UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT

TO

§ 240.13d-2(a)

(Amendment No. 9)1

Psychemedics Corporation

(Name of Issuer)

Common Stock, par value $0.005 per share

(Title of Class of Securities)

744375205

(CUSIP Number)

PETER H. KAMIN

2720 Donald Ross Road, #311

Palm Beach Gardens, FL 33410

DAVID E. DANOVITCH, ESQ.

Sullivan & Worcester LLP

1251 Avenue of the Americas

New York, NY 10020

(212) 660-3000

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 3, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box ¨.

Note: Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies

are to be sent.

1 The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

SCHEDULE 13D/A

| CUSIP NO. 744375205 |

|

Page 2 of 5 |

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

PETER H. KAMIN |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☐ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

| |

|

|

|

|

| |

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

PF, OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

UNITED STATES OF AMERICA |

|

| NUMBER OF |

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

| BENEFICIALLY |

|

|

1,736,741(1) |

|

| OWNED BY |

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

| REPORTING |

|

|

0 |

|

| PERSON WITH |

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

| |

|

|

1,736,741(1) |

|

| |

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

| |

|

|

0 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

1,736,741(1) |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

28.4%(2) |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

IN |

|

| |

(1) |

Includes 218,728 shares of common stock of the issuer (the “Issuer”), par value $0.005 per share (the “Common Stock”), held by the Peter H. Kamin Revocable Trust dated February 2003 (the “Kamin Trust”), of which Peter H. Kamin (the “Reporting Person”) is the sole trustee, 146,998 shares of Common Stock held by the Peter H. Kamin Childrens Trust dated March 1997 (the “Kamin Childrens Trust”), of which the Reporting Person is the trustee (collectively, the “Trusts”), and 1,133,984 shares of Common Stock held by 3K Limited Partnership (“3K Limited”), of which the Reporting Person is the General Partner. |

| |

(2) |

The aggregate percentage of shares of Common Stock reported owned herein is based upon 6,107,227 shares outstanding as of the close of business on December 11, 2024, which is the total number of shares outstanding as indicated to the Reporting Person by the Issuer. |

SCHEDULE 13D/A

| CUSIP NO. 744375205 |

|

Page 3 of 5 |

This

Amendment No. 9 to Statement on Schedule 13D (this “Amendment No. 9”) amends and supplements the Statement on Schedule 13D,

initially filed by the Reporting Person with the U.S. Securities and Exchange Commission (the “SEC”) on December 30, 2020,

as amended by Amendment No. 1 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on August 19, 2021, Amendment

No. 2 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on September 23, 2021, Amendment No. 3 to such Statement

on Schedule 13D filed by the Reporting Person with the SEC on January 26, 2022, Amendment No. 4 to such Statement on Schedule 13D filed

by the Reporting Person with the SEC on April 21, 2022, Amendment No. 5 to such Statement on Schedule 13D filed by the Reporting Person

with the SEC on May 10, 2022, Amendment No. 6 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on June 10,

2022, Amendment No. 7 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on August 13, 2024, and Amendment No.

8 to such Statement on Schedule 13D filed by the Reporting Person with the SEC on December 5, 2024 (the “Amendment No. 8”,

and collectively, the “Schedule 13D”). Except as otherwise set forth herein, this Amendment No. 9 does not modify any of the

information previously reported by the Reporting Person in the Schedule 13D. Capitalized terms used but not defined in this Amendment

No. 9 shall have the meanings ascribed to such terms in the Schedule 13D.

Item 1. Security and Issuer.

The information contained in “Item

1. Security and Issuer.” of the Schedule 13D is not being amended by this Amendment No. 9.

Item 2. Identity and Background.

The information contained in “Item

2. Identity and Background.” of the Schedule 13D is not being amended by this Amendment No. 9.

Item 3. Source or Amount of Funds or Other Consideration.

The information contained in “Item

3. Source or Amount of Funds or Other Consideration.” of the Schedule 13D is not being amended by this Amendment No. 9.

Item 4. Purpose of Transaction.

“Item 4. Purpose of Transaction.”

of the Schedule 13D is being amended by this Amendment No. 9 to add the following:

Repurchase Agreement

On December 10, 2024, following the Issuer’s final determination

of the funds required to purchase all of the fractional share interests that resulted from the reverse stock split based on information

from the Issuer’s transfer agent, the Issuer repurchased 320,708 of such shares of Common Stock from 3K Limited at the same price

3K Limited paid to acquire shares in the Stock Sale, pursuant to a stock repurchase agreement (the “Repurchase Agreement”),

dated December 10, 2024, by and between the Issuer and 3K Limited.

SCHEDULE 13D/A

| CUSIP NO. 744375205 |

|

Page 4 of 5 |

The foregoing description of the Repurchase

Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Repurchase Agreement,

which is filed as Exhibit 99.5 to this Schedule 13D and incorporated herein by reference.

Item 5. Interest in Securities of the Issuer.

"Item 5. Interest in Securities of

the Issuer" of the Schedule 13D is being amemded and restated is by this Amendment No. 9 as follows:

| (a) | The percentage ownership of shares of Common Stock set forth in this Amendment No. 9 is based upon 6,107,227

shares outstanding as of the close of business on December 11, 2024, which is the total number of shares outstanding as indicated to the

Reporting Person by the Issuer. |

| (b) | The Reporting Person has the sole voting power and sole dispositive power with respect to all 1,736,741

shares of Common Stock held by him, the Trusts and 3K Limited. |

| (c) | Except as set forth in Item 4 of this Amendment No. 9 and in Amendment No. 8, the Reporting Person has

not engaged in any transaction with respect to the Common Stock during the sixty days prior to the date of filing this Amendment No. 9. |

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

“Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer.” of the Schedule 13D is being amended by this Amendment

No. 9 to add the following:

On December 10, 2024, 3K Limited and the

Issuer entered into the Repurchase Agreement as described in Item 4 above and attached as Exhibit 99.5 hereto.

Item 7. Material to be filed as Exhibits.

“Item 7. Material to be filed as

Exhibits.” of the Schedule 13D is being amended by this Amendment No. 9 to add the following exhibits:

* Filed as an exhibit herewith.

SCHEDULE 13D/A

| CUSIP NO. 744375205 |

|

Page 5 of 5 |

SIGNATURES

After reasonable inquiry and to the

best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: December 12, 2024

| |

/s/ Peter H. Kamin |

| |

Peter H. Kamin |

| |

|

| |

|

Exhibit 99.5

STOCK REPURCHASE AGREEMENT

This Stock Repurchase Agreement

(this “Agreement”) is entered into as of December 10, 2024 (the “Effective Date”) by and between

Psychemedics Corporation, a Delaware corporation (the “Company”), and 3K Limited Partnership, a Delaware limited

partnership (the “Selling Stockholder”). The Company and Selling Stockholder are each referred to herein as a “Party”

and collectively, the “Parties”.

WHEREAS, the Selling Stockholder

owns 1,409,712 shares of the Company’s common stock, par value $0.005 per share (the “Common Stock”), which the

Selling Stockholder purchased on December 3, 2024, from the Company pursuant to the Stock Purchase Agreement (the “SPA”),

dated as of August 12, 2024, by and between the Company, the Selling Stockholder, and the other Investors named therein (the “Purchase”)

to provide the Company with (a) finance to purchase fractional shares of Common Stock (the “Cash-Out”) resulting from

a reverse stock split (the “Reverse Stock Split”) of the Common Stock that was effectuated by the Company, and (b)

$500,000 for working capital and other general corporate purposes in the Company’s sole discretion;

WHEREAS, in connection with the

completion of the Reverse Stock Split and closing contemplated by the SPA, the Company issued 1,409,712 shares of Common Stock to the

Selling Stockholder pursuant to the SPA based on available estimates of the funds required for the Company to purchase all of the fractional

share interests that resulted from the Reverse Stock Split, and the Company wishes to repurchase from the Selling Stockholder, shares

of Common Stock held by the Selling Stockholder upon the terms and conditions provided in this Agreement, at the same price as used with

the Purchase;

WHEREAS, the uninterested members

of the Company’s Board of Directors previously approved the transactions contemplated by the SPA, as recommended by the Transaction

Committee of the Company’s Board of Directors, comprised solely of independent directors; and

WHEREAS, the Company intends to

use cash on its balance sheet to complete the Repurchase (as defined below).

NOW, THEREFORE, in consideration

of the mutual covenants herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the undersigned hereby agree as follows:

1.

Repurchase.

(a)

Subject to the terms and conditions of this Agreement, at the Closing (as defined below), the Selling Stockholder shall sell to

the Company, and the Company shall purchase, acquire and accept from the Selling Stockholder, 320,708 shares of Common Stock held by the

Selling Stockholder (the “Repurchase Shares”) at a purchase price of $2.35 per share, or an aggregate purchase

price of $753,663.80 (the “Aggregate Purchase Price”), which is the same price at which the shares were purchased (such

transaction, the “Repurchase”).

(b)

The closing of the Repurchase (the “Closing”) shall take place on the date hereof at the offices of Mintz, Levin,

Cohn, Ferris, Glovsky and Popeo, P.C., One Financial Center, Boston, Massachusetts 02111, or at such other time and place as may be agreed

upon by the Company and the Selling Stockholder. At the Closing, (i) the Selling Stockholder shall deliver to the Company the Repurchase

Shares and (ii) the Company shall to deliver to the Selling Stockholder by wire transfer of immediately available funds the Aggregate

Purchase Price. Immediately following the Closing, the Company shall cancel the Repurchase Shares, including, without limitation, any

right of the Selling Stockholder to receive any dividends or other distributions with respect to the Repurchase Shares.

2. Company Representations. In connection with the transactions

contemplated hereby, the Company represents and warrants to the Selling Stockholder that:

(a)

The Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware. The

Company has the corporate power and authority to own, lease and operate its properties and conduct its business as presently conducted

and to enter into, deliver and perform its obligations under this Agreement.

(b)

The Company is a reporting company under the Securities Exchange Act of 1934, as amended, and the Common Stock is listed on the

Nasdaq Stock Market. Notwithstanding the listing of the Common Stock, the Company acknowledges and agrees that the Repurchase as contemplated

by this Agreement will be executed pursuant to the terms and conditions of this Agreement and will be settled directly between the Company

and the Selling Stockholder through the facilities of the Company’s transfer agent.

(c)

All consents, approvals, authorizations and orders necessary for the execution and delivery by the Company of this Agreement and

for the purchase by the Company of the Repurchase Shares hereunder have been obtained, except for such consents, approvals, authorizations

and orders as would not impair in any material respect the consummation of the Company’s obligations hereunder; and the Company

has full right, power and authority to enter into this Agreement and to purchase the Repurchase Shares.

(d)

The execution, delivery and performance by the Company of this Agreement is within the powers of the Company, has been duly authorized

and will not constitute or result in a breach or default under or conflict with any federal or state statute, rule or regulation applicable

to the Company, any order, ruling or regulation of any government, governmental authority or court, or any agreement or other undertaking,

to which the Company is a party or by which the Company is bound, and will not violate any provisions of the Company’s charter documents,

including its incorporation, organization or formation papers, or bylaws, as may be applicable. The signature on this Agreement is genuine,

and the signatory has been duly authorized to execute the same, and this Agreement constitutes a legal, valid and binding obligation of

the Company, enforceable against the Company in accordance with its terms.

(e)

The Company has sufficient cash available to pay the Aggregate Purchase Price to the Selling Stockholder at the Closing on the

terms and conditions contained herein.

3.

Representations of the Selling Stockholder. In connection with

the transactions contemplated hereby, the Selling Stockholder represents and warrants to the Company that:

(a)

The Selling Stockholder has been duly formed and is validly existing in good standing under the laws of its jurisdiction of organization

or formation.

(b)

The Selling Stockholder is the record and beneficial owner of the Repurchase Shares free and clear of all liens, encumbrances,

equities and claims, and, assuming that the Company purchases such Repurchase Shares without notice of any adverse claim, upon sale and

delivery of, and payment for, such securities, as provided herein, the Company will own the securities, free and clear of all liens, encumbrances,

equities and claims whatsoever.

(c)

The Selling Stockholder has received all information it considers necessary or appropriate for deciding whether to consummate the

Repurchase. The Selling Stockholder has had an opportunity to ask questions and receive answers from the Company regarding the terms and

conditions of the Company’s purchase of the Repurchase Shares and the business and financial condition of the Company, and to obtain

additional information (to the extent the Company possessed such information or could acquire it without

unreasonable effort or expense) necessary to verify

the accuracy of any information furnished to them or to which it had access. The Selling Stockholder has had the opportunity to discuss

with its tax advisors the consequences of the Repurchase. The Selling Stockholder has not received, nor is it relying on, any representations

or warranties from the Company other than as a provided herein, and the Company hereby disclaims any other express or implied representations

or warranties with respect to itself.

4.

Notices. All notices, consents, waivers and other communications hereunder shall be in writing and shall be deemed to

have been duly given (i) when delivered in person, (ii) when delivered by facsimile or email, with affirmative confirmation of receipt,

(iii) one (1) business day after being sent, if sent by reputable, internationally recognized overnight courier service, or (iv) three

(3) business days after being mailed, if sent by registered or certified mail, prepaid and return receipt requested, in each case to the

applicable Party at the following addresses (or at such other address for a Party as shall be specified by like notice):

To the Company:

Psychemedics Corporation

5220 Spring Valley Road

Dallas, TX 75254

Attn: Brian Hullinger, President and Chief Executive

Officer

With a copy to (which shall not

constitute notice):

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

One Financial Center

Boston, MA 02111

Attn: Matthew J. Gardella; Matthew W. Tikonoff

To the Selling Stockholder:

3K Limited Partnership

c/o Peter Kamin

c/o David E. Danovich

Sullivan & Worcester LLP

1251 Avenue of Americas

New York, NY 10020

Attn: David E. Danovich

With a copy to (which shall not constitute

notice):

Sullivan & Worcester LLP

1251 Avenue of Americas

New York, NY 10020

Attn: Joseph E. Segilia; Angela Gomes

or such other address or to the attention of such other person as the recipient Party shall have specified by prior written notice to

the sending Party.

5.

Miscellaneous.

(a)

Survival of Representations and Warranties. All representations and warranties contained herein or made in writing by any

Party in connection herewith shall survive the execution and delivery of this Agreement and the consummation of the transactions contemplated

hereby for a period of one year.

(b)

Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective

and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect

under any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other provision

or any other jurisdiction, but this Agreement will be reformed, construed and enforced in such jurisdiction as if such invalid, illegal

or unenforceable provision had never been contained herein.

(c)

Complete Agreement. This Agreement and any other agreements ancillary hereto and executed and delivered on the date hereof

embody the complete agreement and understanding between the Parties with respect to the Repurchase and supersede and preempt any prior

understandings, agreements, or representations by or among the Parties, written or oral, which may have related to the Repurchase in any

way.

(d)

Counterparts. This Agreement may be executed in separate counterparts, each of which is deemed to be an original and all

of which taken together constitute one and the same agreement.

(e)

Assignment; Successors and Assigns. Neither this Agreement nor any of the rights, interests or obligations hereunder shall

be assigned, in whole or in part, by any of the Parties without the prior written consent of the other Parties. Subject to the preceding

sentence, this Agreement shall bind and inure to the benefit of and be enforceable by the Selling Stockholder and the Company and their

respective successors and permitted assigns. Any purported assignment not permitted under this paragraph shall be null and void.

(f)

No Third Party Beneficiaries or Other Rights. This Agreement is for the sole benefit of the Parties and their successors

and permitted assigns and nothing herein express or implied shall give or shall be construed to confer any legal or equitable rights or

remedies to any person other than the Parties to this Agreement and such successors and permitted assigns.

(g)

Governing Law; Jurisdiction. This Agreement, and all matters, claims or causes of action (whether in contract, tort or statute)

that may be based upon, arise out of or in connection with or relate to this Agreement or the negotiation, execution, enforceability or

performance of this Agreement (including any matter claim or cause of action based upon, arising out of or in connection with or related

to any representation or warranty made in or in connection with this Agreement or as an inducement to enter into this Agreement), shall

be governed by and construed and enforced in accordance with the laws of the State of Delaware without reference to the conflict of laws

principles thereof that would result in the application of the law of another jurisdiction. Each party hereto irrevocably agrees that

any legal action or proceeding with respect to this Agreement and the rights and obligations arising hereunder, or for recognition and

enforcement of any judgment in respect of this Agreement and the rights and obligations arising hereunder brought by the other party hereto

or its successors or assigns, shall be brought and determined exclusively in the Delaware Court of Chancery and any state appellate court

therefrom within the State of Delaware (or, if the Delaware Court of Chancery declines to accept jurisdiction over a particular matter,

any federal court within the State of Delaware). Each party hereto hereby irrevocably submits with regard to any such action or proceeding

for itself and in respect of its property, generally and unconditionally, to the personal jurisdiction of the aforesaid courts and agrees

that it will not bring any action relating to this Agreement in any court other than the aforesaid courts. Each party hereto hereby irrevocably

waives, and agrees not to assert in any action or proceeding with respect to this Agreement, (a) any claim that it is not personally subject

to the jurisdiction of the above-named courts for any reason, (b) any claim that it or its property is exempt or immune from jurisdiction

of any such court or from any legal process commenced in such courts

(whether through service of notice, attachment prior

to judgment, attachment in aid of execution of judgment, execution of judgment or otherwise) and (c) to the fullest extent permitted by

applicable legal requirements, any claim that (i) the suit, action or proceeding in such court is brought in an inconvenient forum, (ii)

the venue of such suit, action or proceeding is improper or (iii) this Agreement, or the subject matter hereof, may not be enforced in

or by such courts. EACH PARTY HERETO HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT

OF OR RELATED TO THIS AGREEMENT.

(h)

Mutuality of Drafting. The Parties have participated jointly in the negotiation and drafting of this Agreement. In the event

an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as jointly drafted by the Parties, and

no presumption or burden of proof shall arise favoring or disfavoring any Party by virtue of the authorship of any provision of the Agreement.

(i)

Remedies. The Parties hereto agree and acknowledge that money damages will not be an adequate remedy for any breach of the

provisions of this Agreement, that any breach of the provisions of this Agreement shall cause the other Parties irreparable harm, and

that any Party may in its sole discretion apply to any court of law or equity of competent jurisdiction (without posting any bond or deposit)

for specific performance or other injunctive relief in order to enforce, or prevent any violations of, the provisions of this Agreement.

(j)

Amendment and Waiver. The provisions of this Agreement may be amended, modified or waived only with the prior written consent

of the Selling Stockholder and the Company. No waiver of any of the provisions of this Agreement shall be deemed or shall constitute a

waiver of any other provisions of this Agreement, nor shall any waiver constitute a continuing waiver. No failure by any Party to insist

upon strict performance of any of the provisions of this Agreement or to exercise any right or remedy arising out of a breach thereof

shall constitute a waiver of any other provisions or any other breaches of this Agreement.

(k)

Confidentiality. The Parties hereto agree that this Agreement and the specific terms and conditions thereof will remain

confidential and will not directly or indirectly disclose the terms or conditions to any other person; provided, however, that the Parties

may disclose this Agreement and its terms and conditions: (i) as necessary to effectuate the terms of and enforce rights under this Agreement;

(ii) as necessary to satisfy disclosure obligations imposed by legal process or court order; (iii) as necessary to comply with other laws,

reporting requirements or generally accepted accounting principles; (iv) as necessary and in the ordinary course of business, to the Parties’

attorneys, accountants, auditors, investors, insurers, reinsurers, and regulators, provided that the entity to which the disclosure is

made is advised that this Agreement and its terms are subject to this confidentiality provision; (v) as agreed to by the Parties in writing;

or (vi) as required by federal securities law in connection with any filing with the U.S. Securities and Exchange Commission. If a disclosure

is required as indicated in (ii) above, the disclosing Party will give the other parties written notice prior to such disclosure.

(l)

Further Assurances. Each of the Company and the Selling Stockholder shall execute and deliver such additional documents

and instruments and shall take such further action as may be necessary or appropriate to effectuate fully the provisions of this Agreement.

(m)

Expenses. Each of the Company and the Selling Stockholder shall bear their own respective expenses in connection with the

drafting, negotiation, execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

(n)

Interpretation. The definitions in this Agreement are applicable to the singular as well as the plural forms of such terms.

[Signature page follows.]

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be duly executed by their respective authorized signatories as of the Effective Date.

Company:

PSYCHEMEDICS CORPORATION

By: /s/ Brian Hullinger

Name: Brian Hullinger

Title: President and Chief Executive Officer

Selling

Stockholder:

3K LIMITED PARTNERSHIP

By: /s/ Peter H. Kamin

Name: Peter H. Kamin

Title: General Partner

[Signature Page to Stock Repurchase Agreement]

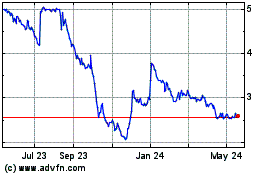

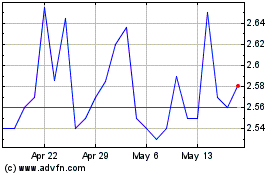

Psychemedics (NASDAQ:PMD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Psychemedics (NASDAQ:PMD)

Historical Stock Chart

From Feb 2024 to Feb 2025