Bally’s Corporation (NYSE: BALY) (“Bally’s” or the “Company”)

today reported financial results for the third quarter ended

September 30, 2024.

Third Quarter 2024 and Recent Highlights

- Company-wide revenue of $630.0 million, a decrease of 0.4%

year-over-year

- Casinos & Resorts revenue of $353.4 million, down 1.6%

year-over-year

- UK online revenues grew 11.8% while overall International

Interactive revenue declined 5.3% year-over-year to $230.9

million

- North America Interactive revenue of $45.7 million, up 54.5%

year-over-year

- Launched second online sportsbook in the UK under the Bally's

brand, joining existing JackpotJoy offering

- Secured $940 million of construction funding for Chicago

project from GLPI

- Began demolition at Tribune site in Chicago; construction

remains on schedule to begin in 2025

- Subsequent to the end of the quarter, completed the controlled

demolition of the Tropicana hotel towers

Summary of Financial Results

Quarter Ended September

30,

(in thousands)

2024

2023

Consolidated Revenue

$

629,974

$

632,477

Casinos & Resorts Revenue

353,358

359,026

International Interactive Revenue

230,937

243,884

North America Interactive Revenue

45,679

29,567

Net loss

(247,855

)

(61,802

)

Adjusted EBITDAR(1)

166,333

________________________________

(1) Refer to tables in this press release

for a reconciliation of this non-GAAP financial measure to the most

directly comparable measure calculated in accordance with GAAP.

Robeson Reeves, Bally’s Chief Executive Officer, commented,

“Bally’s delivered relatively healthy financial results in the 2024

third quarter, with consolidated revenue declining just 0.4% from

the prior year to $630.0 million. On a segment basis, Casinos &

Resorts (“C&R”) revenue declined 1.6% year-over-year and North

American Interactive revenue grew 54.5%, while International

Interactive revenue declined 5.3%, including 11.8% revenue growth

in our U.K. business. During the quarter, we secured a critical

$940 million construction and financing arrangement with Gaming

& Leisure Properties (“GLPI”) which positions the Company to

move forward with the construction of our flagship permanent casino

in the heart of downtown Chicago, America’s third largest city.

Early in the fourth quarter, we also completed the controlled

demolition of the Tropicana hotel towers in Las Vegas, moving the

A’s one step closer to the start of stadium construction and

allowing Bally’s to plan for the broader redevelopment of the site.

Upon completion, the Chicago and Las Vegas development projects

feature unique positioning in their respective markets and

represent two attractive additions to our portfolio that we expect

will drive positive shareholder returns.

“C&R revenue of $353.4 million in the quarter reflects the

generally stable domestic regional gaming environment, although we

saw flow-through decline relative to the prior year period. Results

at our Chicago Temporary Casino have moderated to a somewhat

consistent monthly level and we are focused on running our Chicago

operations with database growth in mind. In Rhode Island, local

bridge construction continues to disrupt traffic during peak

periods which again impacted visitation and revenues at our

flagship Lincoln property. In Atlantic City, previously noted

turnover in our relationship marketing team had an adverse impact

on results in the quarter which included the second half of the

market’s all-important summer season. Primarily reflecting these

impacts, and lower-than-expected hold in Kansas City, third quarter

segment adjusted EBITDAR declined 15.0% year-over-year.

“Our International Interactive business continues to benefit

from healthy U.K. revenue, offset in part by lingering weakness in

other non-U.K. markets, with a particular emphasis on the ongoing

logistical challenges impacting business in Asia. Segment-level

revenue declined 5.3% to $230.9 million though U.K. revenue grew a

healthy 11.8% (8.9% in constant currency). U.K. growth was driven

by all-time high active customer levels and robust Average Revenue

per User metrics along with growing traction for our online sports

betting offerings which include a newly launched Bally’s-branded

product that joins our initial JackpotJoy offering. Despite the

segment revenue decline, adjusted EBITDAR margins improved 400

basis points year-over-year, leading to overall International

Interactive adjusted EBITDAR of $90.0 million, up 5.3%

year-over-year. Flow-through in our International Interactive

segment remains very healthy as a result of diligent U.K. marketing

spend, management of compensation expenses along with the continued

realization of synergies from our technology platform

consolidation.

“North America Interactive operations generated third quarter

revenues of $45.7 million, up 54.5% year-over-year, and an Adjusted

EBITDAR loss of $11.0 million. On balance, we remain very pleased

with the ramp in our iGaming operations in Rhode Island and results

benefited from excellent performance in Pennsylvania during the

quarter. However, we were impacted to a certain extent by softness

in New Jersey. Ultimately, our iGaming product offering and Bally

Bet OSB continue to garner positive player feedback, and we remain

excited by the long-term promise embedded in this segment.”

George Papanier, Bally’s President, added, “Third quarter

revenue performance in our C&R segment demonstrated the

resilience of our broader regional gaming portfolio even as much

work remains to unify the portfolio and manage the business as

such. We continue to implement initiatives to optimize and

centralize property-level C&R functions and with positive

outcomes achieved to date, we remain optimistic regarding the

benefits of these initiatives over the coming quarters. At the same

time, the segment’s many growth opportunities remain firmly intact.

In Chicago, demolition of the former Tribune buildings continues

while we work closely with our partners at GLPI and with the City

to gain final approval for our re-imagined permanent Bally’s

Chicago Casino master plan ahead of the start of construction next

year. Our existing Chicago Temporary Casino is allowing us to build

relationships with players in Chicago and establish our long-term

presence in a market with favorable adult population and

demographics. In Las Vegas, we are moving forward with the planning

for a Bally’s casino on the Las Vegas Strip adjacent to the A’s

stadium which will begin to rise next year following the recent

implosion of the Tropicana hotel towers. Collectively, these growth

opportunities leave us very optimistic regarding the long-term

prospects of our C&R business.”

Marcus Glover, Bally’s Chief Financial Officer, concluded, “Our

broad asset portfolio again delivered healthy financial performance

in the third quarter of 2024 despite some lingering headwinds. The

entire team is working diligently to optimize our cost structure

across the board and enhance the efficiency of our operations,

particularly in the C&R segment and within International

Interactive. While this work is in its early stages and will

continue for the foreseeable future, we believe we will see

tangible results in the near-term as we improve profitability and

enhance our operating performance.”

Reconciliation of GAAP Measures to Non-GAAP Measures

To supplement the financial information presented on a generally

accepted accounting principles (“GAAP”) basis, Bally’s has included

in this earnings release non-GAAP financial measures for

consolidated Adjusted EBITDA and segment Adjusted EBITDAR, which

exclude certain items described below. The reconciliations of these

non-GAAP financial measures to their comparable GAAP financial

measures are presented in the tables appearing below.

“Adjusted EBITDA” is earnings, or loss, for Bally’s, or where

noted Bally’s reportable segments, before, in each case, interest

expense, net of interest income, provision (benefit) for income

taxes, depreciation and amortization, non-operating (income)

expense, acquisition and other transaction related costs,

share-based compensation, and certain other gains or losses as well

as, when presented for Bally’s reporting segments, an adjustment

related to the allocation of corporate costs among segments.

“Segment Adjusted EBITDAR” is Adjusted EBITDA (as defined above)

for Bally’s reportable segments, plus rent expense associated with

triple net operating leases for the real estate assets used in the

operation of the Bally’s casinos and the assumption of the lease

for real estate and land underlying the operations of the Bally’s

Lake Tahoe property. For the International Interactive, North

America Interactive, and Other segments, Segment Adjusted EBITDAR

and segment Adjusted EBITDA are equivalent due to a lack of triple

net operating lease for real estate assets used in those

segments.

Management has historically used consolidated Adjusted EBITDA

and segment Adjusted EBITDAR when evaluating operating performance

because Bally’s believes that these metrics are necessary to

provide a full understanding of Bally’s core operating results and

as a means to evaluate period-to-period performance. Management

also believes that consolidated Adjusted EBITDA and segment

Adjusted EBITDAR are measures that are widely used for evaluating

operating performance of companies in Bally’s industry and a

principal basis for valuing such companies as well. Consolidated

Adjusted EBITDAR is used outside of our financial statements solely

as a valuation metric. Management believes Consolidated Adjusted

EBITDAR is an additional metric traditionally used by analysts in

valuing gaming companies subject to triple net leases since it

eliminates the effects of variability in leasing methods and

capital structures. Consolidated Adjusted EBITDA and segment

Adjusted EBITDAR should not be construed as alternatives to GAAP

net income as an indicator of Bally’s performance. In addition,

consolidated Adjusted EBITDA or segment Adjusted EBITDAR as used by

Bally’s may not be defined in the same manner as other companies in

Bally’s industry, and, as a result, may not be comparable to

similarly titled non-GAAP financial measures of other

companies.

Bally’s does not provide a reconciliation of Adjusted EBITDAR on

a forward-looking basis to net income, its most comparable GAAP

financial measure, because Bally’s is unable to forecast the amount

or significance of certain items required to develop meaningful

comparable GAAP financial measures without unreasonable efforts.

These items include depreciation, impairment charges, gains or

losses on retirement of debt, acquisition, integration and

restructuring expenses, interest expense, share-based compensation

expense, professional and advisory fees associated with Bally’s

capital return program and variations in effective tax rate, which

are difficult to predict and estimate and are primarily dependent

on future events, but which are excluded from Bally’s calculation

of Adjusted EBITDAR. Bally’s believes that the probable

significance of providing this forward-looking valuation metric

without a reconciliation to the most directly comparable GAAP

metric, is that investors and analysts will have certain

information that Bally’s believes is useful and meaningful in

valuing its business. Investors are cautioned that Bally’s cannot

predict the occurrence, timing or amount of all non-GAAP items that

may be excluded from Adjusted EBITDAR in the future. Accordingly,

the actual effect of these items, when determined, could

potentially be significant to the calculation of Adjusted

EBITDAR.

Third Quarter Conference Call

Bally’s third quarter 2024 earnings conference call and audio

webcast will be held today, Wednesday, November 6, 2024, at 4:30

p.m. EDT. To access the conference call, please dial (800) 445-7795

(U.S. toll-free) and reference conference ID BALYQ324. The webcast

of the call will be available to the public, on a listen-only

basis, via the Internet at the Investors section of Bally’s website

at www.ballys.com. An online archive of the webcast will be

available on Bally’s website for 120 days.

About Bally’s Corporation

Bally's Corporation is a global casino-entertainment company

with a growing omni-channel presence. It currently owns and manages

15 casinos across 10 states, a golf course in New York, a horse

racetrack in Colorado, and has access to OSB licenses in 18 states.

It also owns Bally's Interactive International, formerly Gamesys

Group, a leading, global, online gaming operator, Bally Bet, a

first-in-class sports betting platform, and Bally Casino, a growing

iCasino platform.

With 10,600 employees, the Company's casino operations include

approximately 15,300 slot machines, 580 table games and 3,800 hotel

rooms. Upon completing the construction of a permanent casino

facility in Chicago, IL, Bally's will own and/or manage 15 casinos

across 10 states. Bally’s also has rights to developable land in

Las Vegas post the closure of the Tropicana. Its shares trade on

the New York Stock Exchange under the ticker symbol “BALY”.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements may generally be identified by the use of words such as

“anticipate,” “believe,” “expect,” “intend,” “plan” and “will” or,

in each case, their negative, or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. As a result, these statements are not guarantees of future

performance and actual events may differ materially from those

expressed in or suggested by the forward-looking statements. Any

forward-looking statement made by Bally’s in this press release,

its reports filed with the Securities and Exchange Commission

(“SEC”) and other public statements made from time-to-time speak

only as of the date made. New risks and uncertainties come up from

time to time, and it is impossible for Bally’s to predict or

identify all such events or how they may affect it. Bally’s has no

obligation, and does not intend, to update any forward-looking

statements after the date hereof, except as required by federal

securities laws. Factors that could cause these differences include

those included in Bally’s Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and other reports filed by Bally’s with the

SEC. These statements constitute Bally’s cautionary statements

under the Private Securities Litigation Reform Act of 1995.

BALLY’S CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

(In thousands, except per share

data)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue:

Gaming

$

523,906

$

508,895

$

1,564,714

$

1,489,086

Non-gaming

106,068

123,582

305,399

348,317

Total revenue

629,974

632,477

1,870,113

1,837,403

Operating (income) costs and

expenses:

Gaming

234,908

229,131

707,222

665,731

Non-gaming

51,328

58,041

148,152

162,661

General and administrative

273,593

230,582

774,448

732,147

Loss (gain) on sale-leaseback, net

150,000

—

150,000

(374,321

)

Depreciation and amortization

77,800

77,487

316,328

231,235

Total operating costs and expenses

787,629

595,241

2,096,150

1,417,453

(Loss) income from operations

(157,655

)

37,236

(226,037

)

419,950

Other (expense) income:

Interest expense, net

(73,975

)

(70,630

)

(221,306

)

(200,987

)

Other non-operating (expense) income,

net

(49,854

)

15,528

(38,370

)

24,949

Total other expense, net

(123,829

)

(55,102

)

(259,676

)

(176,038

)

(Loss) income before income taxes

(281,484

)

(17,866

)

(485,713

)

243,912

(Benefit) provision for income taxes

(33,629

)

43,936

(3,748

)

153,029

Net (loss) income

$

(247,855

)

$

(61,802

)

$

(481,965

)

$

90,883

Basic (loss) earnings per share

$

(5.10

)

$

(1.15

)

$

(9.96

)

$

1.68

Weighted average common shares outstanding

- basic

48,596

53,580

48,405

53,961

Diluted (loss) earnings per share

$

(5.10

)

$

(1.15

)

$

(9.96

)

$

1.67

Weighted average common shares outstanding

- diluted

48,596

53,580

48,405

54,276

BALLY’S CORPORATION

Revenue and Reconciliation of

Net (Loss) Income and Net (Loss) Income Margin to

Adjusted EBITDAR and Adjusted

EBITDA Margin (unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(In thousands, except percentages)

2024

2023

2024

2023

Revenue

$

629,974

$

632,477

$

1,870,113

$

1,837,403

Net (loss) income

$

(247,855

)

$

(61,802

)

$

(481,965

)

$

90,883

Interest expense, net of interest

income

73,975

70,630

221,306

200,987

(Benefit) provision for income taxes

(33,629

)

43,936

(3,748

)

153,029

Depreciation and amortization

77,800

77,487

316,328

231,235

Non-operating income (1)

22,122

(4,276

)

19,992

(13,528

)

Foreign exchange loss (gain)

30,246

(8,459

)

26,447

(2,512

)

Transaction costs(2)

19,788

20,953

39,123

59,405

Restructuring charges(3)

(1,068

)

411

17,921

20,673

Tropicana Las Vegas demolition

costs(4)

19,643

—

31,904

—

Decommissioning costs(5)

—

—

—

2,343

Share-based compensation

4,099

6,257

11,629

18,587

Loss (gain) on sale-leaseback, net(6)

150,000

—

150,000

(374,321

)

Planned business divestiture(7)

—

35

—

2,089

Impairment charges(8)

—

—

12,757

9,653

Merger Agreement costs(9)

9,802

—

11,791

—

Payment Service Provider write-off(10)

6,333

—

6,333

—

Other(11)

6,475

(3,549

)

7,854

(507

)

Adjusted EBITDA

$

137,731

$

141,623

$

387,672

$

398,016

Rent expense associated with triple net

operating leases(12)

$

28,602

$

88,575

Adjusted EBITDAR

$

166,333

$

476,247

Net (loss) income margin

(39.3

)%

(9.8

)%

(25.8

)%

4.9

%

Adjusted EBITDA margin

21.9

%

22.4

%

20.7

%

21.7

%

________________________________

(1)

Non-operating (income) expense

includes: (i) change in value of commercial rights liabilities,

(ii) gain on extinguishment of debt, (iii) non-operating items of

equity method investments including our share of net income or loss

on an investment and depreciation expense related to our Rhode

Island joint venture, and (iv) other (income) expense, net.

(2)

Includes acquisition, integration

and other transaction related costs, financing costs incurred in

connection with the prior year sale lease-back transaction.

(3)

Restructuring charges

representing the severance and employee related benefits related to

the announced Interactive business restructuring initiatives and

the closure of the Company’s Tropicana Las Vegas property on April

2, 2024.

(4)

Demolition costs associated with

the Tropicana Las Vegas property which is part of the plan to

redevelop the site with a state-of-the-art integrated resort and

ballpark. As part of the binding term sheet, GLPI has agreed to

reimburse the Company for such expenses and will increase rent to

reflect the additional funding.

(5)

Costs related to the

decommissioning of the Company’s sports betting platform in favor

of outsourcing the platform solution to third parties.

(6)

Loss on sale-leaseback of $150

million in the third quarter of 2024 related to the lease

modification of the real estate underlying the Bally’s Chicago

project and gain on sale-leaseback in the prior year related to our

Hard Rock Biloxi and Bally’s Tiverton properties.

(7)

Losses related to a North America

Interactive business that Bally’s was marketed as held-for-sale in

2023.

(8)

Includes impairment charges on

long-lived assets in the second quarter of 2024 and impairment

charges related to assets held-for-sale in 2023.

(9)

Costs incurred in connection with

the merger agreement signed July 25, 2024 with Standard

General.

(10)

In the third quarter, the Company

recorded a $6.3 million charge to reduce amounts due from payment

service providers ("PSP") due to a circumstance whereby the payment

processer for certain online sports wagering deposits failed to

capture and settle funds with patrons of the Company. The Company

was not able to recover the full amount due from the payment

service provider, resulting in a write down to the recoverable

amount. In addition to amounts recovered, the Company received $5.1

million from the PSP as a signing bonus for entering into an

extension agreement.

(11)

Other includes the following

items: (i) non-routine legal expenses and settlement charges for

matters outside the normal course of business, (ii) insurance and

business interruption recoveries, and (iii) other individually de

minimis expenses.

(12)

Consists of the operating lease

components contained within our triple net master lease with GLPI

for the real estate assets used in the operation of Bally’s

Evansville, Bally’s Dover, Bally’s Quad Cities, Bally’s Black Hawk,

Hard Rock Biloxi and Bally’s Tiverton, the individual triple net

lease with GLPI for the land underlying Tropicana Las Vegas,

through it’s closure in April 2024, and the triple net lease

assumed in connection with the acquisition of Bally’s Lake Tahoe

for real estate and land underlying the operations of the Bally’s

Lake Tahoe facility.

BALLY’S CORPORATION

Revenue and Segment Adjusted

EBITDAR (unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(In thousands)

2024

2023

2024

2023

Revenue

Casinos & Resorts

$

353,358

$

359,026

$

1,038,738

$

1,020,974

International Interactive

230,937

243,884

695,016

737,230

North America Interactive

45,679

29,567

136,359

79,199

Total

$

629,974

$

632,477

$

1,870,113

$

1,837,403

Adjusted EBITDAR(1)

Casinos & Resorts

$

100,442

$

118,184

$

289,661

$

334,312

International Interactive

90,030

85,477

254,854

250,352

North America Interactive

(10,976

)

(17,561

)

(27,891

)

(45,809

)

Other

(13,163

)

(12,883

)

(40,377

)

(46,687

)

Total

$

166,333

$

476,247

________________________________

(1) Segment Adjusted EBITDAR is Bally’s

reportable segment GAAP measure and its primary measure for profit

or loss for its reportable segments. “Segment Adjusted EBITDAR” is

Adjusted EBITDA (as defined above) for Bally’s reportable segments,

plus rent expense associated with its triple net master lease with

GLPI for the real estate assets used in the operation of certain

Bally’s casinos, the individual triple net lease with GLPI for the

land underlying Tropicana Las Vegas, through its closure in April

2024, and the assumption of the lease for real estate and land

underlying the operations of the Bally’s Lake Tahoe property. For

the International Interactive, and North America Interactive

segments, segment Adjusted EBITDAR and segment Adjusted EBITDA are

equivalent due to a lack of triple net operating lease for real

estate assets used in those segments.

BALLY’S CORPORATION

Selected Financial Information

(unaudited)

Balance Sheet

Data

(in thousands)

September 30,

2024

December 31,

2023

Cash and cash equivalents

$

190,975

$

163,194

Restricted cash

89,564

152,068

Term Loan Facility(1)

$

1,891,513

$

1,906,100

Revolving Credit Facility

350,000

335,000

5.625% Senior Notes due 2029

750,000

750,000

5.875% Senior Notes due 2031

735,000

735,000

Less: Unamortized original issue

discount

(20,778

)

(23,756

)

Less: Unamortized deferred financing

fees

(34,797

)

(39,709

)

Long-term debt, including current

portion

$

3,670,938

$

3,662,635

Less: Current portion of Term Loan and

Revolving Credit Facility

$

(19,450

)

$

(19,450

)

Long-term debt, net of discount and

deferred financing fees; excluding current portion

$

3,651,488

$

3,643,185

Cash Flow

Data

Three Months Ended

September 30,

Nine Months Ended

September 30,

(in thousands)

2024

2023

2022

2024

2023

2022

Capital expenditures

$

92,316

$

146,685

$

51,282

$

155,757

$

266,231

$

167,363

Cash paid for capitalized software

11,925

21,561

14,330

36,134

35,903

45,785

Acquisition of gaming licenses

446

—

1,470

1,657

10,150

53,030

Cash payments associated with triple net

operating leases(2)

30,861

29,871

13,338

90,762

88,481

36,338

________________________________

(1)

The Company has entered certain

currency swaps to synthetically convert $500 million of its Term

Loan Facility to €461.6 million fixed-rate Euro-denominated

instrument due October 2028 paying a weighted-average fixed-rate

coupon of approximately 6.69% per annum. The Company also entered

certain currency swaps to synthetically convert $200 million

notional amount of its floating rate Term Loan Facility to an

equivalent £159.2 million GBP-denominated floating rate instrument

with tenor of the swap instrument due October 2026. Additionally,

as part of the Company’s risk management program, to further manage

the Company’s exposure to interest rate movements, the Company

entered into an additional $1.0 billion notional in interest rate

contract arrangements maturing in 2028.

(2)

Consists of payments made in

connection with Bally’s triple net operating leases, as defined

above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106597518/en/

Investor Contact Marcus

Glover Chief Financial Officer 401-475-8564 ir@ballys.com

Media Contact James Leahy,

Joseph Jaffoni, Richard Land JCIR 212-835-8500 baly@jcir.com

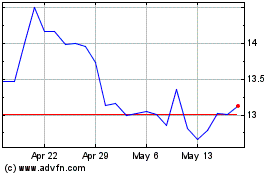

Ballys (NYSE:BALY)

Historical Stock Chart

From Oct 2024 to Nov 2024

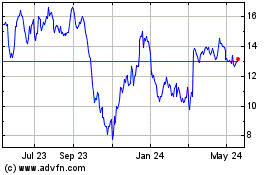

Ballys (NYSE:BALY)

Historical Stock Chart

From Nov 2023 to Nov 2024