Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

06 December 2024 - 10:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 8)1

Psychemedics Corporation

(Name of Issuer)

Common Stock, par value $0.005 per share

(Title of Class of Securities)

744375205

(CUSIP Number)

PETER H. KAMIN

2720 Donald Ross Road, #311

Palm Beach Gardens, FL 33410

DAVID E. DANOVITCH, ESQ.

Sullivan & Worcester LLP

1251 Avenue of the Americas

New York, NY 10020

(212) 660-3000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 3, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies

are to be sent.

|

1 The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

|

SCHEDULE 13D/A

| CUSIP NO. 744375205 |

|

Page 1 of 4 |

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

PETER H. KAMIN |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

| |

|

|

|

|

| |

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

PF, OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

UNITED STATES OF AMERICA |

|

| NUMBER OF |

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

| BENEFICIALLY |

|

|

2,057,449(1) |

|

| OWNED BY |

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

| REPORTING |

|

|

0 |

|

| PERSON WITH |

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

| |

|

|

2,057,449(1) |

|

| |

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

| |

|

|

0 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

2,057,449(1) |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

34.9%(2) |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

IN |

|

| |

(1) |

Includes 218,728 shares of common stock of the issuer (the “Issuer”), par value $0.005 per share (the “Common Stock”), held by the Peter H. Kamin Revocable Trust dated February 2003 (the “Kamin Trust”), of which Peter H. Kamin (the “Reporting Person”) is the sole trustee, 146,998 shares of Common Stock held by the Peter H. Kamin Childrens Trust dated March 1997 (the “Kamin Childrens Trust”), of which the Reporting Person is the trustee (collectively, the “Trusts”), and 1,454,692 shares of Common Stock held by 3K Limited Partnership (“3K Limited”), of which the Reporting Person is the General Partner. |

| |

(2) |

The aggregate percentage of shares of Common Stock reported owned herein is based upon 5,894,461 shares outstanding as of the close of business on December 3, 2024, which is the total number of shares outstanding as indicated to the Reporting Person by the Issuer. |

SCHEDULE 13D/A

| CUSIP NO. 744375205 |

|

Page 2 of 4 |

This Amendment No. 8 to Statement on Schedule

13D (this “Amendment No. 7) amends and supplements the Statement on Schedule 13D, initially filed by the Reporting Person with the

U.S. Securities and Exchange Commission (the “SEC”) on December 30, 2020, as amended by Amendment No. 1 to such Statement

on Schedule 13D filed by the Reporting Person with the SEC on August 19, 2021, Amendment No. 2 to such Statement on Schedule 13D filed

by the Reporting Person with the SEC on September 23, 2021, Amendment No. 3 to such Statement on Schedule 13D filed by the Reporting Person

with the SEC on January 26, 2022, Amendment No. 4 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on April

21, 2022, Amendment No. 5 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on May 10, 2022, Amendment No.

6 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on June 10, 2022, and Amendment No. 7 to such Statement

on Schedule 13D filed by the Reporting Person with the SEC on August 13, 2024 (collectively, the “Schedule 13D”). Except as

otherwise set forth herein, this Amendment No. 8 does not modify any of the information previously reported by the Reporting Person in

the Schedule 13D. Capitalized terms used but not defined in this Amendment No. 3 shall have the meanings ascribed to such terms in the

Schedule 13D.

Item 1. Security and Issuer.

The information contained in “Item

1. Security and Issuer.” of the Schedule 13D is not being amended by this Amendment No. 8.

Item 2. Identity and Background.

The information contained in “Item

2. Identity and Background.” of the Schedule 13D is not being amended by this Amendment No. 8.

Item 3. Source or Amount of Funds or Other Consideration.

“Item 3. Source or Amount of Funds

or Other Consideration.” of the Schedule 13D is being amended by this Amendment No. 8 to add the following:

As described in Item 4, on December 3,

2024, 3K Limited acquired 1,409,712 shares of Common Stock using working capital.

Item 4. Purpose of Transaction.

“Item 4. Purpose of Transaction.”

of the Schedule 13D is being amended by this Amendment No. 8 to add the following:

Purchase Agreement Closing

On December 3, 2024, the Issuer issued

1,409,712 shares of Common Stock to 3K Limited, for an aggregate purchase price of $3,312,824, in connection with the closing of the

Stock Sale based on the estimated purchase price, required for the Issuer’s purchase of fractional shares in its reverse stock

split effected on December 3, 2024.

SCHEDULE 13D/A

| CUSIP NO. 744375205 |

|

Page 2 of 4 |

Item 5. Interest in Securities of the Issuer.

“Item 5. Interest in Securities of the Issuer.” of the Schedule 13D

is being amended by this Amendment No. 8 as follows:

| (a) | The percentage ownership of shares of Common Stock set forth in this Amendment No. 8 is based upon 5,894,461

shares outstanding as of the close of business on December 3, 2024, which is the total number of shares outstanding as indicated to the

Reporting Person by the Issuer. |

| (b) | The Reporting Person has the sole voting power and sole dispositive power with respect to all 2,057,449

shares of Common Stock held by him, the Trusts and 3K Limited. |

| (c) | Except as set forth in Item 4 of this Amendment No. 8, the Reporting Person has not engaged in any transaction

with respect to the Common Stock during the sixty days prior to the date of filing this Amendment No. 8. |

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

The information contained in “Item

6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.” of the Schedule 13D is not

being amended by this Amendment No. 8.

Item 7. Material to be filed as Exhibits.

The information contained in “Item

7. Material to be filed as Exhibits.” of the Schedule 13D is not being amended by this Amendment No. 8.

SCHEDULE 13D/A

| CUSIP NO. 744375205 |

|

Page 2 of 4 |

SIGNATURES

After reasonable inquiry and to the

best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: December 5, 2024

| |

/s/ Peter H. Kamin |

| |

Peter H. Kamin |

| |

|

| |

|

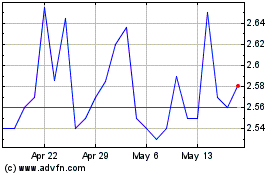

Psychemedics (NASDAQ:PMD)

Historical Stock Chart

From Nov 2024 to Dec 2024

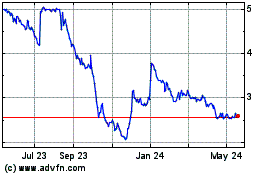

Psychemedics (NASDAQ:PMD)

Historical Stock Chart

From Dec 2023 to Dec 2024