Filed Pursuant to Rule

424(b)(5)

Registration No. 333-256190

PROSPECTUS SUPPLEMENT

(To Prospectus dated December 17, 2021)

ZHONGCHAO INC.

3,094,000 Class A Ordinary

Shares

We

are selling 3,094,000 Class A Ordinary Shares, par value $0.001 per share (“Class A Ordinary Shares”), in a registered direct

offering to certain purchasers in a privately negotiated transaction pursuant to this prospectus supplement at a price of $0.30 per share.

We have not retained an underwriter or placement agent with respect to this offering and therefore are not paying any underwriting discounts

or commissions. We estimate the total expenses of this offering will be approximately $45,000.

Pursuant

to General Instruction I.B.5. of Form F-3, in no event will we sell the securities covered hereby in a public primary offering with a

value exceeding more than one-third of the aggregate market value of our Class A Ordinary Shares in any 12-month period so long as the

aggregate market value of our outstanding Class A Ordinary Shares held by non-affiliates remains below $75,000,000. The aggregate

market value of our outstanding voting and non-voting common equity held by non-affiliates is approximately $2.81 million based on the

closing price of $1.559 per Class A Ordinary Share on August 9, 2024 and 1,802,508 Class A Ordinary Shares held by non-affiliates. During

the 12 calendar months prior to and including the date of this prospectus supplement, we have offered or sold only $928,200 of securities

pursuant to General Instruction I.B.5 of Form F-3.

Our

Class A Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “ZCMD.” The last reported sale price of our

Class A Ordinary Shares on the Nasdaq Capital Market on September 30, 2024 was $2.46 per share.

Investing

in our Class A Ordinary Shares involves risks. See “Risk Factors” beginning on page S-13 of this prospectus

supplement and on page 11 of the accompanying prospectus.

Zhongchao Inc. (the “Company”

or “Zhongchao Cayman”) is an offshore holding company incorporated as an exempted company with limited liability in the Cayman

Islands. We are not a Chinese operating company, but a Cayman Islands holding company with no material operations of our own, Zhongchao

Cayman, through the contractual arrangements (the “Contractual Arrangements”), between Beijing Zhongchao Zhongxing Technology

Limited (“Zhongchao WFOE”), a wholly subsidiary of Zhongchao Cayman incorporated in the PRC, and a variable interest entity

(the “VIE”), Zhongchao Medical Technology (Shanghai) Co., Ltd. (“Zhongchao Shanghai”) and its subsidiaries or

collectively “the PRC operating entities”, consolidate the financial results of the PRC operating entities. We chose such

VIE structure due to the restrictions imposed by PRC laws and regulations on foreign ownership of companies engaged in value-added telecommunication

services and certain other businesses, and the PRC operating entities operate their businesses in which foreign investment is restricted

or prohibited in the PRC through certain PRC domestic companies. If in the future the PRC laws and regulations change, and the PRC regulatory

authorities disallow the VIE structure, it would likely result in a material adverse change in our operations, and the securities of Zhongchao

Cayman may decline significantly in value or become worthless. For a description of the VIE contractual arrangements, see “Prospectus

Supplement Summary - Our Corporate Structure — Contractual Arrangements between the Zhongchao WFOE and Zhongchao Shanghai”

starting on page S-2 of this prospectus supplement.

The securities offered

under this prospectus are securities of Zhongchao Cayman, the Cayman Islands holding company, rather than any securities of the PRC operating

entities, therefore, our investors may never hold equity interests in the PRC

operating entities. You are not investing in the PRC operating entities. Neither we nor our subsidiaries own any share or equity interest

in the PRC operating entities. Instead, we consolidate financial results of the PRC operating entities through the Contractual Arrangements

between Zhongchao WFOE and the VIE. As a result of Zhongchao Cayman’s direct ownership in Zhongchao WFOE and the Contractual Arrangements,

we treat the VIE and the VIE’s subsidiaries as the consolidated entities under U.S. GAAP, but we do not own share or equity interests

in the VIE or its subsidiaries. We have consolidated the financial results of the VIE and the VIE’s subsidiaries in our consolidated

financial statements for accounting purposes in accordance with U.S. GAAP.

As we chose such VIE structure,

we are subject to certain unique risks and uncertainties that may not otherwise exist if we had direct equity ownership in the PRC operating

entities. We do not hold equity interests in the VIE and its subsidiaries. Further, we are subject to risks due to uncertainty of the

interpretation and the application of the PRC laws and regulations, including but not limited to limitations on foreign ownership and

regulatory review of overseas listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the Contractual

Arrangements. We are also subject to the risks of uncertainty of any future actions of the PRC government in this regard that could disallow

the VIE structure, which would likely result in a material change in the operations of the PRC operating entities and/or cause the value

of our securities to decrease significantly or become worthless. However, as of the date of this prospectus supplement, the agreements

under the Contractual Arrangements have not been tested in any courts of law. See “Prospectus Supplement Summary - Permission

Required from the PRC Authorities for Our and PRC Operating Entities’ Operation in China” starting on page S-5 of this

prospectus supplement, and “Item 3. Key Information D. Risk Factor “We depend upon the VIE Arrangements in consolidating

the financial results of the PRC operating entities, which may not be as effective as direct ownership” in our most recent annual

report on Form 20-F filed on April 30, 2024 (the “Annual Report”) and “Risk Factors – We conduct our business

through Zhongchao Shanghai and its subsidiaries by means of VIE Arrangements. If the PRC courts or administrative authorities determine

that these VIE Arrangements do not comply with applicable regulations, we could be subject to severe penalties and our business could

be adversely affected, and our securities may decline in value or become worthless. In addition, changes in such PRC laws and regulations

may materially and adversely affect our business” on page S-14 of this prospectus supplement.

Investing in our securities

is highly speculative, involves a high degree of risk and should be considered only by persons who can afford the loss of their entire

investment.

We face risks and uncertainties

associated with the complex and evolving PRC laws and regulations and as to whether and how the recent PRC government statements and regulatory

developments. The Chinese government may intervene or influence the operation of the PRC operating entities and exercise significant oversight

and discretion over the conduct of PRC operating entities’ business and may intervene in or influence the operations of the PRC

operating entities at any time, or may exert more control over offerings conducted overseas and/or foreign investment in China-based issuers,

which could result in a material change in the operations of the PRC operating entities and/or the value of our securities. Further, any

actions by the Chinese government to exert more oversight and control over offerings that are conducted overseas and/or foreign investment

in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer securities to investors

and cause the value of such securities to significantly decline or be worthless.

Recently, the PRC government

initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including

cracking down on illegal activities in the securities market, adopting new measures to extend the scope of cybersecurity reviews, and

expanding the efforts in anti-monopoly enforcement. On February 17, 2023, the China Securities Regulatory Commission (the “CSRC”)

promulgated the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies, or the Trial Measures,

and five supporting guidelines, which became effective on March 31, 2023. Under the Trial Measures, a filing-based regulatory system applies

to “indirect overseas offerings and listings” of companies in mainland China, which refers to securities offerings and listings

in an overseas market made under the name of an offshore entity but based on the underlying equity, assets, earnings or other similar

rights of a company in mainland China that operates its main business in mainland China. The Trial Measures states that, any post-listing

follow-on offering by an issuer in an overseas market, including issuance of shares, convertible notes and other similar securities, shall

be subject to filing requirement within three business days after the completion of the offering. Further, at the press conference held

for the Trial Measures on February 17, 2023, officials from the CSRC clarified that the PRC domestic companies that have already been

listed overseas on or before the effective date of the Trial Measures, March 31, 2023, shall be deemed as existing issuers, or the Existing

Issuers. Existing Issuers are not required to complete the filing procedures immediately but shall carry out filing procedures as required

if they conduct refinancing or are involved in other circumstances that require filing with the CSRC. Therefore, in the opinion of our

PRC legal counsel, Han Kun Law Offices, we are required to go through filing procedures with the CSRC within three business days after

the completion of the offerings under this prospectus supplement and for our future offerings and listing of our securities in an overseas

market under the Trial Measures. We will begin the process of preparing a report and other required materials in connection with the CSRC

filing, which will be submitted to the CSRC in due course. If we fail to complete such filing requirement, Chinese regulatory authorities

may impose fines and penalties upon the PRC operating entities’ operations in China, limit the PRC operating entities’ operating

privileges in China, delay or restrict the repatriation of the proceeds from the offerings in connection with this registration statement

into China, or take other actions that could have a material adverse effect upon the PRC operating entities’ business, financial

condition, results of operations, reputation and prospects, as well as the trading price of our securities. The officials from the CSRC

have also confirmed that for the PRC domestic companies that seek to list overseas with VIE structure, the CSRC will solicit opinions

from relevant regulatory authorities and complete the filing of the overseas listing of companies with VIE structure which meet the compliance

requirements. As the Trial Measures were newly published, there are substantial uncertainties as to the implementation and interpretation,

and how they will affect our current listing, and future offering or financing. If we are required by the Trial Measures for any future

offering or any other financing activities to file with the CSRC, we cannot assure you that we will be able to complete such filings in

a timely manner, or even at all. Any failure of us to fully comply with new regulatory requirements may significantly limit or completely

hinder our ability to continue to offer our securities, cause significant disruption to the business operations of the PRC operating entities,

severely damage our reputation, materially and adversely affect our financial condition and results of operations and cause our securities

to significantly decline in value or become worthless.

As of the date of this

prospectus supplement, in the opinion of PRC legal counsel, Han Kun Law Offices, although we are required to complete the filing procedure

in connection with our offerings under the Trial Measures, no relevant PRC laws or regulations in effect require that we or the PRC operating

entities obtain permission from any PRC authorities to issue securities to foreign investors in connection with a potential offering made

pursuant to this prospectus supplement as of the date of this prospectus supplement, and neither we nor the PRC operating entities have

received any inquiry, notice, warning, sanction, or any regulatory objection to the offerings in connection with this registration statement

from the CSRC, the CAC, or any other PRC authorities that have jurisdiction over our operations.

In the opinion of our PRC

counsel, Han Kun Law Offices, neither we nor the PRC operating entities are subject to cybersecurity review with the Cyberspace Administration

of China, or the “CAC,” under the Cybersecurity Review Measures which became effective on February 15, 2022, since we or the

PRC operating entities have not been notified by the regulatory authorities as critical information infrastructure operators, and we or

the PRC operating entities currently do not have over one million users’ personal information and do not anticipate that we will

be collecting over one million users’ personal information in the foreseeable future, which we understand might otherwise subject

us, our subsidiaries or the PRC operating entities to the Cybersecurity Review Measures. On November 14, 2021, the CAC released the Regulations

on the Network Data Security Management (Draft for Comments), or the Data Security Management Regulations Draft, to solicit public opinion

and comments. Pursuant to the Data Security Management Regulations Draft, data processor holding more than one million users/users’

individual information shall be subject to cybersecurity review before listing abroad. Data processing activities refers to activities

such as the collection, retention, use, processing, transmission, provision, disclosure, or deletion of data. As of the date of this prospectus

supplement, the MDMOOC online platform has more than 194,370 registered users, and we and the PRC operating entities currently do not

hold more than one million users/users’ individual information. However, we or the PRC operating entities may be deemed as a data

processor under the Data Security Management Regulations Draft. As of the date of this prospectus supplement, we or the PRC operating

entities have not been informed by any PRC governmental authority of any requirement that we file for a cybersecurity review. However,

if we are deemed to be a critical information infrastructure operator or a company that is engaged in data processing and holds personal

information of more than one million users, we could be subject to PRC cybersecurity review. See “Prospectus Supplement Summary

– Permission Required from the PRC Authorities to Issue Our Securities to Foreign Investors.”

As of the date hereof,

in the opinion our PRC legal counsel, Han Kun Law Offices, we are in compliance with the applicable PRC laws and regulations governing

the data privacy and personal information in all material respects, including the data privacy and personal information requirements of

the Cyberspace Administration of China, and we have not received any complaints from any third party, or been investigated or punished

by any PRC competent authority in relation to data privacy and personal information protection. However, as there remains significant

uncertainty in the interpretation and enforcement of relevant PRC cybersecurity laws and regulations, we could be subject to cybersecurity

review, and if so, we may not be able to pass such review in relation to the offerings in connection with this registration statement.

In addition, we could become subject to enhanced cybersecurity review or investigations launched by PRC regulators in the future. Any

failure or delay in the completion of the cybersecurity review procedures or any other non-compliance with the related laws and regulations

may result in fines or other penalties, including suspension of business, website closure, removal of our app from the relevant app stores,

and revocation of prerequisite licenses, as well as reputational damage or legal proceedings or actions against us, which may have material

adverse effect on our business, financial condition or results of operations.

Pursuant

to the Holding Foreign Companies Accountable Act (the “HFCAA”), if the Public Company Accounting Oversight Board, or the

PCAOB, is unable to inspect an issuer’s auditors for three consecutive years, the issuer’s securities are prohibited to trade

on a U.S. stock exchange. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable

Act (“AHFCAA”), which, if signed into law, would amend the HFCA Act and require the SEC to prohibit an issuer’s securities

from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three

consecutive years. Pursuant to the HFCA Act, the PCAOB issued a Determination Report on December 16, 2021 which found that the PCAOB

is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland China of the PRC, and

(2) Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to

these determinations. On August 26, 2022, the CSRC, the Ministry of Finance of the PRC, and PCAOB signed a Statement of Protocol, or

the Protocol, governing inspections and investigations of audit firms based in China and Hong Kong. Pursuant to the Protocol, the PCAOB

has independent discretion to select any issuer audits for inspection or investigation and has the unfettered ability to transfer information

to the SEC. Under the PCAOB’s rules, a reassessment of a determination under the HFCA Act may result in the PCAOB reaffirming,

modifying or vacating the determination. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete

access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate

its previous determinations to the contrary. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections

of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainty and depends on a

number of factors out of our, and our auditor’s, control. The PCAOB is continuing to demand complete access in mainland China and

Hong Kong moving forward, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB

has indicated that it will act immediately to consider the need to issue new determinations with the HFCA Act if needed and does not

have to wait another year to reassess its determinations. In the future, if there is any regulatory change or step taken by PRC regulators

that does not permit our auditor to provide audit documentations located in China or Hong Kong to the PCAOB for inspection or investigation,

or the PCAOB expands the scope of the Determination so that we are subject to the HFCA Act, as the same may be amended, you may be deprived

of the benefits of such inspection which could result in limitation or restriction to our access to the U.S. capital markets and trading

of our securities, including trading on the national exchange and trading on “over-the-counter” markets, may be prohibited

under the HFCA Act. On December 29, 2022, a legislation entitled “Consolidated Appropriations Act, 2023” (the “Consolidated

Appropriations Act”), was signed into law by President Biden. The Consolidated Appropriations Act contained, among other things,

an identical provision to AHFCAA, which reduces the number of consecutive non-inspection years required for triggering the prohibitions

under the Holding Foreign Companies Accountable Act from three years to two. See “Item 3. Key Information—D. Risk Factor

— The recent joint statement by the SEC and the PCAOB, proposed rule changes submitted by Nasdaq, and the Holding Foreign Companies

Accountable Act all call for additional and more stringent criteria to be applied to emerging market companies upon assessing the qualification

of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to

our offering.” in the Annual Report.

Marcum Asia CPAs LLP (“MarcumAsia”

formerly known as “Marcum Bernstein & Pinchuk LLP”) was our auditor for the financial statements for the fiscal year ended

December 31, 2021. The Company then appointed Prager Metis CPAs, LLC (“Prager Metis”) as the independent registered public

accounting firm. Prager Metis replaced MarcumAsia, which the Company dismissed effective as of September 27, 2022. Both MarcumAsia and

Prager Metis are headquartered in New York, New York, registered with PCAOB and subject to laws in the United States pursuant to which

the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Neither our former auditor,

MarcumAsia, nor our current auditor, Prager Metis, was/is headquartered in mainland China or Hong Kong or was identified in the Determination

Report as a firm subject to the PCAOB’s determination.

We intend to keep any future

earnings to re-invest in and finance the expansion of the business of the PRC operating entities, and we do not anticipate that any cash

dividends will be paid in the foreseeable future. Under Cayman Islands law, a Cayman Islands company may pay a dividend on its shares

out of either profit or share premium amount, provided that in no circumstances may a dividend be paid if this would result in the Company

being unable to pay its debts due in the ordinary course of business. Cash proceeds raised from overseas

financing activities, including the cash proceeds from this offering, may be transferred by Zhongchao Cayman to Zhongchao HK, and then

transferred to Zhongchao WFOE via capital contribution or shareholder loans, as the case may be. Cash proceeds may flow to the VIE from

Zhongchao WFOE pursuant to certain contractual agreements between Zhongchao WFOE and the VIE as permitted by the applicable PRC regulations.

The process for sending such proceeds back to mainland China may be time-consuming after the closing of this offering. We may be unable

to use these proceeds to grow the business of the PRC operating entities until the PRC operating entities receive such proceeds in mainland

China. Any transfer of funds by us to our PRC subsidiaries, either as a shareholder loan or as an increase in registered capital, are

subject to PRC regulations. As a holding company, for Zhongchao Cayman’s cash and financing requirements, Zhongchao Cayman may rely

on transfer of funds, dividends and other distributions on equity paid by Zhongchao HK, which relies on transfer of funds, dividends and

other distributions by Zhongchao WFOE, which relies on payment by the PRC operating entities pursuant to the Contractual Arrangement.

If any of these entities incurs debt on its own behalf in the future, the instruments governing such debt may restrict their ability to

pay dividends, make distribution or transfer funds to Zhongchao Cayman. See “Prospectus Supplement Summary – Dividend Distributions

or Transfers of Cash among the Holding Company, Its Subsidiaries, and the Consolidated VIE” on page S-6 of this prospectus

supplement.

For the year ended December

31, 2023, Zhongchao Cayman made cash transfer of $0.1 million to Zhongchao USA. For the year ended December 31, 2022, Zhongchao Cayman

made cash transfer of $1.5 million to Zhongchao USA. Except as otherwise disclosed above, for the years ended December 31, 2023 and 2022,

no other cash transfer or transfer of other assets have occurred between Zhongchao Cayman, its subsidiaries, the consolidated VIE and

the subsidiaries of the VIE. For the years ended December 31, 2023 and 2022, none of our subsidiaries, the consolidated VIE, or the subsidiaries

of the VIE have made any dividends or distributions to Zhongchao Cayman. For the years ended December 31, 2023 and 2022, no dividends

or distributions have been made to any U.S. investors.

We plan to distribute earnings

or settle amounts owed under the Contractual Arrangements with the VIE when required in the future. As of the date of this prospectus

supplement, none of Zhongchao HK, Zhongchao WFOE and the PRC operating entities have made any dividends to Zhongchao Cayman. As of the

date of this prospectus supplement, we have not made any dividends or distributions to any U.S. investors. As of the date of this prospectus

supplement, Zhongchao Cayman and its subsidiaries, as well as the PRC operating entities have not adopted or maintained any other cash

management policies and procedures, and each entity needs to comply with applicable law or regulations with respect to transfer of funds,

dividends and distributions with other entities.

The PRC government also

imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Cash in mainland China

may not be available to fund operations or for other use outside of the PRC due to interventions in or the imposition of restrictions

and limitations on the ability of the Company, it subsidiaries and the PRC operating entities by the PRC government to transfer cash or

assets. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency

for the payment of dividends from our profits, if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future,

the instruments governing the debt may restrict their ability to pay dividends or make other payments. If we or our subsidiaries are unable

to receive all of the revenues from the PRC operating entities’ operations through the current Contractual Arrangements, we may

be unable to pay dividends on our Class A Ordinary Shares. See “Item 3. Key Information—D. Risk Factor — Governmental

control of currency conversion may limit our ability to use our revenues effectively and the ability of our PRC subsidiaries to obtain

financing” in the Annual Report.

The transfer of funds among

the PRC operating entities are subject to the Provisions of the Supreme People’s Court on Several Issues Concerning the Application

of Law in the Trial of Private Lending Cases (2020 Second Amendment Revision, the “Provisions on Private Lending Cases”),

which was implemented on January 1, 2021 to regulate the financing activities between natural persons, legal persons and unincorporated

organizations. In the opinion of our PRC counsel, Han Kun Law Offices, the Provisions on Private Lending Cases does not prohibit using

cash generated from one PRC operating entity to fund another affiliated PRC operating entity’s operations. We or the PRC operating

entities have not been notified of any other restriction which could limit the PRC operating entities’ ability to transfer cash

among each other. In the future, cash proceeds from overseas financing activities, including this offering, may be transferred by Zhongchao

Cayman to Zhongchao HK, and then transferred to Zhongchao WFOE via capital contribution or shareholder loans, as the case may be. Cash

proceeds may flow to Zhongchao Shandong from Zhongchao WFOE pursuant to the Contractual Arrangements between Zhongchao WFOE and Zhongchao

Shandong as permitted by the applicable PRC regulations. For more details, see “Prospectus Supplement Summary — Dividend

Distributions or Transfers of Cash among the Holding Company, Its Subsidiaries, and the PRC Operating Entities” starting on

page S-6 of this prospectus supplement.

Cash dividends, if any,

on our Class A Ordinary Shares will be paid in U.S. dollars. If we are considered a PRC tax resident enterprise for tax purposes, any

dividends we pay to our overseas shareholders may be regarded as China-sourced income and as a result may be subject to PRC withholding

tax at a rate of up to 10.0%. In order for us to pay dividends to our shareholders, we will rely on payments made from Zhongchao Shanghai

to Zhongchao WFOE, pursuant to the Contractual Arrangements between them, and the distribution of such payments to Zhongchao HK as dividends

from Zhongchao WFOE. Certain payments from Zhongchao Shanghai to Zhongchao WFOE are subject to PRC taxes, including business taxes and

value added tax.

Further, any transfer of

funds by us to our PRC subsidiaries, either as a shareholder loan or as an increase in registered capital, are subject to PRC regulations.

Capital contributions to our PRC subsidiaries are subject to the report to the Ministry of Commerce of the People’s Republic of

China, or the MOFCOM, in its local branches and registration with a local bank authorized by the China’s State Administration of

Foreign Exchange, or the SAFE. Any foreign loan procured by our PRC subsidiaries is required to be registered or filed with the SAFE or

its local branches or satisfy relevant requirements as provided by the SAFE. Any medium- or long-term loan to be provided by us to the

VIEs must be registered with the National Development and Reform Commission, or the NDRC, and the SAFE or its local branches. We may not

be able to obtain these government approvals or complete such registrations on a timely basis, if at all, with respect to future capital

contributions or foreign loans by us to our PRC subsidiaries. If we fail to receive such approvals or complete such registration or filing,

our ability to use the proceeds of our financing activities and to capitalize our PRC operations may be negatively affected, which could

adversely affect our liquidity and our ability to fund and expand our business. See “Item 3. Key Information—D. Risk

Factors— Risks Related to Doing Business in China—PRC regulation of loans and direct investment by offshore holding companies

to PRC entities may delay or prevent us from using the proceeds of the initial public offering or any subsequent offerings to make loans

or additional capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and our ability to

fund and expand our business” in the Annual Report.

We are a Cayman Islands

company and consolidate the financial results of the PRC operating entities through the Contractual Arrangement. The substantially all

of the operations and assets of the PRC operating entities are located in China. In addition, our management consists of five officers

who are all located in China and three independent directors, among which two (Mr. John C. General and Mr. Kevin Dean Vassily) are located

in the United States and one (Ms. Dan Li) is located in China. A substantial portion of the assets of these persons is located outside

the United States. As a result, it may be difficult for you to effect service of process within the United States upon these persons.

It may also be difficult for you to enforce the U.S. courts judgments obtained in U.S. courts including judgments based on the civil liability

provisions of the U.S. federal securities laws against us and our officers and directors, none of whom (except two independent director)

are residents in the United States, and whose significant assets are located outside the United States.

Neither

the Securities and Exchange Commission, any state securities commission, nor any other regulatory body has approved or disapproved of

these securities or determined if this prospectus supplement and the prospectus to which it relates are truthful and complete. Any representation

to the contrary is a criminal offense.

| | |

Per

Share | | |

Total | |

| Registered Direct Offering Price | |

$ | 0.30 | | |

$ | 928,200 | |

| Proceeds to Zhongchao Inc. (before expenses) | |

$ | 0.30 | | |

$ | 928,200 | |

The date of this prospectus

supplement is October 1, 2024.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

You

should carefully read this entire prospectus supplement and the accompanying base prospectus, including the information included and referred

to under “Risk Factors” below, the information incorporated by reference in this prospectus supplement and in the accompanying

base prospectus, and the financial statements and the other information incorporated by reference in the accompanying base prospectus,

before making an investment decision.

This

prospectus supplement and the accompanying base prospectus form part of a registration statement on Form F-3 that we filed with

the Securities and Exchange Commission, or SEC, using a “shelf” registration process. This document contains two parts. The

first part consists of this prospectus supplement, which provides you with specific information about this offering. The second part,

the accompanying base prospectus, provides more general information, some of which may not apply to this offering. Generally, when we

refer only to the “prospectus,” we are referring to both parts combined. This prospectus supplement may add, update, or change

information contained in the accompanying base prospectus. To the extent that any statement we make in this prospectus supplement is inconsistent

with statements made in the accompanying base prospectus or any documents incorporated by reference herein or therein, the statements

made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying base prospectus and such documents

incorporated by reference herein and therein

This prospectus supplement

and the accompanying base prospectus relate to the offering of Class A Ordinary Shares. Before buying any securities offered hereby, we

urge you to carefully read this prospectus supplement and the accompanying base prospectus, together with the information incorporated

herein and therein by reference as described under the headings “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference.” These documents contain important information that you should consider when making your investment

decision. This prospectus supplement may add, update, or change information in the accompanying base prospectus.

You

should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide

you with additional or different information. The prospectus may be used only for the purposes for which it has been published. If you

receive any other information, you should not rely on it. You should assume that the information contained in this prospectus is accurate

only as of the date on the front cover. Our business, financial condition, results of operations or prospects may have changed since that

date. You should not rely on or assume the accuracy of any representation or warranty in any agreement that we have filed as an exhibit

to the registration statement of which this prospectus is a part or that we may otherwise publicly file in the future because any such

representation or warranty may be subject to exceptions and qualifications contained in separate disclosure schedules, may represent the

parties’ risk allocation in the particular transaction, may be qualified by materiality standards that differ from what may be viewed

as material for securities law purposes or may no longer continue to be true as of any given date. No offer of these securities is being

made in any jurisdiction where such offer or sale is prohibited.

Unless

we otherwise specify, when used in this prospectus supplement, the terms “Zhongchao,” the “Company,” “we,”

“our” and “us” refer to Zhongchao Inc. and its subsidiaries, except that when such terms are used in this prospectus

supplement in reference to the common shares, they refer specifically to Zhongchao Inc..

COMMONLY

USED DEFINED TERMS

| |

● |

All references to “RMB,” “yuan” and “Renminbi” are to the legal currency of China, all references to “HKD” is to the legal currency of Hong Kong, and all references to “USD,” and “U.S. dollars” are to the legal currency of the United States; |

| |

● |

“Beijing Boya” refers to Beijing Zhongchao Boya Medical Technology Co., Ltd., a PRC company; |

| |

● |

“Beijing Yisuizhen” refers to Beijing Yisuizhen Technology Co., Ltd., a PRC company. |

| |

● |

“China” and “PRC” refer to the People’s Republic of China; |

| |

● |

“Class A Ordinary Shares” refers to the Class A ordinary shares, $0.001 par value per share in the capital of the Company; |

| |

● |

“Class B Ordinary Shares” refers to the Class B ordinary shares, $0.001 par value per share in the capital of the Company; |

| |

● |

“Controlling Shareholder” refers to Mr. Weiguang Yang, the CEO of the Company; |

| |

● |

“Hainan Muxin” refers to Hainan Muxin Medical Technology Co., Ltd., a PRC company. |

| |

● |

“Liaoning Zhixun” refers to Zhixun Internet Hospital (Liaoning) Co., Ltd., a PRC company. |

| |

● |

“Maidemu Health” refers to Shanghai Maidemu Health Management Co., Ltd., a PRC company. |

| |

● |

“Ordinary Shares” refers to Class A Ordinary Shares and Class B Ordinary Shares, collectively; |

| |

● |

“SAIC” refers to State Administration for Industry and Commerce in China and currently known as State Administration for Market Regulation; |

| |

● |

“Shanghai Huijing” refers to Shanghai Huijing Information Technology Co., Ltd., a PRC company; |

| |

● |

“Shanghai Jingyi” or “Shanghai Zhongxin” refers to Shanghai Zhongxin Medical Technology Co., Ltd, a PRC company, which was formerly known as Shanghai Jingyi, or Shanghai Jingyi Medical Technology Co., Ltd., a PRC company and changed to its current name as Shanghai Zhongxin on November 16, 2020. |

| |

● |

“Shanghai Maidemu” refers to Shanghai Maidemu Cultural Communication Corp., a PRC company; |

| |

● |

“Shanghai Xingzhong” refers to Shanghai Xingzhong Investment Management LP, a PRC company; |

| |

● |

“Shanghai Xinyuan” refers to Shanghai Xinyuan Human Resources Co., Ltd., a PRC company; |

| |

● |

“Shanghai Zhongxun” refers to Shanghai Zhongxun Medical Technology Co., Ltd., a PRC company; |

| |

● |

“West Angel” refers to West Angel (Beijing) Health Technology Co., Ltd., a PRC company. |

| |

● |

“Xinjiang Pharmaceutical” refers to Chongqing Xinjiang Pharmaceutical Co., Ltd., a PRC company. |

| |

● |

“Zhongchao BVI” refers to Zhongchao Group Inc., a British Virgin Island company; |

| |

● |

“Zhongchao HK” refers to Zhongchao Group Limited, a Hong Kong company; |

| |

● |

“Zhongchao Shanghai” refers to Zhongchao Medical Technology (Shanghai) Co., Ltd., a PRC company; and |

| |

● |

“Zhongchao WFOE” refers to Beijing Zhongchao Zhongxing Technology Limited, a PRC company. |

FORWARD-LOOKING

STATEMENTS

This

prospectus supplement and the accompanying prospectus, including the documents that we incorporate herein and therein by reference, contain

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Any statements about our expectations, beliefs, plans, objectives, assumptions or future

events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through

the use of words or phrases such as “may,” “will,” “could,” “should,” “expects,”

“intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“projects,” “potential,” “continue,” and similar expressions, or the negative of these terms, or similar

expressions. Accordingly, these statements involve estimates, assumptions, risks and uncertainties which could cause actual results to

differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors

discussed throughout this prospectus supplement and the accompanying prospectus, and in particular those factors referenced in the section

“Risk Factors.”

This

prospectus supplement and the accompanying prospectus contain forward-looking statements that are based on our management’s belief

and assumptions and on information currently available to our management. These statements relate to future events or our future financial

performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed

or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| ● | the direct and indirect impact of the novel coronavirus, or COVID-19, on

our business and operations; |

| ● | our ability to continue normal operations and interactions

with our users during the COVID-19 pandemic; |

| ● | our dependence upon external sources for the financing of

our operations; |

| ● | our ability to obtain and maintain our strategic collaborations

and to realize the intended benefits of such collaborations; |

| ● | our ability to effectively execute our business plan; |

| ● | our ability to continue to innovate and develop new products; |

| ● | our ability to maintain and grow our reputation and to achieve

and maintain the market acceptance of our products; |

| ● | our ability to manage the growth of our operations over time; |

| ● | our ability to maintain adequate protection of our intellectual

property and to avoid violation of the intellectual property rights of others; |

| ● | our ability to gain and maintain regulatory approvals; |

| ● | our ability to maintain relationships with existing customers

and develop relationships with new customers; and |

| ● | our ability to compete and succeed in a highly competitive

and evolving industry. |

These

forward-looking statements are neither promises nor guarantees of future performance due to a variety of risks and uncertainties and other

factors more fully discussed in the “Risk Factors” section in this prospectus supplement and the risk factors and cautionary

statements described in other documents that we file from time to time with the SEC, specifically under “Item 3D. Risk Factors”

and elsewhere in our most recent Annual Report on Form 20-F for the year ended December 31, 2023, and our Reports

on Form 6-K.

Given

these uncertainties, readers should not place undue reliance on our forward-looking statements. These forward-looking statements speak

only as of the date on which the statements were made and are not guarantees of future performance. Except as may be required by applicable

law, we do not undertake to update any forward-looking statements after the date of this prospectus supplement or the respective dates

of documents incorporated by reference that include forward-looking statements.

prospectus

supplement summary

Company Overview

Our Corporate History and Structure

We are a holding company incorporated

on April 16, 2019, as an exempted company under the laws of the Cayman Islands. We have no substantive operations other than holding all

of the issued and outstanding shares of Zhongchao Group Inc., or Zhongchao BVI, established under the laws of the British Virgin Islands

on April 23, 2019.

Zhongchao BVI is also a holding

company holding all of the outstanding equity of Zhongchao Group Limited, or Zhongchao HK, which was established in Hong Kong on May 14,

2019. Zhongchao HK is also a holding company holding all of the outstanding equity of Beijing Zhongchao Zhongxing Technology Limited,

or Zhongchao WFOE, which was established on May 29, 2019 under the laws of the PRC.

We conduct our business through

the VIE, Zhongchao Medical Technology (Shanghai) Corp., or Zhongchao Shanghai, a PRC company, and through 11 subsidiaries of Zhongchao

Shanghai, including Shanghai Zhongxun, Shanghai Zhongxin, Maidemu Health, Beijing Boya, Shanghai Xinyuan, Hainan Muxin, Shanghai Huijing,

Xinjiang Pharmaceutical, Beijing Yisuizhen, West Angel and Liaoning Zhixun, each a PRC company. They commenced their operations under

the name Zhongchao Medical Consulting (Shanghai) Limited, or Shanghai Zhongchao Limited, a limited liability company established under

the laws of the PRC, to provide medical online and offline training services.

Zhongchao Shanghai was incorporated

on August 17, 2012 by Juru Guo and Baorong Xue, who held 60% and 40% equity interests in Zhongchao Shanghai respectively. On May 25, 2015,

the two shareholders transferred all equity interests to Weiguang Yang who held 100% equity interests in Zhongchao Shanghai after the

transfer. On January 15, 2016, the name was changed to Zhongchao Medical Technology (Shanghai) Co., Ltd. On February 5, 2016, the management

completed its registration with the State Administration for Industry and Commerce, or SAIC, to convert Shanghai Zhongchao Limited into

a company limited by shares, or Zhongchao Shanghai. Through direct ownership, Zhongchao Shanghai has established subsidiaries and branch

offices in various cities in PRC, including Beijing, Shanghai, Hainan, Liaoning and Chongqing.

On April 16, 2019, Zhongchao

Cayman was incorporated in the Cayman Islands as an exempted company with limited liability, shortly following which More Healthy Holdings

Limited acquired 5,497,715 Class B Ordinary Shares of par value US$0.0001 per share as founder shares, representing, at that time, 80.94%

of total voting power of the Company, on converted basis, given that each Class B Ordinary Share was entitled to 15 votes and each Class

A Ordinary Share was entitled to 1 vote and assuming the exercise of the HF Warrant (as defined below). More Healthy Holdings Limited

is a BVI company 100% owned by Weiguang Yang (“More Healthy”).

As part of the Company’s

organization for the purpose of the initial public offering and listing on Nasdaq, on August 1, 2019, the Company and HF Capital Management

Delta, Inc., a company incorporated under the laws of the Cayman Islands (“HF Capital”) entered into a certain warrant agreement

to purchase Class A Ordinary Shares of the Company (the “HF Warrant”). At the issuance of the HF Warrant, Yantai Hanfujingfei

Investment Centre (LP), a limited partnership incorporated under PRC laws (“Yantai HF”, whose managing partner, Hanfor Capital

Management Co., Ltd., was the sole member of HF Capital, and together with “HF Capital” hereinafter collectively referred

to as “HF”) was a 6.25% shareholder of Zhongchao Shanghai and planned to withdraw its capital contribution in Zhongchao Shanghai

but to contribute the same amount of capital to Zhongchao Cayman directly via HF Capital.

On July 5, 2023, the Company

held an annual general meeting of shareholders at which shareholders resolved to amend and restate the Company’s memorandum and articles

of association, pursuant to which each holder of Class B Ordinary Shares became entitled to one hundred (100) votes for each Class B Ordinary

Shares held. Each shareholder of the Company’s Class A Ordinary Shares remains entitled to one (1) vote for each Class A Ordinary

Share held.

On February 20, 2024, the

Company held an extraordinary general meeting of shareholders at which shareholders resolved that: (a) with effect upon the commencement

of the second business day following the extraordinary general meeting or such later date as the Company’s board of directors may determine,

that the authorized, issued, and outstanding shares of the Company be consolidated and divided by consolidating: (i) every ten (10) Class

A Ordinary Shares with a par value of US$0.0001 each into one (1) Class A Ordinary Share with a par value of US$0.001 each; and (ii) every

ten (10) Class B Ordinary Shares with a par value of US$0.0001 each into one (1) Class B Ordinary Share with a par value of US$0.001 each,

with such consolidated shares having the same rights and being subject to the same restrictions (save as to par value) as the previously

existing shares of such class (the “Share Consolidation”); (b) subject to and immediately following the Share Consolidation

being effected, the authorized share capital of the Company be increased from US$50,000 divided into 45,000,000 Class A Ordinary Shares

with a par value of US$0.001 each and 5,000,000 Class B Ordinary Shares with a par value of US$0.001 each to US$500,000 divided into 450,000,000

Class A Ordinary Shares with a par value of US$0.001 each and 50,000,000 Class B Ordinary Shares with a par value of US$0.001 each (the

“Share Capital Increase”); and (c) subject to the Share Consolidation and the Share Capital Increase being approved and effected,

the Company adopt an amended and restated memorandum and articles of association in substitution for, and to the exclusion of, the Company’s

existing memorandum and articles of association, to reflect corrected typographical corrections, the Share Consolidation and the Share

Capital Increase.

The Share Consolidation and

the Share Capital Increase were subsequently effected, and the Company’s memorandum and articles of association were amended and restated,

on February 29, 2024.

Beginning with the opening

of trading on February 29, 2024, the Company’s Class A Ordinary Shares began trading on a post-Share Consolidation basis on the

Nasdaq Capital Market under the same symbol “ZCMD,” but under a new CUSIP number of G9897X115.

Contractual Arrangements between the Zhongchao

WFOE and Zhongchao Shanghai

Zhongchao Inc. (the “Company”

or “Zhongchao Cayman”) is an offshore holding company incorporated in the Cayman Islands as an exempted company with limited

liability. As a holding company with no material operations of our own, we, through the contractual arrangements (the “Contractual

Arrangements”), between Beijing Zhongchao Zhongxing Technology Limited (“Zhongchao WFOE”), a wholly subsidiary of Zhongchao

Cayman incorporated in the PRC, and a variable interest entity (the “VIE”), Zhongchao Medical Technology (Shanghai) Co., Ltd.

(“Zhongchao Shanghai”) and its subsidiaries or collectively “the PRC operating entities”, consolidate the financial

results of the PRC operating entities. Due to the restrictions imposed by PRC laws and regulations on foreign ownership of companies engaged

in value-added telecommunication services and certain other businesses, we operate our businesses in which foreign investment is restricted

or prohibited in the PRC through certain PRC domestic companies. Accordingly, the Contractual Arrangements are designed to allow Zhongchao

Cayman to consolidate Zhongchao Shanghai’s operations and financial results in Zhongchao Cayman’s financial statements in

accordance with U.S. GAAP as the primary beneficiary. Neither we nor our subsidiaries own any equity interests in the PRC operating entities.

As we chose such VIE structure,

we are subject to certain unique risks and uncertainties that may not otherwise exist if we had direct equity ownership in the PRC operating

entities. Because we do not directly hold equity interests in the VIE and its subsidiaries, our Contractual Arrangements may not be effective

in providing control over Zhongchao Shanghai. Further, we are subject to risks due to uncertainty of the interpretation and the application

of the PRC laws and regulations, including but not limited to limitations on foreign ownership and regulatory review of overseas listing

of PRC companies through a special purpose vehicle, and the validity and enforcement of the Contractual Arrangements. We are also subject

to the risks of uncertainty about any future actions of the PRC government in this regard that could disallow the VIE structure, which

would likely result in a material change in the PRC operating entities’ operations and cause the value of our securities to decrease

significantly or become worthless. However, as of the date of this prospectus supplement, the agreements under the Contractual Arrangements

have not been tested in any courts of law.

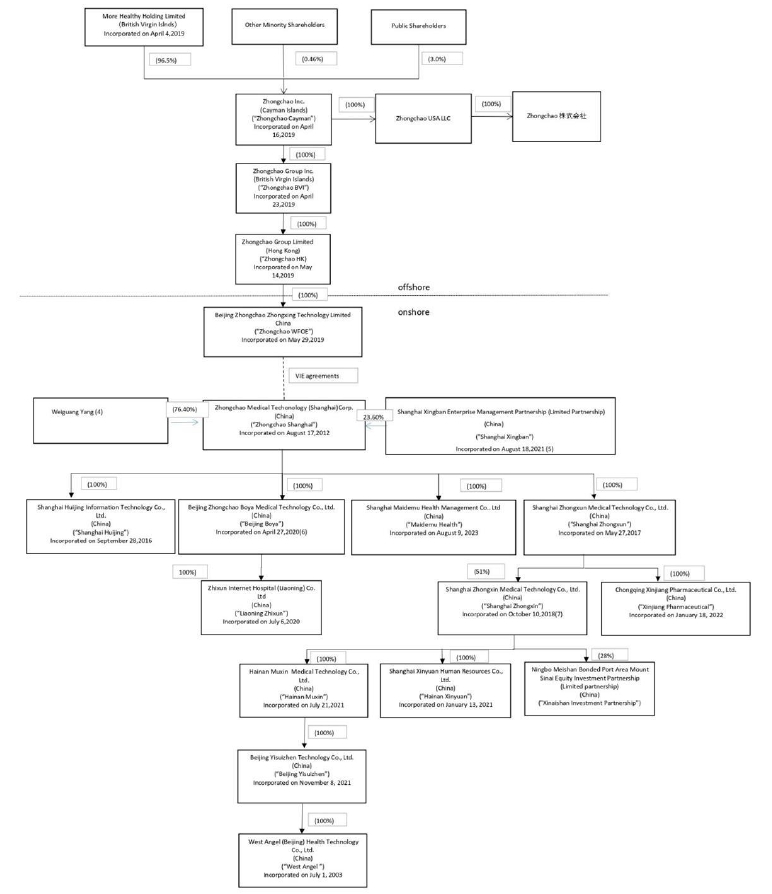

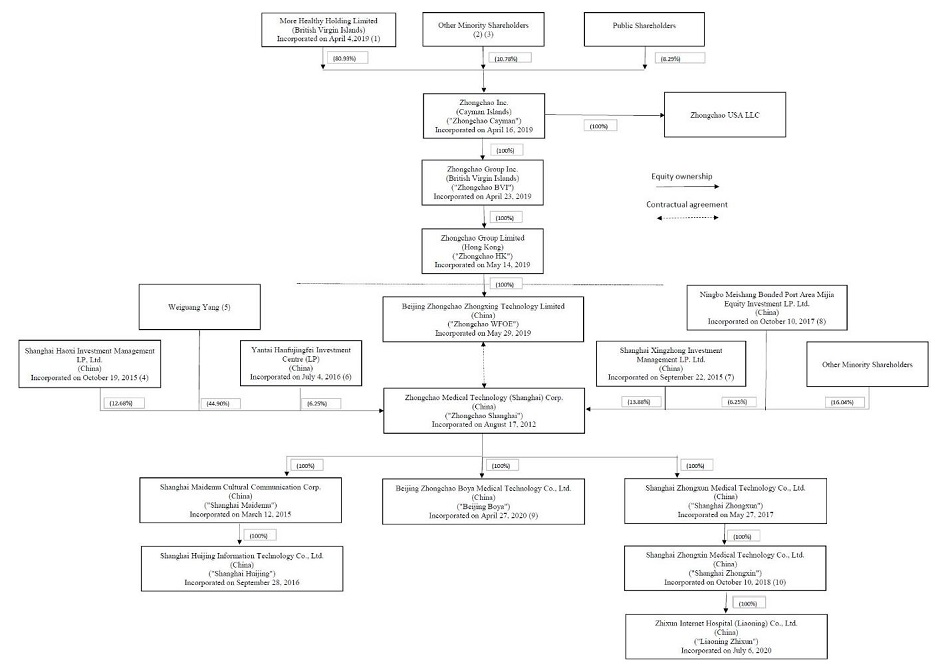

The following charts summarize

our corporate legal structure and identify our subsidiaries, our VIE and its subsidiaries.

Permission Required from the PRC Authorities

to Issue Our Securities to Foreign Investors

As of the date of this prospectus

supplement, in the opinion of our PRC legal counsel, Han Kun Law Offices, although we are required to complete the filing procedure in

connection with our offerings under the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic Companies,

or the Trial Measures, no relevant PRC laws or regulations in effect require that we or the PRC operating entities obtain permission from

any PRC authorities to issue securities to foreign investors in connection with a potential offering made pursuant to this prospectus

supplement as of the date of this prospectus supplement, and neither we nor the PRC operating entities have received any inquiry, notice,

warning, sanction, or any regulatory objection to the offerings in connection with this registration statement from the China Securities

Regulatory Commission (the “CSRC”), Cyberspace Administration of China (the “CAC”), or any other PRC authorities

that have jurisdiction over our operations.

PRC laws and regulations governing

our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material change in the PRC

operating entities’ operations, significant depreciation of the value of our securities, or a complete hindrance of our ability

to offer or continue to offer our securities to investors and cause the value of such securities to significantly decline or be worthless.

The Chinese government may intervene or influence the operations of the PRC operating entities at any time and may exert more control

over offerings conducted overseas and/or foreign investment in China-based issuers, which could result in a material change in the operations

of the PRC operating entities and/or the value of our securities. Further, any actions by the Chinese government to exert more oversight

and control over offerings that are conducted overseas and/or foreign investment in China-based issuers could significantly limit or completely

hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline

or be worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations

in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over

the use of variable interest entities for overseas listing, adopting new measures to extend the scope of cybersecurity reviews, and expanding

the efforts in anti-monopoly enforcement. On February 17, 2023, the CSRC promulgated the Trial Administrative Measures of the Overseas

Securities Offering and Listing by Domestic Companies, or the Trial Measures, and five supporting guidelines, which became effective on

March 31, 2023. According to the Trial Measures, among other requirements, (1) domestic companies that seek to offer or list securities

overseas, both directly and indirectly, should fulfil the filing procedures with the CSRC; if a domestic company fails to complete the

filing procedure or conceals any material fact or falsifies any major content in its filing documents, such domestic company may be subject

to administrative penalties; (2) if the issuer meets both of the following conditions, the overseas offering and listing shall be determined

as an indirect overseas offering and listing by a domestic company: (i) any of the total assets, net assets, revenues or profits of the

domestic operating entities of the issuer in the most recent accounting year accounts for more than 50% of the corresponding figure in

the issuer’s audited consolidated financial statements for the same period; (ii) its major operational activities are carried out

in China or its main places of business are located in China, or the senior managers in charge of operation and management of the issuer

are mostly Chinese citizens or are domiciled in China; (3) where a domestic company seeks to indirectly offer and list securities in an

overseas market, the issuer shall designate a major domestic operating entity responsible for all filing procedures with the CSRC, and

such filings shall be submitted to the CSRC within three business days after the submission of the overseas offering and listing application;

and (4) if the issuer issues securities in the same overseas market after the initial issuance and listing, it shall submit filings with

the CSRC within three business days after the completion of the issuance. Further, at the press conference held for the Trial Measures

on February 17, 2023, officials from the CSRC clarified that the PRC domestic companies that have already been listed overseas on or before

the effective date of the Trial Measures, March 31, 2023, shall be deemed as existing issuers, or the Existing Issuers. Existing Issuers

are not required to complete the filing procedures immediately but shall carry out filing procedures as required if they conduct refinancing

or are involved in other circumstances that require filing with the CSRC. Therefore, in the opinion of our PRC legal counsel, Han Kun

Law Offices, we are required to go through filing procedures with the CSRC within three business days after the completion of the offerings

in connection with this registration statement and for our future offerings and listing of our securities in an overseas market under

the Trial Measures. We will begin the process of preparing a report and other required materials in connection with the CSRC filing, which

will be submitted to the CSRC in due course. If we fail to complete such filing requirement, Chinese regulatory authorities may impose

fines and penalties upon the PRC operating entities’ operations in China, limit the PRC operating entities’ operating privileges

in China, delay or restrict the repatriation of the proceeds from the offerings in connection with this registration statement into China,

or take other actions that could have a material adverse effect upon the PRC operating entities’ business, financial condition,

results of operations, reputation and prospects, as well as the trading price of our securities.

The officials from the CSRC

have also confirmed that for the PRC domestic companies that seek to list overseas with VIE structure, the CSRC will solicit opinions

from relevant regulatory authorities and complete the filing of the overseas listing of companies with VIE structure which meet the compliance

requirements. As the Trial Measures were newly published, there are substantial uncertainties as to the implementation and interpretation,

and how they will affect our current listing, and future offering or financing. If we are required by the Trial Measures for any future

offering or any other financing activities to file with the CSRC, we cannot assure you that we will be able to complete such filings in

a timely manner, or even at all. Any failure of us to fully comply with new regulatory requirements may significantly limit or completely

hinder our ability to continue to offer our securities, cause significant disruption to our business operations, severely damage our reputation,

materially and adversely affect our financial condition and results of operations and cause our securities to significantly decline in

value or become worthless.

In the opinion of our PRC

counsel, Han Kun Law Offices, neither we nor the PRC operating entities are subject to cybersecurity review with the CAC under the Cybersecurity

Review Measures which became effective on February 15, 2022, since we or the PRC operating entities have not been notified by the regulatory

authorities as critical information infrastructure operators, and we or the PRC operating entities and neither we nor the PRC operating

entities currently have over one million users’ personal information and do not anticipate that we will be collecting over one million

users’ personal information in the foreseeable future, which we understand might otherwise subject us to the Cybersecurity Review

Measures. On November 14, 2021, the CAC released the Regulations on the Network Data Security Management (Draft for Comments), or the

Data Security Management Regulations Draft, to solicit public opinion and comments. Pursuant to the Data Security Management Regulations

Draft, data processor holding more than one million users/users’ individual information shall be subject to cybersecurity review

before listing abroad. Data processing activities refers to activities such as the collection, retention, use, processing, transmission,

provision, disclosure, or deletion of data. As of the date of this prospectus supplement, the MDMOOC online platform has more than 194,370

registered users, and we currently do not hold more than one million users/users’ individual information. However, we or the PRC

operating entities may be deemed as a data processor under the Data Security Management Regulations Draft. As of the date of this prospectus

supplement, neither we nor the PRC operating entities have been informed by any PRC governmental authority of any requirement that we

or the PRC operating entities file for a cybersecurity review. However, if we or the PRC operating entities are deemed to be a critical

information infrastructure operator or a company that is engaged in data processing and holds personal information of more than one million

users, we or the PRC operating entities could be subject to PRC cybersecurity review.

Permission Required from the PRC Authorities

for Our and PRC Operating Entities’ Operation in China

As of the date of this prospectus

supplement, except as disclosed in this prospectus and our most recent annual report on Form 20-F on April 30, 2024, we, or the PRC operating

entities are not required to obtain any other permission or approval from the PRC authorities for the PRC operating entities’ operations

in China, nor have we, or the PRC operating entities, received any denial for our operation in China. Given the uncertainties of interpretation

and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, we may be required

to obtain additional licenses, permits, filings or approvals in the future. If any of the PRC operating entities is found to be in violation

of any existing or future PRC laws or regulations, or fail to obtain or maintain any of the requisite licenses and permits, the relevant

PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures. In addition, if any

of the PRC operating entities had inadvertently concluded that such licenses, permits, registrations or filings were not required, or

if applicable laws, regulations or interpretations change in a way that requires any of the PRC operating entities to obtain such licenses,

permits, registrations or filings in the future, the relevant PRC operating entities may be unable to obtain such necessary licenses,

permits, registrations or filings in a timely manner, or at all, and such licenses, permits, registrations or filings may be rescinded

even if obtained. Any such circumstance may subject the relevant PRC operating entities to fines and other regulatory, civil or criminal

liabilities, and the relevant PRC operating entities may be ordered by the competent government authorities to suspend relevant operations,

which will materially and adversely affect our business operations. See “— Risks Related to Doing Business in China—The

PRC operating entities’ failure to obtain, maintain or renew other licenses, approvals, permits, registrations or filings necessary

to conduct their operations in China could have a material adverse impact on our business, financial conditions and results of operations.”

in our most recent annual report on Form 20-F filed on April 30, 2024.

In the opinion of our PRC

legal counsel, Han Kun Law Offices, based on their understanding of the current PRC laws, rules and regulations, that (i) the structure

for operating our business in China (including our corporate structure and VIE Arrangements with Zhongchao Shanghai, Zhongchao Shanghai

and their shareholders), as of the date of this prospectus supplement, do not result in any violation of PRC laws or regulations currently

in effect; and (ii) the Contractual Arrangements among Zhongchao WFOE and Zhongchao Shanghai and their shareholders governed by PRC law

are valid, binding and enforceable in accordance with the terms of each of the VIE Arrangements, and do not result in any violation of

PRC laws or regulations currently in effect. However, there are substantial uncertainties regarding the interpretation and application

of current or future PRC laws and regulations concerning foreign investment in the PRC, and their application to and effect on the legality,

binding effect and enforceability of the Contractual Arrangements. In particular, we cannot rule out the possibility that PRC regulatory

authorities, courts or arbitral tribunals may in the future adopt a different or contrary interpretation or take a view that is inconsistent

with the opinion of our PRC legal counsel.

Dividend Distributions or Transfers of Cash

among the Holding Company, Its Subsidiaries, and the Consolidated VIE

For the year ended December

31, 2023, Zhongchao Cayman made cash transfer of $0.1 million to Zhongchao USA. For the year ended December 31, 2022, Zhongchao Cayman

made cash transfer of $1.5 million to Zhongchao USA. Except as otherwise disclosed above, for the years ended December 31, 2023 and 2022,

no other cash transfer or transfer of other assets have occurred between Zhongchao Cayman, its subsidiaries, the consolidated VIE and

the subsidiaries of the VIE. For the years ended December 31, 2023 and 2022, none of our subsidiaries, the consolidated VIE, or the subsidiaries

of the VIE have made any dividends or distributions to Zhongchao Cayman. For the years ended December 31, 2023 and 2022, no dividends

or distributions have been made to any U.S. investors.

We intend to keep any future

earnings to re-invest in and finance the expansion of the business of the PRC operating entities, and we do not anticipate that any cash

dividends will be paid in the foreseeable future. Under Cayman Islands law, a Cayman Islands company may pay a dividend on its shares

out of either profit or share premium amount, provided that in no circumstances may a dividend be paid if this would result in the Company

being unable to pay its debts due in the ordinary course of business. Cash proceeds raised from overseas financing activities, including

the cash proceeds from this offering, may be transferred by Zhongchao Cayman to Zhongchao HK, and then transferred to Zhongchao WFOE via

capital contribution or shareholder loans, as the case may be. Cash proceeds may flow to the VIE from Zhongchao WFOE pursuant to certain

contractual agreements between Zhongchao WFOE and the VIE as permitted by the applicable PRC regulations. The process for sending such

proceeds back to the mainland China may be time-consuming after the closing of this offering. We may be unable to use these proceeds to

grow the business of the PRC operating entities until the PRC operating entities receive such proceeds in mainland China. Any transfer

of funds by us to our PRC subsidiaries, either as a shareholder loan or as an increase in registered capital, are subject to PRC regulations.

Capital contributions to our PRC subsidiaries are subject to the report to the Ministry of Commerce of the People’s Republic of

China, or the MOFCOM, in its local branches and registration with a local bank authorized by the China’s State Administration of

Foreign Exchange, or the SAFE. Any foreign loan procured by our PRC subsidiaries is required to be registered or filed with the SAFE or

its local branches or satisfy relevant requirements as provided by the SAFE. Any medium- or long-term loan to be provided by us to the

VIEs must be registered with the National Development and Reform Commission, or the NDRC, and the SAFE or its local branches. We may not

be able to obtain these government approvals or complete such registrations on a timely basis, if at all, with respect to future capital

contributions or foreign loans by us to our PRC subsidiaries. If we fail to receive such approvals or complete such registration or filing,

our ability to use the proceeds of our financing activities and to capitalize our PRC operations may be negatively affected, which could

adversely affect our liquidity and our ability to fund and expand our business. See “Item 3. Key Information—D. Risk Factors—

Risks Related to Doing Business in China—PRC regulation of loans and direct investment by offshore holding companies to PRC entities

may delay or prevent us from using the proceeds of the initial public offering or any subsequent offerings to make loans or additional

capital contributions to our PRC subsidiary, which could materially and adversely affect our liquidity and our ability to fund and expand

our business” in the Annual Report.

Under our current corporate

structure, we rely on dividend payments from Zhongchao HK and Zhongchao WFOE to fund any cash and financing requirements we may have,

including the funds necessary to pay dividends and other cash distributions to our shareholders or to pay any debt we may incur:

| ● | Zhongchao WFOE’s ability to distribute dividends is based upon its distributable earnings. Current

mainland China regulations permit Zhongchao WFOE to pay dividends to Zhongchao HK in accordance with applicable PRC laws and regulations

under which Zhongchao WFOE can only pay dividends to Zhongchao HK out of its accumulated profits, if any, determined in accordance with

Chinese accounting standards and regulations. Furthermore, Zhongchao WFOE could make payments to Zhongchao HK pursuant to the relevant

agreements between them as permitted by the applicable PRC regulations. In addition, Zhongchao WFOE is required to set aside certain after-tax

profit to fund a statutory reserve as described below in this section. |

| ● | Based on the Hong Kong laws and regulations, as of the date of this prospectus supplement, there is no

restriction imposed by the Hong Kong government on the transfer of capital within, into and out of Hong Kong (including funds from Hong

Kong to mainland China), except transfer of funds involving money laundering and criminal activities and some tax restrictions between

Hong Kong and mainland China as discussed herein below in this section. As a result, Zhongchao HK may further distribute any dividends

or payments (if any) received from Zhongchao WFOE to Zhongchao Cayman as dividends. |

| ● | Under Cayman Islands law, a Cayman Islands company may pay a dividend on its shares out of either profit

or share premium amount, provided that in no circumstances may a dividend be paid if this would result in the company being unable to

pay its debts due in the ordinary course of business. If we determine to pay dividends on any of our Ordinary Shares in the future, as

a holding company, unless we receive proceeds from future offerings, we will be dependent on receipt of funds from Zhongchao HK, which

will be dependent on receipt of dividends or payments (if any) from Zhongchao WFOE, which will be dependent on payments from the VIE in

accordance with the laws and regulations of the PRC and the Contractual Arrangements between them. |

| ● | Cash dividends, if any, on our Class A Ordinary Shares will be paid in U.S. dollars. The PRC government

also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we

may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency for the payment

of dividends from our profits, if any. Cash in mainland China may not be available to fund operations or for other use outside of the

PRC due to interventions in or the imposition of restrictions and limitations on the ability of the Company, it subsidiaries and the PRC

operating entities by the PRC government to transfer cash or assets. Furthermore, if Zhongchao WFOE, Zhongchao HK or the VIE incurs debt

on its own in the future, the instruments governing the debt may restrict their ability to pay dividends or make other payments. If either

Zhongchao WFOE, Zhongchao HK or the VIE is unable to distribute dividends or make payments directly or indirectly to Zhongchao Cayman,

we may be unable to pay dividends on our Ordinary Shares. |

The transfer of funds among

the PRC operating entities are subject to the Provisions of the Supreme People’s Court on Several Issues Concerning the Application

of Law in the Trial of Private Lending Cases (2020 Second Amendment Revision, the “Provisions on Private Lending Cases”),

which was implemented on January 1, 2021 to regulate the financing activities between natural persons, legal persons and unincorporated

organizations. In the opinion of our PRC counsel, Han Kun Law Offices, the Provisions on Private Lending Cases does not prohibit using

cash generated from one PRC operating entity to fund another affiliated PRC operating entity’s operations. We or the PRC operating

entities have not been notified of any other restriction which could limit the PRC operating entities’ ability to transfer cash

among each other. In the future, cash proceeds from overseas financing activities, including this offering, may be transferred by Zhongchao

Cayman to Zhongchao HK, and then transferred to Zhongchao WFOE via capital contribution or shareholder loans, as the case may be. Cash

proceeds may flow to Zhongchao Shandong from Zhongchao WFOE pursuant to the Contractual Arrangements between Zhongchao WFOE and Zhongchao

Shandong as permitted by the applicable PRC regulations.

We plan to distribute earnings

or settle amounts owed under the Contractual Arrangements with the VIE when required in the future. As of the date of this prospectus

supplement, none of Zhongchao HK, Zhongchao WFOE and the PRC operating entities have made any dividends to Zhongchao Cayman. As of the

date of this prospectus supplement, we have not made any dividends or distributions to any U.S. investors. As of the date of this prospectus

supplement, Zhongchao Cayman and its subsidiaries, as well as the PRC operating entities have not adopted or maintained any other cash

management policies and procedures, and each entity needs to comply with applicable law or regulations with respect to transfer of funds,

dividends and distributions with other entities.

In addition, the mainland

China government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance

of currency out of mainland China. Therefore, we may experience difficulties in completing the administrative procedures necessary to