false

0001449792

0001449792

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 30, 2024

PIONEER

POWER SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35212 |

|

27-1347616 |

(State

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

400

Kelby Street, 12th Floor

Fort

Lee, New Jersey |

|

07024 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(212)

867-0700

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

PPSI |

|

Nasdaq

Stock Market LLC (Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure.

On

October 30, 2024, the Company issued a press release announcing the sale of its Pioneer Custom Electrical Products, LLC business to Mill

Point Capital LLC. A copy of such press release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference. The Company

undertakes no obligation to update, supplement or amend the materials attached hereto as Exhibit 99.1.

The

information in this Current Report on Form 8-K (including Exhibit 99.1 attached hereto) is being furnished pursuant to Item 7.01 and

shall not be deemed to be filed for purposes of Section 18 of the Exchange Act or otherwise be subject to the liabilities of that section,

nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, whether made before

or after the date hereof and regardless of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

PIONEER

POWER SOLUTIONS, inc. |

| |

|

|

| Date:

October 30, 2024 |

By: |

/s/

Walter Michalec |

| |

Name:

|

Walter

Michalec |

| |

Title: |

Chief

Financial Officer |

Exhibit

99.1

Pioneer

Announces Sale of its Pioneer Custom Electrical Products, LLC Business Unit, Including E-Bloc

Total

Consideration of $50 million in cash and equity including the assumption of certain liabilities

Management

to Host Investor Conference Call at 4:30 pm ET on October 30, 2024

FORT

LEE, N.J., October 30, 2024 /Business Wire/ — Pioneer Power Solutions, Inc. (Nasdaq: PPSI) (“Pioneer” or the “Company”),

a leader in the design, manufacture, service and integration of electrical power systems, distributed energy resources, power generation

equipment and mobile electric vehicle (“EV”) charging solutions, today announced it has sold its Pioneer Custom Electrical

Products, LLC (“PCEP”) business unit to Mill Point Capital LLC (“Mill Point”), a middle-market private equity

firm located in New York City, for $50 million in a cash and equity transaction.

PCEP

is the Company’s Electrical Infrastructure business, which provides energy solutions that allow users to effectively and efficiently

protect, control, transfer, monitor and manage their electrical energy usage and requirements. PCEP markets many of these solutions under

the “E-Bloc” brand.

In

a separate press release, Mill Point announced the formation of Voltaris Power LLC (“Voltaris”), an electrical power solutions

platform created by acquiring two distinct entities, PCEP and Jefferson Electric, in two independent transactions. Mill Point expects

the combination of PCEP and the Jefferson Electric transformer business to allow Voltaris to more effectively serve electric power end

markets that are at the heart of the energy transition and re-electrification of America. Pioneer will also receive a minority equity

stake in Voltaris as part of the transaction.

Nathan

Mazurek, Pioneer’s Chairman and Chief Executive Officer, commented, “The divestiture of our E-Bloc business is another

critical step forward in the strategic transformation process we initiated in 2022. Pioneer is now solely focused on the growth of our

Critical Power and eMobility business to fuel its larger potential. With additional capital we are well-positioned to continue to advance

innovative solutions that address the growing grid gap challenges across the U.S. and capture an ever-growing share of a massive market

that has yet to be fully addressed.

“We

are confident that as part of the new Voltaris platform, the PCEP team will continue to build the business as a leader in the rapidly

deployable microgrid, EV charging infrastructure, and unit substations. We expect to continue to collaborate on solutions and combine

technologies where they benefit mutual growth and are very pleased to be significant equity participants in this new electrical equipment

platform.”

Key

Terms of the Agreement

The

sale includes a total cash consideration of $48 million and $2 million in equity of Pioneer Investment LLC and the assumption of certain

liabilities. Under the terms of the agreement, the Company will contribute 4% of its equity in Pioneer Investment LLC and receive a minority

equity ownership position. In addition, Mr. Nathan Mazurek will serve as a member of the Board of Directors of Pioneer Investment LLC.

The Company will outline the strategic vision for its business going forward and discuss the use of proceeds and 2025 revenue and profit

guidance in a conference call when it reports its third quarter financial results in the next couple of weeks.

Conference

Call

Management

will host a conference call at 4:30 p.m. Eastern Time on Wednesday, October 30, 2024, to discuss the transaction announced today and

Pioneer’s first half of 2024 financial results with the investment community.

Anyone

interested in participating should call 1-877-407-0789 if calling within the United States or 1-201-689-8562 if calling internationally.

When asked, please reference conference ID: PIONEER.

A

replay will be available until Wednesday, November 13, 2024, which can be accessed by dialing 1-844-512-2921 if calling within the United

States or 1-412-317-6671 if calling internationally. Please use Access ID: 13749598 to access the replay.

The

call will also be accompanied live by webcast over the Internet and accessible at: https://viavid.webcasts.com/starthere.jsp?ei=1693199&tp_key=40e95ec5ff

About

Mill Point Capital LLC

Mill

Point Capital LLC is a private equity firm focused on control investments in lower-middle market companies across the Business Services,

Industrials and IT Services sectors throughout North America. Mill Point’s experienced team of investors, Executive Partners and

Functional Experts seek portfolio company value enhancement through rigorous implementation of transformative strategic initiatives and

operational improvements. Mill Point is based in New York, NY. For more information, please visit www.millpoint.com.

About

Pioneer Power Solutions, Inc.

Pioneer

Power Solutions, Inc. is a leader in the design, manufacture, integration, refurbishment, service and distribution of electric power

systems, distributed energy resources, power generation equipment and mobile EV charging solutions for applications in the utility, industrial

and commercial markets. To learn more about Pioneer, please visit its website at www.pioneerpowersolutions.com.

Forward-Looking

Statements:

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, as amended. Such statements may be preceded by the words “intends,” “may,” “will,” “plans,”

“expects,” “anticipates,” “projects,” “predicts,” “estimates,” “aims,”

“believes,” “hopes,” “potential” or similar words. Forward-looking statements are not guarantees

of future performance, are based on certain assumptions and are subject to various known and unknown risks and uncertainties, many of

which are beyond the Company’s control, and cannot be predicted or quantified and consequently, actual results may differ materially

from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, risks and

uncertainties associated with (i) the Company’s ability to successfully operate its business after the divestiture of its E-Bloc

business, (ii) the Company’s ability to successfully increase its revenue and profit in the future, (iii) general economic conditions

and their effect on demand for electrical equipment, (iv) the effects of fluctuations in the Company’s operating results, (v) the

fact that many of the Company’s competitors are better established and have significantly greater resources than the Company, (vi)

the Company’s dependence on two customers for a large portion of its business, (vii) the potential loss or departure of key personnel,

(viii) unanticipated increases in raw material prices or disruptions in supply, (ix) the Company’s ability to realize revenue reported

in the Company’s backlog, (x) future labor disputes, (xi) changes in government regulations, (xii) the liquidity and trading volume

of the Company’s common stock, (xiii) an outbreak of disease, epidemic or pandemic, such as the global coronavirus pandemic, or

fear of such an event, (xiv) risks associated with litigation and claims, which could impact our financial results and condition, and

(xv) the Company’s ability to maintain compliance with the continued listing requirements of the Nasdaq Capital Market.

More

detailed information about the Company and the risk factors that may affect the realization of forward-looking statements is set forth

in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual and Quarterly Reports

on Form 10-K and Form 10-Q, respectively. Investors and security holders are urged to read these documents free of charge on the SEC’s

web site at www.sec.gov. The Company assumes no obligation to publicly update or revise its forward-looking statements as a result

of new information, future events or otherwise.

Contact:

Brett

Maas, Managing Partner

Hayden

IR

(646)

536-7331

brett@haydenir.com

v3.24.3

Cover

|

Oct. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 30, 2024

|

| Entity File Number |

001-35212

|

| Entity Registrant Name |

PIONEER

POWER SOLUTIONS, INC.

|

| Entity Central Index Key |

0001449792

|

| Entity Tax Identification Number |

27-1347616

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400

Kelby Street

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

Fort

Lee

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07024

|

| City Area Code |

(212)

|

| Local Phone Number |

867-0700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

PPSI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

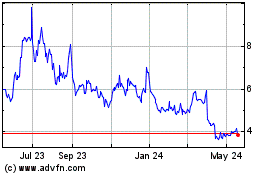

Pioneer Power Solutions (NASDAQ:PPSI)

Historical Stock Chart

From Oct 2024 to Nov 2024

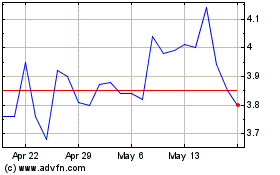

Pioneer Power Solutions (NASDAQ:PPSI)

Historical Stock Chart

From Nov 2023 to Nov 2024