Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

12 March 2025 - 11:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. __)

|

|

|

|

|

| Filed by the Registrant |

|

☒ |

|

|

| Filed by a Party other than the Registrant |

|

☐ |

|

|

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12

|

Trustmark Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

Trustmark experienced a transformational year in 2024 that included the sale of

our insurance agency, the restructuring of our balance sheet, and expanded sales and service initiatives to better meet the needs of our customers. These actions, along with other initiatives in prior years, have significantly enhanced

Trustmark’s financial performance and forward earnings profile. Our capital levels improved meaningfully, which led to the Board’s decision to increase the quarterly cash dividend in the first quarter of 2025 along with our renewed

activity in the share repurchase program in the fourth quarter of 2024.

During the second quarter, Trustmark

completed the sale of Fisher Brown Bottrell Insurance, Inc. (FBBI), a top five bank-affiliated insurance agency and one of the largest agencies in the Southeast. The cash transaction value was $345.0 million, which represented record multiples

of 5.9 times revenue and 28.0 times net income (based upon 2023 performance), and produced a gain on sale of $228.3 million, or $171.2 million, net of taxes.

Financial results in 2024, which included the sale of FBBI, consisted of both continuing

operations and discontinued operations. Discontinued operations reflect the financial results of FBBI prior to the sale as well as the gain on sale in the second quarter. Trustmark reported net income from continuing operations in 2024 of

$45.2 million, representing diluted earnings per share of $0.74. There were three significant non-routine items included in Trustmark’s financial results during the year: restructuring of the

investment securities portfolio, a portfolio sale of 1-4 family mortgage loans, and the fair value adjustment regarding our Visa C shares. Adjusted for these items, Trustmark’s net income from adjusted

continuing operations in 2024 was $186.3 million, or $3.04 per diluted share, compared to net income from adjusted continuing operations in 2023 of $159.2 million, or $2.60 per diluted share. Net income from adjusted continuing operations

in 2024 increased $27.1 million, or 17.0%, compared to the prior year while diluted net income from adjusted continuing operations per share increased $0.44.

For a reconciliation of net income from adjusted

continuing operations (including on a per share basis), which is a

non-GAAP financial measure, to net income from continuing operations (including on a per share basis) determined in accordance with GAAP, please see the section entitled

“Non-GAAP Financial Measures” in Trustmark’s Annual Report on Form 10-K for the year ended December 31, 2024 (2024 Form 10-K) filed with the SEC on February 19, 2025. In addition, please see “Management’s Discussion of Financial Condition and Results of Operations” in Trustmark’s 2024 Form 10-K for a more complete discussion of Trustmark’s results of operations and financial condition in 2024 and prior periods.

Loans held for investment (HFI) totaled $13.1 billion at December 31, 2024, an increase of $139.4 million, or

1.1%, from the prior year. The loan portfolio remains well-diversified by loan type and geography. Deposits totaled $15.1 billion at year-end 2024, down $461.6 million, or 3.0%, from the prior year

driven by intentional declines in public funds and brokered deposits totaling $726.8 million. Personal and commercial deposits totaled $12.9

billion at December 31, 2024, an increase of $265.2 million, or 2.1%, from the prior year.

Trustmark successfully navigated a challenging interest rate environment. Net interest income (FTE) totaled

$597.0 million in 2024, up 5.4% from the prior year, to produce a net interest margin of 3.51%, up 19 basis points from 2023. This growth is attributable in large part to the successful restructuring of the investment securities portfolio.

Our focused attention on customer relationships continues to afford Trustmark a position of leadership in the

majority of the communities we serve. We are pleased to continue to hold the #1 deposit market share in Mississippi. In addition, Trustmark holds a top-three deposit share position in 55% of the markets we

serve. We appreciate the continued confidence our customers have placed in us as their financial partner.

Our

mortgage banking business posted solid performance with revenue totaling $26.6 million during the year while mortgage loan production totaled $1.4 billion. Our commitment to providing opportunities for affordable housing was reinforced by

our team of Community Lending Specialists, mortgage loan originators and tailored product offerings that meet the needs of low-to-moderate income borrowers and

communities, including our Advantage suite of products.

Trustmark’s wealth management business posted a record

year, reflecting increased referrals from across the organization as well as the addition of key talent in the Houston, Texas and Birmingham, Alabama markets. Trustmark’s wealth management business produced revenue of $37.3 million, up

$2.2 million, or 6.2%, from the prior year. In 2024, assets under management and administration expanded 14.2% to $9.4 billion while brokerage assets increased 1.8% to $2.6 billion as of December 31, 2024.

Credit quality and consistent, disciplined underwriting continue to be hallmarks of our

organization. Nonperforming assets declined 19.5% during the year to $86.0 million at December 31, 2024. Net charge-offs represented 0.12% of average loans in 2024, excluding the portfolio sale of

1-4 family mortgage loans in the second quarter.

Allocation of Trustmark’s $160.3 million ACL on loans HFI represented 1.10% of commercial

loans and 1.62% of consumer and home mortgage loans, resulting in an ACL to total loans HFI of 1.22% and 341.20% of nonperforming loans, excluding individually analyzed loans at year-end. Management believes

the level of the ACL is commensurate with the credit losses currently expected in the loan portfolio.

Trustmark’s capital levels strengthened meaningfully during the year and continued to

significantly exceed levels considered to be “well-capitalized.” At December 31, 2024, Trustmark’s tangible equity to tangible assets ratio was 9.13%, while the total risk-based capital ratio was 13.97%. Trustmark returned

capital to shareholders through dividends as well as through repurchases of common stock. In 2024, Trustmark continued quarterly cash dividends to shareholders of $0.23 per share, or $0.92 annually. During the year, Trustmark repurchased

$7.5 million, or approximately 203 thousand of its common shares. In December, the Board authorized a new stock repurchase program through which $100.0 million of Trustmark’s outstanding shares may be acquired through 2025.

In January 2025, the Board announced a 4.3% increase in its regular quarterly dividend to $0.24 per share from $0.23

per share. The Board declared the dividend payable March 15, 2025, to shareholders of record on March 1, 2025. This action raised the indicated annual dividend rate to $0.96 per share. The increase in Trustmark’s quarterly dividend

and resumption of activity in the share repurchase program have been made possible by continued improvement in profitability and capital accretion.

We successfully expanded our digital banking capabilities with mobile applications to

enhance customer satisfaction and engagement while bolstering security measures. Advanced fraud detection protocols were integrated to mitigate risks in digital transactions, and compliance with regulatory standards was strengthened. We also

enhanced security protocols and systems to safeguard our customers’ data against emerging cyber threats. Additionally, we leveraged data analytics and artificial intelligence to gain deeper insights into customer behavior, risk management, and

operational efficiency.

During the year, we continued significant upgrades to our IT infrastructure. We

migrated to cloud-based solutions to achieve better scalability and reliability, upgrading our core banking systems, and ensuring compliance with regulatory standards.

We also continued to refine our organizational structure to provide additional expertise and enhance profitable revenue growth.

Our Retail Banking efforts are focused on Commercial, Business, and Consumer lines of business while Institutional Banking is focused on Commercial Real Estate, Residential Real Estate, Corporate Banking, and Specialty Banking. Our Atlanta, GA-based Equipment Finance business, which focuses on national, middle-to-large ticket businesses, continued to exceed our

expectations. At the conclusion of its second full year of operations, outstanding Equipment Finance balances totaled $444 million at December 31, 2024.

Looking forward, we will continue to pursue opportunities to further leverage investments in technology that will broaden our

reach, enhance the customer experience, and improve efficiency. We are grateful to our associates for their dedication, our shareholders for their investment in Trustmark and its future, and our customers who have chosen us as their financial

partner. Trustmark is “People you trust. Advice that works.”

Sincerely,

|

|

|

|

|

|

|

|

| Gerard R. Host |

|

Duane A. Dewey |

| Chair |

|

President and |

| Trustmark Corporation |

|

Chief Executive Officer |

|

|

Trustmark Corporation |

In 2024, Trustmark celebrated 135 years of dedicated service to communities and

customers throughout our six-state footprint. The company maintains a culture of corporate social responsibility through active community engagement, which includes volunteerism, philanthropy, and community

development. Trustmark associates volunteered more than 7,170 hours in service to local organizations and charities during the year through financial education, cultural events, and partnerships that provided responsive services and products to

support the advancement of families and communities.

Trustmark’s commitment to strengthen communities was

further demonstrated through the investment of more than $3.2 million in contributions and sponsorships to local organizations within our service areas, including $1.2 million to organizations that serve and stabilize vulnerable children

and families through the MS Children’s Promise Tax Credit Program.

Trustmark’s community contributions

also included an investment in Operation HOPE, Inc., a national non-profit organization, to provide financial literacy support through the HOPE Inside Program within the Memphis, Tennessee; Montgomery,

Alabama; and Jackson, Mississippi markets. This program provides banking customers and members of the public with opportunities to receive financial tools and education to strengthen their financial security from within Trustmark branches. Those

services are led by dedicated financial wellness coaches who conduct financial literacy seminars, individualized financial counseling sessions, and provide referrals to disaster relief services. The services and resources are provided at no cost to

community residents, which includes city employees and first responders. In 2024, more than 4,270 services were provided through Trustmark’s partnership with Operation HOPE, Inc.

Trustmark further prioritized its commitment to financial education in 2024, through its partnership

with EVERFI, Inc., a digital financial education company, enabling more than 6,800

middle and high school students throughout Mississippi to receive instruction on financial matters through Trustmark’s Financial Scholars Program. Trustmark’s partnership with EVERFI, Inc. also provides free online financial education

courses to individuals through the Trustmark Financial Education Tool Kit, accessible at trustmark.com.

Trustmark’s commitment to building and supporting resilient communities also includes revitalizing and strengthening underserved communities. In 2024, Trustmark leveraged its membership with the Federal Home Loan Bank of Dallas

to award more than $1.5 million in grant funds to provide affordable housing support to low-to-moderate income individuals and communities. Additional community

support was provided through responsible product and service delivery within all segments of Trustmark’s communities. Trustmark’s investments in

low-to-moderate income areas included more than $265 million in home mortgage loans, $405 million in small business loans and small farm loans and

$134 million in community development loans. Also in 2024, Trustmark provided low-to-moderate income borrowers with more than $368 million in home mortgage

loans. Trustmark’s collaborative work with community service providers, developers, realtors, housing advocates, and others resulted in more than $45.6 million in investments that support and provide affordable housing, employment, and

community services for those with low-to-moderate incomes.

Trustmark’s 135-year history as a trusted community partner is a

legacy our leaders, strategic partners, and associates build on each day. The company’s commitment to community is reflective of the values our associates live by…Integrity, Service, Accountability, Relationships and Solutions.

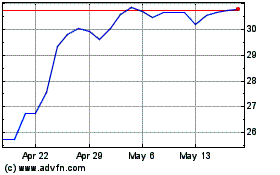

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From Feb 2025 to Mar 2025

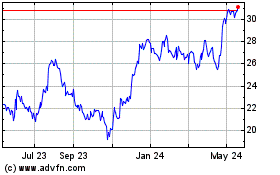

Trustmark (NASDAQ:TRMK)

Historical Stock Chart

From Mar 2024 to Mar 2025