UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 26, 2025

AMCOR

PLC

(Exact

name of registrant as specified in its charter)

| Jersey |

001-38932 |

98-1455367 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 83 Tower Road North |

|

| Warmley, Bristol |

|

| United Kingdom |

BS30 8XP |

| (Address of principal executive offices) |

(Zip Code) |

+44 117 9753200

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Ordinary Shares, par value $0.01 per share |

|

AMCR |

|

The New York Stock Exchange |

| 1.125%

Guaranteed Senior Notes Due 2027 |

|

AUKF/27 |

|

The New York Stock Exchange |

| 5.450% Guaranteed Senior Notes Due 2029 |

|

AMCR/29 |

|

The New York Stock Exchange |

| 3.950% Guaranteed Senior Notes Due 2032 |

|

AMCR/32 |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging growth company

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure |

On February 26, 2025, Amcor plc (“Amcor”)

announced that it has commenced consent solicitations (the “Consent Solicitations”) from the holders of the 1.50% First Priority

Senior Secured Notes due 2027, 1.65% First Priority Senior Secured Notes due 2027, 5.50% First Priority Senior Secured Notes due 2028,

5.800% First Priority Senior Secured Notes due 2031 and 5.650% First Priority Senior Secured Notes due 2034 (collectively, the “Notes”;

and each, a “series of Notes”) issued by Berry Global, Inc., a wholly-owned subsidiary of Berry Global Group, Inc.,

to amend certain provisions of the applicable indenture governing each series of Notes. Berry Global, Inc. has also issued certain

1.57% First Priority Senior Secured Notes due 2026 and 4.875% First Priority Senior Secured Notes due 2026 that are not part of the Consent

Solicitations.

In connection with the Consent Solicitations,

Amcor issued a press release on February 26, 2025 announcing the commencement of the Consent Solicitations. A copy of the press release

is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

The information contained in this Item 7.01, including

Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by

reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific

reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits |

Cautionary Statement

Regarding Forward-Looking Statements

The information contained

in this Current Report includes certain statements that are “forward-looking statements” within the meaning of federal securities

laws. Some of these forward-looking statements can be identified by words like “anticipate,” “approximately,”

“believe,” “commit,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “outlook,” “plan,” “potential,” “possible,”

“predict,” “project,” “target,” “seek,” “should,” “will,” or “would,”

the negative of these words, other terms of similar meaning or the use of future dates. Examples of forward-looking statements include

projections as to the anticipated benefits of the Merger as well as statements regarding the impact of the Merger on Amcor’s and

Berry’s business and future financial and operating results and prospects, the amount and timing of synergies from the Merger and

the closing date for the Merger.

Forward-looking statements

are neither historical facts nor assurances of future performance. Instead, they are based only on Amcor management’s and Berry

management’s current beliefs, expectations and assumptions regarding the future of Amcor’s and Berry’s business, future

plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and

many of which are outside of Amcor’s and Berry’s control. You should not place undue reliance on these forward-looking statements,

which apply only as of the date of this Current Report. Amcor’s, Berry’s and the combined company’s actual results and

financial condition may differ materially from those indicated in the forward-looking statements as a result of various factors. These

factors include, among other things, (i) the termination of or occurrence of any event, change or other circumstances that could

give rise to the termination of the Merger Agreement or the inability to complete the Merger on the anticipated terms and timetable, (ii) the

inability to complete the Merger due to the failure to satisfy any condition to closing in a timely manner or at all, or the risk that

a regulatory approval that may be required for the Merger is delayed, is not obtained or is obtained subject to conditions that are not

anticipated, (iii) the risks related to Amcor and Berry being restricted in the operation of their respective businesses while the

Merger Agreement is in effect, (iv) the ability to obtain financing in connection with the transactions contemplated by the Merger

on favorable terms, if at all, (v) the ability to recognize the anticipated benefits of the Merger, which may be affected by, among

other things, the ability of the combined company to maintain relationships with its customers and retain its management and key employees,

(vi) the ability of the combined company to achieve the synergies contemplated by the Merger or such synergies taking longer to realize

than expected, (vii) costs related to the Merger, (viii) the ability of the combined company to execute successfully its strategic

plans, (ix) the ability of the combined company to promptly and effectively integrate the Amcor and Berry businesses, (x) the

risk that the credit rating of the combined company may be different from what Amcor and Berry expect, (xi) the diversion of Amcor

management’s and Berry management’s time and attention from ordinary course business operations to the consummation of the

Merger and integration matters, (xii) potential liability resulting from pending or future litigation relating to the Merger and

(xiii) the risks, uncertainties and assumptions described in the section entitled “Solicitation Considerations” in the

consent solicitation statement prepared in connection with the Consent Solicitations. The foregoing review of important factors should

not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included elsewhere. Additional

information concerning risks, uncertainties and assumptions can be found in Amcor’s and Berry’s respective filings with the

SEC, including the risk factors discussed in Amcor’s and Berry’s most recent Annual Reports on Form 10-K, as updated

by their Quarterly Reports on Form 10-Q and other filings with the SEC.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: February 26, 2025 |

|

| |

|

| AMCOR PLC |

|

| |

|

| /s/

Damien Clayton |

|

| Name: Damien Clayton |

|

| Title: Company Secretary |

|

Exhibit 99.1

Amcor Announces Consent Solicitations for Berry’s

Outstanding Notes

ZURICH, SWITZERLAND and EVANSVILLE, INDIANA

– 26 February, 2025 – Amcor plc (NYSE: AMCR; ASX: AMC) (“Amcor”), today announced a solicitation of consents

(the “Consent Solicitations”) from all registered holders (the “Holders”) of the 1.50% First Priority Senior Secured

Notes due 2027 (the “EUR Notes”), 1.65% First Priority Senior Secured Notes due 2027 (the “2027 USD Notes”), 5.50%

First Priority Senior Secured Notes due 2028 (the “2028 USD Notes”), 5.800% First Priority Senior Secured Notes due 2031 (the

“2031 USD Notes”) and 5.650% First Priority Senior Secured Notes due 2034 (the “2034 USD Notes” and, together

with the EUR Notes, the 2027 USD Notes, the 2028 USD Notes, the 2031 USD Notes and the 2034 USD Notes, the “Notes”) issued

by Berry Global, Inc. (the “Berry Issuer”), a wholly-owned subsidiary of Berry Global Group, Inc. (“Berry”),

commencing on February 26, 2025 in order to collect requisite consents from the Holders for certain proposed amendments described

below to the indentures (the “Indentures”) governing each series of Notes. Each term which is defined or given a special meaning

in the Statement (as defined below) has the same meaning whenever it is used in this press release.

As previously disclosed on

November 19, 2024, Amcor, Aurora Spirit, Inc., a wholly-owned subsidiary of Amcor (“Merger Sub”), and Berry entered

into an Agreement and Plan of Merger (as it may be amended from time, the “Merger Agreement”). Upon the terms and subject

to the conditions set forth in the Merger Agreement, Merger Sub will merge (such merger, the “Merger”) with and into Berry,

with Berry surviving as a wholly-owned subsidiary of Amcor. The obligations of Amcor and Berry to consummate the Merger in accordance

with the terms thereof are not conditioned on a successful completion of the Consent Solicitations. The Proposed Amendments seek to provide

that, in the event that Amcor, in its sole discretion, provides an unconditional guarantee of the Berry Issuer’s payment obligations

with respect to a series of Notes (the “Amcor Parent Guarantee”), (i) the liens on all of the collateral of the Berry

Issuer granted to secure such series of Notes will be released upon request of the Berry Issuer (the “Lien Release Amendment”)

and (ii) the guarantee of such series of Notes provided by Berry will be automatically released (the “Berry Parent Guarantee

Release Amendment” and, together with the Lien Release Amendment, the “Proposed Amendments”). In the event that Amcor

provides the Amcor Parent Guarantee, (i) Berry and the Berry Issuer will, in accordance with the indentures governing the existing

senior notes issued by certain wholly-owned subsidiaries of Amcor (such subsidiaries of Amcor, the “Amcor Issuers” and such

notes, the “Amcor Notes”), provide an unconditional guarantee of the payment obligations of each Amcor Issuer (the “Berry

Cross-Guarantee”), and (ii) each other obligor in respect of the Amcor Notes at the time that the Amcor Parent Guarantee is

provided (the “Amcor Subsidiary Obligors”) will provide an unconditional guarantee of the Berry Issuer’s payment obligations

with respect to the Notes (the “Amcor Cross-Guarantee”). The Berry Issuer has also issued certain 1.57% First Priority Senior

Secured Notes due 2026 and 4.875% First Priority Senior Secured Notes due 2026 (collectively, the “Berry 2026 Notes”), which

are not part of the Consent Solicitations. We do not expect that any of the Amcor Subsidiary Obligors will guarantee the Berry 2026 Notes.

If the Amcor Parent Guarantee, the Berry Cross-Guarantee and the Amcor Cross-Guarantee are provided as described above, the Amcor Notes

will have, and the Berry 2026 Notes will continue to have, the benefit of a guarantee provided by Berry even though the Notes will not.

If the Proposed Amendments are adopted with respect to all series of the Notes and Amcor provides the Amcor Parent Guarantee, then upon

the repayment of the Berry 2026 Notes, the Berry Global Group guarantee of the Amcor Notes will be released. Amcor is soliciting Consents

to the Proposed Amendments as a single proposal. If a Holder delivers a Consent with respect to a series of Notes, it will constitute

delivery of a Consent to all of the Proposed Amendments with respect to such series of Notes.

The purpose of the Consent

Solicitations is to amend each Indenture so that, following the consummation of the Merger and the repayment of the Berry 2026 Notes,

in the event that (i) Amcor provides the Amcor Parent Guarantee with respect to each a series of Notes, (ii) Berry and the Berry

Issuer provide the Berry Cross-Guarantee and (iii) the Amcor Subsidiary Obligors provide the Amcor Cross-Guarantee, the Notes of

such series will have identical credit support to, and therefore will rank equally with, the Amcor Notes.

The record date for the Consent

Solicitations (the “Record Date”) is 5:00 p.m., New York City time, on February 25, 2025. The Consent Solicitations will

expire at 5:00 p.m., New York City time, on March 5, 2025, unless extended by Amcor in its sole discretion (such date and time, as

the same may be extended, the “Expiration Date”).

If Holders of at least two-thirds

(66 2/3%) in aggregate principal amount then outstanding of a series of Notes validly deliver Consents to the Proposed Amendments (the

“Required Consents”) and do not validly revoke such Consents prior to the earlier of March 5, 2025 and the Consent Effective

Time (the “Revocation Deadline”), and all other conditions have been satisfied or waived by Amcor on or prior to the Expiration

Date, Amcor expects that the Berry Issuer will enter into a supplemental indenture (each such supplemental indenture, individually a “Supplemental

Indenture” and collectively, the “Supplemental Indentures”) with the applicable trustee and notes collateral agent for

such series of Notes, effecting the Proposed Amendments with respect to such series of Notes (such time of execution, the “Consent

Effective Time”). Each Supplemental Indenture will be effective immediately upon execution thereof as to all Holders of such series

of Notes, whether or not a Holder delivered a Consent. However, the Consent Payment (as defined below) with respect to such series of

Notes will only be paid to Holders who have validly delivered (and not validly revoked) Consents, and will not be paid until the consummation

of the Merger, if it is consummated, and the Proposed Amendments with respect to such series of Notes will not become operative until

the Consent Payment with respect to such series of Notes has been made. Consents to the Proposed Amendments may be revoked at any time

prior to the Revocation Deadline, but not thereafter. Once a Supplemental Indenture is effective, all previously delivered Consents given

in respect of the applicable series of Notes may not be revoked.

Subject to the terms and conditions

set forth in the consent solicitation statement dated the date hereof (the “Statement”), Holders who validly deliver (and

do not validly revoke) consents to the Proposed Amendments in the manner described in the Statement will be eligible to receive a cash

payment (the “Consent Payment”) equal to the following:

| Series of

Notes |

Consent

Payment |

| 1.50% First Priority Senior Secured Notes due 2027 |

€2.50 per €1,000 principal amount |

| 1.65% First Priority Senior Secured Notes due 2027 |

$2.50 per $1,000 principal amount |

| 5.50% First Priority Senior Secured Notes due 2028 |

$2.50 per $1,000 principal amount |

| 5.800% First Priority Senior Secured Notes due 2031 |

$2.50 per $1,000 principal amount |

| 5.650% First Priority Senior Secured Notes due 2034 |

$2.50 per $1,000 principal amount |

If the Required Consents with

respect to a series of Notes are not delivered, no Holder of such series of Notes will be eligible to receive the Consent Payment, including

Holders who have validly delivered their Consents.

The Consent Payment is subject

to customary conditions and will only be payable upon and subject to the occurrence of, among other things, the receipt of the Required

Consents, in each case in accordance with the terms and conditions set forth in the Statement. Amcor reserves the right to modify the

Statement and the terms and conditions of the Consent Solicitations or to terminate the Consent Solicitations, in each case with respect

to any series of Notes, at any time.

Goldman Sachs & Co.

LLC and UBS Investment Bank are the lead solicitation agents of the Consent Solicitations and BofA Securities, Inc., J.P. Morgan

Securities LLC (exclusively with respect to Notes denominated in U.S. Dollars), J.P. Morgan Securities plc (exclusively with respect to

Notes denominated in Euro) and Mizuho Securities USA LLC are the co-solicitation agents in the Consent Solicitations (each a “Solicitation

Agent” and, collectively, the “Solicitation Agents”). Global Bondholder Services Corporation has been retained to serve

as the information agent (the “Information Agent”) and tabulation agent (the “Tabulation Agent”). Persons with

questions regarding the terms of the Consent Solicitations should contact Goldman Sachs & Co. LLC at (collect) (212) 357-1452

or (toll free) (800) 828-3182; UBS Securities LLC at (collect) (212) 882-5723 or (toll free) (833) 690-0971 or by e-mail at americas-lm@ubs.com;

BofA Securities, Inc. at (collect) (980) 387-3907 or (toll free) (888) 292-0070 or by e-mail at debt_advisory@bofa.com; J.P. Morgan

Securities LLC, with respect to the Notes denominated in U.S. Dollars, at (collect) (212) 834-3554 or (toll-free) (866) 834-4666 and J.P.

Morgan Securities plc, with respect to the Notes denominated in Euro, by email at liability_management_EMEA@jpmorgan.com; and Mizuho Securities

USA LLC at (collect) (212) 205-7741 or (toll-free) (866) 271-7403. Persons with questions regarding the procedures for delivering Consents

or requests for the Statement should contact Global Bondholder Services Corporation, at (toll free) (855) 654-2014 or (banks and brokers)

(212) 430-3774 or by email to contact@gbsc-usa.com.

None of Amcor, Berry, the

Berry Issuer, the Solicitation Agents, the Information Agent, the Tabulation Agent, the trustees or the notes collateral agents of any

series of Notes or any of their respective directors, officers, employees, representatives, agents or affiliates makes (x) any recommendation

as to whether Holders should deliver Consents in connection with the Consent Solicitations, (y) any representations or warranties

to Holders in connection with the Proposed Amendments or (z) any assessment of the merits of the Consent Solicitations or of the

impact of the Consent Solicitations on the interests of the Holders either as a class or as individuals.

This press release is for

informational purposes only and is neither an offer to sell nor a solicitation of an offer to buy any security. This announcement is also

not a solicitation of consents with respect to the Proposed Amendments or otherwise. The Consent Solicitations are being made solely through

the Statement referred to above and related materials. The Consent Solicitations are not being made to Holders of Notes in any jurisdiction

in which the making of the Consent Solicitations would not be in compliance with the laws of such jurisdiction. In any jurisdiction in

which the securities laws or blue sky laws require the Consent Solicitations to be made by a licensed broker or dealer, the Consent Solicitations

will be deemed to be made on Amcor’s behalf by the solicitation agent or one or more registered brokers or dealers that are licensed

under the laws of such jurisdiction. Neither the Statement nor any documents related to the Consent Solicitations have been filed with,

or approved or reviewed by, any federal or state securities commission or regulatory authority of any country. No authority has passed

upon the accuracy or adequacy of the Statement or any documents related to the Consent Solicitations, and it is unlawful and may be a

criminal offense to make any representation to the contrary.

About Amcor

Amcor plc (NYSE: AMCR; ASX:

AMC), is a global leader in developing and producing responsible packaging solutions across a variety of materials for food, beverage,

pharmaceutical, medical, home and personal-care, and other products. Amcor works with leading companies around the world to protect products,

differentiate brands, and improve supply chains. Amcor offers a range of innovative, differentiating flexible and rigid packaging, specialty

cartons, closures and services. Amcor is focused on making packaging that is increasingly recyclable, reusable, lighter weight and made

using an increasing amount of recycled content. In fiscal year 2024, 41,000 Amcor people generated $13.6 billion in annual sales from

operations that span 212 locations in 40 countries.

About Berry

Berry Global Group, Inc.

(NYSE: BERY) manufactures and supplies non-woven, flexible, and rigid products in consumer and industrial end markets in the United States,

Canada, Europe, and internationally. The company operates through Consumer Packaging International; Consumer Packaging North America;

Engineered Materials; and Health, Hygiene & Specialties segments.

Cautionary Statement

Regarding Forward-Looking Statements

The

information contained in this press release includes certain statements that are “forward-looking statements” within the meaning

of federal securities laws. Some of these forward-looking statements can be identified by words like “anticipate,” “approximately,”

“believe,” “commit,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “outlook,” “plan,” “potential,” “possible,”

“predict,” “project,” “target,” “seek,” “should,” “will,” or “would,”

the negative of these words, other terms of similar meaning or the use of future dates. Examples of forward-looking statements include

projections as to the anticipated benefits of the Merger as well as statements regarding the impact of the Merger on Amcor’s and

Berry’s business and future financial and operating results and prospects, the amount and timing of synergies from the Merger and

the closing date for the Merger.

Forward-looking

statements are neither historical facts nor assurances of future performance. Instead, they are based only on Amcor management’s

and Berry management’s current beliefs, expectations and assumptions regarding the future of Amcor’s and Berry’s business,

future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking

statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to

predict and many of which are outside of Amcor’s and Berry’s control. You should not place undue reliance on these forward-looking

statements, which apply only as of the date of this press release. Amcor’s, Berry’s and the combined company’s actual

results and financial condition may differ materially from those indicated in the forward-looking statements as a result of various factors.

These factors include, among other things, (i) the termination of or occurrence of any event, change or other circumstances that

could give rise to the termination of the Merger Agreement or the inability to complete the Merger on the anticipated terms and timetable,

(ii) the inability to complete the Merger due to the failure to satisfy any condition to closing in a timely manner or at all, or

the risk that a regulatory approval that may be required for the Merger is delayed, is not obtained or is obtained subject to conditions

that are not anticipated, (iii) the risks related to Amcor and Berry being restricted in the operation of their respective businesses

while the Merger Agreement is in effect, (iv) the ability to obtain financing in connection with the transactions contemplated by

the Merger on favorable terms, if at all, (v) the ability to recognize the anticipated benefits of the Merger, which may be affected

by, among other things, the ability of the combined company to maintain relationships with its customers and retain its management and

key employees, (vi) the ability of the combined company to achieve the synergies contemplated by the Merger or such synergies taking

longer to realize than expected, (vii) costs related to the Merger, (viii) the ability of the combined company to execute successfully

its strategic plans, (ix) the ability of the combined company to promptly and effectively integrate the Amcor and Berry businesses,

(x) the risk that the credit rating of the combined company may be different from what Amcor and Berry expect, (xi) the diversion

of Amcor management’s and Berry management’s time and attention from ordinary course business operations to the consummation

of the Merger and integration matters, (xii) potential liability resulting from pending or future litigation relating to the Merger

and (xiii) the risks, uncertainties and assumptions described in the section entitled “Solicitation Considerations” in

the Statement. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with

the other cautionary statements that are included elsewhere. Additional information concerning risks, uncertainties and assumptions can

be found in Amcor’s and Berry’s respective filings with the SEC, including the risk factors discussed in Amcor’s and

Berry’s most recent Annual Reports on Form 10-K, as updated by their Quarterly Reports on Form 10-Q and other filings

with the SEC. Amcor, Berry and the Berry Issuer do not intend to, and disclaim any duty or obligation to, update or revise any

forward-looking statement set forth in this press release to reflect new information, future events or otherwise, except as required under

U.S. federal securities laws.

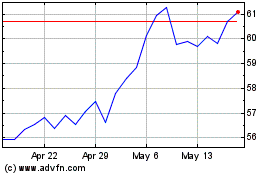

Berry Global (NYSE:BERY)

Historical Stock Chart

From Jan 2025 to Mar 2025

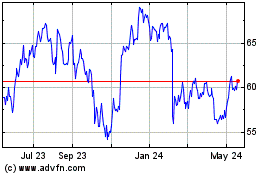

Berry Global (NYSE:BERY)

Historical Stock Chart

From Feb 2024 to Mar 2025