false

0001378992

0001378992

2025-02-25

2025-02-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 25, 2025

Berry Global Group, Inc.

(Exact name of Registrant as specified in its

charter)

| Delaware |

|

001-35672 |

|

20-5234618 |

(State of

incorporation) |

|

(Commission

File No.) |

|

(IRS Employer

Identification No.) |

101 Oakley Street

Evansville,

Indiana 47710

(Address of principal executive offices)

Registrant’s telephone number: (812)

424-2904

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common

Stock, $0.01 par value |

|

BERY |

|

NYSE |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging

Growth Company

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

| Item 5.07. |

Submission of Matters to a Vote of Security Holders. |

At the special meeting of

stockholders (the “Special Meeting”) held on February 25, 2025, the stockholders of Berry Global Group, Inc. (the “Company”)

voted on the following proposals, which are described in more detail in the definitive proxy statement filed by the Company with the Securities

and Exchange Commission on January 23, 2025 (the “Proxy Statement”): (i) a proposal to adopt the Agreement and Plan of Merger,

dated as of November 19, 2024, by and among the Company, Amcor plc (“Amcor”), and Aurora Spirit, Inc., an wholly-owned subsidiary

of Amcor, as it may be amended from time to time (the “Merger Agreement” and, such proposal, the “Merger Proposal”),

(ii) a proposal to approve, on a non-binding, advisory basis, the compensation that may be paid or become payable to the Company’s

named executive officers that is based on or otherwise relates to the transactions contemplated by the Merger Agreement (the “Advisory

Compensation Proposal”), and (iii) a proposal to approve the adjournment of the Special Meeting, if necessary or appropriate, including

to solicit additional proxies if there are insufficient votes at the time of the Special Meeting to approve the Merger Proposal (the “Adjournment

Proposal”). The final voting results for such proposals were as follows:

The Merger Proposal was approved, with the

following votes cast at the Special Meeting:

| Votes For |

|

Votes Against |

|

Abstentions |

| 95,065,449 |

|

1,588,182 |

|

52,005 |

The Advisory Compensation Proposal was approved,

with the following votes cast at the Special Meeting:

| Votes For |

|

Votes Against |

|

Abstentions |

| 60,400,526 |

|

36,184,465 |

|

120,645 |

The Adjournment Proposal was approved, with

the following votes cast at the Special Meeting:

| Votes For |

|

Votes Against |

|

Abstentions |

| 89,920,225 |

|

6,669,337 |

|

116,074 |

Adjournment

of the Special Meeting was not necessary or appropriate because there were sufficient votes at the time of the Special Meeting to approve

the Merger Proposal.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains certain statements

that are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of

the Exchange Act. Some of these forward-looking statements can be identified by words like “anticipate,” “approximately,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “outlook,” “plan,” “potential,” “possible,” “predict,”

“project,” “target,” “seek,” “should,” “will,” or “would,” the

negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to the anticipated

benefits of the proposed transaction, the impact of the proposed transaction on Berry’s and Amcor’s business and future financial

and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and scope of the expected

financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company following the closing

of the proposed transaction and the closing date for the proposed transaction, are based on the current estimates, assumptions and projections

of the management of Berry and Amcor, and are qualified by the inherent risks and uncertainties surrounding future expectations generally,

all of which are subject to change. Actual results could differ materially from those currently anticipated due to a number of risks and

uncertainties, many of which are beyond Berry’s and Amcor’s control. None of Berry, Amcor or any of their respective directors,

executive officers, or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied

in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results

of operations or financial condition of Berry or Amcor. Should any risks and uncertainties develop into actual events, these developments

could have a material adverse effect on Berry’s and Amcor’s businesses, the proposed transaction and the ability to successfully

complete the proposed transaction and realize its expected benefits. Risks and uncertainties that could cause results to differ from expectations

include, but are not limited to, the occurrence of any event, change or other circumstance that could give rise to the termination of

the merger agreement; the risk that the conditions to the completion of the proposed transaction (including regulatory approvals) are

not satisfied in a timely manner or at all; the risks arising from the integration of the Berry and Amcor businesses; the risk that the

anticipated benefits of the proposed transaction may not be realized when expected or at all; the risk of unexpected costs or expenses

resulting from the proposed transaction; the risk of litigation related to the proposed transaction; the risks related to disruption of

management’s time from ongoing business operations as a result of the proposed transaction; the risk that the proposed transaction

may have an adverse effect on the ability of Berry and Amcor to retain key personnel and customers; general economic, market and social

developments and conditions; the evolving legal, regulatory and tax regimes under which Berry and Amcor operate; potential business uncertainty,

including changes to existing business relationships, during the pendency of the proposed transaction that could affect Berry’s

and/or Amcor’s financial performance; and other risks and uncertainties identified from time to time in Berry’s and Amcor’s

respective filings with the SEC, including the Proxy Statement to be filed with the SEC in connection with the proposed transaction. While

the list of risks presented here is, and the list of risks presented in the Proxy Statement will be, considered representative, no such

list should be considered to be a complete statement of all potential risks and uncertainties, and other risks may present significant

additional obstacles to the realization of forward-looking statements. Forward-looking statements included herein are made only as of

the date hereof and neither Berry nor Amcor undertakes any obligation to update any forward-looking statements, or any other information

in this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies or omissions in

them which become apparent. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 26, 2025

| |

Berry Global Group, Inc. |

| |

|

| |

By: |

/s/ Jason K. Greene |

| |

Name: |

Jason K. Greene |

| |

Title: |

Executive Vice President, Chief Legal Officer and Secretary |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

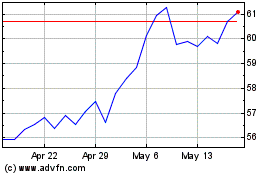

Berry Global (NYSE:BERY)

Historical Stock Chart

From Jan 2025 to Mar 2025

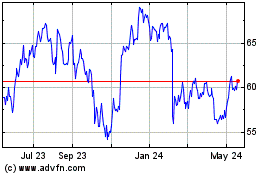

Berry Global (NYSE:BERY)

Historical Stock Chart

From Feb 2024 to Mar 2025