RxSight, Inc., an ophthalmic medical device company dedicated to

providing high-quality customized vision to patients following

cataract surgery, today announced financial results for the three

months and full-year ended December 31, 2024.

Key Quarterly and Full-Year Highlights

- Recognized fourth quarter 2024 revenue

of $40.2 million, an increase of 41% compared to the fourth quarter

of 2023, reflecting:

- The sale of 29,069 Light Adjustable

Lenses (LAL™/LAL+®), representing an 61% increase in procedure

volume compared to the fourth quarter of 2023; and

- The sale of 83 Light Delivery Devices

(LDD™s), expanding the installed base to 971 LDDs at the end of the

quarter, a 46% increase compared to the 666-unit LDD installed base

at the end of the fourth quarter of 2023.

- Recognized full-year 2024 revenue of

$139.9 million, a 57% increase over 2023, driven by unit sales

of 98,055 LALs and 305 LDDs, representing growth of 79% and 15%

respectively, compared to 2023.

“The progress we’ve made over the past year has strengthened our

conviction that adjustability has the potential to transform the

premium cataract market, and that we are still in the early stages

of realizing this vision,” said Dr. Ron Kurtz, Chief Executive

Officer and President of RxSight. “As we look ahead to 2025 and

beyond, we are excited by the opportunity to further expand

adoption globally, advance our technology, and continue delivering

exceptional outcomes for both patients and practices.”

Fourth Quarter Financial Results

In the fourth quarter of 2024, total revenue was $40.2 million,

an increase of 41% compared to $28.6 million in the fourth quarter

of 2023. Revenue growth was driven by a 60% increase in LAL revenue

and a 7% increase in LDD revenue, compared to the fourth quarter of

2023.

Gross profit for the fourth quarter of 2024 was $28.8 million or

71.6% of revenue, an increase of $11.1 million compared to gross

profit of $17.7 million or 61.8% of revenue for the fourth quarter

of 2023. The year over year increase in gross profit was driven by

continued growth in the percentage of LAL sales as a proportion of

total sales, lower cost of sales for both the LDD and LAL, and

sustained pricing stability for company’s capital equipment.

Total operating expenses for the fourth quarter of 2024 were

$37.4 million, a 31% increase from $28.5 million in the fourth

quarter of 2023, on an increase in revenue of 41%, reflecting the

company’s ongoing investments to grow its LDD installed base and

support increased LAL sales volume while managing the company’s

operating expenses.

In the fourth quarter of 2024, the company reported a net loss

of $(5.9) million, or $(0.15) per basic and diluted share, compared

to a net loss of $(9.2) million, or $(0.26) per basic and diluted

share in the fourth quarter of 2023. Adjusted net earnings in the

fourth quarter of 2024 were $1.3 million, or $0.03 per basic and

diluted share, compared to an adjusted net loss of $(4.8) million,

or $(0.13) per basic and diluted share in the fourth quarter of

2023.

Cash, cash equivalents and short-term investments as of December

31, 2024, were $237.2 million.

Fiscal Year 2024 Financial Results

Full-year 2024 total revenue was $139.9 million, an increase of

57% compared to the full year of 2023. The increase in 2024

revenue was driven by a 78% increase in LAL revenue and 24%

increase in LDD revenue compared to 2023.

Gross profit for the full year of 2024 was $98.9 million, or

70.7% of revenue compared to gross profit of $53.8 million, or

60.4% of revenue for the full year of 2023. The increase in gross

profit was due to a favorable product mix from a greater percentage

of revenue from LAL sales and increased margins on the LDD

introduced during the third quarter of 2023.

Total operating expenses for the full year of 2024 were $135.8

million, a 31% increase from $103.9 million for the full year of

2023. The increase was primarily driven by a higher headcount in

sales and marketing to support the growth of the business, costs of

operating as a public company and an operating expense increase of

$8.0 million in non-cash stock-based compensation expense.

In 2024, net loss was $(27.5) million, or $(0.71) per share on a

basic and diluted basis compared to a net loss of $(48.6) million,

or $(1.41) per share on a basic and diluted basis in 2023. Adjusted

net loss was $(2.8) million, or $(0.07) per share on a basic and

diluted basis, in 2024, compared to an adjusted net loss of $(31.1)

million, or $(0.90) per share on a basic and diluted basis in

2023.

2025 Guidance

The company is reiterating guidance for the full-year 2025

revenue, gross profit margin, and operating expenses:

- Revenue in the range of $185.0 million

to $197.0 million, representing implied growth of approximately 32%

to 41% compared to 2024;

- Gross margin in the range of 71% to

73%, representing an implied increase of 30 bps to 230 bps compared

to 2024;

- Operating expenses in the range of

$165.0 to $170.0 million, representing an implied increase of 22%

to 25% compared to 2024;

- Operating expense guidance also

includes non-cash expenses in the range of $22.0 million to $25.0

million.

Conference Call

On Tuesday, February 25, 2025, at 1:30 p.m. Pacific Time, the

company will host a conference call to discuss its fourth quarter

2024 financial results. To participate in the conference call,

please dial (800) 715-9871 or (646) 307-1963 and enter the

conference code: 7159871. The call will also be broadcast live in

listen-only mode via a link on the company’s investor relations

website at https://investors.rxsight.com/. An archived recording of

the call will be available through the same link shortly after its

completion.

About RxSight, Inc.

RxSight, Inc. is an ophthalmic medical device company dedicated

to providing high-quality customized vision to patients following

cataract surgery. The RxSight® Light Adjustable Lens system,

comprised of the RxSight Light Adjustable Lens® (LAL™/LAL+®,

collectively the “LAL”), RxSight Light Delivery Device (LDD™) and

accessories, is the first and only commercially available

intraocular lens (IOL) technology that can be adjusted after

surgery, enabling doctors to customize and deliver high-quality

vision to patients after cataract surgery. Additional information

about RxSight can be found at www.rxsight.com.

Forward-Looking Statements

This press release contains forward-looking statements,

including: management’s view that adjustability has the potential

to transform the premium cataract market; LDD and LAL sales growth

trends; the Company’s plans to expand adoption globally and advance

its technology; the Company’s expectation of continuing to deliver

exceptional outcomes for both patients and practices; and the

Company’s projected revenue, gross margin and operating expenses in

2025. Such statements relate to future events or our future

financial performance and involve known and unknown risks,

uncertainties and other factors that may cause our or our

industry's actual results, levels of activity, performance or

achievements to be materially different from any future results,

levels of activity, performance or achievements expressed, implied

or inferred by these forward-looking statements, In some cases, you

can identify forward-looking statements by terminology such as

“may,” “will,” “should,” “could,” “would,” “expects,” “plans,”

“intends,” “anticipates,” “believes,” “estimates,” “predicts,”

“projects,” “potential,” or “continue” or the negative of such

terms and other same terminology. These statements are only

predictions based on our current expectations and projections about

future events. You should not place undue reliance on these

statements. Actual events or results may differ materially. In

evaluating these statements, you should specifically consider

various factors, including the risk factors that may be found in

the section entitled Part I, Item 1A (Risk Factors) in the Annual

Report on Form 10-K for the year ended December 31, 2024, filed

with the Securities and Exchange Commission (SEC) on or about the

date hereof, and the other documents that the Company may file from

time to time with the SEC. These and other factors may cause our

actual results to differ materially from any forward-looking

statement. We undertake no obligation to update any of the

forward-looking statements after the date of this press release to

conform those statements to reflect the occurrence of unanticipated

events, except as required by applicable law.

Company Contact:Shelley B. ThunenChief

Financial Officersthunen@rxsight.com

Investor Relations Contact:Oliver MoravcevicVP,

Investor Relationsomoravcevic@rxsight.com

| |

|

RxSIGHT, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONSAND COMPREHENSIVE LOSS

(UNAUDITED)(In thousands, except share and per share

amounts) |

|

|

| |

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

40,214 |

|

|

$ |

28,580 |

|

|

$ |

139,927 |

|

|

$ |

89,077 |

|

| Cost of sales |

|

|

11,426 |

|

|

|

10,925 |

|

|

|

40,984 |

|

|

|

35,312 |

|

| Gross profit |

|

|

28,788 |

|

|

|

17,655 |

|

|

|

98,943 |

|

|

|

53,765 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

28,209 |

|

|

|

21,165 |

|

|

|

101,434 |

|

|

|

74,799 |

|

|

Research and development |

|

|

9,208 |

|

|

|

7,341 |

|

|

|

34,367 |

|

|

|

29,051 |

|

|

Total operating expenses |

|

|

37,417 |

|

|

|

28,506 |

|

|

|

135,801 |

|

|

|

103,850 |

|

|

Loss from operations |

|

|

(8,629 |

) |

|

|

(10,851 |

) |

|

|

(36,858 |

) |

|

|

(50,085 |

) |

| Other income (expense),

net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(5 |

) |

|

|

(4 |

) |

|

|

(21 |

) |

|

|

(3,308 |

) |

|

Interest and other income |

|

|

2,708 |

|

|

|

1,661 |

|

|

|

9,474 |

|

|

|

6,574 |

|

|

Loss on extinguishment of term loan |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,769 |

) |

| Loss before income taxes |

|

|

(5,926 |

) |

|

|

(9,194 |

) |

|

|

(27,405 |

) |

|

|

(48,588 |

) |

| Income tax expense |

|

|

12 |

|

|

|

(18 |

) |

|

|

50 |

|

|

|

20 |

|

|

Net loss |

|

$ |

(5,938 |

) |

|

$ |

(9,176 |

) |

|

$ |

(27,455 |

) |

|

$ |

(48,608 |

) |

| Other comprehensive (loss)

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized (loss) gain on short-term investments |

|

|

(344 |

) |

|

|

46 |

|

|

|

180 |

|

|

|

83 |

|

|

Foreign currency translation (loss) gain |

|

|

(12 |

) |

|

|

4 |

|

|

|

(9 |

) |

|

|

7 |

|

| Total other comprehensive

(loss) income |

|

|

(356 |

) |

|

|

50 |

|

|

|

171 |

|

|

|

90 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive loss |

|

$ |

(6,294 |

) |

|

$ |

(9,126 |

) |

|

$ |

(27,284 |

) |

|

$ |

(48,518 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.15 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.71 |

) |

|

$ |

(1.41 |

) |

| Weighted-average shares used

in computing net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Attributable to common stock,

basic and diluted |

|

|

40,356,756 |

|

|

|

35,961,894 |

|

|

|

38,867,726 |

|

|

|

34,455,111 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RxSIGHT, INC.CONDENSED CONSOLIDATED

BALANCE SHEETS (UNAUDITED)(In thousands, except share and

per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

16,706 |

|

|

$ |

9,692 |

|

|

Short-term investments |

|

|

220,517 |

|

|

|

117,490 |

|

|

Accounts receivable |

|

|

30,050 |

|

|

|

20,281 |

|

|

Inventories, net |

|

|

22,009 |

|

|

|

17,421 |

|

|

Prepaid and other current assets |

|

|

4,541 |

|

|

|

3,523 |

|

|

Total current assets |

|

|

293,823 |

|

|

|

168,407 |

|

| Property and equipment, net |

|

|

12,413 |

|

|

|

10,841 |

|

| Operating leases right-of-use

assets |

|

|

11,217 |

|

|

|

2,444 |

|

| Restricted cash |

|

|

750 |

|

|

|

711 |

|

| Other assets |

|

|

360 |

|

|

|

147 |

|

|

Total assets |

|

$ |

318,563 |

|

|

$ |

182,550 |

|

| Liabilities and

stockholders' equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

4,544 |

|

|

$ |

3,863 |

|

|

Accrued expenses and other current liabilities |

|

|

20,358 |

|

|

|

15,239 |

|

|

Lease liabilities |

|

|

974 |

|

|

|

1,801 |

|

|

Total current liabilities |

|

|

25,876 |

|

|

|

20,903 |

|

| Long-term lease liabilities |

|

|

11,322 |

|

|

|

1,211 |

|

| Other long-term liabilities |

|

|

127 |

|

|

|

74 |

|

|

Total liabilities |

|

|

37,325 |

|

|

|

22,188 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

Common stock, $0.001 par value, 900,000,000 shares authorized,

40,428,220 shares issued and outstanding as of December 31, 2024

and 36,139,513 shares issued and outstanding as of December 31,

2023 |

|

|

40 |

|

|

|

36 |

|

|

Preferred stock, $0.001 par value, 100,000,000 shares authorized,

no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

903,127 |

|

|

|

754,971 |

|

|

Accumulated other comprehensive loss |

|

|

166 |

|

|

|

(5 |

) |

|

Accumulated deficit |

|

|

(622,095 |

) |

|

|

(594,640 |

) |

|

Total stockholders' equity |

|

|

281,238 |

|

|

|

160,362 |

|

|

Total liabilities and stockholders' equity |

|

$ |

318,563 |

|

|

$ |

182,550 |

|

| |

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

To supplement our unaudited condensed consolidated financial

statements presented under generally accepted accounting principles

in the United States (“GAAP”), we believe certain non-GAAP

measures, including adjusted net earnings (loss), and adjusted net

earnings (loss) per share, basic and diluted, provide useful

information to investors and are useful in evaluating our operating

performance. For example, we exclude stock-based compensation

expense and loss on extinguishment of term loan because these

expenses are non-cash in nature and we believe excluding these

items provides meaningful supplemental information regarding our

operational performance and allows investors the ability to make

more meaningful comparisons between our operating results and those

of other companies.

We believe that non-GAAP financial information, when taken

collectively, may be helpful to investors because it provides

consistency and comparability with past financial performance.

However, non-GAAP financial information is presented for

supplemental informational purposes only, has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for financial information presented in accordance with

GAAP. In addition, other companies, including companies in our

industry, may calculate similarly titled non-GAAP measures

differently or may use other measures to evaluate their

performance. A reconciliation is provided below for each non-GAAP

financial measure to the most directly comparable financial measure

stated in accordance with GAAP. Investors are encouraged to review

the related GAAP financial measures and the reconciliation of these

non-GAAP financial measures to their most directly comparable GAAP

financial measures, and not to rely on any single financial measure

to evaluate our business.

Adjusted Net Earnings (Loss) and Adjusted Net Earnings

(Loss) Per Share

Adjusted net earnings (loss) is a non-GAAP financial measure

that we define as net earnings (loss) adjusted for (i) stock-based

compensation and (ii) loss on extinguishment of term loan. We

believe adjusted net earnings (loss) provides investors with useful

information on period-to-period performance as evaluated by

management and comparison with our past financial performance and

is useful in evaluating our operating performance compared to that

of other companies in our industry, as this metric generally

eliminates the effects of certain items that may vary from company

to company for reasons unrelated to overall operating

performance.

Reconciliations of net earnings (loss) to adjusted net earnings

(loss) and the presentation of adjusted net earnings (loss) per

share, basic and diluted, are as follows:

| RxSIGHT,

INC.GAAP To NON-GAAP RECONCILIATIONS

(UNAUDITED)(In thousands, except share and per share

amounts) |

|

|

| |

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

|

Year ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Common

Stock |

|

|

|

|

|

|

|

|

|

|

|

|

| Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss available to stockholders, basic and diluted |

|

$ |

(5,938 |

) |

|

$ |

(9,176 |

) |

|

$ |

(27,455 |

) |

|

$ |

(48,608 |

) |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

7,282 |

|

|

|

4,425 |

|

|

|

24,635 |

|

|

|

15,746 |

|

|

Loss on extinguishment of term loan |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,769 |

|

| Adjusted net income (loss)

available to common stockholders, basic and diluted: |

|

$ |

1,344 |

|

|

$ |

(4,751 |

) |

|

$ |

(2,820 |

) |

|

$ |

(31,093 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares outstanding, basic |

|

|

40,356,756 |

|

|

|

35,961,894 |

|

|

|

38,867,726 |

|

|

|

34,455,111 |

|

|

Weighted-average shares outstanding, diluted |

|

|

45,622,429 |

|

|

|

35,961,894 |

|

|

|

38,867,726 |

|

|

|

34,455,111 |

|

| Adjusted net earnings (loss) per

share, basic |

|

$ |

0.03 |

|

|

$ |

(0.13 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.90 |

) |

| Adjusted net earnings (loss) per

share, diluted |

|

$ |

0.03 |

|

|

$ |

(0.13 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.90 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

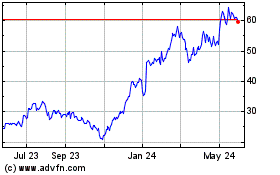

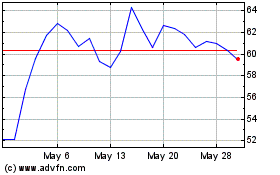

RxSight (NASDAQ:RXST)

Historical Stock Chart

From Feb 2025 to Mar 2025

RxSight (NASDAQ:RXST)

Historical Stock Chart

From Mar 2024 to Mar 2025