

|

$ |

226,715 |

|

|

$ |

347,546 |

|

| Accounts payable |

|

215,793 |

|

|

|

225,549 |

|

|

|

262,369 |

|

| Current portion of operating

lease liabilities |

|

67,610 |

|

|

|

69,235 |

|

|

|

65,266 |

|

| Accrued expenses and other

current liabilities |

|

98,458 |

|

|

|

94,905 |

|

|

|

124,970 |

|

| Total current liabilities |

|

698,516 |

|

|

|

616,404 |

|

|

|

800,151 |

|

| |

|

|

|

|

|

| Long-term debt |

|

— |

|

|

|

49,818 |

|

|

|

49,785 |

|

| Related party long-term

debt |

|

165,354 |

|

|

|

— |

|

|

|

— |

|

| Long-term portion of operating

lease liabilities |

|

110,596 |

|

|

|

118,073 |

|

|

|

63,714 |

|

| Other long-term

liabilities |

|

15,820 |

|

|

|

25,032 |

|

|

|

23,505 |

|

| Total liabilities |

|

990,286 |

|

|

|

809,327 |

|

|

|

937,155 |

|

| |

|

|

|

|

|

| Stockholders' (deficit)

equity |

|

(68,872 |

) |

|

|

(9,019 |

) |

|

|

85,930 |

|

| Total liabilities and

stockholders' (deficit) equity |

$ |

921,414 |

|

|

$ |

800,308 |

|

|

$ |

1,023,085 |

|

* Derived from the audited consolidated financial statements

included in the Company's Annual Report on Form 10-K for the fiscal

year ended February 3, 2024.

| |

|

|

THE CHILDREN’S PLACE, INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(In

thousands)(Unaudited) |

| |

|

| |

Second Quarter Ended |

| |

August 3,2024 |

|

July 29,2023 |

| |

|

|

|

|

Net loss |

$ |

(69,909 |

) |

|

$ |

(64,188 |

) |

| Non-cash adjustments |

|

100,757 |

|

|

|

63,570 |

|

| Working capital |

|

(225,535 |

) |

|

|

(32,087 |

) |

| Net cash used in operating

activities |

|

(194,687 |

) |

|

|

(32,705 |

) |

| |

|

|

|

| Net cash used in investing

activities |

|

(12,478 |

) |

|

|

(18,261 |

) |

| |

|

|

|

| Net cash provided by financing

activities |

|

203,652 |

|

|

|

52,969 |

|

| |

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

(553 |

) |

|

|

154 |

|

| |

|

|

|

| Net (decrease) increase in

cash and cash equivalents |

|

(4,066 |

) |

|

|

2,157 |

|

| |

|

|

|

| Cash and cash equivalents,

beginning of period |

|

13,639 |

|

|

|

16,689 |

|

| |

|

|

|

| Cash and cash equivalents, end

of period |

$ |

9,573 |

|

|

$ |

18,846 |

|

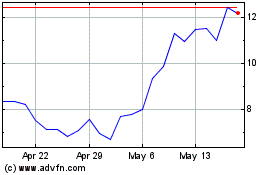

Childrens Place (NASDAQ:PLCE)

Historical Stock Chart

From Feb 2025 to Mar 2025

Childrens Place (NASDAQ:PLCE)

Historical Stock Chart

From Mar 2024 to Mar 2025