false

0001300734

0001300734

2024-07-09

2024-07-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

AND EXCHANGE ACT OF 1934

Date

of report (date of earliest event reported): July 9, 2024

SHINECO,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37776 |

|

52-2175898 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

T1,

South Tower, Jiazhaoye Square,

Chaoyang District,

Beijing,

People’s Republic of China

100022

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (+86) 10-87227366

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each Class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

SISI |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

July 9, 2024, Shineco, Inc.’s (the “Company”) subsidiary, Fuzhou Meida Health Management Co., Ltd. (“Fuzhou Meida”)

entered into distribution agreements (the “Agreements”) with four distributors, Harbin Liaotongtang Chinese Medicine and

Health Research Institute, Three Minutes (Zhejiang) Information Service Co., Hangzhou Misimao Science and Technology Co., Ltd., and Wu

Qiang (each, the “Distributor”), respectively.

Pursuant to the Agreements, Harbin Liaotongtang Chinese

Medicine and Health Research Institute, Three Minutes (Zhejiang) Information Service Co., Hangzhou Misimao Science and Technology Co.,

Ltd., and Wu Qiang agreed to distribute Fuzhou Meida’s water-soluble phospholipid concentrate health food beverage (the “Food

Beverage”) with an annual projected goal of approximately $1,374,420, $1,209,490, $7,256,934 and $2,418,980, respectively,

in sales on a “best-effort” basis, for a term of three years.

The price of the Food Beverage is set by the

Company. Under the terms of the Agreements, the Distributors shall sell the Food Beverage in the directly-operated stores and franchises

owned by such Distributors, and not through any other channels, including e-commerce platforms, without prior authorization from the

Company.

The

foregoing description of the Agreements does not purport to be complete and is qualified in its entirety by reference to the full text

of the Form of the Agreements, a copy of which is filed herewith as Exhibit 10.1 and is incorporated by reference herein.

Item 8.01 Other Events.

On July 10, 2024, the Company issued

a press release to announce the entry into the Agreements. The press release is furnished as Exhibit 99.1 to this Current Report on Form

8-K.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Shineco

Inc. |

| |

|

|

| Date:

July 11, 2024 |

By: |

/s/

Jennifer Zhan |

| |

|

Jennifer

Zhan, Chief Executive Officer |

Exhibit

10.1

JOYWISH

Water-Soluble

Phospholipid Concentrate Health Food

Beverage Distribution Agreement

Contract

No.:_______________________________

Party

A:Fuzhou Meida Health Management Co., Ltd.

Party

B:

Time

of signing:

Place

of signing:

Contact

No.:

| Party A: |

Fuzhou Meida Health Management Co., Ltd. |

| |

|

| |

(hereinafter referred to as Party A) |

Party

B:

(hereinafter

referred to as Party B)

In

order to further develop the market and protect the legitimate rights and interests of Party A and Party B, in accordance with the Food

Safety Law of the People’s Republic of China, the Civil Code of the People’s Republic of China and other relevant legal norms,

and in line with the principle of mutual benefit and common development, the two parties, through friendly consultation, hereby enter

into this agreement:

Article

I. Authorization for Distribution

Party

A authorizes Party B to be Party A’s authorized distributor, and authorizes Party A’s product JOYWISH water-soluble phospholipid

concentrate health food beverage to be sold in Party B’s directly-managed stores and franchised stores.

Article

II. Term of the Distribution Agreement

Term

of validity of the agreement: from July 9, 2024 to July 8, 2027.

Article

III. Price

1、Retail

price

| Name | |

Spec

(Box) | |

Uniform retail price

(Per Box) | | |

Minimum discounted retail price

(Per Box) | |

| JOYWISH water-soluble phospholipid concentrate health food beverage | |

10mLx30 Bags | |

$ | ___ | | |

$ | ___ | |

2、Special

distribution price:$___/ box (including tax).

3、Price

changes: If due to market changes or rising prices of raw materials and other objective factors need to adjust the special distribution

price and related retail prices, Party A will notify Party B in writing seven days in advance, confirmed by Party B in accordance with

the implementation of the new price。

Article

IV.

Distribution

Goal and Payment

1、Party

B’s Distribution Goal

Party

B’s annual distribution goal:__ Boxes (Total Price: $_____)。

2、Payment

Within

3 days after the signing of this agreement, Party B shall prepay Party A $____ for the products. The payment for the products shall be

deducted from Party B’s prepayment. After Party B’s prepayment is fully deducted, Party B needs to pay for the products in

advance。

Party

A bank account information:

Account

Name:

Account

Number:

Bank:Minsheng

Bank Fuzhou Branch

3、Issuance

of invoices: Party A will issue sales invoices before 25th of each month according to the order list of Party B and the amount of actual

payment.

Article

V. Market Deposit

1、Within

three days after the signing of this agreement, Party A shall pay a market deposit of $___ as a form of economic deposit to keep the

agreement and to maintain the market discipline and common value.

2、After

Party A receives the market deposit, Party A will issue a receipt for the market deposit to Party B as a proof of payment or refund,

and this receipt will be kept by Party B.

3、The

market deposit is non-interest-bearing, and Party A will return the market deposit to Party B with the market deposit receipt if Party

B completes the performance of the agreement in accordance with the provisions of the agreement after the termination of the distribution

agreement.

Article

VI. Market Management and Covenant

1、Party

B can only supply sales to Party B’s directly-operated stores and franchises, and shall not supply to other channels. Otherwise,

Party B will be deemed to have infringed the distribution right. If Party B has infringed the distribution right, Party A shall have

the right to impose a fine of two times of the total amount of the products being sold (calculated on the basis of the special distribution

price), and shall have the right to stop the supply of the products or to terminate the agreement.

2、Party

B shall not source product from channels other than Party A. Otherwise, Party B will be deemed to have infringed the distribution

right.

3、Party

B shall strictly be in accordance with the price set by Party A to sell products, shall not lower the price of sales, yet can,

at its discretion, raise the price by up to 10% of the price set by Party A. If Party B and its directly-operated stores or franchisees

sell in accordiance with the price set by Party A, Party A shall have the right to take punitive measures such as warnings, fines, suspension

of supply, and termination of the agreement.

4、When

Party B plans to develop composite distribution channels, it shall submit an application to Party A in advance, and the development of

composite distribution channels can only be carried out after Party A has given its written consent. Otherwise, Party B will be deemed

to have infringed the distribution right.

5、Without

Party A’s written authorization, Party B and Party B’s

directly-operated stores or franchises are not allowed to distribute Party A’s products in the e-commerce platform (including,

but not limited to, Tmall, Taobao, Jingdong, Pinduoduo, Douyin, Xiaohongshu, Kuaishou, and other platforms).

Article

VII, Delivery

1、Party

B can, based on market demand, submit product orders to Party A seven days in advance. Party A will deliver the product within 7 days

after receiving Party B’s product order and payment.

2、Party

A will deliver the product from Party A’s factory or the nearest warehouse.

3、Party

B shall bear all the transportation costs incurred from the place where Party A delivers the product to the destination.

Article

VIII. Inspection

1、Party

A must fully and accurately inspect the packaging, quality, specification and quantity of the products before delivery and notify Party

B in advance in writing.

2、After

the products arrived at the destination, Party B will inspect the packaging, quality, specification and quantity of the products. If

it is found that the packaging of the products is damaged, the quality, specification or quantity is not in accordance with the orders,

Party B should notify Party A in writing within 2 days, and Party A should confirm that Party B can replenish the defective products

or replace the defective ones, and Party A should bear the cost incurred by the defective ones and the replacement of the products.

Article

IV. Replacement

Party

A grants Party B 2% of the annual delivery goal amount of the replacement quota. Replacement products must be valid for more than three

months, with intact packaging, without affecting Party A’s re-sale. The transportation cost of the replacement product shall be

borne by Party B. If within the warranty period, and non-human factors resulting in product quality problems, Party A will unconditionally

grant the replacement of products, and the cost of the replacement of products incurred will be borne by Party A.

Article

X, Party A’s Rights and Obligations

1、Party

A has the right to consult Party B’s sales, the right to know and the right to market inspection.

2、Party

A has the right to supervise, inquire and question Party B’s product sales and inventory information.

3、Party

A has the right to know and suggest Party B’s monthly marketing and promotion work.

4、Party

A has the obligation to protect the legitimate rights and interests of Party B in accordance with the agreement.

5、Party

A is obliged to supply on time, and ensure that the quality of products meets the product quality standards.

6、Party

A is obliged to provide Party B with the information required for the sales of the product and related product approvals, production

and testing reports, etc., to facilitate Party B’s business activities.

7、Party

A is obliged to provide Party B with sales service support, including but not limited to personnel training, product knowledge training,

after-sales service.

Article

XI, Party B’s Rights and Obligations

1、Party

B has the right to operate independently within the scope of the agreement.

2、Party

B has the obligation of confidentiality for Party A’s product management, market expansion and other information.

3、Party

B shall not sell counterfeit and infringing products. If Party B finds that there are counterfeit and infringing products on sale in

the market, it has the obligation to notify Party A at the first time and actively assist Party A to deal with the counterfeit and infringing

behaviors.

4、Within

the agreement term, Party B shall not distribute other similar products.

5、Party

B must engage in product sales activities in accordance with national policies and relevant laws.

6、Party

B is strictly prohibited to use Party A’s relevant documents to carry out illegal activities, and Party B shall bear full responsibility

for all disputes arising therefrom.

7、Party

B shall actively feedback market information to Party A and submit the next month’s order plan of products to Party A before 25th

of each month, so as to facilitate Party A’s reasonable arrangement of related work.

Article

XII, Default and Confidentiality

Party

A and Party B shall strictly perform in accordance with the terms of this agreement, either party shall be liable for breach of the agreement.

Neither party shall disclose the other party’s business information to the third party without authorization, and the party in

breach shall be liable for any damages arising from such disclosure.

Article

XIII, Force majeure

In

the event of force majeure (e.g. war, civil war, lockdown, earthquake, fire, flood, etc.) and any unforeseen accidents not foreseen by

both parties that impede or interfere with the performance of this agreement, the party experiencing force majeure shall, within _____

days from the date of the end of the event, deliver to the other party a certificate of force majeure issued by the relevant authorities

of the country, which shall provide proof of exemption from liability, and the two parties shall discuss matters of suspension or continuation

of the performance of the agreement.

Article

XIV, Appendices

1、Any

matters not covered in this agreement may be supplemented by a written agreement signed by Party A and Party B after negotiation.

2、This

agreement shall be signed in counterpart, both original copies, one for each party. This agreement shall come into effect from the date

of signature and seal of both parties.

3、If

there are any disputes between the two parties, they shall be solved in the manners of friendly negotiation. If the negotiation cannot

solve the dispute, it can be brought to the People’s Court for litigation.

Party

A:

Representative:

Tel:

Party

B:

Representative:

Tel:

Date:

Exhibit 99.1

Shineco

Announces New Distribution Agreements for up to $38 Million in Sales for its New Health Food Beverage

The

Company believes that its Advanced Proprietary Production Technology

Provides it with a Competitive Advantage in the Sector

BEIJING,

July 10, 2024 (GLOBE NEWSWIRE) — Shineco, Inc. (“Shineco” or the “Company”; NASDAQ: SISI), a provider

of innovative diagnostic medical products and related medical devices, announced today that its subsidiary, Fuzhou Meida Health Management

Co., Ltd. (“Fuzhou Meida”), has entered into Distribution Agreements (the “Agreements”) for its water-soluble

phospholipid concentrate health food beverage with a projected goal of $38 million in sales with six distribution companies, for a term

of three years.

Mrs.

Jennifer Zhan, CEO of Shineco, said, “The Company’s sustained research and development efforts have developed a production

process that is expected to open up a potentially vast new market for our health food beverage. We believe that our technologically advanced

production process provides a competitive advantage in the marketplace since it achieves a pure physical separation and extraction of

the naturally active phospholipids.”

“We

have commenced mass production of phospholipids that addresses the current shortage of supply to meet the expected higher demand for

this health food beverage, and we are intent upon expanding the market for this uniquely healthy product. Our strategic plan is to develop

products and services in the healthcare and medical sectors that will generate a diversified revenue stream with the goal of maximizing

shareholder returns,” CEO Ms. Zhan concluded.

Phospholipids

are organic compounds which are utilized in numerous ways in food and other industries. Further, phospholipids are a key component of

cell membranes, forming a bilayer that acts as a barrier that allows some molecules to pass through while blocking others. Phospholipids

have important health effects and are an important element in cell growth and other physiological processes.

The

Company has developed and patented a technologically advanced process utilizing pure physical extraction technology for this highly important

organic material. Its water solvent large column chromatography ultrafiltration membrane protects the natural structure and activity

of phospholipids, as no chemical solvent is involved in the process. Through precise parameter design and regulation, the Company’s

ultrafiltration membrane structure process restores the natural bilayer of phospholipid molecules and achieves a precise separation and

extraction of phospholipid molecules. This patented technologically advanced process results in extraction efficiency, minimizing costs

and maximizing yield.

Shineco

plans to continue to research and develop the application of the naturally active water-soluble phospholipids in the medical, food, beauty

and other fields. According to the market research firm www.factmr.com, the global phospholipids market was valued at $3.7 billion

in 2021, and with a projected CAGR of 7.3% over ten years, this market is likely to reach a valuation of $7.3 billion by the end of 2032.

Shineco

also plans to continue to develop new high value-added products to meet the changing needs of the healthcare and medical sectors. In

addition, it intends to optimize its global sales network to develop and expand the overseas markets for its products. Through continuous

innovation and the development of high-quality products, the Company expects to foster a brighter and healthier future for people around

the globe.

About

Shineco, Inc.

Shineco

Inc. (“Shineco” or the “Company”) aims to ‘care for a healthy life and improve the quality of life’,

by providing safe, efficient and high-quality health and medical products and services to society. Shineco, operating through subsidiaries,

has researched and developed 33 vitro diagnostic reagents and related medical devices to date, and the Company also produces and sells

healthy and nutritious foods. For more information about Shineco, please visit www.biosisi.com/.

Forward-Looking

Statements

This

news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can be identified by terminology

such as “may”, “will”, “should”, “could”, “intend”, “expect”,

“plan”, “budget”, “forecast”, “anticipate”, “believe”, “estimate”,

“predict”, “potential”, “continue”, “evaluating” or similar words. Forward-looking statements

should not be relied upon because they are neither historical facts nor assurances of future performance. Instead, they are based only

on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections,

anticipated events and trends, the economy and other future conditions. Examples of forward-looking statements include, among others,

statements we make regarding the innovativeness and market position of our products and services, our competitive strengths, and our

expectations of product sales by our subsidiaries. You are cautioned not to rely on any forward-looking statements. Actual results may

differ materially from historical results or those indicated by the forward-looking statements as a result of a variety of factors including,

but not limited to, risks and uncertainties associated with the Company’s ability to raise additional funding, its ability to maintain

and grow its business, variability of operating results, its ability to maintain and enhance its brand, its development and introduction

of new products and services, the ability to obtain all necessary regulatory approvals in the jurisdictions where it intends to market

and sell its products the successful integration of acquired companies, technologies and assets into its portfolio of products and services,

marketing and other business development initiatives, competition in the industry, general government regulations, economic conditions,

the impact of the COVID-19 pandemic, dependence on key personnel, the ability to attract, hire and retain personnel who possess the technical

skills and experience necessary to meet the requirements of its clients, and its ability to protect its intellectual property. Shineco

encourages you to review other factors that may affect its future results in its filings with the Securities and Exchange Commission.

The forward-looking statements in this press release are based only on information currently available to us and speak only as of the

date of this press release, and Shineco assumes no obligation to update any forward-looking statements except as required by the applicable

rules and regulations.

For

more information, please contact:

Shineco,Inc.

secretary@shineco.tech

Mobile: +86-010-68130220

Precept

Investor Relations LLC

David

J. Rudnick

david.rudnick@preceptir.com

Mobile:

+1-646-694-8538

v3.24.2

Cover

|

Jul. 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 09, 2024

|

| Entity File Number |

001-37776

|

| Entity Registrant Name |

SHINECO,

INC.

|

| Entity Central Index Key |

0001300734

|

| Entity Tax Identification Number |

52-2175898

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

T1,

South Tower

|

| Entity Address, Address Line Two |

Jiazhaoye Square

|

| Entity Address, Address Line Three |

Chaoyang District

|

| Entity Address, City or Town |

Beijing

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

100022

|

| City Area Code |

+86

|

| Local Phone Number |

10-87227366

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock

|

| Trading Symbol |

SISI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

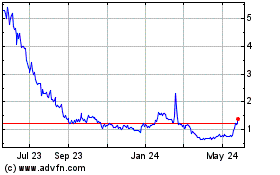

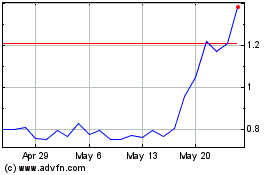

Shineco (NASDAQ:SISI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Shineco (NASDAQ:SISI)

Historical Stock Chart

From Jul 2023 to Jul 2024