Viper Energy Partners LP (NASDAQ:VNOM) (“Viper” or the “Company”),

a subsidiary of Diamondback Energy, Inc. (NASDAQ:FANG)

(“Diamondback”), today announced financial and operating results

for the fourth quarter and the full year ended December 31,

2021.

FOURTH QUARTER HIGHLIGHTS

- Q4 2021 average production of

18,370 bo/d (31,359 boe/d)

- Q4 2021 consolidated net income

(including non-controlling interest) of $117.0 million; net income

attributable to Viper Energy Partners LP of $39.5 million, or $0.50

per common unit

- Adjusted net income (as defined and

reconciled below) of $84.4 million, or $1.07 per common unit

- Q4 2021 cash distribution of $0.47

per common unit, representing approximately 70% of total cash

available for distribution; $0.47 distribution is up 24% quarter

over quarter and implies a 7.2% annualized yield based on the

February 18, 2022 unit closing price of $26.21

- Q4 2021 cash available for

distribution of $0.67 per common unit represents a Company record;

12% higher than the previous record of $0.60 per common unit

generated in Q2 2018

- Repurchased 574,200 common units in

Q4 2021 for an aggregate of $12.4 million; from the end of the

fourth quarter through January 31, 2022, Viper repurchased an

additional 1,580,200 common units for an aggregate of $39.3

million

- Consolidated adjusted EBITDA (as

defined and reconciled below) of $123.9 million and cash available

for distribution to Viper’s common units (as reconciled below) of

$52.8 million

- Ended the fourth quarter of 2021

with total long-term debt of $783.9 million and net debt of $744.5

million (as defined and reconciled below)

- 179 total gross (5.1 net 100%

royalty interest) horizontal wells turned to production on Viper’s

acreage during Q4 2021 with an average lateral length of 10,048

feet

- As previously announced, completed

acquisition of certain mineral and royalty interests from

Swallowtail Royalties LLC and Swallowtail Royalties II LLC

(“Swallowtail”); added approximately 2,313 net royalty acres

primarily in the Northern Midland Basin, roughly 62% of which are

operated by Diamondback

- In addition to the Swallowtail

acquisition, acquired 350 Diamondback-operated net royalty acres

for an aggregate purchase price of $49.1 million during Q4

2021

- Subsequent to the end of the fourth

quarter of 2021, divested 325 net royalty acres for cash

consideration of $29.3 million, subject to post-close

adjustments; represents third party operated acreage located

entirely in Upton and Reagan counties

FULL YEAR 2021 HIGHLIGHTS

- Full year 2021 average production

of 16,625 bo/d (28,110 boe/d)

- Full year 2021 consolidated net

income (including non-controlling interest) of $256.7 million; net

income attributable to Viper Energy Partners LP of $57.9 million,

or $0.85 per common unit

- Declared distributions of $1.43 per

common unit during full year 2021; generated $2.10 per common unit

of total cash available for distribution

- Repurchased 2,612,840 units during

full year 2021 for an aggregate of $46.0 million, representing an

average price of $17.60 per unit

- Generated full year 2021

consolidated adjusted EBITDA (as defined and reconciled below) of

$373.2 million

- Proved reserves as of December 31,

2021 of 127,888 Mboe (71% PDP, 69,240 Mbo), up 29% year over year

with oil up 20% from year end 2020

- 720 total gross (14.0 net 100%

royalty interest) horizontal wells turned to production during 2021

with an average lateral length of 9,823 feet

- Acquired approximately 2,706 net

royalty acres for an aggregate purchase price of $617.0 million;

increased Diamondback-operated acreage by 1,835 net royalty

acres

- Approximately 60% of distributions

paid in 2021 are reasonably estimated to constitute non-taxable

reductions to the tax basis, and not dividends, for U.S. federal

income tax purposes

2022 OUTLOOK

- Initiating average daily production

guidance for the first half of 2022 of 17,750 to 18,500 bo/d

(29,500 to 30,750 boe/d)

- Initiating full year 2022 average

production guidance of 17,750 to 19,000 bo/d (29,500 to 31,500

boe/d)

- As of February 8, 2022, there were

approximately 618 gross horizontal wells in the process of active

development on Viper’s acreage, in which Viper expects to own an

average 1.7% net royalty interest (10.6 net 100% royalty interest

wells)

- Approximately 563 gross (11.6 net

100% royalty interest) line-of-sight wells that are not currently

in the process of active development, but for which Viper has

visibility to the potential of future development in coming

quarters, based on Diamondback’s current completion schedule and

third party operators’ permits

- Approximately 90% of distributions

paid in 2022 are expected to be reasonably estimated to constitute

non-taxable reductions to the tax basis, and not dividends, for

U.S. federal income tax purposes

“During the fourth quarter, Viper generated

record financial and operating results, highlighted by the $0.67

per common unit of cash available for distribution, exceeding our

previous record by over 10%. Importantly, production outperformed

expectations during the quarter following the closing of the

Swallowtail acquisition as third party operated activity levels

exceeded our conservative acquisition assumptions and Diamondback

continued to focus its activity on Viper’s concentrated royalty

acreage,” stated Travis Stice, Chief Executive Officer of Viper’s

General Partner.

Mr. Stice continued, “Looking ahead to 2022,

Viper is uniquely positioned within the industry to be able to

capture numerous tailwinds and return substantial amounts of cash

back to our unitholders. With zero capital requirements and only

limited operating costs, royalty companies will be advantaged in

2022 as we will not face inflationary cost pressures. For Viper

specifically, as our defensive hedges placed in 2020 rolled off at

the end of 2021, our industry leading cash margins will now be

further enhanced by mostly uncapped exposure to strength in

commodity prices. Lastly, Viper continues to have unmatched, high

confidence visibility into Diamondback’s expected forward plan to

support our production profile, with additional upside from third

party operated production continuing to exceed our conservative

activity and timing assumptions.”

MANAGEMENT CHANGES

Austen Gilfillian, currently Senior Finance

Associate, has been promoted to General Manager of Viper. Mr.

Gilfillian’s additional responsibilities will include both the

Viper land and business development functions reporting to him,

along with his existing responsibilities of finance and investor

relations. Mr. Gilfillian will continue to report to Kaes Van’t

Hof, President of Viper’s General Partner.

FINANCIAL UPDATE

Viper’s fourth quarter 2021 average unhedged

realized prices were $74.00 per barrel of oil, $4.82 per Mcf of

natural gas and $36.65 per barrel of natural gas liquids, resulting

in a total equivalent realized price of $56.82/boe.

During the fourth quarter of 2021, the Company

recorded total operating income of $165.8 million and consolidated

net income (including non-controlling interest) of $117.0

million.

As of December 31, 2021, the Company had a

cash balance of $39.4 million and total long-term debt outstanding

(excluding debt issuance, discounts and premiums) of $783.9

million, resulting in net debt (as defined and reconciled below) of

$744.5 million. Viper’s outstanding long-term debt as of

December 31, 2021 consisted of $479.9 million in aggregate

principal amount of its 5.375% Senior Notes due 2027 and $304.0

million in borrowings on its revolving credit facility, leaving

$196.0 million available for future borrowings and $235.4 million

of total liquidity.

FOURTH QUARTER 2021 CASH DISTRIBUTION

& CAPITAL RETURN PROGRAM

The Board of Directors of Viper’s General

Partner declared a cash distribution for the three months ended

December 31, 2021 of $0.47 per common unit. The distribution is

payable on March 11, 2022 to eligible common unitholders of record

at the close of business on March 4, 2022. This distribution

represents approximately 70% of total cash available for

distribution.

On August 19, 2021 and November 18, 2021, Viper

made cash distributions to its common unitholders and subsequently

has reasonably estimated that a portion of such distributions, as

well as a portion of the distribution payable on March 11, 2022,

should not constitute dividends for U.S. federal income tax

purposes. Rather, approximately 90% of distributions expected to be

paid in 2022 and 60% of distributions paid in 2021 are estimated to

constitute non-taxable reductions to the tax basis of each

distribution recipient’s ownership interest in Viper. The Form 8937

containing additional information may be found on

www.viperenergy.com under the “Investor Relations” section of the

site.

During the fourth quarter of 2021, Viper

repurchased 574,200 common units for an aggregate of

$12.4 million. In total through December 31, 2021, the

Company had repurchased 4,657,840 common units for an aggregate of

$70.0 million, reflecting an average price of $15.01 per

unit.

From the end of the fourth quarter through

January 31, 2022, Viper repurchased an additional 1,580,200 units

for an aggregate of approximately $39.3 million, including a

privately negotiated transaction for 1,500,000 units with an

affiliate of Blackstone, Inc. In total through January 31, 2022,

the Company had repurchased 6,238,040 common units at an average

price of $17.50 per unit, utilizing approximately 72.9% of the

$150.0 million approved by the Board for the repurchase

program.

OPERATIONS AND ACQUISITIONS UPDATE

During the fourth quarter of 2021, Viper

estimates that 179 gross (5.1 net 100% royalty interest) horizontal

wells with an average royalty interest of 2.9% were turned to

production on its acreage position with an average lateral length

of 10,048 feet. Of these 179 gross wells, Diamondback is the

operator of 40 gross wells with an average royalty interest of

9.3%, and the remaining 139 gross wells, with an average royalty

interest of 1.0%, are operated by third parties.

As previously announced, on October 1, 2021,

Viper completed the acquisition of certain mineral and royalty

interests from Swallowtail for approximately 15.25 million of our

common units and approximately $225.3 million in cash. The mineral

and royalty interests acquired in the Swallowtail acquisition

represent approximately 2,313 net royalty acres primarily in the

Northern Midland Basin, of which approximately 62% are operated by

Diamondback.

In addition to the Swallowtail acquisition,

during the fourth quarter of 2021 Viper acquired 350 net royalty

acres for an aggregate of approximately $49.1 million, 100% of

which are operated by Diamondback. These acquisitions were funded

through a combination of cash on hand and borrowings under the

Company’s credit facility.

As a result of the acquisitions completed during

the fourth quarter of 2021, the Company’s footprint of mineral and

royalty interests as of December 31, 2021 was 27,027 net

royalty acres.

Subsequent to the end of the fourth quarter,

Viper completed a divestiture of approximately 325 net royalty

acres for total proceeds of approximately $29.3 million,

subject to post-closing adjustments. The mineral and royalty

interests included in the divestiture represent third party

operated acreage located entirely in Upton and Reagan counties.The

following table summarizes Viper’s gross well information:

|

|

Diamondback Operated |

|

Third Party Operated |

|

Total |

| Horizontal wells

turned to production (fourth quarter

2021)(1): |

|

|

|

|

|

|

Gross wells |

40 |

|

139 |

|

179 |

|

Net 100% royalty interest

wells |

3.7 |

|

1.4 |

|

5.1 |

|

Average percent net royalty

interest |

9.3% |

|

1.0% |

|

2.9% |

| |

|

|

|

|

|

| Horizontal wells

turned to production (year ended December 31,

2021)(2): |

|

|

|

|

|

|

Gross wells |

158 |

|

562 |

|

720 |

|

Net 100% royalty interest

wells |

10.2 |

|

3.8 |

|

14.0 |

|

Average percent net royalty

interest |

6.5% |

|

0.7% |

|

1.9% |

| |

|

|

|

|

|

| Horizontal producing

well count (fourth quarter 2021): |

|

|

|

|

|

|

Gross wells |

1,335 |

|

4,371 |

|

5,706 |

|

Net 100% royalty interest

wells |

101.8 |

|

59.4 |

|

161.2 |

|

Average percent net royalty

interest |

7.6% |

|

1.4% |

|

2.8% |

| |

|

|

|

|

|

| Horizontal active

development well count (as of January 27, 2022): |

|

|

|

|

|

|

Gross wells |

106 |

|

512 |

|

618 |

|

Net 100% royalty interest

wells |

6.8 |

|

3.8 |

|

10.6 |

|

Average percent net royalty

interest |

6.4% |

|

0.7% |

|

1.7% |

| |

|

|

|

|

|

| Line of sight wells

(as of January 27, 2022): |

|

|

|

|

|

|

Gross wells |

135 |

|

428 |

|

563 |

|

Net 100% royalty interest

wells |

7.8 |

|

3.8 |

|

11.6 |

|

Average percent net royalty

interest |

5.8% |

|

0.9% |

|

2.1% |

(1) Average lateral length of 10,048 feet.(2)

Average lateral length of 9,823 feet.

The 618 gross wells currently in the process of

active development are those wells that have been spud and are

expected to be turned to production within approximately the next

six to eight months. Further in regard to the active development on

Viper’s asset base, there are currently 39 gross rigs operating on

Viper’s acreage, six of which are operated by Diamondback. The 563

line-of-sight wells are those that are not currently in the process

of active development, but for which Viper has reason to believe

that they will be turned to production within approximately the

next 15 to 18 months. The expected timing of these line-of-sight

wells is based primarily on permitting by third party operators or

Diamondback’s current expected completion schedule. Existing

permits or active development of Viper’s royalty acreage does not

ensure that those wells will be turned to production.

YEAR END RESERVES UPDATE

Ryder Scott Company, L.P. prepared an estimate

of Viper’s proved reserves as of December 31, 2021. Reference

prices of $66.56 per barrel of oil and natural gas liquids and

$3.59 per MMbtu of natural gas were used in accordance with

applicable rules of the Securities and Exchange Commission.

Realized prices with applicable differentials were $64.87 per

barrel of oil, $2.97 per Mcf of natural gas and $25.93 per barrel

of natural gas liquids.

Proved reserves at year-end 2021 of 127,888 Mboe

(69,240 Mbo) represent a 29% increase over year-end 2020 reserves.

The year-end 2021 proved reserves have a PV-10 value (as defined

and reconciled below) of approximately $2.3 billion and a

standardized measure of discounted future net cash flows of $2.1

billion.

Proved developed reserves increased by 26% year

over year to 91,170 Mboe (49,280 Mbo) as of December 31, 2021,

reflecting continued horizontal development by the operators of

Viper’s acreage.

Net proved reserve additions of 38,756 Mboe

resulted in a reserve replacement ratio of 378% (defined as the sum

of extensions, discoveries, revisions, purchases and divestitures,

divided by annual production). The organic reserve replacement

ratio was 293% (defined as the sum of extensions, discoveries and

revisions, divided by annual production).

Extensions and discoveries of 30,981 Mboe are

primarily attributable to the drilling of 407 new wells and from

336 new proved undeveloped locations added. The Company’s negative

revisions of previous estimated quantities of 918 Mboe were driven

primarily by a reassessment of Diamondback’s expected development

plan following two large acquisitions. There were offsetting

positive revisions due to price increases and improved well

performance. The purchase of reserves in place of 9,102 Mboe was

due to multiple acquisitions of certain mineral and royalty

interests, primarily the Swallowtail acquisition.

| |

Oil (MBbls) |

|

Liquids (MBbls) |

|

Gas (MMcf) |

|

MBOE |

|

As of December 31,

2020 |

57,530 |

|

|

21,953 |

|

|

119,450 |

|

|

99,392 |

|

|

Purchase of reserves in

place |

5,246 |

|

|

2,264 |

|

|

9,549 |

|

|

9,102 |

|

|

Extensions and

discoveries |

17,256 |

|

|

7,182 |

|

|

39,256 |

|

|

30,981 |

|

|

Revisions of previous

estimates |

(4,544 |

) |

|

(1,339 |

) |

|

29,788 |

|

|

(918 |

) |

|

Divestitures |

(180 |

) |

|

(114 |

) |

|

(681 |

) |

|

(409 |

) |

|

Production |

(6,068 |

) |

|

(1,913 |

) |

|

(13,672 |

) |

|

(10,260 |

) |

| As of December 31,

2021 |

69,240 |

|

|

28,033 |

|

|

183,690 |

|

|

127,888 |

|

As the owner of mineral and royalty interests,

Viper incurred no exploration and development costs during the year

ended December 31, 2021.

| |

December 31, |

|

|

|

2021 |

|

|

2020 |

|

|

2019 |

| |

(in thousands) |

| Acquisition costs: |

|

|

|

|

|

|

Proved

properties |

$ |

138,882 |

|

$ |

9,509 |

|

$ |

318,525 |

|

Unproved

properties |

|

479,041 |

|

|

56,169 |

|

|

833,221 |

|

Total |

$ |

617,923 |

|

$ |

65,678 |

|

$ |

1,151,746 |

GUIDANCE UPDATE

Below is Viper’s preliminary guidance for the

full year 2022, as well as average production guidance for the

first half of 2022.

|

|

|

|

|

Viper Energy Partners |

|

|

|

| Q1 2022 / Q2 2022 Net

Production - MBo/d |

17.75 - 18.50 |

| Q1 2022 / Q2 2022 Net

Production - MBoe/d |

29.50 - 30.75 |

| Full Year 2022 Net Production

- MBo/d |

17.75 - 19.00 |

| Full Year 2022 Net Production

- MBoe/d |

29.50 - 31.50 |

| |

|

| Unit costs ($/boe) |

|

| Depletion |

$9.75 - $10.75 |

| Cash G&A |

$0.60 - $0.80 |

| Non-Cash Unit-Based

Compensation |

$0.10 - $0.20 |

| Interest Expense(1) |

$3.25 - $3.75 |

| |

|

| Production and Ad Valorem

Taxes (% of Revenue) (2) |

7% - 8% |

| (1) |

|

Expected

interest for the full year 2022 assuming $480.0 million in

principal of senior notes and $300.0 million drawn on the

revolver. |

| (2) |

|

Includes production taxes of 4.6% for crude oil and 7.5% for

natural gas and natural gas liquids and ad valorem taxes. |

CONFERENCE CALL

Viper will host a conference call and webcast

for investors and analysts to discuss its results for the fourth

quarter of 2021 on Wednesday, February 23, 2022 at 10:00 a.m. CT.

Participants should call (844) 400-1537 (United States/Canada) or

(703) 326-5198 (International) and use the confirmation code

5529768. A telephonic replay will be available from 1:00 p.m. CT on

Wednesday, February 23, 2022 through Wednesday, March 2, 2022 at

1:00 p.m. CT. To access the replay, call (855) 859-2056 (United

States/Canada) or (404) 537-3406 (International) and enter

confirmation code 5529768. A live broadcast of the earnings

conference call will also be available via the internet at

www.viperenergy.com under the “Investor Relations” section of the

site. A replay will also be available on the website following the

call.

About Viper Energy Partners LP

Viper is a limited partnership formed by

Diamondback to own, acquire and exploit oil and natural gas

properties in North America, with a focus on owning and acquiring

mineral and royalty interests in oil-weighted basins, primarily the

Permian Basin. For more information, please visit

www.viperenergy.com.

About Diamondback Energy, Inc.

Diamondback is an independent oil and natural

gas company headquartered in Midland, Texas focused on the

acquisition, development, exploration and exploitation of

unconventional, onshore oil and natural gas reserves primarily in

the Permian Basin in West Texas. For more information, please visit

www.diamondbackenergy.com.

Forward-Looking Statements

This news release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

and Section 21E of the Exchange Act, which involve risks,

uncertainties, and assumptions. All statements, other than

statements of historical fact, including statements regarding

Viper’s: future performance; business strategy; future operations;

estimates and projections of operating income, losses, costs and

expenses, returns, cash flow, and financial position; production

levels on properties in which Viper has mineral and royalty

interests, developmental activity by other operators; reserve

estimates and Viper’s ability to replace or increase reserves;

anticipated benefits of strategic transactions (including

acquisitions and divestitures); and plans and objectives of

(including Diamondback’s plans for developing Viper’s acreage and

Viper’s cash distribution policy and common unit repurchase

program) are forward-looking statements. When used in this news

release, the words “aim,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “future,” “guidance,”

“intend,” “may,” “model,” “outlook,” “plan,” “positioned,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” and similar expressions (including the negative of

such terms) as they relate to Viper are intended to identify

forward-looking statements, although not all forward-looking

statements contain such identifying words. Although Viper believes

that the expectations and assumptions reflected in its

forward-looking statements are reasonable as and when made, they

involve risks and uncertainties that are difficult to predict and,

in many cases, beyond its control. Accordingly, forward-looking

statements are not guarantees of Viper’s future performance and the

actual outcomes could differ materially from what Viper expressed

in its forward-looking statements.

Factors that could cause the outcomes to differ

materially include (but are not limited to) the following: changes

in supply and demand levels for oil, natural gas, and natural gas

liquids, and the resulting impact on the price for those

commodities; the impact of public health crises, including epidemic

or pandemic diseases such as the COVID-19 pandemic, and any related

company or government policies or actions; actions taken by the

members of OPEC and Russia affecting the production and pricing of

oil, as well as other domestic and global political, economic, or

diplomatic developments; regional supply and demand factors,

including delays, curtailment delays or interruptions of production

on Viper’s mineral and royalty acreage, or governmental orders,

rules or regulations that impose production limits on such acreage;

federal and state legislative and regulatory initiatives relating

to hydraulic fracturing, including the effect of existing and

future laws and governmental regulations; and the risks and other

factors disclosed in Viper’s filings with the Securities and

Exchange Commission, including its Forms 10-K, 10-Q and 8-K, which

can be obtained free of charge on the Securities and Exchange

Commission's web site at http://www.sec.gov.

In light of these factors, the events

anticipated by Viper’s forward-looking statements may not occur at

the time anticipated or at all. Moreover, the new risks emerge from

time to time. Viper cannot predict all risks, nor can it assess the

impact of all factors on its business or the extent to which any

factor, or combination of factors, may cause actual results to

differ materially from those anticipated by any forward-looking

statements it may make. Accordingly, you should not place undue

reliance on any forward-looking statements made in this news

release. All forward-looking statements speak only as of the date

of this news release or, if earlier, as of the date they were made.

Viper does not intend to, and disclaim any obligation to, update or

revise any forward-looking statements unless required by applicable

law.

|

Viper Energy Partners LP |

|

Consolidated Balance Sheets |

|

(unaudited, in thousands, except unit

amounts) |

| |

|

|

|

| |

December 31, |

|

December 31, |

| |

2021 |

|

2020 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash

equivalents |

$ |

39,448 |

|

|

$ |

19,121 |

|

|

Royalty income receivable (net of allowance for credit

losses) |

|

68,568 |

|

|

|

32,210 |

|

|

Royalty income receivable—related

party |

|

2,144 |

|

|

|

1,998 |

|

|

Other current

assets |

|

989 |

|

|

|

665 |

|

|

Total current

assets |

|

111,149 |

|

|

|

53,994 |

|

| Property: |

|

|

|

|

Oil and natural gas interests, full cost method of accounting

($1,640,172 and $1,364,906 excluded from depletion at

December 31, 2021 and December 31, 2020,

respectively) |

|

3,513,590 |

|

|

|

2,895,542 |

|

|

Land |

|

5,688 |

|

|

|

5,688 |

|

|

Accumulated depletion and

impairment |

|

(599,163 |

) |

|

|

(496,176 |

) |

|

Property, net |

|

2,920,115 |

|

|

|

2,405,054 |

|

| Other

assets |

|

2,757 |

|

|

|

2,327 |

|

|

Total assets |

$ |

3,034,021 |

|

|

$ |

2,461,375 |

|

|

Liabilities and Unitholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts

payable |

$ |

69 |

|

|

$ |

43 |

|

|

Accrued

liabilities |

|

20,980 |

|

|

|

18,262 |

|

|

Derivative

instruments |

|

3,417 |

|

|

|

26,593 |

|

|

Total current

liabilities |

|

24,466 |

|

|

|

44,898 |

|

| Long-term debt,

net |

|

776,727 |

|

|

|

555,644 |

|

|

Total

liabilities |

|

801,193 |

|

|

|

600,542 |

|

| Commitments and

contingencies |

|

|

|

| Unitholders’ equity: |

|

|

|

|

General

Partner |

|

729 |

|

|

|

809 |

|

|

Common units (78,546,403 units issued and outstanding as of

December 31, 2021 and 65,817,281 units issued and outstanding

as of December 31,

2020) |

|

813,161 |

|

|

|

633,415 |

|

|

Class B units (90,709,946 units issued and outstanding

December 31, 2021 and December 31,

2020) |

|

931 |

|

|

|

1,031 |

|

|

Total Viper Energy Partners LP unitholders’

equity |

|

814,821 |

|

|

|

635,255 |

|

| Non-controlling

interest |

|

1,418,007 |

|

|

|

1,225,578 |

|

|

Total equity |

|

2,232,828 |

|

|

|

1,860,833 |

|

|

Total liabilities and unitholders’

equity |

$ |

3,034,021 |

|

|

$ |

2,461,375 |

|

|

|

|

Viper Energy Partners LP |

|

Consolidated Statements of Operations |

|

(unaudited, in thousands, except per unit

data) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Operating

income: |

|

|

|

|

|

|

|

|

Royalty income |

$ |

163,915 |

|

|

$ |

75,124 |

|

|

$ |

501,534 |

|

|

$ |

246,981 |

|

|

Lease bonus

income |

|

1,731 |

|

|

|

900 |

|

|

|

2,763 |

|

|

|

2,585 |

|

|

Other operating

income |

|

141 |

|

|

|

299 |

|

|

|

620 |

|

|

|

1,060 |

|

|

Total operating

income |

|

165,787 |

|

|

|

76,323 |

|

|

|

504,917 |

|

|

|

250,626 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

Production and ad valorem

taxes |

|

9,132 |

|

|

|

5,538 |

|

|

|

32,558 |

|

|

|

19,844 |

|

|

Depletion |

|

28,757 |

|

|

|

28,297 |

|

|

|

102,987 |

|

|

|

100,501 |

|

|

Impairment |

|

— |

|

|

|

69,202 |

|

|

|

— |

|

|

|

69,202 |

|

|

General and administrative

expenses |

|

1,682 |

|

|

|

2,005 |

|

|

|

7,800 |

|

|

|

8,165 |

|

|

Total costs and

expenses |

|

39,571 |

|

|

|

105,042 |

|

|

|

143,345 |

|

|

|

197,712 |

|

| Income (loss) from

operations |

|

126,216 |

|

|

|

(28,719 |

) |

|

|

361,572 |

|

|

|

52,914 |

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

Interest expense,

net |

|

(9,883 |

) |

|

|

(8,130 |

) |

|

|

(34,044 |

) |

|

|

(33,000 |

) |

|

Gain (loss) on derivative instruments,

net |

|

1,240 |

|

|

|

(16,122 |

) |

|

|

(69,409 |

) |

|

|

(63,591 |

) |

|

Gain (loss) on revaluation of

investment |

|

— |

|

|

|

105 |

|

|

|

— |

|

|

|

(8,556 |

) |

|

Other income,

net |

|

2 |

|

|

|

175 |

|

|

|

79 |

|

|

|

1,286 |

|

|

Total other expense,

net |

|

(8,641 |

) |

|

|

(23,972 |

) |

|

|

(103,374 |

) |

|

|

(103,861 |

) |

| Income (loss) before

income

taxes |

|

117,575 |

|

|

|

(52,691 |

) |

|

|

258,198 |

|

|

|

(50,947 |

) |

| Provision for (benefit from)

income taxes |

|

580 |

|

|

|

— |

|

|

|

1,521 |

|

|

|

142,466 |

|

| Net income

(loss) |

|

116,995 |

|

|

|

(52,691 |

) |

|

|

256,677 |

|

|

|

(193,413 |

) |

| Net income (loss) attributable

to non-controlling

interest |

|

77,530 |

|

|

|

(25,072 |

) |

|

|

198,738 |

|

|

|

(1,109 |

) |

| Net income (loss)

attributable to Viper Energy Partners

LP |

$ |

39,465 |

|

|

$ |

(27,619 |

) |

|

$ |

57,939 |

|

|

$ |

(192,304 |

) |

| |

|

|

|

|

|

|

|

| Net income (loss)

attributable to common limited partner units: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.50 |

|

|

$ |

(0.41 |

) |

|

$ |

0.85 |

|

|

$ |

(2.84 |

) |

|

Diluted |

$ |

0.50 |

|

|

$ |

(0.41 |

) |

|

$ |

0.85 |

|

|

$ |

(2.84 |

) |

| Weighted average

number of common limited partner units outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

78,986 |

|

|

|

67,253 |

|

|

|

68,319 |

|

|

|

67,686 |

|

|

Diluted |

|

79,058 |

|

|

|

67,253 |

|

|

|

68,391 |

|

|

|

67,686 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Viper Energy Partners LP |

|

Consolidated Statements of Cash Flows |

|

(unaudited, in thousands) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

Net income

(loss) |

$ |

116,995 |

|

|

$ |

(52,691 |

) |

|

$ |

256,677 |

|

|

$ |

(193,413 |

) |

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

Deferred income tax expense

(benefit) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

142,466 |

|

|

Depletion |

|

28,757 |

|

|

|

28,297 |

|

|

|

102,987 |

|

|

|

100,501 |

|

|

Impairment |

|

— |

|

|

|

69,202 |

|

|

|

— |

|

|

|

69,202 |

|

|

(Gain) loss on derivative instruments, net |

|

(1,240 |

) |

|

|

16,122 |

|

|

|

69,409 |

|

|

|

63,591 |

|

|

Net cash receipts (payments) on derivatives |

|

(31,397 |

) |

|

|

(18,280 |

) |

|

|

(92,585 |

) |

|

|

(36,998 |

) |

|

(Gain) loss on revaluation of investment |

|

— |

|

|

|

(105 |

) |

|

|

— |

|

|

|

8,556 |

|

|

Other |

|

1,378 |

|

|

|

908 |

|

|

|

4,710 |

|

|

|

3,589 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Royalty income receivable |

|

(21,435 |

) |

|

|

(102 |

) |

|

|

(36,358 |

) |

|

|

25,879 |

|

|

Royalty income receivable—related party |

|

19,878 |

|

|

|

12,913 |

|

|

|

(146 |

) |

|

|

8,578 |

|

|

Other |

|

(5,494 |

) |

|

|

(2,914 |

) |

|

|

2,420 |

|

|

|

4,605 |

|

| Net cash provided by (used in)

operating activities |

|

107,442 |

|

|

|

53,350 |

|

|

|

307,114 |

|

|

|

196,556 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

Acquisitions of oil and natural gas

interests |

|

(274,448 |

) |

|

|

(1,170 |

) |

|

|

(281,176 |

) |

|

|

(65,678 |

) |

|

Proceeds from sale of

assets |

|

— |

|

|

|

36,496 |

|

|

|

— |

|

|

|

38,594 |

|

|

Proceeds from the sale of

investments |

|

— |

|

|

|

5,539 |

|

|

|

— |

|

|

|

10,801 |

|

| Net cash provided by (used in)

investing

activities |

|

(274,448 |

) |

|

|

40,865 |

|

|

|

(281,176 |

) |

|

|

(16,283 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

Proceeds from borrowings under credit

facility |

|

243,000 |

|

|

|

9,000 |

|

|

|

330,000 |

|

|

|

104,000 |

|

|

Repayment on credit

facility |

|

(31,000 |

) |

|

|

(51,500 |

) |

|

|

(110,000 |

) |

|

|

(116,500 |

) |

|

Repayment of senior

notes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(19,697 |

) |

|

Debt issuance

costs |

|

(17 |

) |

|

|

(21 |

) |

|

|

(2,885 |

) |

|

|

(111 |

) |

|

Repurchased units as part of unit

buyback |

|

(12,437 |

) |

|

|

(24,026 |

) |

|

|

(45,999 |

) |

|

|

(24,026 |

) |

|

Distributions to public

|

|

(29,840 |

) |

|

|

(6,731 |

) |

|

|

(75,942 |

) |

|

|

(45,674 |

) |

|

Distributions to Diamondback

|

|

(34,772 |

) |

|

|

(9,170 |

) |

|

|

(100,685 |

) |

|

|

(62,282 |

) |

|

Other |

|

(20 |

) |

|

|

(20 |

) |

|

|

(100 |

) |

|

|

(464 |

) |

| Net cash provided by (used in)

financing

activities |

|

134,914 |

|

|

|

(82,468 |

) |

|

|

(5,611 |

) |

|

|

(164,754 |

) |

| Net increase (decrease) in

cash and cash

equivalents |

|

(32,092 |

) |

|

|

11,747 |

|

|

|

20,327 |

|

|

|

15,519 |

|

| Cash, cash equivalents and

restricted cash at beginning of

period |

|

71,540 |

|

|

|

7,374 |

|

|

|

19,121 |

|

|

|

3,602 |

|

| Cash, cash equivalents and

restricted cash at end of

period |

$ |

39,448 |

|

|

$ |

19,121 |

|

|

$ |

39,448 |

|

|

$ |

19,121 |

|

| |

|

|

|

|

|

|

|

|

Viper Energy Partners LP |

|

Selected Operating Data |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

2021 |

|

2020 |

|

2021 |

|

2020 |

| Production

Data: |

|

|

|

|

|

|

|

|

Oil (MBbls) |

|

1,690 |

|

|

1,597 |

|

|

6,068 |

|

|

5,956 |

|

Natural gas

(MMcf) |

|

3,844 |

|

|

3,032 |

|

|

13,672 |

|

|

11,486 |

|

Natural gas liquids

(MBbls) |

|

554 |

|

|

446 |

|

|

1,913 |

|

|

1,848 |

|

Combined volumes

(MBOE)(1) |

|

2,885 |

|

|

2,549 |

|

|

10,260 |

|

|

9,718 |

| |

|

|

|

|

|

|

|

|

Average daily oil volumes

(BO/d) |

|

18,370 |

|

|

17,359 |

|

|

16,625 |

|

|

16,272 |

|

Average daily combined volumes

(BOE/d) |

|

31,359 |

|

|

27,699 |

|

|

28,110 |

|

|

26,551 |

| |

|

|

|

|

|

|

|

| Average sales

prices: |

|

|

|

|

|

|

|

|

Oil ($/Bbl) |

$ |

74.00 |

|

$ |

40.36 |

|

$ |

65.51 |

|

$ |

36.58 |

|

Natural gas

($/Mcf) |

$ |

4.82 |

|

$ |

1.36 |

|

$ |

3.60 |

|

$ |

0.79 |

|

Natural gas liquids

($/Bbl) |

$ |

36.65 |

|

$ |

14.71 |

|

$ |

28.66 |

|

$ |

10.88 |

|

Combined

($/BOE)(2) |

$ |

56.82 |

|

$ |

29.48 |

|

$ |

48.88 |

|

$ |

25.41 |

| |

|

|

|

|

|

|

|

|

Oil, hedged

($/Bbl)(3) |

$ |

55.42 |

|

$ |

30.48 |

|

$ |

50.25 |

|

$ |

32.00 |

|

Natural gas, hedged

($/Mcf)(3) |

$ |

4.82 |

|

$ |

0.84 |

|

$ |

3.60 |

|

$ |

0.02 |

|

Natural gas liquids

($/Bbl)(3) |

$ |

36.65 |

|

$ |

14.71 |

|

$ |

28.66 |

|

$ |

10.88 |

|

Combined price, hedged

($/BOE)(3) |

$ |

45.94 |

|

$ |

22.68 |

|

$ |

39.86 |

|

$ |

21.71 |

| |

|

|

|

|

|

|

|

| Average Costs

($/BOE): |

|

|

|

|

|

|

|

|

Production and ad valorem

taxes |

$ |

3.17 |

|

$ |

2.17 |

|

$ |

3.17 |

|

$ |

2.04 |

|

General and administrative - cash

component(4) |

|

0.48 |

|

|

0.66 |

|

|

0.65 |

|

|

0.71 |

|

Total operating expense -

cash |

$ |

3.65 |

|

$ |

2.83 |

|

$ |

3.82 |

|

$ |

2.75 |

| |

|

|

|

|

|

|

|

|

General and administrative - non-cash unit compensation

expense |

$ |

0.10 |

|

$ |

0.13 |

|

$ |

0.11 |

|

$ |

0.13 |

|

Interest expense,

net |

$ |

3.43 |

|

$ |

3.19 |

|

$ |

3.32 |

|

$ |

3.40 |

|

Depletion |

$ |

9.97 |

|

$ |

11.10 |

|

$ |

10.04 |

|

$ |

10.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

|

Bbl

equivalents are calculated using a conversion rate of six Mcf per

one Bbl. |

| (2) |

|

Realized price net of all deducts for gathering, transportation

and processing. |

| (3) |

|

Hedged prices reflect the impact of cash settlements of our

matured commodity derivative transactions on our average sales

prices. |

| (4) |

|

Excludes non-cash unit-based compensation expense for the

respective periods presented. |

NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA is a supplemental non-GAAP

financial measure that is used by management and external users of

our financial statements, such as industry analysts, investors,

lenders and rating agencies. Viper defines Adjusted EBITDA as net

income (loss) attributable to Viper Energy Partners LP plus net

income (loss) attributable to non-controlling interest (“net income

(loss)”) before interest expense, net, non-cash unit-based

compensation expense, depletion expense, impairment expense,

non-cash (gain) loss on derivative instruments, (gain) loss on

extinguishment of debt and provision for (benefit from) income

taxes, if any. Adjusted EBITDA is not a measure of net income as

determined by United States’ generally accepted accounting

principles (“GAAP”). Management believes Adjusted EBITDA is useful

because it allows them to more effectively evaluate Viper’s

operating performance and compare the results of its operations

from period to period without regard to its financing methods or

capital structure. Adjusted EBITDA should not be considered as an

alternative to, or more meaningful than, net income, royalty

income, cash flow from operating activities or any other measure of

financial performance or liquidity presented as determined in

accordance with GAAP. Certain items excluded from Adjusted EBITDA

are significant components in understanding and assessing a

company’s financial performance, such as a company’s cost of

capital and tax structure, as well as the historic costs of

depreciable assets, none of which are components of Adjusted

EBITDA.

Viper defines cash available for distribution

generally as an amount equal to its Adjusted EBITDA for the

applicable quarter less cash needed for income taxes payable, debt

service, contractual obligations, fixed charges and reserves for

future operating or capital needs that the board of directors of

Viper’s general partner may deem appropriate, cash paid for tax

withholding on vested common units, distribution equivalent rights

and preferred distributions, if any. Management believes cash

available for distribution is useful because it allows them to more

effectively evaluate Viper’s operating performance excluding the

impact of non-cash financial items and short-term changes in

working capital. Viper’s computations of Adjusted EBITDA and cash

available for distribution may not be comparable to other similarly

titled measures of other companies or to such measure in its credit

facility or any of its other contracts.

The following tables present a reconciliation of

the GAAP financial measure of net income (loss) to the non-GAAP

financial measures of Adjusted EBITDA and cash available for

distribution:

|

Viper Energy Partners LP |

|

(unaudited, in thousands, except per unit

data) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

December 31, 2021 |

|

September 30, 2021 |

|

June 30, 2021 |

|

March 31, 2021 |

|

Net income (loss) attributable to Viper Energy Partners

LP |

$ |

39,465 |

|

|

$ |

16,832 |

|

|

$ |

4,662 |

|

|

$ |

(3,020 |

) |

|

Net income (loss) attributable to non-controlling

interest |

|

77,530 |

|

|

|

56,613 |

|

|

|

37,716 |

|

|

|

26,879 |

|

| Net income

(loss) |

|

116,995 |

|

|

|

73,445 |

|

|

|

42,378 |

|

|

|

23,859 |

|

|

Interest expense,

net |

|

9,883 |

|

|

|

8,328 |

|

|

|

7,973 |

|

|

|

7,860 |

|

|

Non-cash unit-based compensation

expense |

|

276 |

|

|

|

243 |

|

|

|

338 |

|

|

|

315 |

|

|

Depletion |

|

28,757 |

|

|

|

25,366 |

|

|

|

23,978 |

|

|

|

24,886 |

|

|

Non-cash (gain) loss on derivative

instruments |

|

(32,637 |

) |

|

|

(15,707 |

) |

|

|

8,606 |

|

|

|

16,562 |

|

|

Provision for (benefit from) income

taxes |

|

580 |

|

|

|

906 |

|

|

|

— |

|

|

|

35 |

|

| Consolidated Adjusted

EBITDA |

|

123,854 |

|

|

|

92,581 |

|

|

|

83,273 |

|

|

|

73,517 |

|

|

Less: Adjusted EBITDA attributable to non- controlling

interest(1) |

|

66,242 |

|

|

|

54,269 |

|

|

|

48,637 |

|

|

|

42,779 |

|

| Adjusted EBITDA

attributable to Viper Energy Partners

LP |

$ |

57,612 |

|

|

$ |

38,312 |

|

|

$ |

34,636 |

|

|

$ |

30,738 |

|

| |

|

|

|

|

|

|

|

| Adjustments to

reconcile Adjusted EBITDA to cash available for

distribution: |

|

|

|

|

|

|

|

|

Income taxes

payable |

$ |

(580 |

) |

|

$ |

(906 |

) |

|

$ |

— |

|

|

$ |

(35 |

) |

|

Debt service, contractual obligations, fixed charges and

reserves |

|

(4,094 |

) |

|

|

(2,996 |

) |

|

|

(4,187 |

) |

|

|

(3,047 |

) |

|

Cash paid for tax withholding on vested common

units |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(20 |

) |

|

Distribution equivalent rights

payments |

|

(52 |

) |

|

|

(62 |

) |

|

|

(55 |

) |

|

|

(24 |

) |

|

Preferred

distributions |

|

(45 |

) |

|

|

(45 |

) |

|

|

(45 |

) |

|

|

(45 |

) |

| Cash available for

distribution to Viper Energy Partners LP

unitholders |

$ |

52,841 |

|

|

$ |

34,303 |

|

|

$ |

30,349 |

|

|

$ |

27,567 |

|

| |

|

|

|

|

|

|

|

| Common limited partner units

outstanding |

|

78,546 |

|

|

|

63,831 |

|

|

|

64,546 |

|

|

|

64,950 |

|

| |

|

|

|

|

|

|

|

| Cash available for

distribution per limited partner

unit |

$ |

0.67 |

|

|

$ |

0.54 |

|

|

$ |

0.47 |

|

|

$ |

0.42 |

|

| Cash per unit approved for

distribution |

$ |

0.47 |

|

|

$ |

0.38 |

|

|

$ |

0.33 |

|

|

$ |

0.25 |

|

| (1) |

|

Does not take

into account special income allocation consideration. |

Adjusted net income (loss) is a non-GAAP

financial measure equal to net income (loss) attributable to Viper

Energy Partners, LP plus net income (loss) attributable to

non-controlling interest adjusted for impairment expense, non-cash

(gain) loss on derivative instruments, (gain) loss on

extinguishment of debt and related income tax adjustments, if any.

The Company’s computation of adjusted net income may not be

comparable to other similarly titled measures of other companies or

to such measure in our credit facility or any of our other

contracts. Management believes Adjusted Net Income helps investors

in the oil and natural gas industry to measure and compare the

Company’s performance to other oil and natural gas companies by

excluding from the calculation items that can vary significantly

from company to company depending upon accounting methods, the book

value of assets and other non-operational factors.

The following table presents a reconciliation of net income

(loss) attributable to Viper Energy Partners LP to adjusted net

income (loss):

|

Viper Energy Partners LP |

|

Adjusted Net Income (Loss) |

|

(unaudited, in thousands, except per unit

data) |

| |

|

| |

Three Months Ended December 31, 2021 |

| |

Amounts |

|

Amounts Per Diluted Unit |

|

Net income (loss) attributable to Viper Energy Partners

LP |

$ |

39,465 |

|

|

$ |

0.50 |

|

|

Net income (loss) attributable to non-controlling

interest |

|

77,530 |

|

|

|

0.98 |

|

| Net income

(loss)

|

|

116,995 |

|

|

|

1.48 |

|

|

Non-cash (gain) loss on derivative instruments,

net |

|

(32,637 |

) |

|

|

(0.41 |

) |

| Adjusted net income

(loss) |

|

84,358 |

|

|

|

1.07 |

|

|

Less: Adjusted net income (loss) attributed to non-controlling

interests |

|

55,627 |

|

|

|

0.71 |

|

| Adjusted net income

(loss) attributable to Viper Energy Partners

LP |

$ |

28,731 |

|

|

$ |

0.36 |

|

| |

|

|

|

| Weighted average

common units outstanding: |

|

|

|

|

Basic |

|

78,986 |

|

|

Diluted |

|

79,058 |

|

RECONCILIATION OF LONG-TERM DEBT TO NET

DEBT

The Company defines net debt as debt (excluding

debt issuance costs, discounts and premiums) less cash equivalents.

Net debt should not be considered an alternative to, or more

meaningful than, total debt, the most directly comparable GAAP

measure. Management uses net debt to determine the Company's

outstanding debt obligations that would not be readily satisfied by

its cash and cash equivalents on hand. The Company believes this

metric is useful to analysts and investors in determining the

Company's leverage position because the Company has the ability to,

and may decide to, use a portion of its cash and cash equivalents

to reduce debt.

| |

December 31, 2021 |

|

Net Q4 Principal Borrowings/(Repayments) |

|

September 30, 2021 |

|

June 30, 2021 |

|

March 31, 2021 |

|

December 31, 2020 |

| |

(in thousands) |

|

Total long-term

debt(1) |

$ |

783,938 |

|

|

$ |

212,000 |

|

$ |

571,938 |

|

|

$ |

541,938 |

|

|

$ |

536,938 |

|

|

$ |

563,938 |

|

| Cash and cash

equivalents |

|

(39,448 |

) |

|

|

|

|

(41,515 |

) |

|

|

(42,422 |

) |

|

|

(11,727 |

) |

|

|

(19,121 |

) |

| Net

debt |

$ |

744,490 |

|

|

|

|

$ |

530,423 |

|

|

$ |

499,516 |

|

|

$ |

525,211 |

|

|

$ |

544,817 |

|

(1) Excludes debt issuance costs, discounts

& premiums.

PV-10

PV-10 is the Company’s estimate of the present

value of the future net revenues from proved oil and natural gas

reserves after deducting estimated production and ad valorem taxes,

future capital costs and operating expenses, but before deducting

any estimates of future income taxes. The estimated future net

revenues are discounted at an annual rate of 10% to determine their

“present value.” The Company believes PV-10 to be an important

measure for evaluating the relative significance of its oil and

natural gas properties and that the presentation of the non-GAAP

financial measure of PV-10 provides useful information to investors

because it is widely used by professional analysts and investors in

evaluating oil and natural gas companies. Because there are many

unique factors that can impact an individual company when

estimating the amount of future income taxes to be paid, the

Company believes the use of a pre-tax measure is valuable for

evaluating the Company. The Company believes that PV-10 is a

financial measure routinely used and calculated similarly by other

companies in the oil and natural gas industry.

The following table reconciles PV-10 to the

Company’s standardized measure of discounted future net cash flows,

the most directly comparable measure calculated and presented in

accordance with GAAP. PV-10 should not be considered as an

alternative to the standardized measure as computed under GAAP.

| (in

thousands) |

December 31, 2021 |

|

Standardized measure of discounted future net cash flows after

taxes |

$ |

2,093,117 |

| Add: Present value of future

income tax discounted at

10% |

|

254,053 |

|

PV-10 |

$ |

2,347,170 |

Derivatives

As of the filing date, the Company had the

following outstanding derivative contracts. The Company’s

derivative contracts are based upon reported settlement prices on

commodity exchanges, with crude oil derivative settlements based on

New York Mercantile Exchange West Texas Intermediate pricing and

Crude Oil Brent. When aggregating multiple contracts, the weighted

average contract price is disclosed.

| |

Crude Oil (Bbls/day, $/Bbl) |

| |

Q1 2022 |

|

Q2 2022 |

|

Q3 2022 |

|

Q4 2022 |

|

Collars - WTI (Cushing) |

|

2,500 |

|

|

|

2,000 |

|

|

|

4,000 |

|

|

|

— |

|

Floor Price |

$ |

45.00 |

|

|

$ |

45.00 |

|

|

$ |

45.00 |

|

|

$ |

— |

|

Ceiling Price |

$ |

79.55 |

|

|

$ |

80.15 |

|

|

$ |

92.65 |

|

|

$ |

— |

|

Deferred Premium Puts - WTI (Cushing) |

|

9,500 |

|

|

|

10,000 |

|

|

|

8,000 |

|

|

|

— |

|

Strike |

$ |

47.51 |

|

|

$ |

47.50 |

|

|

$ |

47.50 |

|

|

$ |

— |

|

Premium |

$ |

(1.57 |

) |

|

$ |

(1.49 |

) |

|

$ |

(1.52 |

) |

|

$ |

— |

| |

Natural Gas (Mmbtu/day, $/Mmbtu) |

| |

Q1 2022 |

|

Q2 2022 |

|

Q3 2022 |

|

Q4 2022 |

|

Costless Collars - Henry Hub |

|

20,000 |

|

|

20,000 |

|

|

20,000 |

|

|

20,000 |

|

Floor Price |

$ |

2.50 |

|

$ |

2.50 |

|

$ |

2.50 |

|

$ |

2.50 |

|

Ceiling Price |

$ |

4.62 |

|

$ |

4.62 |

|

$ |

4.62 |

|

$ |

4.62 |

| |

Natural Gas (Mmbtu/day, $/Mmbtu) |

| |

Q1 2023 |

|

Q2 2023 |

|

Q3 2023 |

|

Q4 2023 |

|

Natural Gas Basis Swaps - Waha Hub |

|

10,000 |

|

|

|

10,000 |

|

|

|

10,000 |

|

|

|

10,000 |

|

|

Swap Price |

$ |

(1.02 |

) |

|

$ |

(1.02 |

) |

|

$ |

(1.02 |

) |

|

$ |

(1.02 |

) |

Investor Contact:

Austen Gilfillian+1

432.221.7420agilfillian@viperenergy.com

Source: Viper Energy Partners LP; Diamondback Energy, Inc.

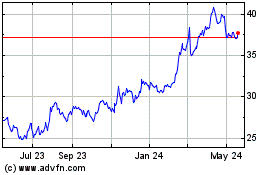

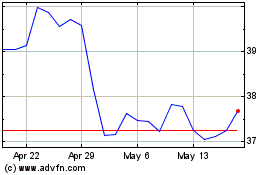

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Nov 2023 to Nov 2024