false

0001041859

0001041859

2025-01-31

2025-01-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 31, 2025

| THE CHILDREN’S PLACE, INC. |

| (Exact Name of Registrant as Specified in Charter) |

| |

| Delaware |

| (State or Other Jurisdiction of Incorporation) |

| 0-23071 |

31-1241495 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

|

| 500 Plaza Drive, Secaucus, New Jersey |

07094 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| (201) 558-2400 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12-b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class |

Trading

Symbol(s) |

Name of each exchange on

which registered |

| Common Stock, $0.10 par value |

PLCE |

NASDAQ Global Select Market |

Item 8.01 Other Events.

As previously disclosed,

on December 31, 2024, the Company commenced a rights offering (“Rights Offering”)

pursuant to which the Company distributed to the holders of record of the Company’s common stock (the “Common

Stock”) as of the close of business on December 13, 2024, the record date for the Rights Offering, non-transferable subscription

rights to purchase, in the aggregate, up to 9,230,769 shares of Common Stock. Each such subscription right consisted of a basic subscription

right and an over-subscription privilege. With the basic subscription rights, subscription rights holders were permitted to purchase 0.7220

shares of Common Stock per subscription right at $9.75 per whole share of Common Stock, subject to rounding down for any fractional shares.

Additionally, subscription rights holders who fully exercised their basic subscription rights were entitled pursuant to an over-subscription

privilege to subscribe, at $9.75 per whole share of Common Stock, for additional shares of Common Stock that remained unsubscribed in

the Rights Offering as a result of any unexercised basic subscription rights, subject to pro rata allocations and adjustments

in the event demand from subscription rights holders for Common Stock pursuant to the over-subscription privilege exceeded the number

of basic subscription rights that were not exercised in the Rights Offering. The subscription price for shares of Common Stock subscribed

for in the Rights Offering was payable by rights holders (i) in cash, (ii) by delivery in lieu of cash of an equivalent amount

of any indebtedness for borrowed money (principal and/or accrued and unpaid interest) owed by the Company to such rights holder, or (iii) by

delivery of a combination of cash and such indebtedness.

The subscription period for

the Rights Offering expired at 5:00 p.m., New York City time, on January 31, 2025 (the “Expiration

Date and Time”). The subscription rights that were not exercised by the Expiration Date and Time expired and have no

value. Overall, the Rights Offering was over-subscribed, with total demand from subscription rights holders for 12,117,812 shares

of Common Stock, taking into account both basic subscription rights exercised and shares of Common Stock sought pursuant to the over-subscription

privilege. Pursuant to the terms of the Rights Offering, 7,368,689 shares of Common Stock were purchased pursuant to the exercise

of basic subscription rights, and, of the 4,749,123 additional shares of Common Stock sought by subscription rights holders pursuant to

the over-subscription privilege, 1,862,080 additional shares of Common Stock were purchased in the Rights Offering. In the aggregate,

the Company is issuing in the Rights Offering 9,230,769 shares of Common Stock at the subscription price of $9.75 per whole share.

Pursuant to the terms of

the Rights Offering, subscription rights holders who validly exercised their over-subscription privilege will, in addition to receipt

of the shares of Common Stock they subscribed for pursuant to their basic subscription rights, receive the portion of the shares of Common

Stock available pursuant to the over-subscription privilege to which they are entitled pursuant to the prospectus, which for the

avoidance of doubt may be adjusted downwards from the number of shares of Common Stock sought by such subscription rights holders pursuant

to the over-subscription privilege due to pro rata allocations. Excess subscription payments will be returned to applicable subscription

rights holders in the manner and form in which such payments were made, without interest or penalty, as soon as practicable in accordance

with the prospectus.

Mithaq Capital SPC (“Mithaq”)

and Snowball Compounding Ltd. (“Snowball”), each fully-exercised their basic

subscription rights. Mithaq additionally sought a further 4,175,480 of shares of Common Stock pursuant to the over-subscription privilege,

which was adjusted downwards due to pro rata allocations. Snowball purchased 722 shares of Common Stock pursuant to its basic subscription

right and paid the entirety of the $7,039.50 subscription price for such shares of Common Stock in cash. Mithaq purchased 6,694,310

of shares of Common Stock pursuant to its basic subscription right and the oversubscription privilege and paid (i) $5,082,519 of the subscription

price for such shares in cash and (ii) the remaining $60,187,003.50 of the subscription price for such shares by delivery of indebtedness

for borrowed money owed by the Company to Mithaq pursuant to that certain interest-free

unsecured promissory note, dated February 29, 2024 (the “First Mithaq Note”),

by and among the Company, certain subsidiaries of the Company, and Mithaq. Accordingly, the aggregate outstanding indebtedness

owed by the Company to Mithaq pursuant to the First Mithaq Note has been reduced to $18,412,996.50.

The Company received approximately

$29,812,994 in gross cash proceeds from the Rights Offering. Pursuant to the Company’s Amended and Restated Credit Agreement

dated May 9, 2019, as amended (the “Credit Agreement”), by and among the Company, certain subsidiaries of the Company, the

lenders party thereto and Wells Fargo, National Association, as Administrative Agent, Collateral Agent, Swing Line Lender and Term Agent,

the Company expects, to the extent permitted by the Credit Agreement, to retain 20% of the net cash proceeds from the Rights Offering

for general corporate purposes and to use the remaining 80% to prepay amounts outstanding pursuant to the revolving credit facility under

the Credit Agreement.

As of the close of business

on February 5, 2025, there were 12,784,972 shares of Common Stock outstanding, which amount does not include any of the shares of Common

Stock issuable pursuant to the Rights Offering. Based on such shares outstanding and the number of shares stated by Mithaq as beneficially

owned by it in Amendment No. 6 to its Schedule 13D filed with the United States Securities and Exchange Commission on February 4, 2025

in respect of the Company (the “Schedule 13D Amendment”), and additionally

assuming (i) the issuance of all of the 9,230,769 shares of Common Stock expected to be issued in the Rights Offering (including the portion

thereof issuable to Mithaq and Snowball) and (ii) no other changes in the number of shares of Common Stock beneficially owned by Mithaq

from the number reported by Mithaq in its Schedule 13D Amendment, the Company believes that following the Rights Offering, Mithaq beneficially

owns approximately 62.2% of the Company’s Common Stock.

The Rights Offering was made

pursuant to the Company’s registration statement (including a prospectus) on Form S-1 filed with the United States Securities and

Exchange Commission (the “SEC”) that was declared effective on December 31,

2024, and a prospectus filed with the SEC on December 31, 2024.

This Current Report on Form

8-K shall not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company, nor shall there be any offer,

solicitation or sale of any securities of the Company in any state or jurisdiction in which such offer, solicitation or sale would be

unlawful under the securities laws of such state or jurisdiction.

Forward-Looking Statements

This Current Report on Form 8-K contains or

may contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of

1995, including, but not limited to, statements relating to the application and use of the net cash proceeds from the Company’s

Rights Offering and the number of shares of Common Stock beneficially owned by Mithaq. Forward-looking statements typically are identified

by use of terms such as “may,” “will,” “should,” “plan,” “project,” “expect,”

“anticipate,” “estimate”, “believe” and similar words, although some forward-looking statements are

expressed differently. These forward-looking statements are based upon the Company’s current expectations and assumptions and are

subject to various risks and uncertainties that could cause actual results and performance to differ materially. Some of these risks

and uncertainties are described in the Company’s filings with the Securities and Exchange Commission, including in the “Risk

Factors” section of its annual report on Form 10-K for the fiscal year ended February 3, 2024. Included among the risks and uncertainties

that could cause actual results and performance to differ materially are the risk that the Company will be unable to achieve operating

results at levels sufficient to fund and/or finance the Company’s current level of operations and repayment of indebtedness, the

risk that the Company will be unsuccessful in gauging fashion trends and changing consumer preferences, the risks resulting from the

highly competitive nature of the Company’s business and its dependence on consumer spending patterns, which may be affected by

changes in economic conditions (including inflation), the risk that changes in the Company’s plans and strategies with respect

to pricing, capital allocation, capital structure, investor communications and/or operations may have a negative effect on the Company’s

business, the risk that the Company’s strategic initiatives to increase sales and margin, improve operational efficiencies, enhance

operating controls, decentralize operational authority and reshape the Company’s culture are delayed or do not result in anticipated

improvements, the risk of delays, interruptions, disruptions and higher costs in the Company’s global supply chain, including resulting

from disease outbreaks, foreign sources of supply in less developed countries, more politically unstable countries, or countries where

vendors fail to comply with industry standards or ethical business practices, including the use of forced, indentured or child labor,

the risk that the cost of raw materials or energy prices will increase beyond current expectations or that the Company is unable to offset

cost increases through value engineering or price increases, various types of litigation, including class action litigations brought

under securities, consumer protection, employment, and privacy and information security laws and regulations, the imposition of regulations

affecting the importation of foreign-produced merchandise, including duties and tariffs, risks related to the existence of a controlling

shareholder, and the uncertainty of weather patterns, as well as other risks discussed in the Company’s filings with the SEC from

time to time. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date

they were made. The Company undertakes no obligation to release publicly any revisions to these forward-looking statements that may be

made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 6, 2025

| |

THE CHILDREN’S PLACE, INC. |

| |

|

|

| |

|

|

| |

By: /s/ Jared Shure |

| |

Name: |

Jared Shure |

| |

Title: |

Chief Administrative Officer, General Counsel & Corporate Secretary |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

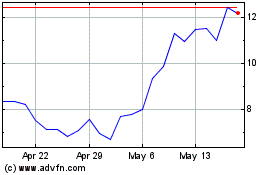

Childrens Place (NASDAQ:PLCE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Childrens Place (NASDAQ:PLCE)

Historical Stock Chart

From Feb 2024 to Feb 2025