Fourth Quarter and Annual 2024

Summary

- Q4 2024 pre-tax income of $134 million, net income of $97

million, or $2.34 per diluted share

- Full year 2024 pre-tax income of $432 million, net income of

$323 million, or $7.77 per diluted share

- SkyWest reached a multi-year contract extension with American

Airlines that allows for a total of 74 CRJ700s under agreement

- SkyWest took delivery of four new E175 aircraft under a

previously announced agreement with United

SkyWest, Inc. (NASDAQ: SKYW) (“SkyWest”) today reported

financial and operating results for Q4 2024, including net income

of $97 million, or $2.34 per diluted share, compared to net income

of $18 million, or $0.42 per diluted share, for Q4 2023. SkyWest

also reported net income of $323 million, or $7.77 per diluted

share, for the 2024 year, compared to net income of $34 million, or

$0.77 per diluted share, for the 2023 year.

Commenting on the results, Chip Childs, Chief Executive Officer

of SkyWest, said, “We are honored to be named one of the World’s

Most Admired™ Companies for 2025 by Fortune Magazine and pleased

that our operational momentum continues. We are continuing to make

improvements in returning daily scheduled service to smaller

communities, increasing the utilization and efficiency of all fleet

types, and quickly placing new aircraft deliveries into service. I

want to thank the SkyWest team for their exceptional teamwork as we

continue to execute on these growth opportunities, including

progress with expanding our CRJ550 and E175 fleets.”

Financial Results

Revenue was $944 million in Q4 2024, up $192 million, or 26%,

from $752 million in Q4 2023. SkyWest’s block hour production

increased 20% in Q4 2024 compared to Q4 2023, which reflects

improvements in captain availability since Q4 2023.

For purposes of revenue comparability year-over-year, SkyWest

recognized $20 million of previously deferred revenue under its

flying contracts during Q4 2024, compared to deferring $63 million

of revenue during Q4 2023. As of December 31, 2024, SkyWest had

cumulative deferred revenue of $322 million under its flying

contracts on its balance sheet.

Operating expenses were $800 million in Q4 2024, up $76 million,

or 10%, from $724 million in Q4 2023, driven by the increase in

flight production year-over-year.

Capital and Liquidity

SkyWest had $802 million in cash and marketable securities at

December 31, 2024, down from $836 million at September 30, 2024 and

down from $835 million at December 31, 2023.

Total debt at December 31, 2024 was $2.7 billion, flat from

September 30, 2024 and down from $3.0 billion at December 31, 2023.

Capital expenditures during Q4 2024 were $186 million for the

purchase of four debt-financed E175 aircraft, spare engines and

other fixed assets.

Under its previously announced share repurchase program

authorized by the SkyWest Board of Directors in May 2023, SkyWest

repurchased 47,000 shares of common stock for $4.9 million during

Q4 2024 at an average price per share of $104.51. As of December

31, 2024, SkyWest had $48 million of remaining availability under

its current share repurchase program.

Commercial Agreements

SkyWest is coordinating with its major airline partners to

optimize the timing of upcoming announced fleet deliveries. The

table below summarizes E175 aircraft deliveries SkyWest received

during 2024 and anticipated future deliveries during the periods

indicated based on currently available information, which is

subject to change.

Completed

Anticipated

2024

2025

2026

Total

Delta Air Lines

1

ꟷ

ꟷ

1

United Airlines

24(1)

7

8

39

Alaska Airlines

ꟷ

1

ꟷ

1

Total

25

8

8

41

(1) 20 of the 24 E175 deliveries completed

in 2024 for United Airlines were partner-financed aircraft.

By the end of 2026, SkyWest is scheduled to operate a total of

278 E175 aircraft.

About SkyWest

SkyWest, Inc. is the holding company for SkyWest Airlines,

SkyWest Charter (“SWC”) and SkyWest Leasing, an aircraft leasing

company. SkyWest Airlines has a fleet of approximately 500 aircraft

connecting passengers to over 240 destinations throughout North

America. SkyWest Airlines operates through partnerships with United

Airlines, Delta Air Lines, American Airlines, and Alaska Airlines

carrying more than 42 million passengers in 2024.

SkyWest will host its conference call to discuss its fourth

quarter 2024 results today, January 30, 2025, at 2:30 p.m. Mountain

Time. The conference call number is 1-888-330-2455 for domestic

callers, and 1-240-789-2717 for international callers. Please call

up to ten minutes in advance to ensure you are connected prior to

the start of the call. The conference call will also be available

live on the Internet at

https://events.q4inc.com/attendee/312398142. This press release and

additional information regarding SkyWest, including access

information for the digital rebroadcast of the fourth quarter 2024

results call, participation at investor conferences and investor

presentations can be accessed at inc.skywest.com.

Forward Looking-Statements

In addition to historical information, this release contains

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Words such as

“forecasts,” "expects," "intends," "believes," "anticipates,"

“estimates,” "should," "likely" and similar expressions identify

forward-looking statements. Such statements include, but are not

limited to, statements about the continued demand for our product,

the effect of economic conditions on SkyWest’s business, financial

condition and results of operations, the scheduled aircraft

deliveries, fleet expansion and anticipated fleet size for SkyWest

in upcoming periods, expected production levels in future periods

and associated staffing challenges, pilot attrition trends,

SkyWest’s coordination with major airline partners to optimize the

delivery of aircraft under previously announced agreements and

quickly placing new aircraft deliveries into service, the expected

terms, timing and benefits related to SkyWest’s leasing, strategic

partnership and joint venture transactions, scheduled flight

service to smaller communities, increasing the utilization and

efficiency of all fleet types as well as SkyWest’s future financial

and operating results, plans, objectives, expectations, estimates,

intentions and outlook, and other statements that are not

historical facts. All forward-looking statements included in this

release are made as of the date hereof and are based on information

available to SkyWest as of such date. SkyWest assumes no obligation

to update any forward-looking statements unless required by law.

Readers should note that many factors could affect the future

operating and financial results of SkyWest and could cause actual

results to vary materially from those expressed in forward-looking

statements set forth in this release. These factors include, but

are not limited to: the challenges of competing successfully in a

highly competitive and rapidly changing industry; developments

associated with fluctuations in the economy and the demand for air

travel, including related to inflationary pressures, and related

decreases in customer demand and spending; uncertainty regarding

potential future outbreaks of infectious diseases or other health

concerns, and the consequences of such outbreaks to the travel

industry, including travel demand and travel behavior, and our

major airline partners in general and the financial condition and

operating results of SkyWest in particular; the prospects of

entering into agreements with existing or other carriers to fly new

aircraft; uncertainty regarding timing and performance of key

third-party service providers; ongoing negotiations between SkyWest

and its major airline partners regarding their contractual

obligations; uncertainties regarding operation of new aircraft; the

ability to attract and retain qualified pilots, including captains,

and related staffing challenges; the impact of regulatory issues

such as pilot rest rules and qualification requirements; the

ability to obtain aircraft financing; the financial stability of

SkyWest’s major airline partners and any potential impact of their

financial condition on the operations of SkyWest; fluctuations in

flight schedules, which are determined by the major airline

partners for whom SkyWest conducts flight operations; variations in

market and economic conditions; significant aircraft lease and debt

commitments; estimated useful life of long-lived assets, residual

aircraft values and related impairment charges; labor relations and

costs; the impact of global instability; rapidly fluctuating fuel

costs and potential fuel shortages; the impact of weather-related,

natural disasters and other air safety incidents on air travel and

airline costs; aircraft deliveries; uncertainty regarding ongoing

hostility between Russia and the Ukraine, as well as Israel and

Hamas, and the related impacts on macroeconomic conditions and on

the international operations of any of our major airline partners

as a result of such conflict; and other unanticipated factors. Risk

factors, cautionary statements and other conditions which could

cause SkyWest’s actual results to differ materially from

management’s current expectations are contained in SkyWest’s

filings with the Securities and Exchange Commission, including its

most recent Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K.

SkyWest, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Income

(Dollars and Shares in Thousands,

Except per Share Amounts)

(Unaudited)

Three Months Ended

Year Ended

December 31,

December 31,

2024

2023

2024

2023

OPERATING REVENUES:

Flying agreements

$

912,845

$

728,267

$

3,412,798

$

2,834,397

Lease, airport services and other

31,557

23,520

115,122

101,035

Total operating revenues

944,402

751,787

3,527,920

2,935,432

OPERATING EXPENSES:

Salaries, wages and benefits

380,493

331,956

1,463,932

1,322,615

Aircraft maintenance, materials and

repairs

202,308

190,271

712,642

673,453

Depreciation and amortization

94,534

95,237

383,880

383,115

Aircraft fuel

22,193

23,340

87,409

85,913

Airport-related expenses

24,771

18,992

85,836

72,640

Aircraft rentals

1,332

1,452

5,257

25,507

Other operating expenses

74,695

62,917

294,307

268,120

Total operating expenses

800,326

724,165

3,033,263

2,831,363

OPERATING INCOME

144,076

27,622

494,657

104,069

OTHER INCOME (EXPENSE):

Interest income

11,835

12,167

47,961

43,928

Interest expense

(27,737

)

(31,049

)

(114,340

)

(130,930

)

Other income, net

5,432

15,698

3,865

23,242

Total other expense, net

(10,470

)

(3,184

)

(62,514

)

(63,760

)

INCOME BEFORE INCOME TAXES

133,606

24,438

432,143

40,309

PROVISION FOR INCOME TAXES

36,229

6,922

109,181

5,967

NET INCOME

$

97,377

$

17,516

$

322,962

$

34,342

BASIC EARNINGS PER SHARE

$

2.42

$

0.43

$

8.02

$

0.78

DILUTED EARNINGS PER SHARE

$

2.34

$

0.42

$

7.77

$

0.77

Weighted average common shares:

Basic

40,317

40,706

40,262

43,940

Diluted

41,702

41,776

41,547

44,599

SkyWest, Inc. and

Subsidiaries

Summary of Consolidated

Balance Sheets

(Dollars in Thousands)

(Unaudited)

December 31,

December 31,

2024

2023

Cash and marketable securities

$

801,628

$

835,223

Other current assets

315,439

296,673

Total current assets

1,117,067

1,131,896

Property and equipment, net

5,521,796

5,405,685

Deposits on aircraft

65,612

77,282

Other long-term assets

435,392

411,430

Total assets

$

7,139,867

$

7,026,293

Current portion, long-term debt

$

535,589

$

443,869

Other current liabilities

894,002

810,423

Total current liabilities

1,429,591

1,254,292

Long-term debt, net of current

maturities

2,136,786

2,562,183

Other long-term liabilities

1,164,709

1,096,316

Stockholders' equity

2,408,781

2,113,502

Total liabilities and stockholders'

equity

$

7,139,867

$

7,026,293

SkyWest, Inc. and

Subsidiaries

Additional Operational

Information (unaudited)

SkyWest’s fleet in scheduled service or

under contract by aircraft type:

December 31, 2024

September 30, 2024

December 31, 2023

E175 aircraft

262

258

237

CRJ900 aircraft

36

36

41

CRJ700 aircraft (1)

119

109

118

CRJ200 aircraft

75

81

89

Total aircraft in service or under

contract

492

484

485

________________ (1) Includes CRJ550

aircraft, a 50-seat configuration of the CRJ700 aircraft.

As of December 31, 2024, SkyWest leased 35 CRJ700/CRJ550s and

five CRJ900s to third parties and had 18 CRJ200s that are

configured for service under SWC operations (these aircraft are

excluded from the table above).

Selected operational data:

For the three months ended

December 31,

For the year ended December

31,

Block hours by aircraft type:

2024

2023

% Change

2024

2023

% Change

E175s

211,519

177,104

19.4

%

792,318

677,886

16.9

%

CRJ900s

23,711

17,198

37.9

%

84,883

76,588

10.8

%

CRJ700s

68,506

59,820

14.5

%

244,909

218,059

12.3

%

CRJ200s

46,582

36,632

27.2

%

169,930

167,910

1.2

%

Total block hours

350,318

290,754

20.5

%

1,292,040

1,140,443

13.3

%

Departures

206,588

177,433

16.4

%

766,742

691,962

10.8

%

Passengers carried

11,231,510

9,925,655

13.2

%

42,335,302

38,597,309

9.7

%

Adjusted flight completion

99.9

%

99.9

%

—

pts

99.9

%

99.9

%

—

pts

Raw flight completion

99.0

%

99.5

%

(0.5

)

pts

98.9

%

98.8

%

0.1

pts

Passenger load factor

82.2

%

83.4

%

(1.2

)

pts

82.8

%

83.6

%

(0.8

)

pts

Average trip length

443

445

(0.4

)

%

464

453

2.4

%

Adjusted flight completion percent

excludes weather cancellations. Raw flight completion includes

weather cancellations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130684506/en/

Investor Relations 435.634.3200

Investor.relations@skywest.com

Corporate Communications 435.634.3553

corporate.communications@skywest.com

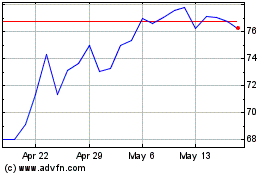

SkyWest (NASDAQ:SKYW)

Historical Stock Chart

From Dec 2024 to Jan 2025

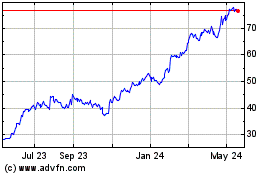

SkyWest (NASDAQ:SKYW)

Historical Stock Chart

From Jan 2024 to Jan 2025