Xometry, Inc. (NASDAQ:XMTR), the global AI-powered marketplace

connecting buyers with suppliers of manufacturing services, today

reported financial results for the fourth quarter and full year

ended December 31, 2024.

“Our AI powered marketplace continues to gain share and deliver

record financial results,” said Randy Altschuler, Xometry’s CEO.

“In Q4, we delivered stronger-than-expected marketplace growth and

generated positive Adjusted EBITDA as our customers increasingly

rely on Xometry for their supply chain resiliency. In 2025, we

remain focused on driving global growth, scale and operating

excellence.”

“In Q4, we delivered strong marketplace revenue growth,

operating leverage and positive Adjusted EBITDA,” said James Miln,

Xometry’s CFO. “Our record marketplace gross margin of 34.5%

and operating efficiencies drove Adjusted EBITDA to a profit of

$1.0 million, a $3.9 million improvement year-over-year.”

Fourth Quarter 2024 Financial Highlights

- Marketplace revenue for the fourth quarter of 2024 was $135

million, an increase of 20% year-over-year.

- Marketplace Active Buyers increased 23% from 55,325 as of

December 31, 2023 to 68,267 as of December 31, 2024.

- Marketplace Accounts with Last Twelve-Months Spend of at least

$50,000 increased 12% from 1,331 as of December 31, 2023 to 1,495

as of December 31, 2024.

- Supplier services revenue for the fourth quarter of 2024 was

$14.0 million, a decrease of 13% year-over-year driven primarily by

the exit of non-core supplier services and to a lesser extent

advertising and marketing services.

- Net loss attributable to common stockholders for the fourth

quarter of 2024 was $9.9 million, a decrease of $0.7 million

year-over-year. Net loss for the fourth quarter of 2024 included

$8.2 million of stock-based compensation, $0.1 million of payroll

tax expense related to stock-based compensation and $3.4 million of

depreciation and amortization expense.

- Adjusted EBITDA for the fourth quarter of 2024 was a profit

$1.0 million, reflecting an improvement of $3.9 million

year-over-year.

- Non-GAAP net income for the fourth quarter of 2024 was $3.2

million, as compared to a Non-GAAP net loss of $0.4 million in the

fourth quarter of 2023.

- Cash, cash equivalents and marketable securities were $240

million as of December 31, 2024, an increase of $5.8 million from

September 30, 2024.

Fourth Quarter 2024 Business Highlights

- Grew the number of Active Suppliers 28% year-over-year from

3,429 to 4,375. In the fourth quarter, we expanded our supplier

base in the U.S. with a focus on key quality certifications to

serve the needs of our larger customers across key industries.

- Expanded international economy pricing on Xometry marketplace,

giving our domestic customers the ability to instantly quote

additive processes with global suppliers. This move reflects our

growing operational capacities in key manufacturing regions such as

Turkey and India.

- Enhanced marketplace certifications for a range of industries

furthering our capabilities for enterprise accounts. Xometry

retained a key certification for the automotive industry – IATF

16949, an international quality standard enabling the company to

expand the breadth of automotive manufacturing on the Xometry

marketplace. This certification joins our other key certifications

– AS9100 certification for the aerospace and defense industries,

and the ISO13485 certification for medical devices which

underscores the quality of the Xometry marketplace.

- Received a new patent for our Xometry Instant Quoting Engine®

entitled "Methods and Apparatus for Machine Learning

Predictions of Manufacturing Processes." Xometry now owns 12 U.S.

patents related to the use of machine learning for generating

fabrication and manufacturing predictions, such as price,

manufacturability and suitable materials.

Full Year 2024 Financial Highlights

- Marketplace revenue for the full year of 2024 was $486 million,

an increase of 23% year-over-year.

- Supplier services revenue for the full year of 2024 was $59.6

million, a decrease of 13% year-over-year driven primarily by the

exit of non-core supplier services and to a lesser extent

advertising and marketing services.

- Net loss attributable to common stockholders for the full year

of 2024 was $50.4 million, a decrease of $17.1 million

year-over-year. Net loss for the full year of 2024 included $29.3

million of stock-based compensation, $1.0 million of payroll tax

expense related to stock-based compensation and $13.0 million of

depreciation and amortization expense.

- Adjusted EBITDA for the full year of 2024 was a loss of $9.7

million, reflecting an improvement of $17.8 million

year-over-year.

- Non-GAAP net loss for the full year of 2024 was $2.1 million,

as compared to a Non-GAAP net loss of $19.4 million for the full

year of 2023.

Full Year 2024 Business Highlights

- Expanded our US marketplace menu with instant pricing and lead

time auto-quote offerings for tube cutting and tube bending.

Through our partnership with Google Cloud, Xometry is leveraging

Vertex AI to accelerate the deployment of new auto-quote methods

and models on our marketplace.

- Introduced new features for our Teamspace enterprise

collaboration software. Teamspace moves the Xometry marketplace

from a focus on individual buyers and parts to procurement teams

managing essential programs. New features include expanded

collaboration, order management tools and comprehensive quote

histories. Since launching Teamspace, over 5,000 teams have been

created.

- Launched a marketplace buyer dashboard for tooling processes,

including injection molding. The new dashboard provides engineers

and procurement professionals details about their various tools,

and a view of their tool production workflow (tracking everything

from quoting, design-for-manufacturability, tool production and

part production).

- Expanded European marketplace menu including new processes,

materials and languages. Xometry Europe added vacuum casting to the

Xometry Instant Quoting Engine, new steel and aluminum grades

options and expanded its finishing options for 3D printing. Xometry

Europe launched the Czech and Hungarian languages on the site.

Worldwide, the Xometry marketplace is available in 18

languages.

- Delivered a suite of tools on the European marketplace that

makes it easier for enterprise customers to order parts for their

high-volume manufacturing projects. The tools give engineers,

designers, procurement professionals and project managers

everything they need to coordinate, collaborate and manage complex

orders.

- In China, launched enhanced customer service capabilities on

our WeChat mini app for buyers to quote, order and track

deliveries.

- Released new features for Thomas, including new self-serve

tools for suppliers to create custom advertising campaigns on

Thomasnet®. The new tools let suppliers select from among 78,000

categories and keywords that best reflect their products and

services and present a range of suggested budgets tailored to their

marketing spend.

|

Financial Summary(In thousands, except per

share amounts)(Unaudited) |

|

|

|

|

|

For the Three Months Ended December 31, |

|

|

|

|

|

For the Year Ended December 31, |

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

148,546 |

|

|

$ |

128,145 |

|

|

|

16 |

% |

|

$ |

545,529 |

|

|

$ |

463,406 |

|

|

|

18 |

% |

| Gross profit |

|

|

59,020 |

|

|

|

49,085 |

|

|

|

20 |

% |

|

|

215,624 |

|

|

|

178,259 |

|

|

|

21 |

% |

| Net loss attributable to

common stockholders |

|

|

(9,889 |

) |

|

|

(10,551 |

) |

|

|

6 |

% |

|

|

(50,401 |

) |

|

|

(67,472 |

) |

|

|

25 |

% |

| EPS, basic and diluted, of

Class A and Class B common stock |

|

|

(0.20 |

) |

|

|

(0.22 |

) |

|

|

9 |

% |

|

|

(1.03 |

) |

|

|

(1.41 |

) |

|

|

27 |

% |

| Adjusted EBITDA(1) |

|

|

1,049 |

|

|

|

(2,850 |

) |

|

|

137 |

% |

|

|

(9,676 |

) |

|

|

(27,490 |

) |

|

|

65 |

% |

| Non-GAAP net income

(loss)(1) |

|

|

3,165 |

|

|

|

(400 |

) |

|

|

891 |

% |

|

|

(2,069 |

) |

|

|

(19,355 |

) |

|

|

89 |

% |

| Non-GAAP EPS, basic and

diluted(1), of Class A and Class B common stock |

|

|

0.06 |

|

|

|

(0.01 |

) |

|

|

700 |

% |

|

|

(0.04 |

) |

|

|

(0.40 |

) |

|

|

90 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketplace |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

134,508 |

|

|

$ |

112,090 |

|

|

|

20 |

% |

|

$ |

485,946 |

|

|

$ |

394,754 |

|

|

|

23 |

% |

| Cost of revenue |

|

|

88,087 |

|

|

|

77,024 |

|

|

|

(14 |

)% |

|

|

323,365 |

|

|

|

273,264 |

|

|

|

(18 |

)% |

| Gross Profit |

|

$ |

46,421 |

|

|

$ |

35,066 |

|

|

|

32 |

% |

|

$ |

162,581 |

|

|

$ |

121,490 |

|

|

|

34 |

% |

| Gross Margin |

|

|

34.5 |

% |

|

|

31.3 |

% |

|

|

3.2 |

% |

|

|

33.5 |

% |

|

|

30.8 |

% |

|

|

2.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Supplier

services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

14,038 |

|

|

$ |

16,055 |

|

|

|

(13 |

)% |

|

$ |

59,583 |

|

|

$ |

68,652 |

|

|

|

(13 |

)% |

| Cost of revenue |

|

|

1,439 |

|

|

|

2,036 |

|

|

|

29 |

% |

|

|

6,540 |

|

|

|

11,883 |

|

|

|

45 |

% |

| Gross Profit |

|

$ |

12,599 |

|

|

$ |

14,019 |

|

|

|

(10 |

)% |

|

$ |

53,043 |

|

|

$ |

56,769 |

|

|

|

(7 |

)% |

| Gross Margin |

|

|

89.7 |

% |

|

|

87.3 |

% |

|

|

2.4 |

% |

|

|

89.0 |

% |

|

|

82.7 |

% |

|

|

6.3 |

% |

| |

- These non-GAAP financial measures, and the reasons why we

believe these non-GAAP financial measures are useful, are described

below and reconciled to their most directly comparable GAAP

measures in the accompanying tables.

Key Operating Metrics(2):

|

|

|

As of December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

Active Buyers(3) |

|

|

68,267 |

|

|

|

55,325 |

|

|

|

23 |

% |

| Percentage of Revenue from

Existing Accounts(3) |

|

|

97 |

% |

|

|

96 |

% |

|

|

|

| Accounts with Last

Twelve-Months Spend of at Least $50,000(3) |

|

|

1,495 |

|

|

|

1,331 |

|

|

|

12 |

% |

| Active Paying

Suppliers(3) |

|

|

6,582 |

|

|

|

7,271 |

|

|

|

(9 |

)% |

| |

- These key operating metrics are for Marketplace and

Supplier Services. See “Key Terms for our Key Metrics and Non-GAAP

Financial Measures” below for definitions of these metrics.

- Amounts shown for Active Buyers, Accounts with Last

Twelve-Months Spend of at Least $50,000, and Active Paying

Suppliers are as of December 31, 2024 and 2023, and Percentage of

Revenue from Existing Accounts is presented for the quarters ended

December 31, 2024 and 2023.

Financial Guidance and Outlook:

| |

|

Q1 2025 |

|

| |

|

(in millions) |

|

| |

|

Low |

|

|

High |

|

|

Revenue |

|

$ |

147 |

|

|

$ |

149 |

|

| |

- For Q1 2025, expect revenue of $147-$149 million, representing

20-21% growth year-over-year. This includes an unfavorable foreign

exchange impact of approximately $1.0 million.

- For Q1 2025, expect Adjusted EBITDA loss of approximately $1.5

million, an improvement of approximately $6.0 million from an

Adjusted EBITDA loss of $7.5 million in Q1 2024.

- For FY 2025, expect total revenue growth to exceed revenue

growth in 2024. We expect marketplace revenue growth of at least

20% year-over-year and expect supplier services revenue to be down

approximately 5-10% year-over-year.

- For FY 2025, expect to be Adjusted EBITDA positive for the full

year.

Xometry’s first quarter 2025 and full year 2025 financial

outlook is based on a number of assumptions that are subject to

change and many of which are outside of its control. If actual

results vary from these assumptions, Xometry’s expectations may

change. There can be no assurance that Xometry will achieve these

results.

Reconciliation of Adjusted EBITDA on a forward-looking basis to

net loss, the most directly comparable GAAP measure, is not

available without unreasonable efforts due to the high variability

and complexity and low visibility with respect to certain charges

excluded from this non-GAAP measure, including interest and

dividend income, benefit for income taxes, charitable contributions

of common stock and impairment of assets. Xometry expects the

variability of these items could have a significant, and

potentially unpredictable, impact on its future GAAP financial

results.

Use of Non-GAAP Financial Measures To

supplement its consolidated financial statements, which are

prepared and presented in accordance with generally accepted

accounting principles in the United States of America (“GAAP”),

Xometry, Inc. (“Xometry”, the “Company”, “we” or “our”) uses

Adjusted EBITDA, non-GAAP net income (loss) and non-GAAP Earnings

Per Share basic and diluted, which are considered non-GAAP

financial measures, as described below. These non-GAAP financial

measures are presented to enhance the user’s overall understanding

of Xometry’s financial performance and should not be considered a

substitute for, nor superior to, the financial information prepared

and presented in accordance with GAAP. The non-GAAP financial

measures presented in this release, together with the GAAP

financial results, are the primary measures used by the Company’s

management and board of directors to understand and evaluate the

Company’s financial performance and operating trends, including

period-to-period comparisons, because they exclude certain expenses

and gains that management believes are not indicative of the

Company’s core operating results. Management also uses these

measures to prepare and update the Company’s short and long term

financial and operational plans, to evaluate investment decisions,

and in its discussions with investors, commercial bankers, equity

research analysts and other users of the Company’s financial

statements. Accordingly, the Company believes that these non-GAAP

financial measures provide useful information to investors and

others in understanding and evaluating the Company’s operating

results in the same manner as the Company’s management and in

comparing operating results across periods and to those of

Xometry’s peer companies. In addition, from time to time we may

present adjusted information (for example, revenue growth) to

exclude the impact of certain gains, losses or other changes that

affect period-to-period comparability of our operating

performance.

The use of non-GAAP financial measures has certain limitations

because they do not reflect all items of income and expense, or

cash flows, that affect the Company’s financial performance and

operations. Additionally, non-GAAP financial measures do not have

standardized meanings, and therefore other companies, including

peer companies, may use the same or similarly named measures but

exclude or include different items or use different computations.

Management compensates for these limitations by reconciling these

non-GAAP financial measures to their most comparable GAAP financial

measures in the tables captioned “Reconciliations of Non-GAAP

Financial Measures” included at the end of this release. Investors

and others are encouraged to review the Company’s financial

information in its entirety and not rely on a single financial

measure.

Key Terms for our Key Metrics and Non-GAAP Financial

Measures

Marketplace revenue: includes the sale of parts

and assemblies on our platform.

Supplier service revenue: includes the sales of

marketing and advertising services and, to a lesser extent,

financial service products, SaaS-based solutions and the sale of

tools and materials, which was discontinued during the second

quarter of 2023.

Active Buyers: The Company defines “buyers” as

individuals who have placed an order to purchase on-demand parts or

assemblies on our marketplace. The Company defines Active Buyers as

the number of buyers who have made at least one purchase on our

marketplace during the last twelve months. We adjusted the number

of our Q4 2023 active buyers in 2024 to reflect an immaterial

correction.

Active Suppliers: The Company defines

“suppliers” as individuals or businesses that have been approved by

us to either manufacture a product on our platform for a buyer or

have utilized our supplier services, including our digital

marketing services, data services, financial services or tools and

materials. The Company defines Active Suppliers as suppliers that

have used our platform at least once during the last twelve months

to manufacture a product.

Percentage of Revenue from Existing Accounts:

The Company defines an “account” as an individual entity, such as a

sole proprietor with a single buyer or corporate entities with

multiple buyers, having purchased at least one part on our

marketplace. The Company defines an existing account as an account

where at least one buyer has made a purchase on our

marketplace.

Accounts with Last Twelve-Month Spend of At Least

$50,000: The Company defines Accounts with Last

Twelve-Month Spend of At Least $50,000 as an account that has spent

at least $50,000 on our marketplace in the most recent twelve-month

period.

Active Paying Suppliers: The Company defines

Active Paying Suppliers as individuals or businesses who have

purchased one or more of our supplier services, including digital

marketing services, data services, financial services or tools and

materials on our platforms, during the last twelve

months.

Adjusted earnings before interest, taxes, depreciation

and amortization (Adjusted EBITDA): The Company defines

Adjusted EBITDA as net loss, adjusted for interest expense,

interest and dividend income and other expenses, benefit for income

taxes, and certain other non-cash or non-recurring items impacting

net loss from time to time, principally comprised of depreciation

and amortization, amortization of lease intangible, stock-based

compensation, payroll tax expense related to stock-based

compensation, lease abandonment, charitable contributions of common

stock, income from unconsolidated joint venture, impairment of

assets, restructuring charges, costs to exit the tools and

materials business and acquisition and other adjustments not

reflective of the Company’s ongoing business, such as adjustments

related to purchase accounting, the revaluation of contingent

consideration, transaction costs and executive severance.

Non-GAAP net income (loss): The Company defines

non-GAAP net income (loss) as net loss adjusted for depreciation

and amortization, stock-based compensation, payroll tax expense

related to stock-based compensation, amortization of lease

intangible, amortization of deferred costs on convertible notes,

loss on sale of property and equipment, charitable contributions of

common stock, lease abandonment and termination, impairment of

assets, restructuring charges, costs to exit the tools and

materials business and acquisition and other adjustments not

reflective of the Company’s ongoing business, such as adjustments

related to purchase accounting, the revaluation of contingent

consideration, transaction costs and executive severance.

Non-GAAP Earnings Per Share, basic and diluted (Non-GAAP

EPS, basic and diluted): The Company calculates non-GAAP

earnings per share, basic and diluted as non-GAAP net income (loss)

divided by weighted average number of shares of common stock

outstanding.

Management believes that the exclusion of certain expenses and

gains in calculating Adjusted EBITDA, non-GAAP net income (loss)

and non-GAAP EPS, basic and diluted, provides a useful measure for

period-to-period comparisons of the Company’s underlying core

revenue and operating costs that is focused more closely on the

current costs necessary to operate the Company’s businesses and

reflects its ongoing business in a manner that allows for

meaningful analysis of trends. Management also believes that

excluding certain non-cash charges can be useful because the amount

of such expenses is the result of long-term investment decisions

made in previous periods rather than day-to-day operating

decisions.

About

XometryXometry’s (NASDAQ:XMTR) AI-powered

marketplace, popular Thomasnet® industrial sourcing

platform and suite of cloud-based services are rapidly digitizing

the manufacturing industry. Xometry provides manufacturers the

critical resources they need to grow their business and makes it

easy for buyers to create locally resilient supply chains. The

Xometry Instant Quoting Engine® leverages millions of pieces of

data to analyze complex parts in real-time, matches buyers with the

right suppliers globally, and provides accurate pricing and lead

times. Learn more at www.xometry.com or follow @xometry.

Conference Call and Webcast InformationThe

Company will host a conference call and webcast to discuss the

results at 8:30 a.m. ET (5:30 a.m. PT) on February 25, 2025. In

addition to its press release announcing its fourth quarter and

full year 2024 financial results, Xometry will release an earnings

presentation, which will be available on its investor website at

investors.xometry.com.

Xometry, Inc. Fourth Quarter and Full Year 2024 Earnings

Presentation and Conference Call

- Tuesday, February 25, 2025

- 8:30 a.m. Eastern / 5:30 a.m. Pacific

- To access the webcast use the following link:

https://register.vevent.com/register

- You may also visit the Xometry Investor Relations Homepage at

investors.xometry.com to listen to a live webcast of the call

Cautionary Information Regarding Forward-Looking

StatementsThis press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, which statements involve substantial risks and

uncertainties. Forward-looking statements generally relate to

future events or our future financial or operating performance. In

some cases, you can identify forward-looking statements because

they contain words such as “may,” “will,” “should,” “expect,”

“plan,” “anticipate,” “could,” “would,” “intend,” “target,”

“project,” “contemplate,” “believe,” “estimate,” “predict,”

“potential” or “continue” or the negative of these words or other

similar terms or expressions that concern our expectations,

strategy, plans or intentions. Forward-looking statements in this

press release include, but are not limited to, our beliefs

regarding our financial position and operating performance,

including our outlook and guidance for the first quarter of 2025

and the full year 2025; our expectations regarding our growth; and

statements regarding our strategies, initiatives, products and

platform capabilities. Our expectations and beliefs regarding these

matters may not materialize, and actual results in future periods

are subject to risks and uncertainties that could cause actual

results to differ materially from those projected, including risks

and uncertainties related to: competition, managing our growth,

financial performance, our ability to forecast our performance due

to our limited operating history, investments in new products or

offerings, our ability to attract buyers and sellers to our

marketplace, legal proceedings and regulatory matters and

developments, any future changes to our business or our financial

or operating model, our brand and reputation, and the impact of

fluctuations in general macroeconomic conditions, such as

fluctuations in inflation and rising interest rates. The

forward-looking statements contained in this press release are also

subject to other risks and uncertainties that could cause actual

results to differ from the results predicted, including those more

fully described in our filings with the SEC, including our Annual

Report on Form 10-K for the year ended December 31, 2024, our

Quarterly Reports on Form 10-Q, and other filings and reports that

we may file from time to time with the SEC. All forward-looking

statements in this press release are based on information available

to Xometry and assumptions and beliefs as of the date hereof, and

we disclaim any obligation to update any forward-looking

statements, except as required by law.

|

Investor Contact: |

Media Contact: |

| Shawn MilneVP Investor

Relations240-335-8132shawn.milne@xometry.com |

Matthew Hutchison Global

Corporate

Communications415-583-2119matthew.hutchison@xometry.com |

| |

|

Xometry, Inc. and Subsidiaries Consolidated

Balance Sheets (In thousands, except share and per share

data)(Unaudited) |

| |

| |

|

December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

22,232 |

|

|

$ |

53,424 |

|

|

Marketable securities |

|

|

217,603 |

|

|

|

215,352 |

|

|

Accounts receivable, less allowance for credit losses of $4.9

million and $2.4 million as of December 31, 2024 and December 31,

2023 |

|

|

73,962 |

|

|

|

70,102 |

|

|

Inventory |

|

|

3,915 |

|

|

|

2,885 |

|

|

Prepaid expenses |

|

|

4,954 |

|

|

|

5,571 |

|

|

Other current assets |

|

|

4,874 |

|

|

|

8,897 |

|

|

Total current assets |

|

|

327,540 |

|

|

|

356,231 |

|

|

Property and equipment, net |

|

|

44,825 |

|

|

|

35,637 |

|

|

Operating lease right-of-use assets |

|

|

8,462 |

|

|

|

12,251 |

|

|

Investment in unconsolidated joint venture |

|

|

4,065 |

|

|

|

4,114 |

|

|

Intangible assets, net |

|

|

32,139 |

|

|

|

35,768 |

|

|

Goodwill |

|

|

262,686 |

|

|

|

262,915 |

|

|

Other assets |

|

|

412 |

|

|

|

471 |

|

|

Total assets |

|

$ |

680,129 |

|

|

$ |

707,387 |

|

| Liabilities and

stockholders’ equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable and accrued cost of revenue |

|

$ |

35,023 |

|

|

$ |

43,878 |

|

|

Other accrued expenses |

|

|

24,401 |

|

|

|

22,677 |

|

|

Contract liabilities |

|

|

7,948 |

|

|

|

7,357 |

|

|

Income taxes payable |

|

|

979 |

|

|

|

2,484 |

|

|

Operating lease liabilities, current portion |

|

|

6,436 |

|

|

|

6,799 |

|

|

Total current liabilities |

|

|

74,787 |

|

|

|

83,195 |

|

|

Convertible notes |

|

|

283,628 |

|

|

|

281,769 |

|

|

Operating lease liabilities, net of current portion |

|

|

5,072 |

|

|

|

10,951 |

|

|

Deferred income taxes |

|

|

229 |

|

|

|

275 |

|

|

Other liabilities |

|

|

817 |

|

|

|

778 |

|

|

Total liabilities |

|

|

364,533 |

|

|

|

376,968 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders’

equity |

|

|

|

|

|

|

|

Preferred stock, $0.000001 par value. Authorized; 50,000,000

shares; zero shares issued and outstanding as of December 31, 2024

and December 31, 2023, respectively |

|

|

— |

|

|

|

— |

|

|

Class A Common stock, $0.000001 par value. Authorized; 750,000,000

shares; 48,289,274 shares and 45,489,379 shares issued and

outstanding as of December 31, 2024 and December 31, 2023,

respectively |

|

|

— |

|

|

|

— |

|

|

Class B Common stock, $0.000001 par value. Authorized; 5,000,000

shares; 1,475,311 shares and 2,676,154 shares issued and

outstanding as of December 31, 2024 and December 31, 2023,

respectively |

|

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

|

685,054 |

|

|

|

648,317 |

|

|

Accumulated other comprehensive (loss) income |

|

|

(328 |

) |

|

|

855 |

|

|

Accumulated deficit |

|

|

(370,273 |

) |

|

|

(319,872 |

) |

| Total stockholders’

equity |

|

|

314,453 |

|

|

|

329,300 |

|

|

Noncontrolling interest |

|

|

1,143 |

|

|

|

1,119 |

|

|

Total equity |

|

|

315,596 |

|

|

|

330,419 |

|

| Total liabilities and

stockholders’ equity |

|

$ |

680,129 |

|

|

$ |

707,387 |

|

| |

|

|

|

|

|

|

| |

|

Xometry, Inc. and SubsidiariesConsolidated

Statements of Operations and Comprehensive Loss(In thousands,

except share and per share amounts)(Unaudited) |

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

148,546 |

|

|

$ |

128,145 |

|

|

$ |

545,529 |

|

|

$ |

463,406 |

|

| Cost of revenue |

|

|

89,526 |

|

|

|

79,060 |

|

|

|

329,905 |

|

|

|

285,147 |

|

|

Gross profit |

|

|

59,020 |

|

|

|

49,085 |

|

|

|

215,624 |

|

|

|

178,259 |

|

| Sales and marketing |

|

|

26,546 |

|

|

|

25,373 |

|

|

|

108,437 |

|

|

|

93,688 |

|

| Operations and support |

|

|

16,057 |

|

|

|

12,922 |

|

|

|

58,975 |

|

|

|

52,372 |

|

| Product development |

|

|

10,370 |

|

|

|

8,892 |

|

|

|

39,322 |

|

|

|

34,462 |

|

| General and

administrative |

|

|

17,487 |

|

|

|

14,437 |

|

|

|

64,957 |

|

|

|

70,916 |

|

| Impairment of assets |

|

|

82 |

|

|

|

- |

|

|

|

82 |

|

|

|

397 |

|

| Total operating expenses |

|

|

70,542 |

|

|

|

61,624 |

|

|

|

271,773 |

|

|

|

251,835 |

|

|

Loss from operations |

|

|

(11,522 |

) |

|

|

(12,539 |

) |

|

|

(56,149 |

) |

|

|

(73,576 |

) |

| Other income

(expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

|

(1,188 |

) |

|

|

(1,188 |

) |

|

|

(4,752 |

) |

|

|

(4,784 |

) |

| Interest and dividend

income |

|

|

2,507 |

|

|

|

2,959 |

|

|

|

10,782 |

|

|

|

11,607 |

|

| Other expenses |

|

|

307 |

|

|

|

(355 |

) |

|

|

(757 |

) |

|

|

(1,511 |

) |

| Income from unconsolidated

joint venture |

|

|

(41 |

) |

|

|

9 |

|

|

|

452 |

|

|

|

446 |

|

| Total other income |

|

|

1,585 |

|

|

|

1,425 |

|

|

|

5,725 |

|

|

|

5,758 |

|

|

Loss before income taxes |

|

|

(9,937 |

) |

|

|

(11,114 |

) |

|

|

(50,424 |

) |

|

|

(67,818 |

) |

| Benefit for income taxes |

|

|

41 |

|

|

|

561 |

|

|

|

21 |

|

|

|

353 |

|

|

Net loss |

|

|

(9,896 |

) |

|

|

(10,553 |

) |

|

|

(50,403 |

) |

|

|

(67,465 |

) |

| Net (loss) income attributable

to noncontrolling interest |

|

|

(7 |

) |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

7 |

|

|

Net loss attributable to common stockholders |

|

$ |

(9,889 |

) |

|

$ |

(10,551 |

) |

|

$ |

(50,401 |

) |

|

$ |

(67,472 |

) |

| Net loss per share, basic and

diluted, of Class A and Class B common stock |

|

$ |

(0.20 |

) |

|

$ |

(0.22 |

) |

|

$ |

(1.03 |

) |

|

$ |

(1.41 |

) |

| Weighted-average number of

shares outstanding used to compute net loss per share,

basic and diluted, of Class A and Class B common stock |

|

|

49,606,759 |

|

|

|

48,096,142 |

|

|

|

49,082,722 |

|

|

|

47,914,039 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(9,896 |

) |

|

$ |

(10,553 |

) |

|

$ |

(50,403 |

) |

|

$ |

(67,465 |

) |

| Comprehensive loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation |

|

|

(1,587 |

) |

|

|

91 |

|

|

|

(1,157 |

) |

|

|

849 |

|

|

Total other comprehensive (loss) income |

|

|

(1,587 |

) |

|

|

91 |

|

|

|

(1,157 |

) |

|

|

849 |

|

| Comprehensive

loss |

|

|

(11,483 |

) |

|

|

(10,462 |

) |

|

|

(51,560 |

) |

|

|

(66,616 |

) |

| Comprehensive income (loss)

attributable to noncontrolling interest |

|

|

16 |

|

|

|

(16 |

) |

|

|

24 |

|

|

|

29 |

|

| Total comprehensive

loss attributable to common stockholders |

|

$ |

(11,499 |

) |

|

$ |

(10,446 |

) |

|

$ |

(51,584 |

) |

|

$ |

(66,645 |

) |

| |

|

Xometry, Inc. and Subsidiaries Consolidated

Statements of Cash Flows(In thousands)(Unaudited) |

|

|

|

|

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(50,403 |

) |

|

$ |

(67,465 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

13,012 |

|

|

|

10,738 |

|

|

Impairment of assets |

|

|

82 |

|

|

|

397 |

|

|

Reduction in carrying amount of right-of-use asset |

|

|

4,458 |

|

|

|

14,355 |

|

|

Stock-based compensation |

|

|

29,322 |

|

|

|

22,118 |

|

|

Revaluation of contingent consideration |

|

|

137 |

|

|

|

571 |

|

|

(Income) from unconsolidated joint venture |

|

|

(42 |

) |

|

|

(46 |

) |

|

Donation of common stock |

|

|

1,686 |

|

|

|

1,029 |

|

|

Loss on sale of property and equipment |

|

|

3 |

|

|

|

92 |

|

|

Inventory write-off |

|

|

— |

|

|

|

223 |

|

|

Amortization of deferred costs on convertible notes |

|

|

1,859 |

|

|

|

1,860 |

|

|

Deferred tax benefit |

|

|

(46 |

) |

|

|

(154 |

) |

|

Changes in other assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

(5,749 |

) |

|

|

(20,594 |

) |

|

Inventory |

|

|

(1,282 |

) |

|

|

(1,550 |

) |

|

Prepaid expenses |

|

|

599 |

|

|

|

1,669 |

|

|

Other assets |

|

|

4,213 |

|

|

|

(80 |

) |

|

Accounts payable and accrued cost of revenue |

|

|

(8,706 |

) |

|

|

12,593 |

|

|

Other accrued expenses |

|

|

2,681 |

|

|

|

1,603 |

|

|

Contract liabilities |

|

|

681 |

|

|

|

(1,404 |

) |

|

Lease liabilities |

|

|

(6,911 |

) |

|

|

(5,520 |

) |

|

Other liabilities |

|

|

527 |

|

|

|

- |

|

|

Income taxes payable |

|

|

(1,505 |

) |

|

|

(312 |

) |

|

Net cash used in operating activities |

|

|

(15,384 |

) |

|

|

(29,877 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

Purchases of marketable securities |

|

|

(18,751 |

) |

|

|

(11,582 |

) |

|

Proceeds from sale of marketable securities |

|

|

16,500 |

|

|

|

50,000 |

|

|

Purchases of property and equipment |

|

|

(18,097 |

) |

|

|

(18,486 |

) |

|

Distributions in excess of earnings |

|

|

90 |

|

|

|

— |

|

|

Proceeds from sale of property and equipment |

|

|

79 |

|

|

|

223 |

|

|

Cash paid for business combination, net of cash acquired |

|

|

— |

|

|

|

(3,349 |

) |

|

Net cash (used in) provided by investing

activities |

|

|

(20,179 |

) |

|

|

16,806 |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

Proceeds from stock options exercised |

|

|

5,104 |

|

|

|

1,909 |

|

|

Payment of contingent consideration |

|

|

(465 |

) |

|

|

(842 |

) |

|

Net cash provided by financing activities |

|

|

4,639 |

|

|

|

1,067 |

|

|

Effect of foreign currency translation on cash and cash

equivalents |

|

|

(268 |

) |

|

|

(234 |

) |

|

Net decrease in cash and cash equivalents |

|

|

(31,192 |

) |

|

|

(12,238 |

) |

| Cash and cash

equivalents at beginning of the year |

|

|

53,424 |

|

|

|

65,662 |

|

| Cash and cash

equivalents at end of the year |

|

$ |

22,232 |

|

|

$ |

53,424 |

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

2,875 |

|

|

$ |

2,875 |

|

| Non-cash investing and

financing activities: |

|

|

|

|

|

|

| Non-cash purchase of property

and equipment |

|

|

1,059 |

|

|

|

5,353 |

|

| Non-cash consideration in

connection with business combination |

|

|

625 |

|

|

|

1,593 |

|

| |

|

Xometry, Inc. and Subsidiaries Reconciliations of

Non-GAAP Financial Measures (In thousands, except share and per

share amounts)(Unaudited) |

|

|

|

|

|

For the Three Months Ended December 31, |

|

|

For the Year Ended December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(9,896 |

) |

|

$ |

(10,553 |

) |

|

$ |

(50,403 |

) |

|

$ |

(67,465 |

) |

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, interest and

dividend income and other expenses |

|

|

(1,626 |

) |

|

|

(1,416 |

) |

|

|

(5,273 |

) |

|

|

(5,312 |

) |

| Depreciation and

amortization(1) |

|

|

3,390 |

|

|

|

2,799 |

|

|

|

13,012 |

|

|

|

10,738 |

|

| Amortization of lease

intangible |

|

|

180 |

|

|

|

180 |

|

|

|

720 |

|

|

|

950 |

|

| Benefit for income taxes |

|

|

(41 |

) |

|

|

(561 |

) |

|

|

(21 |

) |

|

|

(353 |

) |

| Stock-based

compensation(2) |

|

|

8,207 |

|

|

|

5,896 |

|

|

|

29,322 |

|

|

|

22,118 |

|

| Payroll tax expense related to

stock-based compensation(3) |

|

|

89 |

|

|

|

— |

|

|

|

965 |

|

|

|

— |

|

| Lease abandonment(4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,706 |

|

| Acquisition and other(5) |

|

|

— |

|

|

|

481 |

|

|

|

686 |

|

|

|

824 |

|

| Charitable contribution of

common stock |

|

|

623 |

|

|

|

333 |

|

|

|

1,686 |

|

|

|

1,029 |

|

| Income from unconsolidated

joint venture |

|

|

41 |

|

|

|

(9 |

) |

|

|

(452 |

) |

|

|

(446 |

) |

| Impairment of assets |

|

|

82 |

|

|

|

— |

|

|

|

82 |

|

|

|

397 |

|

| Restructuring charges(6) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

738 |

|

| Costs to exit the tools and

materials business |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

586 |

|

| Adjusted

EBITDA |

|

$ |

1,049 |

|

|

$ |

(2,850 |

) |

|

$ |

(9,676 |

) |

|

$ |

(27,490 |

) |

| |

| |

|

For the Three Months Ended December 31, |

|

|

For the Year Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Non-GAAP Net Income

(Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(9,896 |

) |

|

$ |

(10,553 |

) |

|

$ |

(50,403 |

) |

|

$ |

(67,465 |

) |

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization(1) |

|

|

3,390 |

|

|

|

2,799 |

|

|

|

13,012 |

|

|

|

10,738 |

|

| Stock-based compensation

(2) |

|

|

8,207 |

|

|

|

5,896 |

|

|

|

29,322 |

|

|

|

22,118 |

|

| Payroll tax expense related to

stock-based compensation(3) |

|

|

89 |

|

|

|

— |

|

|

|

965 |

|

|

|

— |

|

| Amortization of lease

intangible |

|

|

180 |

|

|

|

180 |

|

|

|

720 |

|

|

|

950 |

|

| Amortization of deferred costs

on convertible notes |

|

|

465 |

|

|

|

464 |

|

|

|

1,859 |

|

|

|

1,860 |

|

| Acquisition and other(5) |

|

|

— |

|

|

|

481 |

|

|

|

686 |

|

|

|

824 |

|

| Loss on sale of property and

equipment |

|

|

25 |

|

|

|

— |

|

|

|

2 |

|

|

|

92 |

|

| Charitable contribution of

common stock |

|

|

623 |

|

|

|

333 |

|

|

|

1,686 |

|

|

|

1,029 |

|

| Lease abandonment and

termination(4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8,778 |

|

| Impairment of assets |

|

|

82 |

|

|

|

— |

|

|

|

82 |

|

|

|

397 |

|

| Restructuring charges(6) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

738 |

|

| Costs to exit the tools and

materials business |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

586 |

|

| Non-GAAP Net Income

(Loss) |

|

$ |

3,165 |

|

|

$ |

(400 |

) |

|

$ |

(2,069 |

) |

|

$ |

(19,355 |

) |

| Weighted-average number of

shares outstanding used to compute Non-GAAP Net Income (Loss) per

share, basic and diluted, of Class A and Class B common stock |

|

|

49,606,759 |

|

|

|

48,096,142 |

|

|

|

49,082,722 |

|

|

|

47,914,039 |

|

| Non-GAAP weighted-average

effect of potentially dilutive Class A common stock |

|

|

2,656,165 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Non-GAAP weighted-average

shares used to compute Non-GAAP Net Income (Loss) per share,

diluted |

|

|

52,262,924 |

|

|

|

48,096,142 |

|

|

|

49,082,722 |

|

|

|

47,914,039 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| EPS, basic and diluted, of

Class A and Class B common stock |

|

$ |

(0.20 |

) |

|

$ |

(0.22 |

) |

|

$ |

(1.03 |

) |

|

$ |

(1.41 |

) |

| Non-GAAP EPS basic and

diluted, of Class A and Class B common stock |

|

$ |

0.06 |

|

|

$ |

(0.01 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.40 |

) |

| |

- Represents depreciation expense of the Company’s long-lived

tangible assets and amortization expense of its finite-lived

intangible assets, as included in the Company’s GAAP results of

operations.

- Represents the non-cash expense related to stock-based awards

granted to employees, as included in the Company’s GAAP results of

operations.

- In the second quarter of 2024, we changed the definition of

Adjusted EBITDA and Non-GAAP Net Income (Loss) to exclude payroll

tax expense related to stock-based compensation. For prior periods,

this amount was considered de minimis and, accordingly, we have not

adjusted the Adjusted EBITDA or Non-GAAP Net Income (Loss) amounts

for such periods.

- Amount is recorded in general and administrative and/or other

expenses.

- Includes adjustments related to purchase accounting, the

revaluation of contingent consideration, transaction costs and

executive severance.

- Costs associated with the May 2023 reduction in workforce.

|

Xometry, Inc. and SubsidiariesReconciliation of

GAAP EPS to Non-GAAP EPS(Unaudited) |

| |

| |

|

For the Three Months Ended December 31, |

|

|

For the Year Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Non-GAAP

EPS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP EPS, diluted, of Class A and Class B common stock |

|

$ |

(0.20 |

) |

|

$ |

(0.22 |

) |

|

$ |

(1.03 |

) |

|

$ |

(1.41 |

) |

| Non-GAAP effect of potentially

dilutive Class A common stock |

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

0.07 |

|

|

|

0.06 |

|

|

|

0.27 |

|

|

|

0.22 |

|

| Stock-based compensation |

|

|

0.16 |

|

|

|

0.12 |

|

|

|

0.60 |

|

|

|

0.46 |

|

| Payroll tax expense related to

stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

0.02 |

|

|

|

— |

|

| Amortization of lease

intangible |

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

0.02 |

|

| Amortization of deferred costs

on convertible notes |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.04 |

|

|

|

0.04 |

|

| Acquisition and other |

|

|

— |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.03 |

|

| Charitable contribution of

common stock |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.02 |

|

| Lease abandonment and

termination |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.18 |

|

| Impairment of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

| Restructuring charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.02 |

|

| Costs to exit the tools and

materials business |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

| Non-GAAP EPS, diluted, of

Class A and Class B common stock |

|

$ |

0.06 |

|

|

$ |

(0.01 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.40 |

) |

| |

|

Xometry, Inc. and SubsidiariesSegment Results(In

thousands)(Unaudited) |

| |

| |

|

For the Three Months Ended December 31, |

|

|

For the Year Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Segment

Revenue: |

|

|

|

|

|

|

|

|

|

|

U.S. |

|

$ |

123,614 |

|

|

$ |

110,574 |

|

|

$ |

456,727 |

|

|

$ |

403,289 |

|

| International |

|

|

24,932 |

|

|

|

17,571 |

|

|

|

88,802 |

|

|

|

60,117 |

|

|

Total revenue |

|

$ |

148,546 |

|

|

$ |

128,145 |

|

|

$ |

545,529 |

|

|

$ |

463,406 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Segment Cost of

Revenue: |

|

|

|

|

|

|

|

|

|

| U.S. |

|

$ |

74,010 |

|

|

$ |

68,137 |

|

|

$ |

274,838 |

|

|

$ |

247,519 |

|

| International |

|

|

15,516 |

|

|

|

10,923 |

|

|

|

55,067 |

|

|

|

37,628 |

|

|

Total cost of revenue |

|

$ |

89,526 |

|

|

$ |

79,060 |

|

|

$ |

329,905 |

|

|

$ |

285,147 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. |

|

$ |

4,018 |

|

|

$ |

(763 |

) |

|

$ |

167 |

|

|

$ |

(15,810 |

) |

| International |

|

|

(2,969 |

) |

|

|

(2,087 |

) |

|

|

(9,843 |

) |

|

|

(11,680 |

) |

|

Total Adjusted EBITDA |

|

$ |

1,049 |

|

|

$ |

(2,850 |

) |

|

$ |

(9,676 |

) |

|

$ |

(27,490 |

) |

|

|

|

Xometry, Inc. and Subsidiaries Supplemental

Information(In thousands)(Unaudited) |

| |

| |

|

For the Three Months Ended December 31, |

|

|

For the Year Ended December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Summary of Stock-based

Compensation Expense and Payroll Taxes Related to Stock-based

Compensation Expense |

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

$ |

2,233 |

|

|

$ |

1,456 |

|

|

$ |

8,233 |

|

|

$ |

4,909 |

|

| Operations and support |

|

|

2,739 |

|

|

|

2,029 |

|

|

|

9,582 |

|

|

|

7,719 |

|

| Product development |

|

|

1,834 |

|

|

|

1,455 |

|

|

|

6,881 |

|

|

|

5,345 |

|

| General and

administrative |

|

|

1,490 |

|

|

|

956 |

|

|

|

5,591 |

|

|

|

4,145 |

|

| Total stock-based compensation

expense and payroll taxes related to stock-based compensation |

|

$ |

8,296 |

|

|

$ |

5,896 |

|

|

$ |

30,287 |

|

|

$ |

22,118 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Summary of

Depreciation and Amortization Expense |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

$ |

182 |

|

|

$ |

52 |

|

|

$ |

731 |

|

|

$ |

172 |

|

| Sales and marketing |

|

|

798 |

|

|

|

782 |

|

|

|

3,185 |

|

|

|

3,162 |

|

| Operations and support |

|

|

34 |

|

|

|

32 |

|

|

|

139 |

|

|

|

174 |

|

| Product development |

|

|

2,166 |

|

|

|

1,976 |

|

|

|

8,078 |

|

|

|

5,974 |

|

| General and

administrative |

|

|

210 |

|

|

|

(43 |

) |

|

|

879 |

|

|

|

1,256 |

|

| Total depreciation and

amortization expense |

|

$ |

3,390 |

|

|

$ |

2,799 |

|

|

$ |

13,012 |

|

|

$ |

10,738 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Summary of

Restructuring Charges |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

224 |

|

| Operations and support |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

230 |

|

| Product development |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

117 |

|

| General and

administrative |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

167 |

|

| Total restructuring

charge |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

738 |

|

| |

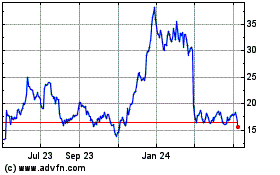

Xometry (NASDAQ:XMTR)

Historical Stock Chart

From Jan 2025 to Mar 2025

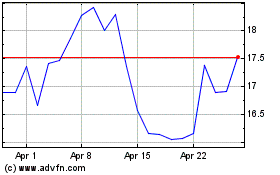

Xometry (NASDAQ:XMTR)

Historical Stock Chart

From Feb 2024 to Mar 2025