Nominates Charlie Morrison, Who Delivered Total

Shareholder Returns of ~760% During His Tenure as CEO of Wingstop,

and Nicole Portwood, an Experienced Marketing Executive and Former

CMO of Tito’s Handmade Vodka, to Company’s Board

Nominees Possess Necessary Restaurant

Operations and Marketing Experience to Drive Greater Urgency on

Enhancing Company Performance

Engaged Capital, LLC (together with certain of its affiliates,

“Engaged” or “we”), which beneficially owns approximately 8.6% of

the outstanding Class A common stock of Portillo’s Inc. (NASDAQ:

PTLO) (“Portillo’s” or the “Company”), today announced that it has

nominated two highly qualified, independent candidates for election

to the Company’s Board of Directors (the “Board”) at the 2025

Annual Meeting of Stockholders (the “Annual Meeting”). In

connection with its nomination, Engaged issued the following

statement:

“Engaged is one of the largest stockholders of Portillo’s

because we believe the Company has a clear path to delivering

enhanced value for stockholders. Portillo’s is an iconic brand with

beloved restaurants that possesses a number of attributes that set

the foundation for highly profitable long-term growth,

including:

- Industry-leading average unit volumes, or AUVs;

- High-quality and differentiated food and beverages offered at

compelling value; and

- Proven portability of the concept based on new store volumes in

expansion markets where overall awareness is still very low

Despite these tailwinds for value creation and a rich legacy as

a Chicago classic, the Company’s performance appears to be

suffering due to outdated restaurant operations, ineffective

marketing and lower than justified restaurant-level cash-on-cash

returns. Although these issues have led to a depressed valuation

for the Company, they are all readily fixable.

Based on our own analysis and engagement with Portillo’s, we

believe the Company has a significant runway to increase same-store

sales and profitably grow restaurant units. We are encouraged by

recent initiatives to address the Company’s challenges, including

the addition of long-time Chipotle CFO Jack Hartung to the Board.

Ultimately, however, we contend the magnitude of value creation at

Portillo’s will depend on leadership’s ability to execute key

initiatives with precision and urgency. The Company needs to refine

its approach to new unit development, modernize restaurant

operations and related technology, and deploy targeted marketing

investments to increase awareness and drive traffic.

We are confident that electing new directors, who possess recent

restaurant operations and marketing experience, will dramatically

improve Portillo’s ability to execute and close the gap with

industry peers. That is why we have nominated two highly qualified,

independent candidates – Charlie Morrison and Nicole Portwood –

whose backgrounds are ideally suited to help resolve these issues

on an expedited basis. Mr. Morrison’s experience as a world-class

restaurant operator, who delivered total shareholder returns of

~760% during his tenure as CEO of Wingstop, and Ms. Portwood’s

marketing expertise for household brands, including Tito’s,

Mountain Dew and Live Nation, will be extremely additive to the

Board.1

It is important to stress that we were forced to resort to this

public nomination after months of unsuccessful private discussions

focused on adding Mr. Morrison to the Board. Much like we have in

other engagements with our portfolio companies, we remain ready and

willing to reach a constructive resolution that spares all

stakeholders an election contest. We believe the anchor for this

type of resolution is further incremental change to the Board. A

strengthened boardroom with collaborative and experienced

restaurant executives, like Mr. Morrison and Ms. Portwood, is a

win-win for all of Portillo’s stockholders and stakeholders.”

THE ENGAGED CAPITAL

NOMINEES

Charles (Charlie) R. Morrison

Mr. Morrison is a leading restaurant industry executive and

director with significant expertise in compounding same-store

sales, optimizing operations and developing high-return unit growth

strategies in the restaurant space.

- Most recently served as Chief Executive Officer of Salad and

Go, a fast-casual restaurant chain, from April 2022 to October

2024, where he also served as a director from November 2020 to

December 2024.

- Prior to that, served as President and Chief Executive Officer

of Wingstop (NASDAQ: WING), an American restaurant chain, from 2012

to March 2022, where he also served as a director and then as

Chairman from 2017 until his resignation.

- Earlier in his career, served as President and Chief Executive

Officer of Pizza Inn Inc. (formerly NASDAQ: PZZI) (n/k/a Rave

Restaurant Group, Inc. (NASDAQ: RAVE)), a publicly traded

international pizza chain, from 2007 to 2012.

Nicole Portwood

Ms. Portwood is an experienced marketing executive with

significant expertise in leading growth and brand transformation at

well-known, global brands.

- Most recently served as Chief Marketing Officer of Salad and

Go, a fast-casual restaurant chain, from October 2023 to February

2025, where she also served as a director from February 2023 to

October 2023.

- Previously served as the General Manager of House of Delola,

LLC, a ready-to-drink cocktail brand developed by Jennifer Lopez,

from June 2022 to September 2023, as well as Chief Brand Officer at

Live Nation Entertainment, Inc. (NYSE: LYV), an American

multinational entertainment company, from June 2021 to June

2022.

- Prior to that, served as Vice President of Marketing – Mountain

Dew, Energy & Flavors at PepsiCo, Inc. (NASDAQ: PEP) from

September 2018 to June 2021, and as Vice President and Chief

Marketing Officer of Tito’s Handmade Vodka at Fifth Generation,

Inc. from 2010 to 2018, where she helped extend Tito’s beyond its

local Texas roots to one of the most recognized brands in the

world.

About Engaged Capital

Engaged Capital, LLC (“Engaged Capital”) is an investment

advisor with a private equity-like investing style in the U.S.

public equity markets. Engaged Capital seeks to help build

sustainable businesses that create long-term stockholder value by

engaging with and bringing an owner’s perspective to the

managements and boards of undervalued public companies and working

with them to unlock the embedded value within their businesses.

Engaged Capital focuses on delivering superior, long-term,

risk-adjusted returns for our limited partners. Engaged Capital was

established in 2012 and is based in Newport Beach, California.

Learn more at www.engagedcapital.com.

CERTAIN INFORMATION CONCERNING THE

PARTICIPANTS

Engaged Capital, LLC (“Engaged Capital”), together with the

other participants named herein, intends to file a preliminary

proxy statement and accompanying WHITE universal proxy card

with the Securities and Exchange Commission (“SEC”) to be used to

solicit votes for the election of its slate of highly-qualified

director nominees at the 2025 annual meeting of stockholders of

Portillo’s Inc., a Delaware corporation (the “Company”).

ENGAGED CAPITAL STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY

TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A

PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO

CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF

THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY

SOLICITOR.

The participants in the anticipated proxy solicitation are

expected to be Engaged Capital Flagship Master Fund, LP (“Engaged

Capital Flagship Master”), Engaged Capital Co-Invest XVII, LP

(“Engaged Capital Co-Invest XVII”), Engaged Capital, Engaged

Capital Holdings, LLC (“Engaged Holdings”), Glenn W. Welling,

Charles R. Morrison and Nicole Portwood.

As of the date hereof, Engaged Capital Flagship Master directly

beneficially owns 3,932,271 shares of Class A common stock, $0.01

par value per share (the “Common Stock”), of the Company, and has

entered into certain cash-settled total return swap agreements

constituting economic exposure to a further 168,452 notional shares

of Common Stock. In addition, as of the date hereof, Engaged

Capital Flagship Master has sold short certain custom covered call

options referencing an aggregate of 620,000 shares of Common Stock,

which have a strike price of $14.00 and expire on May 2, 2025. As

of the date hereof, Engaged Capital Co-Invest XVII directly

beneficially owns 1,547,500 shares of Common Stock. Engaged

Capital, as the general partner and investment adviser of Engaged

Capital Flagship Master and Engaged Capital Co-Invest XVII, may be

deemed to beneficially own the 5,479,771 shares of Common Stock

owned in the aggregate by Engaged Capital Flagship Master and

Engaged Capital Co-Invest XVII. Engaged Holdings, as the managing

member of Engaged Capital, may be deemed to beneficially own the

5,479,771 shares of Common Stock owned in the aggregate by Engaged

Capital Flagship Master and Engaged Capital Co-Invest XVII. Mr.

Welling, as the Founder and Chief Investment Officer of Engaged

Capital and sole member of Engaged Holdings, may be deemed to

beneficially own the 5,479,771 shares of Common Stock owned in the

aggregate by Engaged Capital Flagship Master and Engaged Capital

Co-Invest XVII. As of the date hereof, Mr. Morrison and Ms.

Portwood do not beneficially own any shares of Common Stock.

1 Total shareholder returns of Wingstop Inc. (NASDAQ: WING) from

June 12, 2015 to March 13, 2022, dividends reinvested.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250303691768/en/

Longacre Square Partners Greg Marose / Ashley Areopagita,

646-386-0091 engagedcapital@longacresquare.com

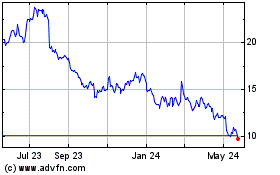

Portillos (NASDAQ:PTLO)

Historical Stock Chart

From Mar 2025 to Apr 2025

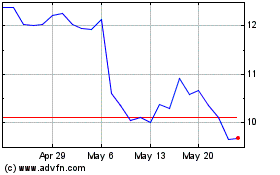

Portillos (NASDAQ:PTLO)

Historical Stock Chart

From Apr 2024 to Apr 2025