UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13E-3

(Rule

13e-100)

Rule

13e-3 Transaction Statement Under Section 13(e)

of

the Securities Exchange Act of 1934

Amendment

No. 1

BALLY’S

CORPORATION

(Name

of Subject Company (Issuer))

Bally’s

Corporation

Epsilon

Sub I, Inc.

Standard

General L.P.

The

Queen Casino & Entertainment, Inc.

SG

CQ Gaming LLC

SG

Parent LLC

Standard

RI Ltd.

Soohyung

Kim

(Names

of Filing Persons)

Common

Stock, $0.01 par value

(Title

of Class of Securities)

05875C

(CUSIP

Number of Class of Securities)

Bally’s

Corporation

100

Westminster Street

Providence,

RI 02903 (401) 475-8474

Attn:

Kim M. Barker,

Jaymin

Patel

(Name,

address, and telephone number of person authorized to receive notices and communications on behalf of filing persons)

with

copies to:

| Richard

Langan, Jr. |

|

Scott

D. Miller |

|

Mark

A. Morton |

|

Ryan

Messier |

| John C. Partigan |

|

Lauren S. Boehmke |

|

Alyssa K. Ronan |

|

Philip Richter |

| Conrad Adkins |

|

Sullivan & Cromwell

|

|

Potter Anderson &

|

|

Fried, Frank, Harris,

Shriver & |

| Nixon Peabody LLP |

|

LLP |

|

Corroon LLP |

|

Jacobson LLP |

| 55 West 46th Street |

|

125 Broad Street |

|

1313 N Market Street |

|

One New York Plaza |

| New York, NY 10036 |

|

New York, NY 10004 |

|

6th Floor |

|

New York, NY

10004 |

| (212) 940-3140 |

|

(212) 558-3109 |

|

Wilmington, DE 19801 |

|

(202) 639-7226 |

| |

|

|

|

(302) 984-6078 |

|

|

This

statement is filed in connection with (check the appropriate box):

| a. ☒ |

The filing

of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities

Exchange Act of 1934. |

| b. ☐ |

The filing of a registration

statement under the Securities Act of 1933. |

Check

the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☒

Check

the following box if the filing is a final amendment reporting the results of the transaction: ☐

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS TRANSACTION, PASSED UPON

THE MERITS OR FAIRNESS OF THIS TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS SCHEDULE 13E-3. ANY REPRESENTATION

TO THE CONTRARY IS A CRIMINAL OFFENSE.

INTRODUCTION

This

Amendment No. 1 to Rule 13e-3 Transaction Statement on Schedule 13E-3, together with the exhibits hereto (as amended, this

“Transaction Statement”), is being filed with the Securities and Exchange Commission (the

“SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”) by (a) Bally’s Corporation, a Delaware corporation (the “Company” or

“Bally’s”), (b) Epsilon Sub I, Inc., a Delaware corporation and subsidiary of the Company (“Merger

Sub I”), (c) Standard General L.P., a Delaware limited partnership (“Standard General”), (d) The Queen

Casino & Entertainment, Inc., a Delaware corporation and affiliate of Parent (“Queen”), (e) SG CQ Gaming LLC,

a Delaware limited liability company, an affiliate of Standard General and stockholder of Queen (“SG Gaming”),

(f) SG Parent LLC, a Delaware limited liability company and an affiliate of Standard General (“Parent”), (g)

Standard RI Ltd., an exempted company incorporated in the Cayman Islands and an affiliate of Standard General and Queen

(“SRL”), (h) Soohyung Kim, an individual, and (i) Noel Hayden, an individual. Collectively, the persons filing

this Transaction Statement are referred to as the “filing persons”.

This

Transaction Statement relates to the Agreement and Plan of Merger, dated July 25, 2024 (as it has been or may be amended, supplemented

or modified from time to time, the “Merger Agreement”), by and among the Company, Merger Sub I, Epsilon Sub II, Inc.,

a Delaware corporation and affiliate of the Company (“Merger Sub II,” and together with the Company and Merger Sub

I, the “Company Parties”), Parent, Queen, and solely for purposes of specified provisions of the Merger Agreement,

SG Gaming (together with Parent and Queen, the “Buyer Parties”). Subject to the terms of the Merger Agreement, at

the closing of the transactions:

| ● | SG

Gaming will contribute all of the 10,967,117.016 shares of common stock, par value $0.00000198

per share, of Queen (the “Queen Common Stock”) held by SG Gaming (the

“Queen Share Contribution”) to the Company, and in exchange therefor the

Company will issue to SG Gaming 26,909,895 validly issued, fully paid, and nonassessable

shares of the Company’s common stock, par value $0.01 per share (the “Company

Common Stock”), based on an exchange ratio of 2.45368905950 (the “Queen

Exchange Ratio”), |

| ● | following

the Queen Share Contribution, Merger Sub I will merge with and into the Company (the “Company

Merger”) with the Company surviving the Company Merger (the “Surviving

Corporation”), in connection with which, at the effective time of the Company Merger

(the “Company Effective Time”), each share of Company Common Stock issued

and outstanding immediately prior to the Company Effective Time (other than shares of Company

Common Stock owned by: (i) the Company or any of the Company’s wholly owned subsidiaries;

(ii) holders exercising appraisal rights; (iii) SG Gaming following the Queen Share Contribution;

or (iv) holders who have validly elected to have such shares remain issued and outstanding

following the Company Merger (a “Rolling Share Election”), subject to

certain exceptions) will be converted into the right to receive cash consideration equal

to $18.25 per share of Company Common Stock, and |

| ● | following

the Company Merger, Merger Sub II will merge with and into Queen (the “Queen Merger”

and together with the “Company Merger”, the “Mergers”)

with Queen surviving the Queen Merger as a direct, wholly owned subsidiary of the Company

(the “Queen Surviving Corporation”), in connection with which each issued

and outstanding share of Queen Common Stock (other than those held by the Company as a result

of the Queen Share Contribution) will convert into shares of Company Common Stock based on

the Queen Exchange Ratio. |

Each record holder of shares of Company Common

Stock (other than Bally’s and its subsidiaries) as of [●], 2024 (the “Record Date”), or who becomes a

record holder of shares of Company Common Stock during the period between Record Date and 5:00 p.m. Eastern time on the date of the special

meeting to approve the Merger Agreement (or such later date mutually agreed by Parent and the Company) (the “Election Deadline”)

and has received an election form for making a Rolling Share Election (an “Election Form”), may submit an Election

Form specifying the number of shares of Company Common Stock held by such record holder that such record holder elects to have remain

issued and outstanding in the Company Merger. In making any Rolling Share Election, each record holder making such election that is accepted

will be deemed to have elected to have each such Rolling Company Share assigned a new CUSIP number (the “Rolling Company Share

CUSIP”) that will identify the Rolling Company Shares. Bally’s will use commercially reasonable efforts to cause the

Rolling Company Shares: (i) to be assigned the new Rolling Company Share CUSIP; and (ii) to be eligible for trading on the New York Stock

Exchange under the ticker symbol BALY.T, from the Election Deadline until the Company Effective Time. Any Company Stockholder who fails

to properly make a Rolling Share Election on or before the Election Deadline with respect to all or any portion of such record holder’s

shares of Company Common Stock will be deemed to have not made a Rolling Share Election with respect to such shares. However, Parent

and the Company (subject to the prior approval by the Special Committee (defined below)) reserve the right to cause one or more periods

for Rolling Share Elections to be made prior to the Company Effective Time subject to such deadlines and procedures as they may determine

to be necessary or appropriate. The Company will notify Company Stockholders of each such period and the related deadlines and procedures

by the filing with the SEC of a Form 8-K or such other report or schedule as may be appropriate. In the event any such additional period

for Rolling Share Elections is elected, Rolling Share Elections made in any prior period for Rolling Share Elections, including those

made prior to the original Election Deadline, may not be revoked by the applicable Company Stockholder who made such prior Rolling Share

Election. In order to validly make Rolling Share Elections, stockholders desiring to make a Rolling Share Election will be required to

waive appraisal rights in respect of any shares of Company Common Stock that they hold or may hereafter acquire that are subject to a

Rolling Share Election.

The

Election Form may provide that the Company Stockholders making a Rolling Share Election agree (i) not to effect any sales or other transfers

of the shares of Company Common Stock subject to the Rolling Share Election from the time of submission of the Election Form until the

earlier of the Election Deadline or the proper revocation of a Rolling Share Election and (ii) after the Election Deadline, not to effect

any sales or other transfer of the shares of any Company Common Stock subject to the Rolling Share Election unless and until the Rolling

Company Share CUSIP is assigned in respect of such Rolling Company Shares.

Any Election Form may be revoked by the applicable

record holder of Company Common Stock by submitting written notice of such revocation to the Payment Agent prior to the Election Deadline.

If an Election Form is properly revoked by the record holder of Company Common Stock, any certificate(s) (or guarantees of delivery,

as appropriate) for the shares of Company Common Stock to which such Election Form relates will be returned promptly to the stockholder

that submitted the same to Equiniti Trust Company, LLC (the “Payment Agent”) and shares represented by such certificates

and book-entry shares in respect of which an Election Form was previously submitted will thereupon become transferable on the stock transfer

books and ledger of the Company with the CUSIP number borne by such shares of Company Common Stock at the time of submission of the Election

Form in connection therewith. All Rolling Share Elections will be revoked automatically if the Payment Agent is notified in writing by

Parent and the Company prior to or after the Election Deadline that the Company Merger has been abandoned and the Merger Agreement has

been terminated in accordance with its terms. In addition, each of Parent and Bally’s will have the authority to revoke all or

any part of a Rolling Share Election at any time prior to the Company Effective Time (both before or after the Election Deadline) if

it determines in good faith that such election is reasonably likely to delay or prevent receipt of any of the requisite gaming approvals

or the holding of shares of Company Common Stock after closing by the holder thereof is reasonably likely to adversely affect the conduct

of gaming activities by the Surviving Corporation or any of its subsidiaries after the closing. If Rolling Share Elections are revoked

in accordance with the foregoing provisions, (i) Bally’s will notify promptly the applicable stockholder(s) thereof, (ii) the shares

of Company Common Stock in respect of which such Rolling Share Elections were revoked will be promptly reassigned the CUSIP number borne

by such shares of Company Common Stock at the time of submission of the Election Form in connection therewith and will thereupon become

transferable on the stock transfer books and ledger of the Company with such reassigned CUSIP number, and (iii) to the extent any shares

of Company Common Stock in respect of which such Rolling Share Elections were revoked were represented by certificate(s), the Company

will provide the applicable stockholders with certificate(s) (or replacement certificate(s)) representing such shares without any Rolling

Company Share CUSIP, all in accordance with such procedures as the Company and Parent will determine to be necessary or appropriate.

Following

the completion of the Mergers, the shares of Company Common Stock may be delisted from trading on the New York Stock Exchange.

The

board of directors of Bally’s (the “Bally’s Board”) formed a special committee of the Bally’s Board

comprised solely of independent directors (the “Special Committee”) to, among other things, evaluate and make recommendations

to the Bally’s Board regarding Merger Agreement and transactions contemplated thereby.

The

Special Committee, as more fully described in the Company’s amended proxy statement (the “Proxy

Statement”) filed concurrently with the filing of this Transaction Statement under

Regulation 14A of the Exchange Act with the SEC, evaluated the Merger Agreement and the transactions

contemplated thereby, with the assistance of its own independent financial and legal advisors.

After careful consideration, the Special Committee unanimously (1) determined that the terms

of the Merger Agreement and the transactions contemplated thereby, including the Company

Merger, are fair to and in the best interests of the Company and the Unaffiliated Company

Stockholders (as defined below), (2) recommended that the Bally’s Board approve and

declare advisable the Merger Agreement and the transaction contemplated thereby, including

the Company Merger, and determine that the Merger Agreement and the transactions contemplated

thereby, including the Company Merger, are fair to, and in the best interests of, Bally’s

and the Unaffiliated Company Stockholders and (3) recommended that, subject to approval of

the Bally’s Board, the Bally’s Board submit the Merger Agreement to the Company

Stockholders for their adoption, and recommend that the Company Stockholders vote in favor

of the adoption of the Merger Agreement.

The

Bally’s Board, acting upon the unanimous recommendation of the Special Committee, by a unanimous vote of the Company’s directors

(excluding directors Soohyung Kim and Terrence Downey, who recused themselves due to their affiliation with Parent and/or Queen), (1)

determined that the Merger Agreement and the transactions contemplated thereby, including the Company Merger, are fair to, and in the

best interests of, Bally’s and the Company Stockholders, including the Unaffiliated Company Stockholders; (2) approved and declared

advisable the Merger Agreement and the transactions contemplated thereby, including the Company Merger, (3) approved and declared advisable

the execution and delivery of the Merger Agreement by the Company, the performance by the Company of its covenants and other obligations

thereunder the Merger Agreement, and the consummation of, the Company Merger and the other transactions contemplated thereby upon the

terms and subject to the conditions set forth in the Merger Agreement, (4) directed that the adoption of the Merger Agreement be submitted

to a vote of the Company Stockholders, and (5) recommended that the Company Stockholders vote in favor of the adoption of the Merger

Agreement.

The

Mergers cannot be completed without the affirmative vote of both: (a) the holders of a majority of all of the outstanding shares of Company

Common Stock entitled to vote thereon and (b) the holders of a majority of the outstanding shares of Company Common Stock held by the

Unaffiliated Company Stockholders and entitled to vote thereon, which excludes all of the shares of Company Common Stock held, directly

or indirectly, by or on behalf of: (i) Parent, SRL, SBG Gaming and Noel Hayden or their respective Affiliates and those members of the

Bally’s Board who are employees of Parent, SBG Gaming or any of their respective Affiliates; (ii) any person that the Company has

determined to be an “officer” of the Company within the meaning of Rule 16a-1(f) of the Exchange Act; and (iii) any Company

Stockholder who, prior to the receipt of the Requisite Stockholder Approval, enters into any contract, agreement or other arrangement

with any Buyer Party or any of its respective Affiliates pursuant to which such Company Stockholder agrees to vote to adopt the Merger

Agreement or to make a Rolling Share Election (collectively, the “Unaffiliated Company Stockholders”).

The Company is filing the Proxy Statement

with the SEC concurrently with the filing of this Transaction Statement under Regulation 14A of the Exchange Act pursuant to which the

Company is soliciting proxies from the Company Stockholders in connection with the Mergers. The Proxy Statement is attached hereto as

Exhibit (a)(1). A copy of the Merger Agreement is attached as Annex A-1 to the Proxy Statement, a copy of the First Merger Agreement

Amendment is attached as Annex A-2 to the Proxy Statement and a copy of the Second Merger Agreement Amendment is attached as Annex A-3

to the Proxy Statement. Terms used but not defined in this Transaction Statement have the meanings assigned to them in the Proxy Statement.

Pursuant

to General Instruction F to Schedule 13E-3, the information in the Proxy Statement, including all annexes thereto, is expressly incorporated

by reference herein in its entirety, and responses to each item herein are qualified in their entirety by the information contained in

the Proxy Statement. The cross-references below are being supplied pursuant to General Instruction G to Schedule 13E-3 and show the location

in the Proxy Statement of the information required to be included in response to the items of Schedule 13E-3.

The

information concerning the Company contained in, or incorporated by reference into, this Transaction Statement and the Proxy Statement

was supplied by the Company. Similarly, all information concerning each other Filing Person contained in, or incorporated by reference

into, this Transaction Statement and the Proxy Statement was supplied by such Filing Person. No Filing Person has provided any disclosure

with respect to any other Filing Person.

SCHEDULE

13E-3 ITEMS

Item

1. Summary Term Sheet.

The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

Item

2. Subject Company Information.

(a)

Name and Address. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet – The Parties to the Merger Transactions”

“Questions

and Answers”

“The

Parties to the Merger Transactions – Bally’s Corporation”

“Important

Information Regarding Bally’s”

“Important

Information Regarding 13E-3 Filing Parties – Name and Address; Business and Background of Schedule 13e-3 Filing Parties”

“Where

You Can Find Additional Information”

(b)

Securities. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet – The Special Meeting – Record Date; Shares Entitled to Vote; Quorum”

“Questions

and Answers”

“The

Special Meeting – Record Date; Shares Entitled to Vote; Quorum”

“Important

Information Regarding Bally’s – Security Ownership of Certain Beneficial Owners and Management”

(c)

Trading Market and Price. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“Important

Information Regarding Bally’s – Market Price of Bally’s Common Stock”

(d)

Dividends. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Important

Information Regarding Bally’s – Dividends”

(e)

Prior Public Offerings. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Important

Information Regarding Bally’s – Prior Public Offerings”

(f)

Prior Stock Purchases. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Important

Information Regarding 13E-3 Filing Parties – Prior Bally’s Stock Purchases”

Item

3. Identity and Background of Filing Person.

(a)

– (c) Name and Address; Business and Background of Entities; Business and Background of Natural Persons. The information set

forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet – The Parties to the Merger Transactions”

“Questions

and Answers”

“The

Parties to the Merger Transactions”

“Important

Information Regarding Bally’s”

“Important

Information Regarding 13E-3 Filing Parties”

“Where

You Can Find Additional Information”

Item

4. Terms of the Transaction.

(a)-(1)

Material Terms. Tender Offers. Not applicable.

(a)-(2)

Material Terms. Mergers or Similar Transactions. The information set forth in the Proxy Statement under the following captions is

incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Plans for the Company After the Company Merger”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“Special

Factors – Accounting Treatment”

“Special

Factors – Material U.S. Tax Consequences of the Merger Transactions”

“Special

Factors – Regulatory Approvals Required for the Merger Transactions”

“Description

and Comparison of Rights of Bally’s Stock Before and After the Merger Transactions”

“The

Special Meeting – Votes Required”

“The

Merger Agreement – Effect of the Merger Transactions”

“The

Merger Agreement – Merger Consideration”

“The

Merger Agreement – Conditions to Closing the Merger Transactions”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

“Annex

C – Support Agreements”

(c)

Different Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“Special

Factors – Limited Guarantee”

“Special

Factors – Financing of the Merger Transactions”

“The

Merger Agreement – Merger Consideration”

“The

Merger Agreement – Treatment of Equity Awards”

“The

Merger Agreement – Exchange and Payment Procedures”

“The

Merger Agreement – Employee Matters”

“The

Merger Agreement – Indemnification and Insurance”

“Proposal

3: Advisory Compensation Proposal”

“The

Support Agreements”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

“Annex

C – Support Agreements”

(d)

Appraisal Rights. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet – Appraisal Rights”

“The

Special Meeting – Appraisal Rights”

“Appraisal

Rights”

(e)

Provisions For Unaffiliated Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated

herein by reference:

“Provisions

for Unaffiliated Stockholders”

(f)

Eligibility For Listing or Trading. Not applicable, but please refer to Information set forth on Proxy Statement under the following

captions, which is incorporation herein by reference:

“The

Merger Transactions – Plans for the Company After the Company Merger”

“Special

Factors – Post-Closing Trading of the Company Stock”

Item

5. Past Contacts, Transactions, Negotiations, and Agreements.

(a)(1)

– (2) Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“Summary

Term Sheet”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Limited Guarantee”

“Special

Factors – Financing of the Merger Transactions”

“Important

Information Regarding Bally’s – Prior Public Offerings”

“Important

Information Regarding Bally’s – Transactions in Company Common Stock”

“Important

Information Regarding Bally’s – Past Contracts, Transactions, Negotiations, and Agreements”

“Important

Information Regarding 13E-3 Filing Parties”

“Proposal

2: Advisory Compensation Proposal”

(b)

– (c) Significant Corporate Events; Negotiations or Contacts. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“Summary

Term Sheet”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Plans for the Company After the Company Merger”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“The

Merger Agreement”

“The

Support Agreements”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

“Annex

C – Support Agreements”

(e)

Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“Special

Factors – Limited Guarantee”

“Special

Factors – Financing of the Merger Transactions”

“The

Special Meeting – Votes Required”

“The

Merger Agreement”

“The

Support Agreements”

“Proposal

3: Advisory Compensation Proposal”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

“Annex

C – Support Agreements”

“Annex

F – Registration Rights Agreement”

Item

6. Purposes of the Transaction and Plans or Proposals.

(b)

Use of Securities Acquired. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“Summary

Term Sheet”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Financing of the Merger Transactions”

“Special

Factors – Post-Closing Trading of the Company Common Stock”

“The

Merger Agreement – Effect of the Merger Transactions”

“The

Merger Agreement – Merger Consideration”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

(c)(1)

– (8) Plans. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Plans for the Company After the Company Merger”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“Special

Factors – Limited Guarantee”

“Special

Factors – Financing of the Merger Transactions”

“The

Merger Agreement – Effect of the Merger Transactions”

“The

Merger Agreement – Directors and Officers; Certificate of Incorporation; Bylaws”

“The

Merger Agreement – Merger Consideration”

“The

Merger Agreement – Exchange and Payment Procedures”

“Important

Information Regarding Bally’s”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

Item

7. Purposes, Alternatives, Reasons, and Effects.

(a)

Purposes. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Plans for the Company After the Company Merger”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

(b)

Alternatives. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Plans for the Company After the Company Merger”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

(c)

Reasons. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Opinion of the Special Committee’s Financial Advisor”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Plans for the Company After the Company Merger”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

“Special

Factors – Unaudited Prospective Financial Information”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“Annex

B – Opinion of Macquarie Capital (USA) Inc.”

(d)

Effects. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Plans for the Company After the Company Merger”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“Special

Factors – Material U.S. Tax Consequences of the Merger Transactions”

“Special

Factors – Limited Guarantee”

“Special

Factors – Financing of the Merger Transactions”

“Special

Factors – Post-Closing Trading of the Company Common Stock”

“Special

Factors – Fees and Expenses”

“The

Merger Agreement – Effect of the Merger Transactions”

“The

Merger Agreement – Directors and Officers; Certificate of Incorporation; Bylaws”

“The

Merger Agreement – Merger Consideration”

“The

Merger Agreement – Employee Matters”

“The

Merger Agreement – Indemnification and Insurance”

“Proposal

3: Advisory Compensation Proposal”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

Item

8. Fairness of the Transaction.

(a)

– (b) Fairness; Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Opinion of the Special Committee’s Financial Advisor”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Plans for the Company After the Company Merger”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“Annex

B – Opinion of Macquarie Capital (USA) Inc.”

(c)

Approval of Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Plans for the Company After the Company Merger”

“The

Special Meeting – Record Date; Shares Entitled to Vote; Quorum”

“The

Special Meeting – Votes Required”

“The

Special Meeting – Voting of Proxies”

“The

Special Meeting – Revocability of Proxies”

“The

Merger Agreement – Conditions to Closing the Merger Transactions”

“Proposal

1: The Merger Proposal”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

(d)

Unaffiliated Representative. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“Summary

Term Sheet”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

(e)

Approval of Directors. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

(f)

Other Offers. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

Item

9. Reports, Opinions, Appraisals, and Negotiations.

(a)

– (b) Report, Opinion, or Appraisal; Preparer and Summary of the Report, Opinion, or Appraisal. The information set forth in

the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Opinion of the Special Committee’s Financial Advisor”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Where

You Can Find Additional Information”

“Annex

B – Opinion of Macquarie Capital (USA) Inc.”

(c)

Availability of Documents. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“Where

You Can Find Additional Information”

The

reports, opinions or appraisals referenced in this Item 9 will be made available for inspection and copying at the principal executive

offices of the Company during its regular business hours by any interested equity holder of Company Common Stock or by a representative

who has been so

designated

in writing.

Item

10. Source and Amounts of Funds or Other Consideration.

(a)

– (b), (d) Source of Funds; Conditions; Borrowed Funds. The information set forth in the Proxy Statement under the following

captions is incorporated herein by reference:

“Summary

Term Sheet”

“Special

Factors – Limited Guarantee”

“Special

Factors – Financing of the Merger Transactions”

“The

Merger Agreement – Conduct of Business Pending the Merger Transactions”

“The

Merger Agreement – Conditions to Closing the Merger Transactions”

“The

Merger Agreement – Other Covenants”

“Important

Information Regarding Bally’s – Description of Company Debt”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

(c)

Expenses. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Certain Effects on Bally’s if the Merger Transactions Are Not Completed”

“Special

Factors – Fees and Expenses”

“The

Special Meeting – Solicitation of Proxies”

“The

Merger Agreement– Indemnification and Insurance”

“The

Merger Agreement – Other Covenants”

“The

Merger Agreement – Termination Fees”

“The

Merger Agreement – Fees and Expenses”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

Item

11. Interest in Securities of the Subject Company.

(a)

Securities Ownership. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“Important

Information Regarding Bally’s – Security Ownership of Certain Beneficial Owners and Management”

“Important

Information Regarding Bally’s – Transactions in Company Common Stock”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

(b)

Securities Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“Important

Information Regarding Bally’s – Transactions in Company Common Stock”

“Important

Information Regarding Bally’s – Transactions by Our Directors and Executive Officers During the Last 60 Days”

Item

12. The Solicitation or Recommendation.

(d)

Intent to Tender or Vote in a Going-Private Transaction. The information set forth in the Proxy Statement under the following captions

is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Intent of Bally’s Directors and Executive Officers to Vote in Favor of the Company Merger”

“Special

Factors – Intent of Certain Stockholders to Vote in Favor of the Merger Transactions”

“The

Special Meeting – Votes Required”

“The

Support Agreements”

“Annex

C – Support Agreements”

(e)

Recommendation of Others. The information set forth in the Proxy Statement under the following captions is incorporated herein by

reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Proposal

1: The Merger Proposal”

Item

13. Financial Statements.

(a)

Financial Information.

Management’s

discussion and analysis of financial condition and results of operations set forth in Item 7 and the audited consolidated financial statements

set forth in Item 8 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and the unaudited financial

statements set forth in Item 1 and management’s discussion and analysis of financial condition and results of operations set forth

in Item 2 of the Company’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024 are incorporated by reference.

The

information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Special

Factors – Certain Effects of the Merger Transactions”

“Special

Factors – Unaudited Prospective Financial Information”

“Important

Information Regarding Bally’s – Selected Historical Financial Data”

“Important

Information Regarding Bally’s – Book Value Per Share”

“Where

You Can Find Additional Information”

(b)

Pro Forma Information. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference:

“Unaudited

Pro Forma Condensed Combined Financial Statements”

“Important

Information Regarding Bally’s – Pro Forma Financial Information”

“Important

Information Regarding the Combined Party After the Merger Transactions – Pro Forma Security Ownership of Certain Beneficial Owners

and Management”

Item

14. Persons/Assets, Retained, Employed, Compensated, or Used.

(a)

– (b) Solicitations or Recommendations; Employees and Corporate Assets. The information set forth in the Proxy Statement under

the following captions is incorporated herein by reference:

“Summary

Term Sheet”

“Questions

and Answers”

“Special

Factors – Background of the Merger Transactions”

“Special

Factors – Reasons for the Company Merger; Recommendation of the Special Committee and the Disinterested Directors”

“Special

Factors – Position of the Buyer Filing Parties as to the Fairness of the Company Merger; Purpose and Reasons of the Buyer Filing

Parties for the Company Merger”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“Special

Factors – Fees and Expenses”

“The

Special Meeting – Solicitation of Proxies”

Item

15. Additional Information.

(b)

Golden Parachute Compensation. The information set forth in the Proxy Statement under the following captions is incorporated herein

by reference:

“Summary

Term Sheet”

“Special

Factors – Interests of Bally’s Directors and Executive Officers in the Merger Transactions”

“The

Merger Agreement – Merger Consideration”

“Proposal

3: Advisory Compensation Proposal”

“Annex

A-1 – Agreement and Plan of Merger”

“Annex

A-2 – Amendment No. 1 to Agreement and Plan of Merger”

“Annex

A-3 – Amendment No. 2 to Agreement and Plan of Merger”

(c)

Other Material Information. The information set forth in the Proxy Statement, including all annexes thereto, is incorporated herein

by reference.

Item

16. Exhibits.

The

following exhibits are filed herewith:

| Exhibit

Number |

|

Description |

| (a)(2)(i) |

|

Preliminary Proxy Statement of Bally’s Corporation (the “Proxy Statement”) (included in the Schedule 14A filed on October 1, 2024 and incorporated herein by reference). |

| (a)(2)(ii) |

|

Form of Proxy Card (included in the Proxy Statement and incorporated herein by reference). |

| (a)(2)(iii) |

|

Letter to Stockholders (included in the Proxy Statement and incorporated herein by reference). |

| (a)(2)(iv) |

|

Notice of Special Meeting of Stockholders (included in the Proxy Statement and incorporated herein by reference). |

| (a)(5) |

|

Press

Release, dated July 25, 2024 (filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K, filed July 25, 2024 and incorporated

herein by reference). |

| (b)* |

|

Debt

Commitment Letter, dated July 25, 2024, executed by Parent, Apollo Global Securities, LLC, and Apollo Capital Management, L.P. |

| (c)(i) |

|

Opinion, dated July 24, 2024, of Macquarie Capital (USA) Inc. to the Special Committee (included as Annex B to the Proxy Statement and incorporated herein by reference). |

| (c)(ii)* |

|

Presentation,

dated July 24, 2024, of Macquarie Capital (USA) Inc. to the Special Committee. |

| (c)(iii)* |

|

Discussion

Materials, dated July 23, 2024, of Macquarie Capital (USA) Inc. for the Special Committee. |

| (c)(iv)* |

|

Discussion

Materials, dated July 19, 2024, of Macquarie Capital (USA) Inc. for the Special Committee. |

| (c)(v)* |

|

Discussion

Materials, dated July 12, 2024, of Macquarie Capital (USA) Inc. for the Special Committee. |

| (c)(vi)* |

|

Discussion

Materials, dated May 23, 2024, of Macquarie Capital (USA) Inc. for the Special Committee. |

| (c)(vii)* |

|

Discussion

Materials, dated May 23, 2024, of Macquarie Capital (USA) Inc. for the Special Committee. |

| (c)(viii)* |

|

Discussion

Materials, dated April 24, 2024, of Macquarie Capital (USA) Inc. for the Special Committee. |

| (d)(i) |

|

Agreement and Plan of Merger, dated as of July 25, 2024 (as it has been or may be amended, supplemented or modified from time to time) by and among, Parent, Queen, Company, Merger Sub I, Merger Sub II, and SG Gaming (included as Annex A-1 to the Proxy Statement and incorporated herein by reference). |

| (d)(ii) |

|

Amendment No. 1 to Agreement and Plan of Merger, dated as of August 27, 2024, by and among, Parent, Queen, Company, Merger Sub I, Merger Sub II, and SG Gaming (included in Annex A-2 to the Proxy Statement and incorporated herein by reference). |

| (d)(iii) |

|

Amendment No. 2 to Agreement and Plan of Merger, dated as of September 30, 2024, by and among, Parent, Queen, Company, Merger Sub I, Merger Sub II, and SG Gaming (included in Annex A-3 to the Proxy Statement and incorporated herein by reference). |

| (d)(iv) |

|

Limited Guarantee, dated July 25, 2024, delivered by Standard RI Ltd. to Bally’s Corporation (included as Annex E to the Proxy Statement and incorporated herein by reference). |

| (d)(v) |

|

Support Agreement, dated as of July 25, 2024, by and among the Company, Parent and SRL (included as Annex C to the Proxy Statement and incorporated herein by reference). |

| (d)(vi) |

|

Support Agreement, dated as of July 25, 2024, by and among the Company, Parent and SBG (included as Annex C to the Proxy Statement and incorporated herein by reference). |

| (d)(vii) |

|

Support Agreement, dated as of July 25, 2024, by and among the Company, Parent and Noel Hayden (included as Annex C to the Proxy Statement and incorporated herein by reference). |

| (d)(viii) |

|

Side Letter, dated July 25, 2024, by and among Standard General Master Fund II L.P., Parent, Queen and the Company (included as Annex D to the Proxy Statement and incorporated herein by reference). |

| (d)(ix) |

|

Registration Rights Agreement (included as Annex F to the Proxy Statement and incorporated herein by reference). |

| (d)(x) |

|

Amended and Restated Bylaws of Bally’s Corporation (included as Annex G to the Proxy Statement and incorporated herein by reference). |

| (f) |

|

Section 262 of the Delaware General Corporation Law (included as Annex H to the Proxy Statement and incorporated herein by reference). |

| 107* |

|

Filing

Fee Table. |

| * | Previously

filed with the Schedule 13E-3 filed with the SEC on August 28, 2024. |

SIGNATURES

After

due inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth

in this statement is true, complete and correct.

| Dated: September 30, 2024 |

|

| |

|

| BALLY’S CORPORATION |

|

| |

|

| By: |

/s/

Marcus Glover |

|

| Name: |

Marcus Glover |

|

| Title: |

Chief Financial Officer |

|

After

due inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth

in this statement is true, complete and correct.

| Dated: September 30, 2024 |

|

| |

|

| EPSILON SUB I, INC. |

|

| |

|

| By: |

/s/

Marcus Glover |

|

| Name: |

Marcus Glover |

|

| Title: |

Director |

|

After

due inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certifies that the information set forth

in this statement is true, complete and correct.

Dated:

September 30, 2024

| Standard

General L.P. |

|

| |

|

| By: |

/s/

Joseph Mause |

|

| Name: |

Joseph Mause |

|

| Title: |

Chief Financial Officer |

|

| THE QUEEN CASINO & ENTERTAINMENT,

INC. |

|

| |

|

| By: |

/s/

Vladimira Mircheva |

|

| Name: |

Vladimira Mircheva |

|

| Title: |

Chief Financial Officer |

|

| SG CQ GAMING LLC |

|

| |

|

| By: |

/s/

Soohyung Kim |

|

| Name: |

Soohyung Kim |

|

| Title: |

Manager |

|

| SG Parent

LLC |

|

| |

|

| By: |

/s/

Soohyung Kim |

|

| Name: |

Soohyung Kim |

|

| Title: |

Chief Executive Officer |

|

| Standard

RI Ltd. |

|

| |

|

| By: |

/s/

Soohyung Kim |

|

| Name: |

Soohyung Kim |

|

| Title: |

Director |

|

| Soohyung Kim |

|

| |

|

| /s/

Soohyung Kim |

|

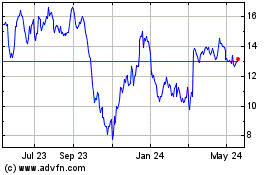

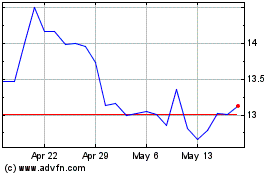

Ballys (NYSE:BALY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ballys (NYSE:BALY)

Historical Stock Chart

From Nov 2023 to Nov 2024