Surrozen, Inc. (“Surrozen” or the “Company”) (Nasdaq: SRZN), a

company pioneering targeted therapeutics that selectively activate

the Wnt pathway for tissue repair and regeneration, today provided

third quarter 2024 financial results and business updates.

“In the third quarter, we made substantial progress on enrolling

patients in the SZN-043 Phase 1b trial, received notification that

Boehringer planned to further develop SZN-413 to advance the

compound and prepare it for clinical testing and nominated a

portfolio of novel preclinical ophthalmology candidates,” said

Craig Parker, President and Chief Executive Officer of Surrozen.

“More recently, we also announced a research collaboration with

TCGFB to utilize Surrozen’s antibody developments capabilities and

expertise to discover antibodies targeting TGF-β. We remain focused

on transforming the treatment of severe diseases of the liver and

eye through leveraging our research capabilities and expertise in

antibody engineering technologies.”

Research and Development Pipeline

Highlights

SZN-043Surrozen is developing SZN-043 for severe liver disease

with an initial focus on severe alcohol-associated hepatitis. The

Phase 1b study is enrolling patients and the Company expects

proof-of-concept data in the first half of 2025. The study is being

conducted at nine sites in five countries.

Surrozen successfully completed dosing and 30-day follow-up for

cohort 1 in its Phase 1b trial of SZN-043 in severe

alcohol-associated hepatitis (sAH). No drug related serious adverse

events (SAEs) were observed in the first cohort of six patients

receiving 0.5mg/kg of SZN-043. There were no patient deaths at day

30 of the study, and the company observed a potential clinical

benefit based on reductions in bilirubin and MELD score. A majority

of patients experienced improvements in AST and ALT levels.

Surrozen expects to present data from the Phase 1b study at an

upcoming liver disease conference.

“Published data in the severe alcohol-associated hepatitis

population indicates an expected mortality rate of approximately 15

to 20% at day 30 and absence of any improvement in markers of liver

physiology such as bilirubin”, said Craig Parker, President and

Chief Executive Officer of Surrozen. “We are encouraged to see that

SZN-043 is safe at the first dose level in the study and showing

signs of providing a clinical benefit to patients. We’re also

looking forward to data from additional higher dose cohorts of sAH

patients in the study. This preliminary data appears to indicate

SZN-043’s mechanism of stimulating hepatocyte specific regeneration

in the liver through Wnt signaling translates to beneficial changes

in liver function and potentially clinical benefit.”

Nominated Novel Portfolio of Ophthalmology Preclinical Product

Candidates to R&D PipelineSurrozen developed multiple novel

ophthalmology product candidates targeting Fzd4 leveraging the

Company’s antibody research capabilities and expertise in antibody

engineering technologies. Wnt signaling has been implicated in

multiple diseases and tissues in the eye. These product candidates

do not fall within the scope of the partnership with BI and are

wholly owned by Surrozen.

Product Candidates SZN-8141 and SZN-8143Data generated in

preclinical models of retinopathy demonstrated that SZN-8141 and

SZN-8143 stimulated Wnt signaling and induced normal retinal vessel

regrowth while suppressing pathological vessel growth.

- SZN-8141 combines Frizzled 4 (Fzd4) agonism and Vascular

Endothelial Growth Factor (VEGF) antagonism which has the potential

to provide benefits over treatment with single agents for Diabetic

Macular Edema (DME) and neovascular Age Related Macular

Degeneration (wet AMD)

- SZN-8143: combines Fzd4 agonism, VEGF antagonism, and

interleukin-6 (IL-6) antagonism which may have benefits over single

agents for treatment of DME/wet AMD/uveitic macular edema

(UME)

Product Candidate SZN-113SZN-113 targets Fzd127 and is in

development for Fuchs’ Endothelial Corneal Dystrophy (FECD) and

Geographic Atrophy (GA).

- FECD preclinical models: SZN-113 enhanced proliferation of

primary human corneal endothelial cells in vitro, demonstrated

evidence of wound healing in acute corneal endothelial injury

models, and rapidly reduced central corneal thickness along with

demonstrating improved corneal clarity in a cryoinjury model in

mouse and rabbit.

- GA preclinical models: Fzd127 molecules stimulated retinal

pigment epithelium cell proliferation and differentiation in

culture and provided neuroprotection in acute injury and

progressive degeneration models of photoreceptor

degeneration.

Corporate Updates

Corporate PartnershipsSurrozen executed a partnership with

Boehringer Ingelheim (BI) in the fourth quarter of 2022 to develop

a Wnt agonist, SZN-413, for the treatment of people with retinal

diseases. In September 2024, Surrozen announced that Boehringer

Ingelheim will further develop SZN-413 to advance the compound and

prepare it for clinical testing. The milestone achievement

triggered a $10 million payment to Surrozen as part of the

agreement. This milestone payment was received in October 2024.

Research Collaboration with TCGFBIn November, Surrozen announced

a strategic research collaboration with privately-held TCGFB, Inc.

(“TCGFB”) to discover antibody therapeutics targeting Transforming

Growth Factor Beta (TGF-β) for the potential treatment of patients

with idiopathic pulmonary fibrosis (IPF). TCGFB will own all TGF-β

product related intellectual property. Under the terms of the

agreement, Surrozen will provide antibody discovery services for a

period of up to two years. In exchange for Surrozen’s research

services, TCGFB will pay Surrozen up to $6 million in the

aggregate, plus any third-party costs, and will issue Surrozen a

warrant for up to 3,380,000 shares of TCGFB common stock at an

exercise price of $0.0001 per share based on certain vesting

conditions.

Financial Results for the Second Quarter Ended September

30, 2024

Cash Position: Cash and cash equivalents

were $31.0 million as of September 30, 2024, compared to $37.8

million as of June 30, 2024. In addition, Surrozen received a $10

million milestone payment from BI in October 2024.

Collaboration and License Revenue:

Collaboration and license revenue for the third quarter ended

September 30, 2024 was $10.0 million, as compared to zero for the

same period in 2023. The increase was due to the recognition of a

milestone achieved under the collaboration and license agreement

with BI in September 2024.

Research and Development

Expenses: Research and development expenses for the

third quarter ended September 30, 2024 were $5.2 million, as

compared to $6.1 million for the same period in 2023. The decrease

was primarily due to the restructuring executed in 2023 to

prioritize and focus our resources on clinical stage programs, as

well as the discontinuation of the clinical development of

SZN-1326. Research and development expenses include non-cash

stock-based compensation expenses of $0.3 million for the third

quarter ended September 30, 2024, as compared to $0.2 million for

the same period in 2023.

General and Administrative

Expenses: General and administrative expenses were

$3.6 million for both the third quarter ended September 30, 2024

and 2023. General and administrative expenses include non-cash

stock-based compensation expenses of $0.7 million for both the

third quarter ended September 30, 2024 and 2023.

Restructuring: Restructuring charges for the

third quarter ended September 30, 2024 were zero, as compared to

$1.5 million for the same period in 2023. The decrease was

attributable to a restructuring plan implemented in 2023.

Interest Income: Interest income for the

third quarter ended September 30, 2024 was $0.4 million, as

compared to $0.7 million for the same period in 2023. The decrease

was primarily related to the decrease in our cash equivalents and

marketable securities.

Other (Expense) Income, Net: Other

(expense) income, net for the third quarter ended September 30,

2024 was a net other expense of $3.1 million, as compared to a net

other income of $0.1 million for the same period in 2023. The

variance was primarily related to the non-cash change in fair value

of warrant liabilities.

Net Loss: Net loss for the third quarter

ended September 30, 2024 was $1.4 million, as compared to $10.4

million for the same period in 2023.

About SZN-043 for Severe Alcohol-Associated

HepatitisSZN-043 is the first development candidate using

Surrozen’s SWEETS™ technology. Surrozen is developing SZN-043 for

severe liver diseases, initially focusing on alcohol-associated

hepatitis. The Company has completed the Phase 1a clinical trial in

patients with chronic liver disease and healthy volunteers. SZN-043

demonstrated acceptable safety and tolerability in all subjects,

with evidence of target engagement, Wnt signal activation and

effects on liver function. Enrollment is ongoing in the Phase 1b

clinical trial in patients with severe alcohol-associated

hepatitis. Cohort 1 in the Phase 1b trial completed enrollment in 6

patients with no drug related SAEs. There were no patient deaths at

day 30 of the study and the company observed a potential clinical

benefit based on reductions in bilirubin and MELD score. A majority

of patients experienced improvements in AST and ALT levels.

Proof-of-concept data is anticipated in the first half of 2025.

About SZN-413 for Retinal DiseasesSZN-413 is a

bi-specific antibody targeting Fzd4-mediated Wnt signaling designed

using Surrozen’s SWAP™ technology. SZN-413 is being developed for

the treatment of retinal vascular-associated diseases. Data

generated by Surrozen with SZN-413 in preclinical models of

retinopathy demonstrated that SZN-413 could potently stimulate Wnt

signaling in the eye, induce normal retinal vessel regrowth,

suppress pathological vessel growth and reduce vascular leakage.

This novel approach could thus potentially allow for regeneration

of healthy eye tissue, not only halting retinopathy, but possibly

allowing for a full reversal of the patient’s disease.

In the fourth quarter of 2022, Surrozen entered into a strategic

partnership with Boehringer Ingelheim for the research and

development of SZN-413 for the treatment of retinal diseases. Under

the terms of the agreement, Boehringer Ingelheim received an

exclusive, worldwide license to develop SZN-413 and other

Fzd4-specific Wnt-modulating molecules for all purposes, including

as a treatment for retinal diseases, in exchange for an upfront

payment to Surrozen of $12.5 million. Surrozen will also be

eligible to receive up to $587.0 million in success-based

development, regulatory, and commercial milestone payments, in

addition to mid-single digit to low-double digit royalties on

sales. After an initial period of joint research, Boehringer

Ingelheim will assume all development and commercial

responsibilities.

In September 2024, Surrozen announced that Boehringer Ingelheim

will further develop SZN-413 to advance the compound and prepare it

for clinical testing. The milestone achievement triggered a $10

million payment to Surrozen as part of the agreement.

About Wnt SignalingWnt signaling plays key

roles in the control of development, homeostasis, and regeneration

of many essential organs and tissues, including liver, intestine,

lung, kidney, retina, central nervous system, cochlea, bone, and

others. Modulation of Wnt signaling pathways has potential for

treatment of degenerative diseases and tissue injuries. Surrozen’s

platform and proprietary technologies have the potential to

overcome the limitations in pursuing the Wnt pathway as a

therapeutic strategy.

About SurrozenSurrozen is a clinical stage

biotechnology company discovering and developing drug candidates to

selectively modulate the Wnt pathway. Surrozen is developing

tissue-specific antibodies designed to engage the body’s existing

biological repair mechanisms with a current focus on severe liver

and eye diseases. For more information, please visit

www.surrozen.com.

Forward Looking Statements This press release

contains certain forward-looking statements within the meaning of

the federal securities laws. Forward-looking statements generally

are accompanied by words such as “will,” “plan,” “intend,”

“potential,” “expect,” “could,” or the negative of these words and

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements include, but are not limited to,

statements regarding Surrozen’s discovery, research and development

activities, in particular its development plans for its product

candidates (including anticipated clinical development plans and

timelines, the availability of data, the potential for such product

candidates to be used to treat human disease, as well as the

potential benefits of such product candidates), the Company’s

partnership with Boehringer Ingelheim, including the potential for

future success-based development, regulatory, and commercial

milestone payments, in addition to mid-single digit to low-double

digit royalties on sales, and the potential of TGF-β to be a novel,

first-in-class therapeutic to treat the pathology of Idiopathic

Pulmonary Fibrosis. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of the management of Surrozen and are

not predictions of actual performance. These forward-looking

statements are provided for illustrative purposes only and are not

intended to serve as, and must not be relied on as a guarantee, an

assurance, a prediction, or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of Surrozen. These

forward-looking statements are subject to a number of risks and

uncertainties, including the initiation, cost, timing, progress and

results of research and development activities, preclinical and

clinical trials with respect to its product candidates; the

Company’s ability to fund its preclinical and clinical trials and

development efforts, whether with existing funds or through

additional fundraising; Surrozen’s ability to identify, develop and

commercialize drug candidates; Surrozen’s ability to successfully

complete preclinical and clinical studies for its product

candidates; the effects that arise from volatility in global

economic, political, regulatory and market conditions; and all

other factors discussed in Surrozen’s Annual Report on Form 10-K

for the year ended December 31, 2023 and Surrozen’s Quarterly

Report on Form 10-Q for the quarter ended September 30, 2024 to be

filed with the Securities and Exchange Commission (“SEC”) under the

heading “Risk Factors,” and other documents Surrozen has filed, or

will file, with the SEC. If any of these risks materialize or our

assumptions prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There

may be additional risks that Surrozen presently does not know, or

that Surrozen currently believes are immaterial, that could also

cause actual results to differ from those contained in the

forward-looking statements. In addition, forward-looking statements

reflect Surrozen’s expectations, plans, or forecasts of future

events and views as of the date of this press release. Surrozen

anticipates that subsequent events and developments will cause its

assessments to change. However, while Surrozen may elect to update

these forward-looking statements at some point in the future,

Surrozen specifically disclaims any obligation to do so, except as

required by law. These forward-looking statements should not be

relied upon as representing Surrozen’s assessments of any date

after the date of this press release. Accordingly, undue reliance

should not be placed upon the forward-looking statements.

Investor and Media

Contact:Investorinfo@surrozen.com

|

SURROZEN, INC.Condensed Consolidated

Statements of Operations(In thousands, except per

share amounts)(Unaudited) |

| |

| |

|

Three Months Ended |

|

|

Nine Months Ended |

|

| |

|

September 30, |

|

|

September 30, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Collaboration and license revenue |

|

$ |

10,000 |

|

|

$ |

— |

|

|

$ |

10,000 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

5,200 |

|

|

|

6,112 |

|

|

|

15,782 |

|

|

|

21,135 |

|

|

General and administrative |

|

|

3,568 |

|

|

|

3,572 |

|

|

|

11,165 |

|

|

|

12,209 |

|

|

Restructuring |

|

|

— |

|

|

|

1,505 |

|

|

|

— |

|

|

|

2,712 |

|

|

Total operating expenses |

|

|

8,768 |

|

|

|

11,189 |

|

|

|

26,947 |

|

|

|

36,056 |

|

| Income (loss) from

operations |

|

|

1,232 |

|

|

|

(11,189 |

) |

|

|

(16,947 |

) |

|

|

(36,056 |

) |

| Interest income |

|

|

431 |

|

|

|

661 |

|

|

|

1,306 |

|

|

|

1,831 |

|

| Other (expense) income,

net |

|

|

(3,097 |

) |

|

|

83 |

|

|

|

513 |

|

|

|

96 |

|

| Loss on issuance of common

stock, pre-funded warrants and warrants |

|

|

— |

|

|

|

— |

|

|

|

(20,397 |

) |

|

|

— |

|

| Net loss |

|

$ |

(1,434 |

) |

|

$ |

(10,445 |

) |

|

$ |

(35,525 |

) |

|

$ |

(34,129 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share

attributable to common stockholders, basic and diluted |

|

$ |

(0.44 |

) |

|

$ |

(5.14 |

) |

|

$ |

(12.57 |

) |

|

$ |

(16.96 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares used

in computing net loss per share attributable to common

stockholders, basic and diluted |

|

|

3,228 |

|

|

|

2,033 |

|

|

|

2,826 |

|

|

|

2,012 |

|

|

SURROZEN, INC.Condensed Consolidated

Balance Sheets(In thousands) |

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

|

2024 |

|

|

2023(1) |

|

|

|

|

(Unaudited) |

|

|

|

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

31,012 |

|

|

$ |

36,043 |

|

|

Accounts receivable |

|

|

12,196 |

|

|

|

2,152 |

|

|

Prepaid expenses and other current assets |

|

|

2,078 |

|

|

|

2,937 |

|

| Total current assets |

|

|

45,286 |

|

|

|

41,132 |

|

| |

|

|

|

|

|

|

| Property and equipment,

net |

|

|

856 |

|

|

|

1,969 |

|

| Operating lease right-of-use

assets |

|

|

817 |

|

|

|

1,889 |

|

| Restricted cash |

|

|

688 |

|

|

|

688 |

|

| Other assets |

|

|

351 |

|

|

|

402 |

|

| Total assets |

|

$ |

47,998 |

|

|

$ |

46,080 |

|

| |

|

|

|

|

|

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

276 |

|

|

$ |

525 |

|

|

Accrued and other liabilities |

|

|

4,317 |

|

|

|

4,126 |

|

|

Lease liabilities, current portion |

|

|

1,527 |

|

|

|

2,497 |

|

| Total current liabilities |

|

|

6,120 |

|

|

|

7,148 |

|

| |

|

|

|

|

|

|

| Lease liabilities, noncurrent

portion |

|

|

— |

|

|

|

882 |

|

| Warrant liabilities |

|

|

36,211 |

|

|

|

115 |

|

| Total liabilities |

|

|

42,331 |

|

|

|

8,145 |

|

| |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock |

|

|

— |

|

|

|

— |

|

|

Common stock |

|

|

— |

|

|

|

— |

|

|

Additional paid-in-capital |

|

|

262,887 |

|

|

|

259,630 |

|

|

Accumulated deficit |

|

|

(257,220 |

) |

|

|

(221,695 |

) |

| Total stockholders’

equity |

|

|

5,667 |

|

|

|

37,935 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

47,998 |

|

|

$ |

46,080 |

|

| |

(1) Derived from the audited financial

statements, included in the Company's Annual Report on Form 10-K

for the year ended December 31, 2023.

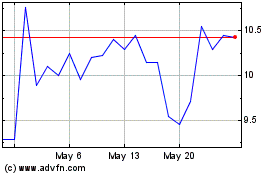

Surrozen (NASDAQ:SRZN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Surrozen (NASDAQ:SRZN)

Historical Stock Chart

From Nov 2023 to Nov 2024