- Establishes Vantive as a leading standalone kidney care

business backed by Carlyle’s global investment team and

resources

- Sale follows robust process focused on maximizing stockholder

value

- Provides increased flexibility to deploy capital toward

opportunities to accelerate Baxter’s and Vantive’s respective

growth objectives

- Represents key milestone in Baxter’s ongoing business

transformation, enabling heightened strategic clarity, operational

efficiency and innovation

- Baxter shares preliminary outlook for select financial metrics

following completion of pending Kidney Care divestiture

Baxter International Inc. (NYSE:BAX), a global medtech leader,

and funds managed by global investment firm Carlyle (NASDAQ:CG)

today announced that they have signed a definitive agreement under

which Carlyle is to acquire Baxter’s Kidney Care segment, to be

named Vantive, for $3.8 billion.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240812810755/en/

Under the terms of the definitive agreement, subject to certain

closing adjustments, Baxter will receive approximately $3.5 billion

in cash with net after-tax proceeds currently estimated to be

approximately $3 billion. Baxter announced its intention to create

a standalone kidney care company in January 2023 as part of its

broader strategic realignment designed to enhance future

performance and create value for all stakeholders. In March 2024,

Baxter announced that it was in discussions to explore a potential

sale of the segment. After reviewing the financial impact of the

potential separation pathways, management and the Baxter Board

determined that selling the business to Carlyle should maximize

value for Baxter stockholders and best position Baxter and Vantive

for long-term success, with enhanced flexibility to deploy capital

toward opportunities that seek to accelerate each company’s

respective growth objectives. Baxter intends to use after-tax

proceeds from the transaction to reduce its debt, consistent with

its stated capital allocation priorities.

Carlyle has been a leading private equity investor in the

medtech sector over the past decade, with investments in medical

technology and diagnostic companies totaling over $40 billion in

enterprise value. Moreover, Carlyle’s investment in Vantive is made

in partnership with Atmas Health, a collaboration among three

industry executives founded in September 2022 to focus on acquiring

and building a market-leading healthcare business. The partnership,

consisting of Kieran Gallahue, Jim Hinrichs, and Jim Prutow, brings

a proven track record of creating value in the medical technology

industry. Kieran Gallahue will serve as the Chairman of Vantive,

working with CEO Chris Toth and the Vantive management team.

“Today’s announcement represents another critical step forward

in the strategic transformation process we announced in early 2023.

As a result of this proposed transaction, Baxter will emerge a more

focused and more efficient company, better positioned to redefine

healthcare delivery and advance innovation that benefits patients,

customers and shareholders,” said José (Joe) E. Almeida, chair,

president and chief executive officer at Baxter. “I am confident

that, under Carlyle’s stewardship and Chris Toth’s leadership, the

Vantive team will continue to build on the business’s 70-year

legacy as a pioneer in kidney disease and vital organ

therapies.”

Vantive is a leader in global kidney care, offering products and

services for peritoneal dialysis, hemodialysis and organ support

therapies, including continuous renal replacement therapy (CRRT).

The business has more than 23,000 employees globally and had 2023

revenues of $4.5 billion.

“I look forward to partnering with the combined Carlyle and

Atmas team and working with my colleagues to advance Vantive’s

mission of extending lives and expanding possibilities,” said Chris

Toth, executive vice president and group president, Kidney Care at

Baxter, who will serve as Vantive’s CEO. “Today’s announcement

signals a new chapter in innovation on behalf of the patients and

care teams around the world who rely on our solutions. Through this

transaction, Vantive will be well-positioned to deepen our

commitment to elevating dialysis through digital solutions and

advanced services, while looking beyond kidney care to invest in

transforming vital organ therapies.”

“The Atmas team is excited to support the growth of the Vantive

business under the leadership of Chris Toth. We look forward to

working together to build upon Vantive’s track record of

patient-focused innovation and create long-term value in this next

phase of the company’s development,” commented Kieran Gallahue,

co-founder of Atmas and chairman of Vantive upon closing of the

transaction.

“Vantive is a strong, growing business with market-leading

franchises, and we are delighted to partner with the Vantive team

to pursue their strategic vision through the separation from Baxter

and transformation into a standalone global business,” said Robert

Schmidt, Carlyle’s Global Co-Head of Healthcare. “Carlyle is

uniquely positioned to support management in that pursuit with our

global investing platform across the Americas, EMEA and Asia, where

each of our regional teams will partner with Vantive to seek to

ensure the success of the business, its employees, as well as its

customers and their ultimate patients worldwide.”

Transaction Timing and Details

The transaction is expected to close in late 2024 or early 2025,

subject to receipt of customary regulatory approvals and

satisfaction of other closing conditions.

Perella Weinberg Partners LP and J.P. Morgan Securities LLC are

serving as financial advisors to Baxter, and Sullivan &

Cromwell LLP and Baker McKenzie are serving as legal advisors to

Baxter. Barclays and Goldman Sachs & Co. LLC are serving as

financial advisors, and Kirkland & Ellis LLP is serving as

legal counsel to Carlyle.

Baxter Highlights Preliminary Financial Expectations

Following Pending Kidney Care Divestiture

Following the completion of the pending sale of Kidney Care,

Baxter is targeting operational sales growth of 4% to 5% annually1

driven by innovation and continued market expansion. For 2025, the

company anticipates an adjusted operating margin1 of approximately

16.5% on a continuing operations basis, which reflects an

anticipated 100 basis point negative impact due to stranded costs,

net of anticipated transition service agreement (TSA) income, and

the manufacturing supply agreement (MSA) the company will enter

into upon the completion of the divestiture of the Kidney Care

segment. Baxter will continue to prioritize capital allocation and

expects to direct investments toward higher-growth, higher-return

opportunities to drive incremental value. To support these efforts,

the company will continue to focus on deleveraging and expects to

reach its investment-grade target of below 3.0X by the end of 2025,

after utilizing proceeds from the sale of Kidney Care to repay

outstanding debt, which may include repayment of its new bridge

facility. Additionally, the company currently expects to fully

offset stranded costs and loss of TSA income in 2027 through cost

containment initiatives, some of which are already underway, which

will further support the company’s objective of delivering annual

adjusted operating margin expansion. Related slides for investors

can be accessed from the Investor Relations section of the

company’s website at www.baxter.com.

Baxter plans to provide additional details regarding the

company’s longer-term strategic and financial outlook at an

investor conference in 2025. In addition, the company expects to

post financial schedules reflecting the Kidney Care segment as a

discontinued operation for certain historical periods prior to the

release of its third-quarter 2024 earnings results.

___________________ 1 Operational sales growth and adjusted

operating margin are non-GAAP financial measures. See the “Non-GAAP

Financial Measures” section below for additional information.

About Baxter

Every day, millions of patients, caregivers and healthcare

providers rely on Baxter’s leading portfolio of diagnostic,

critical care, kidney care, nutrition, hospital and surgical

products used across patient homes, hospitals, physician offices

and other sites of care. For more than 90 years, we’ve been

operating at the critical intersection where innovations that save

and sustain lives meet the healthcare providers who make it happen.

With products, digital health solutions and therapies available in

more than 100 countries, Baxter’s employees worldwide are now

building upon the company’s rich heritage of medical breakthroughs

to advance the next generation of transformative healthcare

innovations. To learn more, visit www.baxter.com and follow us on

X, LinkedIn and Facebook.

About Carlyle

Carlyle (NASDAQ: CG) is a global investment firm with deep

industry expertise that deploys private capital across its business

and conducts its operations through three business segments: Global

Private Equity, Global Credit and Global Investment Solutions. With

$435 billion of assets under management as of June 30, 2024,

Carlyle’s purpose is to invest wisely and create value on behalf of

its investors, portfolio companies and the communities in which we

live and invest. Carlyle employs more than 2,200 people in 29

offices across four continents. Further information is available at

www.carlyle.com. Follow Carlyle on X @OneCarlyle and LinkedIn at

The Carlyle Group.

Non-GAAP Financial Measures

This release contains certain forward-looking financial measures

that are not calculated in accordance with U.S. GAAP (Generally

Accepted Accounting Principles). The forward-looking non-GAAP

financial measures include targeted annual operational sales growth

and targeted adjusted operating margin for 2025. Those measures are

provided on a continuing operations basis and exclude any impact of

the Kidney Care segment, which will be reported as a discontinued

operation.

Targeted annual operational sales growth represents the

company’s targeted future sales growth excluding sales to Vantive

under the MSA and assuming foreign currency exchange rates remain

constant in future periods. Targeted adjusted operating margin

represents targeted adjusted operating income (operating income

excluding special items that may occur during the forecast period)

divided by targeted net sales.

Baxter has not provided reconciliations of targeted annual

operational sales growth to a forward-looking estimate of annual

GAAP sales growth or targeted adjusted operating margin to a

forward-looking estimate of GAAP operating margin because the

company is unable to predict with reasonable certainty the impact

of legal proceedings, future business optimization actions,

separation-related costs, integration-related costs, asset

impairments, unusual gains and losses, and changes in foreign

currency exchange rates, and the related amounts are unavailable

without unreasonable efforts (as specified in the exception

provided by Item 10(e)(1)(i)(B) of Regulation S-K). In addition,

Baxter believes that such reconciliations would imply a degree of

precision and certainty that could be confusing to investors. Such

items could have a substantial impact on GAAP measures of financial

performance.

Forward-Looking Statements

This press release contains forward-looking statements related

to the proposed transaction between Baxter International Inc. and

Carlyle, including Baxter’s estimated after-tax proceeds from the

proposed transaction, the expected timeframe for completing the

proposed transaction, strategic and other potential benefits of the

transaction and other statements about future beliefs, goals, plans

or prospects for Vantive and Baxter (including select longer-term

financial forecasts for Baxter’s remaining business following

completion of the pending divestiture). These forward-looking

statements are subject to risks and uncertainties that include,

among other things, risks related to the receipt of customary

regulatory approvals and the satisfaction of other closing

conditions in the anticipated timeframe or at all, including the

possibility that the proposed transaction does not close; risks

related to the ability to realize the anticipated strategic,

financial or other benefits of the proposed transaction, and other

risks identified in Baxter's most recent filings on Form 10-K and

Form 10-Q and other SEC filings, all of which are available on

Baxter's website. Actual results could differ materially from

anticipated results. Baxter does not undertake to update its

forward-looking statements or any of the statements contained in

this press release.

Baxter is a registered trademark of Baxter International Inc. or

its subsidiaries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240812810755/en/

Baxter Media Stacey Eisen, (224) 948-5353 media@baxter.com

Baxter Investors Clare Trachtman, (224) 948-3020

Carlyle Brittany Berliner, (212) 813-4839

Brittany.Berliner@carlyle.com

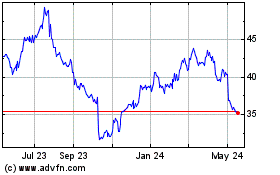

Baxter (NYSE:BAX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Baxter (NYSE:BAX)

Historical Stock Chart

From Jan 2024 to Jan 2025