Diamondback Stockholders,

This letter is meant to be a supplement to our

earnings release and is being furnished to the Securities and

Exchange Commission (SEC) and released to our stockholders

simultaneously with our earnings release. Please see the

information regarding forward-looking statements and non-GAAP

financial information included at the end of this letter.

Endeavor Closing: Diamondback

closed the Endeavor transaction on September 10th, which began the

next chapter of the Company’s short history. In just under two

months, the Diamondback and Endeavor teams have worked quickly

towards a seamless integration. We onboarded more than 1,000

employees, moved over 650 combined offices and began working as one

functional organization in the first week post-close.

The teams have already begun sharing best

practices, which we witnessed in our first pro forma quarterly

operations reviews a few weeks ago. At a high level, we have

essentially merged two teams of basin experts. While we were once

competitors, we can now share best practices and learnings from

years of drilling and completing wells in the Midland Basin with

what we believe is more combined data and basin experience than any

competitor. This is a synergy that could not be modeled in our

spreadsheet when the deal was announced, but I am confident this

will accrue to the benefit of our stockholders in short order.

We are ahead of schedule in delivering the

operational synergies we promised in conjunction with the merger.

Our drilling and completions teams have already implemented the two

most significant operational synergies: clear fluids for drilling

and SimulFrac for completions. All our development in the fourth

quarter will be executed with SimulFrac completions crews, with

spot crews to be used for single-well tests like the Barnett Shale

in the Midland Basin. On the drilling side, as of today, all of our

rigs are operating with clear fluid drilling systems, and we have

already seen wells on legacy Endeavor acreage drilled below

post-synergy-expected cost per lateral foot.

At time of deal announcement, we promised to drill

and complete wells for $625 per lateral foot in 2025 on Endeavor's

acreage. I can say that today, in real time and two months

post-announcement, we are averaging $600 per lateral foot across

the combined Company - above expectations and ahead of

schedule.

We are also actively learning from the Endeavor

teams. On the execution front, we are optimistic about application

and integration of some early learnings around the post-completion,

drill-out process and believe there to be significant best

practices to be shared across the combined production operations

groups. We are also closely studying the various completion designs

from the two companies and are confident the combination of the

best completion design with the lowest cost execution will be a

winning formula.

As a result, I could not be more excited about the

early progress from integration and remain confident in the team’s

ability to meet or exceed the synergies promised at deal

announcement.

TRP Energy (“TRP”) Asset Trade:Our

new combined acreage footprint has given us the flexibility to look

at different opportunities across the Permian Basin. This is

exemplified by a trade we just executed, where we signed an

exchange agreement with TRP that allows us to play offense in our

backyard by swapping a PDP-heavy asset in the Delaware Basin for a

Midland Basin asset with more near-term development potential. In

exchange for our Vermejo asset and ~$238 million in cash, we will

receive TRP’s Midland Basin asset, which consists of approximately

15,000 net acres located in Upton and Reagan counties. The asset we

will acquire in this trade has 55 remaining undeveloped operated

locations, the majority of which compete for capital right away.

The trade is expected to be accretive to our 2025 Cash Flow and

Free Cash Flow per share and will high grade our inventory. We

expect this trade to close by year-end, subject to customary

regulatory approvals and closing conditions.

We will also continue to look for ways to improve

our asset base, whether it be through traditional trades to be able

to drill longer laterals and increase operated working interests or

“out of the box” ideas such as TRP.

Third Quarter Operational

Performance:I am proud of our team’s ability to execute

regardless of the circumstances and the third quarter was no

exception. Our team put operations first even as many moved

offices, integrated new team members and began to understand a

large new asset. We are currently running 20 drilling rigs and

expect to be down to 18 operated rigs by year-end. What we

originally expected to drill with 22 - 24 rigs in 2025, we now

expect we can drill with closer to 18 rigs. This is purely based on

continued efficiency gains, a testament to the prowess of our

drilling organization.

On the completions side of the business, we are

currently running four SimulFrac crews, three of which are

electric. We continue to exceed our original key performance

indicators for 2024. We are completing on average nearly 4,000

lateral feet per day per crew, 30% more than we originally planned

heading into the year. This increase is driven by higher pumping

hours per day, higher average pump rates, lower swap times per

stage and faster move times between pads.

Production:For the quarter,

Diamondback produced 321.1 MBO/d (571.1 MBOE/d), above the high end

of the guidance range of 319 - 321 MBO/d (565 - 569 MBOE/d) that we

released in October. As a reminder, this third quarter production

incorporates twenty-one days of legacy Endeavor production. Well

performance continues to meet or exceed expectations in our core

Midland Basin position, setting us up well to continue to execute

and achieve additional capital efficiency gains.

For the fourth quarter of 2024, we expect to

produce 470 - 475 MBO/d (840 - 850 MBOE/d). This includes a minor

contribution from Viper’s closed acquisition of Tumbleweed. It also

shows we expect to hit pro forma production expectations sooner

than originally expected.

Capital Expenditures:In the

third quarter, we spent $688 million on capital expenditures, which

is in the middle of our updated guidance range of $675 - $700

million. For the fourth quarter, we expect to spend $950 - $1,050

million of capex.

The macro environment for oil prices and near-term

global oil supply and demand dynamics remains volatile at best and

tenuous at worst. Diamondback’s base case 2025 plan is still what

was laid out with the Endeavor merger announcement in February

(“generate oil production of 470 - 480 MBO/d (800 - 825 MBOE/d)

with a capital budget of approximately $4.1 - $4.4 billion”), with

oil production expected to increase by approximately 5 MBO/d due to

contribution from the Viper Tumbleweed acquisition.

On the other hand, we are actively working all our

options for 2025, including continuing to refine this base case

plan. Should oil prices weaken from current levels, we will make

the correct capital allocation decision and focus on Free Cash Flow

generation and capital efficiency over oil volumes. Our size,

scale, cost structure and inventory quality position us well for

whatever direction the macro decides to take. Our return of capital

program, combined with a strong balance sheet, allows us to

increase stockholder returns when volatility increases.

Operating Costs:Total cash

operating costs decreased slightly quarter over quarter to $11.49

per BOE. Lease operating expense (“LOE”) in the third quarter was

$6.01 per BOE, within our annual guidance range of $5.90 -

$6.40 per BOE. Cash G&A was $0.63 within our annual guidance

range of $0.55 - $0.65 per BOE. We have announced a preliminary

look at run rate pro forma operating expenses and expect to

solidify these numbers when we update the market for 2025 unit cost

guidance. DD&A increased quarter over quarter to $14.12 as a

result of the Endeavor assets being added to our balance sheet.

Financial Performance and Return of

Capital:Diamondback generated $1.2 billion of net cash

provided by operating activities and operating cash flow before

working capital changes of $1.4 billion. Adjusted Free Cash Flow

was $1.0 billion. Unique to this quarter, we adjusted Free Cash

Flow upwards to account for two one-time items: $258 million of

merger and integration expense and $37 million of costs associated

with unwinding a portion of our outstanding swap to floating

interest rate hedges.

We will return ~78% of that Adjusted Free Cash Flow

to stockholders through our base dividend and share repurchases.

Our willingness to go above our base 50% return threshold was

driven by our opportunistic share repurchase program, as we bought

back ~$515 million worth of common stock at an average price of

$176.40 / share in the third quarter. This includes 2 million

shares repurchased for ~$350 million at a price of $175.11 per

share in conjunction with the September secondary offering, where

legacy Endeavor stockholders sold approximately 14.4 million

shares. Diamondback’s participation in the offering is consistent

with our opportunistic repurchase methodology, leaning into our

repurchase program when we view our stock to be attractively valued

at mid-cycle oil pricing.

We have continued to be active repurchasing shares

in the fourth quarter, and quarter to date have bought back over

$185 million worth of shares at an average share price of

approximately $180.13.

As previously announced, our Board recently

increased our share repurchase authorization to $6.0 billion from

$4.0 billion previously. This gives us the flexibility to allocate

capital appropriately and buy back shares in times of market

stress.

Balance Sheet:At quarter-end, we

had approximately $13.1 billion of gross debt and $12.7 billion of

net debt. We ended the quarter with $2.6 billion of liquidity at

Diamondback, as we increased our borrowing base and elected

commitments on our revolving credit facility to $2.5 billion from

$1.6 billion previously.

In September, we also received upgrades from two of

the three rating agencies, as S&P upgraded us to BBB from BBB-

and Fitch moved us to BBB+ from BBB. Moody’s remained at Baa2.

As we have stated previously, our near-term goal is

to lower consolidated net debt below $10 billion, which we expect

to achieve through Free Cash Flow generation and proceeds from

non-core asset sales. Our long-term priority is to maintain a

leverage ratio of approximately 0.5x at mid-cycle oil pricing, or

approximately $6 to $8 billion of net debt. We feel we can achieve

this goal within the next couple of years solely by dedicating 50%

of Free Cash Flow to debt paydown, while reserving the ability to

flex up stockholder returns through opportunistic stock repurchases

at times of excessive market volatility or one-time events such as

secondary equity sell-downs.

Other Business:We continue to

use our equity method investments as valuable tools to improve our

core operating business while also generating impressive returns,

adding significant cash to our balance sheet. As we previously

announced in July, Energy Transfer LP completed its acquisition of

WTG Midstream Holdings LLC (“WTG”). Additionally, during the third

quarter we completed the sale of our 4% interest in the Wink to

Webster Pipeline.

With the sales of WTG and Wink to Webster complete,

we now have three equity method investments remaining in our

portfolio: the EPIC crude pipeline (“EPIC”), the BANGL Y-grade NGL

pipeline and the Deep Blue sustainable water management company. We

recently increased our ownership in EPIC from 10.0% to 27.5% and

are excited about the growth potential of this long-haul crude pipe

as well as our other investments. As such, we do not feel now is

the right time to monetize these assets.

We continue to believe we can add significant value

to our minerals company Viper (NASDAQ: VNOM) and Deep Blue through

the potential drop down of Endeavor overrides and minerals to Viper

and the sale of Endeavor’s extensive water infrastructure to Deep

Blue, potentially accelerating our de-leveraging efforts in early

2025.

We are also excited about what we see as the next

wave of equity method investments for Diamondback: power generation

and potentially data center development. By leveraging our 65,000

surface acres in West Texas, cheap natural gas and abundant supply

of produced water, we believe we can be a premier partner in this

new wave of development. By generating our own in-basin power, we

can solve two long-term issues that have plagued the Permian Basin:

the need for natural gas egress and cheap, reliable electricity. We

look forward to updating our stockholders on our progress on these

initiatives in the coming quarters.

Closing:2024 has been a

transformative year for Diamondback. We are intensely focused on

delivering on the promises we made to the market around synergies

and believe, eight weeks in, we have a significant head start

relative to original expectations.

Thank you for your ongoing support and interest

in Diamondback Energy.

Travis D. SticeChairman of the Board and Chief

Executive Officer

Investor Contact:Adam Lawlis+1

432.221.7467alawlis@diamondbackenergy.com

Forward-Looking Statements:

This letter contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Exchange Act of 1934,

as amended, which involve risks, uncertainties, and assumptions.

All statements, other than statements of historical fact, including

statements regarding future performance; business strategy; future

operations (including drilling plans and capital plans); estimates

and projections of revenues, losses, costs, expenses, returns, cash

flow, and financial position; reserve estimates and its ability to

replace or increase reserves; anticipated benefits or other effects

of strategic transactions (including the recently completed

Endeavor merger and other acquisitions or divestitures); the

expected amount and timing of synergies from the Endeavor merger;

and plans and objectives of management (including plans for future

cash flow from operations and for executing environmental

strategies) are forward-looking statements. When used in this

letter, the words “aim,” “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “forecast,” “future,” “guidance,”

“intend,” “may,” “model,” “outlook,” “plan,” “positioned,”

“potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” and similar expressions (including the negative of

such terms) are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. Although Diamondback believes that the

expectations and assumptions reflected in its forward-looking

statements are reasonable as and when made, they involve risks and

uncertainties that are difficult to predict and, in many cases,

beyond Diamondback’s control. Accordingly, forward-looking

statements are not guarantees of future performance and actual

outcomes could differ materially from what Diamondback has

expressed in its forward-looking statements.

Factors that could cause the outcomes to differ

materially include (but are not limited to) the following: changes

in supply and demand levels for oil, natural gas, and natural gas

liquids, and the resulting impact on the price for those

commodities; the impact of public health crises, including epidemic

or pandemic diseases and any related company or government policies

or actions; actions taken by the members of OPEC and Russia

affecting the production and pricing of oil, as well as other

domestic and global political, economic, or diplomatic

developments, including any impact of the ongoing war in Ukraine

and the Israel-Hamas war on the global energy markets and

geopolitical stability; instability in the financial markets;

concerns over a potential economic slowdown or recession;

inflationary pressures; higher interest rates and their impact on

the cost of capital; regional supply and demand factors, including

delays, curtailment delays or interruptions of production, or

governmental orders, rules or regulations that impose production

limits; federal and state legislative and regulatory initiatives

relating to hydraulic fracturing, including the effect of existing

and future laws and governmental regulations; physical and

transition risks relating to climate change; those risks described

in Item 1A of Diamondback’s Annual Report on Form 10-K, filed with

the SEC on February 22, 2024, and those risks disclosed in its

subsequent filings on Forms 10-Q and 8-K, which can be obtained

free of charge on the SEC’s website at http://www.sec.gov and

Diamondback’s website at www.diamondbackenergy.com/investors.

In light of these factors, the events

anticipated by Diamondback’s forward-looking statements may not

occur at the time anticipated or at all. Moreover, Diamondback

operates in a very competitive and rapidly changing environment and

new risks emerge from time to time. Diamondback cannot predict all

risks, nor can it assess the impact of all factors on its business

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those anticipated by

any forward-looking statements it may make. Accordingly, you should

not place undue reliance on any forward-looking statements. All

forward-looking statements speak only as of the date of this letter

or, if earlier, as of the date they were made. Diamondback does not

intend to, and disclaims any obligation to, update or revise any

forward-looking statements unless required by applicable law.

Non-GAAP Financial Measures

This letter includes financial information not

prepared in conformity with generally accepted accounting

principles (GAAP), including free cash flow. The non-GAAP

information should be considered by the reader in addition to, but

not instead of, financial information prepared in accordance with

GAAP. A reconciliation of the differences between these non-GAAP

financial measures and the most directly comparable GAAP financial

measures can be found in Diamondback's quarterly results posted on

Diamondback's website at www.diamondbackenergy.com/investors/.

Furthermore, this letter includes or references certain

forward-looking, non-GAAP financial measures. Because Diamondback

provides these measures on a forward-looking basis, it cannot

reliably or reasonably predict certain of the necessary components

of the most directly comparable forward-looking GAAP financial

measures, such as future impairments and future changes in working

capital. Accordingly, Diamondback is unable to present a

quantitative reconciliation of such forward-looking, non-GAAP

financial measures to the respective most directly comparable

forward-looking GAAP financial measures. Diamondback believes that

these forward-looking, non-GAAP measures may be a useful tool for

the investment community in comparing Diamondback's forecasted

financial performance to the forecasted financial performance of

other companies in the industry.

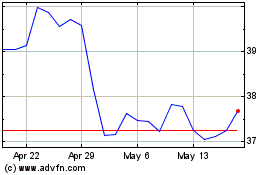

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Jan 2025 to Feb 2025

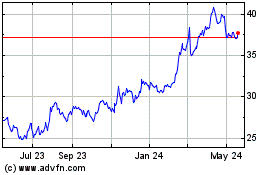

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Feb 2024 to Feb 2025