UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 25, 2025

Berry Global Group, Inc.

(Exact name of Registrant as specified in its

charter)

| Delaware |

|

001-35672 |

|

20-5234618 |

(State

of incorporation) |

|

(Commission

File No.) |

|

(IRS Employer

Identification No.) |

101 Oakley Street

Evansville, Indiana 47710

(Address of principal executive offices)

Registrant’s telephone number: (812)

424-2904

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common

Stock, $0.01 par value |

|

BERY |

|

NYSE |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| x | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging

Growth Company

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

On February 26, 2025, Berry Global Group, Inc. (the “Company”)

and Amcor plc (“Amcor”) issued a joint press release announcing the results of the special meeting of the Company’s

stockholders held on February 25, 2025 and the extraordinary general meeting of Amcor’s shareholders. A copy of the press release

is attached as Exhibit 99.1 hereto and incorporated by reference herein.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains certain statements

that are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of

the Exchange Act. Some of these forward-looking statements can be identified by words like “anticipate,” “approximately,”

“believe,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “outlook,” “plan,” “potential,” “possible,” “predict,”

“project,” “target,” “seek,” “should,” “will,” or “would,” the

negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to the anticipated

benefits of the proposed transaction, the impact of the proposed transaction on Berry’s and Amcor’s business and future financial

and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and scope of the expected

financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company following the closing

of the proposed transaction and the closing date for the proposed transaction, are based on the current estimates, assumptions and projections

of the management of Berry and Amcor, and are qualified by the inherent risks and uncertainties surrounding future expectations generally,

all of which are subject to change. Actual results could differ materially from those currently anticipated due to a number of risks and

uncertainties, many of which are beyond Berry’s and Amcor’s control. None of Berry, Amcor or any of their respective directors,

executive officers, or advisors, provide any representation, assurance or guarantee that the occurrence of the events expressed or implied

in any forward-looking statements will actually occur, or if any of them do occur, what impact they will have on the business, results

of operations or financial condition of Berry or Amcor. Should any risks and uncertainties develop into actual events, these developments

could have a material adverse effect on Berry’s and Amcor’s businesses, the proposed transaction and the ability to successfully

complete the proposed transaction and realize its expected benefits. Risks and uncertainties that could cause results to differ from expectations

include, but are not limited to, the occurrence of any event, change or other circumstance that could give rise to the termination of

the merger agreement; the risk that the conditions to the completion of the proposed transaction (including regulatory approvals) are

not satisfied in a timely manner or at all; the risks arising from the integration of the Berry and Amcor businesses; the risk that the

anticipated benefits of the proposed transaction may not be realized when expected or at all; the risk of unexpected costs or expenses

resulting from the proposed transaction; the risk of litigation related to the proposed transaction; the risks related to disruption of

management’s time from ongoing business operations as a result of the proposed transaction; the risk that the proposed transaction

may have an adverse effect on the ability of Berry and Amcor to retain key personnel and customers; general economic, market and social

developments and conditions; the evolving legal, regulatory and tax regimes under which Berry and Amcor operate; potential business uncertainty,

including changes to existing business relationships, during the pendency of the proposed transaction that could affect Berry’s

and/or Amcor’s financial performance; and other risks and uncertainties identified from time to time in Berry’s and Amcor’s

respective filings with the SEC, including the Proxy Statement to be filed with the SEC in connection with the proposed transaction. While

the list of risks presented here is, and the list of risks presented in the Proxy Statement will be, considered representative, no such

list should be considered to be a complete statement of all potential risks and uncertainties, and other risks may present significant

additional obstacles to the realization of forward-looking statements. Forward-looking statements included herein are made only as of

the date hereof and neither Berry nor Amcor undertakes any obligation to update any forward-looking statements, or any other information

in this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies or omissions in

them which become apparent. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 26, 2025

| |

Berry

Global Group, Inc. |

| |

|

| By: |

/s/ Jason K. Greene |

| Name: |

Jason K. Greene |

| Title: |

Executive Vice President,

Chief Legal Officer and Secretary |

Exhibit 99.1

AMCOR AND BERRY GLOBAL SHAREHOLDERS OVERWHELMINGLY

APPROVE COMBINATION

Approval marks another significant milestone

towards combining these highly complementary businesses

ZURICH, SWITZERLAND and EVANSVILLE, INDIANA – 26 February,

2025 – Amcor plc (“Amcor”) (NYSE: AMCR, ASX: AMC) and Berry Global Group, Inc. (“Berry”) (NYSE: BERY)

today announce that at their respective shareholder meetings, held yesterday, shareholders of both companies overwhelmingly voted to approve

the combination of these two companies. This approval satisfies the shareholder vote condition for the combination, originally announced

in November 2024.

Together, Amcor and Berry will be among the global leaders in

consumer and healthcare packaging solutions with the combined material science and innovation capabilities required to revolutionize

product development and better solve customers’ needs and consumers’ sustainability aspirations. These two highly

complementary businesses are expected to grow faster together in attractive categories and opportunities to

further refine the portfolio. With faster growth and $650 million of identified synergies, this combination is expected to drive

significant near and long term value for all shareholders.

Amcor CEO Peter Konieczny commented, “The resounding support

from both companies’ shareholders marks another important milestone in bringing Amcor and Berry together. Our combined company will

be positioned to serve customers better, grow faster and operate globally in a way neither company could accomplish alone. Together, we

have an exciting and unique opportunity to truly transform the future of packaging.”

Berry CEO Kevin Kwilinski added, “We are excited to take another

important step toward finalizing this combination between Berry and Amcor and are pleased the shareholders of both companies clearly recognize

the significant opportunities we will have as one company to deliver enhanced value for all stakeholders.”

More than 71% of Amcor’s outstanding shares were present or represented

by proxy, and more than 99% of these shares were voted in favor of the relevant proposal. More than 83% of Berry’s outstanding shares

were present or represented by proxy, and more than 98% of these shares were voted in favor of the relevant proposal. Amcor and Berry

will each file the final voting results with the US SEC on Form 8-K.

The combination is well advanced and is expected to close in mid calendar

year 2025, subject to closing conditions.

Amcor Investor Relations Contacts

| Tracey Whitehead |

Damien Bird |

Damon Wright |

| Global Head of Investor Relations |

Vice President Investor Relations Asia Pacific |

Vice President Investor Relations North America |

| T: +61 408 037 590 |

T: +61 481 900 499 |

T: +1 224 313 7141 |

| E: tracey.whitehead@amcor.com |

E: damien.bird@amcor.com |

E: damon.wright@amcor.com |

Amcor Media Contacts

| Australia |

Europe |

North America |

| James Strong |

Ernesto Duran |

Julie Liedtke |

| Managing Director |

Amcor Head of Global Communications |

Amcor Director, Media Relations |

| Sodali & Co |

|

|

Berry Investor Relations / Media Contact

Dustin Stilwell

VP, Head of Investor Relations

T: +1 812 306 2964

E: ir@berryglobal.com

E: mediarelations@berryglobal.com

About Amcor

Amcor plc is a global leader in developing and

producing responsible packaging solutions across a variety of materials for food, beverage, pharmaceutical, medical, home and personal-care,

and other products. Amcor works with leading companies around the world to protect products, differentiate brands, and improve supply

chains. The Company offers a range of innovative, differentiating flexible and rigid packaging, specialty cartons, closures and services.

The company is focused on making packaging that is increasingly recyclable, reusable, lighter weight and made using an increasing amount

of recycled content. In fiscal year 2024, 41,000 Amcor people generated $13.6 billion in annual sales from operations that span 212 locations

in 40 countries. NYSE: AMCR; ASX: AMC

About Berry

Berry is a global leader in innovative packaging

solutions that we believe make life better for people and the planet. We do this every day by leveraging our unmatched global capabilities,

sustainability leadership, and deep innovation expertise to serve customers of all sizes around the world. Harnessing the strength in

our diversity and industry-leading talent of over 34,000 global employees across more than 200 locations, we partner with customers to

develop, design, and manufacture innovative products with an eye toward the circular economy. The challenges we solve and the innovations

we pioneer benefit our customers at every stage of their journey.

Important Information for Investors and Shareholders

This communication does not constitute an offer

to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction.

It does not constitute a prospectus or prospectus equivalent document. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

In connection with the proposed transaction

between Amcor plc (“Amcor”) and Berry Global Group (“Berry”), on January 13, 2025, Amcor filed with the

Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4, as amended on January 21, 2025,

containing a joint proxy statement of Amcor and Berry that also constitutes a prospectus of Amcor. The registration statement was

declared effective by the SEC on January 23, 2025 and Amcor and Berry commenced mailing the definitive joint proxy

statement/prospectus to their respective shareholders on or about January 23, 2025. INVESTORS AND SECURITY HOLDERS OF AMCOR AND

BERRY ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may

obtain free copies of the registration statement and the definitive joint proxy statement/prospectus and other documents filed with

the SEC by Amcor or Berry through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the

SEC by Amcor are available free of charge on Amcor’s website at amcor.com under the tab “Investors” and under the

heading “Financial Information” and subheading “SEC Filings.” Copies of the documents filed with the SEC by

Berry are available free of charge on Berry’s website at berryglobal.com under the tab “Investors” and under the

heading “Financials” and subheading “SEC Filings.”

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains certain statements

that are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange

Act. Some of these forward-looking statements can be identified by words like “anticipate,” “approximately,” “believe,”

“continue,” “could,” “estimate,” “expect,” “forecast,” “intend,”

“may,” “outlook,” “plan,” “potential,” “possible,” “predict,”

“project,” “target,” “seek,” “should,” “will,” or “would,” the

negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to the anticipated

benefits of the proposed transaction, the impact of the proposed transaction on Amcor’s and Berry’s business and future financial

and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and scope of the expected

financing in connection with the proposed transaction, the aggregate amount of indebtedness of the combined company following the closing

of the proposed transaction and the closing date for the proposed transaction, are based on the current estimates, assumptions and projections

of the management of Amcor and Berry, and are qualified by the inherent risks and uncertainties surrounding future expectations generally.

Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are

beyond Amcor’s and Berry’s control. None of Amcor, Berry or any of their respective directors, executive officers, or advisors,

provide any representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements

will actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition

of Amcor or Berry. Should any risks and uncertainties develop into actual events, these developments could have a material adverse effect

on Amcor’s and Berry’s businesses, the proposed transaction and the ability to successfully complete the proposed transaction

and realize its expected benefits. Risks and uncertainties that could cause results to differ from expectations include, but are not limited

to, the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the risk

that the conditions to the completion of the proposed transaction (including shareholder and regulatory approvals) are not satisfied in

a timely manner or at all; the risks arising from the integration of the Amcor and Berry businesses; the risk that the anticipated benefits

of the proposed transaction may not be realized when expected or at all; the risk of unexpected costs or expenses resulting from the proposed

transaction; the risk of litigation related to the proposed transaction; the risks related to disruption of management’s time from

ongoing business operations as a result of the proposed transaction; the risk that the proposed transaction may have an adverse effect

on the ability of Amcor and Berry to retain key personnel and customers; and those risks discussed in Amcor’s and Berry’s

respective filings with the SEC. Forward looking statements included herein are made only as of the date hereof and neither Amcor nor

Berry undertakes any obligation to update any forward-looking statements, or any other information in this communication, as a result

of new information, future developments or otherwise, or to correct any inaccuracies or omissions in them which become apparent. All forward-looking

statements in this communication are qualified in their entirety by this cautionary statement.

Note Regarding Use of Non-GAAP Financial Measures

Included in this communication are measures of

financial performance that are not calculated in accordance with U.S. GAAP. These measures include annual cash flow, adjusted cash earnings

per share and certain cost, growth and financial synergies of the combined company post consummation of the transaction.

In arriving at these non-GAAP measures, Amcor

excludes items that either have a non-recurring impact on the income statement or which, in the judgment of our management, are items

that, either as a result of their nature or size, could, were they not singled out, potentially cause investors to extrapolate future

performance from an improper base. These non-GAAP measures are presented for illustrative purposes only, contain a variety of adjustments,

assumptions and preliminary estimates and are not necessarily indicative of what the combined company’s actual results of operations

or financial condition would be upon completion of the merger.

In the view of Amcor’s management, the

estimated synergies included in this communication were prepared on a reasonable basis, reflecting the best available estimates and

judgments of Amcor’s management at the time of preparation and presented as of the time of preparation, to the best of

Amcor’s management’s knowledge and belief, the expected course of action and the expected performance of the combined

company. While presented with numerical specificity, the estimated synergies presented herein are subject to estimates and

assumptions in many respects, inherently uncertain and, as a result, subject to interpretation. The estimates and assumptions used

to prepare these estimated synergies may prove not to be appropriate for any number of reasons, including general economic

conditions, trends in the packaging industry, including trends in capital spending, inventory and unit production, competition and

the risks discussed under the sections entitled “Cautionary Statement Regarding Forward-Looking Statements” and

“Risk Factors” in the Joint Proxy Statement. Such estimated synergies do not take into account any circumstances or

events occurring after the date such information was prepared and also reflect assumptions as to certain business decisions that are

subject to change.

These

non-GAAP financial measures should not be construed in isolation or as a substitute for, or superior to, results determined in accordance

with U.S. GAAP, are not reported by all of Amcor’s or Berry's competitors and may not be directly comparable to similarly titled

measures of Amcor’s competitors given potential differences in the exact method of calculation.

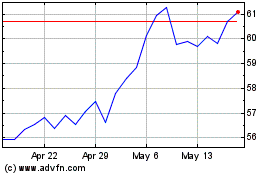

Berry Global (NYSE:BERY)

Historical Stock Chart

From Jan 2025 to Feb 2025

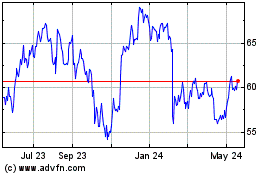

Berry Global (NYSE:BERY)

Historical Stock Chart

From Feb 2024 to Feb 2025