Form 425 - Prospectuses and communications, business combinations

27 February 2025 - 8:05AM

Edgar (US Regulatory)

Filed by Amcor plc

Pursuant to Rule 425 of the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Berry Global Group, Inc.

Commission File No.: 333-284248

Explanatory Note: The following

is an email communication that was sent to employees of Amcor plc on February 26, 2025.

| SUBJECT/// | Another

step toward accelerating the possible |

| TO/// | All

colleagues (All Co-workers (DG) All-Co-workers-DG@Amcor.com) |

| FROM/// | Peter

Konieczny Communications |

| DISTRIBUTION/// | Feb. 26,

2025 |

Team,

I am very pleased to share that we have

just reached another important milestone in the process to combine Amcor with Berry Global. Last night, shareholders of both companies

overwhelmingly voted to approve [LINK] the combination – with [%] and [%] support from Amcor and Berry Global owners respectively.

This positive vote is both a necessary

legal step and a clear confirmation of the exciting potential we see in our future combined company. Together, we will be positioned

to serve customers better, grow faster and operate globally in a way neither company could accomplish alone.

Although we still have some work to do,

our goal of completing the combination by middle of this calendar year is getting closer every day! In parallel, our integration team

is already making great progress in planning for a fast start as a combined company. We will continue to keep you informed as we advance

in the process.

Thank you for voting in favor of the

combination, for working hard to plan the future and – crucially – for maintaining the focus on growing our business. For

now, we operate as two separate companies, so the best way each and every one of us can contribute is by continuing to stay safe, delivering

for our customers and meeting our commitments – month after month, quarter after quarter.

Nothing sets us up for a great tomorrow

like demonstrating our fighting spirit and the strength of our business today!

Thank you. Let’s make it happen.

Peter Konieczny

CEO

Translations will be available here <LINK>.

Please read an

important notice regarding this message.

Cautionary Statement Regarding Forward-Looking

Statements

The information contained in this Current Report

includes certain statements that are “forward-looking statements” within the meaning of federal securities laws. Some of these

forward-looking statements can be identified by words like “anticipate,” “approximately,” “believe,”

“commit,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “outlook,” “plan,” “potential,” “possible,” “predict,”

“project,” “target,” “seek,” “should,” “will,” or “would,” the

negative of these words, other terms of similar meaning or the use of future dates. Examples of forward-looking statements include projections

as to the anticipated benefits of the Merger as well as statements regarding the impact of the Merger on Amcor’s and Berry’s

business and future financial and operating results and prospects, the amount and timing of synergies from the Merger and the closing

date for the Merger.

Forward-looking statements are neither historical

facts nor assurances of future performance. Instead, they are based only on management’s current beliefs, expectations and assumptions

regarding the future of Amcor’s and Berry’s business, future plans and strategies, projections, anticipated events and trends,

the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict and many of which are outside of Amcor’s and Berry’s control.

Amcor’s, Berry’s and the combined company’s actual results and financial condition may differ materially from those

indicated in the forward-looking statements as a result of various factors. These factors include, among other things, (i) the termination

of or occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement or the inability

to complete the Merger on the anticipated terms and timetable, (ii) the inability to complete the Merger due to the failure to satisfy

any condition to closing in a timely manner or at all, or the risk that a regulatory approval that may be required for the Merger is delayed,

is not obtained or is obtained subject to conditions that are not anticipated, (iii) the risks related to Amcor and Berry being restricted

in the operation of their respective businesses while the Merger Agreement is in effect, (iv) the ability to obtain financing in

connection with the transactions contemplated by the Merger on favorable terms, if at all, (v) the ability to recognize the anticipated

benefits of the Merger, which may be affected by, among other things, the ability of the combined company to maintain relationships with

its customers and retain its management and key employees, (vi) the ability of the combined company to achieve the synergies contemplated

by the Merger or such synergies taking longer to realize than expected, (vii) costs related to the Merger, (viii) the ability

of the combined company to execute successfully its strategic plans, (ix) the ability of the combined company to promptly and effectively

integrate the Amcor and Berry businesses, (x) the risk that the credit rating of the combined company may be different from what

Amcor and Berry expect, (xi) the diversion of management’s time and attention from ordinary course business operations to the

consummation of the Merger and integration matters, (xii) potential liability resulting from pending or future litigation relating

to the Merger and (xiii) the risks, uncertainties and assumptions described in the section entitled “Solicitation Considerations.”

The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary

statements that are included elsewhere. Additional information concerning risks, uncertainties and assumptions can be found in Amcor’s

and Berry’s respective filings with the SEC, including the risk factors discussed in Amcor’s and Berry’s most recent

Annual Reports on Form 10-K, as updated by their Quarterly Reports on Form 10-Q and other filings with the SEC.

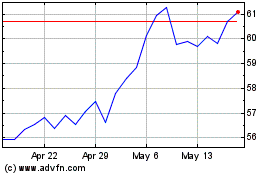

Berry Global (NYSE:BERY)

Historical Stock Chart

From Jan 2025 to Mar 2025

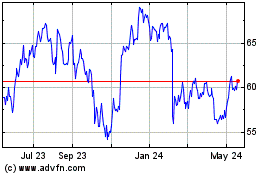

Berry Global (NYSE:BERY)

Historical Stock Chart

From Feb 2024 to Mar 2025