0000012208false00000122082024-10-302024-10-300000012208us-gaap:CommonClassAMember2024-10-302024-10-300000012208us-gaap:CommonClassBMember2024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: October 30, 2024

(Date of earliest event reported)

BIO-RAD LABORATORIES, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-07928

| | | | | | | | |

| Delaware | | 94-1381833 |

| (State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

1000 Alfred Nobel Dr.

Hercules, California 94547

(Address of principal executive offices, including zip code)

(510)724-7000

(Registrant’s telephone number, including area code)

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, Par Value $0.0001 per share | | BIO | | New York Stock Exchange |

| Class B Common Stock, Par Value $0.0001 per share | | BIO.B | | New York Stock Exchange |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | | | | | |

| Emerging growth company | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

ITEM 2.02 Results of Operations and Financial Condition

On October 30, 2024, Bio-Rad Laboratories, Inc. announced its financial results for the quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01 Financial Statements and Exhibits

| | | | | | | | |

Exhibit

Number | | Description |

| 99.1 | | |

| 104.1 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | BIO-RAD LABORATORIES, INC. |

| | | | | |

| Date: | October 30, 2024 | | By: | /s/ Roop K. Lakkaraju |

| | | | | Roop K. Lakkaraju |

| | | | | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Press Release

Bio-Rad Reports Third-Quarter 2024 Financial Results

HERCULES, Calif.—October 30, 2024 -- Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B), a global leader in life science research and clinical diagnostics products, today announced financial results for the third quarter ended September 30, 2024.

Third-quarter 2024 total net sales were $649.7 million, an increase of 2.8 percent compared to $632.1 million reported for the third quarter of 2023. On a currency-neutral basis, quarterly sales increased 3.4 percent compared to the same period in 2023.The increase in net sales was driven by higher sales in our Clinical Diagnostics segment.

Life Science segment net sales for the third quarter were $260.9 million, a decrease of 1.0 percent compared to the same period in 2023. On a currency-neutral basis, sales decreased by 0.6 percent compared to the same quarter in 2023, driven by ongoing weakness in the biotech and biopharma end markets. Currency neutral sales decreased in the Americas, offset by increases in EMEA.

Clinical Diagnostics segment net sales for the third quarter were $388.8 million, an increase of 5.6 percent compared to the same period in 2023. On a currency-neutral basis, sales increased 6.4 percent compared to the same quarter last year. The currency neutral sales increase was primarily driven by increased demand for quality control products, and a favorable compare for our immunology products, which were impacted by supply constraints in the third quarter of 2023. Currency neutral sales increased across all regions.

Third-quarter gross margin was 54.8 percent compared to 53.1 percent during the third quarter of 2023.

Income from operations during the third quarter of 2024 was $64.5 million versus $90.9 million during the same quarter last year.

During the third quarter of 2024, the company recognized a change in the fair market value of its investment in Sartorius AG, which substantially contributed to a net income of $653.2 million, or $23.34 per share, on a diluted basis, versus a net income of $106.3 million, or $3.64 per share, on a diluted basis, reported for the same period of 2023.

The effective tax rate for the third quarter of 2024 was 24.2 percent, compared to 22.5 percent for the same period in 2023. The effective tax rate reported in these periods was primarily affected by the accounting treatment of our equity securities.

“Our third-quarter revenue performance was slightly ahead of expectations, driven by steady growth in clinical diagnostics products, while our life science business continued to improve reflecting a gradual recovery in the biopharma end market,” said Norman Schwartz, Bio-Rad’s Chairman and Chief Executive Officer. "During the quarter, we also welcomed Jon DiVincenzo as President and Chief Operating Officer. Jon joins Bio-Rad's other recently hired senior executives who collectively bring a wealth of life science, clinical diagnostics, and operations experience. With the new senior leadership team in place, we are focused on margin expansion, commercial excellence, and creating long-term shareholder value."

The non-GAAP financial measures discussed below exclude certain items detailed later in this press release under the heading “Use of Non-GAAP and Currency-Neutral Reporting.” A reconciliation between historical GAAP operating results and non-GAAP operating results is provided following the financial statements that are part of this press release.

Non-GAAP gross margin was 55.6 percent for the third quarter of 2024 compared to 53.9 percent during the third quarter of 2023.

Non-GAAP income from operations during the third quarter of 2024 was $73.3 million versus $81.6 million during the comparable prior-year period.

Non-GAAP net income for the third quarter of 2024 was $56.4 million, or $2.01 per share, on a diluted basis, compared to $68.1 million, or $2.33 per share, on a diluted basis, during the same period in 2023.

The non-GAAP effective tax rate for the third quarter of 2024 was 28.8 percent, compared to 23.9 percent for the same period in 2023. The higher rate in 2024 was driven by geographical mix of earnings and a one-time acquired in-process research and development expense.

| | | | | | | | |

| GAAP Results |

| Q3 2024 | Q3 2023 |

| Revenue (millions) | $ | 649.7 | | $ | 632.1 | |

| Gross margin | 54.8 | % | 53.1 | % |

| Operating margin | 9.9 | % | 14.4 | % |

| Net income (millions) | $ | 653.2 | | $ | 106.3 | |

| Income per diluted share | $ | 23.34 | | $ | 3.64 | |

|

| Non-GAAP Results |

| Q3 2024 | Q3 2023 |

| Revenue (millions) | $ | 649.7 | | $ | 632.1 | |

| Gross margin | 55.6 | % | 53.9 | % |

| Operating margin | 11.3 | % | 12.9 | % |

| Net income (millions) | $ | 56.4 | | $ | 68.1 | |

| Income per diluted share | $ | 2.01 | | $ | 2.33 | |

Updated Full-Year 2024 Financial Outlook

Bio-Rad continues to expect its non-GAAP revenue to decline by approximately 2.5 to 4.0 percent on a currency-neutral basis. The company estimates a non-GAAP operating margin of between 12.75 to 13.25 percent, which now also includes the impact of a one-time acquired in-process research and development expense related to an acquisition completed during the third quarter.

Conference Call and Webcast

Management will discuss the company’s third quarter 2024 results and financial outlook in a conference call scheduled for 2 PM Pacific Time (5 PM Eastern Time) on October 30, 2024. To participate, dial 800-579-2543 within the U.S., or (+1) 785-424-1789 from outside the U.S., and provide access code: BIORAD.

A live webcast of the conference call will also be available in the "Investor Relations" section of the company’s website under "Events & Presentations" at investors.bio-rad.com. A replay of the webcast will be available for up to a year.

Use of Non-GAAP and Currency-Neutral Reporting

In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures, including non-GAAP net income and non-GAAP EPS, which exclude amortization of acquisition-related intangible assets, certain acquisition-related expenses and benefits, restructuring charges, asset impairment charges, gains and losses from change in fair market value of equity securities and loan receivable, gains and losses on equity-method investments, and significant legal-related charges or benefits and associated legal costs. Non-GAAP net income and non-GAAP EPS also exclude certain other gains and losses that are either isolated or cannot be expected to occur again with any predictability, tax provisions/benefits related to the previous items, and significant discrete tax events. We exclude the above items because they are outside of our normal operations and/or, in certain cases, are difficult to forecast accurately for future periods.

We utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of our business, in making operating decisions, forecasting and planning for future periods, and determining payments under compensation programs. We consider the use of the non-GAAP measures to be helpful in assessing the performance of the ongoing operation of our business. We believe that disclosing non-GAAP financial measures provides useful supplemental data that, while not a substitute for financial measures prepared in accordance with GAAP, allows for greater transparency in the review of our financial and operational performance. We also believe that disclosing non-GAAP financial measures provides useful information to investors and others in understanding and evaluating our operating results and future prospects in the same manner as management and in comparing financial results across accounting periods and to those of peer companies. More specifically, management adjusts for the excluded items for the following reasons:

Amortization of purchased intangible assets: we do not acquire businesses and assets on a predictable cycle. The amount of purchase price allocated to purchased intangible assets and the term of amortization can vary significantly and are unique to each acquisition or purchase. We believe that excluding amortization of purchased intangible assets allows the users of our financial statements to better review and understand the historic and current results of our operations, and also facilitates comparisons to peer companies.

Acquisition-related expenses and benefits: we incur expenses or benefits with respect to certain items associated with our acquisitions, such as transaction costs, professional fees for assistance with the transaction; valuation or integration costs; changes in the fair value of contingent consideration, gain or loss on settlement of pre-existing relationships with the acquired entity; or adjustments to purchase price. We exclude such expenses or benefits as they are related to acquisitions and have no direct correlation to the operation of our on-going business.

Restructuring, impairment charges, and gains and losses from change in fair market value of equity securities and loan receivable, and gains and losses on equity-method investments: we incur restructuring and impairment charges on individual or groups of employed assets and charges and benefits arising from gains and losses from change in fair market value of equity securities and loan receivable, and gains and losses (including impairments) on equity-method investments, which arise from unforeseen circumstances and/or often occur outside of the ordinary course of our on-going business. Although these events are reflected in our GAAP financials, these unique transactions may limit the comparability of our on-going operations with prior and future periods.

Significant litigation charges or benefits and legal costs: we may incur charges or benefits as well as legal costs in connection with litigation and other contingencies unrelated to our core operations. We exclude these charges or benefits, when significant, as well as legal costs associated with significant legal matters, because we do not believe they are reflective of on-going business and operating results.

Income tax expense: we estimate the tax effect of the excluded items identified above to determine a non-GAAP annual effective tax rate applied to the pretax amount in order to calculate the non-GAAP provision for income taxes. We also adjust for items for which the nature and/or tax jurisdiction requires the application of a specific tax rate or treatment.

From time to time in the future, there may be other items excluded if we believe that doing so is consistent with the goal of providing useful information to investors and management.

Percentage sales growth in currency neutral amounts are calculated by translating prior period sales in each local currency using the current period’s monthly average foreign exchange rates for that currency and comparing that to current period sales.

There are limitations in using non-GAAP financial measures because the non-GAAP financial measures are not prepared in accordance with generally accepted accounting principles and may be different from non-GAAP financial measures used by other companies. The non-GAAP financial measures are limited in value because they exclude certain items that may have a material impact on our reported financial results. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the directly comparable financial measures prepared in accordance with GAAP in the United States. Investors should review the reconciliation of the non-GAAP financial measures to their most directly comparable GAAP financial measures as provided in the tables accompanying this press release.

We do not provide a reconciliation of our non-GAAP financial expectations to expectations for the most comparable GAAP measure because the amount and timing of many future charges that impact these measures (such as amortization of future acquisition-related intangible assets, future acquisition-related expenses and benefits, future restructuring charges, future asset impairment charges, future valuation changes of equity-owned securities, future gains and losses on equity-method investments or future legal charges or benefits), which could be material, are variable, uncertain, or out of our control and therefore cannot be reasonably predicted without unreasonable effort, if at all.

BIO-RAD is a trademark of Bio-Rad Laboratories, Inc. in certain jurisdictions.

About Bio-Rad

Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B) is a leader in developing, manufacturing, and marketing a broad range of products for the life science research and clinical diagnostics markets. Based in Hercules, California, Bio-Rad operates a global network of research, development, manufacturing, and sales operations with approximately 7,700 employees and $2.7 billion in revenues in 2023. Our customers include universities, research institutions, hospitals, and biopharmaceutical companies, as well as clinical, food safety and environmental quality laboratories. Together, we develop innovative, high-quality products that advance science and save lives. To learn more, visit bio-rad.com.

Forward-Looking Statements

This release may be deemed to contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, statements we make regarding estimated future financial performance or results; being focused on margin expansion, commercial excellence, and creating long-term shareholder value; and for the full-year 2024: continuing to expect non-GAAP revenue to decline by approximately 2.5 to 4.0 percent on a currency-neutral basis and estimating a non-GAAP operating margin of between 12.75 to 13.25 percent. Forward-looking statements generally can be identified by the use of forward-looking terminology such as, "expect,” "estimate," "continue," "believe," "anticipate," “target,” "will," "project," "assume," "may," "intend," or similar expressions or the negative of those terms or expressions, although not all forward-looking statements contain these words. Such statements involve risks and uncertainties, which could cause actual results to vary materially from those expressed in or indicated by the forward-looking statements. These risks and uncertainties include reductions in government funding or capital spending of our customers, global economic and geopolitical conditions, the uncertain pace of the biopharma sector’s recovery, the challenging macroeconomic environment in China, supply chain issues, international legal and regulatory risks, our ability to develop and market new or improved products, our ability to compete effectively, foreign currency exchange fluctuations, product quality and liability issues, our ability to integrate acquired companies, products or technologies into our company successfully, changes in the healthcare industry, and natural disasters and other catastrophic events beyond our control. For further information regarding the Company's risks and uncertainties, please refer to the "Risk Factors" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the Company's public reports filed with the Securities and Exchange Commission (the "SEC"), including the Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, and its Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 to be filed with the SEC. The Company cautions you not to place undue reliance on forward-looking statements, which reflect an analysis only and speak only as of the date hereof. Bio-Rad Laboratories, Inc. disclaims any obligation to update these forward-looking statements.

Investor Contact:

Edward Chung, Investor Relations

510-741-6104

ir@bio-rad.com

Media Contact:

Anna Gralinska, Corporate Communications

510-741-6643

cc@bio-rad.com

Bio-Rad Laboratories, Inc.

Condensed Consolidated Statements of Income (Loss)

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 649,729 | | | $ | 632,124 | | | $ | 1,899,025 | | | $ | 1,990,078 | |

| Cost of goods sold | 293,826 | | | 296,441 | | | 862,037 | | | 929,495 | |

| Gross profit | 355,903 | | | 335,683 | | | 1,036,988 | | | 1,060,583 | |

| Selling, general and administrative expense | 200,440 | | | 201,199 | | | 610,042 | | | 634,576 | |

| Research and development expense | 90,997 | | | 43,535 | | | 216,276 | | | 183,528 | |

| | | | | | | |

| Income from operations | 64,466 | | | 90,949 | | | 210,670 | | | 242,479 | |

| Interest expense | 12,174 | | | 12,398 | | | 36,715 | | | 37,078 | |

| Foreign currency exchange (gains) losses, net | 1,641 | | | (1,680) | | | (2,012) | | | (5,280) | |

| (Gains) losses from change in fair market value of equity securities and loan receivable | (792,888) | | | (36,425) | | | 1,680,290 | | | 1,576,542 | |

| Other income, net | (18,081) | | | (20,446) | | | (70,740) | | | (87,365) | |

| Income (loss) before income taxes | 861,620 | | | 137,102 | | | (1,433,583) | | | (1,278,496) | |

| (Provision for) benefit from income taxes | (208,448) | | | (30,845) | | | 305,185 | | | 291,464 | |

| Net income (loss) | $ | 653,172 | | | $ | 106,257 | | | $ | (1,128,398) | | | $ | (987,032) | |

| | | | | | | |

| Basic earnings (loss) per share: | | | | | | | |

| Net income (loss) per basic share | $ | 23.37 | | | $ | 3.65 | | | $ | (39.89) | | | $ | (33.63) | |

| Weighted average common shares - basic | 27,949 | | | 29,102 | | | 28,286 | | | 29,349 | |

| | | | | | | |

| Diluted earnings (loss) per share: | | | | | | | |

| Net income (loss) per diluted share | $ | 23.34 | | | $ | 3.64 | | | $ | (39.89) | | | $ | (33.63) | |

| Weighted average common shares - diluted | 27,985 | | | 29,223 | | | 28,286 | | | 29,349 | |

Note: As a result of the net loss for the nine months ended September 30, 2024 and 2023,

all potentially issuable common shares have been excluded from the diluted shares

used in the computation of earnings per share as their effect was anti-dilutive.

Bio-Rad Laboratories, Inc.

Condensed Consolidated Balance Sheets

(In thousands)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| (Unaudited) | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 410,377 | | | $ | 403,815 | |

| Short-term investments | 1,217,641 | | | 1,208,887 | |

| Accounts receivable, net | 461,940 | | | 489,017 | |

| Inventories, net | 804,276 | | | 780,517 | |

| Other current assets | 161,386 | | | 166,094 | |

| Total current assets | 3,055,620 | | | 3,048,330 | |

| | | |

| Property, plant and equipment, net | 545,304 | | | 529,007 | |

| Operating lease right-of-use assets | 173,866 | | | 194,730 | |

| Goodwill, net | 415,100 | | | 413,569 | |

| Purchased intangibles, net | 307,325 | | | 320,514 | |

| Other investments | 6,002,635 | | | 7,698,070 | |

| Other assets | 103,622 | | | 94,850 | |

| Total assets | $ | 10,603,472 | | | $ | 12,299,070 | |

| | | |

| Current liabilities: | | | |

| Accounts payable, accrued payroll and employee benefits | $ | 268,209 | | | $ | 284,554 | |

| Current maturities of long-term debt | 1,262 | | | 486 | |

| Income and other taxes payable | 43,625 | | | 35,759 | |

| Other current liabilities | 184,847 | | | 202,000 | |

| Total current liabilities | 497,943 | | | 522,799 | |

| | | |

| Long-term debt, net of current maturities | 1,200,062 | | | 1,199,052 | |

| Other long-term liabilities | 1,417,608 | | | 1,836,086 | |

| Total liabilities | 3,115,613 | | | 3,557,937 | |

| | | |

| Total stockholders’ equity | 7,487,859 | | | 8,741,133 | |

| Total liabilities and stockholders’ equity | $ | 10,603,472 | | | $ | 12,299,070 | |

Bio-Rad Laboratories, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | |

| | Nine Months Ended |

| | September 30, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Cash received from customers | $ | 1,920,985 | | | $ | 2,007,482 | |

| Cash paid to suppliers and employees | (1,531,330) | | | (1,722,173) | |

| Interest paid, net | (45,628) | | | (46,394) | |

| Income tax payments, net | (75,710) | | | (40,966) | |

| Other operating activities | 62,731 | | | 95,947 | |

| Net cash provided by operating activities | 331,048 | | | 293,896 | |

| Cash flows from investing activities: | | | |

| | | |

| Payments for purchases of marketable securities and investments | (1,053,660) | | | (537,540) | |

| Proceeds from sales and maturities of marketable securities and investments | 1,069,951 | | | 599,882 | |

| Other investing activities | (145,947) | | | (114,331) | |

| Net cash used in investing activities | (129,656) | | | (51,989) | |

| Cash flows from financing activities: | | | |

| | | |

| Payments on long-term debt | (359) | | | (349) | |

| Other financing activities | (192,193) | | | (224,678) | |

| Net cash used in financing activities | (192,552) | | | (225,027) | |

| Effect of foreign exchange rate changes on cash | (1,021) | | | 6,891 | |

| Net increase in cash, cash equivalents and restricted cash | 7,819 | | | 23,771 | |

| Cash, cash equivalents and restricted cash at beginning of period | 404,369 | | | 434,544 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 412,188 | | | $ | 458,315 | |

| | | |

| Reconciliation of net loss to net cash provided by operating activities: | | | |

| Net loss | $ | (1,128,398) | | | $ | (987,032) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 112,393 | | | 108,724 | |

| Reduction in the carrying amount of right-of-use assets | 31,066 | | | 30,725 | |

| Losses from change in fair market value of equity securities and loan receivable | 1,680,290 | | | 1,576,542 | |

| Changes in working capital | (29,950) | | | (61,623) | |

| Other | (334,353) | | | (373,440) | |

| Net cash provided by operating activities | $ | 331,048 | | | $ | 293,896 | |

Bio-Rad Laboratories, Inc.

Reconciliation of GAAP financial measures to non-GAAP financial measures

(In thousands, except per share data)

(Unaudited)

In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures, including non-GAAP net income and non-GAAP diluted income per share (non-GAAP EPS), which exclude amortization of acquisition-related intangible assets; certain acquisition-related expenses and benefits; restructuring charges; asset impairment charges; gains and losses from change in fair market value of equity securities and loan receivable; gains and losses on equity-method investments; and significant legal-related charges or benefits and associated legal costs. Non-GAAP net income and non-GAAP EPS also exclude certain other gains and losses that are either isolated or cannot be expected to occur again with any predictability, tax provisions/benefits related to the previous items, and significant discrete tax events. We exclude the above items because they are outside of our normal operations and/or, in certain cases, are difficult to forecast accurately for future periods.

We utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of our business, in making operating decisions, forecasting and planning for future periods, and determining payments under compensation programs. We consider the use of the non-GAAP measures to be helpful in assessing the performance of the ongoing operation of our business. We believe that disclosing non-GAAP financial measures provides useful supplemental data that, while not a substitute for financial measures prepared in accordance with GAAP, allows for greater transparency in the review of our financial and operational performance. We also believe that disclosing non-GAAP financial measures provides useful information to investors and others in understanding and evaluating our operating results and future prospects in the same manner as management and in comparing financial results across accounting periods and to those of peer companies.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Three Months Ended | | | | Nine Months Ended | | | | Nine Months Ended | | |

| September 30, 2024 | | % of revenue | | September 30, 2023 | | % of revenue | | September 30, 2024 | | % of revenue | | September 30, 2023 | | % of revenue |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| GAAP cost of goods sold | $ | 293,826 | | | | | $ | 296,441 | | | | | $ | 862,037 | | | | | $ | 929,495 | | | |

| Amortization of purchased intangibles | (4,499) | | | | | (4,507) | | | | | (13,391) | | | | | (13,131) | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Restructuring benefits (costs) | (603) | | | | | (215) | | | | | (1,764) | | | | | (3,922) | | | |

| Non-GAAP cost of goods sold | $ | 288,724 | | | | | $ | 291,719 | | | | | $ | 846,882 | | | | | $ | 912,442 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP gross profit | $ | 355,903 | | | 54.8% | | $ | 335,683 | | | 53.1% | | $ | 1,036,988 | | | 54.6% | | $ | 1,060,583 | | | 53.3% |

| Amortization of purchased intangibles | 4,499 | | | | | 4,507 | | | | | 13,391 | | | | | 13,131 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Restructuring (benefits) costs | 603 | | | | | 215 | | | | | 1,764 | | | | | 3,922 | | | |

| Non-GAAP gross profit | $ | 361,005 | | | 55.6% | | $ | 340,405 | | | 53.9% | | $ | 1,052,143 | | | 55.4% | | $ | 1,077,636 | | | 54.2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP selling, general and administrative expense | $ | 200,440 | | | | | $ | 201,199 | | | | | $ | 610,042 | | | | | $ | 634,576 | | | |

| Amortization of purchased intangibles | (825) | | | | | (1,629) | | | | | (2,686) | | | | | (4,931) | | | |

| | | | | | | | | | | | | | | |

| Acquisition related benefits (costs) | — | | | | | 4,100 | | | | | — | | | | | 4,100 | | | |

| Restructuring benefits (costs) | (819) | | | | | (1,339) | | | | | (3,825) | | | | | (16,655) | | | |

| Other non-recurring items (2) | (1,663) | | | | | (1,877) | | | | | (4,704) | | | | | (5,794) | | | |

| Non-GAAP selling, general and administrative expense | $ | 197,133 | | | | | $ | 200,454 | | | | | $ | 598,827 | | | | | $ | 611,296 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP research and development expense | $ | 90,997 | | | | | $ | 43,535 | | | | | $ | 216,276 | | | | | $ | 183,528 | | | |

| Acquisition related benefits (costs) | (400) | | | | | 14,800 | | | | | (800) | | | | | 14,400 | | | |

| Restructuring benefits (costs) | (19) | | | | | 22 | | | | | (1,519) | | | | | (5,293) | | | |

| Non-GAAP research and development expense | $ | 90,578 | | | | | $ | 58,357 | | | | | $ | 213,957 | | | | | $ | 192,635 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP income from operations | $ | 64,466 | | | 9.9% | | $ | 90,949 | | | 14.4% | | $ | 210,670 | | | 11.1% | | $ | 242,479 | | | 12.2% |

| | | | | | | | | | | | | | | |

| Amortization of purchased intangibles | 5,324 | | | | | 6,136 | | | | | 16,077 | | | | | 18,062 | | | |

| | | | | | | | | | | | | | | |

| Acquisition related (benefits) costs | 400 | | | | | (18,900) | | | | | 800 | | | | | (18,500) | | | |

| Restructuring (benefits) costs | 1,441 | | | | | 1,532 | | | | | 7,108 | | | | | 25,870 | | | |

| Other non-recurring items (2) | 1,663 | | | | | 1,877 | | | | | 4,704 | | | | | 5,794 | | | |

| Non-GAAP income from operations | $ | 73,294 | | | 11.3% | | $ | 81,594 | | | 12.9% | | $ | 239,359 | | | 12.6% | | $ | 273,705 | | | 13.8% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP (gains) losses from change in fair market value of equity securities and loan receivable | $ | (792,888) | | | | | $ | (36,425) | | | | | $ | 1,680,290 | | | | | $ | 1,576,542 | | | |

| Gains (losses) from change in fair market value of equity securities and loan receivable | 792,888 | | | | | 36,425 | | | | | (1,680,290) | | | | | (1,576,542) | | | |

| Non-GAAP (gains) losses from change in fair market value of equity securities and loan receivable | $ | — | | | | | $ | — | | | | | $ | — | | | | | $ | — | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP other (income) expense, net | $ | (18,081) | | | | | $ | (20,446) | | | | | $ | (70,740) | | | | | $ | (87,365) | | | |

| Gains (losses) on equity-method investments | (1,626) | | | | | (697) | | | | | (3,349) | | | | | (2,543) | | | |

| | | | | | | | | | | | | | | |

| Other non-recurring items (3) | — | | | | | 2,500 | | | | | — | | | | | 2,500 | | | |

| | | | | | | | | | | | | | | |

| Non-GAAP other (income) expense, net | $ | (19,707) | | | | | $ | (18,643) | | | | | $ | (74,089) | | | | | $ | (87,408) | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP income (loss) before income taxes | $ | 861,620 | | | | | $ | 137,102 | | | | | $ | (1,433,583) | | | | | $ | (1,278,496) | | | |

| | | | | | | | | | | | | | | |

| Amortization of purchased intangibles | 5,324 | | | | | 6,136 | | | | | 16,077 | | | | | 18,062 | | | |

| | | | | | | | | | | | | | | |

| Acquisition related (benefits) costs | 400 | | | | | (18,900) | | | | | 800 | | | | | (18,500) | | | |

| Restructuring (benefits) costs | 1,441 | | | | | 1,532 | | | | | 7,108 | | | | | 25,870 | | | |

| (Gains) losses from change in fair market value of equity securities and loan receivable | (792,888) | | | | | (36,425) | | | | | 1,680,290 | | | | | 1,576,542 | | | |

| (Gains) losses on equity-method investments | 1,626 | | | | | 697 | | | | | 3,349 | | | | | 2,543 | | | |

| Other non-recurring items (2) (3) | 1,663 | | | | | (623) | | | | | 4,704 | | | | | 3,294 | | | |

| Non-GAAP income before income taxes | $ | 79,186 | | | | | $ | 89,519 | | | | | $ | 278,745 | | | | | $ | 329,315 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP (provision for) benefit from income taxes | $ | (208,448) | | | | | $ | (30,845) | | | | | $ | 305,185 | | | | | $ | 291,464 | | | |

| Income tax effect of non-GAAP adjustments (1) | 185,624 | | | | | 9,408 | | | | | (373,835) | | | | | (364,826) | | | |

| Non-GAAP provision for income taxes | $ | (22,824) | | | | | $ | (21,437) | | | | | $ | (68,650) | | | | | $ | (73,362) | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP net income (loss) | $ | 653,172 | | | 100.5% | | $ | 106,257 | | | 16.8% | | $ | (1,128,398) | | | (59.4)% | | $ | (987,032) | | | (49.6)% |

| | | | | | | | | | | | | | | |

| Amortization of purchased intangibles | 5,324 | | | | | 6,136 | | | | | 16,077 | | | | | 18,062 | | | |

| | | | | | | | | | | | | | | |

| Acquisition related (benefits) costs | 400 | | | | | (18,900) | | | | | 800 | | | | | (18,500) | | | |

| Restructuring (benefits) costs | 1,441 | | | | | 1,532 | | | | | 7,108 | | | | | 25,870 | | | |

| (Gains) losses from change in fair market value of equity securities and loan receivable | (792,888) | | | | | (36,425) | | | | | 1,680,290 | | | | | 1,576,542 | | | |

| (Gains) losses on equity-method investments | 1,626 | | | | | 697 | | | | | 3,349 | | | | | 2,543 | | | |

| Other non-recurring items (2) (3) | 1,663 | | | | | (623) | | | | | 4,704 | | | | | 3,294 | | | |

| Income tax effect of non-GAAP adjustments (1) | 185,624 | | | | | 9,408 | | | | | (373,835) | | | | | (364,826) | | | |

| Non-GAAP net income | $ | 56,362 | | | 8.7% | | $ | 68,082 | | | 10.8% | | $ | 210,095 | | | 11.1% | | $ | 255,953 | | | 12.9% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP diluted income (loss) per share | $ | 23.34 | | | | | $ | 3.64 | | | | | $ | (39.89) | | | | | $ | (33.63) | | | |

| | | | | | | | | | | | | | | |

| Amortization of purchased intangibles | 0.19 | | | | | 0.21 | | | | | 0.57 | | | | | 0.61 | | | |

| | | | | | | | | | | | | | | |

| Acquisition related (benefits) costs | 0.01 | | | | | (0.65) | | | | | 0.03 | | | | | (0.63) | | | |

| Restructuring (benefits) costs | 0.05 | | | | | 0.05 | | | | | 0.25 | | | | | 0.88 | | | |

| (Gains) losses from change in fair market value of equity securities and loan receivable | (28.33) | | | | | (1.25) | | | | | 59.35 | | | | | 53.47 | | | |

| (Gains) losses on equity-method investments | 0.06 | | | | | 0.02 | | | | | 0.12 | | | | | 0.09 | | | |

| Other non-recurring items (2) (3) | 0.06 | | | | | (0.02) | | | | | 0.17 | | | | | 0.11 | | | |

| Income tax effect of non-GAAP adjustments (1) | 6.63 | | | | | 0.33 | | | | | (13.21) | | | | | (12.38) | | | |

| Add back anti-dilutive shares | — | | | | | — | | | | | 0.03 | | | | | 0.16 | | | |

| Non-GAAP diluted income per share | $ | 2.01 | | | | | $ | 2.33 | | | | | $ | 7.42 | | | | | $ | 8.68 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP diluted weighted average shares used in per share calculation | 27,985 | | | | | 29,223 | | | | | 28,286 | | | | | 29,349 | | | |

| Shares included in non-GAAP net income per share, but excluded from GAAP net loss per share as they would have been anti-dilutive | — | | | | | — | | | | | 24 | | | | | 137 | | | |

| Non-GAAP diluted weighted average shares used in per share calculation | 27,985 | | | | | 29,223 | | | | | 28,310 | | | | | 29,486 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of net income (loss) to adjusted EBITDA: | | | | | | | | | | | | | | | |

| GAAP net income (loss) | $ | 653,172 | | | 100.5% | | $ | 106,257 | | | 16.8% | | $ | (1,128,398) | | | (59.4)% | | $ | (987,032) | | | (49.6)% |

| Interest expense | 12,174 | | | | | 12,398 | | | | | 36,715 | | | | | 37,078 | | | |

| (Provision for) benefit from income taxes | 208,448 | | | | | 30,845 | | | | | (305,185) | | | | | (291,464) | | | |

| Depreciation and amortization | 38,891 | | | | | 37,278 | | | | | 112,393 | | | | | 108,724 | | | |

| Foreign currency exchange (gains) losses, net | 1,641 | | | | | (1,680) | | | | | (2,012) | | | | | (5,280) | | | |

| Other income, net | (18,081) | | | | | (20,446) | | | | | (70,740) | | | | | (87,365) | | | |

| (Gains) losses from change in fair market value of equity securities and loan receivable | (792,888) | | | | | (36,425) | | | | | 1,680,290 | | | | | 1,576,542 | | | |

| Dividend from Sartorius AG | — | | | | | — | | | | | 17,930 | | | | | 34,766 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Acquisition related (benefits) costs | 400 | | | | | (18,900) | | | | | 800 | | | | | (18,500) | | | |

| Restructuring (benefits) costs | 1,441 | | | | | 1,532 | | | | | 7,108 | | | | | 25,870 | | | |

| Other non-recurring items (2) | 1,663 | | | | | 1,877 | | | | | 4,704 | | | | | 5,794 | | | |

| Adjusted EBITDA | $ | 106,861 | | | 16.4% | | $ | 112,736 | | | 17.8% | | $ | 353,605 | | | 18.6% | | $ | 399,133 | | | 20.1% |

(1) Excluded items identified in the reconciliation schedule are tax effected by application of a non-GAAP effective tax rate. The non-GAAP tax provision is adjusted for items, the nature of which and/or tax jurisdiction requires the application of a specific tax rate or treatment.

(2) Incremental costs to comply with the European Union's In Vitro Diagnostics Regulation ("IVDR") for previously approved products.

(3) Gain from the release of an escrow for the acquisition in 2021 (2023).

2024 Financial Outlook

Forecasted non-GAAP operating margin excludes 85 basis points related to amortization of purchased intangibles. Forecasted non-GAAP operating margin does not reflect future gains and charges that are inherently difficult to predict and estimate due to their unknown timing, effect and/or significance, such as foreign currency fluctuations, future gains or losses associated with certain legal matters, acquisitions and restructuring activities. We do not provide a reconciliation of our non-GAAP financial expectations to expectations for the most comparable GAAP measure because the amount and timing of many future charges that impact these measures (such as amortization of future acquisition-related intangible assets, future acquisition-related expenses and benefits, future restructuring charges, future asset impairment charges, future valuation changes of equity-owned securities, future gains and losses on equity-method investments or future legal charges or benefits), which could be material, are variable, uncertain, or out of our control and therefore cannot be reasonably predicted without unreasonable effort, if at all.

v3.24.3

Document and Entity Information Document

|

Oct. 30, 2024 |

| Entity Information [Line Items] |

|

| Entity Central Index Key |

0000012208

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 30, 2024

|

| Entity Registrant Name |

BIO-RAD LABORATORIES, INC.

|

| Entity File Number |

001-07928

|

| Entity Tax Identification Number |

94-1381833

|

| Entity Address, Address Line One |

1000 Alfred Nobel Dr.

|

| Entity Address, City or Town |

Hercules

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94547

|

| City Area Code |

(510)

|

| Local Phone Number |

724-7000

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Amendment Flag |

false

|

| Common Class A [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, Par Value $0.0001 per share

|

| Trading Symbol |

BIO

|

| Security Exchange Name |

NYSE

|

| Common Class B [Member] |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Class B Common Stock, Par Value $0.0001 per share

|

| Trading Symbol |

BIO.B

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

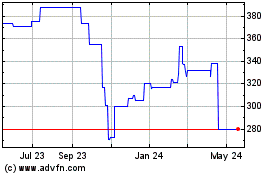

Bio Rad Laboratories (NYSE:BIO.B)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bio Rad Laboratories (NYSE:BIO.B)

Historical Stock Chart

From Nov 2023 to Nov 2024