false

0001554859

0001554859

2025-02-04

2025-02-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 4, 2025

SEMLER SCIENTIFIC, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36305 |

|

26-1367393 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

2340-2348 Walsh Avenue, Suite 2344

Santa Clara, CA |

|

95051 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (877) 774-4211

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

|

Common Stock, $0.001 par value per share

|

|

SMLR |

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

On

February 4, 2025, Semler Scientific, Inc. issued a press release announcing updates with respect to its bitcoin holdings

and “BTC Yield,” a key performance indicator. A copy of the press release is filed as Exhibit 99.1 to this current report

on Form 8-K and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

SEMLER SCIENTIFIC, INC. |

| |

|

|

| Date: February 4, 2025 |

By: |

/s/ Renae Cormier |

| |

|

Name: Renae Cormier |

| |

|

Title: Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer) |

Exhibit 99.1

Semler Scientific® Announces

Updated BTC Activity; Monetizes Minority Investment to Purchase BTC;

Purchased Additional 871 BTC; Now Holds 3,192

BTC; YTD BTC Yield of 152.2% Since July 1, 2024

Santa Clara, CA – February 4, 2025 – Semler

Scientific, Inc. (Nasdaq: SMLR), a pioneer in developing and marketing technology products

and services to assist its customers in evaluating and treating chronic diseases, today announced updates regarding its bitcoin

(BTC) activity and holdings, and BTC Yield, a key performance indicator.

BTC Update

Between January 11, 2025 and February 3, 2025, Semler Scientific

acquired 871 bitcoins for $88.5 million with proceeds generated from its January 2025 senior convertible notes offering and monetization

of a portion of its minority investment in Monarch Medical Technologies, LLC. The average price of its bitcoin purchases was $101,616

per bitcoin, inclusive of fees and expenses. As of February 3, 2025, Semler Scientific held 3,192 bitcoins, which were acquired for

an aggregate $280.4 million at an average purchase price of $87,854 per bitcoin, inclusive of fees and expenses.

BTC Yield as a Key Performance Indicator (KPI)

From January 1, 2025 to February 3, 2025, Semler Scientific’s

BTC Yield was 21.9%. From July 1, 2024 (the first full quarter after Semler Scientific adopted its bitcoin treasury strategy) to

February 3, 2025, Semler Scientific’s BTC Yield was 152.2%.

Semler Scientific uses BTC Yield as a KPI to help assess the performance

of its strategy of acquiring bitcoin in a manner Semler Scientific believes is accretive to stockholders. Semler Scientific believes this

KPI can be used to supplement an investor’s understanding of Semler Scientific’s decision to fund the purchase of bitcoin

by issuing additional shares of its common stock or instruments convertible to common stock.

“We are thrilled with the progress we are making in growing our

bitcoin stockpile,” said Eric Semler, chairman of Semler Scientific. “We were especially pleased with our successful

convertible notes offering, which was substantially oversubscribed with investor demand. Additionally, we were pleased to have monetized

a part of our investment in Monarch Medical in order to buy more bitcoin.”

BTC Yield and Basic and Assumed Diluted Shares Outstanding

| | |

6/30/2024 | | |

12/31/2024 | | |

2/3/2025 | |

| Total Bitcoin Holdings | |

| 877 | | |

| 2,298 | | |

| 3,192 | |

| | |

| | | |

| | | |

| | |

| Basic Shares Outstanding (‘000) | |

| 6,988 | | |

| 9,557 | | |

| 9,596 | |

| 2030 Convertible Shares with Capped Calls $107.01 | |

| | | |

| | | |

| 935 | |

| Options Outstanding | |

| 1,098 | | |

| 691 | | |

| 1,141 | |

| Assumed Diluted Shares Outstanding (1) | |

| 8,086 | | |

| 10,248 | | |

| 11,672 | |

| BTC Yield % (YTD 1/1/25 to 2/3/25) | |

| | | |

| | | |

| 21.9 | % |

| BTC Yield % (7/1/24 to 2/3/25) | |

| | | |

| | | |

| 152.2 | % |

| (1) | Assumed Diluted Shares Outstanding refers to the aggregate of Semler Scientific’s Basic Shares outstanding as of the end of

each period plus all the additional shares that would result from the assumed conversion of all outstanding convertible notes and related

capped calls, and exercise of all outstanding stock option awards. Assumed Diluted Shares Outstanding is not calculated using the treasury

method and does not take into account any vesting conditions (in the case of equity awards), the exercise price of any stock option awards

or any contractual conditions limiting convertibility of outstanding convertible notes or settlement of capped calls. |

Important Information about BTC Yield KPI

BTC Yield is a KPI that represents the percentage change period-to-period

of the ratio between Semler Scientific’s bitcoin holdings and its Assumed Diluted Shares Outstanding. Assumed Diluted Shares Outstanding

refers to the aggregate of Semler Scientific’s actual shares of common stock outstanding as of the end of each period plus all additional

shares that would result from the assumed conversion of all outstanding convertible notes and exercise of all outstanding stock option

awards. Assumed Diluted Shares Outstanding is not calculated using the treasury method and does not take into account any vesting conditions

(in the case of equity awards), the exercise price of any stock option awards or any contractual conditions limiting convertibility of

outstanding convertible notes or settlement of capped calls.

Semler Scientific uses BTC Yield as a KPI to help assess the performance

of its strategy of acquiring bitcoin in a manner Semler Scientific believes is accretive to stockholders. Semler Scientific believes this

KPI can be used to supplement an investor’s understanding of its decision to fund the purchase of bitcoin by issuing additional

shares of its common stock. When Semler Scientific uses this KPI, management also takes into account the various limitations of this metric,

including that it assumes the outstanding convertible notes will be converted into shares of common stock and the capped calls will be

settled in accordance with their respective terms.

Additionally, this KPI is not, and should not be understood as, an

operating performance measure or a financial or liquidity measure. In particular, BTC Yield is not equivalent to a “yield”

in the traditional financial context. It is not a measure of the return on investment Semler Scientific’s stockholders may have

achieved historically or can achieve in the future by purchasing stock of Semler Scientific, or a measure of income generated by Semler

Scientific’s operations or its bitcoin holdings, return on investment on its bitcoin holdings, or any other similar financial measure

of the performance of its business or assets.

The trading price of Semler Scientific’s common stock is informed

by numerous factors in addition to the amount of bitcoins Semler Scientific holds and number of actual or potential shares of its stock

outstanding. As a result, the market value of Semler Scientific’s shares may trade at a discount or a premium relative to the market

value of the bitcoin Semler Scientific holds. BTC Yield is not indicative nor predictive of the trading price of Semler Scientific’s

shares of common stock. As noted above, this KPI is narrow in its purpose and is used by management to assist in assessing whether Semler

Scientific is using equity capital in a manner accretive to stockholders solely as it pertains to its bitcoin holdings.

In calculating this KPI, Semler Scientific does not take into account

the source of capital used for the acquisition of its bitcoin. Semler Scientific notes in particular, it has acquired bitcoin using cash

flow from operations, proceeds from the sale of shares in its at-the-market (ATM) offering, as well as from the offering of convertible

notes, which at the time of issuance and including the capped calls had, and may from time-to-time thereafter have, conversion prices

above the current trading prices of Semler Scientific’s common stock, or as to which the holders of such convertible notes may not

then be entitled to exercise the conversion rights of the notes. Conversely, if Semler Scientific’s convertible notes mature or

are redeemed without being converted into common stock, Semler Scientific may be required to sell shares in quantities greater than the

shares such convertible notes and related capped calls are convertible into or generate cash proceeds from the sale of bitcoin, either

of which would have the effect of decreasing the BTC Yield due to changes in Semler Scientific’s bitcoin holdings and shares in

ways that were not contemplated by the assumptions in calculating BTC Yield. Accordingly, this metric might overstate or understate the

accretive nature of Semler Scientific’s use of capital to buy bitcoin because not all bitcoin may be acquired using proceeds of

equity and convertible debt offerings and not all issuances of equity may involve the acquisition of bitcoin.

Semler Scientific’s ability to achieve positive BTC Yield may

depend on a variety of factors, including its ability to generate cash from operations in excess of its fixed charges and other expenses,

as well as factors outside of its control, such as the availability of debt and equity financing on favorable terms. Past performance

is not indicative of future results.

Semler Scientific has historically not paid dividends on its shares

of common stock, and by presenting this KPI, Semler Scientific makes no suggestion that it intends to do so in the future. Ownership of

common stock does not represent an ownership interest in the bitcoin Semler Scientific holds.

Investors should rely on the financial statements and other disclosures

contained in Semler Scientific’s filings with the Securities and Exchange Commission (SEC). This KPI is merely a supplement, not

a substitute. It should be used only by sophisticated investors who understand its limited purpose and many limitations.

Forward-Looking Statements

This press release contains "forward-looking" statements.

Such statements can be identified by, among other things, the use of forward-looking language such as the words "believe," "goal,"

"may," "will," "intend," "expect," "anticipate," "estimate," "project,"

"would," "could" or words with similar meaning or the negatives of these terms or by the discussion of strategy or

intentions. The forward-looking statements in this release include statements regarding acquiring and holding bitcoin; its BTC yield;

and other express or implied statements regarding the ATM offering, the recent convertible notes offering, capped call transactions and

its healthcare business. Such forward-looking statements are subject to a number of risks and uncertainties that could cause Semler Scientific's

actual results to differ materially from those discussed here, such as risks investing in bitcoin, including bitcoin's volatility; risk

of implementing a bitcoin treasury strategy; risks of indebtedness from the recent convertible notes offering; risks of settlement with

counterparties of the capped calls; along with those other risks related to its healthcare business and the risk factors detailed in Semler

Scientific's filings with the SEC. These forward-looking statements involve assumptions, estimates, and uncertainties that reflect current

internal projections, expectations or beliefs. There can be no assurance that such statements will prove to be accurate, and actual results

and future events could differ materially from those anticipated in such statements. All forward-looking statements contained in this

press release are qualified in their entirety by these cautionary statements and the risk factors described above. Furthermore, all such

statements are made as of the date of this press release and Semler Scientific assumes no obligation to update or revise these statements

unless otherwise required by law.

No Offer or Solicitation

This press release does not and shall not constitute an offer to sell

or a solicitation of an offer to buy any securities of Semler Scientific, nor shall there be any offer, solicitation or sale of such securities,

in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such state or jurisdiction.

About Semler Scientific, Inc.:

Semler Scientific, Inc. is a

pioneer in developing and marketing technology products and services to assist its customers in evaluating and treating chronic diseases.

Its flagship product, QuantaFlo®, which is patented and cleared by the U.S. Food and Drug Administration (FDA), is a rapid point-of-care

test that measures arterial blood flow in the extremities. The QuantaFlo test aids in the diagnosis of cardiovascular diseases, such as

peripheral arterial disease (PAD), and Semler Scientific is seeking a new 510(k) clearance for expanded indications. QuantaFlo is

used by healthcare providers to evaluate their patient’s risk of mortality and major adverse cardiovascular events (MACE). Semler

Scientific also invests in bitcoin and has adopted bitcoin as its primary treasury asset.

INVESTOR CONTACT:

Renae Cormier

Chief Financial Officer

ir@semlerscientific.com

SOURCE: Semler Scientific, Inc.

v3.25.0.1

Cover

|

Feb. 04, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 04, 2025

|

| Entity File Number |

001-36305

|

| Entity Registrant Name |

SEMLER SCIENTIFIC, INC.

|

| Entity Central Index Key |

0001554859

|

| Entity Tax Identification Number |

26-1367393

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2340-2348 Walsh Avenue

|

| Entity Address, Address Line Two |

Suite 2344

|

| Entity Address, City or Town |

Santa Clara

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95051

|

| City Area Code |

877

|

| Local Phone Number |

774-4211

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

SMLR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

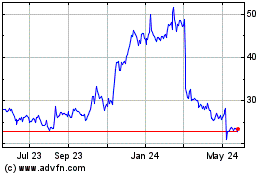

Semier Scientific (NASDAQ:SMLR)

Historical Stock Chart

From Jan 2025 to Feb 2025

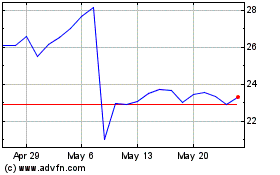

Semier Scientific (NASDAQ:SMLR)

Historical Stock Chart

From Feb 2024 to Feb 2025